Demo trading accounts are a great way to test a broker’s platform and experiment with trading strategies with virtual money. We have tested, ranked and reviewed what we think are the best demo trading accounts in the UK to help you choose the right broker for testing your trading.

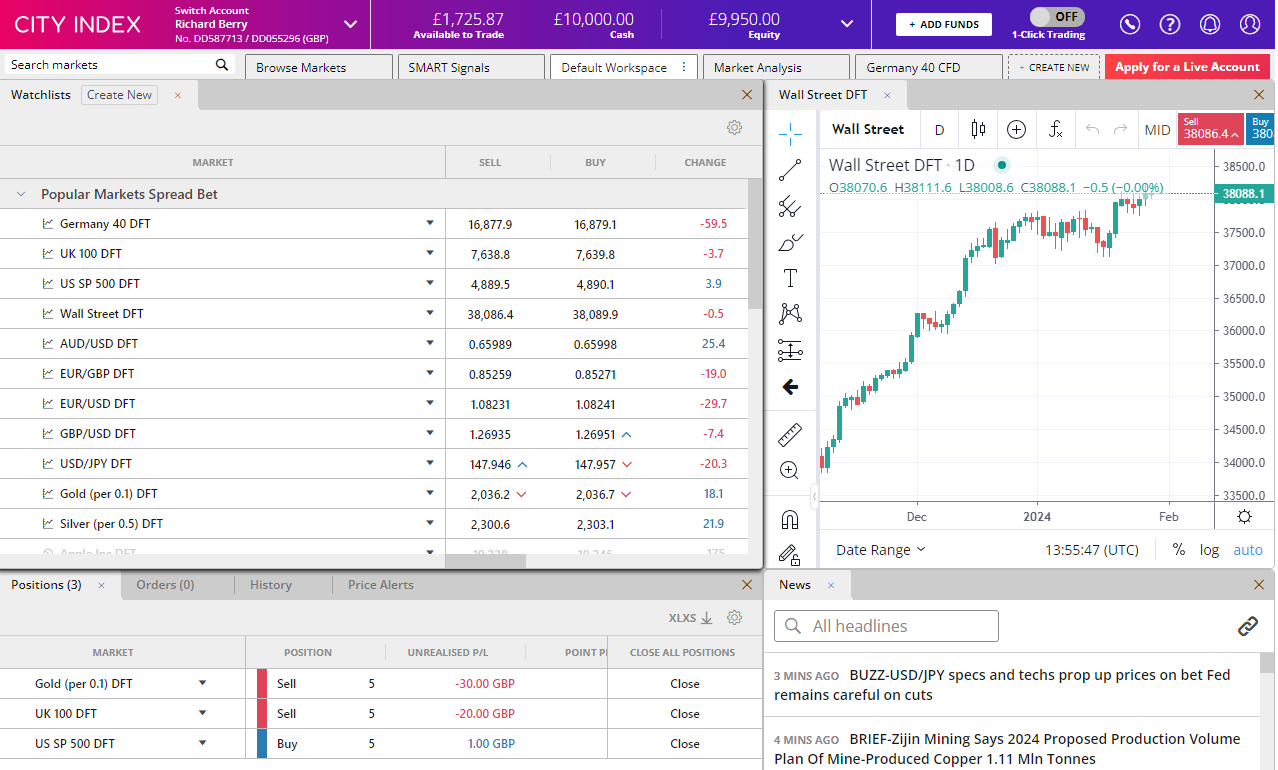

City Index: Best Demo Account For Trading Signals

🏆Award Winner🏆

- Virtual Balance: £10,000

- Length: 12 weeks

- Markets: 13,500

- GMG rating: (4.3)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Demo Account Review

Name: City Index Demo

Description: City Index’s demo account lets you trade for 12 weeks with a virtual balance of £10,000 on all the 13,500 markets that are available on the live trading platform.

69% of retail investor accounts lose money when trading CFDs with this provider

Is City Index's demo any good?

City Index have one of the best demo trading accounts on offer as it is essentially a carbon copy of their live trading platform, which includes trading signals, performance analytics and access to the same broad range of tradable assets.

Pros

- Full demo platform

- All the main features

- Lots of markets to trade

- 12 weeks use

Cons

- Limited options markets

- Some demos offer more virtual funds

- Has a time limit

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

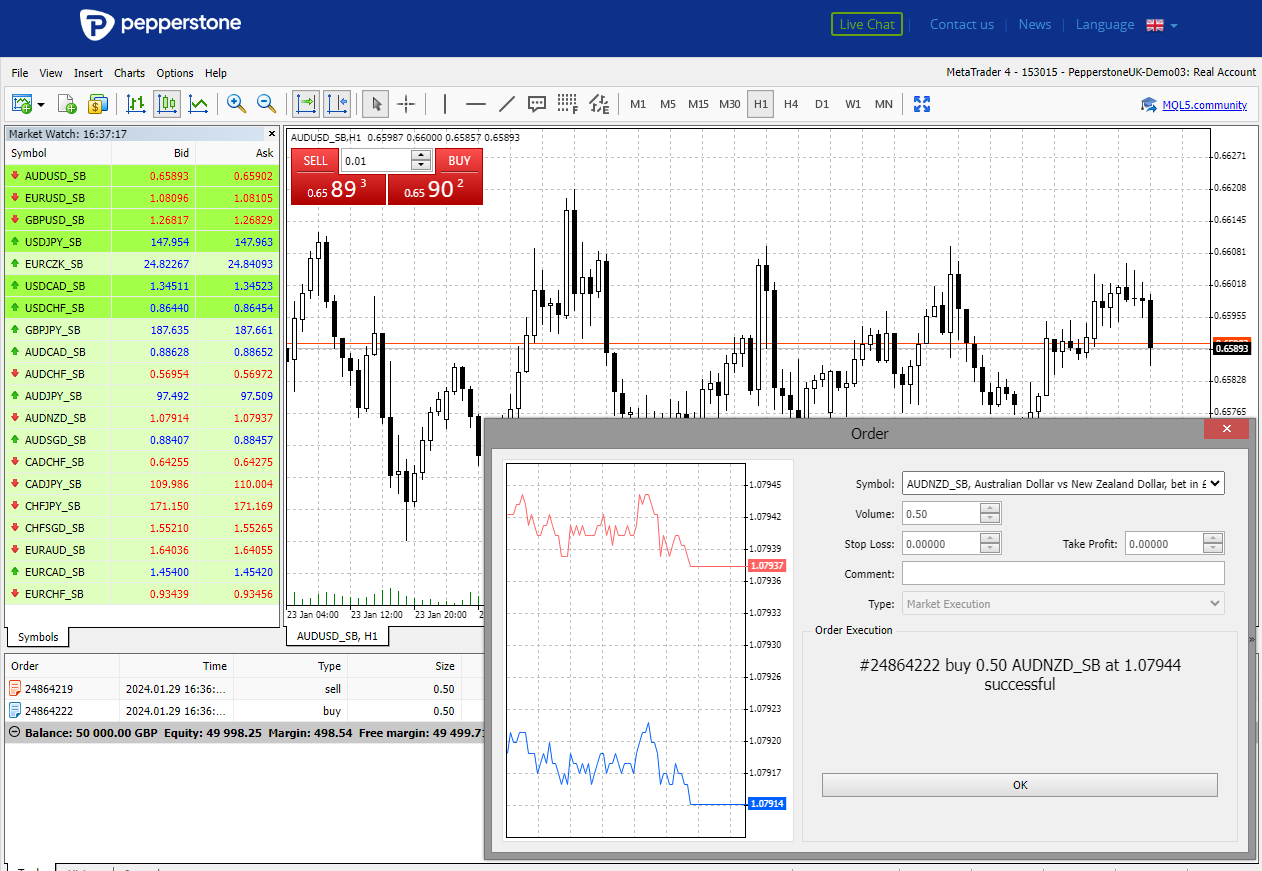

4.3Pepperstone: Best Demo Account For MT4 & MT5 Traders

- Virtual Balance: £200-50k

- Length: 60 days

- Markets: 20

- GMG rating: (3)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Demo Account Review

Name: Pepperstone Demo

Description: Pepperstone’s demo account gives you a balance of up to £50k to test MT4 for 60 days with access to 20 major forex pairs. 75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone's demo account any good?

Pepperstone’s demo account isn’t that great compared to their live trading platform. Yes, you can trial the standard, Razor or spread betting demo, you can also choose how much you want to trade with from £200 to £50,000. But, you only get access to a handful of forex pairs (no commodities, stocks or indices) and you can’t set your own leverage, something you can do with other MT4 demo accounts. It’s a real shame, because the live MT4/5 account from Pepperstone is excellent, it has won “best MT4 broker” in our awards many times, but the demo really lets them down. You also don’t get access to any of the indicators, or research that you do with the main account.

Pros

- Tight pricing

- Set your own virtual funds

- MT4 web and app version

Cons

- Limited market range

- No indicators

- Cannot set your own leverage

-

Pricing

(5)

-

Market Access

(1)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(1)

Overall

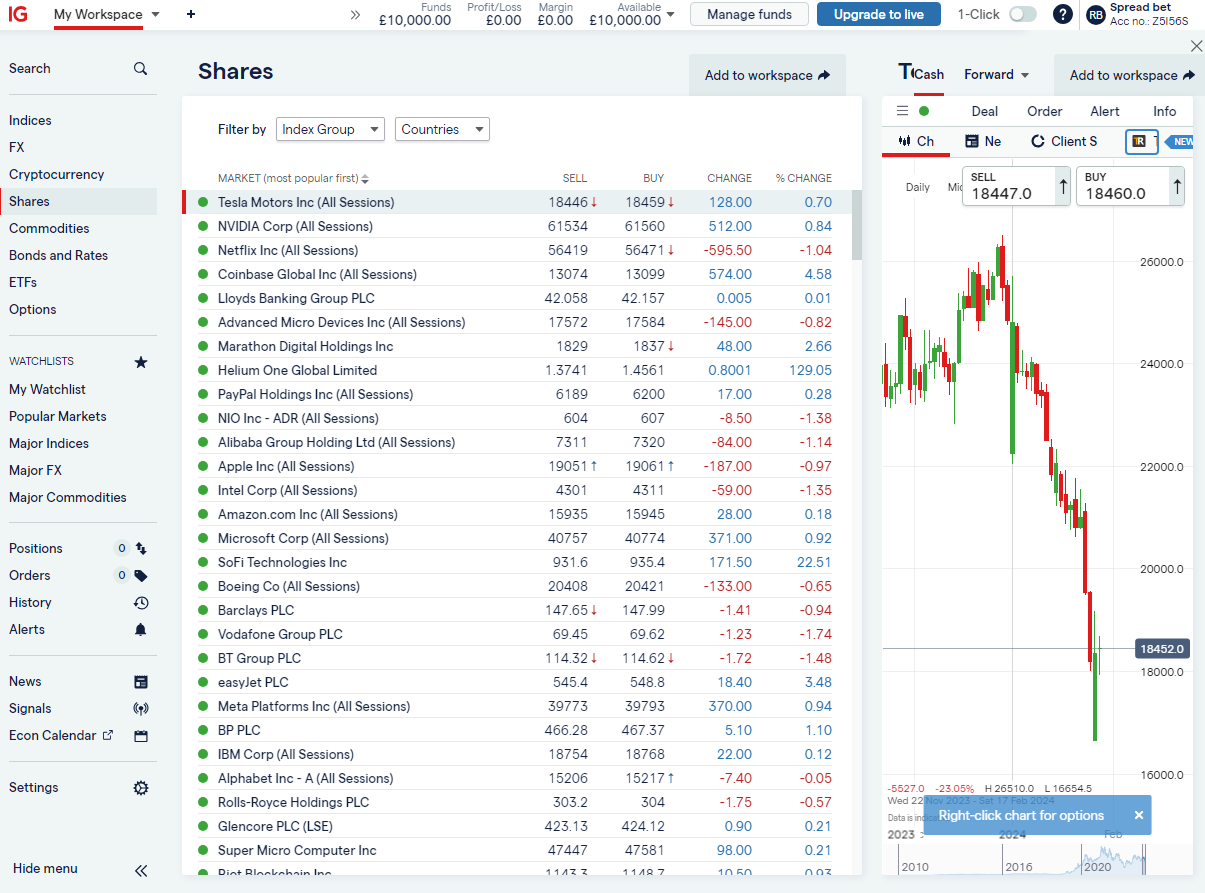

3IG: Best Demo Account For Spread Betting

- Virtual Balance: £10,000

- Length: No limit

- Markets: 17,000

- GMG rating: (4.7)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Demo Account Review

Is IG's demo account any good?

IG’s demo account is excellent as it mirrors the pricing and features of its live platform. You get access to a £10k account for both spread betting and CFDs (so £20k in total), which means you can explore the difference in execution and trade order styles. Plus you get access to their news, trading signals and research without having to deposit funds.

Pros

- Huge range of markets to trade

- Signals, news and research

- Does not expire

Cons

- Can’t see commissions on investing

- No DMA demo account

- No client sentiment data

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

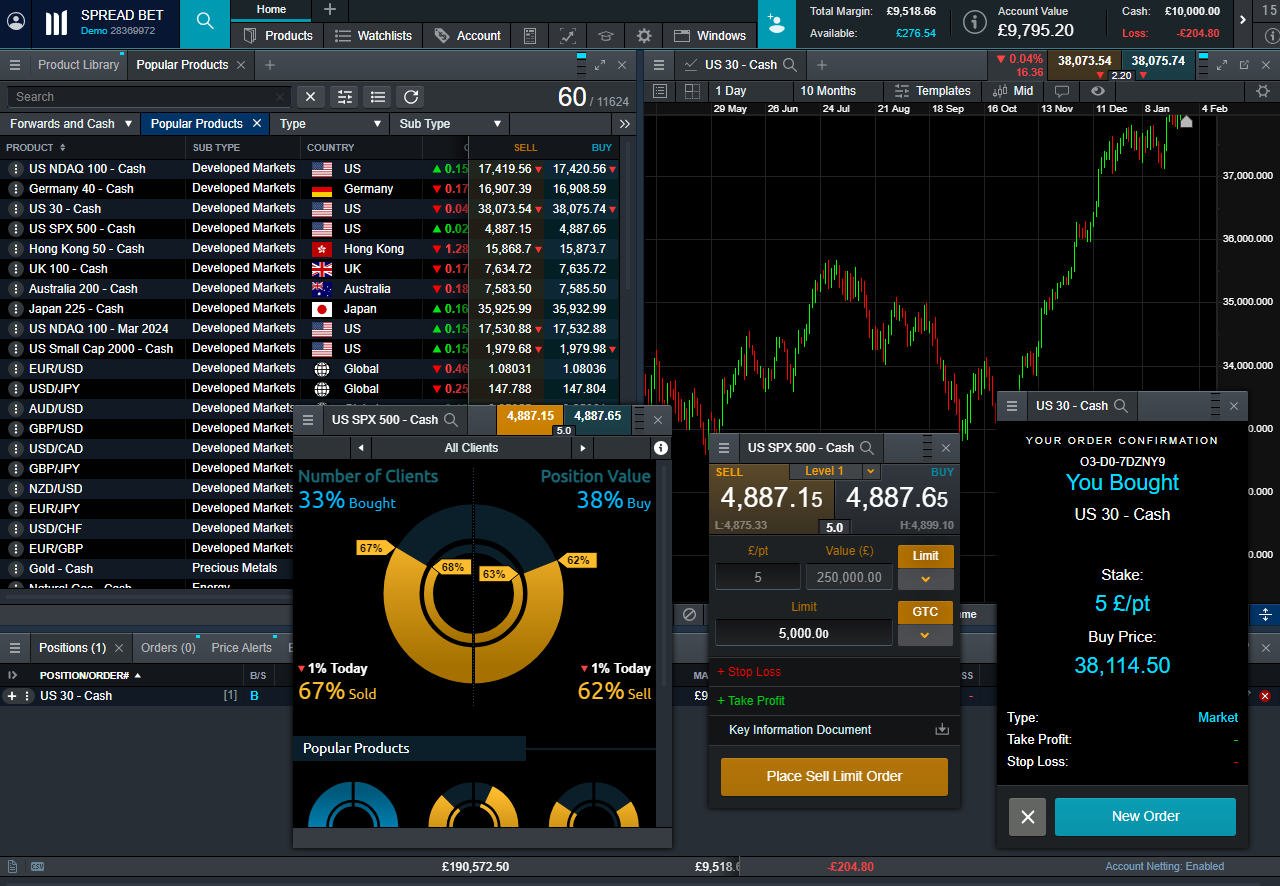

4.7CMC Markets: Best Demo Account For Client Sentiment

- Virtual Balance: £10,000

- Length: No limit

- Markets: 12,000

- GMG rating: (4.6)

- Customer rating: 3.6/5 (107 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Demo Account Review

Name: CMC Markets Demo

Description: CMC Markets demo lets you trade on over 12,000 markets with a virtual and risk free £10,000 with no time limit.

67% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets demo any good?

CMC Markets’ demo is about as good as demo accounts can get. It offers all the main functionality of their live trading platform, including the excellent client sentiment tool, that allows you to see what profitable traders are long or short of.

Pros

- Full access

- Client sentiment indicators

- Full functionality

Cons

- No options trading

- No DMA

- No investing

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

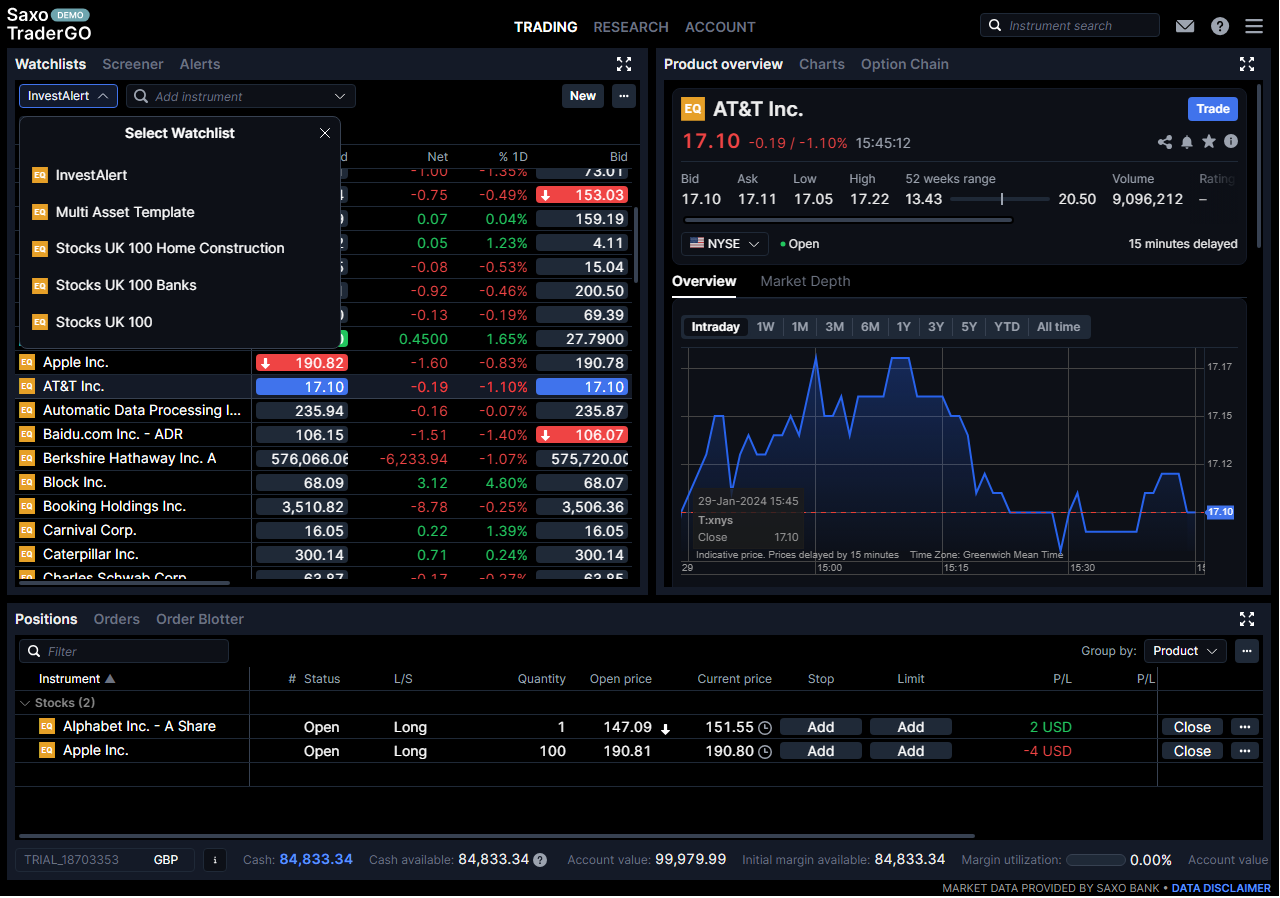

4.6Saxo: Best Demo Account For CFDs

- Virtual Balance: $100,000

- Length: 20 days

- Markets: 1,000+

- GMG rating: (3.4)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Bank Demo Account Review

Name: Saxo Markets Demo

Description: Saxo’s demo account lets you trade with $100,00 virtual funds on around 1,000 physical stocks, CFDs and forex pairs for 20 days.

64% of retail investor accounts lose money when trading CFDs with this provider

Is Saxo's demo account any good?

Saxo’s demo account is hit-and-miss. The real, live platform is institutional grade with most things, most traders could want. But, the Saxo demo is a bit of a letdown. It’s great for functionality and getting a glimpse at the look and feel, but the market range is limited. For instance, you cannot trade indices or commodities (as far as I could tell when testing it). Also, when you first open it up you only have access to around 150 stocks, I had to go into the research tab to enable forex and CFDs. Plus, pricing is delayed (which it also is on the main platform), but it would be better to give potential customers some betting insight into this epic platform, than what is currently on show.

Pros

- Excellent platform

- High virtual balance

- Full functionality

Cons

- No indices

- No commodities

- Delayed pricing

-

Pricing

(4.5)

-

Market Access

(3)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

Overall

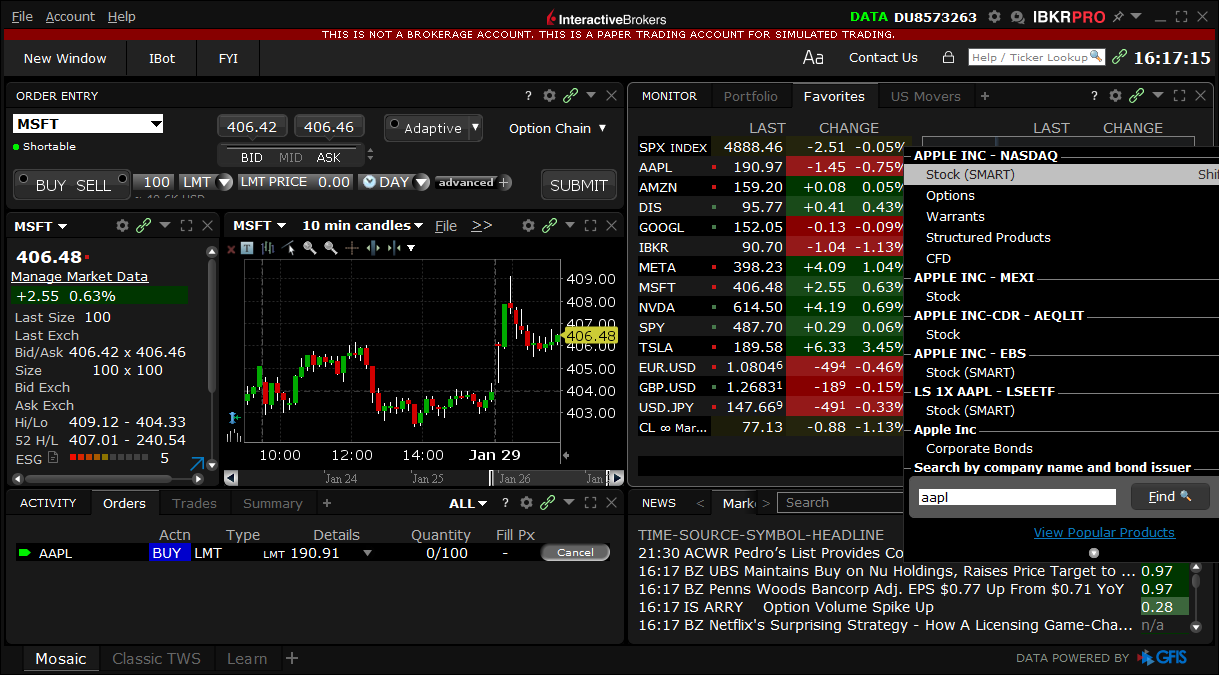

3.4Interactive Brokers: Best Demo Account For Sophisticated Traders

- Virtual Balance: $1m

- Length: No limit

- Markets: 7,000

- GMG rating: (4.4)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Demo Account Review

Name: IBKR Paper Trading

Description: Interactive Brokers’ demo account gives you $1m to paper trade with on over 7,000 markets with no time limit. 62.5% of retail investor accounts lose money when trading CFDs with this provider

Is Interactive Brokers demo account any good?

The downloadable IBKR Workstation demo is excellent. The portal version I gave up on fairly quickly. That’s the problem with demo accounts. They only have a few minutes to capture your attention and the easiest one to access through IBKR is also the worst. The web-based portal has very limited functionality and you can only see stocks. If you want to trade indices, forex or commodities you can’t get any pricing. Far better is the downloadable IBKR Workstation, an absolutely epic trading platform that high-frequency trading hedge funds use. If you have the patience to download and install the software, it is probably the best demo trading platform around.

Pros

- Workstation is excellent

- Lots of functionality

- Full range of markets

Cons

- Portal is very limited

- Hard to navigate

- Have to download software

-

Pricing

(4)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(3)

-

Research & Analysis

(5)

Overall

4.4eToro: Best Demo Account For Copy Trading

- Virtual Balance: $100,000

- Length: No limit

- Markets: 2,976

- GMG rating: (3.2)

- Customer rating: 3.4/5 (223 reviews)

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Demo Account Review

Name: eToro Demo

Description: eToro’ demo account claims to let you trade with $100k virtual money on nearly 3,000 markets with no time limit. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro's demo account any good?

I found it impossible to open a demo account with eToro and place some paper traders, so I can’t tell you if it’s any good I’m afraid. So, not being able to do something as simple as open a demo account when clicking on the button that says demo account, says all I want to say.

Pros

- Very popular

Cons

- Couldn’t open a demo account

-

Pricing

(3.5)

-

Market Access

(3.5)

-

Online Platform

(1)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

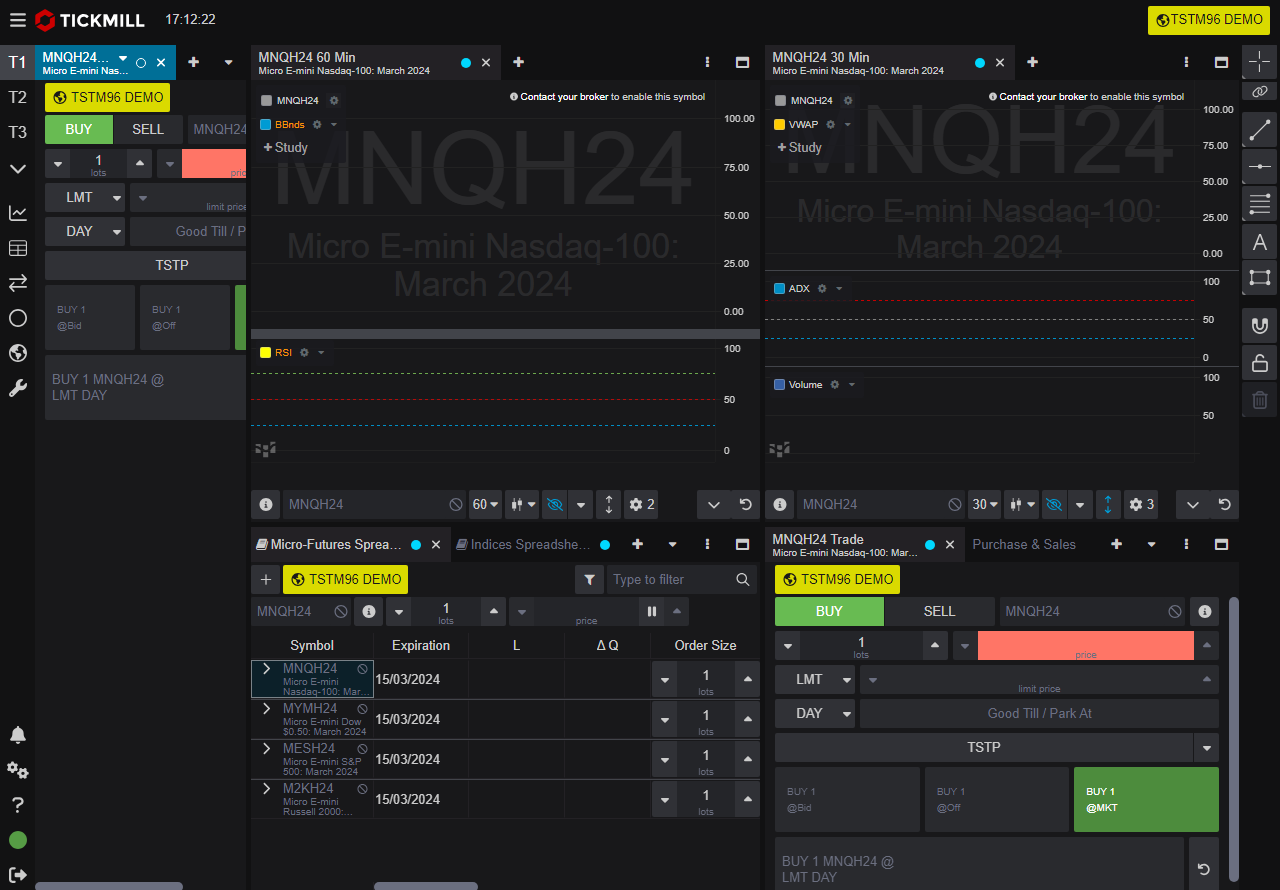

3.2Tickmill: Best For CQG Futures Trading

- Virtual Balance: £1-£1m

- Length: 30 days

- Markets: 578

- GMG rating: (3.3)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Demo Account Reviewed

Are Tickmill's demo accounts any good?

No, in a word. Which is a massive shame because both CQG and MT4 are both brilliant platforms, but for some reason Tickmill’s paper trading versions are hopeless. Firstly, I’ve already tested 7 other demo accounts today so I am not going through the rigmoral of trying to set up another MT4 even though you can set your own leverage and virtual balance. So when CQG figuratively spat in my face and refused to show off its brilliance I became even more tired and irritable. CQG is an amazing trading platform. Tickmill’s live version of it is one of the best around. If you are a high-frequency retail futures trader it gives you almost institutional capabilities. But the demo refused to do anything. In summary, if you want a Tickmill demo, don’t bother, just open a real account and see what it’s really about.

Pros

- MT4 for CFDs and forex

- CQG for futures

Cons

- CQG demo not functioning

-

Pricing

(4)

-

Market Access

(2)

-

Online Platform

(2)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

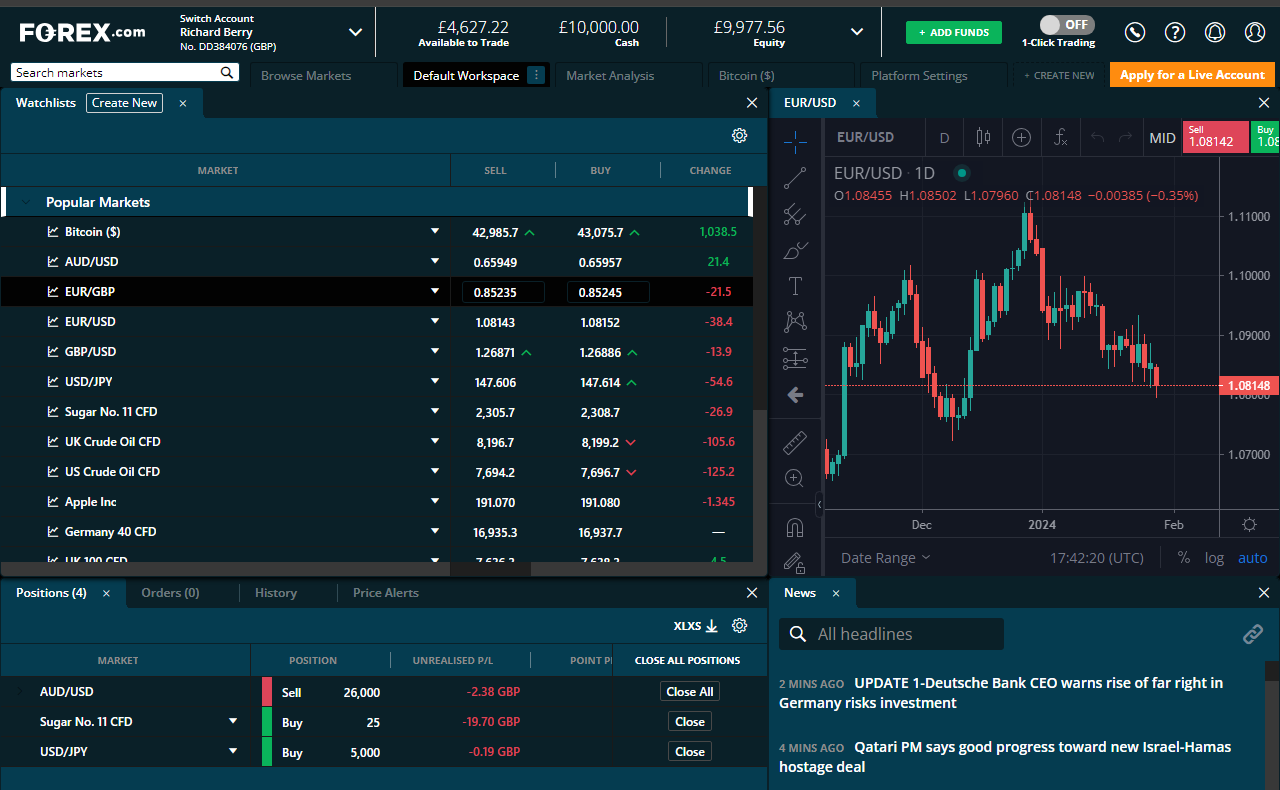

3.3Forex.com: Best Demo Account For Forex Trading

- Virtual Balance: £10,000

- Length: 12 weeks

- Markets: 13,500

- GMG rating: (4.2)

68% of retail investor accounts lose money when trading CFDs with this provider.

Forex.com Demo Account Review

Name: Forex.com Demo

Description: Forex.com’s demo account lets you trade with £10,000 in virtual funds on over 13,500 markets for 12 weeks. 68% of retail investor accounts lose money when trading CFDs with this provider.

Is the forex.com demo account any good?

If you are a budding forex trader and looking for somewhere to paper trade, then forex.com’s demo account is a good place to start. You get the same forex trading signals, post trade analytics and market access as you do with the live platform.

Pros

- Forex trading signals

- Post-trade analytics

- Focus on forex

Cons

- No forex options

- No forex DMA

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.2XTB: Best For Demo Account Ease Of Use

- Virtual Balance: $100,000

- Length: 30 days

- Markets: 2,100

- GMG rating: (4)

- Customer rating: 4.7/5 (117 reviews)

77% of retail investor accounts lose money when trading CFDs with this provider

XTB Demo Account Review

Is the XTB demo account any good?

I’ve always liked XTB, everything about them just works. Yes they may have removed my favourite feature ever (the ability to create your own basket of stocks to trade in one go), but I like the demo too, it just works. It doesn’t do anything fancy, the XTB demo just gives you a good look inside the platform and lets you know what trading with them would be like.

Pros

- Works well

- Good action on execution

Cons

- Overal platform lacking some features

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4ThinkMarkets: Best Textbook Paper Trading Platform

- Virtual Balance: $200,000

- Length: 14 days

- Markets: 3,981

- GMG rating: (3.5)

- Customer rating: 0.0/5 (0 reviews)

66.95% of retail investor accounts lose money when trading CFDs with this provider

ThinkMarkets Demo Account Review

Name: ThinkMarkets Demo

Description: ThinkMarkets’ demo account gives you £200k in virtual funds for 14 days to trade on nearly 4,000 markets. 66.95% of retail investor accounts lose money when trading CFDs with this provider

Is ThinkMarkets' demo account any good?

I’d say thank ThinkMarkets have an absolutely text book demo account. It’s a simple platform that lets you tap away on the major markets and demonstrates the order execution as well as the look and feel. But they keep the added value, like trading signals reserved for live accounts. So top marks for making it both easy to use and as a gateway to get traders wanting more.

Pros

- Easy to use

- Simple to set up

- Demonstrates functionality

Cons

- Trading signals not available

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(3)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

3.5Compare Demo Trading Accounts

| Demo Account | Virtual Balance | Length | Markets | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|---|

| £10,000 | 12 weeks | 13,500 | See Demo | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| £200-£50k | 60 days | 20 | See Demo | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| £10,000 | No limit | 17,000 | See Demo | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| £10,000 | No limit | 12,000 | See Demo | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| $100,000 | 20 days | 1,000+ | See Demo | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| $1m | No limit | 7,000 | See Demo | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| $100,000 | No limit | 2,976 | See Demo | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| £1-£1m | 30 days | 578 | See Demo | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| £10,000 | 12 weeks | 13,500 | See Demo | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| £100,000 | 30 days | 2,100 | See Demo | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| £200,000 | 14 days | 3,981 | See Demo | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

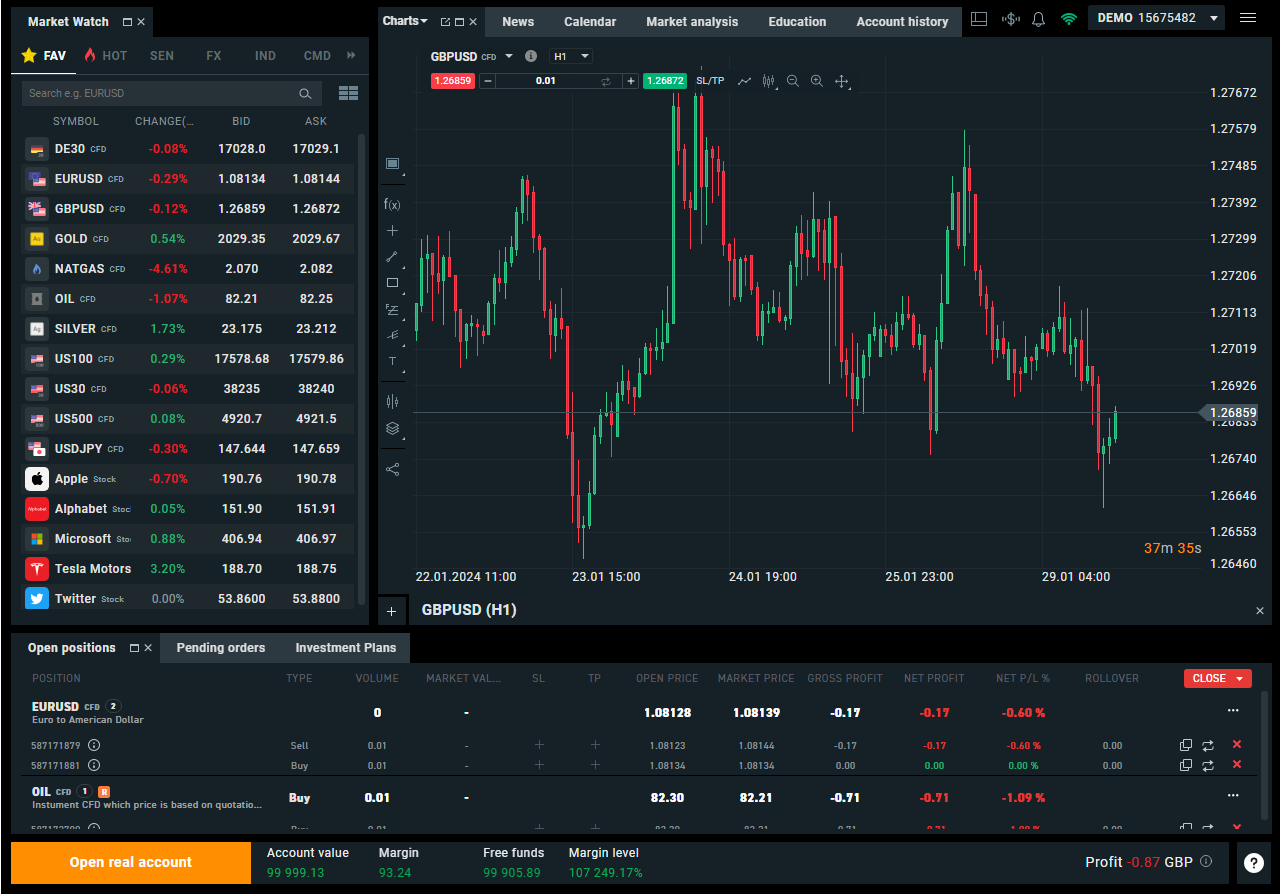

Demo Accounts Versus Trading Live

Before you start trading on a demo account be mindful that you should only use them as a way of exploring a trading platform’s functionality. Trading with real money life is very different from trading with virtual funds in a demo account

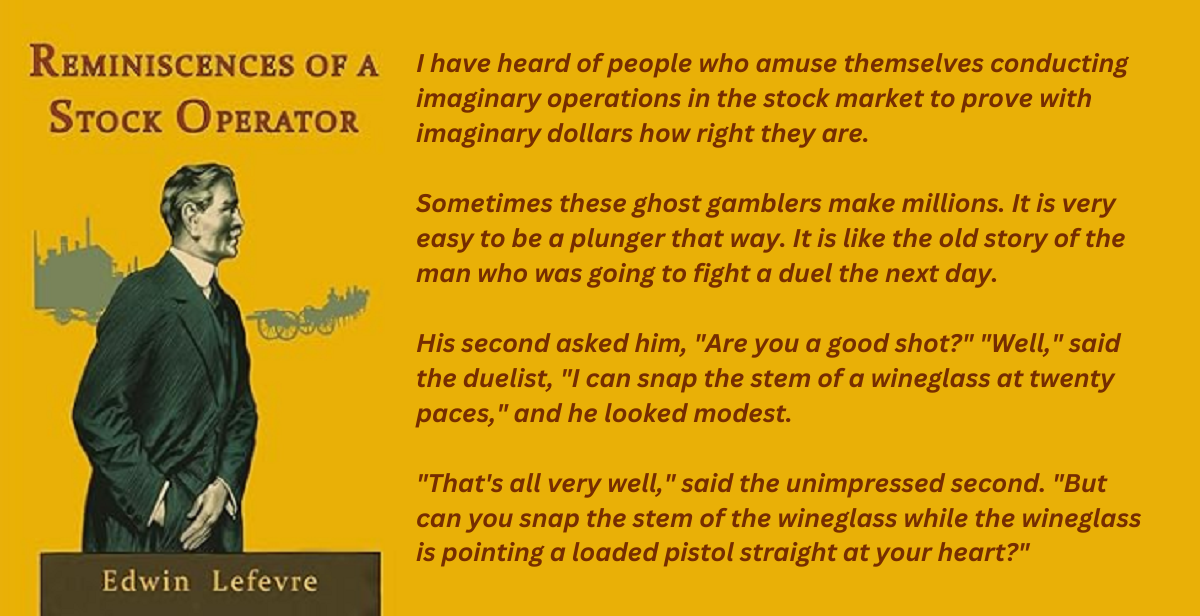

Nothing explains this better than this excellent quote from the 1923 book, Reminiscences of a Stock Operator where the protagonist Larry Livingstone is discussing paper trading.

I have heard of people who amuse themselves conducting imaginary operations in the stock market to prove with imaginary dollars how right they are. Sometimes these ghost gamblers make millions. It is very easy to be a plunger that way. It is like the old story of the man who was going to fight a duel the next day.

His second asked him, “Are you a good shot?” “Well,” said the duelist, “I can snap the stem of a wineglass at twenty paces,” and he looked

modest.

“That’s all very well,” said the unimpressed second. “But can you snap the stem of the wineglass while the wineglass is pointing a loaded pistol straight at your heart?”

Demo Trading Account FAQs

A while ago a reader asked us: Are there any no-deposit brokers for CFDs, Forex & or Spread Betting? A no-depost account means one where you can trade the markets without risking any money. The only way to trade the markets without making a deposit is to open a demo account, where you can test a trading platform’s features before committing real funds.

Most brokers offer a demo account where you can trade without depositing funds first. Then yes there are plenty.

However, if you are asking if there are any brokers that allow you to trade the financial markets with no money on account and make real profits the answer is no.

Or indeed, if you are asking if there are any brokers that offer a welcome bonus with no deposit. The answer is again no. Welcome bonuses for CFDs, Forex and Spread Betting are banned by the FCA.

Demo accounts are great if you just want to practice the process of putting trades on, and experiment with stop losses and technical analysis levels.

However, there are lots of brokers that offer demo accounts where you can trade without making a deposit.

- City Index – excellent trading signals and a breakdown of what markets you win and lose when trading (City Index review)

- IG – great allrounder (IG Review)

- CMC Markets – great sentiment tools and technology

- Saxo Capital Markets – for slightly more experienced traders (Saxo Capital Markets Review)

- Spreadex – good for customer service (Spreadex Review)

You can read our reviews of the different products that these brokers offer here:

It is important to note that trading in a simulated environment is very different from trading with real money.

However, odd it may seem, some traders will do well in demo accounts and they lose money in real accounts. The internet is awash with theories that brokers do this deliberately because they are b-booking your trade and profiting from when you lose money.

The reality, however, is that demo traders may be suffering from beginners’ luck, or even adopting a no emotion trading strategy. Not having a strategy is one of the main reasons traders lose money.

The most common mistakes when moving from a demo account to a live account are:

- Not cutting losses

- Not running winning trade

- Overtrading

- Over leveraging

You may also find this article on why most financial spread betting customers lose money useful.

We’ve written a few guides on a demo account trading strategy that may be helpful:

- Top CFD trading strategies

- Three top forex trading strategies that may actually work

- Four spread betting strategies that actually work and some decent brokers to try them with

It’s always worth opening more than one demo account as, whilst all brokers offer access to the same underlying markets that platform can differ dramatically. Although most MT4 brokers offer the same MetaTrader 4 platform they differ quite a lot if a broker has it’s own proprietary financial spread betting, CFD or forex trading platform.

If you are new to trading and looking to experiment with a trading platform here are some top tips to getting started on a trading broker demo account:

- Start small

- Never trade with money you can’t afford to lose

- Trade the products you understand best.

- If you don’t understand what moves a price you’ll have very little chance of making money

The most popular demo market by far is forex trading. You can read our guides to the most traded instruments on trading accounts and CFD, Forex and Spread betting demo accounts here:

You won’t get full access to live prices, research or added value with a demo account. They are generally used to give you an idea of the look and feel of a trading platform. To get the full features you may have to open a live trading account.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.