In this Wealthify review we give our ratings based on their nearest peers and tell you what we think of them after testing them thoroughly. Plus we highlight the key costs, facts and figures of their accounts.

Wealthify Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

Expert Review

Wealthify Review

Name: Wealthify

Description: Wealthify is a digital wealth manager or “robo-advisor” that offers low-cost pre-made portfolios through their Original or Ethical investment plans. Wealthify is now owned by Aviva, and customers can set their own risk/reward threshold and invest through a general investment account, stocks and shares ISA, junior ISA or pension.

Capital at risk

Why we like it

- Investments: 5 pre-made portfolios

- Account types: GIA, ISA, Pension, JISA

- Costs: 0.6%

Fees: 0.6% of portfolio value. There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Wealthify is a great investment option for people that want a simple low-cost investment account. They offer pre-made diverse portfolios to invest in where you can set your own goals, risks and potential returns.

Pros

- Owned by Aviva

- Simple investment options

- Low-cost

Cons

- Cannot buy individual shares

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.5Ratings Explained

- Pricing: One of the cheapest robo-advisors around.

- Market Access: Limited to their own portfolios, but suitably diverse and you can set your risk level.

- Platform & Apps: Both very easy to use with good portfolio projection tools.

- Customer Service: Rated highly for support from real people in Wales.

- Research & Analysis: Some good analysis around portfolio rebalancing.

Richard’s Wealthify Review

For years people have been trying to make investing interesting, but it’s not, it’s dull. Trading is fun, high-risk, fast, dangerous and like sprinting. But, like trying to run too fast, especially when you hit 40, you’ll probably injure yourself just as in trading, you’ll probably lose money. Investing used to be like a marathon, you’d have an annual four-hour meeting with a wealth manager who will recite your fund prices from the back of the FT, before rolling your portfolio over for his annual commission, but now it’s even more hard work.

To make investing interesting, robo-advisors like Wealthify (or “digital wealth managers” as they prefer to be called) have been trying to democratise it and make investing open for everyone. They say, “look investing can be fun, if you don’t want it to be a marathon, we’ll make it a triathlon instead”. Which, as you know takes roughly about the same amount of time as a marathon, but is a swim, a bike ride and then a run. This closely translates into investing similes as, “it’s still a massive slog, but we’ll make it more interesting, by giving you an app (like Strava) so you can track your performance in real-time and give you variety by risk and region”.

So, by democratising investing, robo-advisors have actually made it harder. You have to make more decisions, be more involved, and you’ve now got an app so you’ll constantly be looking at (and therefore tweaking), your ISA and pension. When actually, what you should be doing is investing, then do nothing.

Or should you?

A while ago I interviewed the Wealthify CEO, Andrew Russell, and one thing we discussed was how important it is to encourage people to start investing, instead of just saving. Because without the benefit of compounding returns in the long-term if you just save and don’t invest, your money will be worth less.

He told me:

Currently, with such low interest rates on savings products, people are walking past their own money really as they are missing out on that opportunity for greater fund growth.

Clearly, if you tried to convince the young to start investing by explaining how compounding works, you’d have no customers at all. But one, thing Wealthify does really well is straight off the bat tell people how much their money “could” be worth in the future, particularly for regular investing.

Which is a very powerful message to send, and one that should always be front and centre.

Generally, the earlier you start investing, no matter how small, the better off you will be.

When I was setting up an account, I said I would invest £100 a month with one of their Adventurous plans which Wealthify said after 23 years it could be worth £43k (or £34k with a Cautious plan). Think of the rubbish you spend £100 a month on. When I retire, I might be able to buy a Caterham, although I’ll be too old to drive it then.

It’s not entirely clear where this prediction comes from when they give it to you, but presumably, it’s based on historic returns from the various plans.

Obviously “past performance is not indicative of future results”. As if the market tanks (which it always does at some point) you’re going to be sitting on a loss. But before robo-advisors came along, if you wanted to open an account and invest with low-to-medium risk you had to go to the bank and sit down with an advisor, fill in a load of forms, and nod in bemusement as they explained why the Asia ex-Japan emerging markets fund would potentially make you more money than a treasury based fund of funds. I remember doing it, and it was exhausting, and I had just come back from working on the NYMEX oil trading floor in New York, so was in the business even back then.

Thankfully now though, it’s so easy to open an account and invest, and that’s where the real democratisation of investing is.

The way people are invested is basically the same, with diverse portfolios spread across asset classes and regions, albeit cheaper, with the use of ETFs instead of active fund managers. People have always been able to invest monthly, with even very modest amounts. But what makes investing accessible is not how it’s done, but how easy it is to get started. Even up to a few years ago, if you wanted to open an ISA account with Hargreaves Lansdown, you had to fill in a paper application and post it back.

With Wealthify, I didn’t even have to put in a password to get started. I managed to fund my account without getting my debit card out of my pocket, by directly linking my bank account, another massive bonus for regular investors (because if you pay by debit card and it expires your contributions stop). I think overall it took less than five minutes to get a plan set up and funded. It’s a very slick app and website, and everything is where you expect it to be. There will always be a debate around active versus passive fund management, but the performance difference between wealth managers is generally very slim as there is a fairly standard way to create risk and region-based portfolios. Plus, if you want to beat the market, you have to take on more risk. If you just want to beat inflation, you probably won’t beat the market.

One of the main advantages of robo-advisors is how cheap they are compared to traditional wealth managers (because you don’t get personal advice) and Wealthify is one of the cheapest of the bunch. Wealthify account fees are 0.6% a year of your portfolio, versus Nutmeg & Moneyfarm’s 0.75%. So if you have £100k on account you’ll be paying Wealthify £600 as opposed to £750 for the other accounts. Over a 23-year period, that is a saving of £3,450 (and that doesn’t take into account compounding returns if you reinvested that saving).

You do of course have to pay fund fees on top of that, which are again cheaper with Wealthify. They say their average fund fees are 0.16% (Nutmeg & Moneyfarm are about 0.2%). Fund fees are the costs of the assets in the Wealthify plans, which are managed by investment professionals. For example, Wealthify plans are made up of funds and ETFs from Vanguard, L&G, HSBC, Fidelity and Mercer. All those funds charge a fee for choosing and managing the assets that the funds are invested in. If you want to know what is in the funds, you can look it up on trustnet, see for example the Vanguard US Equity Index Acc GBP (which is currently 23% of the Adventurous plan). So actually, just like everyone else, your investments are quite heavily linked to US tech stocks like Apple, Microsoft, Alphabet, Amazon, Tesla and Warren Buffet’s Berkshire Hathaway.

For the more ESG and ethically minded, you can still invest in an Ethical Adventurous plan, but assets include funds and ETFs with “sustainable” in the title, like the Liontrust Sustainable Global Fund that contains stocks like Thermo Fisher Scientific, a US stock worth around $200bn that (among other things) makes scientific instruments.

I also really like Weathify as a business. It seems there are new investing apps being set up every week, all with different USPs, but most are woefully underfunded and you have to wonder how many times they will be going back to Seedrs and Crowdcude to tap up investors because their burn rate is extortionate as they have yet to onboard a meaningful number of customers to generate revenue, or even, god forbid, make a profit.

Wealthify, has gone through that, but come out the other side. They were founded by Michelle Pearce-Burkestarted with £500k from Richard Theo in 2015, then a further £1m from crowdfunding on Seedrs in 2016, followed by £15m from Aviva in 2017. Wealthify was then fully bought out by Aviva in 2020. Which, if I were to found a new fintech, would be my dream roadmap.

Even though I have invested with Wealthify, I wish I had also invested “IN” Wealthify, but that’s a whole other story and one with a completely different risk appetite

Being Aviva owned is great for clients because it offers a huge amount of financial security, and of all the robo-advisors out there only Wealthify and Nutmeg (JP Morgan), have the backing to ensure that they may still exist in twenty years time. This is important because investing isn’t like using a credit card or buying car insurance, where you can switch every year. When you invest, you may well be with that provider for fifty years.

When I interviewed Linsey Rix, the head of UK Savings and Retirement at Aviva, one of the reasons they were so interested in Wealthify, was because it gives them a chance to get people investing, who may have been put off by the established and grown-up nature of Aviva.

She told me:

Wealthify plays a very important role for certain types of savers, which means we offer a broad range, both of digital journeys that customers can invest in, but also, we think it important for many of our pension customers to have the opportunity to talk to people as well.

You can tell Wealthify is owned by one of the bigger boys like Aviva as well, because even though it is very easy to set up an account, they are still heavy on the compliance. I actually failed the suitability test. I filled it in as though I was a beginner investor and was told I couldn’t invest because I didn’t understand the risks of stock market investing. Although, I re-took it with a greater appreciation for risk and was granted permission to create a plan. But it’s a good example, of how whilst everyone should be able to invest, not everyone should actually invest.

If you are of the social media persuasion you can also use their refer a friend program to get a £25 boost in your portfolio if they invest more than £250 and leave it there for six months.

Afterall, just like training for a triathlon, if you do it with friends it is easier, and just like investing if you take an active interest in your health you will be healthier and wealthier in the long run.

Wealthify Awards

Wealthify won best “managed stocks and shares ISA” in our 2023 awards.

Wealthify Video Demo

Wealthify Portfolio Performance

For Wealthify’s performance, we have focused on its ‘original’ funds (it also offers ethical funds) between 2019 and 2023. Here, it has five different funds with different risk levels. Performance net of fees is listed below.

| Risk level | Cautious | Tentative | Confident | Ambitious | Adventurous |

| 2023 | 4.7 | 6.2 | 7.8 | 9.4 | 11.3 |

| 2022 | -11.2 | -10.8 | -10.3 | -9.4 | -9.1 |

| 2021 | 0.5 | 3.7 | 6.7 | 9.7 | 12.8 |

| 2020 | 2.7 | 3.9 | 4.9 | 5.1 | 5.1 |

| 2019 | 6.4 | 9.4 | 11.9 | 14.4 | 17.1 |

| £1k would have grown to | £1,021 | £1,117 | £1,211 | £1,307 | £1,405 |

With this provider, £1,000 in the most aggressive portfolio would have grown to £1,405 over the five-year period.

Is Wealthify’s junior ISA ethical or risky?

It’s both! When you invest in a junior ISA through Wealthify, you have the choice of an ethical investment plan. However, as you are investing in ethical elements of the stock market, there is a risk that the value of your child’s portfolio could go down.

Wealthify’s junior ISA, lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

It costs 0.6% to start investing in a junior ISA with Wealthify, which is one of the cheapest robo-advisor general investment account fees. There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Is Wealthify’s pension any good?

Overall we rate Wealthify as a good managed pension, but it is not a SIPP pension as you cannot invest in individual shares, instead you pick one of their portfolios based on how much risk you want to take, so it’s more of a private managed personal pension. We rate Wealthify as a safe pension (despite performance risk) as they are regulated by he FCA and owned by Aviva.

Wealthify charges a flat annual fee of 0.6% for their pension. *There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Please note: Wealthify is unable to accept any pensions that customers are taking an income from or transfer any pensions with defined benefits or guarantees.

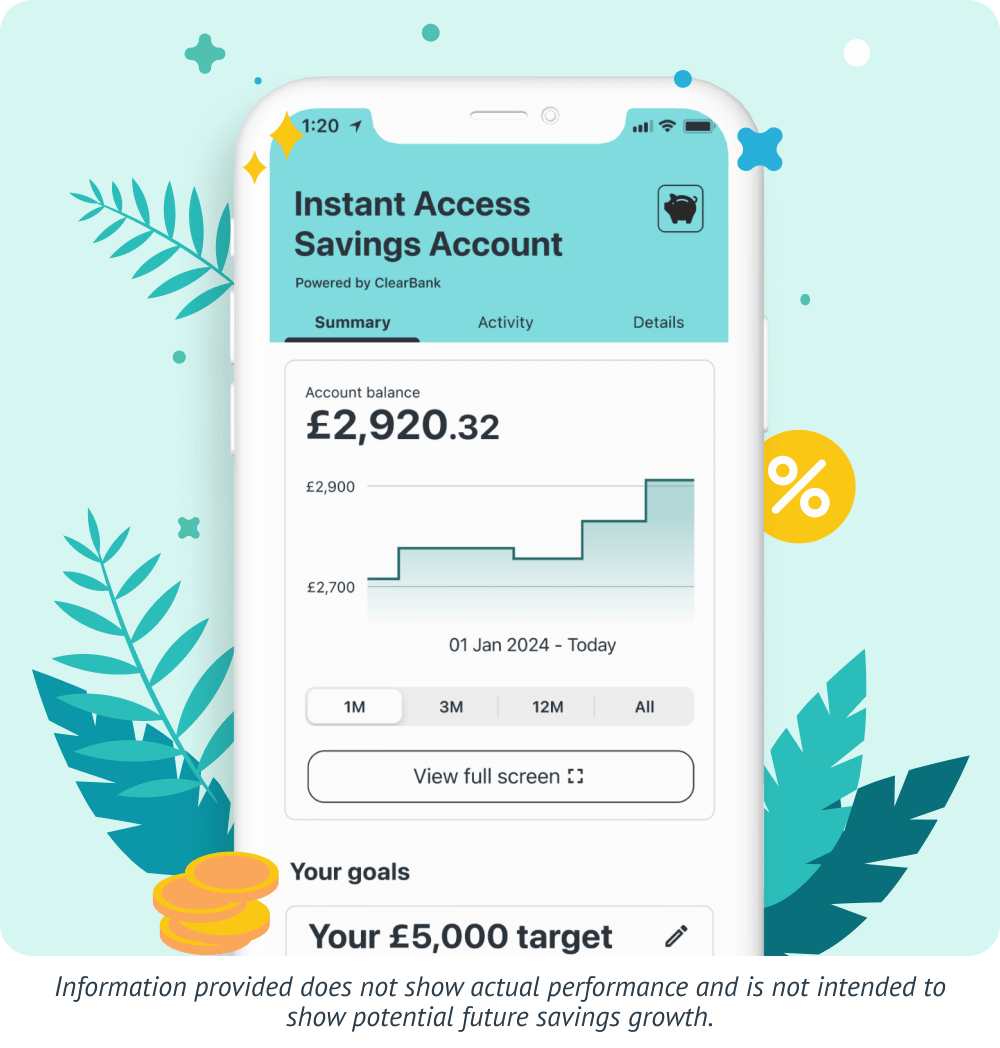

Can you save money with Wealthify risk free?

Up until recently, your only option was to risk your money in the stock market with Wealthify. But now, digital wealth manager has launched an instant savings account that will pay a decent amount of interest on deposits from £1 upwards. And there is no upper limit on deposits into the account. The instant savings account is undergoing a soft launch, though it is featured prominently on Wealthify’s website.

Interest rates

The current rate of interest is +4.91% AER. or an annual equivalent rate, which equates to a rate of +4.80% annually. The rate will be variable and will track changes in UK base rates.

Wealthify even provides a link on its website allowing users to monitor interest rates set by the Bank of England.

A deposit of £1000.00 in the account would earn £49.08 in interest over 12 months, assuming base rates remain unchanged.

The account is open to UK residents who are 18 years of age or older and are UK taxpayers.

For now, at least clients will only be able to open one instant savings account with Wealthify.

Easy access

Customers will be able to access their funds at any time without restrictions via the Wealthify website or app.

Transfers can take up to three hours to process and withdrawals will be paid into the client’s nominated bank account.

This will normally be the account from which the funds were deposited in the first instance.

Clearbank

Wealthify is not a bank and its new instant savings account is powered by ClearBank a fully regulated UK bank.

As such customer deposits will be covered by the UK FSCS, up to a value of £85,000.

ClearBank operates purely online and does not have any physical branches, nor will Wealthify customers be able to withdraw funds from their savings account via an ATM.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.