- Richard Berry

In this guide, we will explain the best ways to send money to abroad using currency brokers for large amounts and money transfer apps for smaller amounts.

Our picks of the best accounts for sending money abroad

Use our comparison of what we think are the best accounts for sending money abroad to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Currencies Direct: Best for sending large amounts of money abroad

If you are sending a large amount of money abroad for a personal property purchase or for business Currencies Direct are a good choice. As these large money transfers are not regular occurrences and can often be quite daunting, having a personal account execution to help with administration and to ensure the process goes smoothly is a real help.

Pros:

- Excellent for large transfers

- Bank beating exchange rates

- Personal service and advice

Cons:

- £25k max transfers on the app

- No cash or credit card deposits

TorFX: Best for currency forwards

If you want to buy a large amount of foreign currency now for a purchase in the future, then TorFX offers currency forward contracts up to 24 months into the future. You can use these to lock in the current exchange rate to protect yourself from the price moving against you.

Pros:

- 24 month forwards

- Buy now, pay later

- Dedicated account executive

Cons:

- Better for larger transfers

- No currency options

Wise: Best for medium-sized money transfers

Wise offer a very low-cost way to send money abroad. There is an excellent tool for getting live quotes on the website and is most suitable for small and medium-sized transfers.

Pros:

- Fixed exchange rates

- Transparent fees

- Simple to use

Cons:

- Expensive for large transfers

- No personal service

Western Union: Best for small transfers & cash

Western Union is one of the oldest money transfer providers in the world. The app has recently rebranded as WU which allows users to send money abroad at excellent rates. This year they have significantly reduced fees for sending money abroad and improved its exchange rates to compete with money transfer startups.

Pros:

- Established network of branches

- Cash and credit card transfers

- Good app and online platform

Cons:

- Better for small transfers

- No personal service or advice on large transfers

Compare exchange rates for sending money abroad

Use our exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large GBP currency transfers versus using your bank when you send money abroad.

Methodology

We have chosen what we think are the best ways to send money to abroad based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

How do you send money abroad?

Sending money abroad via an international money transfer provider is typically a straightforward online process.

After comparing money transfer companies to find the best one for your requirements, the first step is to create an account with a provider. To open an account with an international money transfer app or website, you will need to sign up via their website or app with a phone number, email address and you name. The money transfer company will request your personal details, as well as the details of the bank account you wish to send your money to. Opening an account can take some time because providers today have to perform strict identity checks for money laundering reasons. It can be a good idea to have an account set up well before you want to make a transfer.

If you are sending up to £10,000 abroad the anti-money laundering requirements are less stringent, so it is easier to open an account. However, if you are sending more than £10,000 abroad, you should use a currency broker instead of a money transfer company as they can offer additional services such as advice, exchange rate limits, alerts and personal service.

Once your account is set up and you are ready to make a transfer, it is usually just a matter of agreeing on the exchange rate and making a payment to the provider. Once the provider has received your money, they will then transfer the money to the bank account overseas.

Beware, though, exchange rates are constantly fluctuating. So, if you plan to make an international money transfer, it can pay to keep an eye on exchange rates. By making a transfer when the exchange rate is more favourable, you can potentially save money. If you are sending a large amount of money abroad you can lock in the current exchange rate with a currency forward contract for a transaction in the future.

History of Pound Sterling (GBP)

The Pound Sterling is one of the oldest currencies in the world. It is the official currency of the United Kingdom and some crown dependencies. Sterling’s FX abbreviation is GBP. Most FX quotations are against one Pound Sterling, e.g., GBPUSD specifies how many US dollars for one pound.

As the currency of one of the largest economies, the British Pound is actively traded in the foreign exchange market. It is the fourth most traded currency behind the Dollar, Euro, and the Japanese Yen. Many central banks hold Sterling as part of their foreign exchange reserves (IMF estimates this to be $550 billion).

The Bank of England, the second oldest central bank in the world, manages the monetary policy and policy rate. These two factors bear heavy influence on the movement of Sterling. More specifically, the nine-member Monetary Policy Committee (MPC) meets eight times a year to debate the economy and to adjust the policy rate if necessary. Currently, the policy rate is set at 10 basis point (0.1%), the lowest level in more than 200 years.

Over the past few years, another factor has emerged to influence to movements of Sterling, namely Brexit. But the impact of Brexit is slowly diminishing due to the conclusion of the separation treaty.

Factors that move the Pound Sterling exchange rate

Foreign exchange is a large and interconnected market place. Billions of dollars are transacted 24/7. Unsurprisingly, many factors can influence exchange rates movements. Most factors can be grouped under the three broad categories: 1) Political, 2) Economic, and 3) Monetary. Because of the myriad of market-moving factors, it is hard to calculate the correct value of a currency at any time. Even if we can compute this value, exchange rates rarely stay at that price.

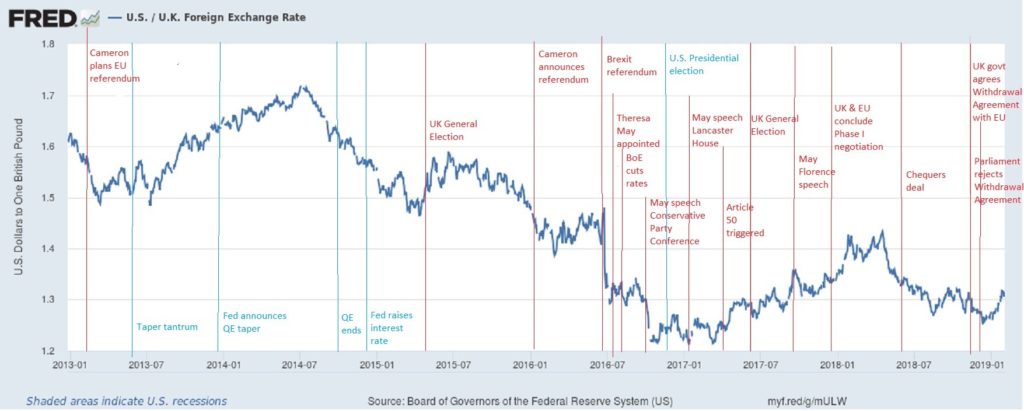

For Sterling, its value since 2015 has been a roller coaster ride. This is due to the political uncertainty arising from the Brexit referendum (see below). At time, Sterling trades like an emerging market currency. But the conclusion Brexit has diminished the impact of the event.

Source: American Express

Apart from Brexit, other factors that drive the exchange rate include the economic outlook, inflation, and quantitative easing.

- Economic outlook – is determined by dynamic factors, including house prices, post-Brexit trading patterns, and the fight against covid-19. UK is one of the fastest countries to vaccinate its population. This makes investors more positive about its economy, hence the rise in Sterling since late 2020.

- Inflation – is one of key aspects of BoE’s mandate. If inflation overshoots the 2 percent target, the central bank will be prepared to raise interest rate to dampen demand.

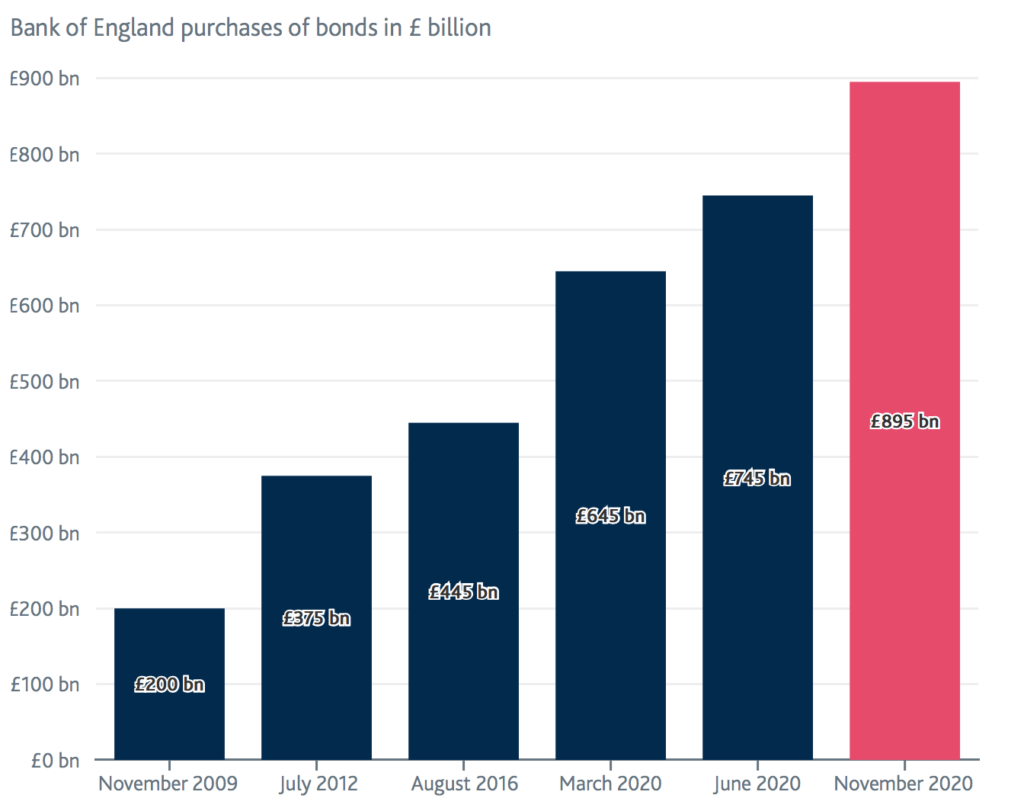

- QE – is a key tool in the fight against the deflationary aspect of a financial crisis and the pandemic. During Mar-Nov 2020, the central bank has increased its balance sheet by about £250 billion to £895 billion. This weakened Sterling.

Another crucial factor is expectations. If investors expect an economy to do well – even from a poor starting point – then they are willing to buy the currency. In contrast, if the market anticipates the economy to deteriorate despite if it doing well now, then the exchange rate will have limited upside.

Bottom line – Sterling has been quite volatile over the past few years because of Brexit. Now that event has passed, economic factors may have more influence on its direction. In 2021, one of the most important factors to watch for is inflation. This is due to a constriction of supply and pent-up demand arising from the pandemic.

Live Pound Sterling (GBP) exchange rates

The current best Pound Sterling exchange rate versus other G10 currencies is the mid market price which is:

| Australian Dollar (AUD) | 1.937005197 |

| Canadian Dollar (CAD) | 1.717931851 |

| European Union Euro (EUR) | 1.169959415 |

| Japanese Yen (JPY) | 192.281773 |

| New Zealand Dollar (NZD) | 2.106946465 |

| Norwegian Krone (NOK) | 13.64861474 |

| Swedish Krona (SEK) | 13.61439871 |

| Swiss Franc (CHF) | 1.134151943 |

| United States Dollar (USD) | 1.243315 |

Sending money to abroad FAQ:

The best way to send large amounts of money abroad is to use a currency broker.

As well as getting the best exchange rates, if you send money abroad with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer money with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of GBP you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better exchange exchange rate than by using your bank.

Our comparison tables and exchange rate quote request forms will help you find the best GBP exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas GBP exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best GBP exchange rate when sending money abroad

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the GBP exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money abroad a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money abroad. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money abroad because of the high fees.

The three main ways to send money to abroad are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money abroad is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.