-

Richard Berry

Richard Berry

- Updated

Buying US stocks from the UK requires an investment platform that offers international investing. In this guide, we explain what US stocks are, the different ways to invest in them, and the pros and cons of buying US stocks. We have also ranked, compared and reviewed some of the best accounts for buying US stocks in the UK that are regulated by the FCA.

Compare US Stock Investing Accounts

You can use our comparison table of platforms that let you buy US shares from the UK to compare how much it costs to deal, what type of accounts you can hold them in, and how much the foreign exchange conversion fee is.

| US Stock Buying Platform | US Commission | FX Rate | Account Fee | ISA | GMG Rating | More Info |

|---|---|---|---|---|---|---|

| 0.5 cents per share | 0.02% | $0 | ✔️ | Visit Broker Capital at risk |

|

| 0.015 USD/Share (min. 1 USD) | 0.25% | 0.12% – 0.08% | ✔️ | Visit Broker Capital at risk |

|

| $0 | 0%-1.5% | $0 | ❌ | Visit Broker Capital at risk |

|

| £0 – £10 | 0.5% | $0 – $96 per year | ✔️ | Visit Broker Capital at risk |

|

| £3.50 – £5 | 0.75% – 0.25% | 0.25% (max £3.50 per month) | ✔️ | Visit Broker Capital at risk |

|

| £5.95 – £11.95 | 1% – 0.25% | $0 | ✔️ | Visit Broker Capital at risk |

|

| £3.99 | 1.5% – 0.25% | £4.99 – £19.99 per month | ✔️ | Visit Broker Capital at risk |

Our picks of the best accounts for buying US stocks and shares

❓ Methodology: We have chosen what we think are the best US stock investing accounts based on:

- over 17,000 votes in our annual awards

- our own experiences testing the US share dealing accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative US stock market investing platforms.

- interviews with the investment account company CEOs and senior management

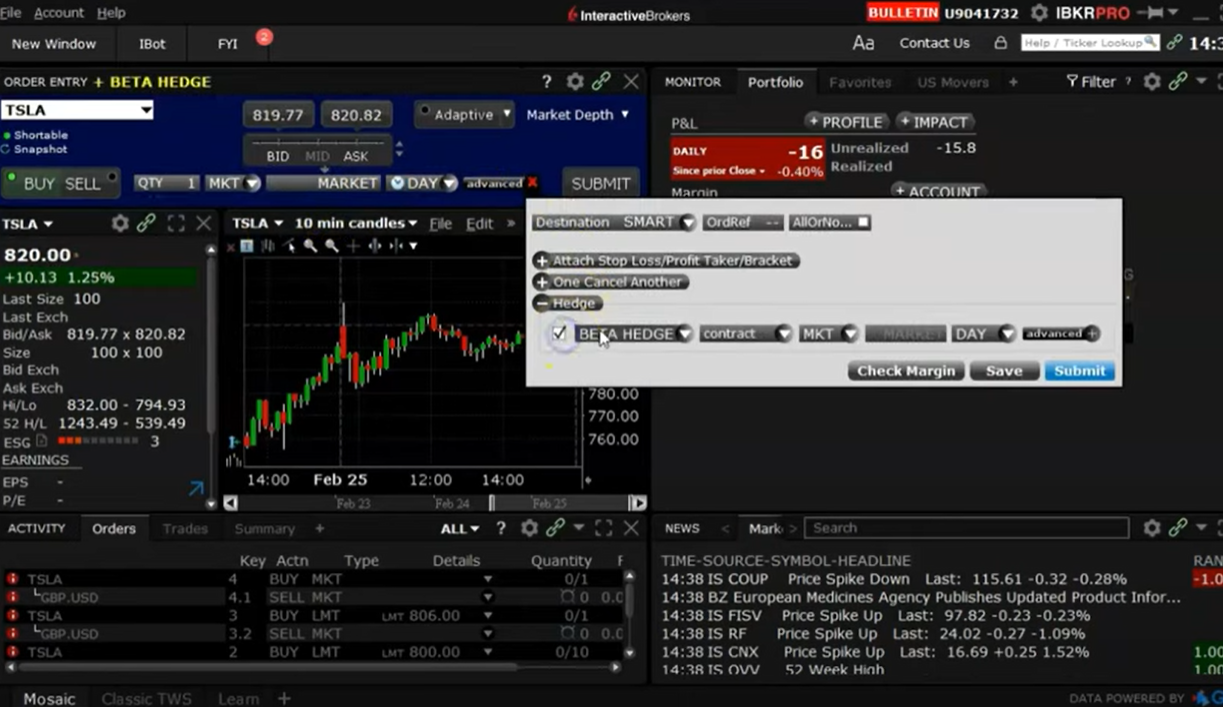

Interactive Brokers: Best overall for buying US stocks from the UK

- US commission: $1 (then 0.5 cents per share)

- FX rate: 0.02%

- Account fee: $0

Hands down, IBKR is the best broker for investing in US stocks because they are, well, American. So you get the widest market access. Plus, IBKR is cheap, very cheap. There is no account fee; they offer the best currency conversion rates in the market (0.02%), plus you can convert money as and when you like.

Dealing charges are low too, you pay a minimum of $1 per trade (so it’s not free) or 0.005 USD per share whatever is great. So basically you pay $1 per share until you are buying over 200 shares of a US company.

For larger investors, their scale trade offers institutional grade execution capabilities like pairs trading (buying and selling one stock against another), a huge range of options markets and an excellent stock screener tool for sniffing out smaller value stocks.

Pros:

- Low US Commission of 0.5 cents per share

- Low FX rate of 0.02%

- Zero account fees

Cons:

- The desktop platform is quite complicated

- Due to their size, customer service can be automated and sometimes frustrating.

- Loggin in is a pain (but very secure)

Read our expert Interactive Brokers review and see what customers think of them here.

Saxo: Buy US stocks with DMA for $1

- US commission: $1 (then 0.015 USD per share)

- FX rate: 0.25%

- Account fee: 0.12% – 0.08%

Capital at risk

Saxo has recently reduced its currency conversion fees, so UK investors can now buy US stocks for as little as $1 and 0.25% when converting GBP into USD. You cross the minimum threshold when you start trading in more than 67 shares at a time and will then pay 1.5 cents per commission on US share deals.

Saxo also offers direct market access to US stocks as a CFD (going long or short), and trade US stock options. Plus, you get access to a fairly comprehensive research suite for US stocks, including investment inspiration, live market updates, expert analysis, podcasts, and webinars from their online trading platform.

Pros:

- $1 US stock dealing commission then 15 cents per share

- Low FX rate of 0.25%

- Low account fee of 0.12% – 0.08%

Cons:

- High-risk derivatives

- More suited to experienced investors

- Subscription cost for live pricing

Want to see the Saxo US stock trading platform in action? Watch our live SaxoTradeGO demo here.

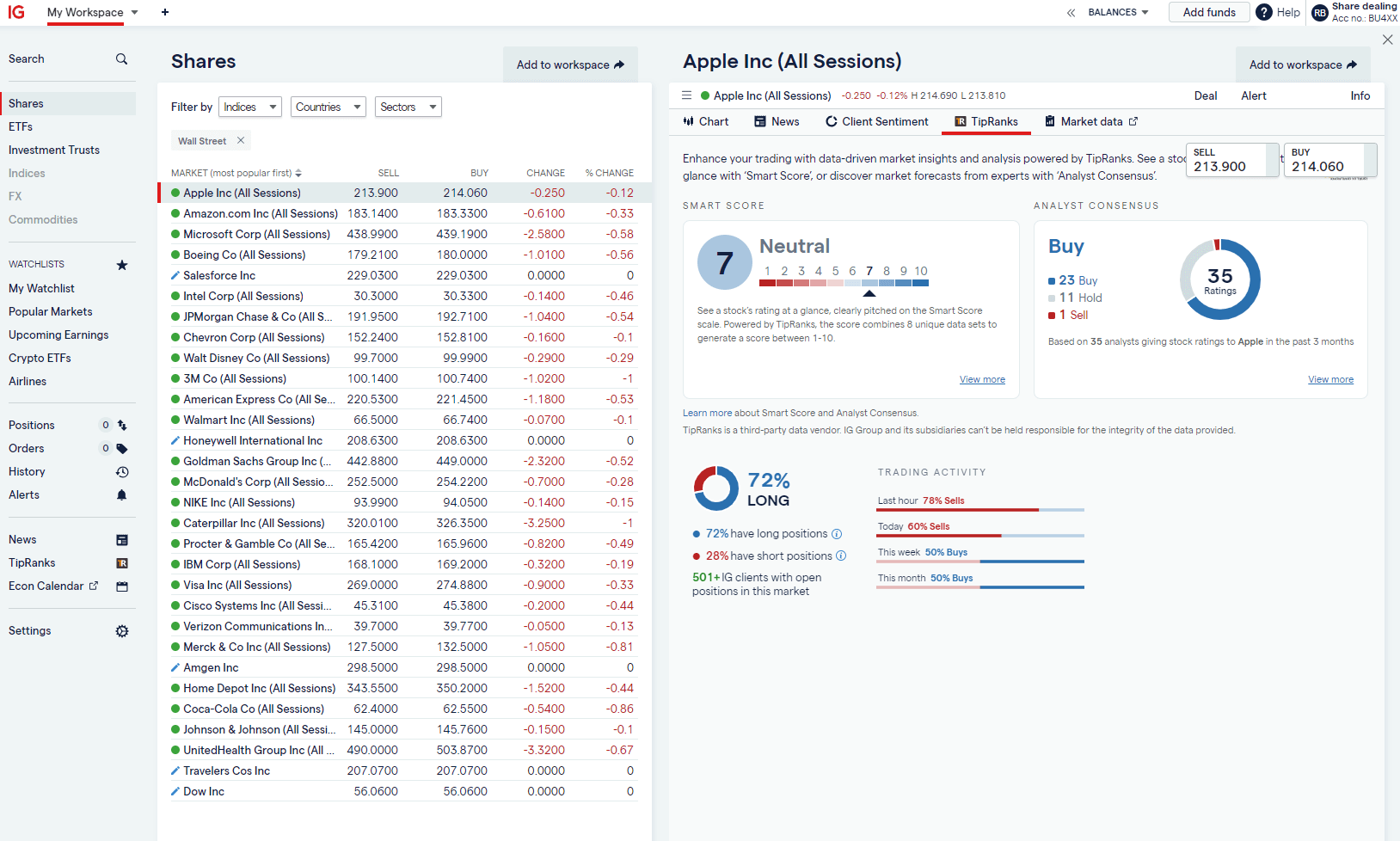

IG: Lots of signals, sentiment and news for US stocks

- US commission: £10-£0

- FX rate: 0.5%

- Account fee: $0 – $96 per year

Capital at risk

If you deal more than three times a month in US shares, IG works out the cheapest, as there is zero commission for regular traders. Otherwise, it is quite expensive with a £10 minimum commission.

I do prefer the way IG sorts its watch lists, where you can filter by index (as opposed to Saxo, where you have to build your own. IG also have quite a lot of integrated sentiment and signal indicators which can give you some guidance on the potential of buying specific US stocks.

Currency conversion fees are fairly in line at 0.5% but could be cheaper.

Pros:

- Tax-free profits on US stocks with spread betting

- Low FX rate of 0.5%

- Signals, sentiment and news

Cons:

- High US Commission of £10 per trade ($0 if you trade more than three times per month)

- More suited to derivatives traders

Find out more about what we think and read our full expert IG review.

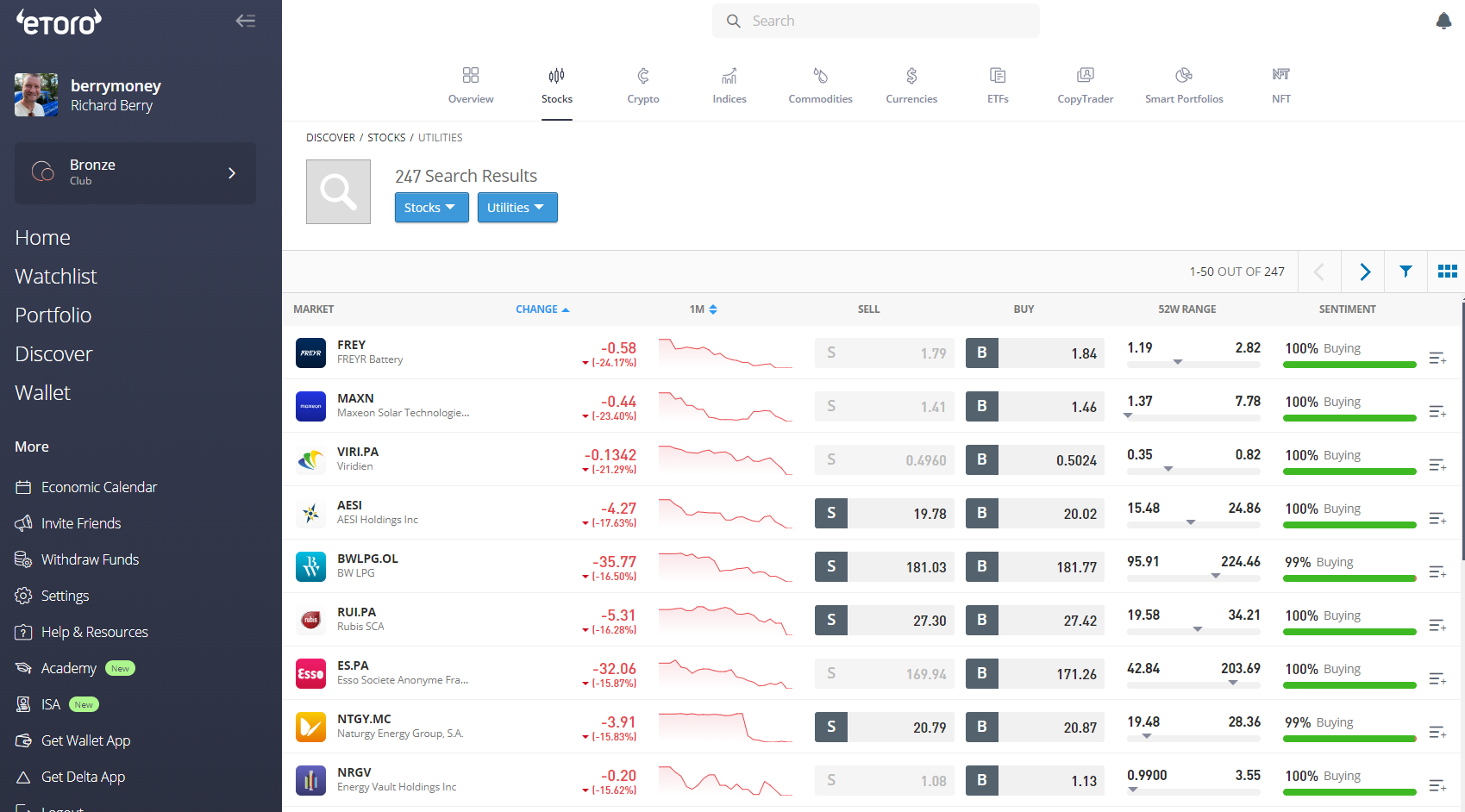

eToro: Easy-to-use US stock trading platform for beginners

- US commission: $0

- FX rate: 0% – 1.5%

- Account fee: $0

Capital at risk

I am really warming to eToro, particularly because I’ve been using it for my “investing $100 a day for 100 days” experiment. In the past, I’ve been very rude about how you can only deal in USD and how high the USD conversion fees and overnight financing rates are.

However, if you are buying US shares to invest in the long term, as opposed to trading in the short term, eToro is actually a very good option, especially if you open an eToro Money account as well.

With an eToro money account, your currency conversion rates are reduced to 0 (as opposed to 1.5%), but you still have to pay 1.5% to convert your USD back to GBP if you want to withdraw it.

But, mostly, investing is free on eToro, so we can’t begrudge them for making some money somehow!

For buying US stocks on eToro I also quite like their Discover section which lets you filter US stocks by exchange and sector. Which you can then rank by day, week and month with a nice mini chart for those who are interested in seeing which stocks are trending up or down.

For example, in the below screenshot, you can see NASDAQ Utility stocks ranked by negative performance over the last month.

Overall, if you predominantly investing in UK stocks there are better investing platforms, but for those that are just buying US stocks, eToro is a very good option.

Pros

- Zero commission

- Low exchange rates for eToro Money users

- Easy-to-use platform

Cons

- High exchange rates for withdrawals

- No SIPPs or ISA account

See what customers think of eToro on their review page.

Hargreaves Lansdown: Excellent US stock data and analysis

- US commission: £5.95 – $11.95

- FX rate: 1% – 0.25%

- Account fee: $0

Capital at risk

Even though HL has a repuation for being expensive, there are some things that they are actually pretty cheap for, and investing in the US is one of them.

If you are buying US stocks in a GIA, there are no account fees, and FX conversion costs are lower than Interactive Investor and eToro (but not AJ Bell).

Hargreaves Lansdown lets you buy US stocks and hold them in our Fund and Share, ISA or Self Invested Personal Pension (SIPP) account, where there is an account charge, of 0.45%, which is quite a lot, but it is capped at £45 a year.

So, for larger accounts, it is cheaper than Interactive Investor and other investing apps that charge a monthly fee for SIPPs like Freetrade.

Pros:

- Huge range of US investments

- Lots of account types

- Low US commission of £7.99

Cons:

- Higher FX rate of 1% – 0.25%

- Account fee can be high for funds

*There is no account charge for shares. Funds are charged at 0.45% for the first £250,000. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

AJ Bell: Easy and low cost US stock investing

- US commission: £3.50 – £5

- FX rate: 0.75% – 0.25%

- Account fee: 0.25% (max £3.50 per month)

Capital at risk

We rate AJ Bell very highly overall as an investing platform, but there are let down a little by their FX charges when you buy and sell US stocks. 0.75% is pretty high compared to newer investing apps, but it’s certainly not “expensive”.

Especially if you are buying over £20k worth of stock at a time when the FX rates drop to 0.25%.

AJ Bell offer online dealing in the main US and Canadian markets for shares that are available as CDIs which are securities representing an underlying interest in an overseas security and can be bought and sold easily in the UK.

Pros:

- Low US Commission of £5

- Low FX rate of 0.5% for deals over £10k

- Low account fee of 0.25%*

Cons:

- Slightly fewer US stocks and funds than other platforms

- High FX fee for smaller deals of 0.75%

*Share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 where there were 10 or more online share deals in the previous month

Interactive Investor: Wide range of US stocks to buy

- US commission: £3.99

- FX rate: 1.5% – 0.25%

- Account fee: £4.99 – £19.99 per month

Capital at risk

Interactive Investor offer one of the widest ranges of US stocks on the market and you can also hold your account in US Dollars to avoid FX fees on buys and sells.

However, it is a bit of a shame that their FX fees are so high. Being charge 1.5% for deals under £25k feels like you’re buying stocks last minute at the airport. Especially from a provider that is generally quite cheap.

Pros:

- Fixed US commission of £3.99

- Fixed account fee of £4.99 a month

- Wide range of US stocks to buy

Cons:

- FX rate can be high at 1.5% – 0.25%

*US stock dealing commissions are a free trade every month, then charged £3.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

⚠️ FCA Regulation

All US stock investing platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK investment accounts that offer access to US stocks are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature US stock buying accounts that are regulated by the FCA, where your funds are protected by the FSCS.

How to buy US stocks from the UK

US stocks are stocks that are traded on American stock exchanges such as the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. Stocks, or ‘shares’ as they are often called, are investments that represent ownership in a company. When you buy a stock, you become a part-owner of the underlying business and are entitled to a share of its profits.

US stocks tend to be popular with UK investors due to the fact that the US stock market is home to some of the world’s most dominant companies, including the likes of Apple, Amazon, and Microsoft. And investing in US stocks can be a good way to diversify an investment portfolio geographically.

- Further reading: See our guide to buying Amazon shares from the UK

In the past, it was quite costly for UK investors to buy US stocks. However, thanks to advances in financial technology over the last few decades, the costs associated with buying US shares have come right down.

The main things to consider when buying US stocks from the UK are:

- Dealing costs – how much does it cost to buy and sell stocks?

- Account charge – how much does it cost to hold US stocks in the investment account

- FX rate – how much does it cost to convert GBP into USD to buy US stocks

- Account types – can you buy US stocks in a GIA, SIPP or ISA

- Derivatives – can you go short US stocks or can you just buy them

Related Guide: Best Investment Apps For US Shares

Advantages of buying US stocks

The benefits of buying US stocks include:

- Geographic diversification. The composition of the US stock market is very different to that of the UK stock market. For example, while the largest companies in the UK are Shell, HSBC, and AstraZeneca, the largest companies in the US are Apple, Microsoft, and Alphabet (Google). This means that the two markets do not move in lockstep. As a result, owning stocks in both markets can reduce overall portfolio risk.

- Higher returns. Over the long run, the US stock market has generated higher returns than the UK stock market. For example, over the last five years, the UK’s FTSE 100 index has risen about 10% in price terms while the US’s S&P 500 index has risen nearly 85% (as 17th June 2024). The FTSE 100 has traditionally had a much higher dividend yield than the S&P 500 over that period; however, even when dividends are factored in, the return from US stocks is far higher than the return from UK stocks.

- World-class companies. Many of the world’s most dominant companies are listed in the US. Examples of highly dominant companies listed in the US include Apple, Microsoft, and Alphabet.

- Innovative markets. The US stock market is home to many innovative companies including large-cap tech companies such as Apple, Alphabet, Amazon, Tesla, and Nvidia, and smaller players such as Roblox, Coinbase, and Teladoc Health. These companies are all enjoying strong growth as the world becomes more digital.

Disadvantages of buying US stocks

The disadvantages of buying US stocks include:

- Foreign exchange (FX) fees. Most brokers charge FX fees to buy US stocks. Hargreaves Lansdown, for example, charges 1.0% per trade for trades under £5,000, on top of regular trading fees. These FX fees can add up.

- Foreign exchange risk. This is the risk that a change in the GBP/USD exchange rate could impact the value of your investment. If you buy US stocks and the British pound strengthens against the US dollar, your investment is going to lose value in sterling terms. For example, let’s say you bought one share in Amazon for $3,000 when the GBP/USD exchange rate was 1.30. Ignoring trading commissions and FX fees, this would have cost you approximately £2,308. Now let’s say Amazon’s share price remains at $3,000 but the GBP/USD FX rate rises to 1.40. As a result of this move in the exchange rate, your Amazon position would be worth approximately £2,143 in GBP terms.

- Higher volatility. US stocks can be highly volatile at times. Technology stocks, in particular, can see their share prices fluctuate wildly. Amazon stock, for example, has regularly had pullbacks of 20% or more in the past.

- W-8BEN forms. To buy US stocks in the UK, you usually have to complete a W-8BEN form for your broker. This is a one-page form that requires you to fill in some personal details. Most brokers won’t let you trade US stocks until you have completed this form. Once you have completed a W-8BEN, only 15% tax is deducted from the dividends you receive from your US stocks, rather than the standard 30% withholding tax.

- Capital Gains Tax. As with UK stocks, gains from US stocks are subject to Capital Gains Tax (CGT) in the UK. However, you can minimise CGT by buying US stocks in a tax-efficient account such as a Stocks & Shares ISA.

Which brokers have the best exchange rates for buying US stocks?

Interactive Brokers has the best FX exchange rates for buying stocks in the US as IBKR only charges 0.02% and you have complete control over when you do the conversion.

FX fees are one of the biggest hidden fees when buying US shares from the UK. When you buy US stocks you need to convert GBP into USD and the cost of doing so varies dramatically from broker to broker and can seriously eat into your investment returns.

See below for the cheapest FX rates for buying US stocks:

- 0.02%: Interacitve Brokers

- 0.25%: Saxo

- 0.5%: IG

- 0.75%: AJ Bell

- 1%: Hargreaves Lansdown

- 1.5%: eToro

- 1.5%: Interactive Investor

We’ve ranked providers by how much it costs to convert under £10,000 into USD, which reflects a typical deal size.

Different ways to buy US stocks

There are several different ways of investing in US stocks from the UK including:

- Buying regular shares. This is one of the most straightforward ways of investing in US stocks. The advantage of this approach is that you are the direct owner of the stocks you buy. The disadvantage is that you need to pay the full value of the trade upfront. You also need to pay trading fees.

- Investment funds. Through platforms such as Hargreaves Lansdown and AJ Bell , it’s possible to invest in funds that are focused purely on the US stock market. Examples include the Baillie Gifford American fund, which is an actively-managed fund (meaning it’s managed by a portfolio manager who picks individual stocks), and the Legal & General US Index, which is a passive fund that tracks the performance of the FTSE USA Index. The main advantage of funds is that they provide a high level of diversification. On the downside, they can be relatively expensive. Actively-managed funds, for example, can have annual fees of more than 1% per year.

- Exchange-traded funds (ETFs). ETFs are passive funds designed to track the performance of specific stock market indexes or assets. They are traded on the stock market in the same way that regular stocks are. Examples of US stock-focused ETFs include the iShares Core S&P 500 ETF (ticker: IVV), which tracks the performance of the S&P 500 Index, and the iShares NASDAQ 100 UCITS ETF (ticker: CNDX), which tracks the performance of the 100 largest companies on the Nasdaq Stock Market. The advantage of ETFs is that they offer diversification and tend to have low annual costs. A disadvantage of ETFs is that you have to pay trading fees to buy and sell them.

- Contracts for Difference (CFDs). CFDs are financial instruments that enable you to profit from a stock’s price movements without actually owning the underlying stock. With CFDs, you can trade in both directions, and also use leverage to increase the size of your trade. The advantage of trading CFDs is that, using leverage, you can potentially invest more money than you have in your account. This can potentially increase your profits. On the downside, losses are magnified if you use leverage, meaning it’s possible to lose a lot of money.

- Spread betting. Spread betting is a form of trading that enables you to profit from a security’s price movements without actually owning the underlying security. As with CFDs, you can trade in both directions and also use leverage to increase your exposure. The advantage of spread betting is that you can use leverage to invest more money than you have in your account. Profits are also exempt from Capital Gains Tax. On the downside, leverage can result in heavy losses if your trade doesn’t go to plan.

- Fractional shares. Fractional shares allow you to buy a fraction of one share. This can be useful if you wish to buy shares in a company that has a very high share price, such as Amazon. At the time of writing, its share price is over $3,000. With fractional shares, you could potentially buy half a share or a quarter of a share if you didn’t have the capital to buy one share. At present, there are only a few companies in the UK that offer fractional shares.

Costs of buying US stocks

There are several costs associated with buying US stocks.

The three main costs to be aware of are:

- Trading commissions. These are the fees you will pay to make a trade, and they vary from broker to broker. Full-service brokers such as Hargreaves Lansdown, for example, tend to charge around £8 to £12 per trade. However, some of the newer investment platforms, such as IBKR and IG, offer zero-commission trading.

- Foreign exchange fees. When you buy US stocks in the UK, you usually need to pay foreign exchange (FX) fees on top of trading commissions. These fees vary from broker to broker. For example, Hargreaves Lansdown, and Interactive Investor charge FX fees of 0.45%, 1.0%, and 1.5% respectively, for US stock purchases under £5,000. Some brokers, including Hargreaves Lansdown and Interactive Investor, offer lower FX fees for larger trades.

- Platform fees. Most investment platforms in the UK charge an annual account fee. This varies from provider to provider, and also varies depending on the type of investment account you have (i.e. regular share dealing account vs a Stocks & Shares ISA). Some providers, however, offer basic share dealing accounts that have no annual fees. Providers that offer basic accounts with no fees include IG and Hargreaves Lansdown. Another fee to be aware of is withdrawal fees.

It’s worth pointing out that while a commission-free investment platform may seem like the cheapest way to buy US stocks from the UK, it may not necessarily be the case. That’s because zero-commission brokers often charge significant FX fees and sometimes have withdrawal fees. Furthermore, zero-commission brokers don’t always offer the best prices for US stocks. Ultimately, you need to consider all fees if you’re planning to buy US stocks.

Which brokers have the best exchange rates for buying US stocks?

Interactive Brokers has the best currency conversion rates for buying US stocks. IBKR charges 0.02%, which is significantly lower than the second cheapest (Saxo at 0.25%). There are some brokers that offer 0% USD conversions like eToro when you buy US shares, but that is only if you have an eToro account, and you are still charged 1.5% when you convert USD back into GBP (which actually make eToro one of the most expensive).

Interactive Brokers also gives you the flexibility to convert GBP to USD whenever you like as opposed to the other brokers on this list wich do it automatically when you trade.

Traditional investment platforms like Hargreaves Lansdown, AJ Bell and Interactive Investors are very expensive for converting GBP to USD, and they also charge commissions on top of exchange rate spreads. They only become cheap when you are dealing in very large amounts.

IG is a fairly cheap option, but there is still a high minimum commission when you trade; it only becomes cost-effective when you deal more than three times a month when the commission is reduced to zero.

US Stock Buying FAQs:

- The main US markets are open from 9:30am Eastern Standard Time (EST).

The main US markets close at 4pm EST.

Yes. Most stocks and shares ISA accounts, including Hargreaves Lansdown, AJ Bell, and Interactive Investor, allow you to hold US stocks in an ISA.

Yes. Most SIPP providers, including the likes of Hargreaves Lansdown, Interactive Investor, and AJ Bell, allow you to hold US stocks in a SIPP.

Yes. With some brokers, such as IG and Interactive Brokers, it’s possible to trade US stocks outside of normal US trading hours. This is known as ‘extended-hours trading’ and it takes place between 4pm EST and 8pm EST.

It’s worth noting that trading volumes during extended-hours trading tend to be significantly lower than they are during normal trading, so shares prices can be very volatile. Share price volatility can be particularly high after a company releases its quarterly results.

Yes, it’s easy to buy US stocks from the UK today. To buy US stocks, you will need to have an account with a stock broker or investment platform.

A W8-BEN form is a form that UK brokers usually require you to complete before you can trade US stocks. It is a one-page form that requires you to fill in your personal details.

W-8BEN forms are valid for three years. Once you have completed the form, withholding tax on dividend payments from US stocks is reduced from 30% to 15%.

On the New York Stock Exchange and the Nasdaq Stock Market, there are around 5,500 stocks in total.

The two major US stock exchanges are the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. Together, these two exchanges account for the bulk of stock trading in North America.

The New York Stock Exchange, which is the oldest exchange in the US, is the largest equities-based stock exchange in the world, based on the total market capitalisation of its listed securities. This exchange is owned by Intercontinental Exchange, and based in New York City.

At present, there are over 2,400 companies listed on the New York Stock Exchange across sectors such as financial services, healthcare, consumer goods, technology, and energy. Some of its more famous companies include Berkshire Hathaway, JP Morgan, Visa, Walt Disney, and Johnson & Johnson.

The Nasdaq, which is also based in New York City, is the second largest exchange in the world behind the NYSE. Created by the National Association of Securities Dealers (NASD) in 1971, it was the world’s first electronic stock market.

Compared to the NYSE, the Nasdaq has more of a technology focus. Companies that are listed on this exchange include Apple, Microsoft, Alphabet (Google), Amazon, and Meta Platforms (formerly known as Facebook).

The best US stocks to buy will depend on your own goals, circumstances, and risk tolerance, but the most popular US stocks to buy are:

Some of the most popular US stocks among UK investors include:

- Apple (NASDAQ: AAPL). Apple is a multinational technology company that specialises in consumer electronics such as smartphones, personal computers, tablets, and wearables.

- Tesla (NASDAQ: TSLA). Tesla is an American electric vehicle and clean energy company that is very popular with growth investors.

- Amazon (NASDAQ: AMZN). Amazon is the largest e-commerce company in the world as well as the biggest player in the cloud computing space.

- Microsoft (NASDAQ: MSFT). Microsoft is a technology company that operates in a number of industries including business productivity software, cloud computing, and video gaming.

- Meta Platforms (NASDAQ: FB). Meta is the owner of Facebook and Instagram.

US dividend stocks that are popular with UK investors include:

- Coca-Cola (NYSE: KO). Coca-Cola is a multinational beverage company that owns a range of brands including Coke, Fanta, and Sprite.

- PepsiCo (NASDAQ: PEP). PepsiCo is a multinational food, snack, and beverage company that owns a range of brands including Pepsi and Doritos.

- McDonald’s (NYSE: MCD). McDonald’s is the largest restaurant chain in the world by revenue.

- Johnson & Johnson (NYSE: JNJ). Johnson & Johnson is a multinational company that develops medical devices, pharmaceuticals, and consumer packaged goods.

- Pfizer (NYSE: PFE). Pfizer is a pharmaceutical and biotechnology company that develops and produces medicines and vaccines for immunology, oncology, cardiology, endocrinology, and neurology.

At the time of writing (Feb 21), the five largest US stocks by market capitalisation were:

- Apple (NASDAQ: AAPL). Market cap – $2.7 trillion

- Microsoft (NASDAQ: MSFT). Market cap – $2.2 trillion

- Alphabet (NASDAQ: GOOG). Market cap – $1.7 trillion

- Amazon (NASDAQ: AMZN). Market cap – $1.5 trillion

- Tesla (NASDAQ: TSLA). Market cap – $886 million

Over the last five years, the best performing US stocks (out of those with a market capitalisation of at least $50 billion) have been:

- Tesla (NASDAQ: TSLA). 5-year share price return – 1,400%

- Atlassian (NASDAQ: TEAM). 5-year share price return – 905%

- Shopify (NYSE: SHOP). 5-year share price return – 885%

- Nvidia (NASDAQ: NVDA). 5-year share price return – 745%

- Advanced Micro Devices (NASDAQ: AMD). 5-year share price return – 710%

Past performance is not an indicator of future performance.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the US stock investing platforms via a non-affiliate link, you can view the product pages directly here: