-

Richard Berry

Richard Berry

- Updated

Spread betting brokers let you speculate on the price of shares, indices, commodities, forex and fixed-income markets going up or down through financial spread betting. Financial spread betting platforms are unique to the UK as trades are structured as bets on a value-per-point movement basis and there is no capital gains tax due on profits.

✅Good Money Guide has tested and ranked the best spread betting brokers in the UK to help you choose the most appropriate platform for your trading strategy.

The UK’s Top Spread Betting Brokers Compared

To find the best platform for you, use our comparison tables of what we think are the best spread betting brokers to compare how many markets they offer, how much it costs to trade major instruments, minimum deposits and what the overnight financing costs are for holding longer-term positions.

| Spread Betting Broker | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 12,000 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider | |

| 3,981 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Our Picks of the Best Spread Betting Brokers Reviewed

✅Methodology: Good Money Guide chose the UK’s best spread betting brokers based on:

- 17,000+ customer votes in The Good Money Guide awards

- Our team’s own experiences testing the spread betting trading platforms with real money

- A deep dive into the features that make them stand out compared to alternatives

- Exclusive Good Money Guide interviews with the spread betting brokers CEOs and senior management

- Read more about how we rate and review here.

City Index: Best Spread Betting Broker For Trading Signals & Post-Trade Analysis

- GMG rating: (4.3)

- Customer rating: 3.6/5 (99 reviews)

- Spread betting markets available: 12,000

- Minimum deposit: £100

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

71% of retail investor accounts lose money when trading CFDs with this provider

Is City Index a good spread betting broker?

City Index is one of the best spread betting brokers and is suitable for all types of traders looking for a tax-efficient way to speculate on the financial markets. City Index also won our “best trader tools” award in 2023.

Overall City Index’s spread betting platform is one of the best around with competitive pricing, a wide range of markets to trade, and some very good added value tools to help traders seek out opportunities and improve their trading strategy

Spread bets at City Index are available on 12,000 markets including, 23 equity indices, thousands of UK and international stocks and ETFs, 19 commodities, bonds, and interest rates, and an industry-leading 182 FX pars. City Index also has an options desk for spread betting on index and populare stock options.

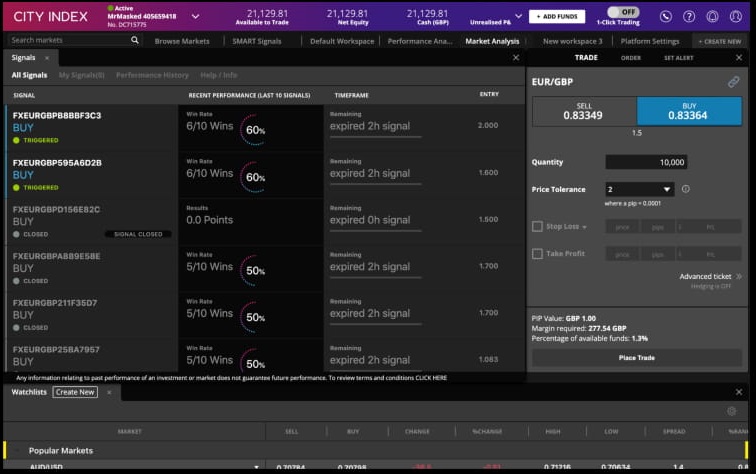

When I tested City Index’s spread betting account there were two things that made it stand out, SMART Signals and Performance Analytics.

SMART Signals, is one of the best trading signal services out there and is developed in-house by City Index. The idea is that the algorithm scans the market for price patterns and highlights upcoming trading opportunities. It differs from the standard offerings from Autochartist and Trading Central, by being fully integrated giving you the ability to trade via a single click, as well as being fully transparent by displaying the previous P&L per asset.

The other spread betting tool, that is unique to City Index is Performance Analytics. Whilst other brokers provide post-trade analysis, When StoneX (City Index’s parent company) acquired Chasing Returns, they were able to exclusively provide a huge amount of data to help their customers stick to a trading plan and provide insights into what can make them a better spread bettor.

As with most spread betting brokers, City Index clients trade via two-way bid-offer prices the difference between the bid and offer representing the spread. These vary by product and contract but in the FTSE 100 index City charges a minimum spread of 1 index point and on the Germany 30 or Dax it charges 1.20 points. You can trade Spread Bets on leading equity indices up to 24 hours per day. For stock trading, spreads of 0.8% for UK and 1.8 cents per share are built into the price.

City Index Spread Betting Platform

City Index Review

Name: City Index

Description: City Index is one of the oldest spread betting and CFD brokers based in the UK. They were founded in 1983 and offer trading in over 13,500 financial markets, to around 126,000 active clients. City Index is currently owned by StoneX, a US brokerage listed on the NASDAQ valued at $1.75bn.

71% of retail investor accounts lose money when trading CFDs with this provider

Why we like them:

City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

Pros

- Excellent trading tools

- Post-trade analytics

- Publically listed (part of StoneX)

Cons

- Trading only, no investment account

- Limited options markets

- No direct market access

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3Pepperstone: Best Spread Betting Platform For MT4/MT5

🏆Featured🏆

- GMG rating: (4.1)

- Customer rating: 4.6/5 (86 reviews)

- Spread betting markets available: 1,200

- Minimum deposit: £1

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone a good spread betting broker?

Pepperstone introduced spread betting in early 2021 with a focus on tight pricing for major instruments and automated trading on through trading platforms.

Overall, Pepperstone is a good choice for clients that want to spread bet on MetaQuotes as it’s MT4 & MT5 package is one of the best around. Plus Pepperstone are one of only two brokers that offers spread betting through TradingView.

Pepperstone operates a tiered approach to spread betting accounts. Newer clients typically joined Pepperstone’s standard accounts; more experienced traders can elect to join the firm’s Razor account. The latter is used mainly for scalping and algorithmic trading. As seen below, Razor accounts have lower spreads than standard accounts in the FX markets but they also incur some commissions.

Pepperstone does not charge an inactivity fee, which is excellent for low-latency traders. The firm has no regular maintenance fee like some investment accounts. There is no minimum deposit either.

In the UK, Pepperstone offers protection on negative balance for retail clients only. This means that should the market swing violently against you and wipe out your risk capital, your account will not go below zero. Professional accounts, however, will be required to post additional equity and can go into negative equity.

For funding, Pepperstone accepts Visa, MasterCard, Paypal or bank transfers.

Most withdrawals are free, although international Telegraphic Transfer (TT) may incur fees by the banks which will be passed on to clients.

Pepperstone Spread Betting on MT4/MT5

Pepperstone Review

Name: Pepperstone

Description: Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Why we like them

Pepperstone is a good choice for traders that want to automate their trading strategies through MT4. As far as MT4 brokers they are one of the biggest and best and offers so good EA packages.

Pros

- Tight pricing

- Wide range of MT4 markets

- Pre-built MT4 indicator packages

Cons

- Limited market access

- Only third-party platforms

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1Spreadex: Best UK Spread Betting Platform For Customer Service & Small Caps

🏆Featured🏆

- GMG rating: (4.4)

- Customer rating: 4.3/5 (255 reviews)

- Spread betting markets available: 10,000

- Minimum deposit: £1

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

72% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex a good spread betting broker?

Spreadex is one of the last spread betting brokers to offer a mixture of financial and sports spread betting, for those who want to trade the FTSE during the week and the Footie on the weekend. I’ve used both services for nearly 20 years and have seen them mature along with the industry.

Overall, Spreadex is an excellent spread betting broker for those who want personal service and the ability to speculate on financial as well as sports markets.

Based in St Albans, just outside of London Spreadex offers a simple but innovative spread betting platform for trading a wide range of assets. Spreadex has always focused on customer service, winning business from referrals and maintaining long-term relationships with their clients.

It’s a testament to the business that they build their own technology in-house and are reserved with marketing campaigns.

They offer access to over 10,000 markets and recently Spreadex has reduced spreads across the major assets and still offers access to smaller-cap stocks compared to some of the other providers.

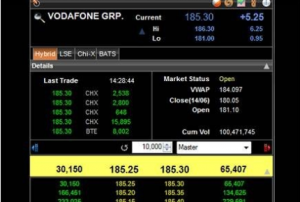

The spread betting platform does have some good charting options, such as adding pro trading tools like WVAP and pro trend lines, as well as the usual obligatory technical indicators like Bollinger Bands and Moving Averages. You can see what percentage of clients are long on watchlists and you can quickly go to a specific time point on a chart.

There is also a wide range of ETFs, ETCs and Trackers to spread bet on for sector speculation, and you also have the option to trade political markets.

Spreadex Spread Betting Platform

Spreadex Review

Name: Spreadex

Description: Spreadex is a financial spread betting broker that has been in operation since 1999. It was founded by ex-city trader Jonathan Hufford and unlike many of its peers, it is not based in London, but instead is headquartered in St Albans Hertfordshire. Spreadex offers both financial spread betting and CFD trading from the same account. The company has some 60,000 account holders and offers access to more than 10,000 financial instruments, including UK small-cap shares, where it is something of a specialist.

Is Spreadex a good broker?

Spreadex is one of the most established spread betting brokers. They focus on providing excellent customer service through experienced dealers and a trading platform built from scratch in-house. A good choice for those that like to spread bet.

Pros

- Spread betting & CFDs

- Smaller cap stock trading

- Great customer service

Cons

- Not publically listed

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

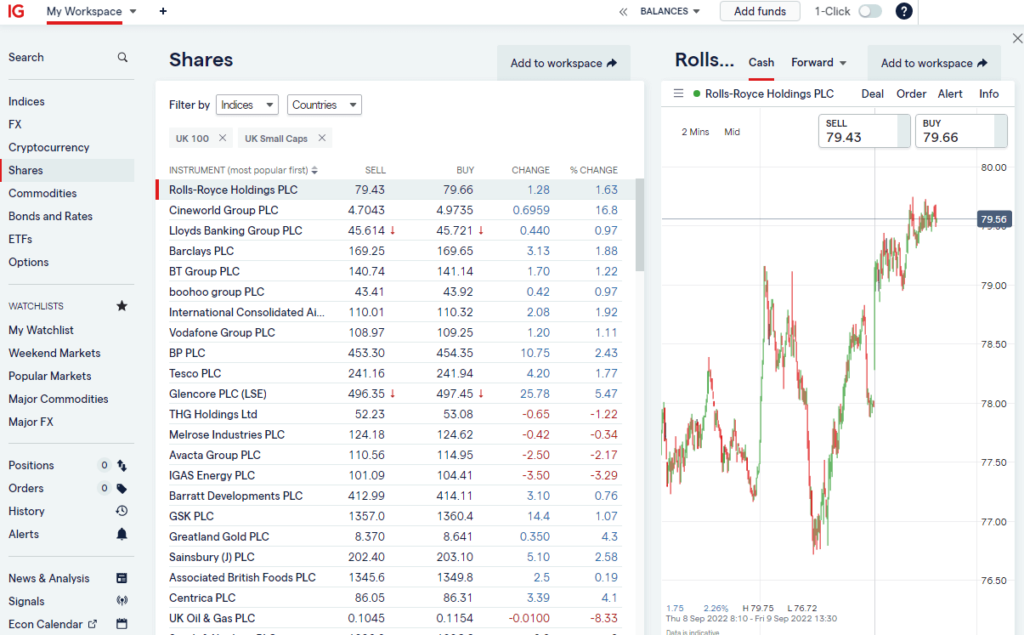

4.4IG: UK’s Best Overall Spread Betting Broker

🏆Award Winner🏆

- GMG rating: (4.7)

- Customer rating: 3.9/5 (677 reviews)

- Spread betting markets available: 17,000

- Minimum deposit: £250

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a good spread betting broker?

IG won “best spread betting broker” in our 2023 and 2022 awards as it continues to be the best spread betting platform. As well as inventing the concept of financial spread betting in 1974, IG also offers access to the most markets, with the most liquidity and are, (by market cap as of April ’22) the biggest spread betting broker valued at over £3.5bn.

Overall, IG is the best spread betting broker is suitable for beginners through to professional high volume and high-frequency traders.

With IG you can spread bet on over 17,000 markets (an industry-leading amount) including 51 forex pairs, 38 commodities, 34 indices and over 10,000 UK and international stocks.

A few key features that make IG’s spread betting platform stand out are the ability to bet on smaller-cap shares, trade IPOs pre-market via their “grey market” and their liquidity. IG’s liquidity can actually be better than the underlying exchange, so you can place and get filled in large orders using IG’s internal liquidity when there might not be the volume on the exchange order book.

Even though IG internalises order flow they do not profit from client losses instead hedging or matching order flow and operating symmetrical tolerance levels. This means that you also benefit from positive slippage, so if you place a spread bet limit order and the market moves in your favour before it is executed you get a better fill.

When I compared pricing against other spread betting brokers IG spreads are always competitive and often market-leading, especially in the major instruments, but where IG wins business is its ability to continually innovate and add value to its spread betting platform. There are trading signals from Autochartist and PIAfirst, but IG takes it a step further by making executing these signals easier and integrating dealing tickets. IG has a good post-trade analytics feature that can show you where you are profitable or not and they create a huge amount of analysis and research around what their clients are trading based on platform analytics.

IG Spread Betting Platform

IG Review

Name: IG

Description: Founded in 1974 as Investors Gold Index, then IG Index, now just “IG” is one of the world’s largest margin trading brokers. IG offer CFDs, FX and Spread Betting (in the UK) alongside share trading and prime brokerage to over 313,000 active clients and offers 17,000 tradable markets. IG also recently introduced physical share dealing and smart portfolios for longer-term investors.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a good trading platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service can be slow

- No DMA futures trading

- Still charges inactivity fee

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7CMC Markets: Best Spread Betting Trading Platform For Sentiment Indicators

- GMG rating: (4.6)

- Customer rating: 3.7/5 (148 reviews)

- Spread betting markets available: 12,000

- Minimum deposit: £1

- Equity overnight financing: 2.9% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

74% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets a good spread betting broker?

Overall, CMC Markets is an exceptional spread betting platform with innovative features suitable to frequent traders wanting to trade on tight spreads.

CMC Markets pioneered electronic trading in the UK during the early 1990’s and introduce financial spread betting to complement its CFD and forex trading in 2001. Since then the Market Maker spread betting platform has evolved into the “Next Generation” platform and is one of the best proprietary trading platforms for active traders in the industry.

CMC Market’s spread betting offering has always won business by producing great technology that reduces the cost of trading. By focussing on mobile and online trading, they now see over 70% of spread bets go through on mobile versus online.

I found that CMC Market’s spread betting prices were always tight and hail from the original online platform name (Deal4Free, and slogan “compare the spread”). CMC Markets also invented the concept of the daily cash rolling spread bet so traders no longer need to trade the futures price, reducing trading costs further.

Whilst CMC Markets focus on the major markets, they do actually offer access to quite a large amount of assets, over 12,00 including an industry-leading 338 fx crosses (CMC did start as a forex platform), 124 commodities, 28 indices and hundreds of UK and international stocks.

Two of CMC Market’s very innovative spread betting features are how they break down client sentiment and their share baskets. It’s commonplace for spread betting brokers to display client sentiment, but CMC Markets let you filter that sentiment down to profitable clients so it can become more valuable. They also provide a wide range of weighted share baskets so you can spread bets on sectors like driverless cars, big tech, cyber security and China tech, where ETFs have not yet been created.

CMC Markets Spread Betting Platform

IG Review

Name: IG

Description: Founded in 1974 as Investors Gold Index, then IG Index, now just “IG” is one of the world’s largest margin trading brokers. IG offer CFDs, FX and Spread Betting (in the UK) alongside share trading and prime brokerage to over 313,000 active clients and offers 17,000 tradable markets. IG also recently introduced physical share dealing and smart portfolios for longer-term investors.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a good trading platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service can be slow

- No DMA futures trading

- Still charges inactivity fee

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7ThinkMarkets: Great For Backtesting Spread Betting Strategies

- GMG rating: (4)

- Customer rating: 5.0/5 (71 reviews)

- Spread betting markets available: 3,981

- Minimum deposit: £10

- Equity overnight financing: n/a

- Pricing: n/a

66.95% of retail investor accounts lose money when trading CFDs with this provider

Think Markets Review

Name: Think Markets

Description: ThinkMarkets is a multi-awarded provider of online trading services. Regulated by the Financial Conduct

Authority (FCA), this reputable broker offers spread betting and CFD trading on global financial markets,

such as forex, stocks, indices, commodities, ETFs, and futures.

ThinkMarkets offers traders the flexibility to trade on a wide range of cutting-edge and advanced trading

platforms, including its proprietary trading platform, ThinkTrader.

68.31% of retail investor accounts lose money when trading CFDs with this provider.

Summary

ThinkMarkets is known for its excellent trading conditions. Forex traders benefit most from its ThinkZero account, with spreads as low as 0.0 pips. Its feature-rich platforms also come with superior tools, such as Signal Centre, Traders’ Gym, and TrendRisk Scanner, all designed to support traders with market insights and trading ideas.

Pros

- Wide choice of platforms

- Tight spreads

- Trading signals & analytics

Cons

- No UK shares

- No options trading

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4How To Choose A Spread Betting Broker?

A spread betting broker lets you trade the financial markets with trades structured as bets. This means that as you are technically gambling rather than investing, all profits are free from capital gains tax.

Financial spread betting is a tax-free type of trading in the UK because the trades are structured as bets. As there is no capital gains tax due on gambling in the UK profits can be tax-free. For more information read our guide on why financial spread betting is tax free.

When choosing a spread betting broker, you need to compare more than just costs. The main things to consider when choosing a spread betting trading platform are:

- Market access – how many instruments can you spread bet on? (IG offers the most markets)

- Minimum deposit – can you test the platform with a small amount when you start? (Spreadex, CMC & Pepperstone all have £1 minimum deposits)

- Account types – do they offer DMA spread betting as well as OTC (over-the-counter)? (IG offers the most account types)

- Inactivity fee – is there a charge if you do not use your account? (CMC, Pepperstone and Spreadex do not charge inactivity fees)

- Founded – how well established is the spread betting platform? (IG is the oldest spread betting broker)

- PLC – public spread bet firms that are listed on stock exchanges have to report their financial health on a more regular basis. (IG and CMC are listed on the LSE, CIty Index is owned by StoneX which is listed on the NASDAQ)

Pros & Cons Of Using A Spread Betting Broker

Pros

- Tax free profits: As traders are strucutred as bets you don’t have to pay capital gains tax on profits.

- Go long or short: As financial spread betting is a derivative product you can speculate on the market gonig up or down.

- Leverage: You can be more effecient with your risk capital and get more exposure to stocks and financial markets with only a small deposit.

Cons

- Risky: You could lose as well as make money when speculating in high risk investment products like spread betting.

- No underlying ownership: When trading stocks as a spread bet you have no voting rights on corporate actions.

- Leverage losses: As you are trading on margin it is possible to lose money very quickly.

✅Good Money Guide only features spread betting brokers and platforms that are FSC regulated:

All spread betting brokers operating in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK spread betting brokers are properly capitalised, treat customers fairly and have sufficient compliance systems.

You are also protected by the FSCS (Financial Services Compensation Scheme).

Best Spread Betting Broker For Beginners

The Good Money Guide team has ranked City Index as the best spread betting broker for beginners as they offer a simple trading platform with lots of analysis and news. You also get trading signals from their unique Smart Signals feature and you can use the Performance Analytics feature to see which particular markets you are trading most profitably.

This comparison table shows which spread betting platforms have tools that are helpful for new traders.

| Account Types: |  |  |  |  |  |

|---|---|---|---|---|---|

| Trading Signals | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ✔️ | ❌ | ❌ | ✔️ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ |

| Low Risk Products | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Investment Account | ❌ | ❌ | ❌ | ❌ | ✔️ |

Our Top-Rated Spread Betting Platform For Experienced Traders

IG is the best spread betting broker for experienced traders as their liquidity and market range are unparalleled. IG’s internal matching means that there can be better liquidity on their order book than on the underlying exchange, which is particularly good for working larger orders above the NMS (normal market size). IG also have a specialist desk for high-net-worth traders with personal dealers assigned to your account.

If you are an advanced trader with plenty of experience spread betting, this comparison table shows the features commonly used by professional traders.

| Advanced Features: |  |  |  |  |  |

|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Algo Trading | ❌ | ❌ | ❌ | ✔️ | ✔️ |

| Prime Brokerage | ❌ | ✔️ | ❌ | ❌ | ✔️ |

Our Favourite Forex Trading Spread Betting Broker

City Index offers the most forex pairs for spread betting on foreign exchange, as well as intra-day trading signals, news, analysis and tight FX pricing.

Spread betting on Forex is all about tight prices, speed and market timing. It is one of the most actively traded markets in the world. Positions are generally turned over much faster than any other asset class, and traders aim to take quick profits. Finding a spread betting broker with really tight FX spreads can make a big difference to your profit and loss at the end of the trading day.

Our trading experts ranked the best spread betting brokers by how many forex pairs they offer:

- CMC Markets: 338

- City Index: 182

- Pepperstone: 62

- Spreadex: 60

- IG: 51

What Spread Betting Broker Is Best For Stocks & Shares?

IG currently offer the largest amount of UK, US and international shares to spread bet on. As well as a huge range of stocks to trade they also provide technical and fundamental trading signals through autochartist and PIAfirst. There is also excellent integrated news coverage and analysis, economic diaries so you can see which companies are reporting and for larger traders excellent liquidity for working orders outside the usual normal market size (NMS).

The Good Money Guide team chose these best spread betting brokers by how many shares you can trade:

| Broker | UK Shares | US Shares | Total Equities |

| IG: | 3,925 | 6,352 | 10,277 |

| City Index: | 5,000 | 2,000 | 7,000 |

| CMC Markets: | 745 | 4,968 | 5,713 |

| Spreadex: | 1,575 | 2,110 | 3,685 |

| Pepperstone: | 192 | 880 | 1,072 |

Which Spread Betting Brokers Is Best For Commodities?

CMC Markets currency offers the most commodities for spread betting on. They offer over 100 commodities as cash best or forwards, and you can also trade a wide range of commodity ETFs on individual commodities or sections such as agriculture, energy or precious metals.

After hands-on analysis, Good Money Guide chose these as the best spread betting brokers by how many commodities you can trade:

- CMC Markets: 100+

- IG: 35

- Pepperstone: 32

- City Index: 20

- Spreadex: 20

Can You Spread Bet On MT4 & MT5?

Yes, Pepperstone is the best MT4 spread betting broker as they offer one of the widest ranges of markets to trade and have a pre-built package of indicators exclusively for their traders.

MT4 is one of the most popular ways to trade the financial markets, and many spread betting brokers now offer MT4 as a platform. If you are interested in spread betting on MT4, you can review the best MT4 spread betting accounts here. Spread betting companies that provide MT4 give clients the ability to upload and purchase custom indicators, and then run automated trading strategies based on pre-set technical perimeters. Traders can also follow “Expert Advisors” and trade based on established FX strategies without the need to execute trades manually.

Good Money Guide hand-picked these best spread betting brokers by how many markets you can trade on MT4:

- Pepperstone: 1,200

- CMC Markets: 200+

- IG: 91

- City Index: 84+

Which Broker Has The Cheapest Spread Betting Spreads?

CMC Markets often have the cheapest spreads of all the spread betting brokers. You can compare how much spread betting platforms charge for the most popular markets in this spreads comparison table:

| Trading Costs |  |  |  |  |  |  |

|---|---|---|---|---|---|---|

| FTSE 100 | 1 | 1 | 1 | 1 | 1 | 1 |

| DAX 30 | 1.2 | 1.2 | 1 | 0.9 | 1.2 | 1.8 |

| DJIA | 3.5 | 2.4 | 2 | 2.4 | 4 | 5 |

| NASDAQ | 1 | 1 | 1 | 1 | 2 | 1.9 |

| S&P 500 | 0.4 | 0.4 | 0.5 | 0.4 | 0.6 | 0.7 |

| EURUSD | 0.5 | 0.6 | 0.7 | 0.09 | 0.6 | 0.8 |

| GBPUSD | 0.9 | 0.9 | 0.9 | 0.28 | 0.9 | 1.3 |

| USDJPY | 0.6 | 0.7 | 0.7 | 0.14 | 0.7 | 0.8 |

| Gold | 0.8 | 0.3 | 0.3 | 0.05 | 0.4 | 0.28 |

| Crude Oil | 0.3 | 0.28 | 3 | 2 | 3 | 0.4 |

| UK Stocks | 0.008 | 0.001 | 0.001 | 0.001 | 0.002 | 0.30% |

Tight spreads are important when choosing a spread betting broker

Make sure your broker offers tight spreads. The spreads and how tight they are is an important part of trading through a spread betting broker, as they impact how quickly you can make money.

There are other important considerations to take into account. For example, a broker may try to win your business by marketing ultra-tight spreads on a couple of the main products, but then increase spreads on the more exotic asset classes.

You also need to make sure when you pick a broker that they offer consistently tight spreads, and not just during normal trading hours. Securing tight spreads when you want to trade is more important to your profits than choosing a broker that offers the cheapest spreads.

Spreads can also vary on the asset class. In some circumstances, it may be best to go with a spread betting broker that has consistently tight spreads throughout their entire asset class range rather than just on a few key products.

That being said, it ultimately depends upon what and how you trade. For example, if you only trade two or three indices and FX pairs, then a broker that will give you the lowest trading costs on these assets will likely make the most sense. You can then use alternative accounts for other instruments.

Spread Betting Broker For The Best Market Access

IG currently offers the most markets for spread betting, around 17,000 financial instruments including UK and international stocks, commodities, forex pairs and indices.

Use our comparison table to see which spread betting broker offer the most tradable assets:

| Market Access: |  |  |  |  |  |  |

|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 10000 | 3700 |

| Forex Pairs | 84 | 51 | 338 | 62 | 54 | 138 |

| Commodities | 25 | 38 | 124 | 32 | 20 | 28 |

| Indices | 21 | 34 | 82 | 28 | 17 | 23 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 1575 | 450 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2110 | 1575 |

| ETFs | n/a | 2000 | 1084 | 107 | 160 | 0 |

Choose a spread betting broker with the best range of offered markets

Some spread betting companies focus on tight spreads on a few key markets. Others focus on providing a good overall value and service. When opening a new account, have in mind what asset classes and individual instruments you want to trade.

If you have AIM and small-cap shares, you will need a spread betting broker that specialises in them, like Spreadex, or IG.

You may need to consider separate accounts if you have a favourite broker for one market but want to trade on a market they don’t offer. However, remember that all brokers will offer the major index, commodities and FX pairs though.

Our Top-Rated Spread Betting Broker For The Best Leverage & Margin Rates

The FCA and ESMA regulators have put caps on how much leverage spread betting companies can offer retail traders so margin rates are standardised across spread betting platforms at:

- Indices: 20%

- Major Forex pairs: 3.33%

- Commodities: 10%

- UK & US shares: 20%

This means if you want to trade shares you have to put down 20% of the value of the trade as a deposit for the initial margin, the equivalent of leveraging your money 5 times. This was in part to protect spread betting clients from over-trading but also to protect the brokers for having to cover client losses. Since the CHF cap was removed and many clients went into negative equity (owing the broker money by losing more than their account balances) the regulators have forced spread betting companies to guarantee that retail client accounts will not go into negative equity.

If a broker is unable to close client positions, they must cover the client losses that exceed their account balance. The margin caps were put in place also to protect the regulator as if a broker cannot cover client losses and defaults, client funds are protected by the FSCS which the regulator is responsible for. So by increasing the amount of margin required for trading, there is less likely hood of larger client losses which the broker, and ultimately the regulator would have to cover.

However, if you are an experienced trader you may be able to upgrade your account to a “professional trading account” and reduce your margin rates. To do so you will need to demonstrate that you have a large investment portfolio, have worked in relevant financial services and are a regular trader.

Trading as a retail or professional spread betting client

If you are new to spread betting, you will be classified as a “retail trader”, which means you get more protection from the regulator, restricted margin rates and standard fees. However, if you are a more experienced trader and can prove it, you may be eligible to upgrade to a “professional trader”. Being a professional trader means you get lower fees and more leverage, but less protection against losses.

Margins can change, here’s why margin increases aren’t always a negative prospect for traders.

Which Platform Offers The Most Other Account Types?

IG offers the most account types in addition to spread betting. You can also trade CFDs, DMA equities and invest for long term capital growth through a general investment account or ISA. This table shows you the account types offered by spread betting brokers to see how else you can trade through them.

| Account Types: |  |  |  |  |  |

|---|---|---|---|---|---|

| Spread Betting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| DMA | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ❌ | ✔️ |

| Investments | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Futures & Options | ❌ | ❌ | ❌ | ❌ | ❌ |

Top Spread Betting Broker For Most Added Value, Research & Tools

City Index has some of the best trading signals to give you some indication of where potential markets may move as well as some great tools for analysing your past traders to see where you get it right and wrong. CMC Markets is one of the most established spread betting brokers and offers a wide variety of webinars, trading tools and indicators on their online platform. IG has lots of sentiment, data and analysis tools, whilst Spreadex have a great reputation for customer service.

| Added Value: |  |  |  |  |  |

|---|---|---|---|---|---|

| Trading Ideas | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Client Sentiment | ❌ | ✔️ | ❌ | ❌ | ✔️ |

| Post Trade Analytics | ✔️ | ❌ | ❌ | ❌ | ✔️ |

| News & Analysis | ✔️ | ✔️ | ❌ | ❌ | ✔️ |

| Web Based Platform | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

Spread betting companies cannot give advice, but they can provide research and analysis to help you find potential trading opportunities. However, one thing to look out for if you are after value (other than tight spreads) is what else you get as part of the spread betting trading platform. Some spread betting accounts provide access to third-party research and analysis services such as autochartist, PIAfirst, trading central and Tipranks.

Spread Betting Platforms With The Best Voice Brokerage

City Index, IG and CMC Markets provide dedicated support if you have a large account where as smaller spread betting brokers like Spreadex tend to provide dealer access to all clients. Spreadex is one of those brokers that people like doing business with. They don’t offer the tightest spreads or even the widest range of markets. But, they do offer a slightly more personal service. It’s their small brokerage attitude that makes them worth trading through.

Being able to get help when you need it and have the ability to trade over the phone is a vital part of spread betting. Whilst over 95% of trades go through online and trading apps ensure you are connected to the market all the time, there still may be occasions when you need the help of experienced dealers.

A few occasions when you will need customer support include corporate actions on stock positions, working large orders, fixing errors, help with margin information, getting new markets added and general questions about how the products work.

All spread betting brokers we feature in our comparison tables have experienced dealers you can talk to should you need it. As spread betting is unique to the UK, spread betting companies have offices in and around London and provide direct lines to dealing staff.

Industry experts told us...

"Financial spread betting is unique to the UK where trader’s profits are not taxed as capital gains are positions are structured as bets. For UK traders, it is a very tax-efficient way to speculate on the financial markets."

Glossary Of Financial Spread Betting Terms

Financial spread betting may seem complicated at first, mainly because of the jargon. But it’s actually quite easy to understand. Here we explain what the most commonly used phrases mean. Ask Price Sometimes called “buy price” this refers to the price which the buyer pays for their security. It is quoted within a bid/ask quote.

What are the major costs and fees of Financial Spread Betting?

Here, we look at the main costs which you will probably encounter once you start trading with a spread betting firm. Size of the Spread Traders have to pay the spread cost on every spread bet. If they are to break even, the spread needs to be overcome by market movements in your chosen direction.

How To Start Spread Betting For Beginners

As spread betting allows you to bet on whether a price is going to fall or rise you will be given a quote from your spread betting broker. This comprises a “sell” price and a “buy” price. As an example, if your provider offers a share at a price of 205/206, the left value is

What Is Financial Spread Betting?

Spread betting is trading the financial markets as a bet rather than buying or selling the underlying instrument. Instead of buying or selling a set amount of shares, futures, options or CFDs, you bet an amount based on every point the market moves through a spread betting broker. As spread betting is trading structured as

Why can’t the media get it that Plus500 does not offer spread betting

CFD broker Plus500 does not offer spread betting. It only offers CFDs (contracts for difference). So why does the nation’s financial media get it wrong all the time? There are some fairly significant differences between financial spread betting and CFDs. I’m not going to go into them here, but you can watch our video discussion

Spread Betting vs CFD Trading: Key Differences Explained

On the surface, CFD trading and spread betting may seem similar, but there are some quite significant differences. In this guide, we will explain in greater detail the differences between CFD trading vs spread betting and why the two products that seem quite similar are actually very different. Differences between spread betting and CFD trading

Spread betting strategies that can help you make money from the financial markets

It is possible to profit and make money spread betting on the financial markets, if you have a good strategy and buy low and sell high, or sell high and buy low. But as with any form of short-term leveraged speculating on the financial markets, it may be harder than you think. If you look

Guaranteed stop losses: What are they and which CFD and spread betting brokers offer them?

If you are looking for an online trading platform that offers guaranteed stop losses, we’ve put together a handy little guide on what guaranteed stop losses are, their advantages and disadvantages and also which brokers offer them. What is a guaranteed stop? Guaranteed stop losses are stops are like normal stop losses but differ in

Can you spread bet on Bitcoin?

Yes, you can spread bet on Bitcoin, although to spread bet on Bitcoin you need a professional trading account as the FCA has banned retail investors from trading cryptocurrency derivatives. Different types of Bitcoin spread betting: There are a few different types of Bitcoin spread betting which enables traders to trade Bitcoin in different ways,

Can I spread bet with zero spreads?

A user has asked: I was after a spread betting platform that offered a no-spread account. SpreadCo were offering it but now say they aren’t bringing it back for a little while so I wondered if I could find such an offer on any other platform? Thanks, Jeremy. Answer: At the moment you will find

Do spread betting companies close your account if you win?

A user has asked: Do spread betting companies close your account if you win? This question comes up quite a lot, because financial spread betting contains the word betting people assume that like bookies brokers don’t want their clients to win. But it’s actually quite different. When you spread bet on the markets your trade

Financial Spread Betting Explained: Trading with tax free profits (if you make them)

What is Financial Spread Betting? Spread betting products have been around in the UK since 1974. With a spread bet the customer attempts to take advantage of rising or falling markets by taking a bet with a spread betting company on the price movement of an underlying instrument, rather than buying or selling the underlying

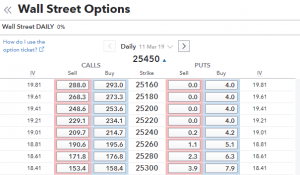

Where to trade options as a spread bet online

There are more and more spread betting brokers offering options trading online these days. We’re not talking about evil binary options which are now thankfully banned by the FCA. We’re talking about real listed options on the DJIA(as an example in the image). Traditional options are generally used as a hedging and limited risk way

What’s the difference between equity DMA CFDs and spread betting?

If you are wondering if trading with direct market access is for you and what the difference is, then here is the breakdown. Trading with direct market access (or DMA) enables you to place your orders direct with the exchange through a broker. Which means instead of having to buy at the offer (the higher

Why is spread betting still tax free? Anecdotally speaking of course…

The factual reason spread betting is tax-free for profits is because the trades are structured as a bet. i.e. I bet you £10 for every point the FTSE goes up etc. Therefore it is structured as a bet and as with all gambling, exempt from capital gains tax. However, the actual reason (according to old

Why spread betting brokers love it when you make money!

There are two types of spread betting firms. The good and the bad. The good spread betting brokers treat their customers as clients and aim to forge long-term relationships by providing excellent customer service and trading tools. The cost of trading may be slightly higher as most of the client trades are hedged in the

Best way to spread bet on the AIM market

One must be careful spread betting on the AIM market. The Alternative Investment Market (AIM) is very different from the traditional markets attractive to spread betting customers i.e. Large cap stocks, FX, index and commodities. What is the AIM market? Here’s what the LSE has to say about it… AIM is the most successful growth market

The main reasons most spread betting clients lose money…

We recently looked at the loss percentages of spread betting and CFD brokers. But why do so many traders lose money? I’ve been a broker for nearly 20 years and dealt for pretty much every client out there. From the absolute spread bet beginner to $100m hedge funds. In a nutshell it is because they

How to choose a spread betting broker – a quick guide to help you decide

Spread betting is one of the greatest innovations in financial markets for the private investor and trader of the last two decades. It has opened up markets and strategies that were previously reserved for professional and institutional investors. By betting on the movement of a share price instead of investing traders can leverage, go short

3 reasons why spread betting margin increases are a good thing

Never mind the ESMA rules. The markets are becoming more and more volatile and the major spread betting brokers have increased margin rates for retail clients. Here are 3 reasons why spread betting brokers put margin rates up. 1) They are based on volatility This is obviously going to upset a few traders, but the bottom

Four spread betting strategies that actually work and some decent brokers to try them with

The right spread betting strategy can make a huge difference to your trading. The market is a ferocious beast and will gobble up the hard earned money of the unprepared quickly. Give yourself a bit of an edge when trading by making sure you stick to a spread betting strategy. Here’s a quick four-step guide

Top accounts for spread betting on US stocks

Even though it is unique to the UK, spread betting on US stocks gives traders the ability to bet on stocks across the pond. Spread betting is unique to the UK, in that it offers UK residents a tax free way to potentially profit on short-term moves in the US financial markets. The US Stock market

A quick guide to how financial spread betting the markets works

Spread betting is a simple cheap and effective way to trade the worlds financial markets. You can trade anything from stocks, FX and commodities to the average cost of houses in the UK. Most spread betting brokers also offer a sort of grey market on unlisted IPO stocks that are about to come to market

The pros and cons of using spread betting as a hedging tool

There are a couple of ways spread betting can be used to hedge exposure. You can hedge pretty much anything as the markets offered by spread betting brokers are so varied. Equity and Stock Hedges though spread betting One of the most common hedges is against profits from equity investments. Traditionally options would have been

Technical analysis versus fundamental analysis in spread betting

Technical analysis and fundamental analysis are both useful tools in trading and investing. The general consensus is that fundamental analysis is more useful for longer-term investments. Technical analysis is better for short-term trading and speculation. Mainly because it looks at market timing and provides a good visual aid for traders to comp… To read this

Why no decent spread betting or CFD broker should actually want churn and burn clients

Peter Cruddas, the founder of leading spread betting broker CMC Markets was quoted in The Times this morning in an article about the end of churn and burn broking. Cruddas highlighted that the days of high client turnover was gone for CMC and that they were focusing on only the “tastiest fish in the sea”

So you want to spread bet on Bitcoin? Here’s a few things you need to know

If you want to spread bet on Bitcoin or other cryptocurrencies here are a few things you need to know. Please note that since this article was written the FCA has banned retail traders from trading cryptocurrency derivatives. If you would like to speculate on Bitcoin and cryptocurrencies you need to use a cryptocurrency exchange

MT4 spreadbetting accounts in euro?

Thanks to Swing Traderkk for asking… Could you add an account currency filter to your comparison site please? There are many, not least the Irish, who would appreciate being able to spreadbet in currencies other than GBP, like EUR or GBP. This is a question that is asked quite frequently and many brokers handle the

3 reasons you really shouldn’t be spread betting

Spread betting is a high risk, high reward form of speculating on the financial markets. The best spread betting brokers in the UK are heavily regulated by the FCA and have to comply with. There are more rules than any other industry designed to protect clients. Every financial promotion you see is littered with risk warning

Can you use shares in your portfolio as collateral for CFD trading and spread betting?

Yes, some brokers will let you lodge liquid shares, bonds or funds as collateral for CFD trading or financial spread betting if you have a professional trading account. However, should you? In general, I like to be positive about spread betting. We’ve often said it is one of the greatest innovations to happen for private

Spread Betting Brokers FAQ:

Commonly, only around 20% of retail clients make money with spread betting brokers. If you are a complete beginner or new to trading altogether, then the sensible thing to do is to read around the subject, define a strategy and practice spread betting using a free demo account before you commit any real money.

See our guide on how to make money spread betting.

Stuart Wheeler the founder of IG, is generally credited with inventing and popularising the concept of betting on financial markets in 1974.

The most popular markets for spread betting are in order:

- Indices

- Stocks & shares

- Forex

- Commodities

You can read more about why these markets are so popular in our guide to the best markets for financial trading.

Yes if you have a professional spread betting account, but not if you are classified as a retail trader. The FCA has banned trading on cryptocurrencies. However, you can buy and sell cryptocurrencies through crypto exchanges.

Yes, spread betting brokers are regulated by the FCA and client funds protected up to a certain amount by the FSCS.

However, over that amount your funds are not protected and as spread betting is an OTC product your risk is with the broker rather than the exchange. The best way to ensure your funds are protected is to always use a well capitalised broker.

An easy way to keep an eye on a company’s financials is to go with brokers that have traded themselves on the London Stock Exchange. Being a public company means that you have to submit financial reports regularly. The share price and market cap are also good indicators of whether or not a company is heading for trouble.

IG, CMC Markets and CIty Index are publicly listed spread betting brokers.

CFDs are for professional traders who use them for direct market access and anonymity (to an extent). Outside the UK, CFDs are used by private clients as there are no tax benefits. Read what the difference is between spread betting and CFDs for more information.

Spread betting in the UK is only possible because there is no capital gains tax on spread betting profits. This does of course mean that you cannot offset spread betting losses, and tax laws can and always will change. Spread betting outside the UK does not exist, as UK spread betters are the only traders that benefit from the tax breaks.

In short, the answer is a simple one, which involves spread betting brokers not having enough experience. Amateur or beginner traders are often guilty of over trading, over leveraging and not cutting their losses or running their profits. However, spread betting is not an easy way to make money, and should not be marketed or promoted as such.

It is a facility to bet on the financial markets to be used appropriately. Most brokers do a good job of ensuring that clients have some investment experience before allowing them an account.

Further reading:

Yes, plus you do not have to pay tax on forex trading if you are spread betting, however you do if you are trading spot or CFDs.

As an alternative to trading CFDs on forex, individuals and UK taxpayers can spread bets on foreign exchange.

Spread betting, as the name suggests, are wagers on the performance of an instrument or market rather than a trade, and though the methodology and pricing of these two types of transactions can look very similar, the tax treatment of any profits made in them is very different.

Profits made from trading are subject to UK capital gains tax, whilst under current legislation, profits generated through spread betting are tax-free. By the same token, losses made in trading can be offset against capital gains made elsewhere, whilst spread betting losses cannot.

For more information on forex trading tax, read our Q&A: Do you have to pay tax on forex trading?

The tax treatment is the principal difference between the two forms of speculation, however, some spread bets may be priced in a similar way to futures contracts; that is with the cost of carry or financing included in the quote at the outset, rather than being charged daily, as is the case in forex trade. Spread bets are also likely to have a fixed expiry, whether daily, weekly or quarterly. While FX trades, which are effectively CFD trades, have no fixed expiry unless you are trading a currency future or option, rather than the rolling spot contract.

The mechanics of spread betting on FX are very similar to those of trading FX. Of course, you will need to open a spread betting account to spread bet rather than a trading account. You will also want to familiarise yourself with the bets that spread betting providers offer and the contract lifetimes, and the way that they are priced that could be very different for say a rolling daily bet, a weekly bet or indeed a monthly or quarterly bet.

One obvious thing to try to do is to match the contract you are going to be betting on with your time horizons, and style of speculation daily bets won’t be much use to you if you have a two- or three-week-time horizon. Equally, a quarterly contract may not be your best choice if you are an intraday bettor.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the spread betting brokers via a non-affiliate link, you can view their financial spread betting pages directly here: