To make money trading options you need to long calls when the market goes up, or long puts when the market goes down. Or you can be short calls when the market does down or short puts if the market goes up. It may sound complicated at first, but trading options is easier than you think and can be a good way to take limited risk positions on stocks, commodities, bonds, indies and FX pairs. In this guide will explain what options are, how you can use them to speculate on the markets as well as the major risks and rewards.

If you want to trade options we have put together a list of the best options trading platforms.

What Is Options Trading?

Options are derivative contracts that confer the right but not the obligation (on the purchaser of an option) to buy or sell a fixed amount of an underlying instrument at a set price during the lifetime of the option. In conferring those rights, the contracts provide the buyer with what’s known as optionality. Which we can think of as the right to choose whether to exercise their option and buy or sell the underlying instruments. Be that an index, a bond, a commodity, an individual share or cryptocurrency.

Option Contracts have existed for some time, a type of options contact evolved in the Dutch Tulip mania almost 400 years ago. Like most derivative contracts options are designed to spread risk; however, their misuse can actually concentrate risk instead.

Options became increasingly popular with the launch of Financial Futures in the 1970s and 1980s, as mathematical models were developed that allowed traders to price and model options structures accurately and to make predictions about their future price movements rather than just trading them on intuition and experience.

How Options Work

There are five things to consider when trading options:

- Calls: A call option gives you the right to buy a certain amount of something at a certain date in the future and are bought when you think the underlying asset will rise.

- Puts: A put option gives you the right to sell a certain amount of something at a certain point in the future and are bought when you think the price of an underlying asset will fall.

- Strike price: A strike price is a price at which you can buy or sell an underlying asset at a certain point in the future. If you buy a call, you are “in the money” if the strike price is below the underlying market price. You are “out of the money” if the price is above. And vice versa; you are “in the money” if you buy a put and the strike price is above the market price and out of the money if the price is below it.

- Premium: The premium is the price you pay when you buy an option or what you receive when you sell an option. It is a combination of time and intrinsic value. Time value is determined by how close the option is to its settlement date or expiry. Intrinsic value is based on how far away the price is from the strike price.

- Date: The date of an option is the date at which the option settles or expires. If you have bought an option, you have two choices at the expiry date. You can either let the option expire worthless if it is out of the money or exercise it if you are in the money.

Pros & Cons Of Options Trading

The benefits of options trading include having a fixed and known downside or maximum loss, if you are just long puts or calls then your maximum loss will always be the premiums you pay plus any commissions or fees.

Options allow you to take a geared or leveraged position when compared to trading in the underlying. That is you can gain greater exposure for a smaller initial outlay. Strategies such as covered call writing can be used to create income streams to boost a portfolio’s returns.

The biggest risk in options trading is that they have a finite life or fixed expiry date, unlike a CFD which could theoretically run forever.

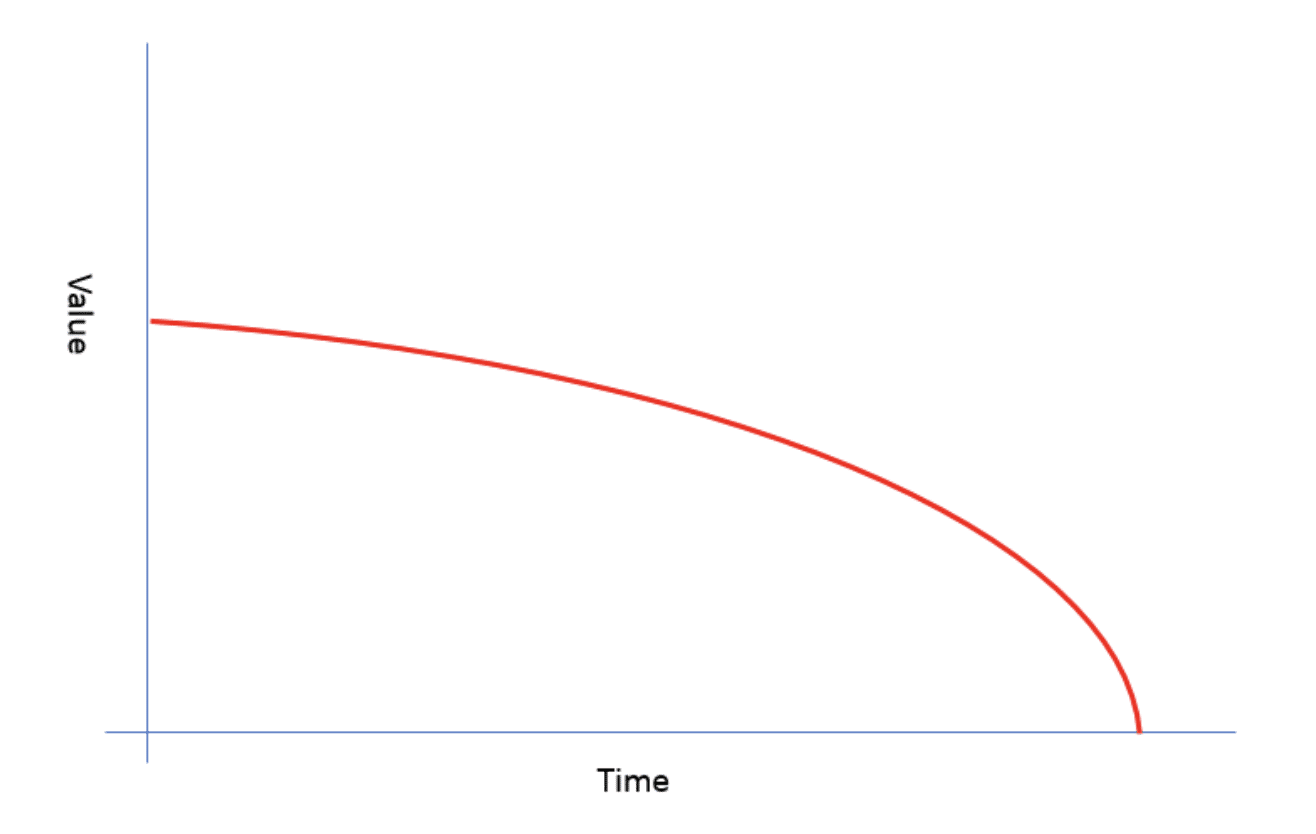

The time value of options steadily decays over their lifetime and is one of the reasons why the majority of options expire worthless. That time decay is not linear in that time value decays very quickly at the end of an options lifetime.

That means that short-dated options have very little or any time value within their price and therefore they are entirely composed of intrinsic value and short term volatility and in those circumstances the risk of losing all of the premium paid for the options is significant.

However, there are also significant risks in selling options for example by selling or going short of call options you have an open-ended risk because there is no limit to how high the price of the underlying instrument. This risk can be ameliorated by selling call options against an equal holding in the underlying instruments. However, traders should be very clear about the risk profiles of their options strategies because this is an area where a little knowledge can be very dangerous indeed.

Advantages (Rewards)

- Options are very cheap to trade

- You can trade on or off-exchange

- Risk is limited to premium (if you are a buyer)

- High potential returns versus risk when buying out of the money calls

- Lots of strategies to speculate on volatility and price movement

- Can be used to protect your long term investments

Disadvantages (Risks)

- Options can quickly become illiquid and or worthless

- Risk is potentially unlimited if you write options

- Options are traded in fixed lots so exact exposure is hard

- You have to pay tax on options trading profits (unless spread betting)

What Can You Trade Options On?

Options can be traded on almost any market. However, some are more liquid than others. In some cases, you can trade options online on major instruments. Other less liquid assets will require a specialist options broker and a market maker to price an option based on the underlying asset price.

The main markets for options trading are:

- Stock options: Equity options are options traded on company shares. You can find equity traded option prices and trade them on the London Stock Exchange. For more information on equity traded options, here is more information on equity options trading.

- Index options: Index options are traded on major stock market indices such as the FTSE, DAX, DOW, S&P and Nikkei.

- Commodity options: Commodities options are trading options on gold, silver, oil, natural gas, corn, wheat and soybeans.

- Forex options: Forex options are currency options that can be traded for speculation or to hedge currency exposure. If you want to buy a currency option to protect a price for an upcoming physical conversion, you need a currency broker that offers OTC FX options. However, if you are more interested in speculating on currency prices with options, most forex brokers have forex options trading on major forex pairs. Here is currency options vs currency forwards & futures to help explain the differences.

How To Trade Options

Options can be used for outright speculation but as we noted earlier in the article they are primarily designed to diversify or mitigate risk for example if you have a portfolio of FTSE 100 stocks and are feeling bearish of the market short term you might be reluctant to sell your stock holdings in case you are wrong.

However, you can take out an” insurance policy” by buying some put options that is the right to sell an underlying instrument for example buying put options on the FTSE 100 index with a notional value equivalent to that of your stock holdings. If done correctly any move lower in the value of the FTSE 100 and therefore your share portfolio should be offset by a corresponding rise in the intrinsic value of your FTSE 100 put options of course to crystallize those running profits on the put options, you will either need to sell or exercise them before they expire and before the FTSE 100 recovers.

Buying Versus Writing (Selling Naked) Options

The positions or obligations of the buyer or seller of an option are completely different.

- Buying: The buyer of an option can choose whether they exercise their rights to buy or sell the underlying instrument.

- Writing: The seller of an option is obligated to take or make delivery of the underlying instrument, if they are exercised against, during the options lifetime.

That leaves you with a choice to make based on your appetite for risk. On the face of it being long (a buyer) of options is far less risky a proposition than being short (a seller) of options.

One thing to consider though is that thanks to the time decay chart and the probabilities of an option not being in the money at the end of its life, the majority of options will expire worthless. Or will have been sold to close for a loss. In fact, as much as 70% of all options will expire out of the money that is with no intrinsic value, and because of expiry (limited lifetime) and no time value either.

Options Trading – An Example

The principal differences between options and futures trading revolve around the obligations that the respective contracts confer. Futures traders are obligated to make or take delivery of the underlying commodity they are trading at the end of the contact lifetime whereas in options trading only the seller of options has obligations buyer of options have the right to take action but not the obligation to do so.

Options can be used to create positions that resemble futures contracts. So for example being long calls and short puts in the same instrument is a synthetic long in the underlying whilst being long puts and short calls in the same instrument create a synthetic short in the underlying instrument being traded.

All futures contracts have a value throughout their lifetime which is the current price times the size of the contract and any changes in the price of the underlying price are reflected in the PnL’s of the buyer and seller.

Conversely, the values of options prices will change even if there is no change in the price of the underlying instrument, because of time decay and reductions in implied volatility. In those circumstances the value of out of the money puts and calls can quickly be eroded and only in the money options will have any value at all at the end of a contract’s lifetime.

Different Types Of Options Trading

The two different types of options broker in the UK are DMA and OTC (over the counter).

- DMA options trading would generally be more appropriate for sophisticated investors as you can buy and sell options. When you sell an option, losses are potentially unlimited so they are very high risk. DMA options through popular brokers like Saxo Markets and Interactive Brokers also allow their clients to trade on more illiquid assets, which would not be appropriate for inexperienced investors as they may not be able to close their positions.

- OTC options via spread bets and CFDs through popular brokers like IG or CMC Markets are more common for retail private investors as trading platforms will provide a selection of options on the most liquid and less volatile markets such as large-cap stocks and major indices. They may also have higher margin requirements than on exchange options, which reduces the risk for investors but still enables them to buy and sell options online.

Options Trading Terminology

Here are some of the major terms you will come across when you trade options through an options broker:

- Options time series: Options have a finite life and are traded in what’s known as time series, for example, they may have a quarterly cycle of December, March, June, and September, or a monthly cycle of December, January, February, etc. Or these days even a weekly cycle.

- Options strike price: An options strike price are the prices at which the option owner can buy or sell the underlying instrument during the lifetime of the option.

- Options values: The value of an option will vary depending upon where its strike price is relative to the current price of the underlying instrument. This is known as being in or out of the money, sometimes abbreviated to ITM or OTM. The degree to which an option is ITM or OTM determines its intrinsic value.

- Option depreciation: Other factors that affect option prices are the options lifetime or duration. This is known as an options time value. Note though that this decays over the lifetime of an option, and decays very quickly as the option approaches its expiry date. Options are generally tradeable in their own right and the combination of intrinsic and time value goes a long way to determining the ultimate value of an option. Though, we need to factor volatility into the mix to derive more accurate values for options.

- Options volatility: Volatility is a measure of the propensity for price change and the frequency with which it occurs. It’s the volatility in the underlying instrument that an option is over, that we are interested in. The maths of option modeling can be quite complex; however, we can think about it like this. We can derive an expectation of how volatile an instrument, such as a share or bond, will be in the future, by looking at its historic volatility and the current market conditions. By combining those factors it’s possible to create a forecast or probability about how volatile the price of the underlying instruments will be in future, which is known as the implied volatility. Higher rates of implied volatility mean a higher likelihood of sharp or outsize price changes in the underlying instrument. Which, in turn, means that there is more chance of an option moving into the money and therefore having a higher intrinsic value or being worth more. Note though that the level of volatility says nothing about the direction of future price movements.

- Options Delta: Options delta is the sensitivity of the price of an option to a change in the price of the underlying. Deltas range between 0 and 1, the price of an option with a delta of 1, moves point for point with the price of the underlying.

- Options Gamma: Gamma measures the rate of change in delta, effectively it’s a gauge of how stable the delta is for a given option, and it can be used to forecast the future prices of options and their chances of moving into the money.

- Options Vega: Vega measures the likelihood of changes in implied volatility, which itself is a fundamental component of option pricing. Higher levels of volatility tend to push options prices higher. Lower levels can depress premiums. Tracking Vega can allow us to factor in those potential changes to an options theoretical value.

- Options Theta: Theta measures the rate of time decay in an option under the curve above. For example, the value of out of the money options (which have no intrinsic value) decay at a faster rate towards the end of their lifetime and have a higher theta as a result.

- Options premiums: The option premium is the options price or the premium that you pay for the right to buy or sell the underlying. Or it’s the premium that you receive for selling options and becoming obligated to have make or take delivery of the underlying. Effectively option sellers have a 30% chance of being exercised against whilst option buyers have a 70% percent chance of losing their premium if all options are held to expiry.

Where Are Options Traded?

There are two types of traded options – OTC (over the counter) and on exchange:

- OTC options are options traded via CFDs, financial spread betting or forex. They are more common for trading than most liquid indices, commodities and forex pairs.

- On-exchange options are options traded on an exchange like the London Stock Exchange, CME (Chicago Mercantile Exchange) or COBE (Chicago Board Options Exchange). On-exchange options cover a much wider spectrum of instruments like small to large-cap stocks and treasuries.

FAQ: Options Trading Explained

Here are some answers to some commonly asked questions about how to trade options:

Very little. The great thing about options is that if you buy a very low value out of the money call and a stock rises above the strike price you can make a significant return on your investment.

Look at the option board on your brokers trading platform. That will list as assets tradable options by strike price and month. It will show a bid offer price of where you can buy and sell.

Options is a way to trade stocks, it can be a better way to trade if you want to limit your risk to what you pay for the option premium or speculate on a stock price going down rather than up. However, options often expire worthless, whereas if you buy a stock it does not often go to zero.

By calling the market correctly, as with any form of trading. If you buy calls, you profit when the market goes up. If you buy puts you profit when the market goes down.

Yes, it is very risky. The value of an option can go to zero, which means you lose your entire investment. Also, if you sell naked options (i.e. you are short the market with no protection) and the market rallies, your potential losses are unlimited.

A reader recently asked us: “I’m looking to sell call options on shares that I already own. I don’t want to pay fees so have looked at online brokers/services however none of them actually trade the underlying only CFD Options. Do you know of any UK brokerages that offer this service?”

They raised an interesting point here in that many options brokers do only trade CFDs on options, rather than options themselves. But one of the benefits of trading in CFDs rather than in on-exchange products is that the fee structures are often lower. That said margin trading and spread betting brokers like IG and others offer CFD options on some stocks but not on all.

One question I had is why they are set on dealing in the exchange-traded options as opposed to CFDs on them? As you can operate a buy-write strategy using either format.

A buy-write is a trade that involves selling out of the money call options against your shareholding in order to take in the option premium. Assuming the price of the underlying stock remains below the strike prices of the calls you have sold, you will be not exercised against and when the options expire, or, you buy back your short calls, you will be able to repeat the process once more.

By writing through an options broker is becoming an increasingly popular strategy for those investors who are looking to add income to a portfolio in an era of low or even negative interest rates.

That said the regulators in their wisdom have classified options as complex products which of course means that clients wishing to trade them have to meet certain suitability criteria so they are not for everyone.

The other benefit of covered buy-write is that the stock you own can act as collateral or margin against the short leg of the trade. However, changes to margining rules arising from Mifid II mean that the stock is no longer pledged to the option clearinghouse but instead it is segregated and collateralised at the options broker. In other words, they hold the stock and use their cash as margin at the clearinghouse. At scale that can have balance sheet implications for the broker so not everyone offers this facility

Yes, you can trade US company options as a UK resident through an options broker. Restrictions on trading tend to focus on US citizens trying to trade UK products such as CFDs or other OTC derivatives, which are basically off-limits to most US citizens or residents. However, there are few restrictions for UK traders wishing to trade US instruments, in this case, options.

On-exchange US options versus CFD options

There is a subtle distinction but it can be an important one if, for example, you are intending to pursue buy-write strategies, where you are hoping to take in or deliver the underlying stock on exercise. If so you will need to trade on-exchange options.

However, If you are just looking for economic exposure via options, and have no designs on ownership of the underlying, then CFDs on options could work for you too. The size of your account may also be relevant, simply because it may limit what you can trade in. Exchange-traded options are only traded in whole lots or multiples thereof.

Whilst CFDs on options (or indeed Spread bets on the same) allow you to trade in fractions of an options lot.

Remember that options are complex products and you will need to demonstrate an understanding of how they work and the risks involved in trading them. You need to demonstrate a working knowledge of geared derivatives to open a CFD or Spread Betting account, and you have to pass a suitability quiz to do so. Companies like Interactive Brokers, Saxo Markets and IG are some of the best places you can trade US equity options.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.