Saxo Markets has reduced its minimum deposit requirements in more than 9 different markets. Traders in the UK, France, Singapore, Switzerland, Poland, Czechia, Slovakia and Australia, among others, will no longer be subject to a minimum deposit requirement when funding their accounts.

Saxo Bank Markets removes minimum deposit

Saxo may have removed its minimum deposit requirement, however, that doesn’t mean that new Saxo clients can open anything other than a Classic account, with a modest cash balance.

That’s because under Saxo’s tiered system, which is based on activity and account size, you will need to deposit £200,000 to qualify for a Platinum account, and £1,000,000 or more to make the jump up to VIP account status at the broker.

Platinum and VIP accounts enjoy perks such as tighter spreads, smaller commissions, dedicated support lines and relationship managers.

For example, Classic account holders pay a minimum ticket charge of $10 on US equity trades while their Platinum and VIP colleagues pay minimum charges of $7.0 and $3.0 respectively.

Fast growing client base

The tiered account system and variable charges do not seem to have deterred new clients from joining the broker.

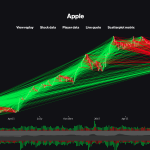

In its 2022 results, Saxo acknowledged that it had opened 157,000 new accounts, that year. Taking the total number of clients at the broker to 876,000, with client assets of DKK 584 billion or almost US $83.0 billion.

Saxo also recently announced a new open banking partnership with Mastercard which will allow customers to easily move money into their trading accounts.

The new payment feature has been successfully trialled in Denmark and will now be rolled out across Europe.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com