Trading platforms let you speculate with leverage on the price of stocks, commodities, indices, fixed income and foreign exchange by going long or short via futures, options, CFDs or spread betting. We have tested, ranked and reviewed the best trading platforms in the UK that are regulated by the FCA.

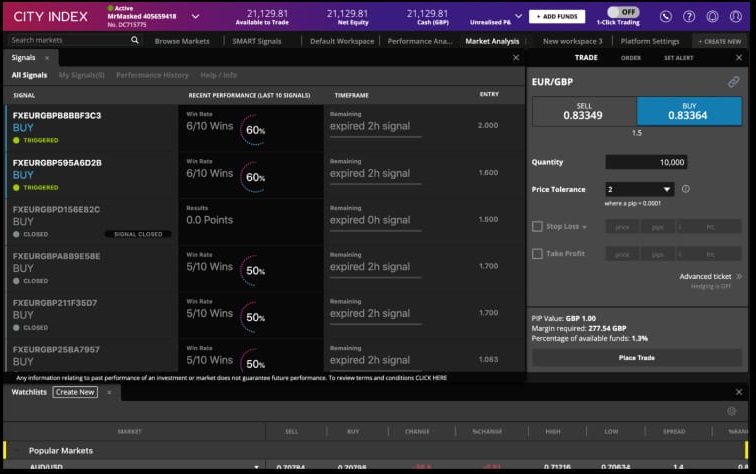

City Index: Best online trading platform trader tools

🏆Award Winner🏆

- GMG rating: (4.3)

- Markets available: 13,500

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

- Customer rating: 3.6/5 (97 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Trading Platform Review

Name: City Index Trading Platform Review

Description: City Index won “best trading platform” in our 2022 and 2023 awards for their trading signals. The trading platform has grown considerably since the acquisition of Gain Capital by StoneX and includes some excellent added-value features like Performance Analytics and SMART signals. When I was testing the trading platform, there were enough signals to discover some additional trading opportunities I wouldn’t have otherwise come across.

70% of retail investor accounts lose money when trading CFDs with this provider.

Is City Index a good trading platform?

Yes, on City Index’s trading platform, you can trade more than 13,500 markets, including 40 equity indices, over 10,000 UK and international shares and ETFs, 19 commodities, and 183 FX pairs. This means they offer more markets than most of the other online trading platforms regulated by the FCA in the UK.

Founded in 1983 City Index has a solid and longstanding presence in online trading; its trading platform is a genuine rival to IG and CMC Markets. In major UK markets, City Index pricing is competitive and often market-leading, but can be expensive for Asian markets.

City Index’s free desktop trading platform is web-based, so there is nothing to download you simply log in and trade on your internet browser. You can create and customise your own workspaces and layouts, adding quotes, charts, news and trading signals. However, you can also use City Index’s Market 360 feature to create a top-down view of an instrument in a single click, which contains charts, quotes, news and product information all in one place.

You can trade or place limit orders directly from a chart or you can click on the bid-ask quote at the top of the page in the 360 view. You can instantly access technical analysis, calendars, and newsflow by clicking on the market analysis, but the trading platform’s stand-out features are the SMART Signals, which produces trading ideas based on technical analysis and Performance Analytics which provides constantly updated reports on how to improve your trading, based account history.

Overall the City Index trading platform is very intuitive to use and it has a clean, clearly laid out interface making it suitable for beginners who want a simple platform with trading signals. It is also advanced enough for experienced traders executing large orders and needing post-trade analytics or voice brokerage as backup.

Pros

- Smart Signals

- Performance analytics

- Wide range of markets

Cons

- No DMA

- No investing account

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.3Pepperstone: Best online trading package of MT4 indicators

- GMG rating: (4)

- Markets available: 1,200

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

- Customer rating: 4.6/5 (78 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Trading Platform Review

Name: Pepperstone Trading Platform

Description: Pepperstone’s trading platform is a good choice for traders looking to speculate on the major markets, particularly those wanting to automate their trading through expert advisors on MT4 & MT5.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Is Pepperstone a good trading platform?

Yes, I’ve used both trading platforms that Pepperstone offer, MT4/5 and cTrader, which include sTradingView charting. cTrader is a more traditional trading platform with a basic layout, simple order execution and sentiment indicators. Whereas MT4 is one of the most popular and complex trading platforms available used by millions of traders and thousands of brokers.

However, what makes Pepperstone’s MT4 offering stand out is the brokerage behind it. Pepperstone offers it’s MT4 clients experienced account executives based in London and other local offices around the world. Plus, Pepperstone have put together a package of expert indicators and trader tools that are available to download for free that can be plugged into MT4.

To win business Pepperstone competes on price and compared to other trading platforms it is one of the cheaper options. For example, the Razor account can offer forex trading with zero pips, with the commission charged post-trade. Or traders can opt for the standard account, which adds a 1 pip markup, but is built into the spread.

Overall, Pepperstone’s MT4 is a good option for traders that want to automate their trading or want a basic account with very low costs.

Pros

- Good MT4 package

- Discounted spreads

- Stocks on MT4 & MT5

Cons

- Third-party trading platforms

- Limited market range

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Spreadex: Best online trading platform for customer service

- GMG rating: (4.3)

- Markets available: 10,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

- Customer rating: 4.2/5 (234 reviews)

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Trading Platform Review

Name: Spreadex Trading Platform

Description: Spreadex offers more than 10,000 markets that cover equities, ETFs, commodities FX, Bonds and interest rates. You can also speculate on political markets and trade options on the UK and German markets. There are also some quick-fire watch lists that help you see what stocks and markets are moving.

72% of retail investor accounts lose money when trading CFDs with this provider.

Does Spreadex have a good trading platform?

Yes, Spreadex is one of the most established online trading platforms and excels in providing personal service to a high-value customer base. I’ve been using them for nearly twenty years now and when I tested them for this review and over the years, the trading platform has remained simple yet effective.

It has been entirely developed in-house from St Albans, just outside of London and you can trade directly from charts on the platform or overlay a range of indicators and macroeconomic data.

It’s nice to see a trading platform these days that doesn’t rely completely on Tradingview for charting.

You can add pro trading indicators like the VWAP and also save and edit chart templates allowing you to have a consistent view of the markets and the indicators that you like to use.

Overall, Spreadex is a suitable online trading platform for those that know what they are doing that is backed up by experienced dealers, from an established and trusted UK brokerage.

Pros

- Excellent customer service

- Smaller cap stock trading

- Wide market range

Cons

- Limited options trading

- Trading only, no investing

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

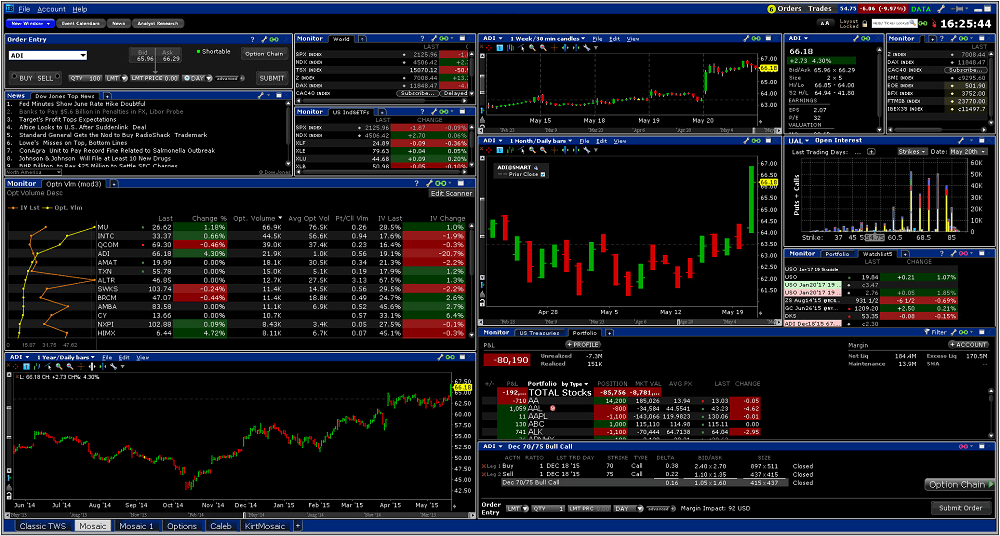

4.3Interactive Brokers: Best overall trading platform

- GMG rating: (4.4)

- Markets available: 7,000

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Equity overnight financing: 1.5% +/- SONIA

- Pricing: Shares 0.02%, FTSE 0.005%, GBPUSD 0.0008%

- Customer rating: 4.3/5 (869 reviews)

62.5% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers won “best trading platform” in our 2023 awards as they offer an exceptionally advanced platform for advanced traders, but also a very simple interface for beginners. They also scored very highly in our annual survey for pricing and market range.

Interactive Brokers Trading Platform Review

Name: Interactive Brokers Trading Platform

Description: We rank Interactive Brokers as the best online trading platform as it is exceptionally good for sophisticated trading. It offers by far the most access to the most markets through DMA futures, options, physical shares and CFDs. it also has the most advanced execution tools for retail traders, including complex order types such as VWAP, pairs trading, iceberg, and algorithmic trading.

60% of retail investor accounts lose money when trading CFDs with this provider.

Is Interactive Brokers trading platform any good?

Yes, when I was testing the trading platform, one thing that is immediately obvious though is that the desktop version is almost too good for retail traders and most will only use a small percentage of its capabilities. However, new traders should not be put off by its institutional-grade offering. The heavy-duty Interactive Brokers Trader Workstation is available as a download on PC, but there is also a simplified web-based version that is very simple to use called Portal.

On the web-based Portal trading platform, you can execute trades as physical deals, CFDs, futures and options (on the widest range of stocks). There are lots of webinars (with the founder Thomas Peterffy and his team) that cover trading strategy. You can also evaluate your portfolio based on how ethical your positions are. There are stock scanners, fund scanners, bond scanners, a fundamentals explorer for hunting out undervalued stocks and you can convert currency at some of the best exchange rates around.

IBKR also gives you more control over your currency exposure. Most other trading platforms automatically convert currency when you trade instruments outside your base currency but IBKR lets you do it manually on a per-trade or ad hoc basis.

Overall, Interactive Brokers, as the pioneer of the online trading industry, remains one of the best all-round online trading platforms for sophisticated investors and traders.

Pros

- Low cost

- Wide market range

- Investment accounts

Cons

- HQ in the US

- Complex desktop platform

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

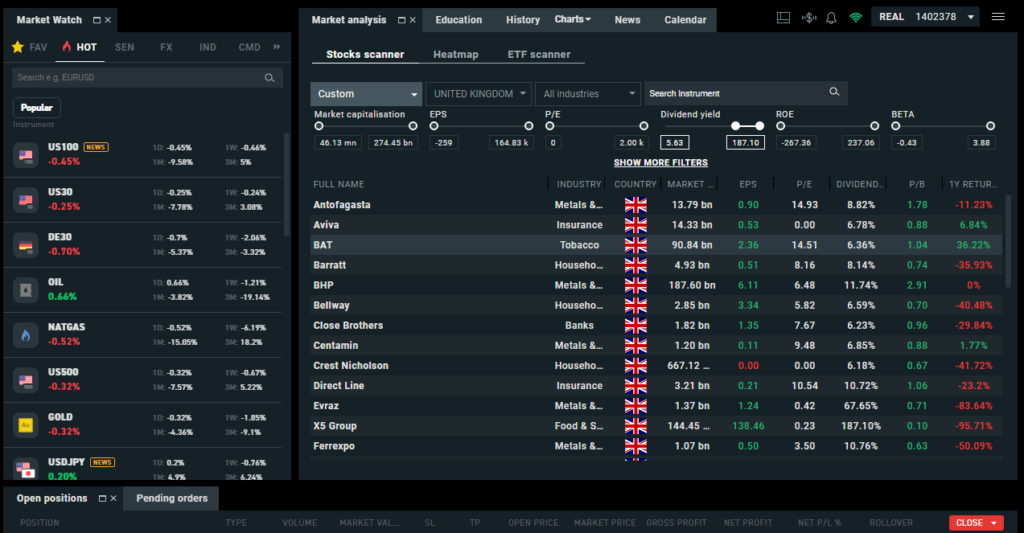

4.4CMC Markets: Best for sentiment indicators and active online trading

- GMG rating: (4.2)

- Markets available: 12,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.9% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

- Customer rating: 3.7/5 (146 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Trading Platform Review

Name: CMC Markets Trading Platform

Description: CMC Markets trading platform is very much a technology-driven solution that aims to offer institutional-grade tools and execution to retail and experienced clients.

74% of retail investor accounts lose money when trading CFDs with this provider.

Is CMC Markets trading platform any good?

Yes, one of the stand-out features of CMC Market’s main trading platform is the client sentiment indicators. Whilst most trading platforms provide this information, where you can see what percentage of the client base is long or short an asset, with CMC Markets you can break sentiment down by time frame and profitable clients. Essentially, giving you an indication of where the smart money is going.

Another key feature I liked when testing the platform was the share baskets. CMC has created it’s own sectors on popular themes like driverless cars, cannabis and cyber security. These give traders the ability to quickly speculate on themes through share baskets which are quicker to build than ETFs, meaning as a trader you can take advantage of sector moves quicker than on other trading platforms.

CMC Markets trading platform has one of the widest market ranges for CFD and spread betting clients, you can trade over 12,000 instruments including an industry-leading 338 forex pairs, 124 commodities, and over 1,000 ETFs. However, CMC Markets doesn’t offer as many UK shares (745) and US stocks (4968) as other platforms, instead focussing on the most heavily traded and liquid companies.

Compared to IG, CMC Markets trading platform feels a bit more professional, it has a classic black background, more flashing lights and a slightly more urgent trading ticket. As such, it is more suitable for more active traders trading intra-day.

Overall, an excellent trading platform and a well-run company.

Pros

- Excellent platform

- Client sentiment indicators

- Tight pricing

Cons

- No DMA

- Limited options trading

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2XTB: Good platform for multi-asset online trading

- GMG rating: (3.9)

- Markets available: 2,100

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Shares 0.3%, FTSE 1.7, GBPUSD 1.4

- Customer rating: 4.6/5 (133 reviews)

77% of retail investor accounts lose money when trading CFDs with this provider

XTB Trading Platform Review

Name: XTB Trading Platform

Description: XTB’s Xstation5 trading platform is highly customisable and it was clear from when I tested the platform that it is going to appeal to traders needing a little bit more than point-and-click trading.

81% of retail investor accounts lose money when trading CFDs with this provider.

Is XTB a good trading platform?

Yes, XTB’s trading platform offers access to the usual markets and pricing is fairly standard, but what sets it apart from other brokers is some of the trading platform’s unique functionality.

Most brokers offer it now but XTB was actually one of the first brokers to offer post-trade analysis, where the trading platform will show you where you are profitable and where you lose money.

One nice feature is the ability to close all of your positions in one go. A time saver if you are a day trader and want to be flat at the end of the day, or if you want out of the market in a hurry.

XTB produce their own market news, which is constantly updated throughout the day, which you can filter by asset class. If you combine this with the heatmap feature, stock scanner, sentiment indicators and automatically updated “hot” watchlist that shows where the order flow is going you can hunt out trading ideas

Overall, XTB is a very good trading platform that offers a lot more than just vanilla trading, suitable for new traders or more experienced investors wanting to create and hedge their own markets.

Pros

- Multi-asset trading

- Competitively priced

- Lots of markets to trade

Cons

- Not UK HQ’d

- No DMA

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

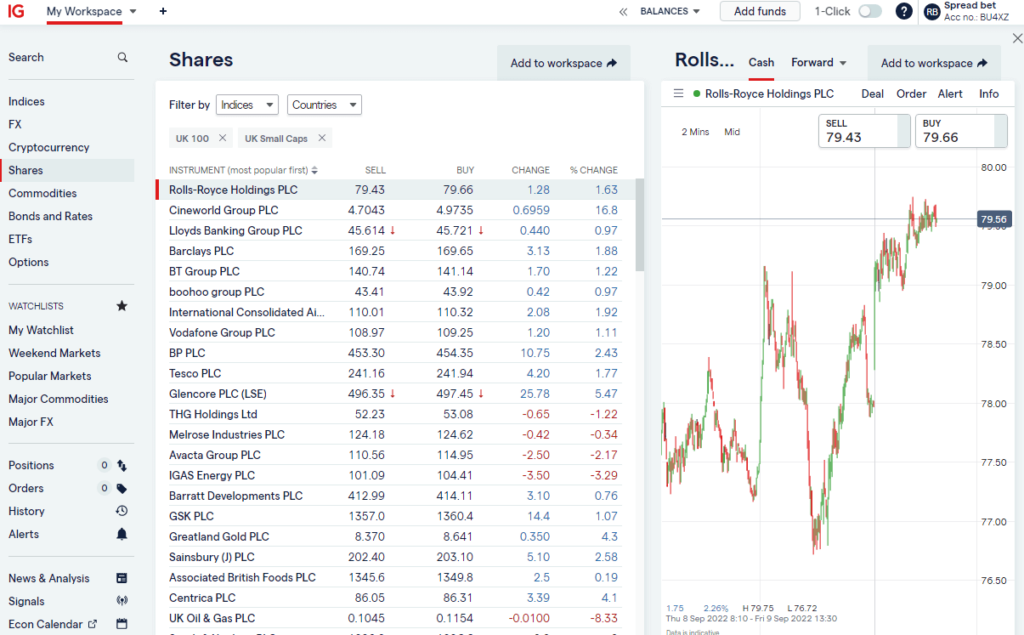

3.9IG: Best online trading platform for liquidity & market range

- GMG rating: (4.3)

- Markets available: 17,000

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

- Customer rating: 3.9/5 (674 reviews)

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Trading Platform Review

Name: IG Trading Platform

Description: IG remains at the forefront of the online trading industry and has one of the best online trading platforms for new and experienced traders. I really like trading on IG’s platform and have done so for over 20 years now. As an experienced trader I find it very intuitive, but for new traders, it offers a simple layout with lots of news, research, and technical analysis indicators. For experienced traders, it offers deep liquidity, the largest market range, and DMA execution through L2 dealer.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG's trading platform any good?

Yes, IG’s main web-based trading platform is used by CFD and Spread Betting clients, although clients can also download MT4, ProRealtime and L2 Dealer. The platform is developed in-house and is suitable for most traders where you can access 17,000 markets to trade as a CFD or financial spread bet. The trading platform also provides access to none leveraged trading accounts for physical shares dealing and ETF investing with SIPP and ISA options.

There are a few limitations to the main platform though, for example, there is no facility for automated trading strategies. However, IG offers two alternative platforms (MT4 & 5) for those clients who use Algos and trading bots. However, for most users, IG’s in-house platform will be more than sufficient for their needs.

Some stand-out features of the trading platform are how Autochartist and PIA trading signals are copied straight to order tickets and their ability to constantly innovate features such as adding logarithmic charting and creating news and research around what traders are looking at on the platform.

Compared to other online trading platforms IG’s pricing is always competitive, they are by no means the cheapest broker, but they are not expensive. IG tends to win business based on market range, service, and liquidity and keeps spreads to the lower end of the industry standard. Whilst pricing is an important factor when choosing a trading platform, with IG, you get what you pay for and that is a fairly priced excellent all-round service.

Overall IG has one of the most comprehensive trading platforms around. And after 46 years of offering margin products to retail customers, IG knows what works and what customers expect from their broker, namely reliable pricing, technology and customer service.

Pros

- Excellent market range

- Deep liquidity

- DMA & level-2 pricing

Cons

- Some pricing is not competitive

- Very big so customer service can be a little slow

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

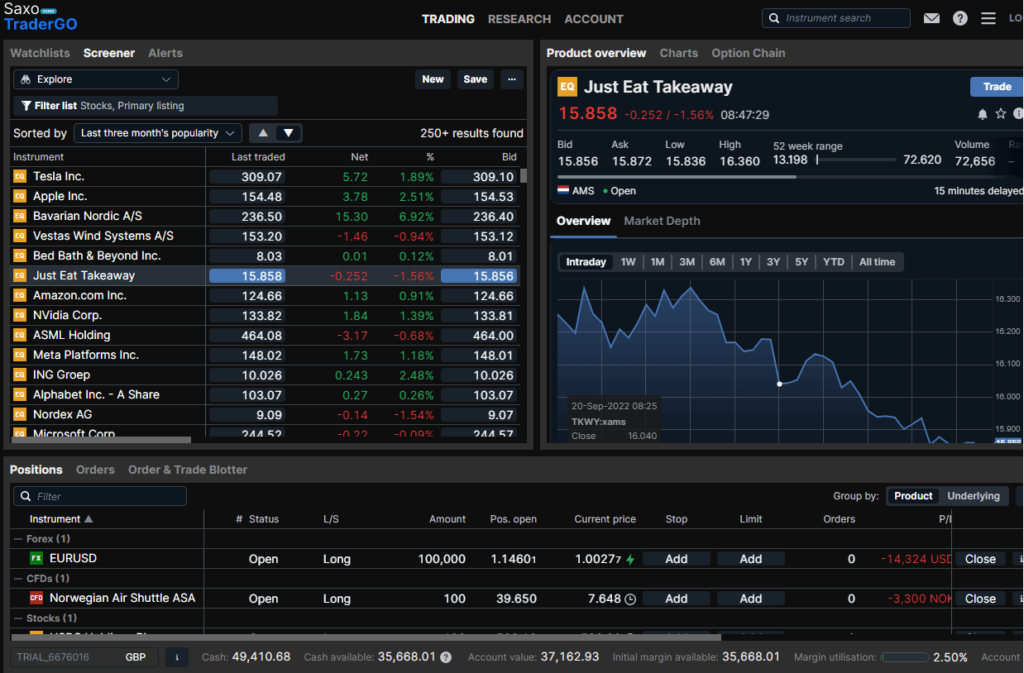

4.3Saxo: Best for advanced & professional online trading

- GMG rating: (4.4)

- Markets available: 9,000

- Minimum deposit: £0

- Account types: CFDs, futures & options, DMA, investing

- Equity overnight financing: 2.5% +/- SAXO RATE

- Pricing: Shares 0.05%, FTSE 1, GBPUSD 0.7

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets Trading Platform Review

Name: Saxo Markets Trading Platform

Description: Saxo Markets SaxoTraderGo offers a very advanced trading platform and voice brokerage service for experienced and professional traders and investors.

65% of retail investor accounts lose money when trading CFDs with this provider

Is Saxo's trading platform any good?

Yes, I’ve been using Saxo’s online trading platform for around ten years now and it’s evolved nicely over the years. The core functionality remains consistently high-end, whilst the front end is given a facelift every few years.

Whilst Saxo Markets does offer MT4, it’s own proprietary trading platform (SaxoTraderGo) is a well-established work-horse. The platform is exceptionally robust and suitable for institutional-grade hedge fund businesses as well as individual traders. It really stands out among peers as a serious platform for serious traders that is backed up by the products on offer, such as DMA CFDs, on-exchange futures, options, a huge range of bonds and access to dealers via voice brokerage who can work complex orders for you.

Unlike more retail-based trading platforms where CFD commissions are built into the spread with Saxo Markets, you trade at the bid-offer (or DMA) and commission is charged afterward. This enables clients to trade inside the market price if they have opted for direct market access.

Commissions are very competitive as Saxo Market is most suited to high-volume and high-net-worth traders. Smaller traders may be put off by auxiliary costs such as having to subscribe to live pricing from exchanges, level-2 data fees, and minimum commission charges.

Saxo Market’s trading platform market range is vast, you can go long or short over 19,000 instruments, which is more than any other retail derivatives provider with the SaxoTraderGO platform or apps.

The platform also has built-in post-trade analytics so you can see where you have been profitable in the past, and has an integrated research portal, webinars, trading signals, and market analysis.

Saxo Markets can be suitable for smaller traders as it has three different tiers of trading accounts – Classic, Platinum and VIP. Classic is the most basic with a minimum deposit of £1,500 whilst the VIP requires at least £1 million in funding, where traders will have access to the tightest spreads and dedicated Saxo service.

Overall, Saxo Markets is an excellent platform for experienced traders.

Pros

- Professional trading platform

- Direct market access

- Futures & options

Cons

- Can be too complicated for beginners

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

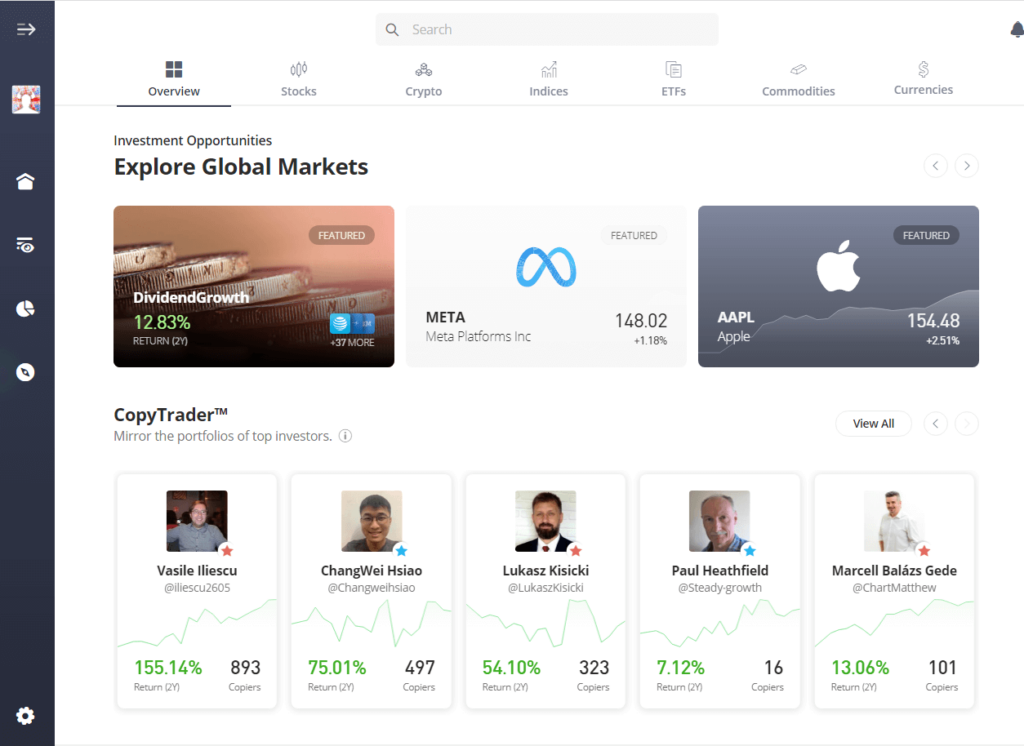

4.4eToro: Best trading platform for social & copy trading

- GMG rating: (3.6)

- Markets available: 2,976

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Equity overnight financing: 6.4% +/- SONIA

- Pricing: Shares 0.15%, FTSE 1.5, GBPUSD 2

- Customer rating: 3.4/5 (273 reviews)

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Trading Platform Review

Name: eToro Trading Platform

Description: eToro has a very simple online trading platform and offers a social way to speculate on global markets. Through social and copy trading you can see other traders’ portfolios and copy their trades. You can only trade and invest in USD, but you do have the option to buy and sell cryptocurrency.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro's trading platform any good?

Yes, the ability to look at the positions (and then copy) of consistently profitable traders is an excellent want for new investors to see how to construct a diverse portfolio is not just an excellent way to invest, it is a fantastic learning tool. I spoke to the founder of eToro Yoni Assia ages ago about whether or not copy trading could be an investible asset class, and there are signs that it perhaps could be.

Pros

- Social and copy-trading

- Easy-to-use platform

- Can change your leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Limited market range

-

Pricing

(3.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(3.5)

-

Research & Analysis

(3.5)

Overall

3.6❓Methodology: We have chosen what we think are the best trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the trading platform CEOs and senior management

What is an online trading platfom?

Trading platforms are operated by stockbrokers, CFD brokers, spread betting brokers and forex brokers and act as a platform for buying and selling underlying securities or OTC (over-the-counter) products.

All trading platforms are different and specialise in certain things. For example, City Index has some of the best trading signals and post-trade analysis for traders that want a bit of stimulus and to improve their execution strategy. Or, IG can have better liquidity than the underlying exchanges so is excellent for larger traders.

Here are the main things to consider when choosing an online trading platform:

- Market access – How many stocks, commodities, indices and forex pairs can you trade?

- Account types – Does a trading platform offer spread betting (tax-free profits), CFDs, Spot FX and futures & options?

- Trading experience – Is the platform better for beginners or experienced traders?

- Regulation – All online trading platforms need to be regulated (by the FCA in the UK)

- Costs & fees – Which brokers are cheapest for your type of trading?

- Added value – Is it just a trading platform or do they offer added value trading tools, analysis and education

- Voice brokerage – Can you work complex orders over the phone?

Is using a trading platform a good idea?

Trading is a high-risk form of investing and not for everyone, and even though FCA-regulated trading platforms are safe, there is a risk to your capital. Here we highlight some of the advantages and disadvantages of online trading platforms.

Pros

- Margin – Trade on margin to leverage your risk capital

- Tax efficient – Profits can be tax-free through financial spread betting

- Low cost – No stamp duty for short-term speculation

Cons

- Risky – Trading is a very high-risk form of investment

- Complex – Trading order types can be hard to understand

- Short-term – Expensive for long-term investing

Industry experts told us

"A broker's trading platform is the gateway to the financial markets. Most traders only use a small percentage of a platform capability so it's work exploring what added value (like trading signals and post-trade analytics are on offer before assigning risk capital."Compare Online Trading Platforms

| Trading Platform | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 13,500 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| 7,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 5,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider. |

What is the best trading platform for beginners?

For beginners, City Index, is a good choice as they provide some good trading signals through SMARTSignals and Trading Central. IG and CMC Markets are easy to use, offer lots of educational material, trading signals, and seminars and are well established. eToro is also a good choice as they offer lower-risk investment accounts as well as the ability to reduce your leverage. This is particularly helpful for beginners as one reason most new traders lose money is from taking on too much risk with excessive leverage. You can use the below comparison table to see which trading platforms offer the most features that are good for beginner traders.

| Beginner Features: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Low-Risk Products | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Investment Account | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

Why choose a broker that is right for your level of trading experience?

When private clients trade online, they are split into two different categories – Retail or Professional.

The different ways to trade tend to revolve around how much experience you have, and it’s vital that you choose a broker that offers the right type of trading and markets for how experienced you are. If you are a beginner, you should consider starting with low-risk investments through a stockbroker to gain experience before moving on to riskier asset classes like leveraged trading.

- Beginner? Read our guide on how to start trading.

What is the best trading platform for professional traders?

Sophisticated trading platforms like Saxo Markets or Interactive Brokers are best for experienced traders as they also offer on-exchange futures and options and have very advanced order execution functionality and DMA (direct market access). Using our comparison table of features that are helpful for professional and advanced traders, Saxo Markets comes out on top as they tick all the boxes.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

Whenever you open a trading account to trade derivatives products like CFDs (Contracts for difference) or financial spread betting, you will be asked by your broker to take an “appropriateness test” during the account application process. This is to make sure you understand the risks of trading on margin before you can have an account. It is required by the regulator and designed to stop clients without enough experience speculating with too much risk.

- Experienced trader? Read our guide to the best professional trading accounts.

Which trading platform offers the most account types?

IG offers the most account types. The trading platform started with just spread betting in 1974 but now offers, CFD trading, DMA access, and investment accounts including stocks & shares ISAs.

Some brokers will only offer one of these types of trading with discounted rates, while others may offer all of them but be slightly more expensive.

Each different type of trading has its own advantages and disadvantages. For example, the main advantage of financial spread betting is that profits are free of capital gains tax. The disadvantage, however, is unlike futures trading platforms and physical investing, you cannot work orders inside the bid or offer, so strategies such as scalping are not as effective and net costs can seem a little higher.

Account Types:

CFD Trading ✔️ ✔️ ✔️ ✔️ ✔️ ✔️ ✔️ ✔️

Spread Betting ✔️ ❌ ✔️ ✔️ ✔️ ❌ ✔️ ✔️

DMA ❌ ✔️ ❌ ❌ ❌ ✔️ ✔️ ❌

Pro Accounts ✔️ ✔️ ✔️ ✔️ ❌ ✔️ ✔️ ✔️

Investments ❌ ✔️ ❌ ❌ ❌ ✔️ ✔️ ❌

Futures & Options ❌ ✔️ ❌ ❌ ❌ ✔️ ❌ ❌

Which trading platform offers the best market access?

IG offers access to the most markets with over 17,000 assets available to trade via their online trading platform as a spread bet or CFD.

| Market Access: |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 9000 | 5233 | 10000 | 8,000 | 3700 | 2,100 |

| Forex Pairs | 84 | 51 | 338 | 62 | 182 | 100 | 54 | 20 | 138 | 57 |

| Commodities | 25 | 38 | 124 | 32 | 19 | 20 | 20 | 10 | 28 | 22 |

| Indices | 21 | 34 | 82 | 28 | 29 | 13 | 17 | 10 | 23 | 25 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 5000 | 500 | 1575 | na | 450 | 230 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2000 | 3500 | 2110 | na | 1575 | 1080 |

| ETFs | n/a | 2000 | 1084 | 107 | 675 | 1100 | 160 | na | 0 | 138 |

Why choosing a broker that offers all the markets you want to trade is important.

When choosing an online broker, you first need to think about “what” you want to trade and “how” you want to trade it. If you only want to trade the most popular forex pairs, you will have a larger choice of brokers than if you want to trade stocks as well. However, online brokers that only offer a small selection of markets mean you may miss opportunities to trade other assets such as international stocks, minor forex pairs, fledgling indices, and ETFs.

What trading platform has the cheapest commission and fees?

CMC Markets is often the cheapest broker for trading the major markets as their platform is heavily geared towards more active and frequent traders.

| Trading Costs |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| FTSE 100 | 1 | 1 | 1 | 1 | 1 | 0.01% | 1 | 1 | 1 | 1.7 |

| DAX 30 | 1.2 | 1.2 | 1 | 0.9 | 1 | 0.01% | 1.2 | 1.2 | 1.8 | 1 |

| DJIA | 3.5 | 2.4 | 2 | 2.4 | 3 | 0.01% | 4 | 2.4 | 5 | 3 |

| NASDAQ | 1 | 1 | 1 | 1 | 1 | 0.01% | 2 | 1 | 1.9 | 1 |

| S&P 500 | 0.4 | 0.4 | 0.5 | 0.4 | 0.5 | 0.01% | 0.6 | 0.4 | 0.7 | 0.5 |

| EURUSD | 0.5 | 0.6 | 0.7 | 0.09 | 0.6 | 0.00% | 0.6 | 0.6 | 0.8 | 0.9 |

| GBPUSD | 0.9 | 0.9 | 0.9 | 0.28 | 0.7 | 0.00% | 0.9 | 0.9 | 1.3 | 1.4 |

| USDJPY | 0.6 | 0.7 | 0.7 | 0.14 | 0.6 | 0.00% | 0.7 | 0.7 | 0.8 | 1.4 |

| Gold | 0.8 | 0.3 | 0.3 | 0.05 | 0.6 | 0.00% | 0.4 | 0.3 | 0.28 | 0.35 |

| Crude Oil | 0.3 | 0.28 | 3 | 2 | 0.5 | 0.00% | 3 | 0.28 | 0.4 | 3 |

| UK Stocks | 0.008 | 0.001 | 0.001 | 0.001 | 0.0005 | 0.02% | 0.002 | 0.001 | 0.30% | 0.0008 |

Why choosing a broker that transparently explains the costs of their online trading platform is important.

Comparing the costs and fees of brokers for online trading is not as easy as you’d think. Neither is it simply about just finding the cheapest broker. Brokers charge in different ways, so it makes direct cost comparison difficult.

Even if cost comparison were simple, choosing the cheapest broker may mean you don’t get the best broker for your needs. For instance, one CFD broker may charge commission by widening the spread around market prices, whereas another may give you the underlying price, but charge a commission on top.

Minimum deposit levels and account inactivity fees are all costs you may have to face too, so finding these out in advance can help you realise which brokers offer the cheapest trading for you over time. The actual rate you are charged can be hard to calculate if the spread is being widened, but it makes calculating your P&L easier. However, with DMA CFD brokers, you can trade at better prices but will have to include commission costs as a separate line on your trading P&L.

The most common types of fees that online trading platforms charge are:

- Widening the bid/offer spread

- Commission charged post-trade

- Financing on overnight positions

You also need to be aware that if you are trading an OTC (over the counter) product like CFDs, FOREX, or spread betting, brokers may not hedge your trades in the underlying market. This basically means that they think your trades will be losers, so they accept your trade more like a bookie than a broker.

This is called the B-Book. There is a big debate about whether brokers hedging positions or not via the B-Book is a good or bad thing. In some cases, it is good because it reduces the need for brokers to widen the bid/offer spread, meaning that clients get better prices. However, some argue that it is bad because there is a clear conflict of interests as these brokers make money when clients lose.

Ultimately, whether clients make money or lose money, trading the market has little to do with how different brokers hedge their exposure, but rather more to do with the decisions that traders themselves make.

What trading platform offers the most added value?

IG offers some of the most added value as they tick all the boxes in our comparison table, including trading ideas, client sentiment indicators, post-trade analytics as well as news and analysis.

| Added Value: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Ideas | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Client Sentiment | ❌ | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

| Post Trade Analytics | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ❌ |

| News & Analysis | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Web Based Platform | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

Why choosing a broker that gives you added value and trading ideas is important.

If you are looking for a broker to help with trading ideas, you need to be very careful. Whether or not you use the suggestions made by your broker, a broker’s recommendations should depend significantly on how much of an experienced trader you are.

Online platforms that offer trading to retail customers are not allowed to provide trading ideas, advice or anything that can be considered implied advice. We’ve covered in detail why you shouldn’t use advisory CFD brokers and why most trading educational courses are a waste of time.

You should not rely on others to help you make decisions in high-risk trading products like futures, options, CFDs and spread betting. Advice from wealth managers structuring your investments in a tax-effective manner through SIPPs and ISAs is one thing, but if you are a retail trader and a broker is phoning to pitch trading ideas, you should report them to the FCA.

Professional and institutional clients are allowed to discuss the markets and get advice from their brokers. This is because they have been appropriately classified as traders that fully understand the risks involved in the markets and leveraged products. Caveat emptor is a phrase that still applies to this, as trading is a self-directed form of speculation.

Which trading platform has the best margin rates and most leverage?

The FCA regulates online trading platforms in the UK for retail traders so margin rates are set and standard across most trading platforms.

Margin rates in the UK are capped at:

- Indices: 20%

- Major Forex pairs: 3.33%

- Commodities: 10%

- UK & US shares: 20%

Getting the best margin rate from an online trading platform

These margin figures represent the deposit you have to put down when opening new positions and are in place to protect brokers as well as clients. The percentage is set based on what a big percentage move would be in the market to ensure that clients and brokers can fund a position.

However, if you are an experienced trader you can opt for a professional account, and get better margin rates. These differ from broker to broker. You can see the current professional margin rates in our professional trading account comparison.

Margin enables traders to leverage their risk capital and get more exposure to the market. For example, if you are trading the FTSE 100 you can trade £100,000 worth of FTSE with only £5,000 in your account if your broker is offering 5% margin. The advantage of this is that you get more exposure to the market and can diversify positions. However, the disadvantage is that your losses are multiplied and if you can lose your entire account balance with small percentages moves.

Which trading platforms are best for voice brokerage?

Saxo Markets, City Index and IG are three large online trading platforms that offer voice brokerage.

Choosing a broker that offers telephone trading as well as an online trading platform

Whilst most traders will choose a broker based on their ability to trade online, having an experienced dealer who can execute trades for you whilst you are not in front of a computer can be very important.

Some traders still prefer to trade over the phone, and those that do may form very close relationships with their dealers. Some traders talk to their brokers more than anyone else, so making sure that any broker you choose has a good desk of experienced dealers is vital.

Dealing over the phone is also handy if things go wrong and an error needs sorting out or if you have a particularly complicated strategy to execute that requires cross margin calculations that cannot be done online.

Voice brokerage is usually more common at prime brokers for professional and institutional traders, where hedge funds want to reduce the risk of trading errors by getting their traders to give orders over the phone or messaging systems rather than do it themselves. If you ask a dealer to execute a trade for you and they do it wrong, they will have to make good on what you asked for. Whereas if you are trading yourself online on a dealing platform and press buy instead of sell, you only have yourself to blame.

⚠️ FCA Regulation

All online trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Trading For Beginners Explained

Keen to start trading but don’t know how? Confused about the lingo and don’t know where to start? In this guide, we’ll give you all the information you need to know to learn how to trade.

In a rush? Here are your key takeaways on learning how to trade:

👉 Trading is different to investing

👉 You can trade in different ways on different markets

👉 Risk management is vital

👉 Know how to minimise your losses

👉 There are tons of great online trading platforms.

What Is Trading & How Does It Compare To Investing?

Trading is the process of buying and selling assets, such as stocks, bonds, currencies, and commodities, in the expectation of making a profit from short-term price moves, and trends in those assets. Traders typically use technical analysis or other indicators and data to identify trends and patterns in the market, they then make trades based on their predictions and the perceived likelihood of success, also known as the risk-reward ratio.

Trading and investing are two different approaches to the financial markets.

Traders typically focus on short-term profits and is high risk, while investors focus on long-term growth and is generally considered to be lower risk.

Traders often look at charts and study price action to identify trends and patterns in the market, while investors are more likely to use fundamental analysis to evaluate the financial health and economic prospects of a stock or other instrument.

⚠️Think trading is too risky and want to invest instead? Compare investing accounts here.

Why Learn How To Trade?

Trading is one of the riskiest types of investing because it involves taking large risks for large rewards. As such, and as you will see on risk warnings that are required by the FCA to be published on all trading platforms and trading advertising, up to 80% of those that try trading lose money.

So, it’s important to learn how trading works before risking any money, then start small and not trade with anymore than you can afford to lose. We have a dedicated guide to where you can learn to trade from respected and regulated providers.

1. Going Long And Short With Leveraged Trading

Long/short, leveraged trading is a strategy that involves taking either long or short positions in the market.

- Long positions are effectively bets that the market will go up, trades go long or buy assets in the belief that the price of those assets will rise above their purchase price creating a trading profit.

- Short positions are bets that the market will go down. Short selling is the practice of selling an asset you don’t own, in the hopes of buying it back at a lower price, at some point in the future, to make a trading profit.

- Leverage or gearing can be thought of as using money borrowed from your broker or an exchange, with which to make larger trades.

Long/short, leveraged trading can be a very risky strategy, if you don’t recognise and manage those risks. However, it can also be very profitable for traders if those risk are managed and the strategy is executed correctly.

Related guides: Short-selling tips and best short-selling platforms

2. Types Of Trading Accounts To Access The Markets

When you trade you are always trading the same underlying markets, but there are a few different ways to trade which are:

➡️CFDs (Contracts For Differences)

Contracts for Differences are a type of derivative contract that allows you to speculate on the price movement of an underlying asset, without actually owning the asset. CFDs are traded on margin, which means that you only need to put up a small amount of money (the margin) to control a larger position. This can magnify your profits, but it can also magnify your losses.

➡️Spread Betting

Spread Betting is another form of leveraged speculation. However Spread Betting deals are structured as a wager rather than a financial contract, such as a CFD. Which means that profits made through spread betting are free of capital gains and income taxes, under current UK legislation. Though you must be an individual UK taxpayer to benefit from that exemption. However, losses made through Spread Betting cannot be offset against capital gains made elsewhere.

➡️Futures

Futures are a type of derivative contract that allows you to buy or sell a known amount of an asset at a predetermined price, on a future date. Futures trade in standardized contract sizes for a fixed expiry or delivery date. Futures are often used to hedge against risk or to speculate on future price movements in either direction.

Futures are exchange-traded instruments, futures traders pledge margin against their open positions at their broker, who in turn pledges that to the clearinghouse /central counterparty which underwrites futures trading by acting as the buyer to every seller and the seller to every buyer.

➡️ Options

Options are a type of derivative contract that confers the right, but not the obligation, on an options purchaser, to be able to buy or sell an asset at a predetermined price, on or before a specified expiry date. Option sellers on the other hand are obligated to deliver or take delivery of the underlying asset that the options contract is over. That distinction creates a very asymmetric risk profile for the two groups.

Note that some options are deliverable whilst others are settled in cash, most options trade on exchange with margins or deposits pledged to a clearing house, central counterparty. However, Spread Bets and CFDs over options contracts are traded OTC or off-exchange, between counterparties (the client and their broker), as are many FX options.

Options are often used to protect against risk or to try and make speculative profits from price movements. However, they are complex instruments and therefore are not for the uninitiated.

Spot FX and Metals FX and precious metals, such as gold are also often traded off-exchange between counterparties, in what is known as OTC or over-the-counter trading. They are traded in spot markets – effectively a cash market for the price of an instrument at a given moment in time.

Spot markets can be traded on margin and traders pay or receive funding based on interest rate differentials, borrow rates and the positions they hold. Typically long positions pay funding whilst short positions receive funding or rollover fees.

3. Different Financial Markets Come With Different Risks

➡️ Shares (Stocks)

➡️ Indices

➡️ Commodities

➡️ Forex

➡️ Bonds

➡️ ETFs

They are typically low-cost investments that can offer instant asset allocation and diversification, which can help to hedge or reduce risks. But they can also be used for speculative purposes. For example, if you believe that semiconductors are going to rise in value, you might take a long position in iShares Semiconductor Index ETF or SOXX.

➡️ Cryptocurrency

Cryptocurrency is a digital or virtual currency linked to a blockchain or immutable distributed ledger, that uses a cryptographic method to record and confirm transactions in and ownership of the cryptocurrency. Cryptocurrencies mostly exist outside of traditional financial markets and trading in them is largely unregulated.

There have been many high-profile hacks or thefts, as well as outright frauds in the crypto ecosystem. However, the lack of regulation and the decentralised nature of crypto trading, and issuance, has also been one of their biggest selling points.

Learn How To Trade Stocks

4. High-Risk Trading Means Potentially High Rewards

Trading in the financial markets can be a way to make money, but it is important to be aware of the risks involved. Here are some of the pros and cons of trading in the financial markets:

Pros:

- Potential for high returns: The financial markets can be volatile, meaning that prices can rise and fall quickly. That creates opportunities for high returns if you are able to make accurate predictions about the direction of the markets.

- Access to a wide range of assets: There are a wide variety of assets that can be traded in the financial markets. Many brokers offer access to more than 10,000 trading instruments so you should always be able to find trading opportunities.

- Liquidity: The financial markets can be very liquid, meaning that there are usually always buyers and sellers. That liquidity makes it easier to quickly trade in and out of your positions, so you can move quickly and take advantage of trading opportunities as you spot them.

Cons:

- High risk: The financial markets are risky, and there is always the potential to lose money. This is especially true if you are not experienced in trading, or if you make bad decisions and are led by your emotions.

- Volatility: The financial markets can be volatile, prices in them can fluctuate very quickly and sometimes randomly. This can make it difficult to make accurate predictions about the direction of the market and that can mean trading losses.

- Fees: There are fees associated with trading in the financial markets, such as commissions and spreads. These fees can eat into your profits and your capital, so it is important to understand what these fees are and to factor them into your trading decisions.

- Experience: Trading the financial markets is essentially a competition between you and other traders. These include experienced retail, professional and institutional traders all of whom are very happy to profit from your trading mistakes.

5. Risk Management And Protecting Your Downside

Understanding Leverage

Many of the instruments that traders use are geared or leveraged products. Leverage is a very powerful tool because it allows traders to control a much larger portion of an asset than the capital would otherwise allow.

If you are trading with a leverage of 10:1 then every £1000 you have in your trading account could control £10,000 worth of an underlying asset, say a stock index, a commodity like gold or an FX pair such as dollar yen.

Using leverage can magnify trading profits but is just as effective at magnifying trading losses and eating through hard-won capital.

Many novice or newbie traders lose money because they don’t understand the effect of leverage on their trading PnL and account balances.

Overtrading

Overtrading occurs when a trader takes on more risk than they and or their account can handle. This can happen when a trader is trying to make money too quickly, or when they fail to calculate and adequately manage their risk.

Overtrading can lead to losses, and excess costs and can even put a trader’s whole account at risk. Traders need to understand the risk in every trade they make, both individually and cumulatively.

This means knowing the size of each position, and the maximum downside on each trade. The margin requirements for each trade and the effect that pledging margin, both initial and variation will have on their account balances.

A trader should always be aware of these numbers, before they trade, as part of their risk management strategy. Which itself should form part of their overall trading plan.

That should include rules about the size of each trade, the amount of capital at risk per trade and the maximum number of trades they will have open at any one time.

6. Why Do Traders Lose Money? (And How To Avoid It Happening)

Losing money is part of trading even the best traders do not get it right all the time, you can have the right idea and the wrong timing and make a loss

However inexperienced traders often lose money because they don’t follow a defined trading plan or strategy. In many cases breaking or ignoring their own rules when they trade.

For example, by having too many trades open, or trading in a position size that’s too large for their account and ignoring stop loss levels.

When you combine inexperience with leverage, then you have a recipe for disaster.

It is possible to avoid these pitfalls. However, you need to be disciplined, follow your risk management rules, and use the trading tools and order types at your disposal. These include stop losses, trailing stop losses and limits.

7. Beware Of Trading Educators & Social Media Influencers

Trading the financial markets involves money and where there is money there are unfortunately people looking to take it from you. Often by selling those new to trading a dream that doesn’t exist.

Their methods range from posting glitzy lifestyle pictures on Instagram with claims that trading has funded their life of luxury- which you can have too- if you send them your money. Or promises that they have unlocked the secrets of the markets which they will be happy to sell to you, for a fee.

Don’t fall for these scams there are no get-rich-quick schemes in the market instead traders learn to become profitable through a process of education and trial and error.

Recognising and learning from their mistakes and correcting that behaviour the next time out.

Learning to trade with the help of a trading educator can help new traders understand the markets, why prices move the way they do and strategies that they can use to benefit from that.

There are good trading educators out there but you shouldn’t be paying thousands of pounds to take their courses, particularly when there are so many educational resources available online.

As to social media, new traders can learn a lot about the markets from far more experienced traders on platforms such as Twitter. But be wary of those that boast about how much money they are making, and instead look for those who offer rational comments and opinions backed up by facts.

8. Trading Signals Can Give You Ideas, But You Have To Make The Final Decision

Trading systems and signals are often pushed by social media influencers, and others, as a way to make profits without putting in the effort. Few if any of these services will work.

Think about it if you a had system that continuously made you money from trading, why would want to share that with anyone else?

And if you wanted to sell it what value would place on that golden goose?

Not all trading services are a scam but at best trading signals are tools that can highlight better risk-reward opportunities.

If you have the inclination or ability you can build your own trading signals using any number of resources on the internet.

For example, one popular trading signal is the Moving Average crossover. A moving average is simply the rolling average price of a stock, or other asset over, a set period for example 20 days. Moving averages are typically displayed as an indicator on a price chart.

If we use two moving averages of different periodicities then we can compare how these two lines are moving relative to each other and the price of the underlying security.

If we use a short-term MA and longer-term MA line then we can get an insight into changes in price momentum by for example noting when the short-term faster-moving MA line crosses over the slower moving, longer-term MA line.

A cross above the slower-moving line is typically seen as indicating upside price momentum while a cross to the downside is associated with downside price momentum.

In the chart below of Western Digital Corp (WDC), the price line is shown in blue with the 20 and 50-day MA or moving average lines drawn in orange and green respectively.

The red ellipses highlight MA cross-overs in both directions.

Other indicators that traders regularly use to create trading signals include RSI 14, Bollinger Bands and Stochastics.

9. Your Personality Will Determine What Sort Of Trader You Are Going To Be

As you move through your trading journey It’s important to try and identify what type of trader you are going be. Here are some examples and brief descriptions of trader types and styles.

- Scalper: A trader who buys and sells securities for small profits within seconds or minutes, taking advantage of price fluctuations and market inefficiencies.

- Day trader: A trader who opens and closes positions within the same trading day, the day traders leverages short-term market movements, while avoiding overnight risk.

- Swing trader: A trader who holds positions for a few days to a few weeks, aiming to identify and capture intermediate-term trends and price momentum in either direction.

- Technical trader: A trader who uses technical analysis -the study of historical and current price patterns and indicators on a chart, to analyse market movements and identify trading opportunities.

- Fundamental trader: A trader who bases trading decisions on the intrinsic value of securities, using economic data, financial statements, and news events to evaluate discrepancies between current prices in and the intrinsic value of securities.

- Trend trader: A trader who follows the direction of the dominant market trend, whether it is up, down, and tries to profit from that trend until it reverses course.

- Social/sentiment trader: A trader who uses social media platforms, online forums, and crowd-sourced opinions to gauge the mood and sentiment of the market and anticipate its behaviour. Social traders often also use copy trading services.

- Macro trader: A trader who takes positions based on the global economic and political landscape and data, focusing on factors such as interest rates, inflation, trade policies, and geopolitical events.

- Algo & API trader: A trader who uses computer programs and algorithms to execute trades automatically based on predefined rules and criteria, and who connects to trading platforms via application programming interfaces, or APIs to access market data and execute their trading algos.

10. Practice With A Demo Account (But Don’t Be Fooled By Initial Wins!)

The good news for would-be traders is that it’s possible to try before you buy, thanks to the availability of demo trading accounts.

Most brokers and trading platforms offer potential clients the chance to test the platform and their trading aptitude in a simulated trading environment, which behaves in a very similar way to the live markets.

This provides the perfect opportunity for you to get familiar with the way that markets move and how the trading platform operates.

However the demo environment can lull traders into a false sense of security because you are not trading with real money and that makes a big difference to your trading psychology.

There is a great line in the book Reminiscences of a Stock Operator, about why demo accounts are good for testing functionality, but they cannot prepare you for real live trading when your money is actually at risk. The story is about a man who was going to fight a duel the next day.

His second asked him, “Are you a good shot?” “Well,” said the duelist, “I can snap the stem of a wineglass at twenty paces,” and he looked modest. “That’s all very well,” said the unimpressed second. “But can you snap the stem of the wineglass while the wineglass is pointing a loaded pistol straight at your heart?”

Overall it’s a good idea to spend time in the demo environment but you will need to migrate to the live markets to begin trading, and to do that, you will need to open a live brokerage account.

The best way to do that is to think about what you will want from your broker listing items such as the markets and instruments you want to trade, the size of trades and account opening balances, educational resources and support etc.

Once you have created your list of requirements you can use our trading account comparison tables to find a broker that will meet your needs.

Online Trading Platform FAQs:

As long as you are classified as a retail trader and use an FCA-regulated broker for online trading, your money is protected up to a certain amount by the FSCS.

Publically traded online trading platforms like IG, CMC Markets, City Index (owned by StoneX) and Interactive Brokers are generally safer as they must report their financial status to the stock exchange and investors more frequently than private companies. By keeping an eye on a company’s share price you can see how healthy its balance sheet is.

There is no guarantee that any trading platform will not go bankrupt, but there are ways to keep an eye on the health of the company behind it.

Funds up to £85k are predicted by the FSCS if a broker defaults, but not above that amount, unless insurance is in place.

All trading platforms have demo accounts and it is one of the easiest ways to compare trading platforms is to open a demo account before you apply for a full account.

- Related comparison: Best demo trading accounts reviewed

Testing a broker’s trading platform with a demo account

Most demo accounts will give you a good idea of the look and feel of a broker’s trading platform and usually come with some virtual funds to trade with. Demo accounts allow you to test order tickets, layouts and the trading tools that are available on the real platform.

Comparing demo accounts for trading is quick and easy to do as most provide almost instant access after confirming your details via email. Be aware that brokers use demo accounts as a lead generation tool to convert prospects into real traders. However, most salespeople at respectable brokers are very knowledgeable about the technology on their platform and are more than willing to talk to prospective clients on the phone, via email or in-person about the features on offer. One point to note though is that if a salesman is too pushy, that should be a warning signal that they are best avoided.

Brokers such as IG, Saxo Markets and Interactive Brokers that provide DMA or hedge client positions allow scalping where traders buy and sell positions quickly in order to take small profits and losses.

Yes, it is possible to make money trading online. However, online trading is a very high-risk form of investment, and only around 20% of online retail customers make money trading online.

Margin rates are the amount of leverage you get when you trade. For example, a margin rate of 10% in share trading means that you can buy £1,000 worth of shares with a £100 deposit, the equivalent of 10 times leverage.

All trading platforms in the UK must be regulated by the FCA and on the Good Money Guide, we only feature trading platforms that are regulated by the Financial Conduct Authority.

Choosing a broker that is appropriately regulated for your type of trading

One of the most important things about choosing a broker for online trading is ensuring that they are properly regulated for the type of trading you want to do.

You can look up whether a broker is regulated by searching the FCA register. The FCA register keeps a record of all regulated persons and firms in the UK, as well as what financial services and products they are allowed to offer.

Regulated trading platforms must display the fact they are regulated and also appropriate risk warnings that display the risk of the products that they offer.

Never trade with a trading platform that is not regulated by the FCA, as your funds are not covered by the FSCS.

You will need your national insurance number, ID and the ability to prove you understand the risk involved in trading online.

A level-2 trading platform shows the market depth as well as the bid-offer prices. They are useful for getting better pricing, placing big orders, and seeing liquidity on the order book.

MT5 is the successor to MT4, one of the most popular trading platforms across the global. Brokers without their won trading platforms are able to use branded versions on MT5 to give their clients access to the markets.

IG is the oldest online trading platform and was founded in 1974

It is no longer possible to trade cryptocurrencies through spread betting and CFDs as the FCA has banned crypto trading. However, you can buy and sell cryptocurrencies without leverage through a cryptocurrency exchange. Be careful though as cryptocurrencies are an unproven and unregulated asset class and extremely high risk.

However, you can read our analysis on some of the best accounts for buying cryptocurrency here.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the trading platforms via a non-affiliate link, you can view the product pages directly here: