Private pensions are a tax-efficient way to invest and save for your retirement. They can give you greater control over where your money is invested as you (or with the help of an adviser) decide what different asset classes to invest in from stocks, bonds ETFs, investment trusts and funds.

Our industry experts have tested, ranked, compared and reviewed some of the best SIPP providers and accounts in the UK that the FCA regulates.

AJ Bell: Best for low-cost DIY pension investing

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- SIPP account charge: 0.25%

- SIPP Dealing fee: Shares £3.50 – £5, funds £1.50

AJ Bell SIPP Review

Name: AJ Bell SIPP

Description: AJ Bell offers the cheapest SIPP account when you compare them against providers that charge a percentage of your portfolio value. You can invest in a wide range of investments, including stocks in more than 20 markets, over 2,000 funds, ETFs, and bonds.

Capital at risk.

Is AJ Bell's pension any good?

Yes, AJ Bell offers one of the cheapest SIPP accounts when you compare them against providers that charge a percentage of your portfolio value. You can invest in a wide range of investments, including stocks in more than 20 markets, over 2,000 funds, ETFs, and bonds.

Special Offers:

- Up to £500 cashback: Switch your SIPP to AJ Bell and they will pay up to £35 per investment and £100 in exit fees as cash back to cover your costs up to £500.

- £100 gift vouchers: If you refer a friend to AJ Bell that opens an ISA or SIPP with more than £10,000 you both get £100 of One4All gift vouchers.

Pros

- Low SIPP account fees of 0.25% & share dealing commission

- Wide range of shares, bonds and funds

- Ability to add a Junior SIPP for your children

Cons

- High phone dealing charges

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.4Interactive Investor: Best for fixed-fee DIY pension investing

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- SIPP account charge: £12.99 per month

- SIPP dealing fee: £3.99 – £5.99

Capital at risk

Interactive Investor SIPP Review

Name: Interactive Investor SIPP

Description: One advantage of Interactive Investor’s SIPP is that it offers a flat-fee structure. This means that annual account charges do not increase as your SIPP grows in size. This structure can help those with larger SIPP portfolios save on fees.

Capital at risk.

Is Interactive Investors' SIPP (pension) any good?

Yes, Interactive Investor’s SIPP costs 12.99 a month for new customers, but if you already have a II shares dealing account you can add a SIPP for £10 per month instead of £12.99. Dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Pros

- Flat account fee of £12.99 per month

- £1 minimum deposit makes it easy to get started

- Fixed SIPP account fee that does not increase with your investments

Cons

- Fixed fee expensive for very small accounts below £1,000

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2Hargreaves Lansdown: Best overall DIY pension account

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £100

- SIPP account charge: Shares 0.45%, funds 0.45%

- SIPP dealing fee: Shares £5.95 – £11.95, funds £0

Capital at risk

Hargreaves Lansdown SIPP Review

Name: Hargreaves Lansdown SIPP

Description: We have ranked Hargreaves Lansdown as the best SIPP provider in our 2022 Awards. The main advantage of Hargreaves Lansdown’s SIPP is that it offers access to a vast range of investments. Investors have access to domestic and international equities, over 3,000 funds, bonds, as well as plenty of research and investment tools.

Capital at risk

Is Hargreaves Lansdown SIPP (Pension) Any Good?

Yes, Hargreaves Lansdown SIPP costs start at 0.45% of your portfolio value. The account charge for shares is capped at £200 per year. Funds are charged at 0.45% for the first £250,000, then 0.25% between £250k and £1m, then 0.1% between £1-£2m. There is no charge above £2m. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

Pros

- Widest range of shares, bonds and funds to invest in.

- Get started with as little as £100 or a £25 regular investment

- Share fees capped at £200

- Excellent research & data to help you choose what to invest in

Cons

- Can be expensive for large fund portfolios

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3Bestinvest: Good for pension investment advice and low costs

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- SIPP account charge: 0.2% to 0.4%

- SIPP dealing fee: Shares £4.95, funds £0

Capital at risk

Bestinvest SIPP Review

Name: Bestinvest SIPP

Description: Bestinvest has combined low-cost online investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. A good choice for large long-term investors.

Capital at risk.

Is Bestinvest's SIPP (Pension) any good?

Yes, Bestinvest SIPP fees are 0.2% for holding ready-made portfolios, above £500,000 it reduces to 0.1%. For other investments, the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

Pros

- SIPP investment advice and buy/sell recommendations

- Low minimum deposit of £1

- Very low account fees from 0.2% on pre-made portfolios

Cons

- No bonds

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4Nutmeg: Best managed private pension in 2023

Approved by Nutmeg on the 11 September 2023

- Investments: 5 investment styles

- Minimum investment: £500

- Pension charges: 0.75%-0.45%

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future

Nutmeg won “best private pension” in our 2023 awards as they offer low fees and make it very simple to pick an appropriate portfolio. They also have a great selection of socially responsible funds and are good value for larger pension pots.

Nutmeg Pension Review

Name: Nutmeg Pension

Description: Nutmeg has created five pension styles (portfolios) which have been built by experts and use exchange-traded funds to diversify across stocks, bonds, industries, and countries. This also importantly keeps costs down.

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

Is Nutmeg's pension any good?

Yes, Nutmeg pensions cost 0.75% for their managed portfolios which drops to 0.35% for balances over £100k. For their fixed allocation portfolios, they charge 0.45% dropping to 0.25% for balances over £100k. For all portfolios, there is an additional charge by the investment fund managers of around 0.2% and the market spread on buying and selling portfolios is currently between 0.04% and 0.09%. More information on fees and products can be found here.

Pros

- Low account fee of 0.75%

- Part of J.P. Morgan

- Simple pre-made portfolios

Cons

- £500 minimum investment

- No individual funds

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4“We’re really pleased to win this award for Nutmeg because it is just rewards rewards for all the hard work that our team puts in back in our Vauxhall office from client services to operations to product to the investment team everybody’s played a partner. We’re really proud to win.”

James McManus

Chief investment officer at Nutmeg

Wealthify: Pension investing from just £50

- Investments: Managed funds

- Minimum investment: £50

- Pension charges: 0.6%*

Capital at risk. Your tax treatment will depend on your individual circumstances and it may be subject to change in the future.

Wealthify Pension Review

Name: Wealthify Pension

Description: Wealthify’s pension lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

Capital at risk. Your tax treatment will depend on your individual circumstances and it may be subject to change in the future.

Is Wealthify's pension any good?

Yes, Wealthify charges a flat annual fee of 0.6% for their pension. *There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans. Capital at risk.

Please note: Wealthify is unable to accept any pensions that customers are taking an income from or transfer any pensions with defined benefits or guarantees.

Pros

- Managed pension

- Low minimum deposit of £50

- Low account annual fee of 0.6%*

Cons

- Cannot invest individual shares

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2Moneyfarm: Best digital pension for starting small

- Investments: 7 managed funds

- Minimum investment: £1

- Pension charges: 0.75%

Capital at risk

Moneyfarm Pension Review

Name: Moneyfarm Pension

Description: Moneyfarm lets you invest your pension in one of seven ready-made simple and diverse portfolios with different degrees of risk and reward. Users can transfer a pension or setup a new one and Moneyfarm will manage your portfolio based on your retirement target date by reducing the risk as the time approaches.

Capital at risk.

Is Moneyfarm's pension any good?

Yes, Moneyfarm’s pension account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Pros

- Simple investment options

- Low account fee of 0.75%*

- Easy to use

Cons

- Limited amount of individual shares

- No US shares available

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

3.8Dodl: Easy to use app-based pension for beginners

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- Account types: GIA, ISA, Pension, LISA

- Account charge: 0.15%

- Dealing fee: £0

Capital at risk

AJ Bell Dodl Pension Review

Name: AJ Bell Dodl Pension

Description: AJ Bell Dodl’s pension lets you invest in some of the largest funds and shares in the UK and US. They are backed by AJ Bell, and as the pension is aimed at first time investors, costs are very low.

Capital at risk.

Is a Dodl pension any good?

Yes, a Dodl pension costs 0.15% of the value of your investments in each account, per year. This is charged monthly with a minimum of £1. An AJ Bell Dodl pension is for beginners and has a limited range of investments, but the full AJ Bell platform lets you invest in thousands of shares, funds and ETFs in a SIPP.

Pros

- Low cost

- Backed by AJ Bell

- Aimed at beginners

Cons

- Limited investment range

- App only

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1❓Methodology: We have chosen what we think are the best private pension accounts based on:

- over 17,000 votes in our annual awards

- our own experiences testing the private pension accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative private pensions.

- interviews with the private pension provider CEOs and senior management

You can use our comparison of private pension providers to compare account charges, the minimum deposits to get started, and if you have to make your own investment decisions or a fund manager does it for you.

What Is A Personal Pension?

A private pension is a type of investment that’s a tax-efficient way of building funds for your retirement.

For most people, relying solely on the basic State pension will not provide a suitable standard of living in retirement. Supplementing your retirement income with a private personal pension can mean the difference between just surviving and really living.

Typically, private personal pensions are defined contribution arrangements (sometimes called money purchase), which means the account holder bears all the investment risk.

The size of the final pot depends on what you paid in and how well the investments performed.

Private personal pensions differ from workplace pensions set up by an employer into which they will also contribute.

Pros & Cons Of Personal Pensions

Here is a round up of the advantages and disadvantages of personal pensions:

Pros

- Tax relief – private pensions are the most tax-efficient way to save for your retirement

- Compound interest – the earlier you invest the greater your potential returns can be

- Employer contributions – your employer will top up your pension contributions

- Guaranteed retirement income – if you buy an annuity to provide you with regular income

Cons

- No access until age 55 – when you invest in a private pension you cannot access your money until you are 55

- Underperformance – if you choose your own investments you run the risk of picking investments that do not perform as well as those chosen by a professional investment manager

- Complex – private pensions are not for everyone so if you do not understand pricing structures or suitable long-term investment products that can be hard to understand

Compare UK Private Pensions & Providers

| Private Pension Provider | Pension Account Charges | SIPP or Managed | Minimum Investment | GMG Rating | More Info |

|---|---|---|---|---|---|

| 0.25% – 0.1% | SIPP | £500 | See Pension Capital at risk |

|

| 0.45% – 0.25% | SIPP | £1 | See Pension Capital at risk |

|

| £5.99 a month | SIPP | £1 | See Pension Capital at risk |

|

| 0.6% | Managed | £50 | See Pension Capital at risk |

|

| 0.15% | SIPP | £1 | See Pension Capital at risk |

|

| 0.4% – 0.2% | SIPP | £1 | See Pension Capital at risk |

|

| 0.75% -0.35% | Managed | £500 | See Pension Capital at risk |

|

| 0.75% – 0.35% | Managed | £500 | See Pension Capital at risk |

|

GoodMoneyGuide.com Pension Calculator

Find out quickly and easily how much your pension contributions will be worth with our free online pension calculator.

It’s important to note that you only get tax relief on contributions up to £60,000 per year.

How To Choose A Pension Provider

The main things to look for when deciding what private pension provider to use are:

- FCA regulation: Always look for regulated providers that are part of the Financial Services Compensation Scheme, which offers 100% protection should the pension company fail. In addition, if you’ve received bad advice in relation to your pension, you could be eligible to claim up to £85,000.

- Cold calls: Watch out for providers – or advisers – that contact via cold calls (which are now illegal) or unsolicited marketing material. Always take the advice of a fully regulated independent financial adviser. Always check the list of regulated and approved list of providers on the Financial Conduct Authority’s website: https://www.fca.org.uk/firms/financial-services-register

- Investment options: The amount of fund options available are important; look for providers offering options that meet your risk appetite. If you are interested in a self-invested personal pension, which allows more freedom to invest in individual stocks, make sure the provider has the appropriate expertise and range suited to your preferred portfolio.

- Contribution levels: Make sure you ask about minimum contribution levels and that you understand fees and charges.

- Exit fees: Many firms will charge exit fees if you want to transfer to a new provide, which can often be expensive.

What is the best performing private pension?

Our analysis shows that of the providers we compare Nutmeg’s portfolios perform best, however, all the returns were pretty average relative to a global tracker!

Here you can compare the performance of four of the most popular private pensions from Nutmeg, Wealthify, IG, and Moneyfarm.

Comparing the long-term returns of different managed private pensions isn’t easy. This is due to the fact that not all companies provide access to the latest performance data. For instance, InvestEngine does not show historical data and Wealthify, for example, doesn’t list Jan-Dec calendar performance data on its website and when I called them up they said they didn’t have it.

To standardise the data, we looked at the returns from the different providers in each calendar year between 2019 and 2023. This allowed us to obtain five-year performance figures.

Below, we reveal the annual performance for each provider. We also show how much a £1,000 investment in each product would have grown over the five-year period.

Nutmeg

For Nutmeg, we have focused on its ‘fully managed’ portfolios. Here, it has 10 portfolios with different risk levels where level 1 is conservative and level 10 is aggressive. Performance net of fees is listed below.

| Risk level | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 2023 | 5.2 | 6.4 | 6.9 | 8.2 | 8.7 | 9.7 | 10.4 | 11.3 | 12.2 | 12.6 |

| 2022 | -5.4 | -8.6 | -10.4 | -12.2 | -13.2 | -12.6 | -11.6 | -11 | -10.5 | -9.6 |

| 2021 | 0.1 | 1.8 | 3.2 | 5.3 | 7.5 | 9.9 | 12.7 | 15.4 | 18.1 | 19.6 |

| 2020 | 0.8 | 3.1 | 4.4 | 5.2 | 6.2 | 6.2 | 6.4 | 6.4 | 7.0 | 7.2 |

| 2019 | 1.2 | 5.3 | 7.4 | 9.0 | 11.1 | 12.8 | 15.1 | 17.0 | 18.4 | 18.7 |

| £1k would have grown to | £1,024 | £1,075 | £1,108 | £1,147 | £1,197 | £1,262 | £1,347 | £1,423 | £1,502 | £1,549 |

With this managed private pension, £1,000 in the most aggressive portfolio at the start of 2019 would have grown to £1,549 by the end of 2023.

Wealthify

For Wealthify, we have focused on its ‘original’ funds (it also offers ethical funds). Here, it has five different funds with different risk levels. Performance net of fees is listed below.

| Risk level | Cautious | Tentative | Confident | Ambitious | Adventurous |

| 2023 | 4.7 | 6.2 | 7.8 | 9.4 | 11.3 |

| 2022 | -11.2 | -10.8 | -10.3 | -9.4 | -9.1 |

| 2021 | 0.5 | 3.7 | 6.7 | 9.7 | 12.8 |

| 2020 | 2.7 | 3.9 | 4.9 | 5.1 | 5.1 |

| 2019 | 6.4 | 9.4 | 11.9 | 14.4 | 17.1 |

| £1k would have grown to | £1,021 | £1,117 | £1,211 | £1,307 | £1,405 |

With this provider, £1,000 in the most aggressive portfolio would have grown to £1,405 over the five-year period.

Moneyfarm

For Moneyfarm, we have focused on its seven non-ESG managed portfolios. Performance net of fees is shown below.

| Risk level | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 2023 | 4.6 | 6.7 | 7.6 | 9 | 10.3 | 11.5 | 12.4 |

| 2022 | -8.1 | -9 | -9.3 | -9 | -11.5 | -11.7 | -12.3 |

| 2021 | -1.5 | 2.7 | 5.8 | 8.8 | 11.3 | 13.9 | 16.6 |

| 2020 | -0.2 | 2 | 3.3 | 2.9 | 4.9 | 6.3 | 6.3 |

| 2019 | 2.9 | 6.6 | 9.5 | 11.7 | 14.6 | 16.5 | 19.8 |

| £1k would have grown to | £972 | £1,084 | £1,168 | £1,240 | £1,306 | £1,389 | £1,464 |

Here, £1,000 invested in the highest risk option would have grown to £1,464.

IG

As for IG, it has five ‘Smart Portfolios’. Performance before fees is listed below.

| Risk level | Conservative | Moderate | Balanced | Growth | Aggressive |

| 2023 | 4.3 | 6 | 8.9 | 10.8 | 12.5 |

| 2022 | -5.6 | -9.4 | -11.4 | -11.9 | -12.2 |

| 2021 | -0.4 | 3.4 | 8.8 | 13.5 | 18.2 |

| 2020 | 2.0 | 7.4 | 9.2 | 11.4 | 10.9 |

| 2019 | 3.6 | 10.0 | 14.1 | 17.0 | 19.4 |

| £1k would have grown to | £1,036 | £1,173 | £1,308 | £1,444 | £1,546 |

With IG, £1,000 invested in the Aggressive fund would have grown to £1,546 before fees. Fees are 0.72% per year.

⚠️ FCA Regulation

All pension providers that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK pension provider platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature pension accounts that are regulated by the FCA, where your funds are protected by the FSCS.

Pensions & Taxes

The key benefit of saving into a private pension is tax relief. Contributions receive 25% tax relief for those on the basic rate, and they are free from inheritance tax if you start accessing your pot before you reach age 75. You can also take 35% of your pension tax-free once you reach age 55, but you cannot draw before this point, or you’ll pay hefty penalties.

Private pensions are arguably the most tax-efficient way to save and invest for retirement in the UK.

- Government top-up: When you pay into a personal pension from your net pay, the Government automatically adds 25% as a top-up for basic rate tax relief. If you’re a higher or additional rate taxpayer, you may benefit from even more tax relief.

- No capital gains tax: In addition, any returns made on the investments in your pension are free from capital gains tax.

Private Pensions & Fees

Fees and charges vary considerably between providers. Moneyfarm charges 0.35% while Nutmeg’s fee is 0.75%, but the services and fund choices will also vary between providers.

It is important to remember that low fees do not necessarily mean the best value. Paying lower fees for poor performance may prove a false economy, but excessive fees can decimate a pension fund.

For example, assuming a pension pot value of £50,000 growing at 5% a year, reducing your charges from a high level of 1.2% to a very reasonable 0.4% could save you £23,000 over 20 years. Make sure you explore precisely what is included in the costs and what impact these have on the likely final pension pot.

Some providers charge for setting your pension up, but this is not a universal charge, so it makes sense to shop around.

Other charges include platform fees, which cover the administration of your pension. They’re usually charged as a percentage of the money you’ve saved.

- Annual Management Charge: The annual management charge (AMC) pays for running and administering your plan, and for investing contributions. The AMC is charged as a set amount or as a percentage of the value of your pension investments. Each investment tends to have a different annual management charge to reflect the type of investment fund. Some are more specialist or are more actively managed, and they often have higher charges. An annual charge above 1% is generally considered expensive for a basic personal pension. For fully managed SIPPs with significant fund charges and financial advice included, fees can often exceed 1%.

- Exit Penalties & Fees: It is likely that you will pay an exit fee if you want to transfer your pension to a new provider. These vary from company to company – and even between products within the same provider – and can be as much as 10%, which might negate any benefit of leaving. You may also incur an early exit fee to cover the long-term management and handling charges over the life of the pension. Exit fees and penalties are not always clear, so it is important that you read the small print before making any decisions.

- Ongoing Fund Management Charges: There is also an ongoing charges figure (OCF), which covers the day-to-day costs of running an investment fund that is included in your pensions. It’s usually charged as a percentage of the value of your investments.

Private Pension Statistics

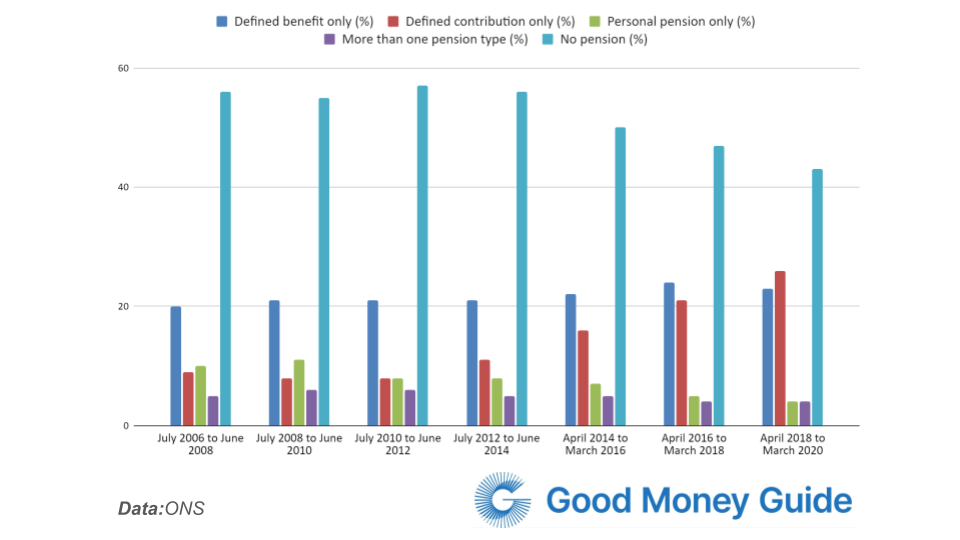

This graph using data from ONS shows the ages of people making contributions to personal pension providers:

Private Pension FAQs:

When you invest in a private pension, an administrator is responsible for any payments into your pension. They will also reclaim basic rate tax relief and process any income withdrawals that you make.

SIPP providers such as Hargreaves Lansdown, AJ Bell and PensionBee administer pensions as part of the service. Other providers use third party administrators to manage this function on their behalf, for example Barclays SIPP uses AJ Bell.

Third-party administrators also usually take care of workplace pensions on behalf of employers.

All third-party administrators (and the administration of SIPP providers if done in-house) are regulated by the Financial Conduct Authority which expects firms to clearly establish roles and responsibilities and have procedures to ensure all employees are properly trained and competent.

If you have concerns or complaints about the way your pension is administered, you need to contact the Pensions Ombudsman.

Should the administrator fail completely your pension will be protected by the Financial Services Compensation Scheme.

Further reading: Can I change SIPP administrators?

Yes. If you feel that you are paying too much in fees to your current private pension provider, or they do not offer the flexibility and fund choices you need, it might be worth transferring. However, not all schemes accept transfers.

You can usually transfer a defined benefit pension to a new pension scheme at any time up to one year before the date of when you’re expected to start taking your pension. Some schemes will let you transfer only a part of your benefits. You’ll need to check with your provider to see if they offer this option.

If you are considering leaving your DB scheme, before you can start the advice process, you need to get a transfer value from your scheme. The transfer value is set for three months, so line up an adviser ahead of time to avoid having to make rushed decisions. If you don’t complete the transfer process within the three-month period for which the transfer value is guaranteed, you might have to apply for another value, which will likely incur a cost.

When you’ve transferred to a new scheme, you’ll usually have given up all benefits under the old scheme, and when you start taking your pension, you can’t usually move your pension elsewhere.

If you take regulated financial advice, the IFA bears the risk of any poor decisions rather than you.

Defined benefit scheme members must seek regulated independent financial advice before taking a transfer out if their pot is worth more than £30,000. Thousands of DB members have received bad advice, resulting in them losing their valuable DB pensions. The FCA says good advisers will ask you about current financial circumstances and aims; priorities and spending plans in retirement; other pensions, assets and debts; and your health and your family’s health.

As with DB members, if your DC scheme has ‘safeguarded benefits’ such as a guaranteed annuity rate, and the value of these benefits is more than £30,000, you’ll have to get regulated financial advice before you can transfer.

If you have small pension pots worth less than £10,000, consider keeping them where they are. This is because if you’re considering taking a small pot lump sum at some point before you retire, by withdrawing the whole amount, this will not affect any future pension contributions.

It is almost always better to remain in your occupational or workplace pension because you enjoy contributions from your employer. However, if you are in a defined benefit pension and approaching retirement, you will not be able to take the same flexibilities as those offered to DC members. You must seek financial advice before switching out of DB, and remember that you will be giving up protection of an income for life. Even if your employer is vulnerable to insolvency, your DB pension is protected by the Pension Protection Fund; something not extended to DC funds.

If you are a member of several workplace DC pensions, it might make sense to consolidate these in one place, since your scheme is not transferred automatically when you change jobs.

It may also make sense to transfer your pension to a specialist provider if you are moving overseas. Not all schemes can take contributions from abroad, so you need to fund a qualifying recognised overseas pension scheme.

Private pensions are flexible on death, which means you can nominate a recipient to receive your retirement income.

If you die before your 75th birthday and haven’t started drawing your pension, it can be passed to your beneficiaries tax-free. The beneficiaries will be able to choose how they draw the income (lump sum, drawdown or annuity).

If you die before your 75th birthday, and are already receiving your pension, it will impact how beneficiaries can access the pot. If you took a lump sum and you have remaining cash in your bank account outside of your pension, this will be counted as part of your estate. If you are using drawdown, your beneficiaries can access whatever’s left in your pension entirely tax-free.

If you die after your 75th birthday, your beneficiaries will pay income tax on any pensions you leave behind, at their marginal rate.

If you are not confinement that you fully understand private pensions then yes, you should talk to an independent financial advisor. The market for private pensions is huge, and with so much choice, finding the right plan can be confusing. It is worth considering taking independent advice to find the most appropriate pension for you.

However, there are plenty of well-known companies offering good value private pensions . These include Nutmeg, Wealthify and moneyfarm. Some will offer access to a wide range of ways to invest, while others will keep it more basic. Typically, these firms charge around 0.5% of your pot to run the plan. They offer access to tracker funds which deliver returns in line with how the main indexes are performing your contributions are spread across bonds, stocks, commodities and property. They will also diversify across geographies providing access to global markets.

You can also invest into a self-invested personal pension (SIPP), which allows you to choose exactly how your money is invested.

Yes, you can invest in a private pension and a Lifetime ISA (LISA) simultaneously.

Individuals aged over 18 and under 40 can consider opening a LISA, which is a savings account designed solely to buy a first home or to provide a retirement income.

LISAs are tax-advantaged, so you won’t pay tax, capital gains, or dividend tax on money you take out, but contributions are made after income tax, and they are subject to inheritance tax.

LISAs are also restricted to a maximum £4,000 a year contribution limit, which goes towards the £20,000 ISA contribution cap. You can only withdraw once you reach 60 or if the money is to purchase a first property. Unauthorised withdrawals are subject to a 20% charge.

Further reading: Compare the best lifetime ISAs here

The State pension is paid by the Government to all those with at least 10 years of National Insurance Contributions. A private pension is entirely separate from the State pension and consists of contributions you have made.

To receive the maximum State pension amount – currently £179.60 per week (2021/22) or £9,339.20 per year, you need to have 35 ‘qualifying’ years.

Couples entitled to the full state pension receive a maximum of £359.20 per week or £18,678.40 per year as of 2021/22.

Given the relatively low level of income from the State pension, those who also save into a private pension will most likely be far better off. In addition, you can draw from your private pension from age 55, but the State pension is only available from age 66 (rising to 67 from 2028). There is also a lot of flexibility available with private pensions, giving you the chance to grow your money (however, investments can fall as well as rise).

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the pension provides via a non-affiliate link, you can view the product pages directly here: