There are effectively two choices when it comes to trading options you can opt for exchange-traded options or you can choose to trade CFDs/spreadbets over those options or their OTC equivalents. In this guide, we will explain what FTSE 100 options are, how you can trade them, and what hedging the FTSE 100 with options is.

A reader asked:

I would like to trade FTSE 100 index options. I would also like to hedge UK shares with options. Which broker/brokers do you recommend and why?

FTSE Options (on-exchange)

FTSE options give you the right (but not the obligation) of a set amount of FTSE 100 futures at a set date in the future. They are a good way of either speculating on the FTSE 100 either moving a lot or not at all. We go in to more detail on who options work in our how-to trade options guide, but for now we shall focus on the specifics of the FTSE.

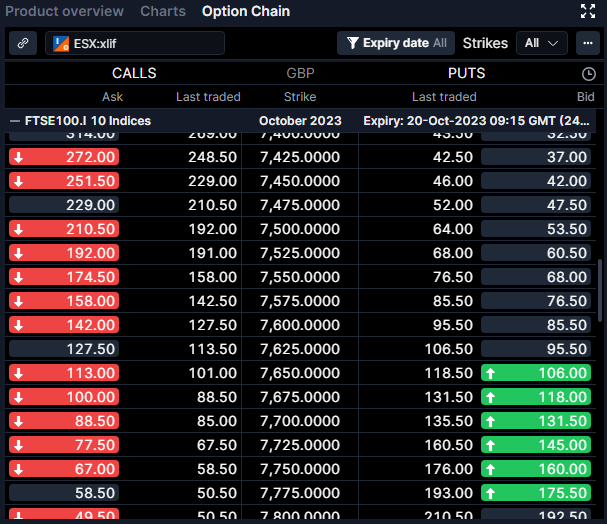

When you buy FTSE 100 options you will be presented with an options chain window, like this one on Saxo Market’s platform. Saxo offers direct market access and a very robust trading platform.

FTSE 100 CFD/Spread Bet Options

Because options on the FTSE 100 are cash-settled and not deliverable, that is they are a CFD themselves, in this instance, there isn’t that much difference between the two.

The key advantage of FTSE 100 CFD options is that you can trade in smaller size, as an on-exchange FTSE 100 option contract size traded on ICE is £10 per index point. So CFDs give you more flexibility over the size of your position.

However, the same is true of spread betting on options and you get the added advantage of your profits being tax-free (as trades are structured as a bet). So if you are buying FTSE 100 options to hedge your portfolio exposure to reduce the amount of tax you pay by not selling your shares to realise capital gains. If the market drops and you have bought FTSE 100 put options as a spread bet, you won’t pay tax on the profits from your hedge.

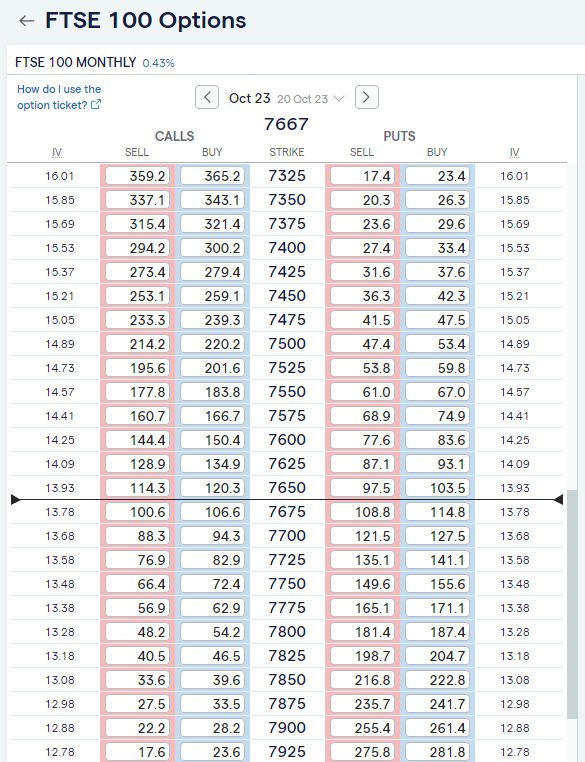

IG offer quite a comprehensive FTSE options chain for spread betting. Unlike other brokers who offer FTSE 100 OTC options, they call them FTSE rather than UKX, suggesting that they have invested in the official licence to use the FTSE trademark.

If you go down the exchange-traded route the counterparty risk is between you, your broker and the options clearinghouse. Whereas, of course, if you go down the CFD route your counterparty will be the CFD broker.

- Related guide: Compare FTSE 100 trading platforms.

However, in the event of failure, retail client monies are covered up to a value of £85,000 by the Financial Services Compensation Scheme or FSCS.

Hedging Shares With FTSE 100 Options

In terms of hedging physical shareholdings, if you are just looking for an equal and opposite offset against a drop in the monetary value of your share portfolio, in say a market downturn, then CFDs on options would likely work for you as well.

The outright logistics of putting on a hedge will be determined by the composition of your portfolio, which probably won’t match a particular index exactly. Nor will it be valued at a nice round amount. If that’s the case then hedging with options won’t be a perfect fit but with a little work, you should get to a very close approximation.

Being able to deal in fractions of an options lot may be of assistance here, that’s an advantage that CFDs on options have over their exchange-traded counterparts.

- Related guide: How to invest in the FTSE 100?

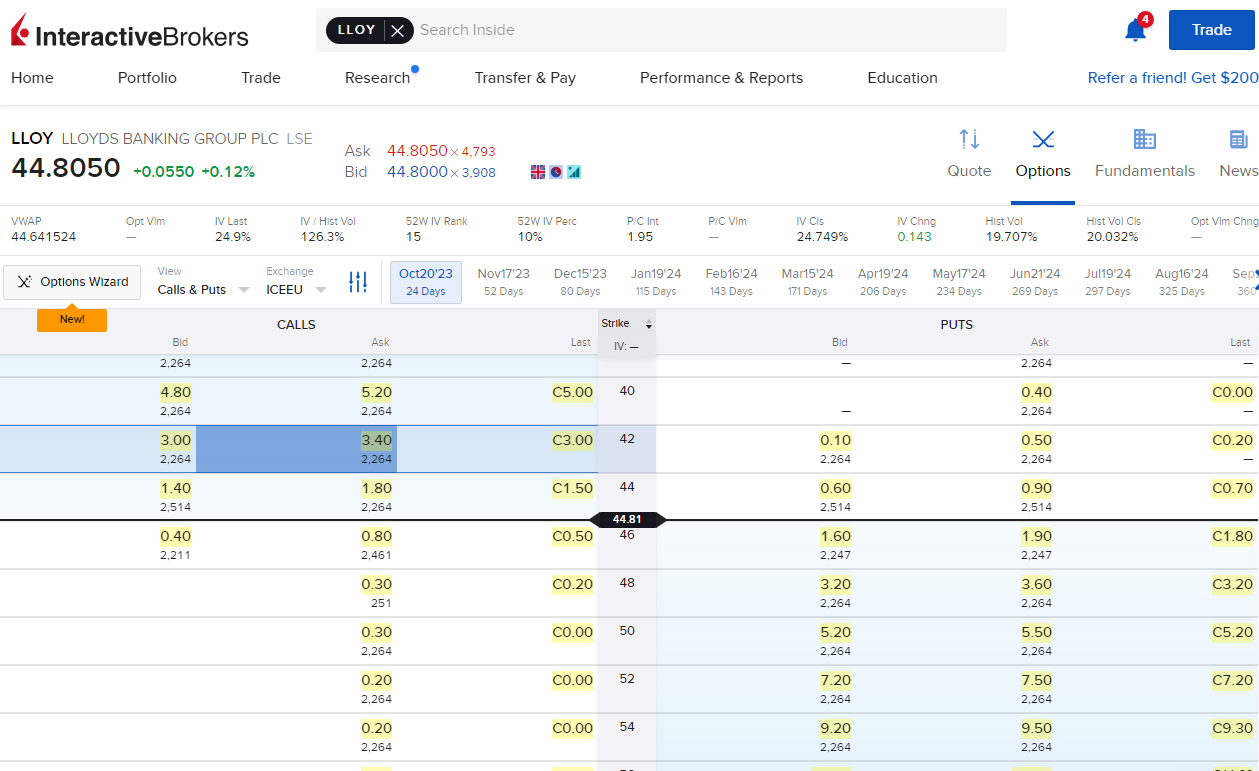

One of the cheapest and best platforms for trading single stock options is Interactive Brokers, which offer an easy to use web-based platform, and an extremely advanced desktop options trading platform for more experienced options traders. You can see an example of their options chain on Lloyds bank shares.

FTSE 100 Index Options Expiry

Don’t forget however that options have a finite lifetime and as such an options hedge won’t last forever, and may need to be periodically renewed or rolled which may incur additional costs.

Values of the FTSE 100 index options are calculated at 10:15am (GMT) on the date of expiration.

Exercise windows are between 18:10 – 18:40 London time on the last trading day.*

As to which brokers you should use, without knowing more about your circumstances, it’s not possible to say but why not have a look at our Compare Options Brokers in the UK page which will provide you with the information you need to make a choice.

Here are our tips on trading with historical data.

We have had quite a bit of interest in options trading recently and we don’t always publish Q&As that are very similar but we like to answer every question with a specific response and publish those that we think will help our users.

- Related guide: What is the FTSE 100 index?

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.