If you want to buy Dogecoin follow these simple steps:

- Choose a cryptocurrency exchange

- Deposit some funds (never risk more than you can afford to lose)

- Buy Dogecoin ( you will have to convert your GBP or USD into DOGE

- Decided if you want to leave your Dogecoin on an exchange or download it to a cryptocurrency wallet.

Two important things to remember about investing in cryptocurrency.

- If you keep your crypto on an exchange you may lose it if the exchange goes bust

- If you keep your crypto in a wallet you may lose it if you lose your wallet

Crypto is unregulated and very risky. There is a very high change you may lose all your money and investment.

Should you buy Dogecoin after Elon Musk changed Twitter’s logo?

Buying Dogecoin after Elon Musk changed Twitter’s logo is just GameStop with different fleas

Elon Musk has been taking the absolute mick again, when it comes to using his businesses to move markets. This time by changing the logo of Twitter to Dogecoin’s shiba inu. It’s an absolute miracle, especially after his comments on the Tesla share price, that he hasn’t been fined for his irresponsibility. But, now that Dogecoin is up 25% after the move, and people searching for how to buy Dogecoin has gone up by nearly 2,000% should you be investing in Dogecoin? Err no…

Firstly what is Dogecoin?

Dogecoin is a cryptocurrency that was originally created in 2013 by two software engineers as a joke. It is designed to be a light-hearted alternative to traditional cryptocurrencies such as Bitcoin. It started as a joke and has in my opinion has no intrinsic value at all. The problem is though, April Fools is lighthearted, the satire on Daily Mash is lighthearted, but making people think that a joke is investible and them then losing money is not lighthearted at all…

What drives the Dogecoin price?

Sentiment.

The Dogecoin price is driven by demand. This basically means, if people are interested in buying in (and do) then the price will go up. The inverse is true, in that when people stop being interested in it, the price will fall.

Why did Elon Musk change the Twitter logo to Dogecoin’s shiba inu?

According to City AM, it’s because of a tweet sent over a year ago in which @WSBChairman said Musk should “just buy Twitter… and change the bird logo to a Doge”.

Is now a good time to buy Dogecoin then?

This has all the markings of a a classic pump and dump scheme. Which means you talk up the price of a stock (or more recently cryptocurrency) that you own. The more you talk about it, the more people want to buy it so the price goes up. You can then sell it for more than you bought it for. Then, as I said earlier, when the buyers run out, the price goes down.

If you hadn’t already made the connection, @WSBChairman runs a twitter account with nearly 1m followers that has this pinned tweet:

GameStop united the country at a time when nothing else could.

— Chairman (@WSBChairman) January 28, 2021

I personally, don’t think that GameStop united any country. All it did was encourage inexperienced investors to pile their money, into a highly volatile stock, at a time when the world was in chaos. The account also links to Discord accounts and Reddit forums. I hope you get the picture…

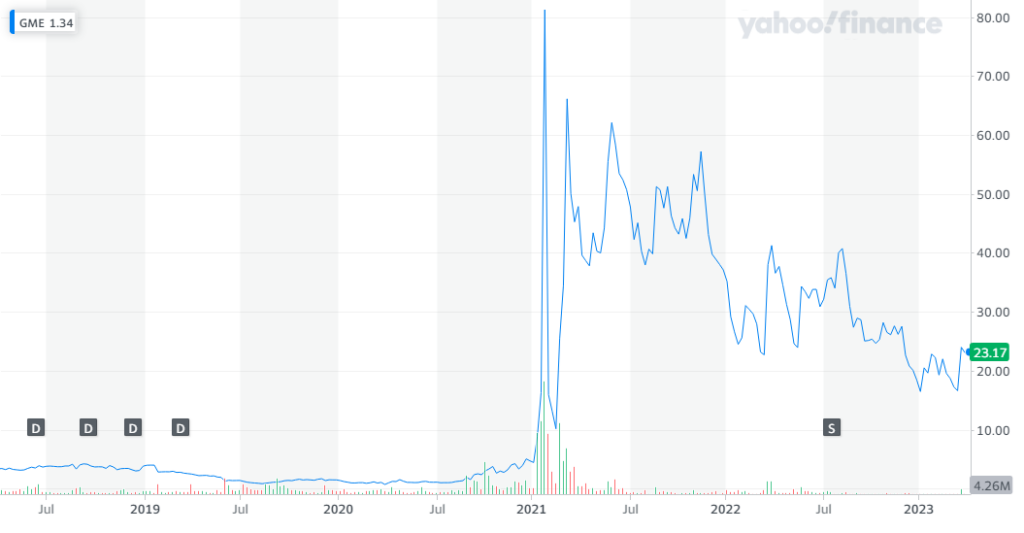

Take a look at the Gamestop share price now, for those that bought after the hype, they have not done well.

So, no, if you own Dogecoin, it may be a good time to lock in some profits from the recent rally. Although, over a year, even with the 25% rise after the Twitter logo changed, it is still down 34%.

You can also see in this chart from Yahoo Finance, that it bears a sticking similarity to the Gamestop rise and fall.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.