Gold trading platforms let you speculate on the price of gold going up or down in the short term via leveraged derivatives like futures, CFDs, and financial spread betting. You can also invest in gold in the long term via gold ETFs and gold miners. You can use our comparison table of what we think are the best gold trading platforms in the UK to compare commission, minimum deposits and the type of gold trading each platform offers. All gold brokers featured are regulated by the FCA.

City Index: Best broker for Gold CFD trading

- Costs & spreads: 0.8

- Minimum deposit: £100

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated Gold trading on MT4

- Costs & spreads: 0.5

- Minimum deposit: £1

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: Gold trading with personal service

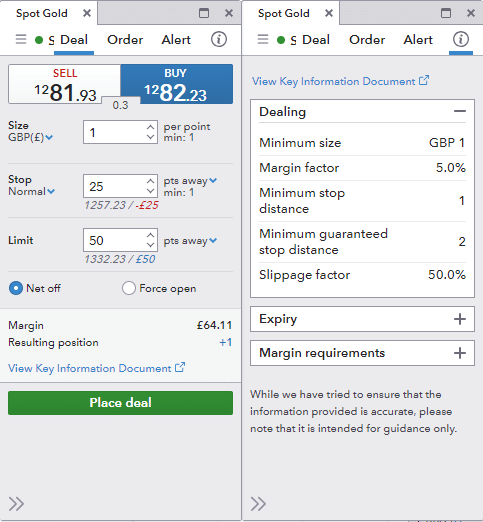

- Costs & spreads: 0.3

- Minimum deposit: £1

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount Gold trading & conversions

- Costs & spreads: 0.0007%

- Minimum deposit: $2,000

- Account types: CFDs, DMA, futures & options

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: High-tech Gold trading platform

- Costs & spreads: 0.3

- Minimum deposit: £1

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best broker for Gold ETFs & investing

- Costs & spreads: 0.5

- Minimum deposit: £500

- Account types: CFDs, futures & options

70% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s Gold trading

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

XTB: Good Gold trading educational material

- Costs & spreads: 0.35

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

Tickmill: Gold futures on CQG or CFDs on MT4

- Costs & spreads: 0.9

- Minimum deposit: $100

- Overnight financing: na

- Account types: CFDs, futures & options

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

❓Methodology: We have chosen what we think are the best gold trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the gold trading accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the gold broker’s CEOs and senior management

Compare Gold Trading Platforms

| Gold Broker | Gold Trading Costs | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 0.8 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.5 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.3 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 0.3 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.5 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.9 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 0.9 | $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 0.3 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.0007% | $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.8 | £100 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 0.35 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 19 cents | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

How to trade Gold: 5 different ways to trade gold (with different risk)

The Wall Street Journal has recently reported that as the world falls out of love with Cryptocurrency, more people than ever are searching for “how to trade gold”. So, in this guide, we explain the different ways to speculate on the gold price, the risks involved in trading gold. Plus how to profit from gold tax-free and what moves the gold markets.

In the days before computers were invented, gold could only be traded physically. You had to buy and sell gold bars, coins or jewellery. (As a historical note: during the Great Depression, US citizens couldn’t even own gold legally!)

But all this has changed. Today’s hyper-connected economy has accelerated the trading of the yellow metal. First, gold was delinked from the US Dollar in 1971. This created movements in the gold price. Second, the invention of gold futures popularised gold trading. More recently, the arrival of gold exchange-traded funds (ETFs) further excited gold investors.

Now you can get exposure to gold in your portfolio in five ways:

- Physical gold

- Gold-related company shares

- Gold spread betting/CFDs & futures

- Gold ETFs

- Gold options

Physical gold

Buy gold bars or coins through dealers and store them in secured places (eg bank vaults, with annual charges of course). There is an active market for these precious metal assets in the UK. The problem with trading physical gold is friction: Storage costs, wide spreads and unfavourable commissions. Not to mention security. And unlike stocks, there is no dividends from owning gold bars.

Gold-related company shares

Precious metal stocks are another way to gain exposure to gold. Many junior mining companies prospect for gold (exploration) but these companies are fairly risky. For more conservative investors, mature gold miners – miners that already have productive mines – are a better bet. These gold companies are listed on stock exchanges where any investors can buy their shares. The US has the biggest gold stock sector in the world, followed by Canada and Australia. These two countries have tremendous mineral resources and have developed a vibrant mining industry.

On the London Stock Exchange, there is a relatively small gold industry. The largest is Fresnillo (FRES), a £6 billion silver miner. Other smaller players are Centamin (CEY), Acacia (ACA), Hochschild Mining (HOC).

Gold ETFs

Exchange Traded Funds (ETFs) that contain assets that track the gold price such as:

- ETFS Gold (LSE:PHGP) or ETFS Silver (LSE:PHAG)

- In the US: Gold (US:GLD) or Silver (US:SLV). Other choices include IAU

ETFs are popular because they are easily tradeable. You buy and sell ETFs like stocks.

Did you know this interesting fact? The US Gold ETF (GLD) was once the world’s largest ETF during the 2011 gold bubble? GLD’s assets under management soared to a staggering $76 billion back in August 2011. Current AUM is still a weighty $56 billion.

Now, apart from physical gold ETFs, there is a suite of gold miner ETFs. These ETFs buy and hold a variety of companies engaging in gold mining activities. The VanEck Gold Miner ETF (GDX) is one of the largest ETFs specialises in holding a portfolio of gold miners. Asset under management totalled $13 billion spread over 49 stocks, including Newmont (US:NEW), Barrick Gold (US:Gold) and Franco Nevada (US:FNV). These are mature miners.

The junior version of GDX is the VanEck Junior Gold Miner (GDXJ), which tend to hold the more speculative miners.

However, a note to remember is this: Precious metal stocks and gold prices may not move exactly. Inexperienced investors tend to assume they move together. So when gold rallies they pile into miners. This is incorrect. At times, gold and gold miners may not even trend in the same direction. Stocks could vastly outperform or underperform the underlying metal – and vice versa. Consequently, many view gold stocks, particularly junior miners, as a ‘high beta’ bet on gold.

Saxo Markets, for example, offers a wide range of Gold ETFs. Note there will be an annual management fee for these ETFs and some will be US Dollar denominated.

Gold spread betting/CFDs & futures

You can spread bet and trade CFDs on gold/silver prices directly with a large number of spread betting firms, such as IG. Spread betting is speculating on the direction of an asset price. You don’t actually own the gold physically – just the price movements of gold.

If you expect gold price to rally, you open a long position in gold, which is either based on spot prices (position normally closed at the end of the session) or futures prices (depending on the latest contract month, called the front month).

On the other hand, if you anticipate gold prices to drop, you open a short position.

The key in spread betting is the position size: How much are you going to bet on each position? Too large (relative to your equity) the position may hit your portfolio hard if prices move adversely. Too small the gains are insufficient to compensate for the losses. The art of spread betting is selecting a position size that makes the gains larger than losses over time.

Note that spread betting gold prices is more speculative that owning gold ETF because the leverage is higher. Some spreadbet instruments are based on gold futures prices, which need to be rolled over at certain months, adding costs to the position.

CFDs are a more global product for European traders as they do not benefit from the UK tax breaks. Future are for larger traders as they are traded on exchange with small minimum contract sizes.

Gold Options

Options on gold/silver prices is another way to bet on gold prices. Options are financial derivatives that leverage one’s position on the direction of the gold prices.

To acquire options, you pay a premium to buy or sell gold/silver at certain prices. This premium depends on price volatility, interest rates and the ‘strike price’. That is, the price you wish to buy gold. You can win or lose a large amount of capital with options since options can expire worthless. On the other side, you can sell options for a premium (option writing).

Clearly, options are not a suitable avenue for everyone due to the complexity of the instrument and the embedded leverage of the contract. Options are short-term instruments that magnifying the returns on gold prices.

Why is gold such a popular investment?

Gold has fascinated people since time immemorial. ‘As rich as Croesus’ is an ancient phrase that originated from the gold mine River Pactolus in Turkey. Spanish conquistadors brave the sea and found gold in the New World. Gold Rush in mountains however barren still sucked in men and women from all over the place. Extreme hardship, it seemed, is amply compensated by the discovery of nuggets of gold.

You see, the allure of gold is very powerful, now and then.

These days, people invest in gold for a variety of reasons. They believe that gold provides stability. Some believe that gold is a hedge against inflation. Many ardent proponents of gold, called goldbugs, believe that gold is the ultimate hedge against money printing. They often point out that gold is up from $35 in 1971 to $1,900 now – a gain of 5,000%!

During periods of market stress, traders and investors tend to buy gold – as it is believed that the metal is a ‘safe haven asset’. Investors also assumed that gold prices move inversely to other assets like stocks.

Whatever the reason, gold trading has increased significantly since 2000.

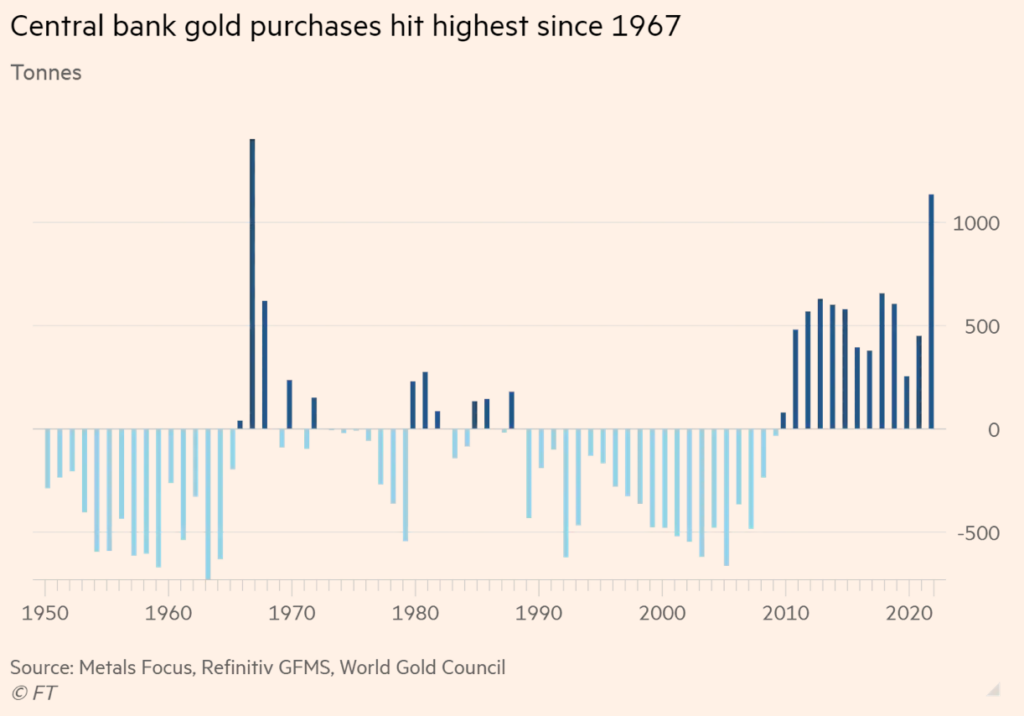

More recently, particularly after the pandemic boom, investors are re-examining their portfolios and found gold to be a better bet. Central banks are now a major buyer of gold. In fact, some estimated that in 2022 central banks bought gold at the fastest rate since 1967! (see below)

Reasons for this massive central bank buying include:

- Geopolitical tensions across the world

- A decade of global quantitative easing (aka ‘money printing’) that debased currencies

- Rising inflation – central banks assume gold is returning as an inflation hedge and are thus anchoring their portfolios in the metal

What are the major risks of trading gold?

Like all asset classes, gold prices go up and down. Buy gold at the wrong price or at the wrong time can result in a significant portfolio drawdown. For example, owning gold in the early eighties after the bubble burst led to a significant wealth contraction.

More importantly, gold bull markets don’t come around all that often. The last time we had a big bull was back in 2001 to 2011 – ten years of consecutive price increase. After that, prices slumped by 40-50 percent. (Gold miners performed even worst – some collapsed by 80-90 percent.)

So the second risk of trading gold is missing out the long bull in gold. This is known as the ‘sin of omission’.

Then, it must be pointed out that when trading gold futures and options, be aware of the inherent leverage. Gold prices themselves are already volatile enough. Coupled with leverage, this is a recipe for volatile – and sometimes disastrous – results. Ergo, the third risk in trading gold is overleverage. Do not fall into this trap.

The last risk in gold trading is missing out opportunities elsewhere. When gold is in a bear market, a trader should concentrate on other assets instead of forcing trades in gold.

For example, during the nineties, the best asset to own was in tech stocks. In 2021, it was ‘meme’ stocks. Gold traded sideways. Now it appears gold is gaining relative strength. Investors should switch focus back to the commodity.

What moves gold prices in trading?

Gold is a macro asset. It derives its price pattern mostly from macro conditions.

Of course, supply and demand is important. But these statistics are often backward looking and contain little or no predictability that traders can use. And then there is the issue of accuracy. Few authoritative statistics are available to confirm the global gold supply or demand. Hence, these statistics may not impact gold’s day-to-day prices.

What, then, moves gold prices?

Economic Indicators

Since gold is a macro asset, economic indicators can swing its price chart sharply. Data such as US GDP, unemployment, Fed minutes or FOMC meetings are some of the catalysts that affect gold prices.

Sometimes, a financial crisis will also hit gold prices acutely. The Euro crisis in 2009-2011 sparked a rush into safe haven assets – assets like the Japanese Yen, Swiss Franc and gold. The latter soared from $1,300 per ounce to $2,000.

Fundamental economics

Later, quantitative easing programs also led to periodic rallies in gold prices. In June 2020 during the pandemic, gold prices surged as the Fed sought to resuscitate the wilting economy by pumping an enormous amount of credit into the banking system. Part of this liquidity flowed into gold.

Market sentiment

The general market sentiment also impact gold prices, perhaps inversely. When ‘risk off’ strikes, it may lead to a frantic buying of gold.

Technical indicators

Lastly, technical patterns in gold is equally important. For two reasons. First, strength begets strength. A strong gold price will attract more speculative capital and this will push gold prices higher. Second, many funds trade based on price movements alone. A breakout above, say the round number level at $1,500, will immediately cause a cascade of buy orders. Trend traders follow gold trends with trend-following indicators like 150-day moving average. Of course, technical patterns may fail. A failed breakout leads to whipsaws. An uptrend can reverse abruptly.

Financial prices are not set in stone. There are many factors can can move prices. Ultimately, gold prices are based on supply and demand. If you are long term investors buying at $1500 or $1550 makes little difference. The issue is finding the suitable strategy for you.

What are the cost of trading and investing in gold?

Depending on what you own, there are cost in investing in gold. Owning physical gold, for example, entails storage charges and insurance cost. Security is also another issue.

Trading financial gold prices – such as spread betting – will incur transaction costs slippage and overnight financing charges. Over time, these trading frictions are not cheap. You will have to beat these frictions to make money in trading gold.

Overtrading is a risk for traders because of these frictions. Overtrading means a trader is buying and selling too frequently – instead of waiting for good market opportunities.

Another word of warning: the cost of trading gold often increases during volatile sessions.

During a period of market upheaval, because brokers will widen spreads to protect their positions. Slippage will increase tremendously.

When the price moves are dramatic – say limit up for five consecutive sessions – exchanges may even will increase margins to calm things down. By demanding more collateral may force a liquidation of positions.

A recent famous disruption in commodity trading was Nickel in March 2022. Prices soared in the initial phase of the Ukraine war. LME ceased trading immediately and canceled trades.

⚠️ FCA Regulation

All gold trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK gold brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature gold trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Gold Trading FAQs:

IG is one of the best brokers to trade gold with as you can speculate via tax-efficient spread betting, as well as trade CFDs and invest in physical gold through shares and ETFs.

You can either trade gold directly on exchange with a futures and options broker, or speculate on derivatives through an OTC product like spread betting or CFDs.

You can but it is very expensive to store and take delivery of enough gold to speculate on. It is much cheaper and safer to trade gold through an FCA-regulated commodities broker.

Yes, you can make money trading gold if you time the market correctly. However, as with all speculative trading, a large percentage of retail traders lose money if using leverage.

The safest or lowest-risk way to buy gold is to invest in a Gold ETF through an FCA-regulated investment platform. However, it’s important to note that if the price of gold goes down your investments will be worth less.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the gold brokers via a non-affiliate link, you can view their gold trading pages directly here: