Options brokers offer options trading platforms that enable traders to hedge and speculate on the price of financial markets through buying or selling puts or calls. There are two types of options broker, DMA options brokers, which connect their clients directly to exchange to buy and sell options and OTC options brokers, where you can trade options as a CFD or spread bet. We have tested, compared, ranked and reviewed the options brokers in the UK that are regulated by the FCA.

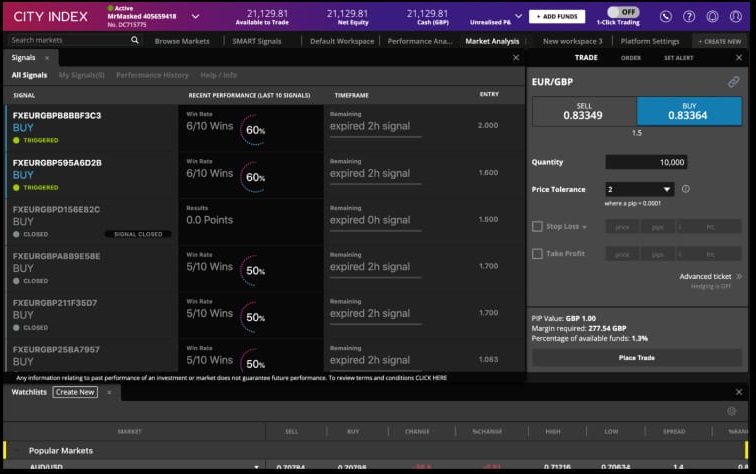

City Index: Best options broker for spread betting and CFDs

🏆Award Winner🏆

- Options markets available: 40+

- Options costs: OTC (built into the spread)

- Minimum deposit: £100

- Account types: CFDs & spread betting

- GMG rating: (4)

- Customer rating: 3.6/5 (86 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

City Index Options Trading Review

Name: City Index Options Trading

Description: City Index offer options trading via spread bets and CFDs, the benefit of the course of trading options as a spread bet for UK customers is that profits are free from capital gains tax. Phone trading is one feature that sets City Index apart from other retail options brokers. They provide personal service and can assist with complex options execution strategies.

70% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Options markets available: 40+

- Options costs: OTC (built into the spread)

- Minimum deposit: £100

- Account types: CFDs & spread betting

Pros

- Smart Signals

- Performance analytics

- Easy to use options trading platform

Cons

- No US customers

- No DMA options

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4Interactive Brokers: Best options trading platform overall

- Options markets available: 10,000

- Options costs: from £0.6 per contract

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- GMG rating: (4.2)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

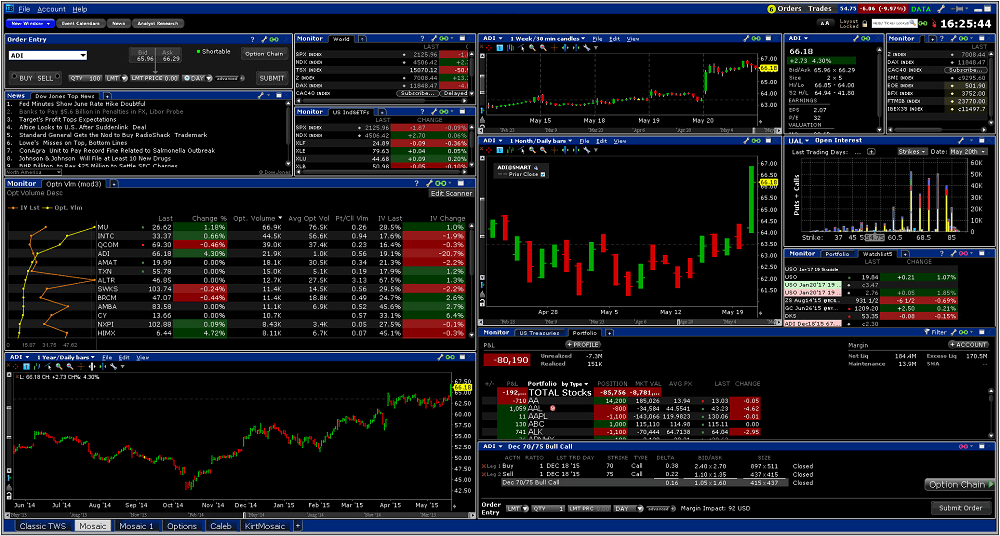

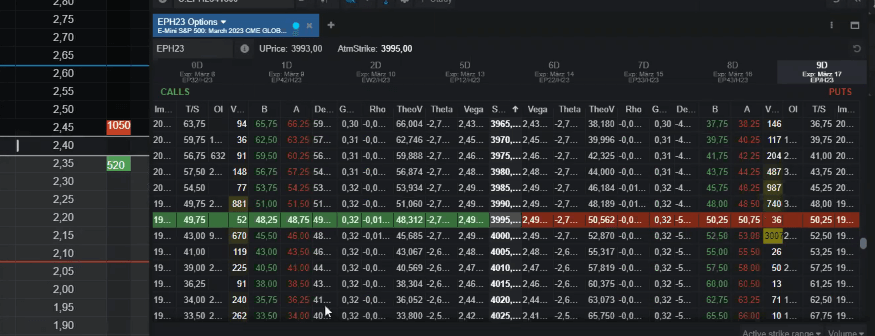

Interactive Brokers Options Trading Review

Name: Interactive Brokers Options Trading

Description: IBKR offers one of the most, if not the most advanced options trading platform for private clients, both for derivatives markets (indices, commodities and forex) and stocks and shares. They provide access to a huge amount of UK and international stock options, but where they really win business is by their execution capabilities.

60% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Options markets available: 10,000

- Options costs: from £0.6 per contract

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

Pros

- Widest range of options to trade

- Online options strategy execution

- Excellent options trading platform

Cons

- No tax free options spread betting

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

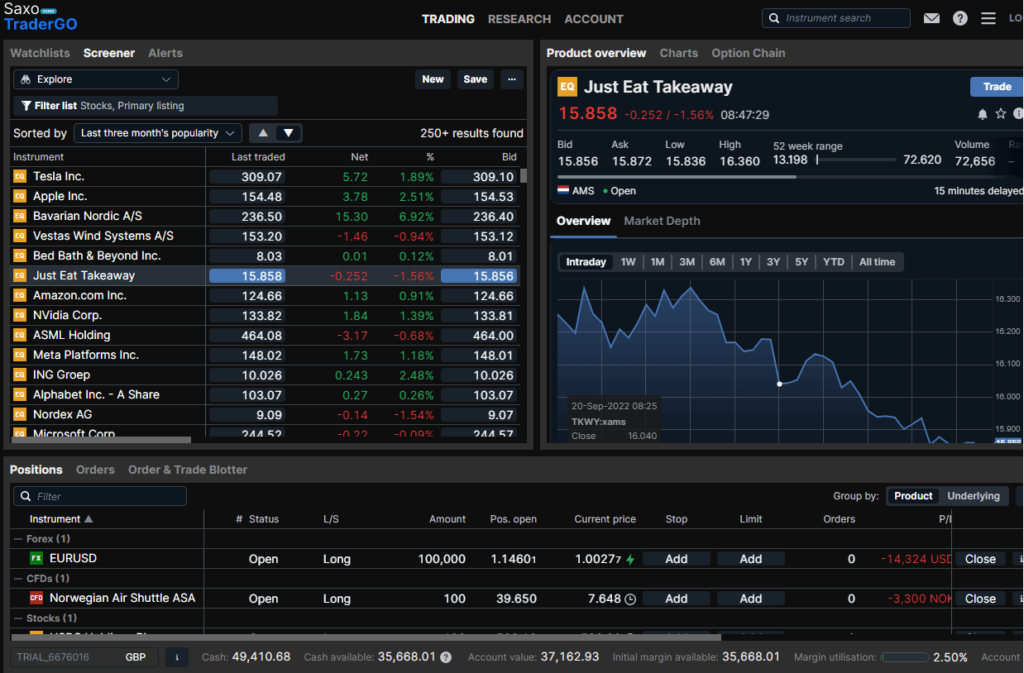

4.2Saxo Markets: Best for on-exchange stock options trading

- Options markets available: 1,200

- Options costs: From £1 per contract

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- GMG rating: (4)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets Options Trading Review

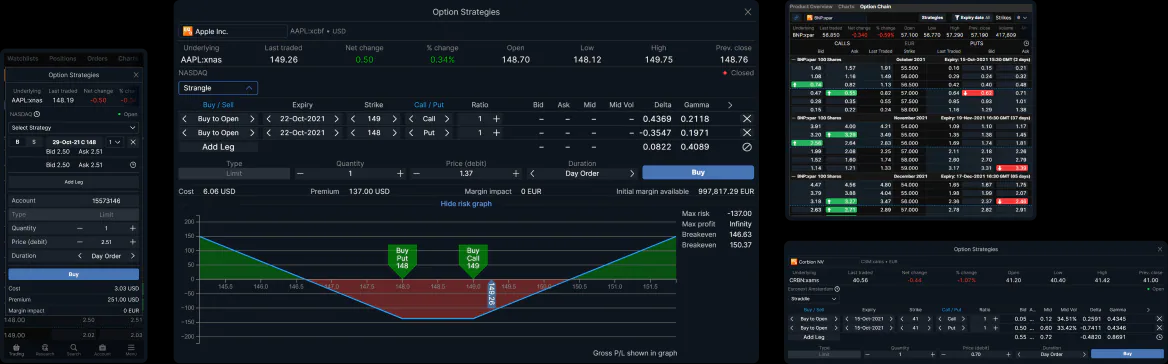

Name: Saxo Markets Options Trading

Description: Saxo is one of the better value brokers for larger traders where you can trade stock options from USD 0.85, EUR 1 or GBP 1. Saxo Markets provides access to 1,200+ listed options from 23 exchanges worldwide, across equities, indices, interest rates, energy, and metals.

64% of retail investor accounts lose money when trading CFDs with this provider

Summary

- Options markets available: 1,200

- Options costs: From £1 per contract

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

Pros

- Excellent options chain boards

- DMA on-exchange options trading

- Good research and analysis

Cons

- No tax efficient options spread betting

- High minimum deposit

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

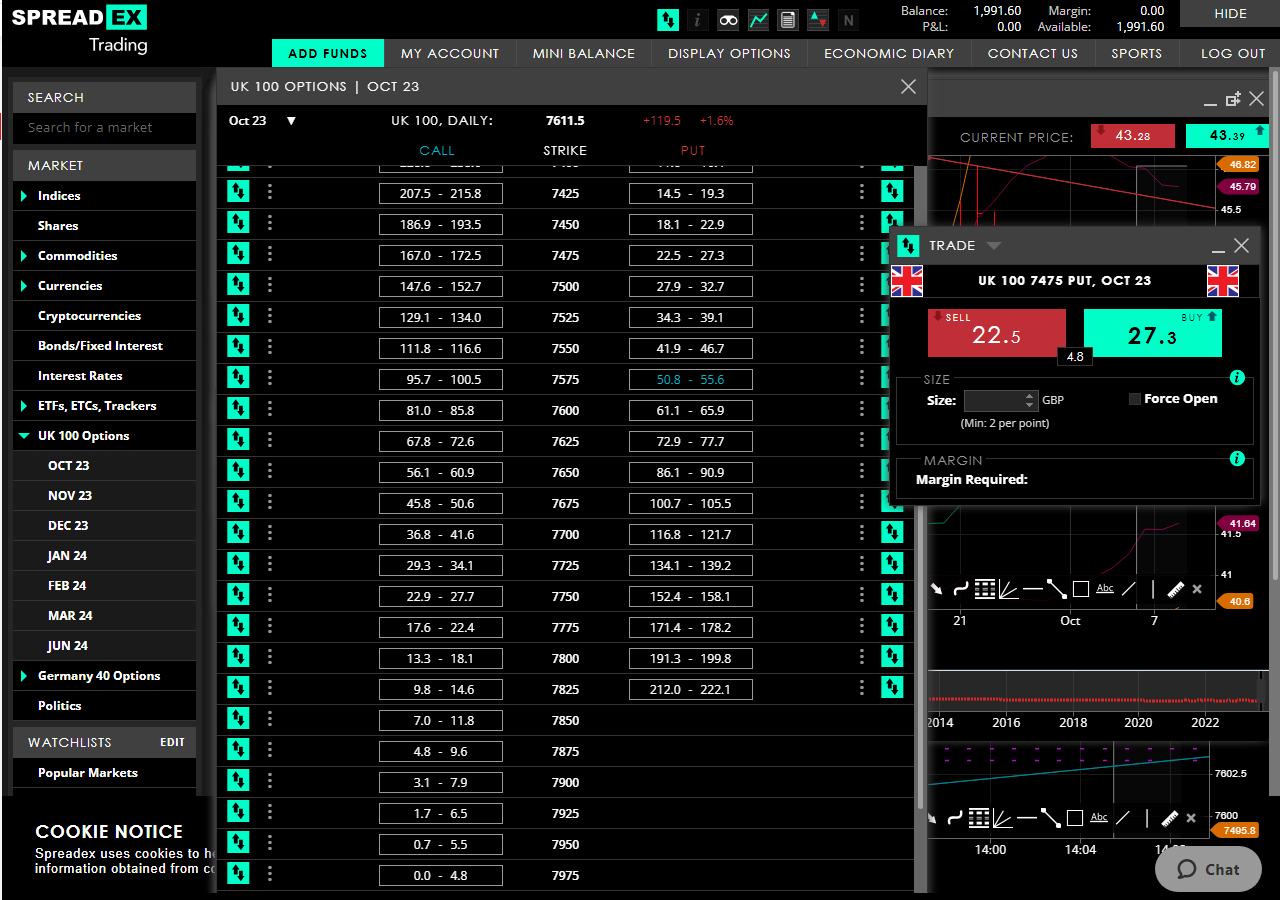

4Spreadex: Good for CFD options on major indices

- Options markets available: 5+

- Options costs: OTC (built into the spread)

- Minimum deposit: £1

- Account types: CFDs, spread betting

- GMG rating: (4)

- Customer rating: 4.2/5 (177 reviews)

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Options Trading Review

Name: Spreadex Options Trading

Description: With Spreadex you can trade options as a CFD of spread bet and spreads for UK 100 and Germany 30 start from 4 points with a minimum stake of £2. Whilst you are limited on what you can trade online, Spreadex will let you trade options on the major markets.

72% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Options markets available: 5+

- Options costs: OTC (built into the spread)

- Minimum deposit: £1

- Account types: CFDs, spread betting

Pros

- Simple to use platform

- UK based

- Options trading via spread bets

Cons

- Limited options on indices

- No equity options

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4IG: Widest range of options for CFDs and spread betting

- Options markets available: 50+

- Options costs: OTC (built into the spread)

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- GMG rating: (4)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

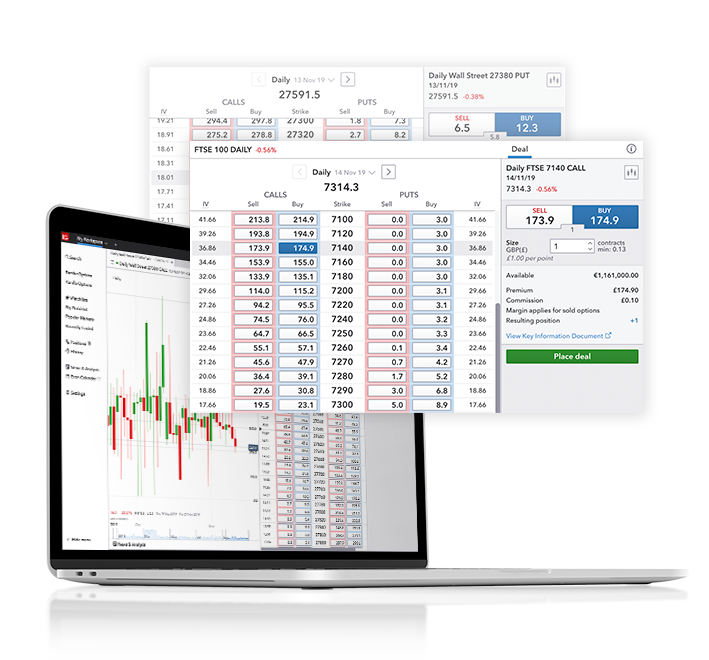

IG Options Trading Review

Name: IG Options Trading

Description: IG offers options trading via financial spread betting or CFDs as daily, weekly, monthly and quarterly markets. If you have a professional account, you can trade short-term limited-risk options as well, with time-frames as low as 1 minute.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Options markets available: 50+

- Options costs: OTC (built into the spread)

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

Pros

- Options spread betting

- Wide range of other markets

- Publically listed company

Cons

- Limited equity options online

- No DMA options trading

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Tickmill: Options trading on CQG

- Options markets available: 10+

- Options costs: $1.30 per contract

- Minimum deposit: £1,000

- Account types: DMA

- GMG rating: (4)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Options Trading Review

Name: Tickmill Options Trading

Description: Tickmill offers options trading on CQG, which they have set up with specific options trading screens. They have a particularly helpful strategy builder that lets you set up options strategies loke condor spreads with the click of a button.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Options markets available: 10+

- Options costs: $1.30 per contract

- Minimum deposit: £1,000

- Account types: DMA

Pros

- Options strategy builder

- CQG options trading platform

- DMA options trading

Cons

- Limited options market range

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

3.9❓Methodology: We have chosen what we think are the best options trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the options trading platforms with real money

- an in-depth comparison of the features that make the options broker stand out compared to alternatives.

- interviews with the options trading platform CEOs and senior management

Compare Options Trading Platforms

Use our comparison table of what we think are the best options brokers to compare how many options markets are available, minimum deposits and what other types of accounts they offer.

| Options Trading Platform | Options Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 40+ | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 10,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 50+ | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 5+ | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 10+ | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 40+ | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. |

Beginners

Saxo Markets is the best options trading platform for beginners based on our matrix and criteria.

It’s important that if you are a complete beginner to investing, you should accept that options may not be for you. However, you can use the below comparison table to see which options trading platforms offer beginner-friendly features.

| Beginner Features: |  |  |  |

|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ |

| Seminars | ❌ | ✔️ | ✔️ |

| Leverage Control | ❌ | ❌ | ❌ |

| Low-Risk Products | ✔️ | ✔️ | ❌ |

| Investment Account | ✔️ | ✔️ | ❌ |

| Mini Contracts | ✔️ | ✔️ | ✔️ |

| Micro Contracts | ✔️ | ✔️ | ✔️ |

Options can be quite simple and quite complex, and in many cases, there is the risk of losing your entire premium. If you do not fully understand the risks involved in options trading an options broker should not allow you to open an options trading account.

So, if you are a beginner options trader and looking for a platform, make sure you have significant experience in trading and investing. And most importantly, make sure your broker understands that you are a beginner to options trading.

Many options brokers can provide advice on strategy and execution (although not on what to buy or sell). Options brokers also understand the market well, so don’t be afraid to trade over the phone to make sure that you explain exactly what you want to do.

For beginners, it may be more appropriate to trade options where you are limited to buying equity options and have your risk limited to the premium you pay for an option.

Advanced & Professional Traders

Interactive Brokers is the best options broker for sophisticated investors as it offers DMA on exchange options, and robust trading platform as well as CFD option products with algo and API trading. You can compare which options trading platforms offer these in the comparison table below.

| Advanced Features: |  |  |  |

|---|---|---|---|

| Voice Brokerage | ❌ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ |

| Level-2 | ✔️ | ✔️ | ✔️ |

| Algo Trading | ✔️ | ✔️ | ✔️ |

| Prime Brokerage | ✔️ | ✔️ | ❌ |

For experienced traders, it would be more appropriate to trade on exchange options with a DMA broker, where you can work bid/offers inside the spread as well as utilise strategies for more complex options trading.

Equity Options (Stocks & Shares)

In the UK Saxo Markets is the best options broker for buying stock options as they provide access to 26 exchanges and fees per options contract are as low as $1.25 on FTSE 250 and NASDAQ stocks. Interactive Brokers, does offer cheaper charges on US option contracts, however, Saxo has more of a base in the UK.

You can trade options on most large-cap shares listed on the London Stock Exchange. The smaller the market cap of a listed company, the less likely there will be liquidity or a market maker making prices for smaller-cap shares.

Indices

Saxo Markets is the best options broker for trading index options in the UK as based on our matrix, they offer more index options trading types than any other broker including DMA index options and CFD options on indices.

Forex

Saxo Markets is the best forex options broker as they have one of the widest range of currency pairs to trade options on a DMA and CFD basis.

Commodities

Saxo Markets is the best commodity options broker as they offer DMA and CFD options on commodity markets. Other brokers like IG do offer commodities options, but the range of commodities to trade them on is small and they can only be executed as a CFD.

⚠️ FCA Regulation

All online options trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK options platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature options brokers that are regulated by the FCA, where your funds are protected by the FSCS.

Options Trading Platform FAQs:

If you are looking for a broker to trade options and want to compare options trading brokers in the UK, here are the main things to look out for:

- Types of options offered – does a broker offer DMA and/or OTC options?

- Costs of options trading – how much does it cost to trade options?

- Market access – what stocks, indices, commodities, and currency pairs can you trade?

- Dealer experience – are they capable of helping with strategy creation and execution?

All options brokers regulated by the FCA are listed on the FCA register. We also only include brokers in our options broker comparison table that are regulated by the FCA. Whether a broker is offering OTC or DMA options trading, they need to be regulated by the FCA. Any broker claiming to offer options trading that the FCA does not regulate is breaking the law and may well be a scam.

US traders are not allowed to trade on leverage through products like CFDs of financial spread betting. There is some form of margin trading permitted through margin loans and ETFs. If a US trader wants to increase their leverage on a position, options are one of the only ways to do it. In the UK, margin trading is readily accessible, so options markets are not as liquid and are therefore more expensive.

There are two types of spread when trading options which need to be considered when using an options broker:

- Options spread strategies – this is the name of an options strategy, the most common being straddles, strangles, condors and butterflies. Some of these can be traded online, but the majority need to be traded over the phone with a dealer. The better relationships your dealers have with market makers, the better the price of your spreads will be.

- OTC bid-offer spreads – unlike DMA options trading where you are charged a commission per lot, if you are trading OTC options via a CFD or spread bet, the commission will be built into the premium (also known as the bid-offer spread).

Saxo Markest offers the most types of options trading as you can trade options as a CFD or on-exchange on a huge range of stocks, indices, commodities and forex pairs. However, Saxo Markets does not offer options spread betting. IG, currently offers 50 markets for options trading as a spread bet or CFD.

All options trading except for financial spread betting is subject to capital gains tax. Financial spread betting is unique to the UK and is free of capital gains tax as trades are structured as a bet. However, it is important to speak to an independent financial advisor or tax specialist as tax can be different based on individual circumstances and is subject to change.

US residents are only allowed to trade options with a US-regulated options broker. UK brokers will not open an account for a US resident.

Yes, you can if you call the market right. Options are a tool for investing or trading and there is an opportunity to make a profit and lose money. As with all investing, you can make money trading options if you call the market correctly, but in equal measure, you can lose it. Relative to other forms of investing, options trading should be considered high risk and only suitable for experienced and sophisticated investors.

They offer both, the options contract and exchange are what determine whether an option is classified as American or European. American options can be exercised at any time whereas European options can only be exercised on expiry.

To start trading options you need to have the below:

- An account with an options broker

- Funds to trade with

- An idea of how much risk you want to take

- A full understanding of the risks and rewards of trading options

The first thing you need is a broker that offers access to the type of options you want to trade. You can compare options brokers in our options broker comparison table. All the brokers we feature are regulated by the FCA and offer access to on-exchange and OTC options. It’s important to remember that whilst options trading can be a good way to hedge exposure they can also be a very high risk form of speculation so make sure you fully understand the risks before you start trading options.

The most popular markets for options trading include stock indices and individual stocks, commodities such as gold and oil and trading options over ETFs is becoming more commonplace as well. The volatility seen in the markets during 2020 heightened interest in option trading and strategies and the volumes and values of options trading have picked up significantly because of that. Studies show that traders are increasingly attracted to weekly options and are using these short-term instruments to try and capture the momentum of US markets in particular.

Further reading: These are the most popular markets for online trading.

Yes, you can trade options in the UK. You need an options broker that is regulated by the FCA.

You can trade options through an options broker. Options trade on exchange or OTC for example UK single stock options trade on what was the LIFFE exchange now owned by the ICE or intercontinental exchange. FX Options on the other hand almost exclusively trade off-exchange or OTC. Your choice trading method and venue will be influenced by what you want to achieve with your options trading. Some brokers will offer you the ability to trade on exchange options whilst others will make options process to as either CFD or Spread Betting contracts however these will not be exercisable into the underlying assets the options are over. But if that’s not important to you then you may be better off trading with a margin trading broker who may allow you to trade in fractions of a lot which you couldn’t do on exchange.

Options are considered to be complex products so a retail trader will need to demonstrate their understanding of the risks involved in trading them of course their suitability tests for all derivative trading accounts these days. But live options trading is certainly not for novices or inexperienced investors. Particularly if you are going to be doing anything other than buying puts or calls.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the options brokers via a non-affiliate link, you can view their options trading pages directly here: