Moneyfarm Customer Reviews

For me, they are an…

For me, they are an exceptional business and long may that continue. Enjoyed being part of the journey since 2017 and would highly recommend. Feel I am in very good hands when it comes to wealth management.Thank you!

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

For me, they are an…

For me, they are an exceptional business and long may that continue. Enjoyed being part of the journey since 2017 and would highly recommend. Feel I am in very good hands when it comes to wealth management.Thank you!

very good

very good

The “human touch” when seeking…

The “human touch” when seeking general advice around products & how best to use those products .

?

?

use them on line

use them on line

valid service for letting others…

valid service for letting others invest for you

Can’t fault them for customer…

Can’t fault them for customer service and investment advice

Outstanding platform for people who…

Outstanding platform for people who are new to investing. You receive a designated investment advisor who manages your portfolio and contacts you when opening your account to discuss your relevant experience of investing and investment goals. The customer service team is also immediately on hand if you need anything with their easy to use and functional app. Very happy I chose Moneyfarm as a new investor.

Very professional and reliable

Very professional and reliable

Happy to let Moneyfarm invest…

Happy to let Moneyfarm invest my savings.

Very good returns since 2011

Very good returns since 2011

5/5

Great customer service app easy…

Great customer service app easy to read and find what you want

Very happy with it

Very happy with it

An excellent service provided by…

An excellent service provided by Money farm since I’ve invested with them

Very easy to register on…

Very easy to register on their website. Comfortable and confident in their advice. Blogs Excellent, easy to read and understand.

Good performance

Good performance

Trustworthy, easy to understand, efficient

Trustworthy, easy to understand, efficient

Easy to use & cost…

Easy to use & cost effective

Really good, easy to use…

Really good, easy to use app, good for someone starting off in investments, wish they would produce a detailed CGT report for tax purposes

5/5

Excellent all round

Excellent all round

Fantastic and able to get…

Fantastic and able to get advice

Fabulous customer support

Fabulous customer support

ok

ok

Very easy to deal with…

Very easy to deal with and the results speak for themselves.

I have found Moneyfarm a…

I have found Moneyfarm a excellent company to invest with.

Informative and very helpful

Informative and very helpful

Excellent

Excellent

Easy to use, friendly customer…

Easy to use, friendly customer service

easy to understand investments

easy to understand investments

Great app that makes investment…

Great app that makes investment easy. Also good advice given by telephone with your nominated person at MoneyFarm

More experience with this and…

More experience with this and find it comprehensive and user friendly.

5/5

Comprehensive and detailed with plenty…

Comprehensive and detailed with plenty of information and analysis.

Daily updates – good service…

Daily updates – good service with low fees

Modern investment platform

Modern investment platform

The sign of a good…

The sign of a good product is when nothing goes wrong and everything seems to take care of itself. That’s mostly the case with MoneyFarm. I did one one issue where an investment I made was not showing up in my portfolio and the technical support team were excellent in solving the problem quickly.

Regular updated info

Regular updated info

Very good at keeping you…

Very good at keeping you informed about your investment and the current finacial situation

Simple, reliable and quality

Simple, reliable and quality

Fantastic customer support that makes…

Fantastic customer support that makes you feel like a very valued customer. The help and guidance is second to none and the investments themselves are very professionally handled.

Very good investment

Very good investment

It’s quite good and I…

It’s quite good and I hope it will give a good return

Excellent

Excellent

Great investment app. Really good…

Great investment app. Really good customer service. Amazing company

I personally love their customer…

I personally love their customer service, keeping customer in the know and efficient app, flexible and easy to use.

Simple to use

Simple to use

Great platform, easy to navigate…

Great platform, easy to navigate and intuitive

Very good service,easy to understand…

Very good service,easy to understand ,and kept up to date.

It’s easy to navigate. Offers…

It’s easy to navigate. Offers choice of options. Good value fees

Always there to help

Always there to help

A relaible platform with good…

A relaible platform with good stats and service

Easy to invest with sound…

Easy to invest with sound advice and reasonable fees

really excellent

really excellent

Is probably the best and…

Is probably the best and easiest to use of all the platforms

Steady and trustworthy, good for…

Steady and trustworthy, good for long term investors who can rely on your contributions being invested sensibly

I had only positive experience…

I had only positive experience with Moneyfarm

Great service , returns ,…

Great service , returns , pricing and easy to use app . Highly

I have been using Moneyfarm…

I have been using Moneyfarm for several years and find them trustworthy and honest, and they communicate regularly.

Moneyfarm stands out as a…

Moneyfarm stands out as a noteworthy investment platform, particularly for those seeking a combination of user-friendly features and robust customer support. One of the platform’s most commendable aspects is its customer service. The support team is both prompt and accurate in addressing queries, ensuring that any concerns are resolved swiftly. This level of service is crucial for both new and experienced investors who value timely and precise assistance. Beyond customer support, Moneyfarm offers a well-structured investment service, designed to cater to a variety of financial goals. The platform’s intuitive interface makes it accessible, while its diverse portfolio options provide flexibility for different investment strategies. Overall, Moneyfarm excels in providing a seamless user experience, bolstered by a responsive and knowledgeable support team. Whether you are just starting out or looking to diversify your investments, Moneyfarm’s commitment to user satisfaction and efficient service makes it a solid choice

It’s another form of income

It’s another form of income

Excellent Investment company

Excellent Investment company

very informative and clear platform

very informative and clear platform

Easy to use and provide…

Easy to use and provide a good overview

Easy-going

Easy-going

Does what is does well

Does what is does well

Accessible and relatively cheap fees….

Accessible and relatively cheap fees. Professional in all aspects.

An efficient, proactive organization.

An efficient, proactive organization.

Great service and app

Great service and app

Best in class

Best in class

n/a

n/a

Faultless experience

Faultless experience

Easy and efficient way to…

Easy and efficient way to invest with user-friendly app

Moneyfarm is the investment platform…

Moneyfarm is the investment platform that I’ve been with for numerous years I’ve never looked back.

A great experience in starting…

A great experience in starting to invest for the first time.

Like the opportunity to talk…

Like the opportunity to talk to an advisor and they are excellent at keeping in touch. Risk is managed well when you set up an account.

Great return great telephone support…

Great return great telephone support reasonable fees

Cost effective and good customer…

Cost effective and good customer support, with the exception of one consultant who has now been replaced. Disinvesting can be cumbersome and the process and time scales should be clearer.

Good communicator and client support

Good communicator and client support

Easy to use

Easy to use

Great platform and excellent customer…

Great platform and excellent customer services

Impressive

Impressive

Easy

Easy

Very user friendly.

Very user friendly.

Great value for the customers

Great value for the customers

Brilliant in every regard. Exceptional…

Brilliant in every regard. Exceptional service and customer support as well as investing strategy for a reasonable fees.

Very good at contact and…

Very good at contact and reviews. Comparativly low fees

A good investment platform. …

A good investment platform. .

Great service cheap and excellent…

Great service cheap and excellent returns

excellent service and trustworthy

excellent service and trustworthy

ok

ok

I’ve held an ISA here…

I’ve held an ISA here for a long time, managed by MoneyFarm. The growth has been good and the dividends far outweigh the fees. They provide regular updates on market news and regularly rebalance the portfolio based on forecast trends. They also periodically check on my risk appetite to ensure my investments are allocated accordingly

Easy to navigate and understand

Easy to navigate and understand

Excellent customer service & performance

Excellent customer service & performance

Very Good

Very Good

Simple, accessible, transparent investing.

Simple, accessible, transparent investing.

great app with good info

great app with good info

Good

Good

Confident that my Investment is…

Confident that my Investment is in good hands and Im delighted with my Returns

Easy to use and user…

Easy to use and user friendly

Easy to talk with someone…

Easy to talk with someone -good app and website so you can always see your account

Very good

Very good

Easy to use app, useful…

Easy to use app, useful information, good customer service and low fees

Good

Good

4/5

Approachable

Approachable

amazing customer service, great value…

amazing customer service, great value for money

Moneyfarm offers a great investment…

Moneyfarm offers a great investment opportunity and services. It provides a platform through which I can monitor all the transactions in my business and in a very transparent manner too. I would highly recommend their services who is keen on medium to long term investment.

Great service and experience.

Great service and experience.

Nice website and dedicated personal…

Nice website and dedicated personal advisor for financial checkups

I dont have any knowledge…

I dont have any knowledge of investments and Money farm has been extremely helpful. I trust them

5/5

user friendly, good returns

user friendly, good returns

Good returns. Good personal support

Good returns. Good personal support

Very easy to find help…

Very easy to find help and to use

Everything is OK

Everything is OK

My portfolio is growing very…

My portfolio is growing very well

Quality

Quality

I find moneyfarm very good…

I find moneyfarm very good at communication with my personal account questions and also very informative information on the latest changes in the financial sector. The fees are good as they are managing my account. The app is quite straight forward use.

Excellent app customer service quick…

Excellent app customer service quick to reply accurate information value for money overall an excellent provider

Easy to set up, excellent…

Easy to set up, excellent support very good customer service

Easy to use, polite &…

Easy to use, polite & helpful advice, good results

Good product options, better returns…

Good product options, better returns than elsewhere and industry insights are useful.

Too high charges

Too high charges

Excellent

Excellent

Excellent customer service. Happy with…

Excellent customer service. Happy with growth of my investment.

Excellent for small investor

Excellent for small investor

They keep me informed of…

They keep me informed of the performance of my investment and the current market trends which could affect the performance.

excellent

excellent

Very good personnel service

Very good personnel service

good.. user friendly

good.. user friendly

Easy to transfer in an…

Easy to transfer in an existing ISA and help when needed at the end of an email

Great platform, low costs, have…

Great platform, low costs, have made me a ton of money

Credible

Credible

5/5

Easy to manage and informative….

Easy to manage and informative. Responsive to requests for help

Excellent

Excellent

Easy to use platform

Easy to use platform

Investments seem to perform very…

Investments seem to perform very well

Excellent experience no complaints

Excellent experience no complaints

Advice available, not the cheapest…

Advice available, not the cheapest put performance is reasonable.

Happy with the service and…

Happy with the service and the investment of my money

Great for placing active management…

Great for placing active management investments

Good value

Good value

Low fees, good performance

Low fees, good performance

Good all round

Good all round

Very helpful for visualizing my…

Very helpful for visualizing my financial goals

no comment

no comment

I’m not sure but I…

I’m not sure but I Steven Talewa of Tari Hela Province of Papua New Guinea select only for the year

Good, fair

Good, fair

cc

cc

Average for passive investments and…

Average for passive investments and performance

transferred a pension less than…

transferred a pension less than a year ago; so far, excellent

Easy to use

Easy to use

Good returns, Great support. App…

Good returns, Great support. App could be better as it often requires updated, but it is clear and easy to use

Easy to use, tailored service

Easy to use, tailored service

5/5

5/5

3/5

good

good

Bad value and bad service

Bad value and bad service

Good experience about 1 year…

Good experience about 1 year good app and fair ETF

.

.

Seems to have good customer…

Seems to have good customer service but to new to comment on performance

No thoughts

No thoughts

Experts on hands

Experts on hands

User-friendly roboinvestment platform with ethical…

User-friendly roboinvestment platform with ethical investment options giving good returns, and a focus on sharing market insight and education with customer base.

4/5

2/5

Pros:

One screen tells me the value of my investment

Cons:

Not ask for cookie verification every time

4/5

Pros:

Onboarding

Cons:

n/a

3/5

4/5

Pros:

Set and forget investment

Cons:

Lower fees

4/5

5/5

3/5

Pros:

No thought

Cons:

Better support

3/5

4/5

3/5

5/5

3/5

3/5

Pros:

Website

5/5

Cons:

Increase return on investment

5/5

Pros:

Ease of use

4/5

4/5

Pros:

The advisory team

2/5

5/5

Pros:

Allocation Fees

Cons:

Lower Fees

4/5

Pros:

Great allround

2/5

3/5

Pros:

Good insight information

Cons:

Match invest engines charges

3/5

Pros:

Not sure ?

Cons:

Not sure

1/5

Pros:

None

Cons:

–

2/5

Pros:

Easy to use

Cons:

Cost competitiveness

4/5

Pros:

Blogs

Cons:

Better investing

3/5

5/5

Pros:

Competency

Cons:

Value

4/5

Pros:

Ease of use

Cons:

All good

3/5

4/5

Capital at risk

Expert Moneyfarm Review

In this Moneyfarm review we, give our ratings based on their nearest peers. Tell you what we think of Moneyfarm after testing them with real money and highlight the key costs, facts and figures of their accounts.

Moneyfarm Review

Name: Moneyfarm Review

Description: Moneyfarm is a digital wealth manager that aims to make personal investing simple and accessible. It was launched initially in Italy in 2012 by Italian bankers Paolo Galvani and Giovanni Dapra and entered the UK in 2016 and has big-name financial backers such as Allianz Global Investors, Cabot Square Capital, United Ventures and Poste Italiane.

Is Moneyfarm any good?

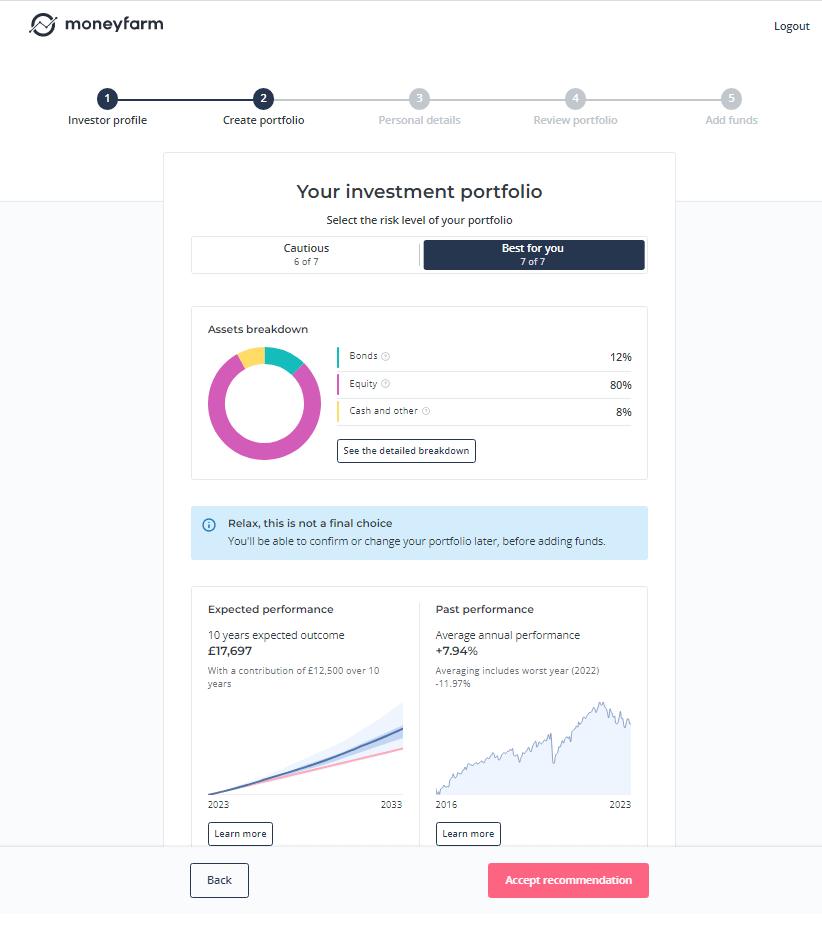

Yes, Moneyfarm is more of a digital wealth manager rather than a robo-advisor as the portfolios are put together by investment managers, rather than automatically. The automation, as it where, is fine-tuning your portfolio to match your risk/reward choices. As opposed to other robo advisors you can also top-up your portfolio with individual shares and ETFs.

- Investments: 7 pre-made portfolios

- Account types: GIA, ISA, Pension, JISA

- Costs: 0.75% to 0.6%

Fees: Moneyfarm charges 0.75% to 0.6% up to £100k then 0.45% to 0.35% over £100k. Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%.

Pros

- Easy to use

- Low fees

- Diverse portfolios

Cons

- High £500 minimum investment

- 0.75%* account fee is relatively high

- No individual US shares available

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.4Capital at risk

Moneyfarm CEO Interview

If you want to know more about how Moneyfarm works and why it was set up you can read our exclusive interview: Giovanni Daprà, Moneyfarm CEO on why his digital wealth management firm is so much more than a robo-advisor.

Capital at risk

Moneyfarm Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | 135K |

| 💰 Minimum Deposit | £500 |

| 💸 Client Funds | £3.9 billion |

| 📅 Founded | 2012 |

Account Costs | |

| ➡️ Investment Account | 0.25%-0.75% |

| ➡️ SIPP | 0.25%-0.75% |

| ➡️ Stocks & Shares ISA | 0.25%-0.75% |

| ➡️ Junior ISA | 0.25%-0.75% |

| ➡️ Lifetime ISA | ❌ |

Dealing Costs | |

| ➡️ UK Shares | £3.95 per trade |

| ➡️ US Stocks | £3.95 per trade |

| ➡️ ETFs | £3.95 per trade |

| ➡️ Bonds | 0.3% for Liquidity + |

| ➡️ Funds | £3.95 per trade |

Capital at risk

Is Moneyfarm’s pension any good?

Moneyfarm’s pension is a managed private pension account where you invest in prebuilt portfolios, it’s more of a managed pension rather than a SIPP, but you can still invest in individual shares in their ISA and GIA.

Moneyfarm lets you invest your pension in one of seven ready-made simple and diverse portfolios with different degrees of risk and reward. Users can transfer a pension or setup a new one and Moneyfarm will manage your portfolio based on your retirement target date by reducing the risk as the time approaches.

Moneyfarm’s pension account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Capital at risk

Can you invest in a Moneyfarm JISA for your children?

Yes, the Moneyfarm junior ISA has the same portfolios as the standard GIA, ISA and pension account. So you can invest tax free for when your children turn 18.

- Investments: Pre-made portfolios

- Minimum deposit: £500

- JISA account charge: 0.75%

- Dealing fee: £0

Moneyfarm smart tech allows you to monitor your JISA’s performance from anywhere, automate your monthly deposits so you’ll never miss an opportunity again, and their team of dedicated investment consultants are on hand to answer any queries you may have via anytime calls, chats, or emails.

Moneyfarm junior stocks and shares ISA account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Capital at risk

Moneyfarm Performance

For Moneyfarm, we have focused on its seven non-ESG managed portfolios. Performance net of fees is shown below between 2019 and 2023.

| Risk level | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 2023 | 4.6 | 6.7 | 7.6 | 9 | 10.3 | 11.5 | 12.4 |

| 2022 | -8.1 | -9 | -9.3 | -9 | -11.5 | -11.7 | -12.3 |

| 2021 | -1.5 | 2.7 | 5.8 | 8.8 | 11.3 | 13.9 | 16.6 |

| 2020 | -0.2 | 2 | 3.3 | 2.9 | 4.9 | 6.3 | 6.3 |

| 2019 | 2.9 | 6.6 | 9.5 | 11.7 | 14.6 | 16.5 | 19.8 |

| £1k would have grown to | £972 | £1,084 | £1,168 | £1,240 | £1,306 | £1,389 | £1,464 |

Here, £1,000 invested in the highest risk option would have grown to £1,464.

Capital at risk

Is Moneyfarm’s GIA a good investment account?

Moneyfarm is a trusted investment account based on our metrics of regulation, size and products. The GIA is not as good as the Moneyfarm ISA for your first £20k invested each year though as you have to pay capital gains on any profits outside of your ISAs.

Moneyfarm’s GIA is a digital wealth manager and makes setting up a diverse investment account easy and cheap. As with other robo-advisors, you cannot buy individual stocks, but instead choose to invest in any of their seven risk-based portfolios through a stocks and shares ISA, a pension or a general investment account.

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Account types: GIA, ISA, Pension, JISA

- Account charge: 0.75% annual charge

- Dealing fee: £0

Moneyfarm’s investment platform is like a big quiz directing you towards the most appropriate portfolio based your responses to risk-based questions.

Is Moneyfarm a cash or investment ISA?

Moneyfarm has a stocks and shares ISA that invests your money in the stock market. You can get better returns than with a cash ISA, but as with all investing the stock market goes up and down so you could get less than you originally invested. So if you don’t want to risk losing any money a cash ISA with someone like Hargreaves Lansdown Active Savings would be a better option.

Moneyfarm’s ISA invests in ETFs to keep the costs low, so you aren’t paying for active managers. Instead, you are benefiting from tracking a series of diversified indices that are regularly rebalanced. This should mean you get to keep most of your returns rather than paying hefty fees to fund managers.

- Investments: Pre-made portfolios

- Minimum deposit: £500

- ISA account charge: 0.75%

- ISA dealing fee: £0

Fees: Moneyfarm’s ISA investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Is your money safe in the Moneyfarm app?

Yes, the Moneyfarm app connects to all their accounts and lets you view your portfolio balance and performance whilst on the move.

As Moneyfarm is a fairly passive investment account and not that complicated, you can also use the app for making deposits and choosing investment portfolios.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com