The pound-to-euro forecast is an indication of where technical and fundamental analysts think the GBPEUR price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Euros, or if you should wait until the price improves.

| GBPEUR Price | 1 Day Change | 1 Week Change | 1 Month Change | 1 Year Change |

| 1.17101 | 0.15% | 0.15% | -1.82% | 0.65% |

👉If you have a large upcoming Euro money transfer, we can recommend Currencies Direct as a secure FCA-regulated currency broker that can offer bank-beating exchange rates. Get a quote now.

GBPEUR Forecast Highlights

- GBPEUR ranging sideways in 1Q and keeping long-term uptrend intact

- A break below 1.180 support would be near-term bearish

- Economic and monetary trends show no great divergence between GBP/EUR; extended horizontal trading expected

How has the Pound performed against the Euro recently?

The financial world has endured a profound directional shift in the past eight weeks. But GBPEUR appears to have circumvented the turbulence seen in other parts of the market like the US tech sector. Prices just bounced up and down within the 1.185-1.210 zone (see below).

While GBPUSD has rebounded sharply (see recent update here), the story here is less bullish. The re-test of the 1.210 resistance has been rejected once more. Prices continue to trade below 1.200.

What next? Will the rate extend its multiyear uptrend, a trend guided largely by the uptrend support? Possible, but for this to happen prices have to stay firmly north of 1.180, as this prolong the pattern of ‘higher lows’.

A break below this level – which also coincides with lateral support – would be near-term bearish.

Therefore, unless the Eurozone or the UK takes a turn for the worse I expect GBPEUR stay in a flat range for the time being.

Is it a good time to buy Euros with Pounds?

Based on the above analysis, it is a good time to buy Euros now?

If you need the Euros now, you may want to buy some Euros when the rate is still trading close to 1.200. The rate recently rebounded off the 1.185 support. But this technical bounce appears half-hearted. A regression back to the floor is still possible.

You can, of course, wait for the rate to appreciate above 1.210. However this rebound is by no means guaranteed.

You can secure these Euros for use in the future with a currency forward.

Will the pound get stronger against the Euro in the first half of 2025?

Weak economic growth aside, the European Union now faces two new challenges. One is Euro-US tariffs war. The second is defence. Specifically, how to (sustainably) increase spending to bulk up EU’s defence capability in the brave new world.

For now, the continent no longer has to worry about inflation. This is pointed out recently by the ECB member Piero Cippolone. Two economic factors have contributed to lower than expected inflation figures:

First, energy prices have fallen significantly. The upward revision to projected inflation for this year was based on increased energy costs, but the pressure has eased as this trend reverses. Second, the euro has appreciated and real rates have increased, which contributes to lower inflation.

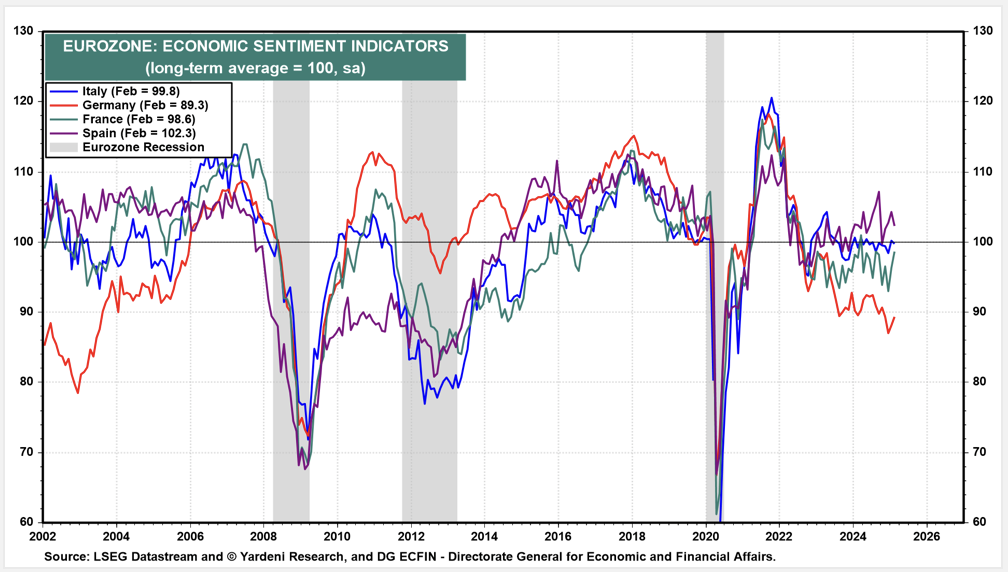

In other words, the ECB may be able to cut rates further in the quarters ahead. This may bring some financial relief to debtors. Still, the continent faces long term fiscal pressure. There needs to be a structural reform (another one!) to deal with social, financial and now, defence issues. Economic sentiment in all large EU countries are not euphoric. Germany, previously the star of the region, is now struggling (see below). The region’s growth appears to be muddling along.

But the UK is not performing great either. A ‘mini austerity drive’ is underway, as the Chancellor embarks on another round of budget cuts. Will this dent UK’s growth prospects? The market is waiting to see the details in the Spring budget.

Overall, Sterling is unlikely to make significant headway against the Euro since both regions are not moving in the opposite direction. Synchronicity is the economic theme between EUR and GBP. A weak EU is most likely going to drag the UK. As such, unless some unexpected economic catalysts emerge GBPEUR likely to stay around 1.180-1.220 in the near term.

Source: Yardeni.com (Mar 2025)

What is the GBPEUR forecast in weeks, months, years?

GBPEUR is a rate that seldom leaps over a great distance in a short time. For example, over a two-year period, GBPEUR’s uptrend ran from 1.130 to just 1.190.

Therefore in the coming quarter the same pattern is expected to repeat. Tiny swings within a defined band.

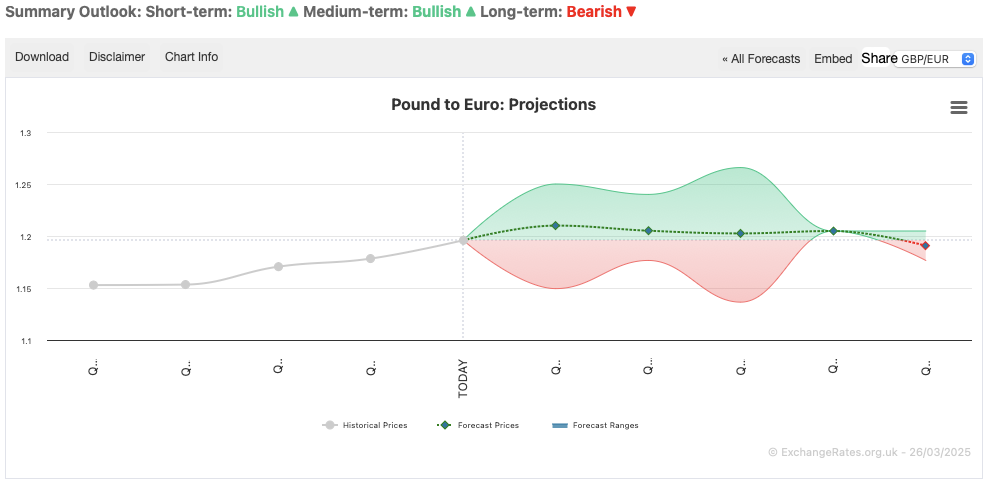

Forecasters called by Exchangerateforecast.org.uk pencilled in the band at 1.15-1.25, where the rate is expected to fluctuate in the next few years (see below). No large one-sided trend is predicted.

Source: Exchangerates.org.uk (Mar 2025)

Where is the best place for buying large amounts of Euros from Pounds

There are two different ways people buy Euros from Pounds

- Through a currency broker like Currencies Direct, OFX or Global Reach– when transferring money abroad

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of currency

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum Euro transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPEUR, you can compare forex brokers here.

What is the live GBPEUR exchange rate?

The current GBPEUR exchange rate is 1.17101 which is a change of 0.15% from the previous days closing price. Over a week GBPEUR is 0.15%, compared to it’s change over a month of -1.82% and one year of 0.65%.

GBPEUR exchange rate data is updated every 15 minutes.

Other Forecasts:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com