CFD brokers offer “contracts for difference” (CFD) trading, which is an over-the-counter (OTC) high-risk type of trading that lets you speculate on the price of underlying financial markets without actually owning the asset by either taking a long (buy) or short (sell) position. We have tested, ranked, reviewed and compared some of the best CFD brokers for trading contracts-for-difference that are regulated by the FCA in the UK.

City Index: Best CFD broker for trading signals and post-trade analysis

🏆Award Winner🏆

- CFD markets available: 12,000

- Minimum deposit: £100

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

- GMG rating: (4.3)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index CFD Trading Review

Name: City Index CFD Trading

Description: City Index offers CFD trading on over 13,500 markets including 40 equity indices, 4,700 international shares, ETFs, 19 commodities, 183 forex pairs, government bonds and interest rates giving it one of the largest market ranges of all the major CFD brokers.

70% of retail investor accounts lose money when trading CFDs with this provider

Summary

A good CFD trading platform for traders who want trading signals and post-trade analytics.

- CFD markets available: 12,000

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

Charges and commissions are included in the spread for CFD trading and are very competitive including 0.5 pips for EURUSD, 1 point spreads on the FTSE (UK100 CFDs), 0.8% on UK shares and 1.8 cents per share on USD stocks (2 cents per share being industry standard).

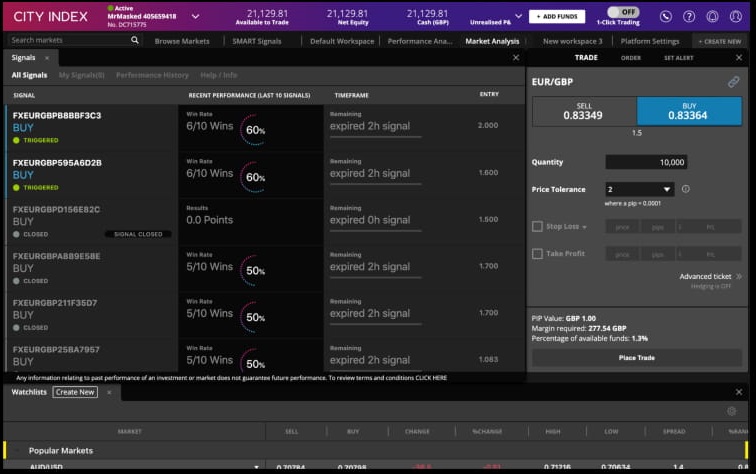

Whilst I was testing City Index’s CFD trading platform for this review there were a few things that make them stand out. Firstly they offer proprietory trading signals on CFDs through SMART Signals. These signals have been developed in-house and enable trades to quickly see upcoming trading opportunities. Signals are ranked based on how successful the type of signal has been in the past for specific assets and you can see the assets signal historic P&L performance based on the pre-determined stop and limit levels.

Performance Analytics is another tool that can help traders improve their CFD profitability. Performance Analytics looks at your CFD trading history and shows you where you do well and when you do not. The idea is to make you a better trader by encouraging you to stick to a trading plan and gives you guidance on when your plan is working and what markets, times and conditions suit your trading style the most.

As well as offering a CFD trading platform and mobile app City Index has always catered to, and still does, to high-value traders over the phone. It is one thing that makes them different from the majority of trading platforms in that you can actually talk to an experienced dealer who knows your account as well as deal electronically.

For new traders, there is a huge amount of educational and informational content from “how-to” videos and articles to more lighthearted CFD, and focussed programming like the Traders Academy.

Overall, City Index offers one of the best CFD trading platforms, on a wide range of markets with low costs and is suitable for large traders who want personal service and new traders how need assistance looking for trading ideas.

Pros

- CFD trading signals

- Post CFD trading analytics

- Wide range of CFD markets

Cons

- No DMA CFDs

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

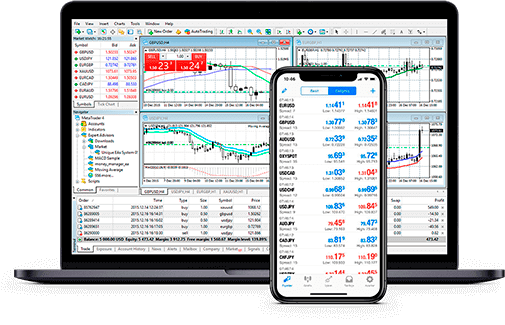

4.3Pepperstone: Best broker for trading CFDs on MT4 & MT5

- CFD markets available: 1,200

- Minimum deposit: £1

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

- GMG rating: (4)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone CFD Trading Review

Name: Pepperstone CFD Trading

Description: Pepperstone offers CFD traders TradingView as well as two platforms cTrader and MT4 (or 5) which are suited to two different types of traders. cTrader for a more traditional look and click trader and MT4 for automated trading strategies.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, Pepperstone offers one of the best MT4 CFD trading packages and is suitable for those wanting to trade the major markets on tight spreads.

- CFD markets available: 1,200

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

I found when testing that Pepperstone’s main proposition is pricing through, either through MT4 or cTrader CFD traders do get some of the most competitive spreads through Pepperstone.

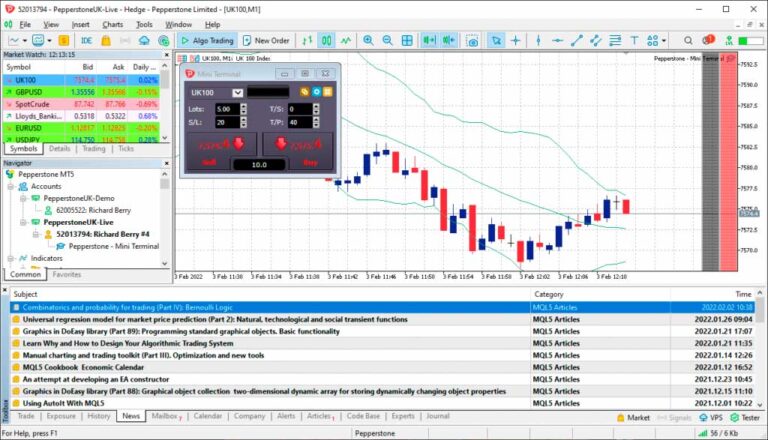

MT4 is a very good trading platform for automated trading strategies and Pepperstone has a suite of exclusive indicators and trading tools for their CFD traders.

cTrader, is more of a traditional trading platform for trading from charts and sentiment indicators. For chartists, you can also trade CFDs through TradingView with Pepperstone.

Pepperstone has a relatively limited range of CFD markets on offer with 1200 in total including 100 FX pairs, 28 commodities, 28 indices and 900+ UK, US and international shares. The list of shares is growing though and Pepeprstone say that if you want to trade CFDs on a stock that is not listed on it’s platform they will add it on request if there is enough volume and liquidity.

Pros

- Good package of MT4 CFD indicators

- Trade CFDs automatically

- Wide range of stock CFDs on MT4/MT5

Cons

- No DMA CFDs

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Spreadex: Best CFD broker for CFD trading with personal service

- CFD markets available: 10,000

- Minimum deposit: £1

- Equity overnight financing: 3% +/- SONIA

- CFD pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

- GMG rating: (4.3)

- Customer rating: 4.2/5 (177 reviews)

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex CFD Trading Review

Name: Spreadex CFD Trading

Description: Spreadex is a smaller CFD broker that offers trading on a relatively large amount of markets, 10,000 including lots of smaller UK shares. I’ve used them for about 10 years and know some of the staff well.

72% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall Spreadex is a good CFD broker for traders that want to trade on major and minor shares and put more of a focus on customer service than technology.

- CFD markets available: 10,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- CFD pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

Spreadex has been providing trading since 1999, but only recently introduced CFD trading in 2017. The trading platform, whilst quite basic, does represent what Spreadex is good at, which is the major markets and customer service. Being a smaller CFD broker they have a bank of experienced dealers who can work orders for you and provide support for the CFD app and platform.

Recently Spreadex has become much more competently priced, offering UKX CFD trading with 1 pips spreads, 0.6 pips on EURUSD and 0.2% on UK shares. There is no minimum deposit and no inactivity fee.

Pros

- Excellent customer service

- Smaller cap stock CFD trading

- Wide range of CFD markets

Cons

- Limited options trading

- Trading only, no investing

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.2Saxo Markets: Best CFD broker 2023

- CFD markets available: 9,000

- Minimum deposit: £1

- Equity overnight financing: 2.5% +/- SAXO RATE

- CFD pricing: Shares 0.05%, FTSE 1, GBPUSD 0.7

- GMG rating: (4.2)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets CFD Trading Review

Name: Saxo Markets CFD Trading

Description: Saxo Markets won the “best CFD broker” in our 2023 and 2022 Awards as it offers the widest range of account types, market access and tradable assets.

64% of retail investor accounts lose money when trading CFDs with this provider

Summary

Overall, Saxo Markets is the best CFD trading platform suitable for traders with experience who need access to a wide range of markets and order types.

- CFD markets available: 9,000

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Equity overnight financing: 2.5% +/- SAXO RATE

- CFD pricing: Shares 0.05%, FTSE 1, GBPUSD 0.7

When I tested the CFD platform with Saxo Markets, I traded CFDs and a few options. But, what makes Saxo Markets different though is how you can trade CFDs compared to other brokers. You can trade CFDs with direct market access (DMA) through the main trading platform or app. This means you can place OTC CFD orders directly on the exchange order book, getting better fills and better prices. You can also trade options as a CFD.

Saxo Markets is more of a professional CFD trading platform, so best suited to CFD traders who are graduating from a simple trading platform to something with more order types and support for higher-volume and sophisticated traders. The CFD trading platform is backed up with excellent support from personal dealers and experienced back-office staff, who cater for individual traders, professionals, and institutions like hedge funds and banks.

There is a huge amount of research data and analysis available on the trading platform that can help traders seek out trading opportunities and some very good post-trade analytics that will show you where you trade profitably and which markets you lose in, and therefore can potentially avoid.

Pros

- Excellent CFD market coverage

- DMA CFD trading

- Robust CFD trading platform

Cons

- High minimum deposit

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.4Interactive Brokers: Best CFD trading platform for advanced order execution

- CFD markets available: 7,000

- Minimum deposit: £2,000

- Equity overnight financing: 1.5% +/- SONIA

- CFD pricing: Shares 0.02%, FTSE 0.005%, GBPUSD 0.0008%

- GMG rating: (4.4)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers CFD Trading Review

Name: Interactive Brokers CFD Trading

Description: IBKR offers CFD trading on around 5,200 markets including 100 forex pairs, 20 commodities, 13 indices, and thousands of international stocks. I’ve traded through IBKR a fair bit and there is no doubt that Interactive Brokers CFD offering is one of the best around.

60% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, Interactive Brokers is one of the best CFD brokers, most appropriate for experienced and sophisticated CFD traders. But it also has lighter versions of it’s platforms for newer traders that may want to stick with one platform as they become more experienced.

- CFD markets available: 7,000

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Equity overnight financing: 1.5% +/- SONIA

- CFD pricing: Shares 0.02%, FTSE 0.005%, GBPUSD 0.0008%

Whilst Interactive Brokers does not offer the most CFD markets, they do offer one of the best ways to trade them. With IBKR CFDs you can trade with direct market access (DMA) on the exchange so you can place your orders directly on the order book at better prices than the bid/offer. The commission is charged post-trade so you get clean prices with no mark-up and IBKRs commission rates (added post trade) are the best around. Commission on UK stocks is 0.02% and 0.003% on US stocks.

In reality, CFD brokers with the most markets are those that offer access to small or illiquid stocks which are probably not suitable for CFD trading anyway. But, IBKR offers access to the majority of stocks and markets most traders could need.

You can also trade CFDs with the most types of order execution with IBKR, for instance, VWAP, pairs trading, time and price-sensitive order entry. These tools are most suited to professional and very high-volume traders, or hedge funds that are working very large orders and don’t want to scare the market. Most retail CFD traders will have no need for them, but it is representative of IBKRs overall service in that it provides an exceptional institutional-grade CFD platform to retail clients.

Pros

- Low-cost CFD trading

- Wide market range of CFD markets

- DMA CFD trading

Cons

- Better for advanced CFD traders

- Complex desktop platform

-

Pricing

(5)

-

Market Access

(4.5)

-

Online Platform

(5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

4.4CMC Markets: Best CFD broker for sentiment trading tools

- CFD markets available: 12,000

- Minimum deposit: £1

- Equity overnight financing: 2.9% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

- GMG rating: (4.1)

- Customer rating: 3.6/5 (107 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets CFD Trading Review

Name: CMC Markets CFD Trading

Description: CMC Markets is one of the original CFD brokers launched in 1989. They offer access to over 12,000 markets and are known for tight pricing and good trading platform tech.

74% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, CMC Markets is an excellent CFD trading platform with good market coverage and very competitive pricing. It’s most suited to short-term CFD traders speculating on the major markets.

- CFD markets available: 12,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.9% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

One of the main features I like when trading through their platforms that makes CMC Markets stand out is how they present their CFD client sentiment indicators. Most brokers provide sentiment indicators based on what their clients are trading, but CMC enables CFD traders to break down what long and short positions their clients have by time frame and profitability. So you can filter in more profitable traders or longer-term positions.

CMC charges a bid-offer spread on CFDs on indices, commodities, FX and interest rates etc but charges a commission on CFDs over individual stocks and ETFs. Commissions start at 0.10% of the notional value of the trade for UK and European stocks, and at 2 cents per share for CFDs over US equities. Spreads vary by product and contract but are competitively priced relative to peers such as IG and Saxo Markets.

There are some excellent other features as well like thematic indices, share baskets, a wide range of order types, and the ability to enter, work and move orders direct from the charts.

Pros

- Excellent CFD trading platform

- Client CFD sentiment indicators

- Tight CFD spreads and pricing

Cons

- No DMA CFDs

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1XTB: Good CFD trading educational material

- CFD markets available: 2,100

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Shares 0.3%, FTSE 1.7, GBPUSD 1.4

- GMG rating: (3.9)

- Customer rating: 4.7/5 (117 reviews)

81% of retail investor accounts lose money when trading CFDs with this provider

XTB CFD Trading Review

Summary

Overall, XTB, is a well-established CFD trading platform with some nice added value that is suitable for most traders.

- CFD markets available: 2,100

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Shares 0.3%, FTSE 1.7, GBPUSD 1.4

When I tested XTBs CFD brokerage I found what sets them apart is some of the platform features.

There are also some nice close-off features, so you can close all your CFD positions in one go, or if you want to cut your losses, just close the losers, or if you want to lock in profits you can just close your winning trades.

There is a lot of educational content on how to trade from various independent “experts” such as Tom Hougaard, Lee Stanford. As well as different courses on how to understand specific aspects of trading like technical analysis and trading psychology.

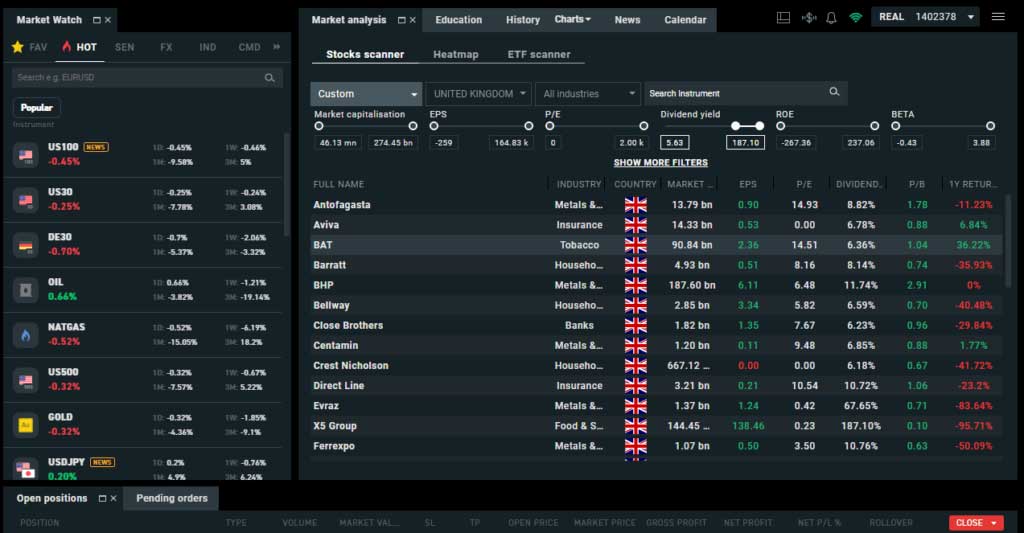

You also have a comprehensive suite of CFD trader tools like constantly updating market analysis including stock screeners, heatmaps and ETF scanners to help you pick out new trades. There is also an integrated news feed and economic calendar so you can check for upcoming events or news flow that may affect your open positions.

Pros

- Multi-asset trading

- Competitively priced

- Lots of markets to trade

Cons

- Not UK HQ’d

- No basket trading

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

3.9IG: Best CFD trading platform for liquidity and market range

- CFD markets available: 17,000

- Minimum deposit: £250

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

- GMG rating: (4.3)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG CFD Trading Review

Name: IG CFD Trading

Description: IG Index (as they were then called) was one of the originators of retail CFD trading and offers access to the widest range of markets with the best liquidity. I’ve used them for over 20 years and regularly test the platform. In fact, CFD liquidity on major instruments is often better with IG than the underlying exchanges does to IG’s symmetrical hedging policy and order flow.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

Overall, IG offers one of the best CFD trading platforms around and provides excellent educational guides and market access for every sort of trader.

- CFD markets available: 17,000

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

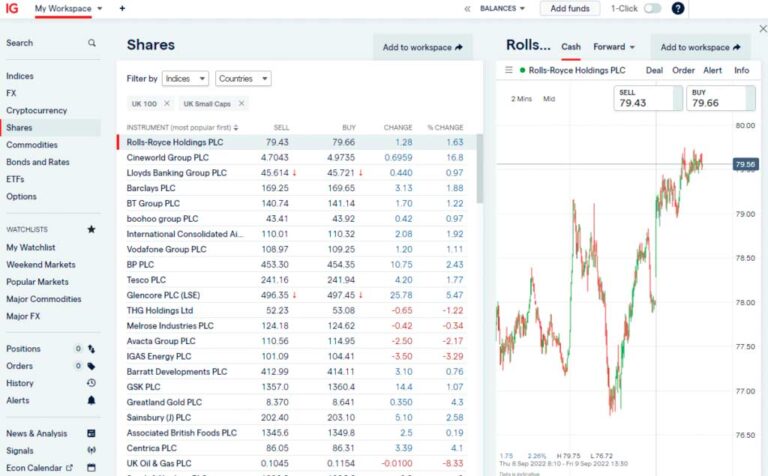

CFD costs are included in the spread for retail traders, but you also have the option of trading with direct market access (DMA) on level-2 prices. This enables CFD traders to place orders within the bid/offer spread and get better prices. The commission is then charged post-trade. DMA CFD trading is often must more cost-effective for high-volume larger traders as fills are quicker and at better prices.

You can trade over 17,000 CFD markets with IG including 51 forex pairs, 38 commodities, 34 indices and over 10,000 stocks. You can also trade CFDs on IPO through their grey market. The CFD trading platform is constantly evolving due to customer feedback and IG has a wide range of news, sentiment and analysis that is based on the analytics from the platform on what traders are trading. So for example, if there is a lot of order flow around a particular stock or market, research is created to help traders better understand market moves.

The main thing though that makes IG stand out is it’s size and coverage. As a public company valued at over £3.5bn April 2022) they cater for new, experienced, professional as well as institutional CFD traders.

Pros

- Wide range of CFD markets

- Excellent CFD liquidity

- DMA & level-2 CFD trading

Cons

- Some CFD pricing is not competitive on smaller caps

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

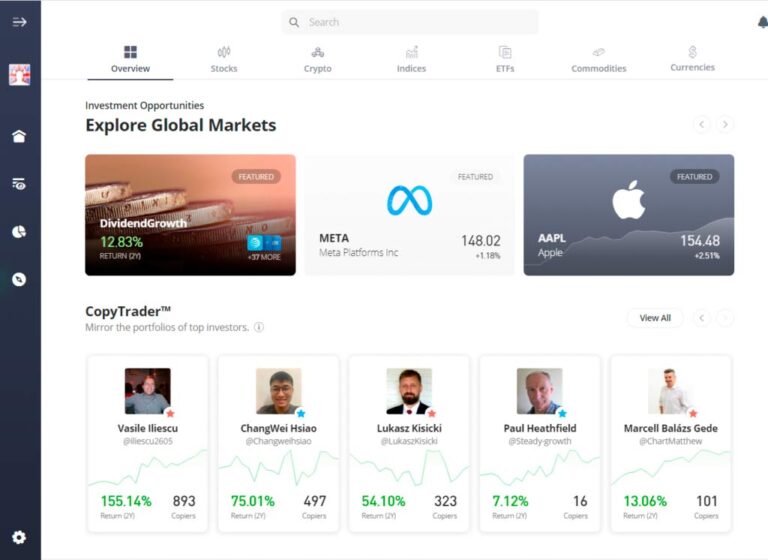

4.3eToro: Best CFD broker for controlling your CFD leverage

- CFD markets available: 2,976

- Minimum deposit: $50

- Equity overnight financing: 6.4% +/- SONIA

- CFD pricing: Shares 0.15%, FTSE 1.5, GBPUSD 2

- GMG rating: (3.8)

- Customer rating: 3.4/5 (223 reviews)

77% of retail investor accounts lose money when trading CFDs with this provider

eToro CFD Trading Review

Name: eToro CFD Trading

Description: eToro lets you trade CFDs on major indices, forex pairs and stocks. One advantage of trading CFDs with eToro is that you can set your own leverage and reduce the amount of risk you take on per trade. A good option for new traders who want to see what other investors are trading through their social trading feature.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Summary

- CFD markets available: 2,976

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Equity overnight financing: 6.4% +/- SONIA

- CFD pricing: Shares 0.15%, FTSE 1.5, GBPUSD 2

Pros

- Social and copy CFD trading

- Easy-to-use CFD platform

- Can change your CFD leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Limited market range

-

Pricing

(3.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

3.8Tickmill: CFD trading on MT4 & MT5

- CFD markets available: 578

- Minimum deposit: £100

- CFD pricing: US shares 0%, FTSE 0.9, GBPUSD 0.3

- GMG rating: (4.1)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill CFD Trading Review

Name: Tickmill CFD Trading

Description: Tickmill’s offers CFD trading via MT4 & MT5 on the most liquid forex, indices, commodities and US shares. A good option, if you are looking for tight spreads through MetaQuotes.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Summary

- CFD markets available: 578

- Minimum deposit: £100

- Account types: CFDs, futures & options

- CFD pricing: US shares 0%, FTSE 0.9, GBPUSD 0.3

Pros

- Low-cost US Share trading

- MT4 & MT5 platforms

Cons

- No UK shares

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4❓Methodology: We have chosen what we think are the best CFD brokers based on:

- over 17,000 votes in our annual awards

- our own experiences testing the CFD trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the CFD brokers CEOs and senior management

Compare CFD Brokers

| CFD Broker | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 12,000 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 7,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 12,000 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 5,000 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 2,100 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 3,981 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Best Overall

Saxo Markets won “best CFD broker” in our 2023 awards as they offer a huge range of markets, with direct market access. This is backed up by robust technology, experienced dealers and a well-capitalised company. Use our comparison table of what we think are the best CFD brokers to compare how many markets they offer, how much it costs to trade major instruments, minimum deposit amounts and what the overnight financing costs are for holding longer-term CFD positions.

Beginners

City Index is one of the best CFD trading platforms for beginners as they offer trading signals, lots of analysis and educational materials. They also have a feature call Performance Analytics that analyses your trading and tells you where you are more successful and which markets you should avoid based on your trading style.

| Beginner Features: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Low-Risk Products | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Investment Account | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

It is important to note though that CFD trading is a high risk form of investment and if you are completely new to investing it is not suitable to start trading CFDs. It is less risky to invest through tax-efficient stocks and shares ISAs.

Advanced & Professional Traders

Saxo Markets is one of the best brokers for professional CFD trading, predominantly because their client base is generally more sophisticated than other CFD brokers. As such, their trading platform has been designed with professional traders in mind with DMA access, physical trading on a robust, institutional-grade platform.

Likewise, IG and Interactive Brokers (IBKR) both offer DMA trading and physical investing.

Whilst both IG and IBKR both offer institutional trading for hedge funds and professional traders, IBKR (as with Saxo Markets) also offers on-exchange futures and options trading, so comes in second and IG, third.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

For more information on professional trading accounts, see our dedicated pro trader comparison page.

IG tops this list as they are a publicly listed CFD broker and offer DMA CFD trading and a personal service for larger clients.

Saxo Capital Markets is another good CFD broker for HNWs, as you can trade DMA, buy physical shares, bonds, and trade all sorts of exotic derivative products. They also have professional brokers available over the phone for trading if you want to work VWAP or other algo orders that may otherwise move the market if you did them yourself.

Low Spreads & Commissions

Saxo Markets and Interactive Brokers have the cheapest commission for CFD trading. City Index and CMC Markets often have the highest spreads.

| Trading Costs |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| FTSE 100 | 1 | 1 | 1 | 1 | 1 | 0.01% | 1 | 1 | 1 | 1.7 |

| DAX 30 | 1.2 | 1.2 | 1 | 0.9 | 1 | 0.01% | 1.2 | 1.2 | 1.8 | 1 |

| DJIA | 3.5 | 2.4 | 2 | 2.4 | 3 | 0.01% | 4 | 2.4 | 5 | 3 |

| NASDAQ | 1 | 1 | 1 | 1 | 1 | 0.01% | 2 | 1 | 1.9 | 1 |

| S&P 500 | 0.4 | 0.4 | 0.5 | 0.4 | 0.5 | 0.01% | 0.6 | 0.4 | 0.7 | 0.5 |

| EURUSD | 0.5 | 0.6 | 0.7 | 0.09 | 0.6 | 0.00% | 0.6 | 0.6 | 0.8 | 0.9 |

| GBPUSD | 0.9 | 0.9 | 0.9 | 0.28 | 0.7 | 0.00% | 0.9 | 0.9 | 1.3 | 1.4 |

| USDJPY | 0.6 | 0.7 | 0.7 | 0.14 | 0.6 | 0.00% | 0.7 | 0.7 | 0.8 | 1.4 |

| Gold | 0.8 | 0.3 | 0.3 | 0.05 | 0.6 | 0.00% | 0.4 | 0.3 | 0.28 | 0.35 |

| Crude Oil | 0.3 | 0.28 | 3 | 2 | 0.5 | 0.00% | 3 | 0.28 | 0.4 | 3 |

| UK Stocks | 0.008 | 0.001 | 0.001 | 0.001 | 0.0005 | 0.02% | 0.002 | 0.001 | 0.30% | 0.0008 |

Some CFD trading platforms have fixed spreads, no matter how wide the underlying markets, for example, others have variable spreads which they widen and tighter depending on volatility and liquidity. For example, economic indicators like non-farm payrolls can make the market more volatile and widen spreads. Whereas, high market liquidity times like the open and close can mean that spreads are tightened. The general norm though is for brokers to offer spreads slightly wider than the underlying bid/offer to incorporate their commission.

Market Access

IG offers the best market access with 17,000 instruments available to trade on it’s CFD trading platform. Plus you can trade CFDs with DMA (direct market access) and work orders inside the bid/offer spread.

| Market Access: |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 9000 | 5233 | 10000 | 8,000 | 3700 | 2,100 |

| Forex Pairs | 84 | 51 | 338 | 62 | 182 | 100 | 54 | 20 | 138 | 57 |

| Commodities | 25 | 38 | 124 | 32 | 19 | 20 | 20 | 10 | 28 | 22 |

| Indices | 21 | 34 | 82 | 28 | 29 | 13 | 17 | 10 | 23 | 25 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 5000 | 500 | 1575 | na | 450 | 230 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2000 | 3500 | 2110 | na | 1575 | 1080 |

| ETFs | n/a | 2000 | 1084 | 107 | 675 | 1100 | 160 | na | 0 | 138 |

Why choosing a CFD broker based on what markets you can trade is important.

The more market access the better, as you want flexibility when trading to give you as many opportunities as possible.

The major markets for CFD trading are:

- Forex

- Indices

- Shares

- Commodities

- Treasuries

While you can trade more things with Saxo Markets overall, IG has one of the widest choices of markets to trade CFDs on. If you want to trade something unusual, Spreadex will also look at markets on request.

Account Types

IG offers the most account types with CFD trading, spread betting, DMA access, CFD options, and also general and ISA accounts for your longer-term investing.

Choosing a CFD broker that offers DMA CFDs

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

There are two types of CFD trading DMA, where you execute your trades directly on the exchange order book or OTC where you are trading on your broker’s bid/offer prices. Whilst technically all CFD trading is OTC (over-the-counter) because you are entering into a contract between the opening and closing difference in price with your broker, DMA CFD trading is when your OTC CFD orders are routed directly to the exchange.

The main advantage of DMA (direct market access) CFD trading is that you get better prices.

For DMA CFD trading your CFD broker will charge a commission after you execute a trade, but for OTC CFD trading, the commission is included in the spread.

Being able to buy at the bid rather than the offer and sell at the bid rather than the offer can make a big difference to when you enter and exit positions. However, many traders prefer OTC CFD trading where commission is included the spread as it makes calculating P&L and exit points simpler.

Added Value

City Index provides the best trading signals through Smart Signals and post-trade analytics through Performance Analytics.

| Added Value: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Ideas | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Client Sentiment | ❌ | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

| Post Trade Analytics | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ❌ |

| News & Analysis | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Web Based Platform | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

Get added value from your CFD broker with trading tools

Most CFD brokers provide some kind of research and analysis on the markets for their customers. But generally, the better the broker, the better the research, tools and analysis. For example, some brokers like IG will provide lots of analysis tools, economic calendars, stock screeners and technical analysis signals. Whereas, others like Plus 500 will only provide a trading platform with no added value. It costs a lot of money to hire analysts and provide data to clients, and some of it (if you know how to use it) can be exceptionally useful.

Technical analysis provides a good overview of the markets, based on charts and historical data

- Fundamental analysis uses company financial releases to evaluate the health of a share price.

- Economic data and calendars show when important announcements are due that could result in a price move.

Here’s where you can find out about 2020’s award-winning brokers.

Base Currencies

Interactive Brokers let you have complete control over your FX and you can have an account in almost any major currency. Whereas other brokers like Saxo Markets will give you the choice of a few currencies and automatically convert your P&L into whatever base currency you are trading. So you can run three separate subaccounts in GBP, USD and EUR, depending on what you trade. Whilst other more retail focusses CFD provides like eToro only let you trade in USD, so it doesn’t matter if you deposit GBP and trade GBP stocks and have GBP P&L, your account base currency will always be in USD.

Managing your foreign exchange exposure

When you trade CFDs the trade is usually settled in the contract currency. So, if you trade the FTSE, your P&L is in GBP, when you trade the US30, your P&L is in USD and when you trade USDJP your P&L is in JPY. This can result in lots of different currency conversions racking up FX fees, or it can result in you running a deficit in a currency and being charged interest. This is one area where CFD trading differs from financial spread betting where no matter the currency of an instrument your P&L is always in your base currency.

CFD Broker FAQs

Yes, it is possible to make money with an online trading platform. However, it is also possible to lose money.

If you want to be a profitable CFD trader then you need to follow some golden rules of CFD trading. It’s not difficult to make profitable trades, but what is difficult is ensuring that you make more profits on your winning trades than you make losses on your losing trades.

It’s a well-known fact that even the best traders in the world only get it right half the time. It’s how they manage their CFD positions that sets them apart and makes them better traders.

We have a full guide on how to trade CFDs here but the basic rules for CFD trading are:

- Don’t trade with more than you can afford to lose

- Run your profitable trades

- Cut your losing trades quickly

- Use stop losses to minimise risk

- Combine technical and fundamental analysis before trading

- Don’t trade with more than you can afford to lose

You should not risk money by trading CFDs that you need for something else. CFD trading is high risk and there is a high probability that inexperienced traders will lose money quickly. CFD trading can successfully form part of your overall investment portfolio. Around 10% is a suitable percentage to assign to high-risk investments.

It’s important to budget and balance your portfolio to include a range of diversified low, medium and high-risk investments, with a larger portion being allocated to medium and low-risk, long-term investment products such as tax-efficient SIPPs and stocks and shares ISAs.

If you only have a small amount of money to invest and choose to trade it all through CFDs, there is a large chance that your entire risk capital will be eroded as you learn to trade CFDs.

Here are four key ways to improve your CFD trading

- Run your profitable trades: Managing a position is one of the most challenging aspects of trading CFDs. CFD traders are often too keen to take small profits, rather than keep a winning position alive. Using trailing stop losses on your online CFD trading platform can be effective in running profitable positions as the market moves in your favour. If you buy as the market is going up (or go short as the market is going down), it is more profitable to keep the position open and ride the trend as far as you can.

- Cut your losing trades quickly: Another key mistake that CFD traders make is to let losses increase without closing a position in the hope that the market will turn around. When trading, it is good practice to have a loss limit in place so that your profitable trades are not wiped out by a large loss. If you have a losing position, consider closing it and re-evaluating the market and trying again when the market is looking more predictable.

- Use stop losses to minimise risk: Using a stop loss means having a level in the market where your position is automatically closed to minimise loss. Stop losses are triggered automatically, even when you are not in front of your trading platform. The benefit of using stop losses is that you limit your downside risk (loss) on a position automatically and protect your account balance. Some CFD brokers offer guaranteed stop losses, which trigger even if the market crashes, and guarantee to give you your stop price, regardless of slippage.

- Combine technical and fundamental analysis before trading: The two most common forms of generating trading ideas are fundamental and technical analysis. Fundamental analysis means looking at the financial health of a business or economy. Technical analysis means looking at charting patterns of markets to see what has happened in the past and what is likely to happen in the future. The benefits of technical analysis are that it is somewhat self-fulfilling in that in the most liquid CFD markets, traders are looking for similar patterns and will trade when they occur, potentially moving the market. It is more popular in short-term trading. Fundamental analysis can be used to trade around economic indicators if you disagree with the consensus before the data is announced. Fundamental analysis is more popular for longer-term investing. For more information, read our guide on the difference between technical and fundamental analysis.

Yes. If you have a professional CFD trading account, you can lose more than your account balance. However, for CFD traders classified as retail clients, there is negative balance protection, which means that your CFD trading account is guaranteed to not go into negative equity.

- Further reading: If you want a safer way to trade, try comparing share dealing accounts

Yes, CFDs can provide long-term investors with a way to hedge portfolio risk in periods of market volatility, and for traders to create market-neutral pairs trading and spread strategies.

- Further reading – Use these inverse ETFs in a bear market to protect your portfolio.

The most popular traded markets on CFD trading platforms are forex, indices and stocks as these have the most liquidity and news flow. You can see why they are so popular in our guide to the best markets for CFD trading.

In theory, you can keep a CFD trade open indefinitely. However, as overnight financing charges can add up quickly, CFD trading is more of a short-term speculation tool or hedge rather than a product for long-term investing.

- Further reading – what are overnight financing charges?

Yes. You have to pay capital gains tax on CFD trading profits. You can offset CFD trading losses against other investment profits.

Leverage in CFD trading means investors can leverage their money (or capital) to increase their exposure by trading on margin. CFD trading platforms allow those trading to take larger positions than they would be able to do through traditional investing platforms. The benefit is that your profits are multiplied. However, inversely, if you lose money, your losses are equally multiplied.

STP means Straight Through Processing, which means that when you put an order in, it goes into the market and the broker buys or sells on your behalf. The alternative is where a broker matches up with other traders or does not hedge your positions at all. In the grand scheme of trading, it does not matter whether your broker is STP or uses a B-Book. You make money if you call the market right. You can’t blame the broker if your trades are not profitable.

Here’s more about ECN brokers and STP brokers which may be of interest to more experienced traders

CFD trading platforms like Saxo Markets and Interactive Brokers charge a commission. Other CFD brokers like IG, CMC Markets and City Index charge a spread. Widening the spread is equivalent to charging a commission. It is not normal for CFD brokers to charge private clients and retail traders a commission for CFD trading.

Normally, it’s only DMA (direct market access) CFD brokers that charge commission.

One of the advantages of trading CFDs is that the commission is built into the price you buy and sell at, so there is no need for additional calculations to determine your profit and loss after the commission is charged.

The disadvantage of this is that when trading CFDs, the bid-offer spread will be wider, so the market needs to move further before a trade turns profitable.

When you are trading CFDs the tighter the spread, the better, as this reflects what your trading costs are. The CFD spread is usually a fixed amount per share and for things like Forex and Index trading and is comparable to a percentage.

For example, if on your CFD trading platform the spread on Vodafone shares could be 0.25% from the actual price, and this represents a commission of 0.25% on the value of the trade. Or if you are trading the FTSE 100 and the market price (or bid/offer) is 5801 (to sell), 5801.5 (to buy), a CFD broker may offer a spread of 5801 (to sell) and 5802 (to buy), which means they have widened the spread by 0.5.

The size of the bid-offer spread quoted by a CFD broker is important because it has a big impact on the cost of your trading. If a CFD platform quotes spreads that are 0.5 points wide and you are trading 1,000 CFDs, the cost of each trade will be £5. So, if you trade 100 times over a year, you will have paid £500 in dealing costs. But, if that spread is 1 point instead of 0.5 points, you will have paid £1,000 in spreads. The difference of £500 can have a significant impact on your profit and loss.

- Want to know how much your trading costs over a year? Try our trading cost calculator.

Yes, you can scalp with CFD brokers like IG, City Index and Saxo Markets.

If you are scalping the market and trying to make lots of small, profitable trades, the tightness of a spread can make all the difference between success and failure. Essentially, narrower spreads mean quicker potential profits and wider spreads mean greater price changes needed to make a profit.

- Further reading: what is scalping and what brokers allow it?

If you’re a professional CFD trader dealing in significant sizes and frequently, you will get much better execution prices if you deal through a DMA CFD broker. As the commission is charged after a DMA CFD trade, it is easier to make small, profitable trades as the bid/offer spread is tighter.

However, you will have to calculate your commission in your P&L as it may turn a profitable trade into a loss.

DMA CFD brokers are usually only suitable for clients that qualify for institutional traders or private clients with professional account status, who have a thorough understanding of CFD trading.

All CFD trading platforms operating in the UK must be regulated by the FCA.

Never go with a broker that is not fully authorised and regulated by the FCA or some of your funds are not covered by the FSCS scheme. Most client funds are segregated now, but if your broker goes bust, provided FCA regulation and FSCS contributions are up to date, the Government will cover your deposit losses up to a certain point. You can view more information on the FSCS website here.

Note: we only include CFD trading platforms that are regulated by the FCA in our comparison tables and reviews. You can find out more about unregulated CFD brokers in our guide to CFD scams.

Only fully FCA-authorised and regulated CFD brokers offer client funds protection under the FSCS. From the 1st September 2019, this protection extends to:

- Limiting leverage to between 30:1 and 2:1 by collecting minimum margin as a percentage of the overall exposure that the CFD provides.

- Closeout a customer’s position when their funds fall to 50% of the margin needed to maintain their open positions on a CFD account.

- Provide protections that guarantee that a client cannot lose more than the total funds in their CFD account.

- Stop offering monetary and non-monetary inducements to encourage trading.

Provide a standardised risk warning, which requires firms to tell potential customers the percentage of their retail client accounts that make losses.

source; FCA website, 01/07/2019.

No. Unfortunately, you can’t trade CFDs in the US. Derivatives trading in the US needs to be done on regulated exchanges. As CFDs are an OTC (over the counter) product, they are not allowed and are illegal to offer to US residents. Therefore, if you want to trade on margin, you must do it with either futures, options or through a broker that offers margin trading.

If you are a US citizen or resident, you can’t trade CFDs with a UK CFD broker. UK and US regulations prohibit US clients trading with overseas online trading platforms or brokers.

But if you are a UK or European trader, you can trade US stocks on CFDs with a UK CFD broker. You can however compare US CFD stock brokers where you can usually trade on margin. The US equivalent of CFD trading is margin trading. Margin trading in the US is where a broker lends you money to buy shares.

So, unlike CFDs, where you are not buying shares but taking out a “contract for difference” with US margin trading, you are paying full price for the shares you want to buy. You will need to put down some initial margin of (for example) 25%.

Then the broker will lend you the rest of the money for the purchase. For instance, if you want to buy $1,000 of Apple shares, you will need to put down $250 and the broker will lend you the other $750. You cannot withdraw money a US broker lends you and you pay daily interest on what you borrow.

Some CFD brokers in the UK offer financial spread betting as well because CFDs are fairly similar in some respects but very different in others.

The key similarities for both financial spread betting and CFD trading are:

- You can go long and short

- You can trade on margin

- Both are OTC derivative products

- Both are regulated by the FCA

- Both are a high-risk investment product

The key differences between CFD trading and financial spread betting are:

- Spread betting is free from capital gains tax, CFDs profit and losses are taxable

- With spread betting, you bet a certain amount per point move

- With CFDs, you buy an equivalent amount of CFD as you would shares

CFDs are available to international clients - Financial spread betting is unique to the UK

Here’s a video and some more information on the difference between spread betting and CFD trading.

No, you should not. Advisory CFD brokers used to be quite common when it was harder to open a CFD account. Before CFDs became available to all private clients, investors wishing to trade CFDs would have to prove that they understood the risks involved.

As CFDs were mainly offered to sophisticated investors, the regulators were less concerned with the fact that advisory CFD brokers offered little added value to traders. However, CFDs are a very high-risk product and clients must understand the risks involved before opening an account.

Over the years, the FCA has clamped down on advisory CFD brokers providing advice and hardcore sales tactics used by CFD brokers to get clients to trade more. This website is all about execution-only CFD brokers – that means CFD brokers that do not provide advice or recommend trades. Here is how to find a CFD stock broker.

They are best avoided altogether. Most advisory CFD brokers use the services of the execution-only ones then mark the commission up for their supposed added value.

Yes, you can trade cryptocurrency CFDs in the UK if you have a professional trading account. If you are not an experienced trader and are classified as retail, the FCA has banned crypto derivatives, so you cannot trade cryptocurrency.

IG has one of the broadest ranges of commodities trading via CFDs. If you want the simplicity and flexibility of trading commodities via CFD then IG have an excellent offering.

Most CFD trading platforms and CFD brokers offer access to gold, silver and crude oil, a good CFD trading platform for trading commodities should also include the lesser traded softs and exotic commodities.

For a full breakdown of CFD brokers that offer commodities trading, view our comparison table.

IG offers the most (80) global stock market indices for trading, as well as ETFs. Spreads are competitive and IG also offer index trading at the weekend on European, UK, Asian and US indices. IG offers CFD trading on over 80 global indices, as well as ETFs. Index trading is fairly straightforward and is second only to forex trading in popularity, and CMC Markets comes in a close second as their primary focus is Forex. Saxo Markets are also a good choice for trading indices via CFD, and for more information, you can compare all brokers for trading indices here.

Saxo Markets has a great offering for UK CFD trading and also the option (as with IG) to trade UK stocks via DMA.

Spreadex is also worth a look as they have recently launched CFDs (in addition to spread betting). Spreadex are a much smaller broker but offer personal traders who can work CFD orders on smaller stocks on request.

If you are trading UK stocks via CFD then IG is your best option because they offer some unique trading features that others don’t. For instance, you can trade CFDs on the grey market price of an IPO before it lists. IG offer weekend and out-of-hours trading on UK stocks, as well as CFD trading on smaller cap UK stocks.

If you are going to trade US stocks via CFD, you may as well do it with a US broker, and the best of the bunch is Interactive Brokers, AKA IBKR for short. IBKR was the pioneer of electronic trading (read up on them in our interview with Thomas Peterffy, the founder and CEO). While the Americans are not allowed to trade CFDs themselves, IBKR offer CFD trading through their UK office.

Saxo and IG are a close second and third as both brokers offer round the clock CFD trading on US shares. Both brokers offer DMA and out of hours trading, although IG pips Saxo to second place because of their presence in the US (albeit for forex trading only).

For more information on trading shares as a CFD read our how to choose an equity CFD broker.

Saxo Markets stands out, with an excellent options board on a wide range of markets that can be traded as a CFD. CFD trading on options has grown in popularity as brokers try to compete on market coverage. Most CFD brokers offer a smattering of CFD options on the most popular traded instruments like US stocks and major indices and forex pairs. For more information on brokers offering options trading, view our options broker comparison table.

For retail clients CFD margin is standard across brokers since ESMA and the FCA introduced caps on what margin is available to retail CFD trading. Current margin rates for retail CFD traders are:

- Indices: 20%

- Major Forex pairs: 3.33%

- Commodities: 10%

- UK & US shares: 20%

Choosing a CFD broker based on margin and leverage

Professional trader margin rates vary from broker to broker and the lower the margin requirements, the more exposure you can have with the least funds on the account. You can compare professional CFD trading margin in our comparison table, but beware, the lower the margin, the riskier a trade, as you are leveraging your money sometimes up to 500 times.

So, if you have £1,000 on account, you could have £500,000 of exposure. If a price moves 10%, you have lost £50k, meaning that you owe the broker £49k. Many brokers now are introducing no negative equity protection, which means that you can never lose more than your account balance. Of course, this means that the leverage on offer will be reduced.

City Index offers an excellent phone brokerage service for larger traders.

Trading is a lifelong relationship

The ability to phone up an experienced dealing desk quickly is an essential requirement of a CFD trading platform. Whilst smaller traders may be happy to tap away online, but, if you are a big CFD or spread betting trader (and by that we mean £50k upwards), you need a broker that is going to give you a bit more than just the top ten traded forex pairs and a few commodities to trade online, you may need a dedicated dealer to help with corporate actions or to work large orders for you in illiquid markets.

Pepperstone, one of the largest brokers globally, but HQ’d in Australia, offers MT4 and is worth a look as they won “Best MT4 broker” in our 2020 awards.

MT4 brokers are a dime a dozen and there are so many terrible ones, to be honest. MT4 is the most popular trading platform out there because of its plug and play nature.

While not overly promoted, IG and Saxo also offer MT4 as a trading platform option, should you find their proprietary trading platforms not sufficient for your needs.

You can compare all the MT4 brokers we feature here

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the CFD brokers via a non-affiliate link, you can view their CFD trading pages directly here: