Natural Gas brokers let you trade and invest in Natural Gas markets through their online platforms via futures, CFDs, spread bets or ETFs. You can use our comparison table of what we think are the best natural gas trading platforms to compare spreads, commission, minimum deposits and what type of market access a broker provides to the natural gas markets.

City Index: Best Nat Gas CFD trading platform

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated Natural Gas trading on MT4

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: Nat Gas trading with personal service

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount Natural Gas trading

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: High-tech Nat Gas trading platform

74% of retail investor accounts lose money when trading CFDs with this provider

XTB: Good Oil trading educational material

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best Nat Gas futures trading & ETF platform

70% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s Gas trading

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Tickmill: Natural Gas futures on CQG or CFDs on MT4

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

❓Methodology: We have chosen what we think are the best natural gas trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the nat gas trading accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the natural gas broker’s CEOs and senior management

Compare Natural Gas Trading Platforms

| Nat Gas Broker | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|

| £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| £250 | See Platform | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| £1 | See Platform | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider. | |

| £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

What is natural gas?

How can you trade natural gas?

Natural gas is a popular commodity for traders and hedgers. Prices are notoriously volatile, lending to quick potentially profitable trades. You can trade natural gas through futures, options, stocks, spread betting or ETFs. We review these instruments below.

Best Natural Gas Trading Platform For Futures

Saxo Markets is one of the best futures brokers for trading Natural Gas futures. They provide a professional trading platform with direct market access to nat gas futures contracts and exchanges.

Natural gas futures are one of the most popular methods to speculate on natural gas prices. Simply, futures contracts are a form of financial derivatives with an element of embedded leverage (due to low margin requirements). Most futures contracts are standardised with a specified size, minimum price fluctuations and delivery dates.

The Henry Hub Natural Gas (ticker: NG) is the industry benchmark in the world and they are active traded on the NYMEX under the Chicago Mercantile Exchange Group. Like crude oil contracts, natural gas futures are available in all calendar months. For example, the first six contracts are shown below.

Source: CME

Best Natural Gas Trading Platform For Options

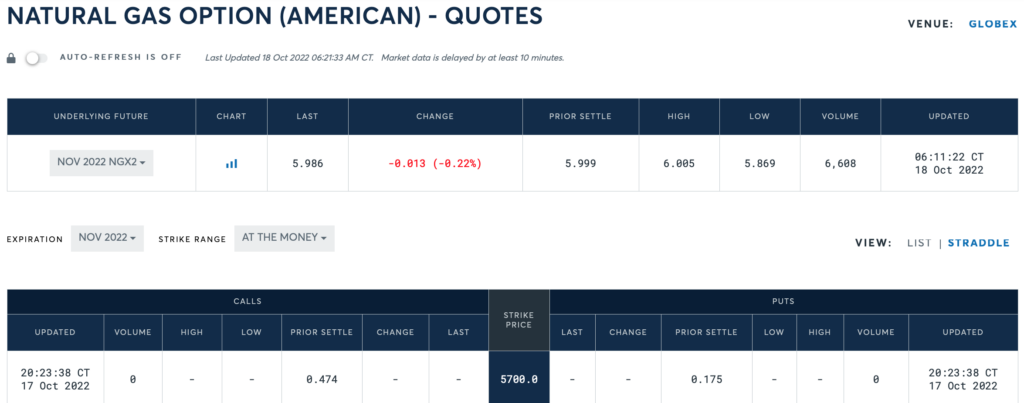

Interactive Brokers is one of the best brokers for trading Natural Gas options. They have an excellent nat gas options trading board, chain and order execution strategy tool, plus commissions are very low.

Options are time-limited financial contracts on a specified future price. The degree of leverage in option contracts is as high as futures. Some option contracts can be worthless at expiry dates (‘out of money’ options).

To trade natural gas options, some knowledge about options is needed, including terms (strike prices, duration, delta), the calculation of option premium, and strategies. You buy ‘call options’ if you think natural gas prices will rise; and a ‘put option’ if you anticipate price declines. You can write natural gas options but that entails further specialised knowledge and experience.

- Further reading: options trading explained

A screenshot of the CME American-style option is exhibited below:

Source: CME

Please Note: Natural gas options are only suitable for experienced investors and traders.

Best Natural Gas Trading Platform For Investing

Hargreaves Lansdown provides access to a wide range of companies with exposure to natural gas. They have excellent market data pages for analysing the financial health of companies as well as display broker recommendations for specific stocks you are interested in buying.

Apart from futures and options, another option is equities. The natural gas industry is a huge sector. Many companies engage in producing and exporting nat gas; while some focus on building the infrastructure to transport the commodity. A few are even Fortune 500 companies.

Apart from oil majors, the following companies are engaged in the natural gas industries:

- Cheniere Energy (LNG:US) – a $40 billion company that exports LNG

- EQT Corporation (EQT:US) – one of the largest natural gas producers

- Kinder Morgan (KMI:US) – operates many pipelines and terminals

- Smaller companies: Anterior Resource (AR:US), Range Resources (RRC:US), Southwestern Energy (SWN:US)

In the UK, some non-major companies that explore the North Sea include Serica Energy (SQZ:UK), Harbour (HBR) and EnQuest (ENQ).

One big difference between natural gas and natural gas stocks is that the latter may go bankrupt. Remember, natural gas is a highly cyclical industry. Companies that took on excessive debt to expand during the boom times often suffer when prices decline. An example is Chesapeake Energy, which filed for bankruptcy in 2020.

Therefore, buying natural gas stocks entail doing further research into the financial aspect of these companies.

Best Natural Gas Trading Platform For Spreadbetting and CFDs

City Index is one of the best brokers for trading natural gas as a spread bet or CFDs. They offer some good performing trading signals through their SMART Signals feature and also post-trade analytics so you can see where you trade profitable trade natural gas.

You can trade CFDs spread bet natural gas prices with financial brokers if you wish to avoid holding futures contracts. You can either hold a position on spot or future natural gas prices and also benefit from rising or falling markets by going long (buying) or short (selling).

Spot positions are usually for day-traders while futures-based contracts are positional trades, ie, multi-day/week trades.

Like future contracts, you will need sufficient margin to open a position. If the position moves against you, additional capital is required to maintain the trade. If not, the broker will liquidate the underwater position.

Best Natural Gas Trading Platform For ETFs

IG is one of the best brokers for trading natural gas ETFs, as you can go long and short them through either CFDs or spread bets, but also invest in them in the long term with their physical share trading account.

What moves natural gas prices?

Gas prices, like most other commodities, are linked to a number of macro factors. Broadly speaking, you will need to know these two:

- Fundamentals

- Technicals – and psychology, too

The weight and importance of each factor interact with one another to produce the trend we see on charts. We look at each in turn.

Fundamentals

Commodity prices seldom exist in a vacuum. A vast quantity of information bombards the market each day to create minute price moves, which, over time, lead to price ‘trends’.

Fundamental factors are concerned with two elements: Supply and demand. It is the juxtaposition of both factors that create the natural gas market.

Supply

On supply, traders are concerned with the following:

- Current inventories and storage levels

- Future production levels

- Catalysts that result in ‘supply shocks’ (eg, war in gas-producing countries)

Basically, traders estimate using historical data if the natural gas market will be in deficit, surplus, or in equilibrium over the medium term.

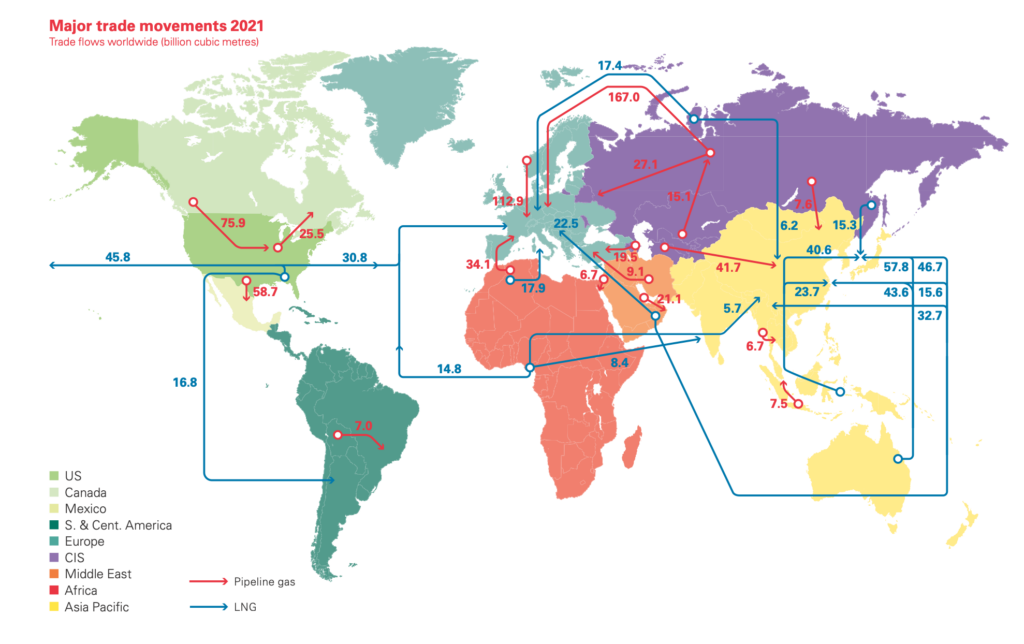

Did you know that natural gas reserves are highly concentrated? A mere 7 countries has 70 percent of the total gas reserves. Russia alone sits on top of 24% of the global gas reserves. Therefore, any political turbulence in these countries will disrupt the supply of natural gas and cause price spikes.

Demand

On demand, investors assess the following factors:

- Current and future global requirements

- Seasonal changes

- Catalysts that will impact the above

Weather is a big factor in the analysis of natural gas. An unusually cold or warm winter will precipitate volatile natural gas price action since it impacts demand unexpectedly.

However, data by itself is not enough – as every major investor already ‘know’ these data. You have to assume that what is widely available is not worth knowing because it is already ‘priced in’.

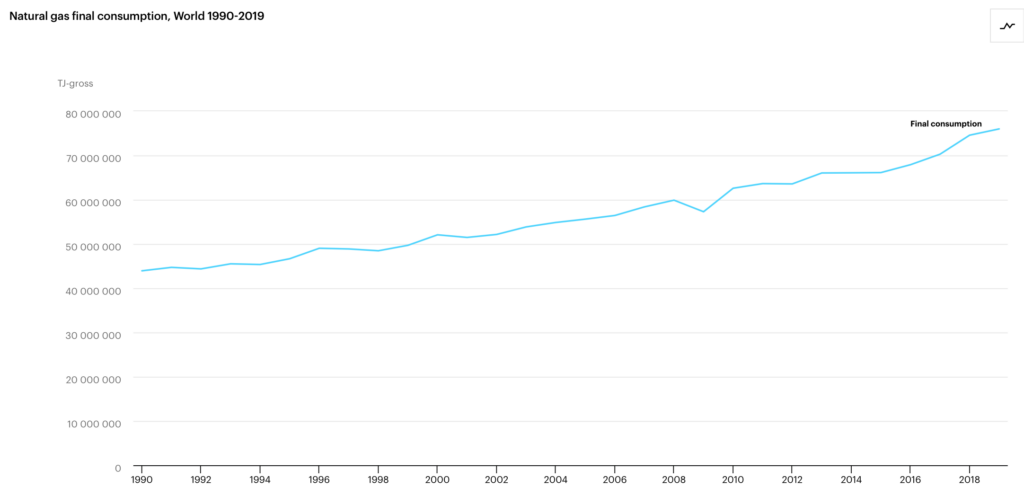

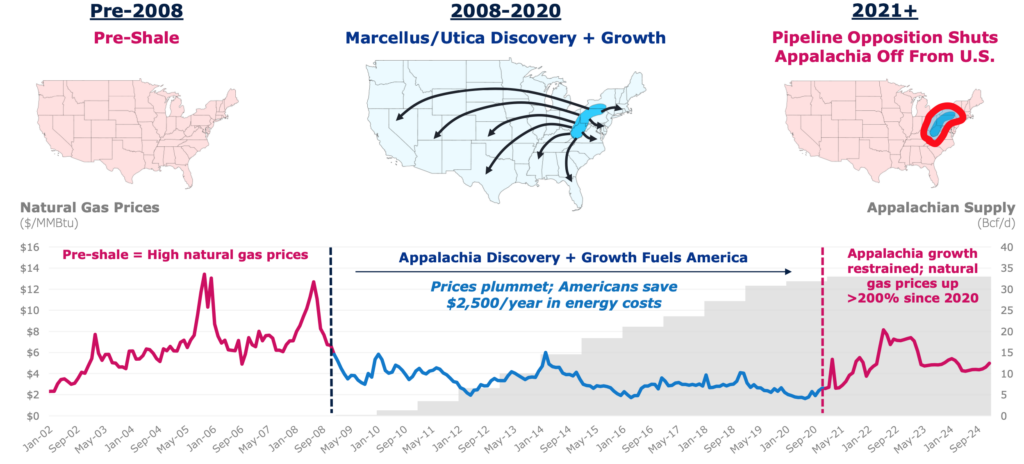

The market anticipates future levels – and that’s what drives current prices. Sometimes, technology may come into play. One example is ‘shale gas’ – a form of natural gas (methane) found in shale rocks. The last decade saw a steady supply of shale gas in the market. This factor alone caused natural gas prices to stay subdued for years, as depicted in the chart below:

Source: EQT Corp

Technicals and psychology

The next set of important factors impacting natural gas prices are technicals. By technicals we mean:

- Chart formations

- Indicators – eg moving averages

- Important levels and trends

Of course, not every investor will subscribe to charting techniques. Many view indicators as ‘voodoo’ economics. However, there are a few things worth re-capping about charts and their significance in the financial market.

One is the role of self-fulfilling expectations. For example, upon a strong rally above $3.80 – eg, a level not seen for many quarters – many traders will buy natural gas contracts simply because prices have rallied above a referenced ceiling. The breakout creates additional demand regardless of the fundamentals.

Two, price trends will tell investors instantly whether demand is strong or weak. A very strong market may lead to an exuberant buying of natural gas. There are many ‘trend-following’ funds in the market that buy when the trend is bullish and sell when the trend is bearish. This creates lasting momentum beyond any fundamental news.

Lastly, it is worth remembering that market participants drive prices. And market participants are subject to strong emotions. Traders can be irrational at times because of fear and greed. These will create wild swings in natural gas prices.

Natural Gas Trading Tips & Strategy

One, before risking hard-earned capital trading natural gas, you must have a clear plan of how to trade the commodity. Spell out the strategy of when to buy the commodity, how much, and what to do if the position slips into a loss or hits a profit target. Having a rough plan is better than no plan at all.

Two, do not over-trade the market – unless you are experienced with the contract and price behaviour. Over-leverage is a deadly sin that even veterans fall into. In 2006, Brian Hunter’s oversized position in natural gas caused a multi-billion loss in Amaranth Advisors as prices went against him.

Three, keep tabs on macro instruments too, such as the Dollar (since it affects the pricing of natural gas), energy sectors (spillovers effect), and the general market sentiment (‘risk on, risk off’).

Four, be aware that natural gas prices are ‘mean reverting’ – unlike stock prices where a company can grow 50x over time (eg Apple). Look at this long-term chart of natural gas – there is a clear ceiling. Spikes are common too. The natural gas market becomes exuberant and bearish over a short period of time.

Five, do not go against the market unless you have very deep pockets to sustain the position. An overbought trend can become overbought; whilst an oversold decline could become even more oversold in the near term.

⚠️ FCA Regulation

All nat gas trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK natural gas brokers platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature natural gas trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Natural Gas Trading Platform FAQs:

In the US, the Henry Hub natural gas future trades:

- Chicago 17:00 – 04:00 Sunday to Friday (Central time)

- New York 18:00 – 05:00 Sunday to Friday (Eastern time)

And in London:

- London 23:00 – 10:00 Sunday to Friday (UK time)

There are a few ways to trade natural gas.

- The first is directional. You open positions in, say, November contract in the summer hoping that prices will rally into the year end.

- Some traders prefer using reversionary tactics, buying at range lows and selling at range highs.

- There are others who trade spreads – buying a near-month contract and selling a far-month contract and vice versa.

Each strategy has its own strength and weakness. As a trader, you will need to be comfortable using the strategy.

Nat gas swing trading is a trading strategy designed to exploit price swings. Natural gas prices are notoriously volatile – even before the disruption caused by Russia’s invasion of Ukraine. Astute traders will use technical oscillators to measure overbought/oversold trends and open positions in anticipation of a modest price trend emerging.

Yes. You can short natural gas through futures, options, spread betting and CFD trading to potentially profit from price falls as well as increases.

- Further reading – what is short selling?

There are natural gas data produced by governments or agencies. One of them is called inventories/storage data. In the US, the Energy Information Administration (EIA) produces the Natural Gas Storage report that measures the weekly change in the number of cubic feet of natural gas held in underground storage. Some traders use this report to trade natural gas.

In most natural gas future contract, the specification is measured in MMBtu – which stands for Metric Million British Thermal Unit. A BTU measures the energy content of gas and equals the amount of heat required to raise the temperature of a pound of liquid water by 1 °F.

Yes. As with all financial markets if you call the market correctly you can make money. However, natural gas is one of the most volatile commodities and therefore one of the hardest to make money from on a regular basis because of the unpredictability of it’s price.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the natural gas brokers via a non-affiliate link, you can view their nat gas trading pages directly here: