Investing apps are the mobile version of an investment account’s platform, which allows investors to buy and sell a range of investments (depending on provider) including, shares, bonds, ETFs, funds through a general investing account, stocks and shares ISA, SIPP or pension. We have tested, ranked, compared and reviewed some of the best investment apps in the UK that are regulated by the FCA.

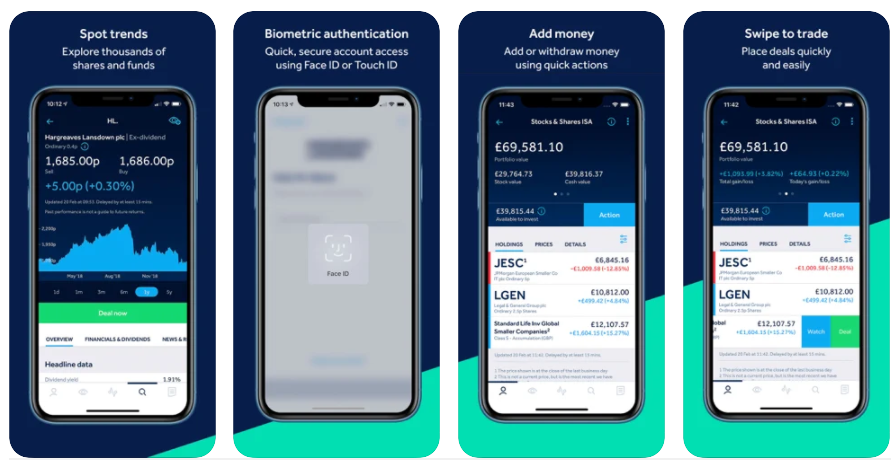

Hargreaves Lansdown: Best investing app for DIY investors

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA, JISA, JSIPP

- Account charge: Shares £0, funds 0.45%

- Dealing fee: Shares £5.95 – £11.95, funds £0

We have ranked Hargreaves Lansdown as the best investing app for those that want to make their own investing decisions. HL offers some of the best analysis and research on it’s app, as well as stock screeners, buy and sell signals and company fundamentals. For longer-term investors, it also offers the widest range of funds and international markets.

Hargreaves Lansdown Investing App Review

Name: Hargreaves Lansdown Investing App

Description: We have ranked Hargreaves Lansdown as the best investing app in our 2022 Awards. Hargreaves Lansdown wins best investing app in our 2022 awards the because it is suitable for anyone from absolute beginners to experienced active investors as you get a huge amount of information, data, research, market access and order types.

Capital at risk

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA, JISA, JSIPP

- Account charge: Shares £0, funds 0.45%

- Dealing fee: Shares £5.95 – £11.95, funds £0

Fees: There is no account charge for shares in a general investment account with Hargreaves Lansdown. Funds are charged at 0.45% for the first £250,000. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

App:

Pros

- Thousands of UK and international shares, bonds & funds

- Ready-made portfolios with different levels of risk

- Excellent research and analysis

- An established and listed company on the LSE.

Cons

- Can be expensive for large fund portfolios

-

Pricing

(3.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3Interactive Investor: An excellent fixed-fee investing app

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA

- Account charge: Shares £0, funds 0.45%

- Dealing fee: £3.99 – £5.99

Capital at risk

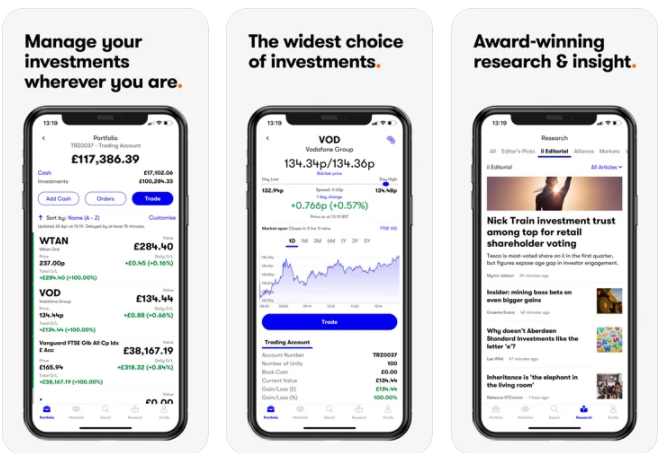

Interactive Investor App Review

Name: Interactive Investor App

Description: Interactive Investor is a good investing app for active investors who want to make their own investment decisions and will be adding a lot of funds as well as shares to their portfolio as fees are capped. II’s app also has a wide range of news and analysis with a particular focus on educational videos and investment editorials.

Capital at risk

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA

- Account charge: Shares £0, funds 0.45%

- Dealing fee: £3.99 – £5.99

Fees: It costs £9.99 a month for a general investing account with Interactive Investor. Dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

If you want level-2 pricing, you can also add Quotestream for £20 per month.

Special Offers:

- One free trade per month – One buy or sell order is free every month, after that, the cost is between £3.99 and £5.99 depending on what plan you are on.

- Free investing for your friends and family – You can give up to five people a free investment account subscription with Interactive Investor’s Friends and Family plan. You pay a single extra fee of £5 a month, and their monthly cost is zero. Each member can invest up to £30,000 in an ISA or a general investing account with free regular investing and no account fees. However, they will still pay normal dealing commissions when they buy and sell investments.

- Get £200 when you refer a friend to Interactive Investor – Recommend a friend or family member to ii and get a £200 reward. Your friend will get their first year’s service plan for free – saving £120. To qualify, your friend must transfer or fund their account with at least £10,000 in combined cash/investments. However, your friend will not receive the usually monthly free trade.

App:

Pros

- Pick your own investments or use their model portfolios

- £1 minimum deposit makes it easy to get started

- Fixed account fee that does not increase with your investments

- Joint account options

Cons

- Fixed fee expensive for very accounts below £1,000

- No Lifetime ISA account

- No Junior SIPP account

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.5AJ Bell: Best low-cost app investing

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- Account types: GIA, ISA, SIPP, JISA, JISA, JSIPP

- Account charge: 0.25% annual charge

- Dealing fee: Shares £3.50 – £5, funds £1.50

Capital at risk

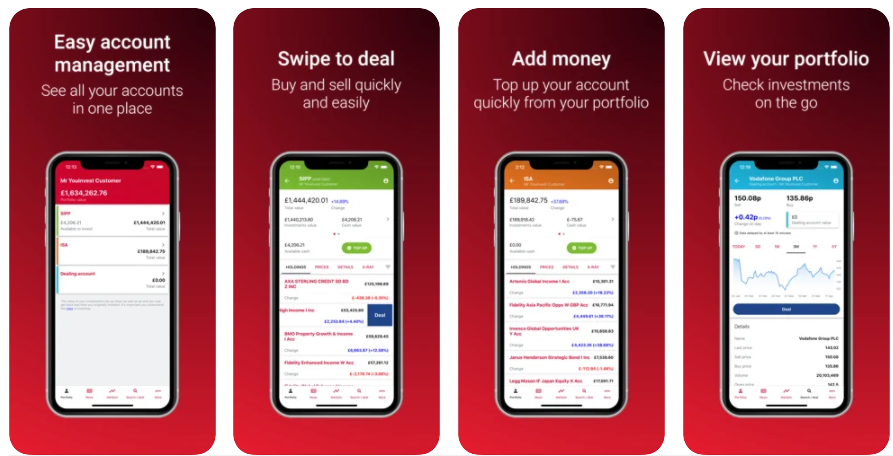

AJ Bell Investing App Review

Name: AJ Bell Investing App

Description: AJ Bell’s investing app is a good choice for anyone who is more interested in keeping costs at a bare minimum whilst still having access to a huge range of markets and account types. It’s not quite as suitable for very active investors as II and HL due to the lack of execution order types, but for those who just want to build a portfolio without trying to time the market too much, it is a very good option.

Capital at risk

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- Account types: GIA, ISA, SIPP, JISA, JISA, JSIPP

- Account charge: 0.25% annual charge

- Dealing fee: Shares £3.50 – £5, funds £1.50

Fees: AJ Bell charges 0.25% of the value of your for a general investment account, but share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 where there were 10 or more online share deals in the previous month

Special Offers:

- Recommend a friend, and you’ll both get £100 gift vouchers – When you recommend a friend to AJ Bell that invests more than £10,000 in a SIPP or ISA, you and your friend can get One4All gift vouchers worth £100.

- Switch your share dealing account and receive up to £500 to cover exit fees – If you transfer your share dealing general investment account valued at more than £20,000 to AJ Bell they will help cover any exit fees charged by your current provider. They will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person.

- Free subscription to Shares Magazine worth £220

Get a free subscription to Shares (worth over £220 per year) by maintaining a balance of £4,000 or more across your AJ Bell investing accounts.

App:

Pros

- Pick your own shares, funds and bonds or use their investing ideas

- Low account fees capped at £3.50 a month for shares

- Lots of account types

Cons

- High phone dealing charges

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

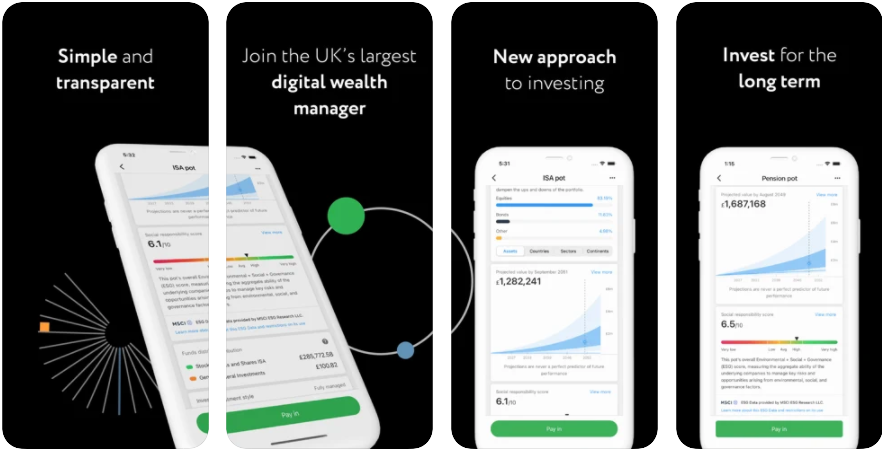

4.2Nutmeg: Best investment app for managed accounts (passive investing)

Approved by Nutmeg on the 11 September 2023

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Account types: GIA, ISA, Pension, JISA, LISA

- Management fee: 0.75% – 0.45%

- Dealing fee: £0

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future

For those that want to take a passive approach to investing and buy into ready-made portfolios via an app, Nutmeg is our top pick. Nutmeg is now owned by JP Morgan so offers financial security and is very easy to use with four key portfolios to invest in from fixed, flexible, socially responsible and Smart Alpha.

Nutmeg Investing App Review

Name: Nutmeg Investing App

Description: Owned by J.P. Morgan Nutmeg app is a great way to start investing with low to medium risk. The app is easy to use, and you don’t need to make investment decisions as there are pre-made portfolios to choose from.

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Account types: GIA, ISA, Pension, JISA, LISA

- Management fee: 0.75% – 0.45%

- Dealing fee: £0

Fees: Nutmeg charge 0.75% for their managed portfolios which drops to 0.35% for balances over £100k. For their fixed allocation portfolios, they charge 0.45% dropping to 0.25% for balances over £100k. For all portfolios, there is an additional charge by the investment fund managers of around 0.2% and the market spread on buying and selling portfolios is currently between 0.04% and 0.09%. More information on fees and products can be found here.

App:

Pros

- Simple investment platform for beginners

- Regular investing available (one off payment or Direct Debits)

- Scaled account fees that reduce as your portfolio grows

Cons

- Cannot invest in individual shares

-

Pricing

(4)

-

Market Access

(3)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

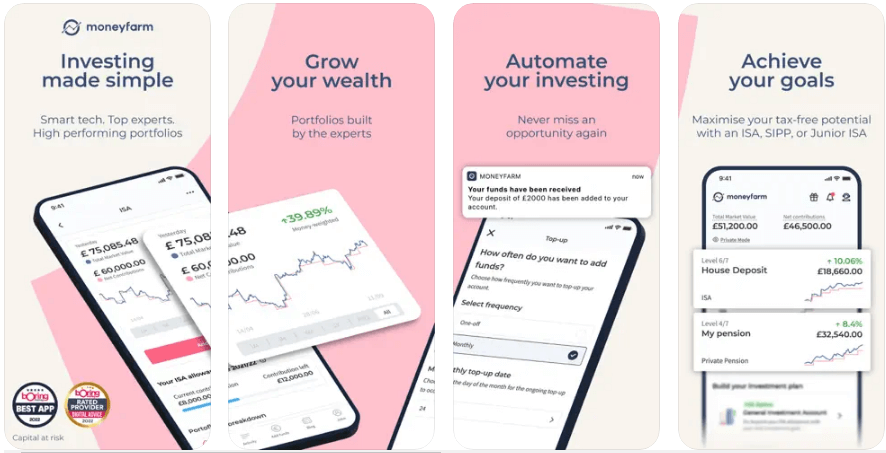

4Moneyfarm: Best investing app for simple risk-based portfolios

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Account types: GIA, ISA, Pension, JISA

- Account charge: 0.75% annual charge

- Dealing fee: £0

Capital at risk

Moneyfarm Investing App Review

Name: Moneyfarm App

Description: As a robo-advisor, Moneyfarm’s digital wealth management investing app makes personal investing simple as you don’t have to pick your own investments. You just decide how much risk you want to take. You can invest in any of their seven risk-based portfolios through a stocks and shares ISA, a pension or a general investment account.

Capital at risk.

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Account types: GIA, ISA, Pension, JISA

- Account charge: 0.75% annual charge

- Dealing fee: £0

Fees: Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%.

App:

Pros

- Risk-based portfolios

- Low-cost investing

- Easy-to-use

Cons

- Cannot buy and sell individual shares

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

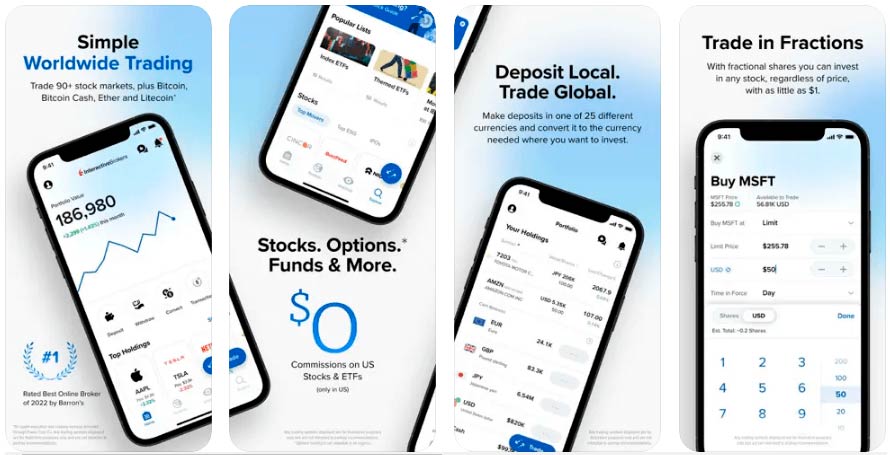

3.8Interactive Brokers: Best app for international investing

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: £0

- Dealing fee: Shares £1 – 0.05%

Capital at risk

Interactive Brokers App Review

Name: Interactive Brokers App

Description: Interactive Brokers GlobalTrader app is an excellent choice for investors who are just starting out (as it is so cheap) but will become larger and more sophisticated as their portfolio grows and want to access more sophisticated investment products. You can access thousands of markets around the world and have a wide range of investing tools. A good choice for most types of investors.

Capital at risk

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: £0

- Dealing fee: Shares £1 – 0.05%

Fees: There is no account charge for general investment accounts at Interactive Brokers. When you buy and sell shares minimum, dealing commissions are £1 in the UK or 0.05% of the deal size.

Special Offers:

- $200 when you refer a friend to Interactive Brokers – IBKR clients can “Refer a Friend” and earn USD 200 for each qualified referral while giving their friend the opportunity to earn up to USD 1000 of IBKR stock.

IBKR App:

Pros

- Excellent market coverage

- Advanced investment platform

- Low-cost investing

Cons

- Customer service can be hard to contact

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(3.5)

-

Research & Analysis

(4.5)

Overall

4.6IG: Best app for a mixture of short and long-term investing

- Investments: Shares, ETFs, investment trusts & pre-made portfolios

- Minimum deposit: £250

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: £24 per quarter

- Dealing fee: Shares £3 – £8

Capital at risk

IG Investing App Review

Name: IG Investing App

Description: IG’s investing app is a good choice if you are a regular trader and are more interested in high-risk products like CFDs and spread betting but also want to invest in the long-term. IG’s app offers a very cheap way for you to include physical shares and funds in your portfolio without the need to run multiple accounts.

Capital at risk

Summary

- Investments: Shares, ETFs, investment trusts & pre-made portfolios

- Minimum deposit: £250

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: £24 per quarter

- Dealing fee: Shares £3 – £8

Fees: IG charges a flat custody fee of £24 a quarter (£96 a year) for general investing accounts. However, if you have more than £15,000 in a Smart Portfolio managed fund or place over three trades per quarter that fee is waived. Standard dealing fees are £8 for UK and £10 for US shares. Smart Portfolio fees are 0.5% – capped at £250 per year. Fund management charges are 0.13% and transaction costs are 0.09%.

Special Offer:

- Free US stock investing – There is zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month.

Investing App:

Pros

- Low-cost investing account

- UK & international shares

- Pre-made portfolios

Cons

- Also provides access to high risk investment products

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

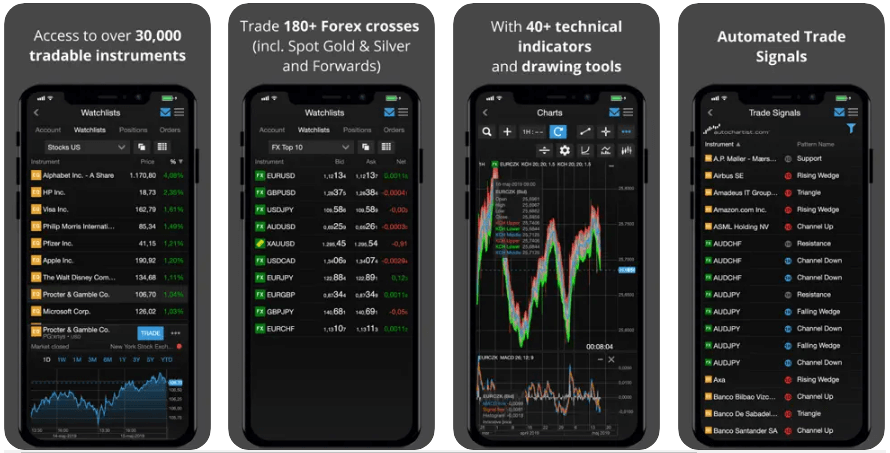

4.4Saxo Markets: Best app for experienced and professional investors

- Investments: Shares, ETFs, funds, bonds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: €10 per month or 0.12%

- Dealing fee: Shares 0.1% – 0.05%

Capital at risk

Saxo Markets App Review

Name: Saxo Markets App

Description: Saxo Markets investing app is a good choice if you are a sophisticated investor and want to manage every aspect of your portfolio actively and need an established platform. Saxo Markets app also has some of the best pricing and order execution types, meaning you can work large orders on the move as well as from their standard desktop platform.

Capital at risk.

Summary

- Investments: Shares, ETFs, funds, bonds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, derivatives

- Account charge: €10 per month or 0.12%

- Dealing fee: Shares 0.1% – 0.05%

Fees: Saxo Markets charge EUR10 a month or 0.12% a year based on the value of your portfolio (depending on which is higher). If you have a VIP account this fee is reduced to 0.08%. Dealing charges are commission based as a percentage of transaction size. They are very competitive, though and UK shares trading commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders.

Special Offers:

- Platinum – if you have £200,000 or more on account, you can apply for 30% lower transaction and account costs.

- VIP – For accounts with portfolios over £1m, you get even better pricing, direct connection to experts, 1:1 SaxoStrats access and propriety event invitations.

Investing App:

Pros

- Direct market access

- Excellent platform

- Low commissions

Cons

- May be too complicated for beginners

- Subscription fees for live pricing

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

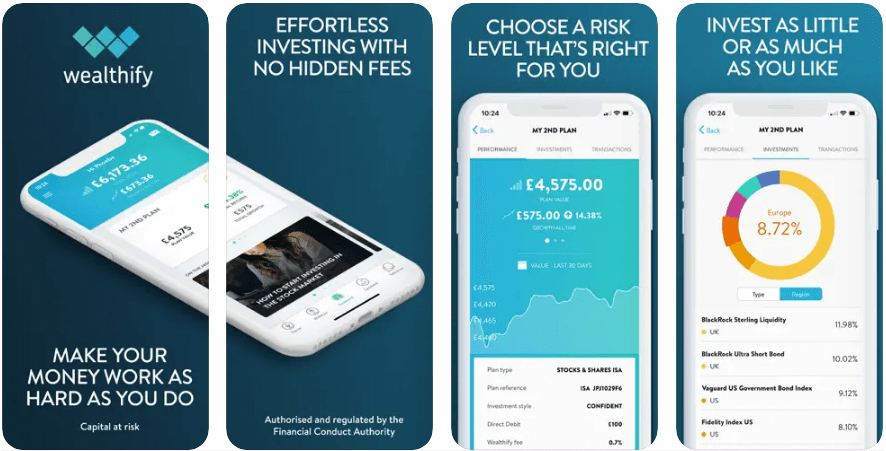

4.4Wealthify: Invest from just £1

- Investments: Pre-made portfolios

- Minimum deposit: £1

- Account types: GIA, ISA, Pension

- Account charge: 0.6% annual charge

- Dealing fee: £0

Capital at risk

Wealthify App Review

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £1

- Account types: GIA, ISA, Pension

- Account charge: 0.6% annual charge

- Dealing fee: £0

Fees: It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor general investment account fees. There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Special Offer:

- £50 when you refer a friend – You can get a unique link when you have a funded Wealthify account to use to recommend them to friends. To get the £50 bonus, your friend needs to invest at least £250 for three months.

App:

Pros

- Managed portfolios

- Low minimum deposit of £1

- Low account fee of 0.6%

Cons

- Cannot trade individual shares or ETFs

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

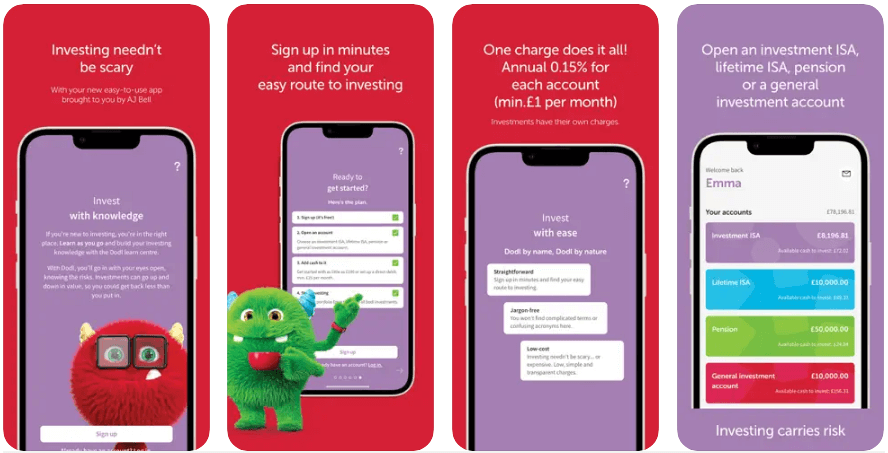

4.2Dodl: Best investing app for beginners

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- Account types: GIA, ISA, Pension, LISA

- Account charge: 0.15%

- Dealing fee: £0

Capital at risk

AJ Bell Dodl App Review

Summary

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- Account types: GIA, ISA, Pension, LISA

- Account charge: 0.15%

- Dealing fee: £0

App:

Pros

- Cheap

- Easy

- Part of AJ Bell

Cons

- Limited investment rage

- App only (no desktop)

-

Pricing

(4.5)

-

Market Access

(3)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(3.5)

Overall

4❓Methodology: We have chosen what we think are the best investing apps based on:

- over 17,000 votes in our annual awards

- our own experiences testing the investing apps accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative investment apps.

- interviews with the investment app company CEOs and senior management

Compare Investing Apps

In our comparison of UK investing apps, we compare accounts based on what different types of accounts they offer. You can also see which apps let you choose your own investments and which accounts are managed by professional fund managers.

| Investing App | App Account Fee | Min Deposit | DIY or Managed | GMG Rating | More Info |

|---|---|---|---|---|---|

| From £4.99 a month | £1 | DIY | See App Capital at risk |

|

| Shares: £0 Funds: 0.45% | £1 | DIY | See App Capital at risk |

|

| 0.25% (capped at £3.50 pm) | £500 | DIY | See App Capital at risk |

|

| 0.75%-0.45% | £500 | Managed | See App Capital at risk |

|

| 0.75% | £500 | Managed | See App Capital at risk |

|

| £0 | £1 | DIY | See App Capital at risk |

|

| £24 per quarter | £250 | DIY & Managed | See App Capital at risk |

|

| €10 per month or 0.12% | £1 | DIY | See App Capital at risk |

|

| 0.6% | £1 | Managed | See App Capital at risk |

|

| 0.2% to 0.4% | £1 | DIY & Managed | See App Capital at risk |

|

| 0.15% | £1 | DIY | See App Capital at risk |

Market Access

Hargreaves Lansdown offers access to the most funds, UK and international shares, bonds and ETFs.

You can see here how many investments different investment apps offer.

Account Types

From our comparison of investing apps both Hargreaves Lansdown and AJ Bell offer access to the full suite of account types including a general investment account, SIPP, ISA, Junior ISA, Junior SIPP and Lifetime ISA. However, we rank Hargreaves Lansdown as the investing app with the most account types as they also offer cash savings though their Active Savings product.

| Account Types |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| GIA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| ISA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| SIPP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Pension | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Junior ISA | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Junior SIPP | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Lifetime ISA | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

⚠️ FCA Regulation

All investing apps that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK investment apps are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only investing apps that are regulated by the FCA, where your funds are protected by the FSCS.

Investing App FAQs:

Only investing apps that are regulated by the FCA are safe. If you invest with an FCA-regulated investing app your funds are covered up to a certain amount by the FSCS.

- Further reading: Are investing apps safe?

Yes, investing apps are an essential tool for making and maintaining a successful portfolio. Everyone should download an investing app as soon as possible. Investing apps provide a very low cost and often free way to start investing. By starting small and early you can use compounding returns to maximise your investments for later on in life.

Investing apps, are particularly worth it if you have a small starting balance, a five-year + investment time frame and are prepared to take some risk to get better returns than in savings accounts.

Even if you are a large investor, that uses your brokers main platform investing apps provide an excellent way to remain connected to the markets and check on performance wherever you are.

However, there is a downside to investment apps. Because you have constant access to your long-term investments, you may be tempted to buy and sell on a more regular basis. Which is more of a trading strategy, rather than investing.

Investing apps make money through commission when customers buy and sell investments as well as account charges. You can see a comparison of account charges and commission in our investment account comparison table.

Investing apps, are different to trading apps, in that investing apps are for long term capital growth where you can invest in normal investing accounts, stocks and shares ISAs and SIPPs, whereas trading apps are more for short term speculation like financial spread betting and CFDs.

Yes, generally investing apps are free to download from the relevant app stores. The providers of the investment apps will charge for the services that are on offer through the app. This charge is usually deducted from your investment account, rather than charged through an app store.

Yes, you can make money with an investing app. However, when investing you only make money if you choose good investments. the value of any investment can go up as well as down.

Investing apps connect to investment platforms and allow you to monitor your portfolio and make trades on the go via devices such as smartphones and tablets. All you need is your device and an internet connection. The key advantage of apps is the level of convenience they provide – you can invest wherever you are and react quickly to opportunities if you need to.

AJ Bell Youinvest is the cheapest investing app, with account fees starting from 0.25%. It is important to note that some other investing apps like IG and Interactive Brokers offer free investing accounts, but as they are primarily derivatives platforms they have been discounted from this comparison.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the provide via a non-affiliate link, you can view the product pages directly here: