-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

To invest in an IPO (initial public offering), you need to apply for shares though and have a stock broker to hold the shares in. This guide explains how to invest in IPOs, the process, the risks and also some of the best accounts to get access to new issues and placing.

You can buy shares in an IPO, new issue or placing through an aggregator platform like PrimaryBid or directly through a stockbroker like Hargreaves Lansdown, Interactive Investor or AJ Bell. We ranked, compared and reviewed some of the best accounts for investing in IPOs, new issues and placings in the UK that are regulated by the FCA.

| IPO Access Account | Good For | Customer Reviews | More Info |

|---|---|---|---|

| Offers grey market pricing on IPOs | 3.9

(Based on 678 reviews)

| See Offers Capital at Risk |

| Very good overall for new issues, IPOs and placings | 4.3

(Based on 1,119 reviews)

| See Offers Capital at Risk |

| Excellent access and allocation to IPOs, new issues and placings | 3.8

(Based on 1,758 reviews)

| See Offers Capital at Risk |

| Apply directly for IPOs and new issues | 4.3

(Based on 1,119 reviews)

| See Offers Capital at Risk |

| Global IPO & new issue portal | 3.6

(Based on 140 reviews)

| See Offers Capital at Risk |

IG – offers grey market pricing on IPOs

- A large range of markets

- Go long and short

- Low-cost trading

Capital at risk

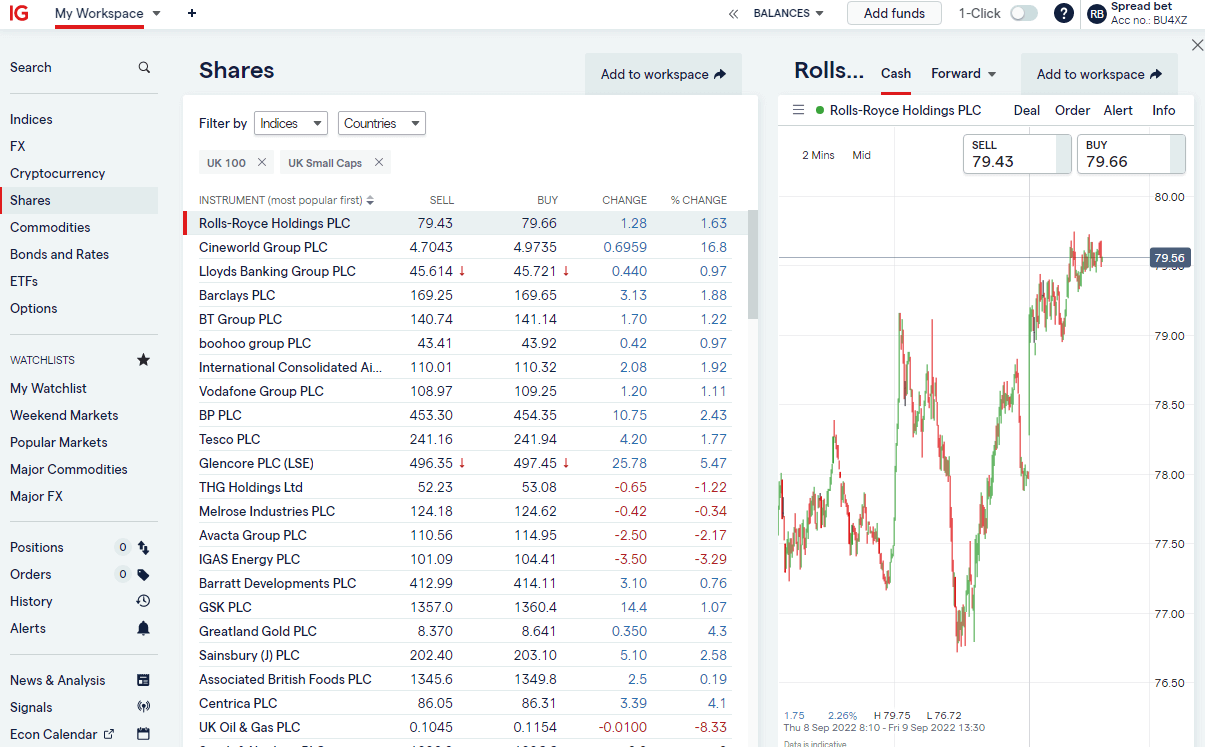

IG allows its share dealing clients to subscribe to IPOs and placings through PrimaryBid. To do this you will need to have an IG share dealing account and an account at PrimaryBid then it’s just a case of linking the two. Once that’s done you can apply for placings and new issues through PrimaryBid and any allocations you receive will be transferred to your IG Share dealing account. See our review of PrimaryBid.

IG makes no additional charges for subscribing to IPOs and placings through PrimaryBid, which levies no charges either.

However, IG will also often make a so-called “grey” market price in major IPOs. The grey price is a price in the shares of a company that is listing before it floats allowing traders to take an early view on the stock ahead of the IPO. If you believe the IPO will exceed the likely issue price then you would go long in the grey market or should you believe that the price of that stock will fall below the suggested IPO price, then you would go short in the grey market.

IG Won Best Trading App in the 2025 Good Money Guide Awards

Provider: IG

Verdict: IG is one of the largest and best brokers in the world and offers the full suite of investing and trading accounts for all types of investors. Highly recommended. Founded in 1974 as Investors Gold Index, then IG Index, and now just “IG”, it’s one of the world’s largest margin trading brokers. IG offers contracts for difference (CFDs), FX and spread betting (in the UK) alongside share trading and prime brokerage to over 400,000 clients, and covers 15,000 tradeable markets. IG also offers physical share dealing and smart portfolios for longer-term investors.

71% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a Good Trading Platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

First up, I must disclose that IG is my default broker. When I review brokers, I ask: “Why would you trade here rather than at IG?” It was my first trading account – I’ve had it for about 20 years and I remember the first online trading platform when it was basically a messaging system through to the dealing desk. When I was interning on the NYMEX and IPE trading floors in London and New York as a ticket checking clerk, I’d tap away on IG on my Ericsson R380. Along with Trading Places (my dog is even called Winthorpe #notobsessed) I hold IG accountable for the path my career has taken.

Who is IG?

Stuart Wheeler, IG’s founder, basically invented financial spread betting in the attic of a Chelsea townhouse in 1974. It was first called Investors Gold Index, then IG Index and then just IG. As the product range grows, the name shortens.

His biography (Winning Against the Odds, My Life in Gambling and Politics) makes clear IG was founded for the love of the business (that business being gambling and investing).

One of the things that makes IG stand out is that it’s good at what it does, and seems to want to be the best.

I certainly gathered from my interview with the former IG CEO, June Felix, that the company wants to be on the client’s side, believing it’s better to try to help the client win, and give them good service, so they’re still a client 20 years later, rather than the churn and burn approach.

Index & Forex Trading

IG was one of the first brokers to let private individuals trade the financial markets, and IG clients can now trade a market-leading 80+ indices.

You can also trade forex on the platform. But unlike most other forex brokers, which see the largest percentage of their volumes in the forex markets, IG’s most popular asset class is indices, followed by currency trading.

Quality Service

IG has always taken the view that clients trade with it because of the service it offers, rather than because of any incentives.

No B-Book

One draw for big clients is that whilst IG does internalise orders, it has symmetrical exposure limits, so it doesn’t take a view on the markets. This means that IG is not betting against you with a B-Book. And, if you’re a big trader, because of IG’s liquidity there may actually be bigger volume on IG’s bid and offer than there is in the underlying market. You get positive slippage, so if you place a limit order and the market suddenly moves in your favour you get filled at a better price than your limit.

Spread Betting & CFD Trading

With IG you can trade CFDs or spread bet 24 hours on major indices, forex and commodities markets. There are extended hours on global equities, where some fairly significant volume goes through, particularly on US equities when company announcements are made after the main market shuts.

IG is one of the few brokers to allow trading during the weekend, so you can still take a view or limit your exposure if something big comes out politically.

IG is one of the best CFD trading platforms as it offers a huge range of markets to trade and DMA access for more sophisticated traders. Also, because IG offers CFDs globally (with the exception of the US) it has a huge amount of volume and liquidity meaning that sometimes you can place bigger orders via IG’s order book than you could do on the underlying exchanges like the LSE or NYSE. Because of the sheer volume of CFD trades, IG is able to internally match up orders for quicker and larger fills.

One key disadvantage of trading CFDs through IG is that you have to pay tax on profits. However, CFDs are not the only product that IG offers. You can also trade financial spread bets, where you do not have to pay capital gains tax on profits as this is classed as gambling.

IPO Grey Market

One feature that’s now unique to IG (lots of other brokers used to do it) is the “grey market”, where it will offer you a price in unquoted stocks that are due to come to market. You essentially take a bet on what the market cap will be of a company when it lists. Or you can just apply for shares in the IPO through PrimaryBid, which will deliver them to your IG account.

Global Differences

IG is good at knowing what customers in each region want. The UK, for example, is the only country that is offered financial spread betting, and the rest of the world trades on margin with CFDs. That’s with the exception of the Americans, who trade on margin by taking out a loan to buy stock (from their broker) or trade options, which are much more popular on equities. Japan has knockouts and Europe has barrier options and Turbos Warrants.

What Does the Trading Platform & App Look Like?

IG’s trading platform is DIY online, but still with phone support if you need it.

IG is keen to push its added value; the platform tries to integrate as much as possible. IGTV is based on the platform analytics of what people are trading, and IG creates programmes around what markets and assets traders are looking for information on. The news and analysis comes from Reuters, with snapshot videos and a series of IG market commentary videos.

We rate IG’s trading app as extremely safe because of IG’s regulation and reputation. However, it’s important to note that while trading on the app itself is financially secure, the products on offer are high risk and IG does offer investments that are not safe for capital preservation. IG offers financial spread betting and CFDs which are high risk, potentially high reward products.

High Net Worth Accounts

If you are a high-volume trader, you can also trade DMA with ProRealTime, and you can get level 2 pricing and trade directly on the exchange order book. This can be done on the IG trading app or by downloading the L2 dealer software. There is a cost, of course, but if you do a few trades that is rebated back. Brokers have to pay the exchanges for providing level 2 data to their clients, so the charge is there to dissuade everyone signing up without trading. If you are really clever and have developed your own trading algorithm, you can plug that into IG’s platform too. Or MT4/MT5 which it also offers, if you’re into that sort of thing.

Sticky Clients

A problem all brokers are desperate to address is people losing money. It’s always been the case that only around 20% of people made money. A few brokers have implemented post-trade analytics, to help their clients try and win more. IG’s Trade Analytics tool does just that. Its sole purpose is to try and help traders win more by getting a better understanding of where they profit and lose in the markets. It’s been developed in-house by IG, based on analytics and to provide clarity.

James Perry, a former IG Client Experience Manager, told me “We desperately want our clients to win, as the more they win, the longer they are going to be a client, and the more they are going to trade.” And the more commission IG will make.

I know this to be true from my own trading, when you’re on a winning run you trade more, and when you can’t call the market right you step away until another day.

Investing, ETFs & Share Dealing

IG also offers longer-term investing products, where you can buy and hold stocks, ETFs and funds in a stocks and shares ISA, or IG Smart Portfolio. It has a trading academy so you can learn through video and interactive courses. IG can see from its analytics that clients that use these become better traders. IG bought DAILY FX (for $40m) and offers live webinars to provide analysis and trading strategy.

You can invest and trade ETFs with IG. You have the option of either investing in the long term by buying ETFs in the general investment account, SIPP or ISA. Or you can speculate on them going up or down by going long or short via CFDs or financial spread bets.

IG is not the cheapest place for investing in ETFs, (that is probably Interactive Brokers) but it does have very good customer service and is a really easy-to-use ETF platform.

Ratings Explained

- Pricing: Industry leading spreads and with DMA you can get inside the bid/offer.

- Market Access: Best around for spread betting and CFD trading.

- Platform & Apps: Loads of added value, signals and execution features.

- Customer Service: IG is very big, but still managed to score well here.

- Research & Analysis: Superb, news, analysis, social feeds, plus free premium subscriptions for active clients.

Overall, if you are going to trade, I would be surprised if you didn’t have an account with IG.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service occasionally slow

- No DMA futures trading

- Not the cheapest for ETFs

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7Interactive Investor – Best overall for new issues, IPOs and placings

- Fixed fee investing

- DIY & managed accounts

- IPO, new issue & placing access

Interactive Investors offers its customer access to new issues and IPOs from companies listing on the stock exchange for the first time. You can apply for shares in these businesses through II, but you will need to open a trading account to do so. II advertises the available new issues on the dedicated IPO section of its website there and there are links to offer documents and details of the issue. II does not charge a commission for new issue applications.

interactive investor offers fixed fee investing on a wide range of investments

Provider: Interactive Investor

Verdict: Interactive Investor’s fixed fee account structure make them one of the most cost effective ways for people with large portfolios to manage their investments, ISAs and pensions. ii are expecially good for high value portfolios and those wanting access to small cap stocks.

What does interactive investor do?

Interactive Investor or II as its known is one of the UK’s largest self-determined investor platforms. II can trace its roots back to 1995 and the startup floated on the London stock exchange back in the year 2000 before being bought by the Australian business Ample in 2002. Today, Interactive Investor is a owned by abrdn with assets under administration of more than £50 billion and 400,000 customers to whom II offers share trading and investment services including, ISAs SIPPs and share dealing, alongside research and analysis. Including model portfolios, selected funds and thematic investments.

Interactive Investor differs from other investment platforms as it charges a fixed account fee, rather than a percentage of the funds you have on account. Which, over time, could save you thousands in costs.

As a low-cost provider ii competes directly with the likes of Hargreaves Lansdown and AJ Bell offering general investment accounts, ISAs and pensions.

Pricing: Brilliant for medium and large investors, expensive for small accounts.

Market Access: You’ll be hard-pressed to find something you can’t invest in.

Platform & Apps: Very good, excellent data and usability.

Customer Service: They are massive and mostly online, but you can call them directly, generally good.

Research & Analysis: Loads, daily and weekly updates across all the asset classes they cover, with lots of analysts and opinions. No advice service though.

Does interactive investor pay interest on cash?

Yes, but only 2% for under £10k and you need at least £100k in your account to get their best rate of 3.25%. There are other brokers that offer better rates on uninvested cash, though.

interactive investor versus Interactive Brokers

interactive broker and interactive investor may sound similar but cater to different investor profiles and operate under different jurisdictions and cater for different types of investors.

interactive brokers is a US‑based global brokerage offering a wide spectrum of asset classes and advanced trading tools, often targeting active traders and professionals. interactive investor, by contrast, is a UK‑focused subscription‑based platform offering a fixed‑fee structure suited to medium‑to‑long‑term investors primarily in equities, funds, bonds, Gilts, ISAs, and SIPPs.

interactive investor employs simpler platforms with relatively basic charting tools, while interactive brokers features a more complex interface and lower per-trade costs but with more variable fees. interactive investor is better for large longer term investment accounts because of its simplicity, flat monthly fee and broad UK offerings, whereas Interactive Brokers suits users seeking global market access and sophisticated execution tools.

Can you buy Gilts on interactive investor?

Yes, ii supports investment in government bonds, including UK Gilts, via its platform. This is confirmed on the site, which lists bonds and Gilts as available investments .

Pros

- Fixed account fees

- Easy to use

- Good research

Cons

- No Lifetime ISA

- Expensive for very small accounts

- No derivatives for hedging

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

5Hargreaves Lansdown – excellent access and allocation to IPOs, new issues and placings

- Good customer service

- Cheap for shares

- Good IPO access

Capital at risk

Hargreaves Lansdown offers the chance to get involved with IPOs alongside other investments. You can access the latest share offers through their website. If you have heard of one which they have not covered for any reason, you can also let them know about it.

Hargreaves Lansdown Review: The Waitrose of the investing world

Provider: Hargreaves Lansdown

Verdict: Founded in 1981 Hargreaves Lansdown is one of the largest investment platforms in the UK. They offer investing, savings, ISAs and SIPP account to over 1.8 million clients with 142bn in assets under management.

Is Hargreaves Lansdown a good broker?

Yes, Hargreaves Lansdown is one of our best-rated stock brokers and investment platforms. HL offers access to a huge range of investment types, through a wide range of general and tax-efficient accounts and is suitable for almost all types of investors.

I always think of Hargreaves Lansdown as the Waitrose of the investing world. Yes, it may be a bit pricier sometimes, but I think it’s just a nicer, safer place to shop for stocks.

Pros

- Wide range of investments and accounts

- Top-notch customer service

- Excellent research and analysis

Cons

- There are cheaper options for fund investing

- Limited portfolio hedging tools

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.9AJ Bell – apply directly for IPOs and new issues

- Low-cost investing

- Lots of account options

- Good research & analysis

Capital at risk

Through AJ Bell it is possible to invest in some Initial Public Offerings (IPOs). You can find information on upcoming IPOs on the company’s IPO page.

To participate in an IPO, you must have an account with AJ Bell. You can apply for shares within any of your AJ Bell accounts.

There are no dealing charges or stamp duty payable for making an IPO application. However, normal dealing charges will apply if you choose to sell your IPO shares once they are issued.

AJ Bell Review: A low cost full service investing platform

Provider: AJ Bell

Verdict: AJ Bell is an award-winning, low-cost online investing platform for UK DIY investors. Founded in 1995, AJ Bell has grown to become one of the UK’s leading investment platforms. Today, it has more than 440,000 customers and assets under administration (AUA) of over £150 billion.

Is AJ Bell good for investing?

AJ Bell is an excellent full-service stock broker that offers a wide range of services for investors, including share dealing, fund investing, cash-saving services, and mobile dealing. It also offers a range of accounts including Stocks and Shares ISAs, Lifetime ISAs, Self-Invested Personal Pensions (SIPPs), dealing accounts, and investment accounts for children.

Pros

- Wide range of investments

- Low account costs

- Discounts for frequent investors

Cons

- High charge when you deal over the phone

- High FX charges below £10k

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.8PrimaryBid – best for access to all IPOs, new issues & placings

- Allocate to your broker from PrimaryBid

- Access most IPOs, new issues and placing

- Specialist IPO access

Capital at risk

Using PrimaryBid you can apply for shares in companies that are floating on the stock exchange for the first time. These deals are known as flotations or IPOs and are part of the primary markets through which companies access capital, as opposed to the secondary markets, where shares are traded independently of any fundraising.

To apply for shares in a new issue you first need to open a PrimaryBid account and to do that, you will first need to download their app from either the Apple or Android app store, or register using their website.

Note though that for some issues you will also need to be an existing customer or account holder of the company that’s floating, added to which you will need to have a trading account with a stockbroker into which PrimaryBid can transfer any shares you are allocated.

PrimaryBid is not the first platform to try and democratise new issues. ALL IPO which was acquired by ADVFN in 2009, ran a similar service, however that shut down in 2018 creating a gap in the market for PrimaryBid to try and fill.

PrimaryBid Review: Aggregated IPO & New Issue Access

Provider: PrimaryBid

Verdict: PrimaryBid lets you invest in IPOs, new issues and stock placings, by operating a central platform that brings these offerings directly to retail investors who have to some extent been excluded from the primary markets. The business has been involved in 100 deals to date with participation ranging between £500,000 and £10,000,000. With individual ticket or trade sizes running between £1,000 and £500,000 has accessed more than half a million retail investors to date.

Summary

A revolution for investors that want access to as many IPOs, new issues and placings as possible.

Pros

- Lots of IPOs, new issues & placings

- No costs or fees

- Connect to your existing stock broker

Cons

- Allocation not guaranteed

- Cannot invest with SIPPs or ISAs

-

Pricing

(5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4.2What is an IPO?

IPO, short for Initial Public Offering, is the process of selling part of a company to the public.

The IPO process is usually conducted by regulated financial institutions like investment banks and stockbrokers. A lead manager of the IPO is known as a book runner. They will first study the company (‘due diligence’), write up an offer document for investors, called a ‘prospectus’, and then roadshow the business to institutional clients and sound out their appetite for the company.

They will underwrite the IPO to sell the shares successfully. In return, bankers earn fees for this effort. Some IPOs are so huge that the IPO fee can be tens of millions.

If you are more interested in buying into more established public companies here is how to buy shares in any company.

Are IPOs a good investment?

IPOs can be a good investment if they are priced right before they come to market. If an IPO is priced below expectations, it will likely rally on the first day of trading. However, if market conditions are not right or the company is of little interest to investors, then you may be better off waiting for the share price to settle after it comes to market.

Here we highlihgt some of the advantage and disadvantages of investing in IPOs.

Pros

- Discounted offering – . The biggest advantage is that you get to buy shares at a discount to their current value. When IPOs launch, shares are typically offered at a discount to attract buyers. So if you are able to pick up shares as part of the initial offering, you are likely to take advantage of a potential discount. For example, Facebook (NASDAQ:META) was listed in May 2012 at $38, when its pace of growth was high. Tesla (NASDAQ:TSLA) first sold shares to the public in 2010, when it was still small and growing. Investors who bought into the listing would have made a bundle over the past few years.

- Potential for positive volatility – depending on the success of an IPO, there is typically lots of volatility within the first few days of its launch on the stock market. If there is huge demand for the shares, there is the potential for positive volatility where prices could rise as much as 40% within the first few days. For example, Royal Mail (LON:IDS) shares rose 38% on its first day with prices almost doubling in value within a few weeks

- You can short IPOs – when trading as opposed to investing, you don’t have to just buy an IPO and hope that prices will rise. You can also short-sell them, meaning you can take advantage of falling prices, giving you greater flexibility. So if you think an IPO will underperform, you can short sell its prices with a CFD broker.

Cons

- Expect volatility – as mentioned above, most IPOs suffer from volatility in the first hours and days of its launch. This can make trading them extremely hard to predict, especially when done so using leverage. On the one extreme you have the Royal Mail example. On the other you have Facebook, which launched at $38, rose to a high of $45 within hours only to fall back to $38 by market close on its first day. Within a few months, shares were trading as low as $20.

- Form can be temporary – how an IPO trades on its initial days as a publicly traded company is no guarantee of how it can trade in the subsequent months or years. So for some investors it may be wise to wait until the volatility has calmed before getting involved in trading an IPO

- Beware first earning season – when private companies goes public, it means they are now required to update shareholders on their earnings every quarter, as opposed to once a year. This can add even more volatility to the stock as initial investors react to whether the firm is living up to the claims made in its prospectus.

- You can lose money – Not all IPOs are guaranteed to make money for investors. New issues are by nature speculative because the business is new. Valuations are driven by sentiment, which can be volatile. Worst-than-expected results can also lead to a persistent downtrend of its stock price. Share prices of an IPO can – and often do – trade below that of the issued price. Investors who bought into the IPO will suffer losses. One example is Aston Martin (LON:AML). The luxury car company sold its shares to the public at £19 in October 2018. After a while, the stock slumped and last year traded below 50p.

What to consider when investing in an IPOs

Should you wish to participate in newly-listed companies, here are five key questions you should ask before plunging in:

1) What’s the story?

Every new company has a good story to tell. What’s the vision? Is the sector a completely new one? Two decades ago, dot-com firms were all the rage. Now, payment, AI, cloud, automation, robotics, and software are some of the hottest sectors. These fads often change, but more often than not, an exciting story will be easier to sell to investors.

2) Is the firm profitable and growing?

While most investors would prefer a profitable company, the real factor driving the success of a company is often growth.

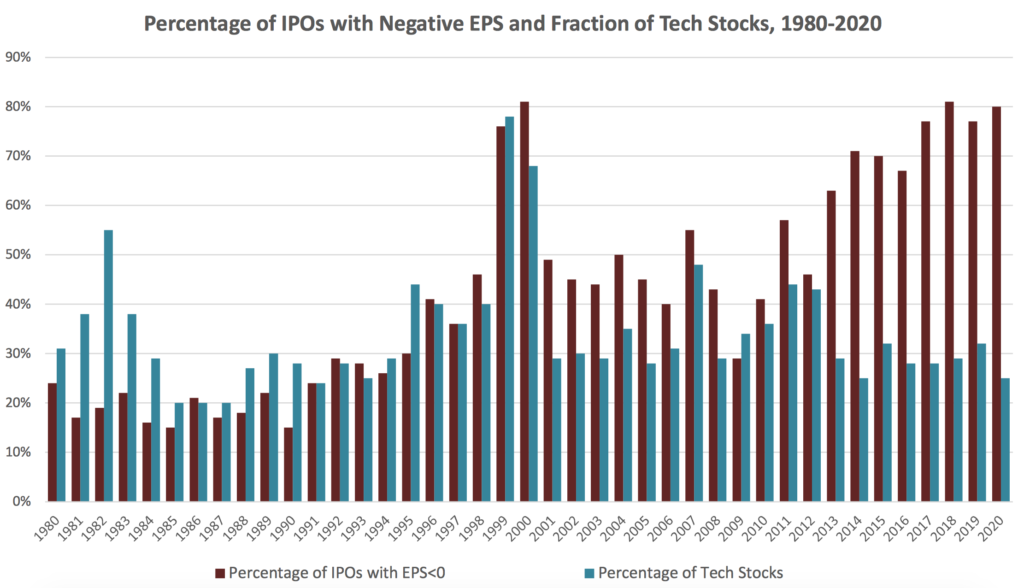

Young companies in a new sector grow rapidly. They will need to spend heavily to acquire new customers or build the latest state-of-the-art factories. Thus, investors will overlook its present loss-making activities and support the IPO for future growth. Many tech companies were losing money when they were an IPO, including Amazon.

In recent years, most US companies seeking an IPO were loss-making. Some studies showed that up to 80% of IPOs in America have negative earnings (see below).

Source: Prof Jay Ritter (link)

3) How did the previous IPOs perform?

This is an important question because it is about investor psychology. Investors are more likely to buy more if prior IPOs, especially in the same sector, were hugely successful.

Investors who made money trading the IPO will most likely reinvest the profits in the next one.

4) What is the valuation?

IPOs follow the stock market cycle. Demand is no doubt stronger during the bull phase. Valuations are higher, liquidity more plentiful.

Investors and traders can make lots of money ‘flipping’ IPOs during a mania, such as the dot-com boom in the nineties. Many companies take advantage of the positive mood and IPO at a high valuation – without making an effort to build a real underlying business.

Once the speculative mania ends, many IPOs went bankrupt. The new businesses weren’t sustainable.

As an investor, you will need to determine which cycle we are in now and whether the IPO is sensibly priced. If it is too high, it means expectations are overly bullish. Future growth is already priced in the share price. Even the company does well in the future, this may to lead low price growth.

5) Are any big cornerstone investors buying into the IPO?

A large successful investor buying into an IPO signals that the investors believe in the company for the long term. This is a positive and bullish signal.

Last year, Warren Buffet bought his first IPO since 1956, in a company called SnowFlake (SNOW). Now, hearing that, would you be more or less confident of the offering?

IPO investing FAQs:

Stock placings are another way in which companies that are not currently listed can gain access to stock markets and the investors in them.

Placings are often used by companies who do not necessarily need to raise money, or if they do, they wish to have only a select number of new institutional shareholders.

Placings are typically organised by the company’s brokers/bankers, who approach institutional investors and invite them to participate in the placing, setting out the terms of the proposed issue and the nature of the business that they will be investing in. In this type of issue, there is usually little or no opportunity for retail investors to participate.

That said, the placing is proving popular among listed smaller companies looking to raise additional capital.

Often, the company will issue new shares at a discount to the current share price.

Depending on the size of the issue and the demand for the shares, these placings may take place through just one or two brokers, though in larger issues, there may be a bigger underwriting group.

In theory, there should be an opportunity for retail investors to participate in these secondary placings, though they are often conducted on a first-come-first-served basis. So, whether you hear about them before they’re completed may depend on your broker and their connections.

Retail investors can invest in IPOs, but, they are certainly not for everyone There are no guarantees that the listing price of new issues, however they are brought to market, will be higher than the issuing price.

If the share price of the new issue in the secondary market falls below the issued price, then you will have a running loss on your investment. You then have a decision to make as to whether you should sell the shares and take that loss, or hold on in the hopes that the price will recover above the issue price in future.

New issues are by nature speculative; investors are putting money into businesses that may have little or no track record, valuations for which are often driven by sentiment and can prove to be fragile, if, for example, the recently floated company experiences a downturn in its markets, loses a large order or suffers some other form of disappointment.

New issues are a form of IPO but more often than not these days, the term IPO refers to the floatation of a large ongoing concern such as a tech unicorn or state-owned business etc.

When smaller companies come to list or float on the stock exchange, they are referred to as being a new issue. This is particularly true of the UK, the phrase IPO being an Americanism.

The term new issue can also be used to describe an issuance of shares or debt/bonds from an existing and listed business; for example, a company whose ordinary shares are listed on the stock exchange may make a new issue of convertible bonds to raise additional working capital for a project or expansion.

But whether the new issue is from a business listing for the first time or an issue of new paper from a company that’s already listed, the process is very similar to that of the IPO, but on a smaller scale. The issue will typically be underwritten; permission to list the new securities is sought from the exchange and offer documents are prepared. The underwriters and their associates will gauge demand and applications for the new shares or bonds are invited from investors and the new issue is listed on the exchange.

Investment returns will depend on many variables, such as the issues you apply for and participated in, your approach to trading the issues, that is whether you sell the new issue on the first day of trading regardless, or whether you tuck them away for a few weeks, months or even longer.

As the FT pointed in May 2019 (written in the wake of the disappointing IPO of ride-sharing app Uber NYSE:UBER ), the price of Facebook (NASDAQ:META) moved very little in its early trading after it IPO’d back in 2012, but its share price has risen multiple times in value over the last seven years.

A long-term study of US IPOs, using data from 1980 through to 2016, conducted by Professor Jay Ritter of the University of Florida, found that the average return from among more than 8,500 US IPOs was +17.90%, based on their first day of trading, and some +21.90% over a three-year holding period.

Those returns, of course, are based on the idea that an investor participated in each one of the new issues and using averages can, of course, mask a wide range of underlying individual outcomes.

The London Stock Exchange keeps a list of upcoming new issues here.

The number one reason is to raise new equity to expand the business. The other reason is to raise money and repay some of the debt raised earlier. Early investors in the company may also wish to sell their shares to the public to exit the investment.

In an IPO prospectus, it will list all the important information related to the IPO, such as:

- Valuation of the company

- Number of new shares to be issued

- Exchange to be listed

- Indicative price range

- Offer period

- Timing of the IPO, among others

A global tech company usually considers a US listing first because investors there are more receptive to these type of companies. A mining company, on the other hand, may look to the UK.

In recent years, stock exchanges have competed aggressively with each other to attract the largest IPOs. To date, the largest IPO in history is Saudi Aramco floatation in 2019 at $29.4 billion, followed by Alibaba (BABA) listing in 2014 at US$25 billion.

Stockbrokers can provide access to IPOs or you can invest through PrimaryBid and normally have some allocation for retail investors. If you’re interested in IPOs, ask your stockbroker to add you to their list of contacts. Hargreaves Lansdown has this IPO alert where you can sign up.

Depending on the popularity of the IPO, you may not get all the shares you wanted to buy. During a roaring tech bull market, for instance, most tech IPOs were hoovered up by institutional investors.

Another point worth noting is that not all IPOs are available to retail investors.

No, it is quite common for private investors to get less than they applied for if an IPO is oversubscribed.

Once the key points of the IPO have been nailed down, investors will weigh how much shares to buy and what its allocation is.

In popular IPOs, investors tend to apply for more stock than they actually want in expectation of their allocation being scaled back in the final issue; the more demand there is for the new shares then the higher the IPO price is likely to be.

Firstly, you will need to have a stockbroker that allows its clients to participate in the new issue’s markets in the widest sense.

If your broker does offer new issues and you meet the criteria, you will also need to have liquidity at hand. When you apply for new issues, you typically apply for a fixed number of shares at a set price (the issue price) and you will need to have the funds available, on-demand, to pay for those newly issued shares.

It’s worth bearing in mind that new issues crop up regularly and that if all your money is tied up in one issue, you run the risk of missing out on others. That may be ok if you are cherry-picking, but Stags, as those who trade in new issues are known, often try to participate in as many new issues as possible to try and spread their risk and diversify their returns.

This depends on the individual issue, though there will normally be a minimum holding period.

The purpose of the new issue is usually to raise fresh cash and create new shareholders for a company. The underwriters and other advisors to a new issue don’t like to see the new money they have raised, and the new shareholders they have created immediately heading for the exit.

There may also be some practical issues that can delay the ability to sell a new issue. For example, you may need to be in possession of the newly issued shares before you can sell them. It’s best to check what these restrictions are before you invest in a new issue, on a case by case basis.

For larger IPOs, CFD and spread betting brokers will often make prices in the IPO, which means that there is potential to put on a hedge if you can’t immediately sell your new shares.

A stock market floatation is when shares are first admitted to be publically traded rather than privately held.

The phrase floatation comes from the term “free float” of shares, which refers to the amount of shares that are available for the public to buy and sell.

A good example of a company with a low float is VinFast the EV car maker from Vietnam. We reported in our analysis that one of the reasons the VinFast share price crashed after they IPOd was because when they floated the company shares there were very few shares available for the public to trade.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the IPO investment accounts via a non-affiliate link, you can view the product pages directly here: