IG Group is probably best known as a provider of margin trading services be that FX, CFDs or Spread Betting, but they also acts as a stockbroker and fund manager and provide Smart Portfolios in conjunction with one of the world’s largest asset managers, Blackrock.

IG Smart Portfolio Review

Product Name: IG Smart Portfolio

Product Description: IG in conjunction with Blackrock, has created create a series of five smart diversified investment style portfolios including stocks, bonds and commodities that range from conservative through to aggressive risk/reward.

Summary

IG Smart portfolios are a great way to invest in pre-made managed portfolios with one of the UK’s largest investing and trading platforms.

Pros

- Cheaper than other robo-advisors

- Blackrock investment style

- Diversified portfolios

Cons

- Erratic performance

- A high minimum of £500

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1What is an IG Smart Portfolio?

The five IG smart portfolios which were launched a little under three years ago at the end of February 2017. Four of the five funds replicated existing BlackRock products but the fifth, the aggressive portfolio, was created specifically for IG, by BlackRock.

BlackRock is best known as an originator of ETFs and other passive investments however the products it produced for IG are not index trackers.

The minimum investment for IG Smart Portfolios is £500 and you can request a withdrawal from your account at anytime and your portfolio will be reduced to cover the withdrawal amount.

Fee reductions

Back in 2020, IG announced that it was reducing the management fees it charges on the smart portfolios to just 0.50% per annum, and it also capped those fees at £250 a year.

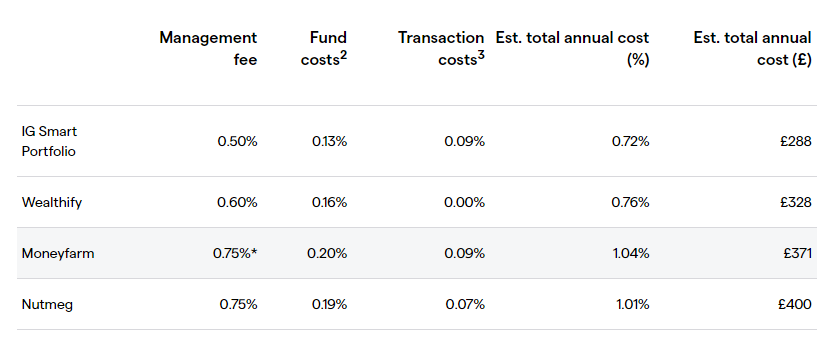

According to IG’s Smart portfolio price comparison, their portfolios work out significantly cheaper than robo-advisor competitors, Wealthify, Moneyfarm and Nutmeg.

As IG Smart Portfolio fees are capped at £250 a year, it means that anything you invest above £50k is effectively fee-free.

Investment Strategy

IG Smart Portfolios are smart beta funds, rather than index trackers. Smart beta is an investment style that tries to benefit from idiosyncratic features associated with particular groups of stocks this is also known as factor investing. These factors or characteristics include traits and identifiers such as value, growth, momentum, size, low volatility and others.

The thinking behind this approach is that by identifying and isolating these factors we can create portfolios which could outperform or are uncorrelated to a broad market basket.

This is the type of strategy that Hedge Funds might employ.

Smart beta portfolios such as those offered by IG stockbrokers aim to bring these quantitative and qualitative investment approaches to their clients, via low-cost vehicles

Performance

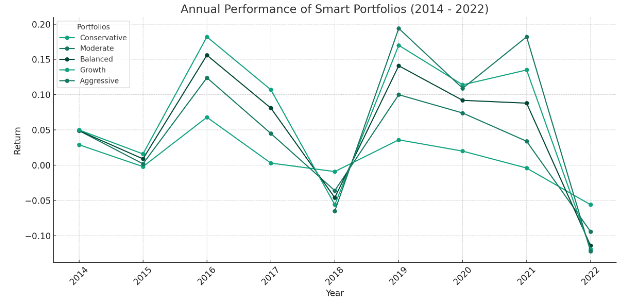

IG Smart portfolios have a six-year track record and generally perform well. Overall the growth portfolio generated the best returns for investors, with the Aggressive fund lagging due to it’s shorter run time and early losses in 2018 doubtless caused by the sharp selloff in the markets at the end of that year.

Smart Portfolio All time returns from 2014 to Sept 2023

- Conservative +10.20%

- Moderate +32.70%

- Balanced +55.70%

- Growth +79.30%

- Aggressive +47.60%

However, it’s been a bit of a rocky ride with some portfolios having losing years, especially 2022 when they all took a battering. The chart below shows each portfolio’s yearly performance but does not include 2023, which you would expect to be good seeing as the overall markets are up around 20%.

| Smart Portfolio | All time | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Conservative | 10.20% | -5.60% | -0.40% | 2.00% | 3.60% | -0.90% | 0.30% | 6.80% | -0.20% | 2.90% |

| Moderate | 32.70% | -9.40% | 3.40% | 7.40% | 10.00% | -3.60% | 4.50% | 12.40% | 0.20% | 4.90% |

| Balanced | 55.70% | -11.40% | 8.80% | 9.20% | 14.10% | -4.60% | 8.10% | 15.60% | 0.90% | 4.90% |

| Growth | 79.30% | -11.90% | 13.50% | 11.40% | 17.00% | -5.60% | 10.70% | 18.20% | 1.60% | 5.00% |

| Aggressive | 47.60% | -12.20% | 18.20% | 10.90% | 19.40% | -6.50% |

Investing versus trading at IG

Despite this positive performance the fund management business has not caught the imagination of the IG client base in the same way that say trading CFDs or Spread bets on equity indices have.

For example, in the FY 2019 margin trading clients generated revenues of £454 million pounds for IG, whilst the investments and stockbroking division returned revenues of just £5.9 million. A positive result but a drop in the ocean when compared to the margin trading business.

Since the departure of former CEO Peter Hetherington IG has made no secret of its desire to broaden both its product range and customer base. It has recently recruited both a new chairman and a head of institutional business, with that in mind.

The reduction in fees, and in some cases the removal of them altogether, in the Smart portfolio’s business is doubtless aimed at growing both funds under management and annual revenues.

Welcome though this cost reduction is, we can’t help but feel that the existing funds IG offers are somewhat staid when compared to what’s available elsewhere and the type of products and trading the wider group is involved in

IG would surely be able to attract money to funds that replicated or in some way participated in the firm’s own trading book

After all the business takes no directional view on the market but rather hedges customer flows, once the firm’s risk reaches certain predetermined levels.

You can count the number of losing days that IG experiences in a year, on the fingers of one hand and surely that’s the kind return that people would be prepared to pay up for.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.