- Richard Berry

Trading the Hang Seng Index is speculating on the benchmark stock market index of Hong Kong. The index has 50 constituents, including a host of HK-based companies and Chinese firms. The index is maintained by Hang Seng Indexes Company, a private company owned by the Hang Seng bank.

Started in 1969, the index has a long and interesting history. Manias, bubbles, and severe corrections are some of the hallmarks of the index. In 2008, for example, the index lost almost two-thirds of its value.

Currently, some of the biggest companies in the world are included in this index, including HSBC, Tencent, and AIA. The recent listing of Alibaba could see its inclusion into the index soon.

How do you trade the Hang Seng Index?

There are multiple financial products derived from the underlying Hang Seng Index that you can trade with, including:

- Index Futures (HKEX) – Compare futures brokers

- Index Options (HKEX) – Compare options trading platforms

- Exchange-Traded Funds – Compare ETF investing platforms

- Spread trading – Compare spread betting brokers

- CFDs – Compare CFD trading platforms

The biggest ETF based on the HS Index is the HSI ETF (ticker: 2833 HK). This ETF is gaining popularity because of the ease of trading, unlike futures or options where there are rollover costs and expiry dates. The currency of trade is the Hong Kong Dollar (HKD).

On index futures, they usually expire on March, June, September, and December.

- Related guide: Here’s everything you need to know about index trading.

Best brokers for trading the Hang Seng

Below are a selection of the best trading platforms that offer access to the Hang Seng index:

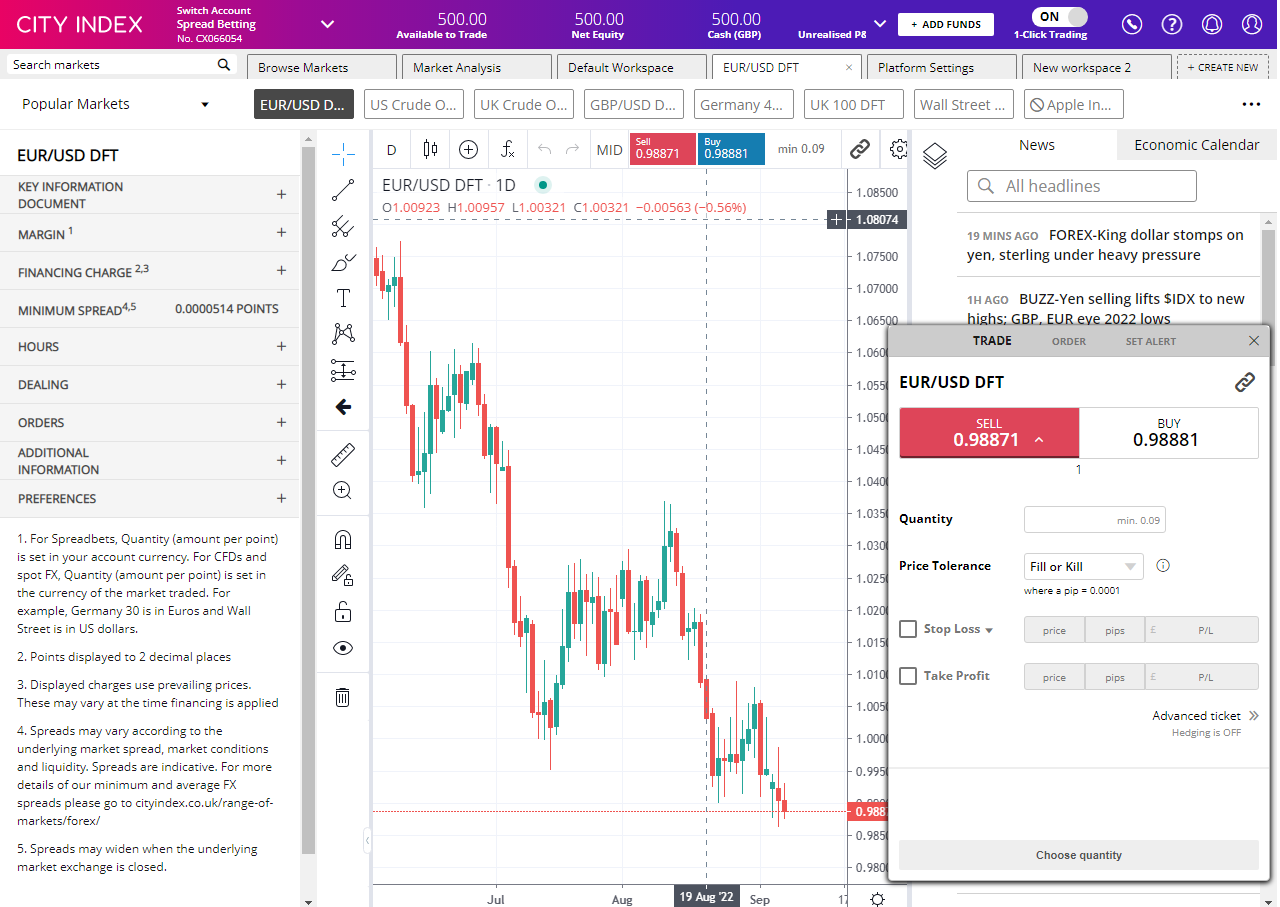

City Index

Types of Hang Seng trading: CFDs, spread betting

City Index Gives Traders A Huge Range Of Added Value & Markets

Provider: City Index

Verdict: City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders. City Index is also one of the oldest spread betting and CFD brokers based in the UK founded in 1983 and offer trading in over 13,500 financial markets, to around 126,000 active clients. City Index is currently owned by StoneX, a US brokerage listed on the NASDAQ valued at over $4bn.

71% of retail investor accounts lose money when trading CFDs with this provider

Is City Index a good broker?

I really like City Index and have used them for years. They offer some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

A big plus for me is that they are one of the oldest and most established trading platforms offering CFDs and financial spread betting, with a huge range of markets to trade, post execution analytical tools and trading signals.

Some of the best trader tools around

I opened my first City Index account way back in 2008, when they were one of only a handful of spread betting firms catering to high net worth traders in the City of London. Back then when I was a derivatives broker at MF Global, City Index used to hedge their CFD business through us so I could see they always had a fairly sophisticated client base. But over the years, as traders and investors have become more educated and akin to taking more risk, City Index now takes on more and more private clients.

If you’re thinking about trading with City Index, but haven’t quite made up your mind yet, I’ve tested all their trading platform’s features, visited their offices and interviewed their senior management for my review to hopefully provide enough information for you to decide if they are the right broker for you.I’ve always liked City Index, it’s been a stalwart of the London CFD broker scene since it was founded by Chris Hales and Jonathan Sparke in 1983 as a way for institutions to hedge their exposure through spread betting and CFDs. But soon became popular with more retail traders. Always advertising on billboards in the City, always having a colourful client base, always being bought and sold at the whim of billionaires and bigger boys. But in recent years, it had gone off a bit from its glory days. Back in the good ol’ days, you could open an account and put on a million-dollar trade over the phone with no ID, no deposit, and no idea. Well, you could if you happened to be on a yacht with Michael Spencer (the then City Index owner and City grandee), who was convinced he knew which way the Euro was headed and goaded one of his guests into putting the trade on, as the story goes away.

But those days are long gone and incumbent brokers have to fight hard to differentiate themselves against the fintechs nipping at their heels, as well as provide more trader tools to lure new customers back to traditional markets away from the wild west of Crypto.

City Index seems to have matured nicely though, it’s grown out of its lumbering adolescence under the ownership of Gain Capital and is now owned by US Behemoth StoneX (previously INTL FCStone). Since then, the platform has had a few upgrades and long-term investment products will hopefully be added shortly.

City Index Awards

In our latest awards City Index won “best trading app” in 2024 and “best trader tools” 2023. City Index has in previous years won “best trading platform”, “best trading app” & “best forex broker” in 2022.

Giles Watts, Senior VP of UK & EU at City Index said after winning best trader tools in 2023: “We are delighted to have been recognized for the added value we provide our clients. Delivering actionable post trade insights direct to the platform, is just one of the reasons our clients stay with us over the long term.”

Trading Platform

The City Index platform used to have a slightly off-the-rack feel about it, instead, the business relied on word of mouth and friendly referrals from HNW clients who would use experienced dealers to work large orders over the phone. Whilst voice brokerage still forms part of City Index’s offering, they are, as with everyone else, doing the majority of their business online and working hard to make their platform stand out.

Pricing & Spreads

City Index has always been competitive with it’s pricing. As City Index is an OTC broker they charge customers by widening the spread rather than adding commission after you trade. They are one of the cheapest around for trading UK stocks with the bid/offer being widened by only 0.08% (20% less than the industry standard of 0.1%) and for US stocks they only charge 1.8 cents per share (industry standard is 2 cents per share). Overnight financing rates are also inline with what you would expect 2.5% over/under SONIA rates.

Stocks, Forex, Indices and Commodities

You can buy over 13,500 stocks on City Index as a CFD or financial spread bet, however, you can’t trade equity options or invest in physical shares.

Obviously, they have access to more than the usual forex, index and commodity markets and add value with some nice thematic-themed indices (like ESG), and a good pool of sectors to speculate on. You can also trade options (CFD or spread bets thereof) on a good range of indices and commodities like Natural Gas or EU stocks. Plus, you can trade on synthetic markets. Everyone loves a bit of volatility speculation in choppy markets.

Spread Betting

Spread betting is City Index’s forte, and it’s the product that a lot of their high-net-worth customers use for trading stocks. As one of the original spread betting brokers City Index offers access to one of the widest selections of UK, US and European shares (as well as the major indices). The key advantage of spread betting of course is that profits are free of capital gains tax.

CFD Trading

Unlike spread betting CFD profits are subject to capital gains tax, so are less popular among UK traders. Historically, City Index would offer CFDs to more professional traders and spread betting to smaller clients. CFDs and spread betting are similarly priced with City Index, with the commission being included in the spread, which is slightly wider than the underlying market bid/offer. The main reason why both products are on offer is that spread betting is only available to UK residents, whereas City Index can offer CFD trading to its global client base.

Trading App

I actually prefer the City Index app to the desktop version of the trading platform. Sometimes I can find the desktop version to be a bit clunky, but the app is really slick, and clearly in our mobile-first world, where all the recent development has been focused. And why not, the desktop trading platform is brilliant for research, trading signals and post-trade analytics, but at the point of execution the app is a quick and simple stripped-down version with all the salient features front and centre.

MT4 (MetaQuotes)

You can trade on MT4 and MT5 with City Index, but functionality and market access is not as good as their main proprietary trading platform or some of their MT4 competitors. You can only trade around 84 markets on MT4 through City Index, but if you just want to trade the major markets, City Index is a good broker for MT4 based on their regulation, service and pricing.

Performance Analytics

Another acquisition from parent StoneX is Chasing Returns, now integrated into the platform as Performance Analytics. Which really drills down into where you are trading well and where you are losing money. Performance Analytics can break down your wins and losses and tell you what markets you trade best, what time of day you are most profitable, if you make money trading in quick succession or, if you do better if you take a break between trades. It’ll even tell you if your first trade of the day is often a winner or loser, or if you are a better bull or bear and also if you are as good at trading volatility as you pretend to enjoy doing, but letting you know if you trade better in calm or erratic markets.

Economic Calendar

One thing, though that does let them down is City Index’s economic calendar, it’s terrible. In fact, most brokers, even IG just have a bog standard list of upcoming earnings and economic announcements. But I think you need more from a trading platform these days, especially as when logged into the desktop platform the format is all off. One broker that has absolutely nailed their economic calendar is ThinkMarkets. With TM when you’re logged in you get a really good visualisation of previous data, volatility and most importantly what impact it had on relevant institutions like EURUSD. It’s a great way to see how markets have moved against previous numbers. Honestly, City Index should embed this too as it’s available from Trading Central who they have a deal with anyway.

Extended Hours Trading

You can trade CFDs premarket and after the market closes on a range of US equities in the pre and post-market sessions which bookend regular share trading in New York that takes place between 9.30 a.m. and 4.00 p.m. Eastern time.

The list of 73 stocks available to trade in the pre and post-markets includes leading US shares such as Apple, Microsoft and Nvidia. Widely traded names such as the Ark Innovation ETF, Coinbase, Robinhood and Gamestop.

As well as established blue chips like Bank of America, Boeing, Procter and Gamble, and Walmart, alongside a selection of index-tracking and thematic ETFs.

Verdict, overall, a great all-round platform that is backed by one of the largest financial institutions in the world.

Pricing: Always competitive, especially for major markets.

Market Access: Excellent coverage, especially for small-cap stock and exotic currency pairs.

Platform & Apps: Some excellent added value trading signals and portfolio analytics (even though the desktop version can be a bit fiddly).

Customer Service: Lots of experienced dealers to help with any issues, who you can get through to on the phone.

Research & Analysis: City Index excels here, lots of educational guides, trading ideas and analysis, to keep traders aware of major market moves.

Pros

- Excellent trading tools

- Post-trade analytics

- Publicly listed (part of StoneX)

Cons

- Trading only, no investment account

- Limited options markets

- No direct market access

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.8Capital.com

Types of Hang Seng trading: CFDs, spread betting

Capital.com Voted Best Trading Account In 2025

Provider: Capital.com

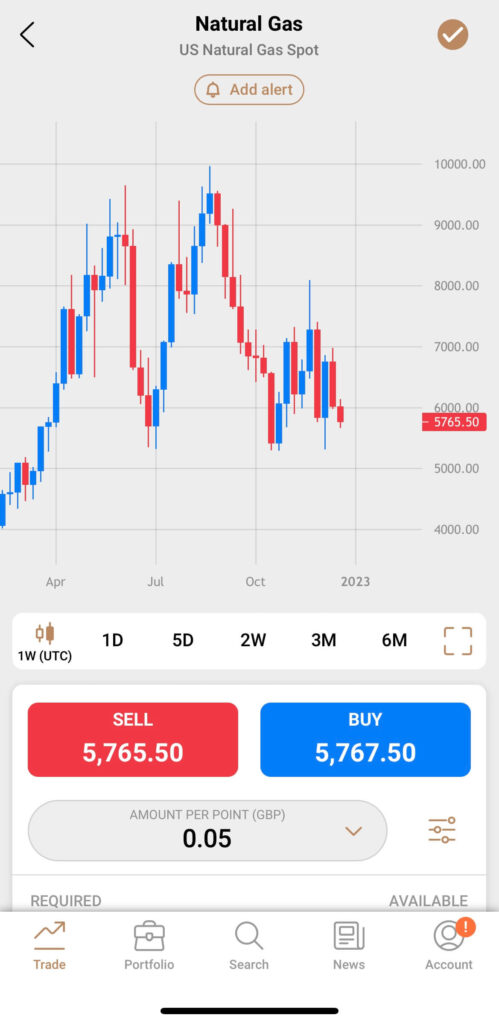

Verdict: Capital.com won the People’s Choice vote for “Best Trading Account” in the 2025 Good Money Guide Awards and “Best Trading App” in our 2023 awards as they have one of the most intuitive apps for trading the most popular markets globally. Capital.com was founded in 2016 and is a CFD trading platform broker with offices in the UK and around the world. Since then, they have grown to offer over 3,000 tradable assets to 100,000 monthly active clients.

85.24% of retail investor accounts lose money when trading CFDs with this provider. CFDs trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

Is Capital.com any good for trading?

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been capital.com’s forte, and in 202, it won our award for “best trading app” not in part due to the fact that the company CTO has extensive experience in building engaging apps like Candy Crush.

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been capital.com’s forte, and in 202, it won our award for “best trading app” not in part due to the fact that the company CTO has extensive experience in building engaging apps like Candy Crush.

What makes Capital.com different? Thumbs up, literally

Do you know what one of the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app.

I don’t mean that in a facetious way, it’s genuinely a brilliant feature.

This may not sound like much but it’s a good example of how Capital.com has integrated decades of analytics, experience, feedback and customer data into creating a very easy-to-use intuitive trading app from scratch.

When Capital.com first became authorised by the FCA back in 2018, I visited their offices in London to have a chat about what they offer. The two main things we discussed were button placement and AI.

Trading App

But anyway, if you’ve updated your iPhone to the latest iOS you’ll notice that Apple has started moving things to the bottom of the screen, the search bar for instance. This is because, phones are getting bigger, and your thumb can’t reach the top of the screen if you are holding it with one hand. This is something that Capital.com figured out would make trading easier 5 years ago. I’ve just been through a bunch of other trading apps on my phone and still, amazingly enough, none of the other brokers have done this yet.

Capital.com was also the first to integrate artificial intelligence to help you improve your trading, they say, based on the Martingale theory. When I spoke to Chris Demetriou, the head of sales in the UK, he said that the system should give you prompts based on your previous trades. So for example, if you are about to do a trade that is similar to ones you have constantly lost on before, you should get a “are you sure you want to do this” notification.

Leverage Control

Everybody knows, that one of the main reasons people lose money when trading is overleverage. This could be either from not having enough free cash on account to give your position breathing space, or simply putting on trades that are too risky. One really good feature is that you can change your leverage based on asset class. The default leverage is the max that retail traders in the UK are permitted, but you can change this to 1:1 so you need to fully pay up for positions. A sensible thing to do if you are just getting started, which can help reduce excessive losses. As your experience grows you can increase your leverage accordingly.

Hedging

You can also set the platform to put on hedging positions, so you can be long and short the same thing at the same time. Why you ask? Well, it can help you run longer-term positions and short-term hedges. This in fact is the very point of CFDs. They were originally hedging tools, and still a good way to protect your long-term investment portfolio against short-term market corrections without having to close off your positions.

Customer Support

Customer support is pretty good too, you can get in touch via the chat widget on the platform, whatsapp or telegram. When I tested it I got a response within a minute and the issue I had was dealt with quickly (uploading ID to verify my account if you must know).

TradingView

You can’t trade from the charts, but when you have open positions they are overlayed along with your stops and limits, which you can move by dragging and dropping. But, if charting is your thing, you can join the other 78,000 Capital.com customers using and trading from TradingView.

Proprietory Tech

One thing I quite like though is that instead of relying on third-party software, the Capital.com trading platform is built in-house, and if you want something you can ask for it. For example, previously on the app you could see where an asset is as a percentage relative to the daily range. But, a customer asked, if you could see it in points too. So, that was quickly integrated so that you can now toggle between percentages and points. A small thing, but indicative of a broker that can do things and does do things, rather than just logging a helpdesk ticket.

Refinitiv

There are no trading signals on the platform or app, but you do get access to Refinitiv reports on US stocks, which give you a good overview of historic and potential future financial health. A good feature for those looking at slightly longer-term positions.

Overnight funding

Talking of long positions, or longer long positions, Capital.com also display quite clearly what your overnight financing rates are going to be on a daily basis. I’m sure this is a regulatory obligation anyway, but it’s done in a way that you can actually see what the price is, rather than an opaque formula. It gives a bit more transparency about how much a position is going to cost you.

Investmate

If you are new to trading, they have a stand-alone app called Investmate, which puts you through a series of bitesize courses that explain the financial markets. Capital.com also own currency.com if you fancy a punt on crypto, and shares.com so we can expect to see more comprehensive physical investing options soon.

Pros

- Innovative and intuitive app

- Set your own leverage

- Proprietary technology

Cons

- Trading only

- No options markets

-

Pricing & Spreads

(4.5)

-

Market Access

(4)

-

Apps & Trading Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

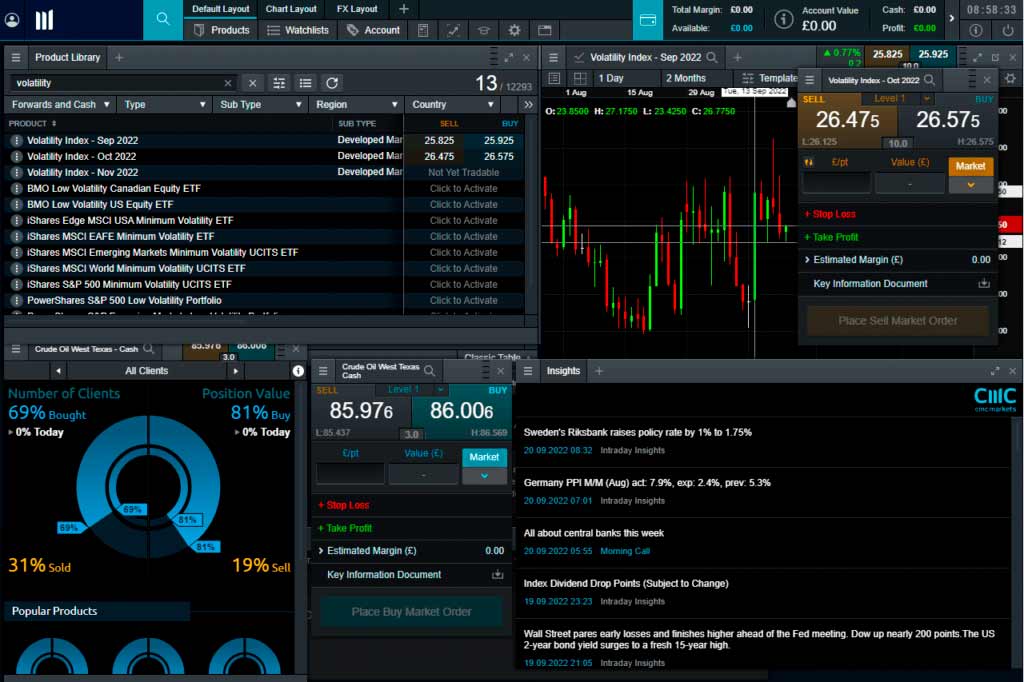

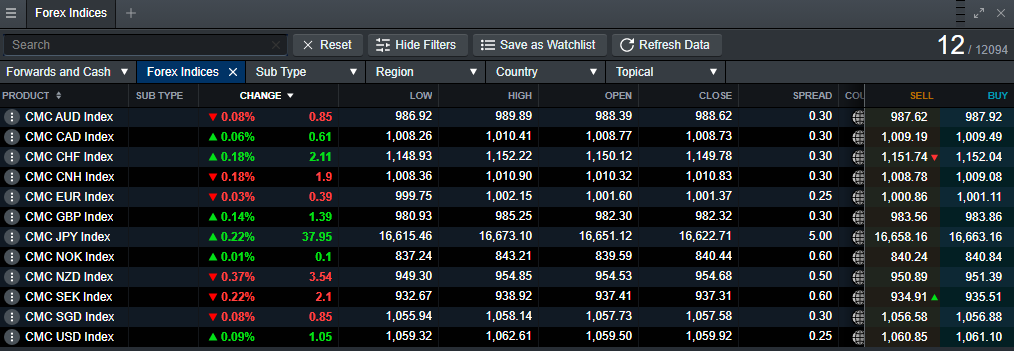

4.5CMC Markets

Types of Hang Seng trading: CFDs, spread betting

CMC Markets Offers Great Tech for Active Traders

Provider: CMC Markets

Verdict: CMC Markets is one of the best and fastest trading platforms available for active traders to speculate on the most popular markets. The company is one of the original spread betting and CFD brokers based in the UK. It’s been providing forex trading services since 1989 and is now listed on the London Stock Exchange. The broker has over 300,000 active clients trading online and is operated from 13 global offices, with headquarters in the City of London.

70% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets a Good Broker?

Yes, CMC Markets has always offered, and still offers, one of the best trading platforms for high-frequency and active traders. It’s a good choice for those who want to trade on tight spreads, with a platform built on exceptional tech.

I’ve used CMC Markets for 20 years now and it’s typically been my go-to broker for trading forex and equity sectors.

I recently gave it another full test with real money and live trades. I’ve also interviewed its founder and its head of product. In this review, I share my views on what CMC Markets is good at, where it needs to improve and which types of trader it suits.

Almost 20 years ago, when I first had my account, I remember sitting in CMC’s reception, eager to pick up a CD-ROM of the Market Maker trading platform so I could trade personal account when I was a stockbroker at Phillip Securities.

I used to flit between using IG and CMC Markets back then. IG had a few more markets, but the platform was a bit basic. CMC Markets had tighter pricing and because the platform had a dark background, and more flashing lights you felt like a real pro. Despite the fact that CMC’s heritage is in the FX markets, I could never really get the hang of those so I’d trade indices, and FTSE 100 shares (also, CMC only really did the main market stuff back then).

I could have waited for CMC to post me a disc, but I had a real itch to try it out. It was an excellent trading platform then, and it still is today.

What Does the Platform Look Like?

History Of CMC

The current CEO, Peter Cruddas, set up CMC as Currency Management Corporation in 1989 after leaving Western Union, where he learned how the foreign exchange markets worked, in particular the market-making side of the business. Originally offering forex trading, then financial spread betting and moving into CFD broking in 2000, CMC began to expand internationally in 2002. CMC Markets was listed on the London Stock Exchange in 2016.

CMC Markets, which is now a member of the FTSE 250 index, has over 310,000 active clients globally, and in the 2023-24 financial year generated a net operating income of £332.8 million.

When I visited the CMC offices a few years ago, the brokerage world was switching from voice to online. CMC was one of the first forex brokers to invest heavily in technology and has always led the way in online trading platform innovation.

CMC Markets: Spread Betting & CFDs

CMC Markets only offers CFD trading, rolling spot forex and spread betting in the UK. These are generally short-term speculative products. You can invest in the long term and buy physical shares through CMC Invest in the UK (although in Australia CMC Markets does offer stockbroking).

If you don’t know what these are you shouldn’t be trading them. But if you do and you want to trade them, CMC Markets is in my view one of the best places to do so. In 2024, the platform came up with a nice tagline…

Calling all calculated risk takers…

This is the essence of trading, really. Yes, trading is risky, but it’s a calculated risk. And one way to reduce risk is to go with a well-established and well-capitalised provider. CMC Markets is a public company so you can see how well it’s doing as a business. Trading is hard enough without having to worry if your broker is going to go bust. In the UK, retail client money is held in segregated client bank accounts, in a regulated bank.

CMCX Share Price

The current CMC Markets (LON:CMCX) share price is 252p which is a change of -1.5 or 0.59% from the last closing price of 253.5 with 233,945 shares traded giving CMC Markets a market capitalisation of £705,134,808. The most recent daily high has been 261.5 and daily low 250. The CMC Markets share price 52 week high has been 349 and the 52 week low 183.4. Based on the most recent CMC Markets share price opening of 252, the current CMC Markets EPS (earnings per share) are 0.23 and the PE (price earnings ratio) is 11.15. Pricing data automatically updates every 15 minutes, last updated: 16:35 30-Jun-2025.

Although you’re out of luck if you want to trade CMC shares on CMC, I tried when I was demonstrating how to do a pairs trade against its main rival IG. I had to trade CMC on IG and IG on CMC.

Market Range

CMC Markets definitely has one of the best market ranges of all brokers. Although it doesn’t offer all shares – around 12,000 assets vs IG’s 17,000 or Interactive Brokers’ epic coverage – it has some really great markets that are exclusive to CMC. I’ve always used it for trading the most popular shares, and I would say it’s aimed at active traders more than its rivals. You only really miss out on smaller cap stocks that aren’t appropriate for margin trading anyway, as they are growth investments.

CMC Markets Sector Bets & Diversification

One of the things that I’ve always liked about CMC is its approach to diversification. Everyone knows that you shouldn’t put all your eggs in one basket when it comes to investing, and the same is true of trading. You’ve got a better chance of beating the market consistently if you spread your risk across different asset classes and don’t go crazy Rio trading.

I find forex trading incredibly difficult. I’ve never been able to make any money at it because I can’t judge forex price action – I find it too fast-paced. What I like to speculate on is the overvaluation or undervaluation of one currency against another.

CMC has a market called weighted currency indices, which basket together one currency against many others. So you can trade how you think USD is going to perform against the EUR, GBP, AUD, CAD, CHF, CNH, JPY and SGD in one go. So instead of an outright punt, you are taking on a dollar position rather than a USD-GBP trade.

What Does the Forex Section Look Like?

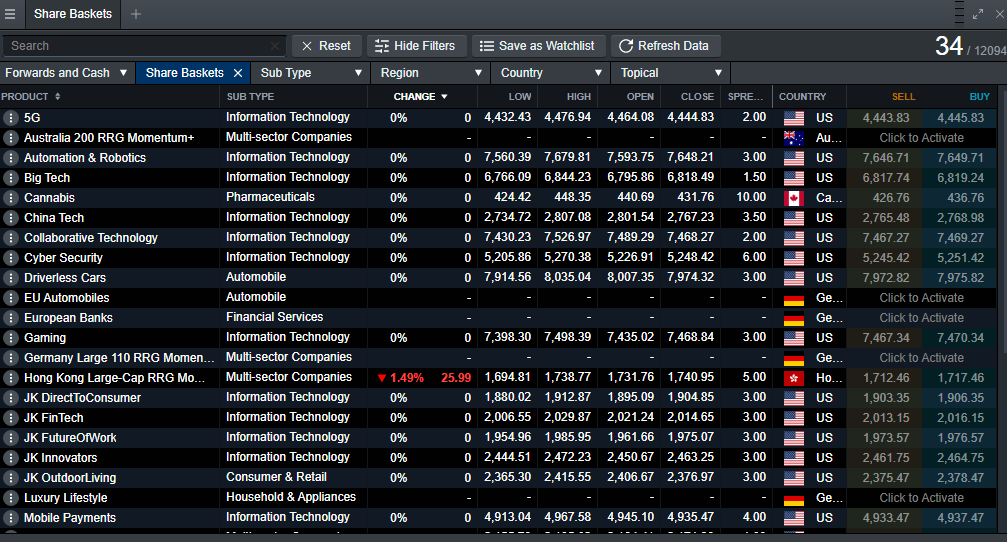

Share Baskets

CMC Markets has always enabled sector bets, but it has fine-tuned these over the years because of the proliferation of ETFs into share baskets, like US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology. This is great, because I really like trading stocks. I find this quite easy compared to forex as stocks are based on fundamentals I understand.

One trading strategy that is relatively simple is trend following, especially now with the Reddit generation getting so worked up. If you see a sector getting some good press you can jump on the bandwagon without having to sniff out the individual stocks. Likewise, if sentiment is turning negative, it may be time to go short.

Deal4Free

Did you know that CMC Markets was once called Deal4Free? You obviously can’t say that anything is free now, because the regulators frown on that sort of thing. Instead, you have to say something like “zero commission”, because you’re being charged something somewhere – you just don’t see it on your statement.

Trading with CMC Markets is obviously not free, but it is cheap. It has always been one of the best value trading platforms, primarily because it unashamedly acts as a market maker.

If you are spread betting, charges are built into the spread and are competitive. It’s always been part of the appeal that if you are trading the most popular and liquid assets, CMC is one of the cheapest places to do it. Commission charges on single stock CFDs are set at 2 cents per share in the US (minimum $10) and 0.10% for UK and European equities (minimum of £9/€9). So you get the choice. If you are a normal trader you can have your costs built into the spread, or if you are one of the bigger boys you can trade CFDs with better pricing and commission charged afterwards.

Alpha & Price Plus

There are two ways to get recognition at CMC. Firstly, you can buy your way in with a minimum deposit of £25,000 and join its premium membership, Alpha. It’s a nice name because, as I’m sure you know, an alpha in trading is trying to outperform the market. You get interest on cash balances and discounted spreads. There’s also a free subscription – it was to the FT but is now to Bloomberg.

If you can’t afford to buy your way in, you can still get reduced spreads by putting the volume through. The more you trade the lower your spreads will be…

CMC: Profitable Client Sentiment

CMC offers users access to client sentiment and positioning tools that show the aggregate positioning of its customers in various instruments. The data includes long-short percentages by clients and value as well as a breakdown of the current day’s order flow. Once again, this is broken down by both client percentage and value. What’s more, you can filter the positioning sentiment by client type, segmenting the data into top clients and other clients.

The top clients view shows the positioning, in a particular instrument, of those clients who have made money on their trading account in the last 3 months, and who have an open position in the instrument under observation.

The ability to filter the sentiment and positioning by client type gives CMC clients a potential advantage over peers who don’t get this additional insight.

Positioning and sentiment data can be used to trade, though how you use it will be determined by your outlook on the markets. Experienced traders take the view that as the majority of CFD and spread betting clients lose money it follows that positioning data is a reverse indicator, especially when the clients seem to be opposing an established trend.

In these days of social trading and large crowds, however, that may not always be the case. On balance it’s probably best to think of sentiment and positioning gauges as decision or trade support tools, rather than decision-makers in their own right.

CMC Markets: Education & Analysis

CMC has plenty of education and analysis available for its clients. It’s divided into separate sections: current news and analysis, a section on learning to trade that covers FX, CFDs and spread betting, and equities trading.

As well as technical analysis, CMC offers trading from home and trading strategies.

CMC Markets also offers what it calls market intelligence through its specialist website OPTO, which includes a magazine full of insightful articles, plus podcasts, and interviews with high-profile guests from the markets.

The trading guides are aimed at beginners and less experienced traders whereas OPTO is for more experienced traders who are looking for fresh ideas and inspiration. News and analysis from CMC’s in-house analysis team sits comfortably between them, and as we noted earlier, there is also an online moderated charting community within the trading platform.

All of this is available at no additional charge and much of it is available to the public as well as CMC clients. Many of the major providers have a general education program and support their traders with news and in-house analysis. But OPTO stands out from the crowd and, to my mind, this elevates the CMC offering above the competition.

CMC Markets offers an investment option with CMC Invest.

Institutional Prime Services (CMC Connect)

Recently rebranded to CMC Connect, the institutional side of the business is where CMC expects to grow over the next 5 to 10 years. The company has high profile joint ventures such as the stockbroking services it provides to the clients of ANZ Bank. Alongside these partnerships, it offers institutional liquidity, outsourced trading technology and connectivity, as well as pre and post-trade processing and trade reporting.

These services are aimed at institutional customers such as hedge funds, family offices and prop traders. HNWI and the most active professional clients might be able to use some of CMC Connect’s services but the division is really aimed at corporate customers and funds.

CMC competes with all of the large-scale margin trading brokerages in the CFD, FX and spread betting arenas. It’s also making inroads into the institutional and B2B spaces through liquidity provision, white labels, and JVs. That push on the institutional side and the firm’s focus on in-house trading technology, and the use of currency and share baskets, are the key differentiators from its competitors.

CMC Markets Review Ratings Explained

- Pricing. It used to be called Deal4Free, and pricing is still good…

- Market Access. CMC focuses on the main markets, but still offers many exotic pairs to trade

- Platform & Apps. CMC Markets has some of the best trading tech around for active traders

- Customer Service. London-based support staff (still thankfully, despite all the Brexit pomp)

- Research & Analysis. Top class client sentiment tools

Pros

- Excellent trading platform

- Good liquidity

- Unique sentiment tools

Cons

- Trading only (investing is on CMC Invest)

- Limited smaller cap stocks

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.6Pepperstone

Types of Hang Seng trading: CFDs, spread betting

Pepperstone is a great broker for automated trading and active traders

Provider: Pepperstone

Verdict: Pepperstone is a great all round broker for active traders looking for low costs. Especially for those that want to automate their trading as they are one of the biggest and best MT4 brokers with a very good set of EA packages. Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone a good broker?

Pepperstone is a great trading platform for traders who want low costs, wide market access and wide range of trading platforms, including one of the best MT4/MT5 packages available to retail traders worldwide.

Pricing: Razor tight pricing (on their Razor account).

Market Access: Mainly FX, but lots more stocks are being added.

Platform & Apps: Pepperstone’s MT4 and cTrader packages are top-notch.

Customer Service: Local offices around the world and personal account managers for large active traders

Research & Analysis: Lots of education and technical and algo indicator documentation.

Yes, I’ve used both trading platforms that Pepperstone offer, MT4/5 and cTrader, which include TradingView charting. cTrader is a more traditional trading platform with a basic layout, simple order execution and sentiment indicators. Whereas MT4 is one of the most popular and complex trading platforms available used by millions of traders and thousands of brokers.

However, what makes Pepperstone’s MT4 offering stand out is the brokerage behind it. Pepperstone offers it’s MT4 clients experienced account executives based in London and other local offices around the world. Plus, Pepperstone have put together a package of expert indicators and trader tools that are available to download for free that can be plugged into MT4.

To win business Pepperstone competes on price and compared to other trading platforms it is one of the cheaper options. For example, the Razor account can offer forex trading with zero pips, with the commission charged post-trade. Or traders can opt for the standard account, which adds a 1 pip markup, but is built into the spread.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts (apart from the Tennis and now sponsoring Aston Martin) and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. They are a global brokerage so you can at the moment trade crypto, but only if you are a professional client in the UK or are in a jurisdiction that hasn’t banned crypto derivatives.

Management: If you want to know more about the man currently running Pepperstone you can read my interview with Tamas Szabo, who has been Group CEO of Pepperstone since 2017, joining from IG where he started in 1996. So plenty of experience at the helm, Tamas, has been in the business for 25 years.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts or anything like that and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign.

As I said Pepperstone offers CFD trading for international clients and spread betting for UK customers. Spread betting of course unique to the UK as trades are structured as bets so if you make money trading you don’t have to pay capital gains tax on your profits.

Trading Platforms: Pepperstone doesn’t actually have its own proprietary trading platform instead they offer TradingView, MT4/5 and cTrader. MetaTrader is gradually pushing brokers and clients to MT5 because it’s faster and a bit more user friendly, however, there is a lot of resistance from traders, especially those that use EA’s or Electronic Advisors, as most have been written for MT4 and can’t be converted for MT5 without being re-written.

Automated Trading: If you haven’t used one an EA, an Electronic Advisor enables you to trade automatically based on certain market criteria, usually based on technical analysis. So if the market does x, you buy, if the market does y you sell. The idea is that you set up a trading strategy and set it on autopilot to trade on your behalf. It’s not necessarily high-frequency trading that was featured in Flash Boys or Flash Crash, but it’s similar.

If you want to know more about high-frequency trading those are two books well worth reading, Michael lewis has an excellent way of explaining complex derivatives and I particularly enjoyed Flash Crash because the chap it’s about was a client at the brokerage where I used to work and some people I know were mentioned in it, which is always quite amusing.

A few things to note though about EAs, unless you have a VPS or VPN they won’t work if you turn your trading screen isn’t on and you can’t use them on the web version or mobile. However, Pepperstone will set you up with a free VPS connection if you want one and do a certain amount of business.

MT5 versus MT4: MT5 is one of the most popular trading platforms on the planet and is used by millions of traders and hundreds of brokers. The key benefits are that it’s pretty simple to use and universally recognised, so if you used MT4 or 5 with one broker, switching accounts is fairly easy. Initially, it does have a clunky institutional feel to it, but once you get the hang of it it’s fairly simple to use.

Pepperstone’s MT5 does have its advantages over other brokers though. Mainly the packages they offer, the spreads and the execution, but also the regulation. Pepperstone are regulated by the FCA, so if you are a UK client a certain amount of your funds are protected by the FSCS if Pepperstone was to go bust. You are not protected if you are using MT4 or 5 through an offshore broker, and to be honest, if you are based in the UK you should always be trading with an FCA regulated broker, or the FCA regulated entity of a broker. It is tempting to go offshore to get better margin rates since ESMA capped them but you can get them as a professional client and if you can’t qualify as a professional client you probably shouldn’t be trading with excessive leverage anyway.

One of the main things that make Pepperstones MetaTrader offering stand out is market range, you get loads of forex pairs, the major indices and they are also increasing the number of shares they offer. They have the major FTSE 100 stocks and a few hundred US, European and Australian stocks, but that is growing. But, it is still nowhere near as many markets as someone like IG or Saxo offers. Also, Pepperstone is still only a trading platform so you can’t hold any of your long-term investments with them.

Trading Tools: Pepperstone also has a unique package of MT5 downloads which they call Smart Trader Tools, which include plugins like Trade Terminal where you can set your preferences for assets. So for example if you always trade cable in 1 lot, and have a stop 10 pips away and a limit 20 pips that will be your default OCO when you trade.

You also get things like a Pivot Points plugin where you can trade off previous highs and lows. Some other main features of MT4 are one-click trading, and the ability to trade off the charts. You can also move your entry and exit points automatically. If you trade four markets you can have four set up on screen and have your defaults for each one.

cTrader: One of the major drawbacks about MT5 though is that it doesn’t show your margin when you trade, which to be honest isn’t great if you are a beginner because you have no idea what your exposure is or how much risk capital is going to be used up. It will tell you your overall margin position, but it won’t show you your individual margin rates. Which is daft. However, Pepperstone’s other platform cTrader does do this. To be honest, I actually prefer cTrader, I think it’s more user-friendly, it breaks down your margin. The disadvantage of course is that you can’t run net and hedged positions.

You can’t trade with EAs but I don’t really like them anyway, I think the chances of clients making money with an off-the-rack automated trading strategy is pretty slim. It may work for a bit to nick a trade here and there but if you leave it running over a massive market correction you can get wiped out. You also can’t trade as many shares on cTrader as you can on MT5, which is a shame.

I think it has a cleaner layout, with everything pre-installed and you can trade in a web browsers rather than having to download the software. If you are building your own EA then MT5 is for you but if you are just eyeballing the market and taking a view I prefer cTrader as you get news, calendars, plus Autotrachtists is on there as well and is linked to the pair you are looking at.

Education & Analysis: One other thing to note as well is that when it comes to learning to trade or understanding the markets it is incredibly difficult. Pepperstone has partnered with The Corillian Academy, to provide some educational content. Corillian was set up by some fairly sophisticated traders with decent backgrounds. Richard Adcock for example has been on the board of the society of technical analysts for 30 years.

Customer Service: Although probably the main benefit of Pepperstone over the majority of MT4 brokers is customer service. It’s a big risk trading the financial markets and there are often big sums of money involved. So being able to phone someone up who can execute trades for you and give you a full demo of the platform is almost more important, in my mind anyway, than pricing and market access. If you’re in the UK, you get to talk to your dealers in London, through direct dial.

Pros

- Tight pricing

- Wide range of MT4 markets

- Pre-built MT4 indicator packages

Cons

- Limited market access

- Only third-party platforms

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1Saxo Markets

Types of Hang Seng trading: Futures, options, CFDs, spread betting

Saxo have some of the best trading and investing platforms for advanced and beginner investors

Is Saxo Markets a good broker?

Yes, Saxo has a great choice of accounts for beginners with SaxoInvestor and for professionals, the more sophisticated SaxoTrader go provides direct market access. The pro platform, analysis, and direct market access may be too complicated for beginners. But, for experienced traders, its coverage, commissions and research are unrivalled.

Saxo is one of the largest investing and trading platforms worldwide and provides direct market access to equities, bonds, forex, futures and options as well as being a major liquidity and infrastructure provider to wealth managers, banks and smaller brokers.

Awards: Saxo won best investing app and best DMA/Professional account in 2024. Before that, in our 2023 awards, Saxo won ‘Best CFD Broker’, and ‘Best DMA & Professional Trading Account’. In 2022 Saxo also scooped ‘Best Bond Broker’.

Pricing: Commissions have just been reduced further making Saxo one of the cheapest brokers

Market Access: Saxo offers a huge range of markets for both derivatives trading and physical investing

Platform & Apps: Saxo has an industry-leading robust workhorse of a platform

Customer Service: Experienced dealers for active larger customers

Research & Analysis: Some of the best opinions on the markets around.

Plus, with Saxo posting its best financial results in history (with over $118bn customer funds on account) and now that it has been 70% bought out by J. Safra Sarasin Group, they will be in an even better position to continue to provide excellent market access. This, combined with founder Kim Fournais still owning 28% will keep the firm’s customer-first ethos intact.

Overall, Saxo Markets is an excellent trading platform for retail traders and investors who want institutional-grade pricing, robust execution and wide market coverage.

Pros

- Direct market access

- Low commissions

- Robust trading platform

Cons

- Seen as a trading platform for professionals

- Have to subscribe for live prices

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

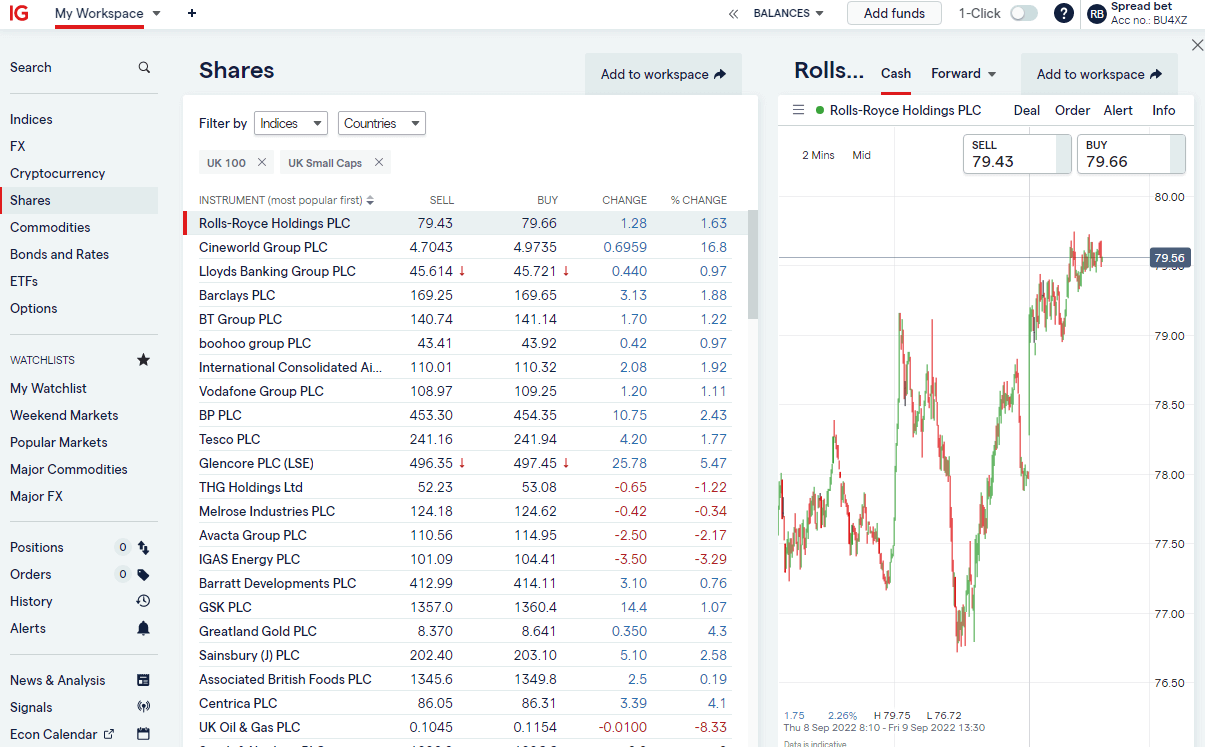

4.9IG

Types of Hang Seng trading: CFDs, spread betting

IG Won Best Trading App in the 2025 Good Money Guide Awards

Provider: IG

Verdict: IG is one of the largest and best brokers in the world and offers the full suite of investing and trading accounts for all types of investors. Highly recommended. Founded in 1974 as Investors Gold Index, then IG Index, and now just “IG”, it’s one of the world’s largest margin trading brokers. IG offers contracts for difference (CFDs), FX and spread betting (in the UK) alongside share trading and prime brokerage to over 400,000 clients, and covers 15,000 tradeable markets. IG also offers physical share dealing and smart portfolios for longer-term investors.

71% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a Good Trading Platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

First up, I must disclose that IG is my default broker. When I review brokers, I ask: “Why would you trade here rather than at IG?” It was my first trading account – I’ve had it for about 20 years and I remember the first online trading platform when it was basically a messaging system through to the dealing desk. When I was interning on the NYMEX and IPE trading floors in London and New York as a ticket checking clerk, I’d tap away on IG on my Ericsson R380. Along with Trading Places (my dog is even called Winthorpe #notobsessed) I hold IG accountable for the path my career has taken.

Who is IG?

Stuart Wheeler, IG’s founder, basically invented financial spread betting in the attic of a Chelsea townhouse in 1974. It was first called Investors Gold Index, then IG Index and then just IG. As the product range grows, the name shortens.

His biography (Winning Against the Odds, My Life in Gambling and Politics) makes clear IG was founded for the love of the business (that business being gambling and investing).

One of the things that makes IG stand out is that it’s good at what it does, and seems to want to be the best.

I certainly gathered from my interview with the former IG CEO, June Felix, that the company wants to be on the client’s side, believing it’s better to try to help the client win, and give them good service, so they’re still a client 20 years later, rather than the churn and burn approach.

Index & Forex Trading

IG was one of the first brokers to let private individuals trade the financial markets, and IG clients can now trade a market-leading 80+ indices.

You can also trade forex on the platform. But unlike most other forex brokers, which see the largest percentage of their volumes in the forex markets, IG’s most popular asset class is indices, followed by currency trading.

Quality Service

IG has always taken the view that clients trade with it because of the service it offers, rather than because of any incentives.

No B-Book

One draw for big clients is that whilst IG does internalise orders, it has symmetrical exposure limits, so it doesn’t take a view on the markets. This means that IG is not betting against you with a B-Book. And, if you’re a big trader, because of IG’s liquidity there may actually be bigger volume on IG’s bid and offer than there is in the underlying market. You get positive slippage, so if you place a limit order and the market suddenly moves in your favour you get filled at a better price than your limit.

Spread Betting & CFD Trading

With IG you can trade CFDs or spread bet 24 hours on major indices, forex and commodities markets. There are extended hours on global equities, where some fairly significant volume goes through, particularly on US equities when company announcements are made after the main market shuts.

IG is one of the few brokers to allow trading during the weekend, so you can still take a view or limit your exposure if something big comes out politically.

IG is one of the best CFD trading platforms as it offers a huge range of markets to trade and DMA access for more sophisticated traders. Also, because IG offers CFDs globally (with the exception of the US) it has a huge amount of volume and liquidity meaning that sometimes you can place bigger orders via IG’s order book than you could do on the underlying exchanges like the LSE or NYSE. Because of the sheer volume of CFD trades, IG is able to internally match up orders for quicker and larger fills.

One key disadvantage of trading CFDs through IG is that you have to pay tax on profits. However, CFDs are not the only product that IG offers. You can also trade financial spread bets, where you do not have to pay capital gains tax on profits as this is classed as gambling.

IPO Grey Market

One feature that’s now unique to IG (lots of other brokers used to do it) is the “grey market”, where it will offer you a price in unquoted stocks that are due to come to market. You essentially take a bet on what the market cap will be of a company when it lists. Or you can just apply for shares in the IPO through PrimaryBid, which will deliver them to your IG account.

Global Differences

IG is good at knowing what customers in each region want. The UK, for example, is the only country that is offered financial spread betting, and the rest of the world trades on margin with CFDs. That’s with the exception of the Americans, who trade on margin by taking out a loan to buy stock (from their broker) or trade options, which are much more popular on equities. Japan has knockouts and Europe has barrier options and Turbos Warrants.

What Does the Trading Platform & App Look Like?

IG’s trading platform is DIY online, but still with phone support if you need it.

IG is keen to push its added value; the platform tries to integrate as much as possible. IGTV is based on the platform analytics of what people are trading, and IG creates programmes around what markets and assets traders are looking for information on. The news and analysis comes from Reuters, with snapshot videos and a series of IG market commentary videos.

We rate IG’s trading app as extremely safe because of IG’s regulation and reputation. However, it’s important to note that while trading on the app itself is financially secure, the products on offer are high risk and IG does offer investments that are not safe for capital preservation. IG offers financial spread betting and CFDs which are high risk, potentially high reward products.

High Net Worth Accounts

If you are a high-volume trader, you can also trade DMA with ProRealTime, and you can get level 2 pricing and trade directly on the exchange order book. This can be done on the IG trading app or by downloading the L2 dealer software. There is a cost, of course, but if you do a few trades that is rebated back. Brokers have to pay the exchanges for providing level 2 data to their clients, so the charge is there to dissuade everyone signing up without trading. If you are really clever and have developed your own trading algorithm, you can plug that into IG’s platform too. Or MT4/MT5 which it also offers, if you’re into that sort of thing.

Sticky Clients

A problem all brokers are desperate to address is people losing money. It’s always been the case that only around 20% of people made money. A few brokers have implemented post-trade analytics, to help their clients try and win more. IG’s Trade Analytics tool does just that. Its sole purpose is to try and help traders win more by getting a better understanding of where they profit and lose in the markets. It’s been developed in-house by IG, based on analytics and to provide clarity.

James Perry, a former IG Client Experience Manager, told me “We desperately want our clients to win, as the more they win, the longer they are going to be a client, and the more they are going to trade.” And the more commission IG will make.

I know this to be true from my own trading, when you’re on a winning run you trade more, and when you can’t call the market right you step away until another day.

Investing, ETFs & Share Dealing

IG also offers longer-term investing products, where you can buy and hold stocks, ETFs and funds in a stocks and shares ISA, or IG Smart Portfolio. It has a trading academy so you can learn through video and interactive courses. IG can see from its analytics that clients that use these become better traders. IG bought DAILY FX (for $40m) and offers live webinars to provide analysis and trading strategy.

You can invest and trade ETFs with IG. You have the option of either investing in the long term by buying ETFs in the general investment account, SIPP or ISA. Or you can speculate on them going up or down by going long or short via CFDs or financial spread bets.

IG is not the cheapest place for investing in ETFs, (that is probably Interactive Brokers) but it does have very good customer service and is a really easy-to-use ETF platform.

Ratings Explained

- Pricing: Industry leading spreads and with DMA you can get inside the bid/offer.

- Market Access: Best around for spread betting and CFD trading.

- Platform & Apps: Loads of added value, signals and execution features.

- Customer Service: IG is very big, but still managed to score well here.

- Research & Analysis: Superb, news, analysis, social feeds, plus free premium subscriptions for active clients.

Overall, if you are going to trade, I would be surprised if you didn’t have an account with IG.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service occasionally slow

- No DMA futures trading

- Not the cheapest for ETFs

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7What is the attraction of the HK Hang Seng Index?

One of the most keenly traded indices in Asia is the Hang Seng Index. The index is attractive to investors and traders alike because:

- HSI stocks combines both local and regional exposure, including the exposure to China

- HSI offers good liquidity as some of these stocks are huge (e.g. HSBC, Tencent, and and AIA)

- HSI offers indirect exposure to leading the financial sector and the Chinese economy.

As noted above, many Chinese firms, including State-Owned Enterprises SOEs, are listed in HK. Many of them are financials and telco like CCB, Ping An, ICBC, and China Mobile.

Historically, HSI is a very volatile index which offers scope for short-term trading. Hence its popularity with traders.

What drives the Hang Seng Index?

Stock markets are often driven by a wide variety of factors. For the Hong Kong stock market, the number one factor is global growth. This is because the market is dependent on trade, goods flow, and capital movements. A fall in global trade will hit the market hard.

Other important factors for HKI include:

- Earning factors (e.g., profitability and earnings momentum)

- Technical factors (e.g., new highs or lows)

- Political factors (e.g., street protests)

- Monetary factors (e.g., the peg against the USD)

The latter has been an over-riding factor of late due to the non-stop protests throughout the summer and autumn. The region is falling into a technical recession.

A 7-Point Guide to trading Asian stock indices

Trading Asian stock indices has always a lure for many aspiring traders. In the past, many western observers referred to Japan/HK as the ‘Far East’. But in these days of instant electronic trading, investing in Asian markets has never been easier. But there are some things you may need to watch out for.

- Understand that ‘Asia’ is a very big continent. You have to know which countries you want to invest in. At the minimum, know whether the Asian country you are interested in is a developed, developing or a frontier economy. There are more than 35 countries in Asia, stretching from Japan to Pakistan. So there are a lot of cycles overlapping one another. Other things to watch out for include:

- Economic cycles

- Currency trends (managed, pegged, or free float?) – very important

- Political trends and elections

- Sector niche

- Understand your requirements for trading Asian stocks. Are you in just to get a ‘kick’? Or do you invest for the long term? Are dividends important? This will dictate what you invest in and how you do it.

- Anticipate the market catalysts for buying in (or selling out). In many Asian markets, an election can have a massive positive impact on the local stock market. Modi in India is one example. Shinzo Abe of Japan is another. They bring in new policies that often rejuvenate the economy (at least for a while).

- Research what type of exposure available. Not all Asian markets are available to foreign investors. China used to be a totally closed market but is now gradually opening up. Still, there is a limit. Other countries are more open, such as Singapore and Hong Kong. Therefore, if you are preparing to invest understand how you wish to carry out your transactions. Can you invest locally or through a fund? Can you buy Asian stocks from where you are?

- Identify the sector niche. Not all countries can be competitive in every sector. For Singapore/HK, the bigger sectors are property, banks, insurance etc. For Indonesia and Australia, resource stocks are better. In Korea, tech/chip stocks are worth watching. So before you invest with MSCI country ETFs or indices, you have to know what the constituents are. Check and see if these stocks are what you want to hold.

- Examine the risk and reward. Asian markets are very attractive to many investors simply because of the higher growth rates there. China is growing at 5-6%; so is India. Countries like Vietnam, Philippines, Indonesia all showing promising trends one way or another. However, not all is rosy. You can lose serious amount of money if you overpay for securities. So are you buying blue-chip Asian stocks or are you buying growth stocks? Different type of stocks carry different kind of risks.

- Commit capital but go slow initially. Especially if you’re unsure what or how to trade Asian markets. Drip feed capital into Asian funds or ETFs just to experience the pricing behaviour.

Alternative Indices For Hong Kong (Hang Seng Index) Trading

You can read about the major indices in our guide to the best indices for index trading.