S&P trading platforms let you speculate on the Standard & Poor’s 500 stock market index (ticker: SPX), one of the oldest equity benchmarks. We’ve compiled a list of some of the best brokers for trading the S&P 500 (SPX) that are authorised and regulated by the FCA. We have personally tested each platform, interviewed the company CEOs, and compared costs, fees, market access, and the different types of accounts for trading the S&P.

City Index: S&P 500 trading signals and post-trade analysis

- Costs & spreads: 0.4

- Minimum deposit: £100

- Overnight financing: 2.5% +/- SOFR

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated US500 trading on MT4

- Costs & spreads: 0.4

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SOFR

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: SPX trading with personal service

- Costs & spreads: 0.6

- Minimum deposit: £1

- Overnight financing: 3% +/- SOFR

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount S&P trading & investing

- Costs & spreads: 0.005%

- Minimum deposit: $2,000

- Overnight financing: 1.5% +/- SOFR

- Account types: CFDs, DMA, futures & options

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: Best broker for SPX CFD trading

- Costs & spreads: 0.5

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SOFR

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

XTB: Good SPX trading educational material

- Costs & spreads: 0.5

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best broker for S&P 500 futures & ETF trading

- Costs & spreads: 0.5

- Minimum deposit: £500

- Overnight financing: 2.5% +/- SAXO RATE

- Account types: CFDs, futures & options

70% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s S&P trading

- Costs & spreads: 0.75

- Minimum deposit: $50

- Overnight financing: 6.4% +/- SOFR

- Account types: CFDs

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Tickmill: S&P futures on CQG or CFDs on MT4

- Costs & spreads: 0.39

- Minimum deposit: $100

- Overnight financing: na

- Account types: CFDs, futures & options

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

❓Methodology: We have chosen what we think are the best S&P trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the SPX trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the SP500 trading platform CEOs and senior management

Compare S&P 500 (SPX) Brokers

| S&P 500 Broker | S&P 500 Trading Costs | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 1 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.4 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 2 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 2.4 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 1.93 | $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 0.005% | $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £100 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 1 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.4 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

How do you trade the S&P 500 index?

You cannot buy the actual index, you have to trade a derivatives product based on it’s price There are multiple financial products derived from the underlying S&P 500 Index that you can trade with, including:

- Futures

- Options

- Exchange-Traded Funds (link)

- Investment Funds

- Spread trading

- CFDs

Why is the S&P so popular for trading?

It is one of the most followed equity index in the world. SPX is attractive to investors and traders alike because:

- S&P 500 is a highly liquid index – you can buy/sell underlying components easily

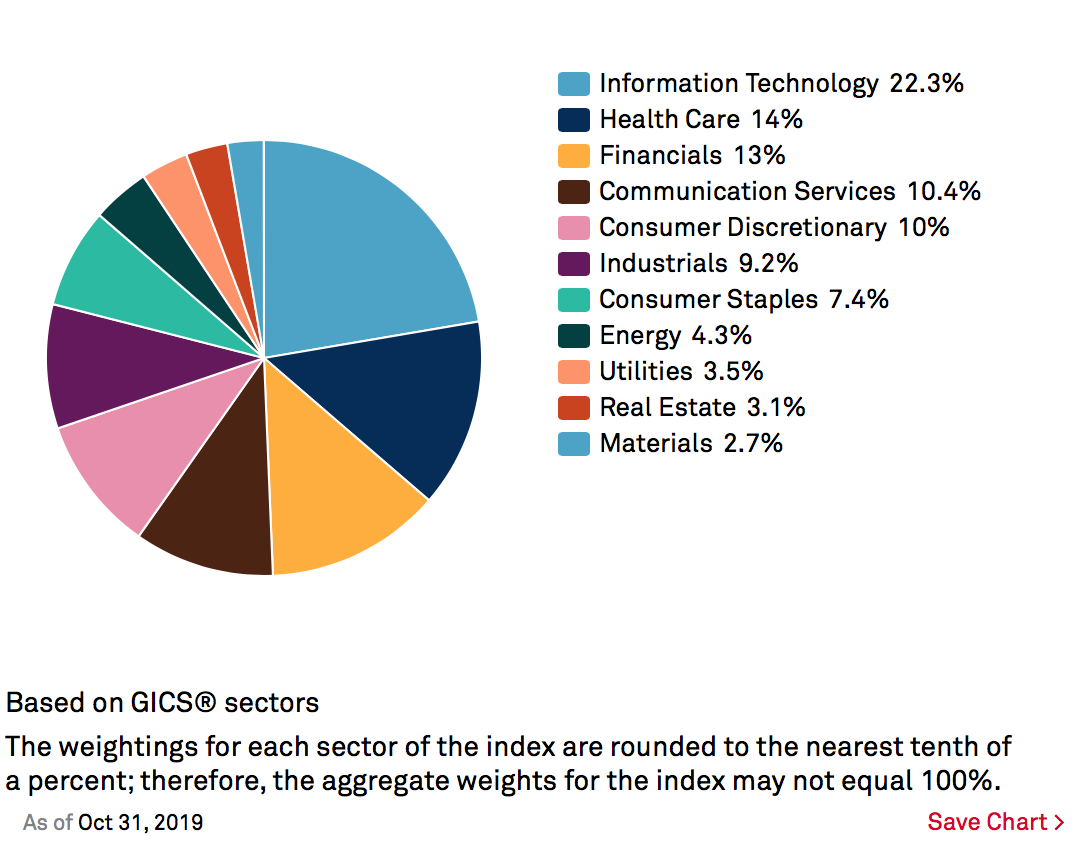

- SPX components are a good spread of various sectors. It is not dominated by any one sector (see below).

- SPX is a bellwether of the US economy

Therefore, many trader likes to trade this index, especially during trading hours where liquidity is better.

Source: Standard & Poor’s

What moves the S&P 500 price?

Stock markets are driven by a wide variety of factors, including some of the following:

- Macro factors (e.g. GDP, unemployment, business indicators etc)

- Monetary factors (e.g., Quantitative Easing, rates movements, yield curve etc)

- Technical factors (e.g., new highs)

If you are trading SPX short term, you will need to pay attention to news flow and data announcements because they can have massive impact on the index over the short term.

Another area to watch out for are Federal Reserve meetings and the release of FOMC minutes. Any change in interest rates beyond market expectations can cause violent swings in the SPX. For example, if investors were expecting a 0.25% hike but the central bank raised it by 0.5% – this may cause prices swing massively after the announcement.

Studying the reaction of the market to these factors are important.

S&P 500 technical trading indicators

Trading the S&P profitably requires a good strategy, of which technical indicators could come in handy. Technical indicators include:

- Price action

- Oscillators

- Support & resistance levels

- Trend indicators like moving average

- Patterns like breakout and reversals

For example, you may use the moving averages to judge whether the index is still trending or due for a reaction.

Another favourite indicator is a break of resistance or support levels. Look at the S&P 500 ETF (SPY) below. It was clear that the breakout above the 300 key resistance last month resulted in a persistent rally into 310 (see below).

Bear in mind, however, the different traders will gravitate towards different trading styles. Therefore you must find the technical indicators that best support your trading objectives.

Alternative S&P indices for traders

You can read about the major indices in our guide to the best indices for index trading.

S&P 500 Trading FAQ:

The Index takes the largest 505 stocks in the US exchanges and calculates the index prices based on stock price movements minute by minute.

The biggest ETF based on the S&P 500 Index is the S&P500 ETF (ticker: SPY).

Formed in 1957, the index is now the most popular stock market barometers in the world.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the S&P 500 brokers via a non-affiliate link, you can view their SPX/US500 trading platform pages directly here: