Saxo has launched CFD index options on 15 of the major global indices.

It’s a nice addition to Saxo’s already excellent options offering.

You can already trade on exchange index options, forex options, equity options on SaxoTraderGo (compare options brokers here).

The options are European style and settle as cash (as opposed to American style which can be settled early).

The launch of CFD index options has come at a fairly relevant time as the stock markets are (for want of a better phrase) “a bit top heavy”. Many pundits are suggesting a large correction is coming and as such options provide a great tool for investors to protect portfolios and exposure against significant and unexpected moves.

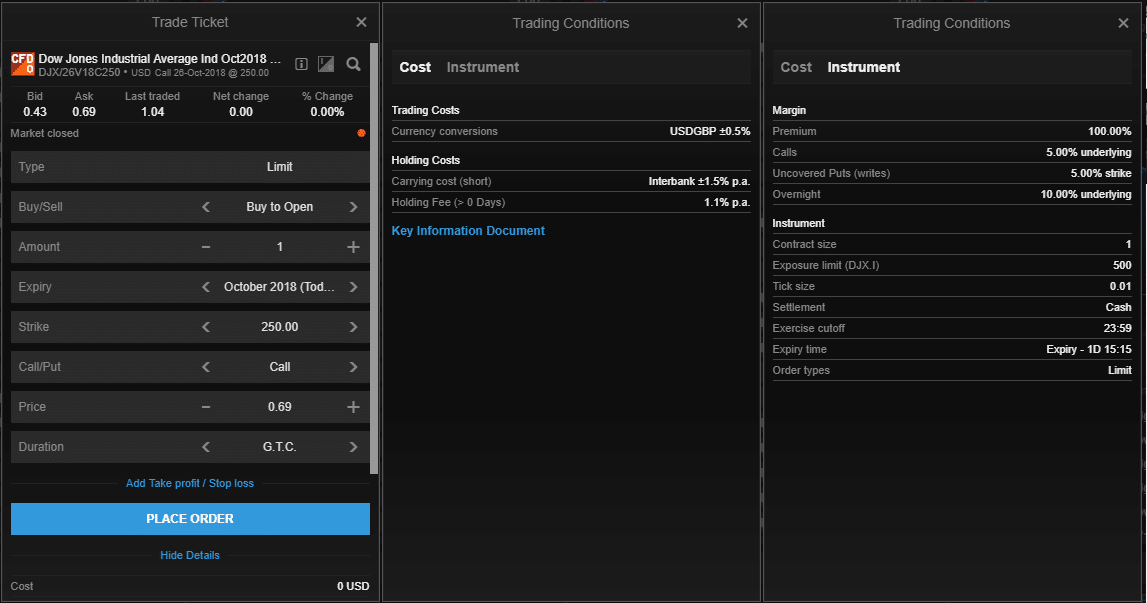

Here’s an example of Saxo’s CFD index options on the DJIA (DJX)

There’s no watchlist set up for the CFD index options, but if you use the below table and enter the code into the search box it launches the CFD index options deal ticket.

Commenting on the launch, Magnus Sundby, Product Manager – CFD & Equities, said:

“This new product range will lower the entry barrier for clients looking to trade options, as CFD options reduce the cost of trading for clients by giving them access to cost-effective investment and hedging strategies as well as tools to help them manage the risk. Compared to traditional Listed Options, the CFD Options will also provide clients with greater flexibility in terms of contract size, since the lot is equal to one Index. By lowering the size of the contract, we allow more clients to trade Index Options, and enable them to manage their risk more efficiently – yet another example of how we continue to democratise trading and investing.”

Saxo Clients can trade CFD index options on the below (we’ve also included their handy size and fee guide)

Saxo Index Option CFD pricing and search codes

| OPTION ROOT | DESCRIPTION | CONTRACT SIZE | DAILY HOLDING FEE | CURRENCY |

|---|---|---|---|---|

| AEX | AEX Index | 1 Index | 1.10 | EUR |

| DJX | Dow Jones Industrial Average Index | 1/100 Index | 1.10 | USD |

| ESX | FTSE 100 Index | 1 Index | 1.10 | GBP |

| HSI | Hang Seng Index | 1 Index | 1.10 | HKD |

| MIBO | FTSE MIB Index | 1 Index | 1.10 | EUR |

| NDX | Nasdaq 100 Index | 1 Index | 1.10 | USD |

| NKY | Nikkei 225 (Osaka) | 1 Index | 1.10 | JPY |

| OBX | OBX Index | 1 Index | 1.10 | NOK |

| ODAX | DAX Index | 1 Index | 1.10 | EUR |

| OESX | Euro Stoxx 50 Index | 1 Index | 1.10 | EUR |

| OMXSWE30 | OMX Stockholm 30 Index | 1 Index | 1.10 | SEK |

| OSMI | SMI Index | 1 Index | 1.10 | CHF |

| PXA | CAC 40 Index | 1 Index | 1.10 | EUR |

| SPX | S&P 500 Index | 1 Index | 1.10 | USD |

| XJO | S&P ASX200 Index | 1 Index | 1.10 | AUD |

If you want to put on options strategies like straddles, strangles or other multi-legged options strategies you can do so with their combination order ticket. The combo ticket was launched back in 2016 and here’s what Georgio Stoev, Futures and Listed Options Product Manager, said:

“Instead of trading options leg by leg using multiple trade tickets, the different legs can now be delivered as one order and executed as one.”

“Through multi-legged strategies, clients will be presented with unique opportunities to participate in established option strategies such as straddle, ratio spreads and iron condor, among others.”

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.