Saxo Customer Reviews

Tell us what you think of this provider.

After IB experience it is like day and night bad

My german bank decided to discontinue doing business with me as I am resident in the UAE and I want to transfer the commerzbank account to Saxo so that it is EU regulations. transfer took 8 weeks and multiple calls, account opening takes similarly very time consuming and several problems moreover the platform offers much less ETFs and bonds to compare to IB and prices are higher.

Four Stars

Very efficient trading in world wide Shares, Funds and ETF’s

More compelted platfomr but more…

More compelted platfomr but more asset/ivestment options

4/5

Good experience so far

Good experience so far

Sound

Sound

Easy to trade with provision…

Easy to trade with provision for options with stops and security features

Basic trading platform, with a…

Basic trading platform, with a wide range of stocks.

No comment

No comment

Easy to use with excellent…

Easy to use with excellent pricing and range of equities across multiple markets

2/5

3/5

I find the website difficult…

I find the website difficult manage and customer service substandard.

x

x

too big

too big

no thoughts

no thoughts

uk

uk

Fantastic platform and really wide…

Fantastic platform and really wide choice of instruments – ability to get reports and track performance is superb

2/5

As above

As above

Saxo Expert Review

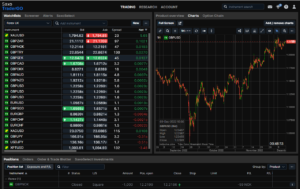

Saxo have some of the best trading and investing platforms for advanced and beginner investors

Provider: Saxo

Verdict: Saxo is an excellent investing and trading platform for those that who want institutional grade pricing, robust execution and wide market coverage as well as simple to use apps for beginners.

62% of retail investor accounts lose money when trading CFDs with this provider

Is Saxo Markets a good broker?

Yes, Saxo has a great choice of accounts for beginners with SaxoInvestor and for professionals, the more sophisticated SaxoTrader go provides direct market access. The pro platform, analysis, and direct market access may be too complicated for beginners. But, for experienced traders, its coverage, commissions and research are unrivalled.

Saxo is one of the largest investing and trading platforms worldwide and provides direct market access to equities, bonds, forex, futures and options as well as being a major liquidity and infrastructure provider to wealth managers, banks and smaller brokers.

Awards: Saxo won best investing app and best DMA/Professional account in 2024. Before that, in our 2023 awards, Saxo won ‘Best CFD Broker’, and ‘Best DMA & Professional Trading Account’. In 2022 Saxo also scooped ‘Best Bond Broker’.

Pricing: Commissions have just been reduced further making Saxo one of the cheapest brokers

Market Access: Saxo offers a huge range of markets for both derivatives trading and physical investing

Platform & Apps: Saxo has an industry-leading robust workhorse of a platform

Customer Service: Experienced dealers for active larger customers

Research & Analysis: Some of the best opinions on the markets around.

Plus, with Saxo posting its best financial results in history (with over $118bn customer funds on account) and now that it has been 70% bought out by J. Safra Sarasin Group, they will be in an even better position to continue to provide excellent market access. This, combined with founder Kim Fournais still owning 28% will keep the firm’s customer-first ethos intact.

Overall, Saxo Markets is an excellent trading platform for retail traders and investors who want institutional-grade pricing, robust execution and wide market coverage.

Pros

- Direct market access

- Low commissions

- Robust trading platform

Cons

- Seen as a trading platform for professionals

- Have to subscribe for live prices

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.962% of retail investor accounts lose money when trading CFDs with this provider

Saxo Facts & Figures

Saxo Markets Total Markets | 60,000+ |

| ➡️Forex Pairs | 190 |

| ➡️Commodities | 20+ |

| ➡️Indices | 29 |

| ➡️UK Stocks | Over 5,000 |

| ➡️US Stocks | 2,000+ |

| ➡️ETFs | Over 6,400 |

Saxo Markets Key Info | |

| 👉Number Active Clients | 850,000 |

| 💰Minimum Deposit | £1 |

| ❔Inactivity Fee | ❌ |

| 📅 Founded | 1992 |

| ℹ️ Public Company | ❌ |

Saxo Markets Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ✔️ |

| ➡️Options Trading | ✔️ |

| ➡️Investing Account | ✔️ |

Saxo Markets Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1 |

| ➡️DJIA | 3 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.7 |

| ➡️GBPUSD | 0.8 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.5 |

| ➡️Crude Oil | 0.3 |

| ➡️UK Stocks | 0.0005 |

| ➡️US Stocks | $0.01 per share |

62% of retail investor accounts lose money when trading CFDs with this provider

Saxo News

Saxo Introduces Instant Funding

UK investors using Saxo can now fund their accounts instantly and directly from their bank, as the multi-asset investment platform expands its payment options for UK clients. Saxo’s new instant funding feature allows eligible users to deposit money in real time using supported instant payment methods, with funds typically credited within seconds and available to

Saxo unveils its 2026 Outrageous Predictions as last year’s wild ideas edge closer to reality

Saxo has released its annual Outrageous Predictions for 2026, the latest instalment in a long-running series of low-probability but high-impact scenarios designed to push debate beyond the consensus. While the forecasts are not Saxo’s house view, they explore the moments when gradual change gives way to sudden shifts. This year’s list spans quantum risk, culture,

Saxo Australia Rebrands to Totality After DMA Takeover

Saxo Australia has officially rebranded to Totality, marking the start of a new chapter for one of the country’s most established multi-asset brokers. The move comes after Saxo Bank sold an 80.1% stake in its Australian subsidiary to SCM DMA Pty Ltd, the local arm of South African fintech DMA, in a deal first announced

Does Saxo offer CFD trading in the UAE?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Saxo Options Trading Expert Review

Compare Saxo Against Other Options Brokers Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at

Saxo Forex Trading Platform Review

Saxo is excellent for forex trading, especially for sophisticated traders. For smaller FX traders, there are better forex trading platforms. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings

Saxo DMA Trading Expert Review: Direct market access for CFDs & futures

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Saxo Stocks & Shares ISA Has Low-Cost Access to 11,000 Global Investments

Compare Saxo’s ISA to other Stocks and Shares ISA accounts below: Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having

Saxo Singapore Expert Review: Premium Trading Platforms and Global Market Access for Serious Investors

Tina TengTina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of

How to use Saxo’s trading platform and what it’s good for.

Compare Saxo to other trading platforms below: Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker

Saxo CFD Trading Expert Review: Best CFD Broker 2025

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Saxo share dealing gets better as UK trading clients surge 32% after cutting fees

Saxo saw a 132% rise in trading clients in the UK last year, with the bank attributing the rise to wide-ranging reductions in its fees. According to the unaudited report, this came as the proportion of new clients under the age of 25 on the UK platform rose to 15% in 2024 from 9% in

Saxo futures trading makes them one of the best brokers in the UK

There are literally thousands of brokers offering online trading platforms in the UK, but what separates the wheat from the chaff is if a broker offers access to the futures markets with DMA. Being able to trade wheat futures instead of wheat CFDs, is what makes Saxo stand out as one of the best brokers

Is Saxo regulated for forex trading in the UAE?

Expert opinion: Saxo Markets reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker

Is Saxo a good commodities broker?

Saxo customers can trade a wide range of commodities as CFDs, futures, options, spot pairs or exchange-traded commodities (ETCs) with tight spreads, integrated Trade Signals, news feeds and innovative risk-management features. As a commodities broker Saxo offers one of the best trading platforms for retail and professional traders. For professional and institutional commodities traders, you

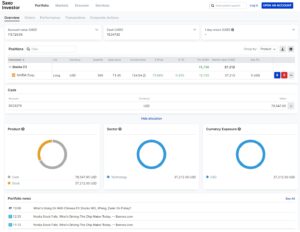

Saxo’s Investing App are Great for Beginners and Excellent for Professionals

Even though Saxo is traditionally a trading platform for short-term speculation on the markets going up or down. It is also an excellent choice for longer-term investors as Saxo is a very well-capitalised company, heavily regulated in the UK and all the regions they operates in, and has excellent customer service for small and large

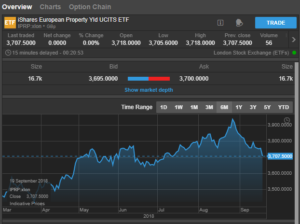

Can you buy ETFs on Saxo and how do charges compare?

Saxo is one of the best brokers for buying ETFs, especially compared to other retail platforms like eToro. With Saxo you can buy ETFs in local currencies like GBP, EUR and USD, whereas with eToro you are forced to buy GBP and EUR ETFs in USD (which includes FX conversion fees). When you trade ETFs

Saxo’s trading app gives you professional grade tech in your pocket

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Saxo’s demo trading account lets you paper trade like the professionals

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Is Saxo good for indices trading?

Yes, Saxo is one of the best indices brokers in our matrix as they offer DMA access to index futures, as well as OTC CFDs, and direct market access index options. If you are an investor rather than a trader you can buy index ETFs for longer-term exposure to all the stocks in major indices

Is SaxoInvestor a good general investing account for beginners?

SaxoInvestor UK First Look – Is it good for beginner investors? 30th September 2024 To answer your question straight away, as I know that is probably all you want to know, yes, I think SaxoInvestor is good for beginner investors. If you’re interested in knowing why, read on. If you don’t care why, just click

Saxo wins Best DMA & Professional Trading Account at the Good Money Guide Awards 2024

Saxo won Best DMA Professional Trading Account this year for their robust, workhorse trading platform, offering direct access to UK and US equities, as well as futures and options globally. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015.

Saxo wins Best CFD Broker at the Good Money Guide Awards 2024

Saxo won Best CFD Broker, at the Good Money Guide Awards 2024, as they have in the past, because they offer direct market access for trading contracts for difference (CFDs) on UK equities and global markets. Their platform provides low commissions and is a robust, institutional-grade trading solution. Richard BerryRichard is the founder of the

Saxo Bank circled by bidders including Interactive Brokers

Saxo Bank has reportedly attracted acquisition bids from investors and rival platforms, including Interactive Brokers. Denmark-headquartered Saxo has seen interest from bidders such as Interactive Brokers Group, Bloomberg reported yesterday, citing sources with knowledge of the matter. Other parties interested in acquiring the firm include a consortium of Altor Equity Partners and Centerbridge Partners, which

Saxo’s US election trading hub rolls-out commission-free US stocks

The launch of the Saxo US election trading hub also provides new clients access to commission-free trading of the most 100 popular US stocks. The hub also provides hand-picked investment shortlists for likely election scenarios. It also links to relevant US market news. The Saxo US election trading service has provided commission-free execution of trades

Andrew Bresler, the new UK CEO of Saxo, on the importance of diversified investing

In our latest CEO interview, I talk to Andrew Bresler, the new UK CEO of Saxo. We discuss the company’s transition from a trading-focused platform to one that caters to investors, explore the launch of a new investor platform, and the changing demographics of Saxo’s client base. Plus we highlight the importance of education and

Saxo cuts trading and investing fees

Saxo Markets has cut the fees it charges clients when they trade. A move that Saxo says is designed to empower investors, allowing them to make more of their returns. Commission reductions The broker has introduced what it called “substantial price reductions” cutting commission charges on UK shares US stocks ETPs ETFs Futures Options Saxo

Saxo launches fund investing in the UK

Saxo is introducing dealing in mutual funds to its UK retail investors, who will now have the opportunity to invest in any of the thousands of funds that Saxo has selected, from leading money managers, such as Vanguard, Fidelity, BlackRock and JP Morgan. Saxo fund investing This new fund universe includes more than 500 equity

Saxo Bank reduces minimum deposits to make account opening easier

Saxo Markets has reduced its minimum deposit requirements in more than 9 different markets. Traders in the UK, France, Singapore, Switzerland, Poland, Czechia, Slovakia and Australia, among others, will no longer be subject to a minimum deposit requirement when funding their accounts. Saxo Bank Markets removes minimum deposit Saxo may have removed its minimum deposit

Saxo Bank receives a BBB investment grade rating from S&P

Danish-based broker Saxo Bank has received a coveted BBB credit rating from S&P. The bank which can trace its roots back more than 25 years, is also on the cusp of being recognised as a Systematically Important Financial Institution, or SIFI, in its home state, by the Danish Financial Supervisory Authority, the FSA. S&P BBB

M&G Wealth &me to offer mutual funds in collaboration with Saxo UK & Moneyfarm

In conjunction with Moneyfarm, Saxo Markets will provide access to mutual funds for M&G Wealth &me customers. Saxo is the custodian bank for Moneyfarm and has been working with the online wealth manager for the last eight years. M&G Wealth &me mutual funds The new service will offer M&G Wealth &me clients access to some

Saxo Markets ups cash interest to 2.64% but stops paying on balances below £10k

Saxo Markets will stop paying interest on free cash balances below £10,000 but is not capping higher interest rates for larger customers. Free cash is classified as the excess cash on an account that’s not invested or being used as margin. How does Saxo Markest compare to other brokers? Read our expert Saxo Markets review

Saxo markets partners with Guotai Junan Securities in China

Saxo Bank has entered China via a strategic partnership with Guotai Junan Securities, one of the country’s largest investment banks and securities traders. The deal was structured by Saxo’s Singaporean division, Saxo Markets Singapore, which is run by CEO Adam Reynolds. Under the deal, Guotai Junan’s Chinese clients will gain access to Saxo’s global markets

Charlie White-Thomson, UK CEO of Saxo Markets on what’s in store for the next 30 years

In our latest CEO interview, I sit down with Charlie White-Thompson the CEO of Saxo Markets UK. We discuss where Saxo sits within in the brokerage landscape and what type of clients they can best service. We also talk about, whether free investing is sustainable, the biggest mistakes traders make, the best thing about working

No dry January for Denmark’s Saxo Bank

Denmark’s Saxo Bank started the New Year on the front foot and had one of its best months over the last two years. Significant growth in margin trading The margin trading and multi-asset broker saw client activity levels grow by +21.0% month over month to $438.0 billion, a figure that eclipsed the previous high, posted

Saxo Capital Markets launches “Rewards” program for loyal traders

The UK arm of Denmark’s Saxo Bank, CFD & Forex broker Saxo Markets UK, has announced a new customer loyalty scheme under which clients will earn and collect points based on their level of trading activity. Existing customers of Saxo Capital Markets will automatically be enrolled in the scheme and Saxo will email its clients

Saxo introduces negative interest rates on certain larger balances

Danish CFD trading and investment house Saxo Capital markets announced it was to introduce negative interest rates on positive free equity balances in selected currencies from the April 1st and don’ts this wasn’t an early April fools. Negative interest rates have been a fact of life in parts of Europe for several years and in

SaxoSelect: Saxo launches a range of seven funds managed by experts

Denmark’s Saxo bank has a history of innovation when it comes to the products and services it offers to its clients. This week Saxo Capital Markets has launched a series of managed portfolios which it calls SaxoSelect. There are seven funds to choose from and Saxo has collaborated with the likes of Morning Star, Nasdaq

Andrew Edwards, Saxo Capital Markets UK CEO on how and why, they serve such a broad range of clients

‘Saxo’, has always been one of those brokers that sit there and get on with it. They have that sort of Scandinavian approach that just seems to work. A bit like Ikea, it just does an excellent job of what it does without fuss or fanfare. In the 20 or so years I’ve worked in

A tough September for both Gain Capital and Saxo Bank

We got a chance to look under the bonnet of two of the leading margin trading providers this week as both Gain Capital and Saxo Bank published their monthly volume figures for September. Gain Capital, of course, is the owner of City Index here in the UK, but the parent company is listed in New

Saxo Capital Markets backs ASICs plans to reduce leverage available to inexperienced investors

Saxo Capital Markets, one of the proper CFD brokers that generally caters to a more sophisticated trader base has backed ASICs plans to follow the FCA and ESMA to reduce the leverage available to retail traders. Everyone else, of course, is in an absolute uproar about how appalling it is that regulators are sticking their

Saxo offering the chance to win £5,000 towards your ISA allowance

Saxo are giving new and existing clients the chance to win £5,000 towards their ISA allowance. If you’ve not already filled up your investment ISA this year, then Saxo is offering a nice incentive if you go with them. One randomly selected client who invests a minimum of £1,000 in a Saxo investment stocks and

Here’s a quick run down of Saxo’s Awards at Finance Magnates mean if you’re a trader

If you are a CFD trader, you may not have noticed that there was a conference called Finance Magnates earlier in the week. To be fair though, for retail CFD traders, it’s not really relevant as it’s an industry conference. If you want to know what conferences are worth going to if you are a

Saxo expands it’s tradeable CFD & Options universe with CFD Index Options

Saxo has launched CFD index options on 15 of the major global indices. It’s a nice addition to Saxo’s already excellent options offering. You can already trade on exchange index options, forex options, equity options on SaxoTraderGo (compare options brokers here). The options are European style and settle as cash (as opposed to American style

Here’s what Saxo thinks is going to happen to the markets in Q4: #SaxoStrats

Saxo, one of the few brokers out there who deal with private clients and produce research that is informative, applicable and sometimes outrageous have released their Q4 outlook. Most other spread betting and CFD platforms shy away from giving market outlooks, advice or even implied advice. However, Saxo, deal with more of an institutional client base

Saxo Bank valued at EUR 1.325 billion following regulatory approval of share sale to Geely

Saxo Bank, the owner of leading CFD broker Saxo Capital Markets, today received regulatory approval for China’s Zhejiang Geely Holding Group Co. Ltd (Geely Holding Group) and Sampo plc of Finland (Sampo) to buy out (amoung others) Saxo founder Lars Seier Christensen. The deal values Saxo bank at EUR 1.325 billion. If you’ve not used Saxo

Saxo increases currency conversion charges

In a note to clients Saxo Capital Markets one of the more professional CFD brokers has increased the charges for converting one currency to another. One erk about having an account with Saxo is that the account generally automatically does currency conversions to your base currency. So if you make a profit in USD it

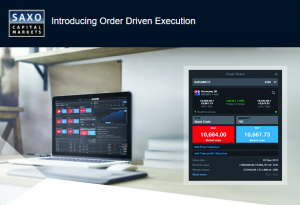

Saxo introduces Order Driven Execution

No doubt as part of the “best execution” policy brokers must now adhere to Saxo has introduced order driven execution. In a nutshell, this means that client trades could be crossed up with other Saxo customers as well as secondary markets. Order driven execution will go live on the 15th Nov for SaxotraderGo clients and

Saxo Markets FAQ:

Yes, Saxo Markets does act as a market maker for OTC products like CFDs. But, Saxo Markets does not act as a market maker if you are dealing in exchange products like listed options, futures or DMA stocks and shares.

No. Saxo used to offer a spread betting service through a partnership with London Capital Group. However, Saxo announced back in 2015 that it would be shutting down it’s spread betting service. Clients of Saxo Spread Betting migrated to deal with Capital Spreads directly.

The Saxo spread betting services was a white label of the London Capital Group platform, whose own brand is Capital Spreads.

The news came after there were significant changes at London Capital Group with a reported 75% staff turnover since Charles-Henri Sabet took the reigns and focusses on building the spread betting and forex broker back to profitability.

There is was also a significant amount more competition in the spread betting industry than in 2009 when Saxo launched the service. Increased competition and a decline in active spread betting clients may lead to more consolidation in the sector. This may include more white-label contracts being cancelled (like City Spreads, another LCG white label) or acquisitions (like City Index by Gain Capital or Cantor Index to Spreadex).

It is free to have an account with Saxo Markets. However, there are some monthly fees for accessing live data on certain markets. There is a custody fee for holding physical shares, but there is no inactivity fee if you don’t trade.

For a Classic account there is no minimum deposit, but for Platinum accounts the minimum deposit is £200,000 and for VIP accounts the minimum is £1,000,000.

Beginners may find Saxo Markets a bit complex as they are more suited to experienced traders. However, beginners can still open an account and invest in the stock market without trading derivatives.

No. There is no fee to withdraw funds. However, to avoid delays with requesting funds back make sure your account information is completely up to date as Saxo Markets will have to comply with AML regulations before returning money.

Yes, to switch from limit order to market order on Saxo Trader GO follow these steps:

- Go to the “Orders” tab at the bottom of the trading screen.

- Find the order you want to change

- Click the three dots on the right-hand side that look like this “…”.

- Select “change to market order”

- Approve the change on the confirmation screen.

Your order will be executed at the currency market price and your limit cancelled.

62% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.