Short selling is a type of trading where you try to profit from the price of a stock, index, commodity or ETF going down rather than up. You can either short stocks through financial spread betting, CFDs, inverse ETFs of single stock futures. In this guide, we explain what short selling is and review some of the best trading platforms for “going short”.

City Index: Best for short selling trading signals and analysis

City Index was one of the original CFD and spread betting brokers to enable retail investors to short the market. You can go short on around 4,700 global shares, 84 currency pairs, 40 indices and 20+ commodities. Spreads and pricing is competive, but the main benefit of City Index is their trading signals and post trade analytics. City Index have their own trading signal feature called SMART signals which generates signals when markets are a potential sell. They also have Performance Analytics which tells you whether you are better at going long or short the market based on your trading history.

Pros:

- Smart short trading signals

- Post-trade short trading analytics

- Good education and analysis program

Cons:

- No DMA short selling

- Limited traded options as CFDs & spread bets

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Best for on-exchange short trading

Interactive Brokers offers on exchange DMA trading so you can short stocks and markets with direct market accounts. They also have transparent, low commissions and financing rates for short positions.

Pros:

- Low cost index trading

- On exchange index futures & options

- Excellent trading platform & apps

Cons:

- US-based

- Desktop platform too complex for beginners

60% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: Best for customer service

Spreadex offers short selling on thousands of large and small cap stocks, via financial spread betting or Contracts For Difference on the world’s major stock indices – with low commission on stocks and tight spreads on the most popular markets from 1pt on UK 100, 1pt on Germany 40 & 1.7pts on Wall Street.

Pros:

- Easy-to-use platform

- Low minimum deposit

Cons:

- Limited put options

- No DMA short selling

72% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: Best for low-cost short selling

With CMC Markets you can short thousands of markets, but also see what their most profitable traders are bearish on. You can go short via CFDs or spread bet with tight spreads, lightning-fast execution and the highest-rated customer service in the industry.*

Pros:

- Excellent client sentiment indicators

- Tight pricing

- Very good trading platform

Cons:

- No investing ETFs

- No DMA short trading

77% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Best for short selling stocks on MT4 & MT5

Pepperstone has one of the largest ranges of stocks to short through their MT4, MT5 and cTrader trading platforms. Pepperstone’s strength is tight pricing in liquid markets and is a good option for those that also want to automate their short trading on major indices.

Pros:

- Good for automated index trading

- Lots of indices on MT4/MT5

- Tight index pricing

Cons:

- No DMA index trading

- No index options

74% of retail investor accounts lose money when trading CFDs with this provider

IG: Best liquidity for large short sellers

IG has some of the best liquidity due to it’s size and customer base which means it is especially good for large traders who want to short stocks in size. They can often provide better liquidity than the underlying exchanges. Plus they offer smaller-caps stocks for shorting, not just the main market shares.

Pros:

- Excellent short selling liquidity

- Wide range of shares to go short

- Good short signals & analysis

Cons:

- No on exchange futures

- Put options only available as a CFD and spread bet

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Saxo Markets: Best for DMA short selling

Saxo Markets has offered short selling facilities to larger individual and institutional traders for decades. They cater slightly more towards more professional short sellers and can help with larger borrow requests and access to on exchange liquidity and options strategies.

Pros:

- DMA short selling

- Tight pricing

- Excellent analysis and data

Cons:

- No short selling spread betting

70% of retail investor accounts lose money when trading CFDs with this provider

Pros:

- Simple to use

- Copy and social trading

- Set your own index leverage

Cons:

- USD only accounts

- High FX conversion fees

- Spreads can be wide

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

❓ Methodology: We have chosen what we think are the best brokers for going short based on:

- over 7,000 votes in our annual awards

- our own experiences testing the short selling on the platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the CFD short-selling platform CEOs and senior management

Compare Brokers For Short Selling

Use our comparison table of what we think are the best brokers for short selling to compare how many markets they offer, how much it costs to short sell major instruments, minimum deposit amounts and what the overnight financing costs are for holding longer-term short positions.

| Trading Platform | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 13,500 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| 7,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 5,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider. |

⚠️ FCA Regulation

All short-selling trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK brokers that offer short-selling are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature short-selling platforms that are regulated by the FCA, where your funds are protected by the FSCS.

How does short selling work?

Short selling is speculating that the price of a financial asset will go down rather than up. Short selling is mainly used for trying to profit from falling shares prices, protecting investment portfolios in bear markets and derivatives trading like CFDs, spread betting and futures trading.

When you go short you are selling a stock that you do not own in the hope that it will reduce in value before you buy it back. The principle of shorting stocks is not new, professional traders and hedge funds have been shorting stocks it for years. It works like this:

- Fund A thinks the share price of Vodafone will go down and they want to bet on a drop in the short term (a few months).

- Fund A knows that Fund B has a long term (a few years) position in Vodafone shares.

- Fund A asks to borrow Fund B’s Vodafone shares so they can sell them to someone else.

- Fund B lends Fund A the Vodafone shares and charges 5% of the value as a fee.

- Funds A sells the Vodafone shares on the London Stock Exchange

- A month later Vodafone shares have dropped in price and Fund A buys them back.

- Fund A then gives the shares back to Fund B.

Different ways to “go short”

The main ways to short-sell the market are:

- Financial spread betting – take a bet on a stock

- CFDs – a contract based on the difference between the opening and closing price of your trade

- Inverse ETFs – these are exchange-traded funds that go up when the asset they track goes down

- Options – you can either buy puts or sell calls to speculate on the market going down

Short selling with financial spread betting

For the private spread betting investor, going short it is much simpler as you do not have to go through the process of borrowing stock to sell it. You can just bet a certain amount per point that the shares will go down. Plus, with a financial spread betting profits are tax-free as trades are structured as bets.

To do this, you will need an account with a spread betting broker that will either net the position off against one of their clients that is long or will borrow the stock just like Fund A did in the example above. Then give it back when you close your position.

This example is based on a single trade and the intricacies of a brokers stock lending and borrowing team are much more complex than this.

So for example, if you bet £10 a point (cent) that Deutsche Bank stock (priced at 7.72) moves then you could potentially make £7,720 if it goes to zero. In order to execute the trade you would have to deposit £1,500 in initial margin and make sure you have enough money on your account for daily P&L margin.

Another benefit of shorting as a spread bet is that even though Deutsche Bank trade in Euros you can have a GBP position.

- Further reading – compare the best spread betting brokers here or read our guide to how financial spread betting works

Short selling with CFDs (contracts for difference)

Short selling with a CFD is similar to spread betting in that you trade on margin but instead of betting a £ per point you buy and sell an equivalent amount of CFD instead of selling the shares. Be mindful that you always trade in the currency of the underlying asset so using our DB example, your P&L will be in Euros.

- Further reading: compare the best CFD brokers in the UK here

Short selling by buying a put option

Buying a put option will give you the right to sell a certain amount of stock in Deutsche Bank at set price.

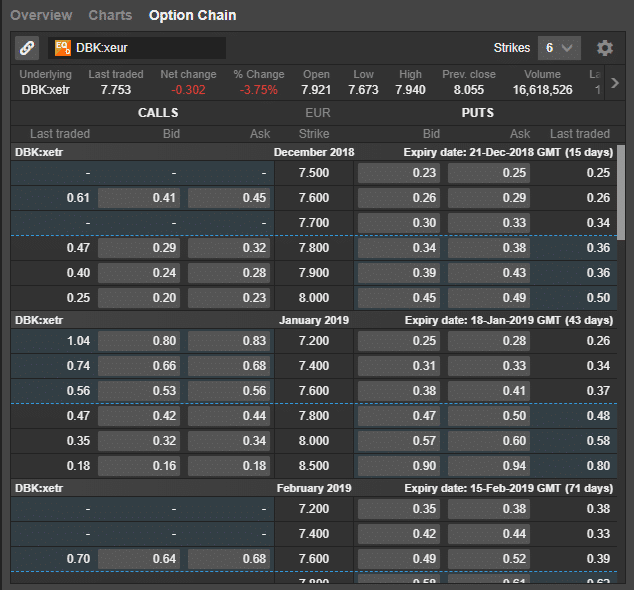

So taking an example from the below options chain on Deutsche Bank shares. If you buy some 7.6 January 2019 put options you will have the right to sell your Deutsche Bank at 7.6 even if the price is trading on the market at 6. Of course, you don’t have to wait till the option expires, you can sell your option position. If the price has moved lower the intrinsic value of the option will have increased from 0.41. However, the closer the option gets to expiry the lower the time value will get.

You can read more about calculating the time value of an option for options trading here.

The risk with options is that you lose the premium that you paid and the option expires out of the money worthless. The benefits of shorting via options are that your risk is limited, but they can expire worthless.

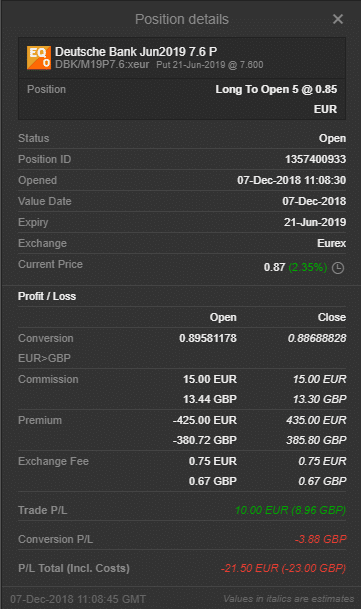

An example of a put options order execution ticket below:

Short selling buy selling a call option

This is a very high-risk form of short selling because your losses are unlimited. Unlike buying a call options where your losses are limited to the premium you paid for the options and your potential profits are unlimited. When selling call options (or writing call options) your profit is limited to the price you receive for the call option but your losses are unlimited.

- Further reading: compare the best options trading platforms in the UK here.

Pros & cons of short selling

|

Advantages of short selling |

Disadvantages of short selling |

| 👍Make money when the market goes down | 👎Unlimited losses if the market rises |

| 👍Can be used to hedge long term investments | 👎Can be hard to borrow stocks |

| 👍Simpler alternative to trading options | 👎Short positions can be called in and automatically closed |

Bull and bear markets are the yin and yang of financial cycles. Learning to short-sell may prove to be lucrative when the markets head south.

When people think of short selling, they associate it with financial vultures, unscrupulous hedge funds, and doom merchants. Even regulators are not too kind towards this activity. Banning short-selling activities is the first thing they do during market panics. But is short selling really that negative?

In a modern, sophisticated and complex financial market, short selling is an invaluable activity. It helps to burst the unfounded optimism of a sector, prevent irrational buying of assets, and uncover frauds. It is a vital part of an efficient market and price discovery.

The risks of short selling

Short selling is taking a punt on the downside of a stock. To short sell a stock, you borrow shares from someone who already owned them, and sell these shares on the market hoping to back them back cheaper in the future. For example, you borrow XYZ plc shares and sell them at 120p now. If prices go down to 100p next week, you make a 20p gain.

After you buy back the stock, you return these shares back to the original owners.

Unlike buying shares, short selling is not cheap. On top of the usual CFD or spread betting brokerage fees, short sellers may have to pay a fee to the owners of the shares and whatever dividends accrued to them during the period shares out on loan.

Moreover, short selling is fairly high risk. This is because a stock’s upside is limitless. The most XYZ plc can only go down is 100% (bankrupt). But it can double or triple over a short period of time. Thus brokers who arranged the shares often require counterparts to post large collateral to guard against this risk.

But this is not the most crucial factor. The most dangerous risk for CFD traders short selling is a short squeeze. This describe a manic scramble to buy back shares previous shorted. The catalyst could be better-than-expected results, a takeover approach, or a new product discovery. Suddenly, every short seller rush to cover their short positions by buying back the shares they previously shorted. When everyone buys a stock, it creates an immense upward pressure on prices which hurt short sellers even more.

One example is Tesla (TSLA), which was heavily shorted in 2018-’19. But when its financial position was not as dire as predicted, Tesla began to surge – and prompted a massive wave of short covering. The spike to near $1,000 indicates this panic buying. Once this wave passes, prices collapsed back to $400. That’s why naked short selling is often limited to experienced and sophisticated investors with deep pockets.

Benefits of short selling

- Short selling could be suitable for experienced investors who enjoy going against the grain. It is a lucrative activity for successful investigative traders who know what they are doing. There are professional funds that are dedicated to this activity alone.

- Short selling pays off just when you need it. For example, your short-selling activities may net you a fortune during severe bear markets. This gives you a layer of protection on your long-only portfolios.

- Short selling allows you to take more aggressive long activities because you have some downside hedge.

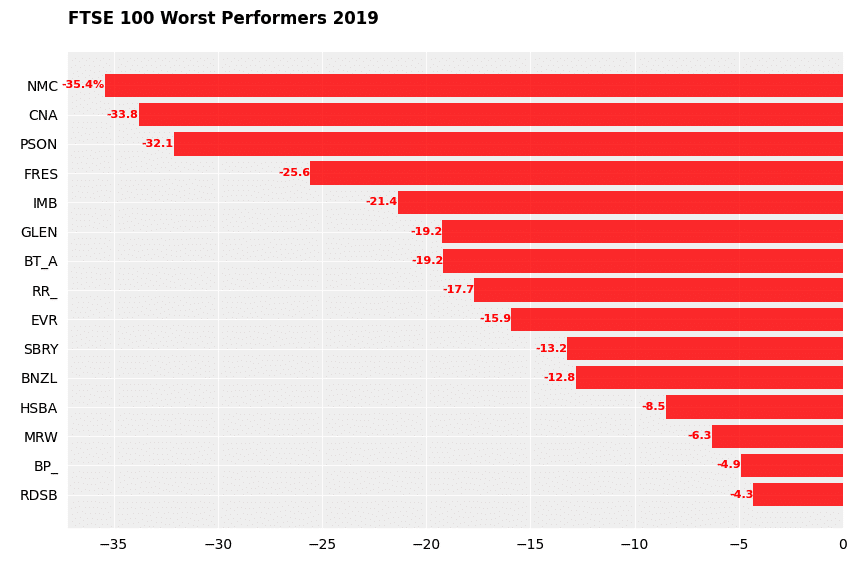

- There are plenty of opportunities for short sellers in the UK. During a relatively steady year (2019), there are many blue-chip FTSE stocks that plummeted in value. For example, Centrica (CNA), Fresnillo (FRES), Glencore (GLEN) all drop by double digits (see below). This created opportunities for short sellers.

When to consider short selling

There are three scenarios where short selling can be considered, speculation, fraud and portfolio protection.

- Related guide: 50 rules for successful trading

Speculative Mania

When stock markets have been rising to stratospheric levels and incredibly expensive valuation, it is ripe for short selling. One instance that comes to mind is the dot-com boom. Many stocks slumped by 99% in the crash that followed. Not to forget is that during the Global Financial Crisis in 2008 many short sellers made a fortune because they bet against the credit bubble. One key thing to bear in mind is that selling a mania requires a near-perfect timing. An expensive stock can become even more expensive before prices turn down.

Undiscovered Fraud

This means that investors are generally unaware of the underlying ill financial health of a company. One recent example in the UK is NMC Health (NMC), a former darling of the stock market. In December of 2019, the company was accused by Muddy Waters – a specialised research outfit that targets financial frauds – for concealing its true debt levels. Initially, the firm rejected these accusations. Then the true picture emerged weeks later and NMC was suspended, but not before its share prices collapsed by 75% from its peak (see below). If you smell something fishy about a stock, stay away. Better still, short sell it.

Bear Markets

During a bear market, most stocks will depreciate. Prices decline as profit outlook turn negative. Valuation of a stock shrinks. This means that the path of least resistance is to the downside, create trends that are favourable to short sellers.

Short selling in summary

Short selling stocks is speculating that the price of a stock with go down and trying to profit from that move by selling a stock before you own it and buying it back later.

If you think that a share price is going down then you can put on short position to profit from a falling market. Here’s a quick guide to shorting stocks, the risks, the potential rewards, the types of trading and the brokers that offer short selling.

There are three main ways to of short selling stocks, spread betting, CFDs and options.

- Spread betting – take a $ per cent bet on the stock. Spread betting is one of the most popular ways for private investors to short US stocks. Commissions are worked into the spread, so you just see one price. Profits are also tax free.

- CFDs – are a contract for difference between the opening and closing prices of a trade. Spread betting tax benefits are unique to the UK so Europeans trade CFDs instead. CFDs are also useful for larger more tax efficient traders who want DMA (Direct Market Access) to get better pricing.

- Options– this gives you the right to sell a certain amount of stock at a certain level in the future. You don’t have to which is why it’s called an option. If you think a share price is going down, you would buy a “put” which gives you the right to sell stock at a certain price. The price of a put will increase the further down the stock goes, allowing you to sell the put at a higher price and therefore making a profit on the options.

How to short sell stocks

To short sell stocks you need a broker that offers short selling. But before actually place your trades, given that short selling is risky, you should consider these factors that may increase your success:

-

- Know the company inside out, especially if you are short selling individual stocks. You need to be able to ascertain a company’s true financial picture better than the market. Not easy to do, given markets are relatively efficient. Seek discrepancies in the firm’s debt, cash flow, product sales, etc – and compare it with its peers. Does it make sense? Is high valuation a reason to short sell it?

- Look for triggers. Shorting a stock on its way up is highly dangerous because you may not have the financial power to sustain margin calls. Better to wait until prices peak and start to come down. During the dot-com, one trigger to short a stock was the expiration of lock-up periods. When these lock-up expired, management, early investors, and founders all dump their stock holdings to turn their paper wealth into cash. This created massive downward pressure on prices.

- Start small. Only add when prices are starting to move favourably in your direction. Stoplosses are essential.

- Analyse short activities. Find out what other funds are shorting – because this may create herding behaviour

Risks of short-selling stocks

- Unlimited potential losses: The main risk is that share prices can go up indefinitely, but only down to 0. So in theory, if you are shorting Facebook stock you potential losses are infinite. Also, if the company is bid for or a takeover rumour emerges the share price will surge.

- Over leverage: Shorting shares is generally done on margin. Using leverage to trade means that you get exposure to more stock than funds on account. So for example, if the margin rate for Facebook is 10% you can short $10,000 worth of stock with only $1,000 on account. If the stock drops 50% you make $5k, but if it rallies, just 10% you’ve lost all your money.

- Currency Risk: Facebook is an American stock so there is a currency exposure. If the GBPUSD rate changes significantly, this can wipe out all your profits. You can avoid this through by trading a GBP position in a USD stock with a spread betting or CFD broker.

Rewards of short-selling stocks

- You can profit when the stock goes down. Shorting stocks, is not a new principle for UK investors. Spread betting and CFD trading have been around for years. Spread betting and CFD traders have been speculating on currencies, indices and stocks going up and down for decades. Shorting is of course an excellent tool for protecting long term investments against short term downtrends. But also provides a trade for short term speculation. It is risky though, so always make sure you understand the risks involved.

- Receiving income from overnight financing. When you trade on leverage there is an overnight financing charge for long positions. Most accounts are set to charge 2.5% over/under 1 month LIBOR (or thereabouts). What this means is that if you are long, you have to pay 2.5% plus the 1 month LIBOR rate to hold the position. But, if you are short you should receive the interest. In practice though (at the moment) interest rates are so low the short credit ends up negative so you check with your broker if you actually pay interest on short positions.

Short Selling Broker FAQs:

You make money shorting when you sell a stock or asset before you own it and buying it back cheaper. It is also possible to make money by receiving interest on overnight positions.

Some brokers will credit your account with overnight interest if their rate is less than the local rate. For example, if a broker charges =/-2.5% SONIA and interest rates are 5%, you should receive 2.5% from overnight funding?

Yes, if an exchange “calls in short” positions a broker will be obliged to buy back your position in the market or close off if you have traded OTC.

If you have a short position in a stock that gets suspended you will not be able to trade out of it until it comes back to market or you broker agrees to close the position. You will also have to put up efecetilvey 100% margin for the position as you cannot have leverage positions in suspended securities.