IG is rated extremely highly on Good Money Guide, particularly for active traders and investors seeking a full-service platform. Experts highlight IG’s long track record, strong regulation, huge market range and advanced trading tools, positioning it as one of the most established brokers in the UK. Customer reviews on Good Money Guide are generally positive, with users praising reliability, platform quality and market access, though some note that pricing and platform complexity can be higher than simpler app-based rivals. 68% of retail investor accounts lose money

IG Customer Reviews

Tell us what you think of this provider.

There are no reviews yet. Be the first one to write one.

IG Expert Review

IG Won Best Trading App in the 2025 Good Money Guide Awards

Provider: IG

Verdict: IG is one of the largest and best brokers in the world and offers the full suite of investing and trading accounts for all types of investors. Highly recommended. Founded in 1974 as Investors Gold Index, then IG Index, and now just “IG”, it’s one of the world’s largest margin trading brokers. IG offers contracts for difference (CFDs), FX and spread betting (in the UK) alongside share trading and prime brokerage to over 400,000 clients, and covers 15,000 tradeable markets. IG also offers physical share dealing and smart portfolios for longer-term investors.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Is IG a Good Trading Platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

First up, I must disclose that IG is my default broker. When I review brokers, I ask: “Why would you trade here rather than at IG?” It was my first trading account – I’ve had it for about 20 years and I remember the first online trading platform when it was basically a messaging system through to the dealing desk. When I was interning on the NYMEX and IPE trading floors in London and New York as a ticket checking clerk, I’d tap away on IG on my Ericsson R380. Along with Trading Places (my dog is even called Winthorpe #notobsessed) I hold IG accountable for the path my career has taken.

Who is IG?

Stuart Wheeler, IG’s founder, basically invented financial spread betting in the attic of a Chelsea townhouse in 1974. It was first called Investors Gold Index, then IG Index and then just IG. As the product range grows, the name shortens.

His biography (Winning Against the Odds, My Life in Gambling and Politics) makes clear IG was founded for the love of the business (that business being gambling and investing).

One of the things that makes IG stand out is that it’s good at what it does, and seems to want to be the best.

I certainly gathered from my interview with the former IG CEO, June Felix, that the company wants to be on the client’s side, believing it’s better to try to help the client win, and give them good service, so they’re still a client 20 years later, rather than the churn and burn approach.

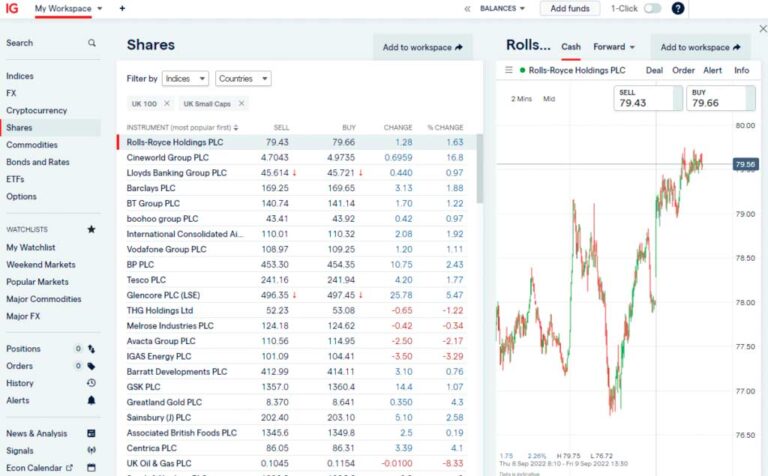

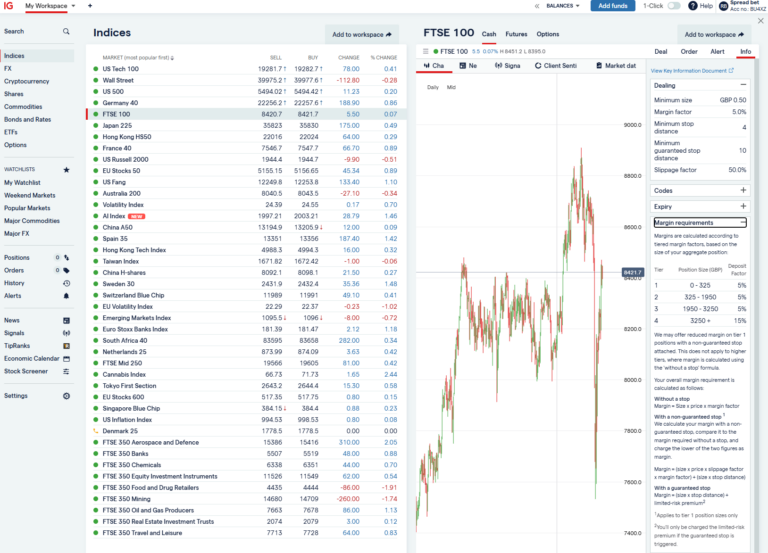

Index & Forex Trading

IG was one of the first brokers to let private individuals trade the financial markets, and IG clients can now trade a market-leading 80+ indices.

You can also trade forex on the platform. But unlike most other forex brokers, which see the largest percentage of their volumes in the forex markets, IG’s most popular asset class is indices, followed by currency trading.

Quality Service

IG has always taken the view that clients trade with it because of the service it offers, rather than because of any incentives.

No B-Book

One draw for big clients is that whilst IG does internalise orders, it has symmetrical exposure limits, so it doesn’t take a view on the markets. This means that IG is not betting against you with a B-Book. And, if you’re a big trader, because of IG’s liquidity there may actually be bigger volume on IG’s bid and offer than there is in the underlying market. You get positive slippage, so if you place a limit order and the market suddenly moves in your favour you get filled at a better price than your limit.

Spread Betting & CFD Trading

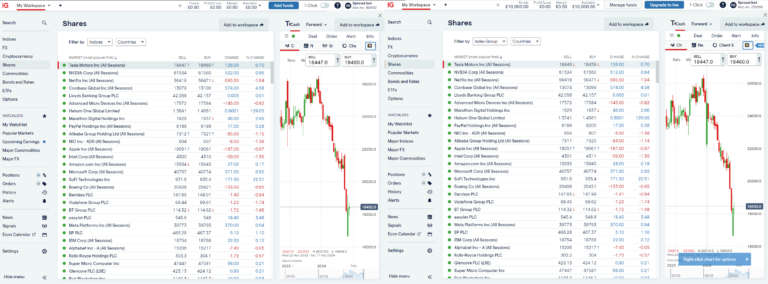

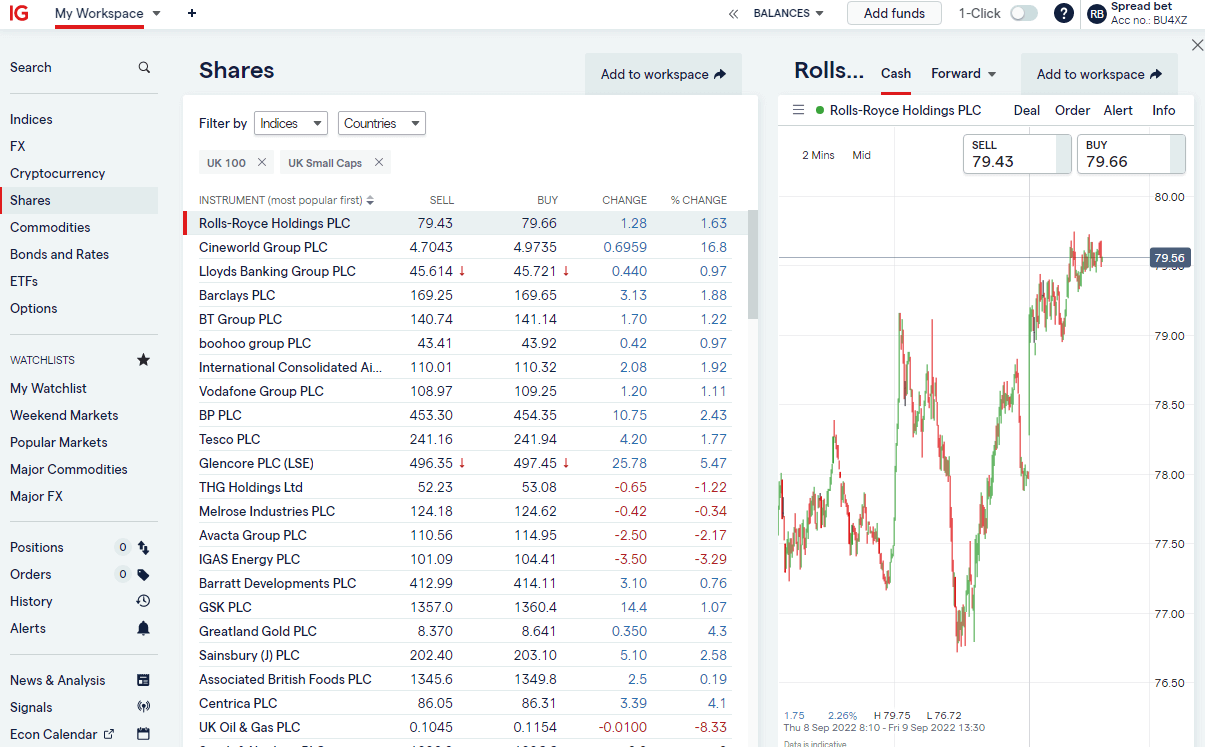

With IG you can trade CFDs or spread bet 24 hours on major indices, forex and commodities markets. There are extended hours on global equities, where some fairly significant volume goes through, particularly on US equities when company announcements are made after the main market shuts.

IG is one of the few brokers to allow trading during the weekend, so you can still take a view or limit your exposure if something big comes out politically.

IG is one of the best CFD trading platforms as it offers a huge range of markets to trade and DMA access for more sophisticated traders. Also, because IG offers CFDs globally (with the exception of the US) it has a huge amount of volume and liquidity meaning that sometimes you can place bigger orders via IG’s order book than you could do on the underlying exchanges like the LSE or NYSE. Because of the sheer volume of CFD trades, IG is able to internally match up orders for quicker and larger fills.

One key disadvantage of trading CFDs through IG is that you have to pay tax on profits. However, CFDs are not the only product that IG offers. You can also trade financial spread bets, where you do not have to pay capital gains tax on profits as this is classed as gambling.

IPO Grey Market

One feature that’s now unique to IG (lots of other brokers used to do it) is the “grey market”, where it will offer you a price in unquoted stocks that are due to come to market. You essentially take a bet on what the market cap will be of a company when it lists. Or you can just apply for shares in the IPO through PrimaryBid, which will deliver them to your IG account.

Global Differences

IG is good at knowing what customers in each region want. The UK, for example, is the only country that is offered financial spread betting, and the rest of the world trades on margin with CFDs. That’s with the exception of the Americans, who trade on margin by taking out a loan to buy stock (from their broker) or trade options, which are much more popular on equities. Japan has knockouts and Europe has barrier options and Turbos Warrants.

What Does the Trading Platform & App Look Like?

IG’s trading platform is DIY online, but still with phone support if you need it.

IG is keen to push its added value; the platform tries to integrate as much as possible. IGTV is based on the platform analytics of what people are trading, and IG creates programmes around what markets and assets traders are looking for information on. The news and analysis comes from Reuters, with snapshot videos and a series of IG market commentary videos.

We rate IG’s trading app as extremely safe because of IG’s regulation and reputation. However, it’s important to note that while trading on the app itself is financially secure, the products on offer are high risk and IG does offer investments that are not safe for capital preservation. IG offers financial spread betting and CFDs which are high risk, potentially high reward products.

High Net Worth Accounts

If you are a high-volume trader, you can also trade DMA with ProRealTime, and you can get level 2 pricing and trade directly on the exchange order book. This can be done on the IG trading app or by downloading the L2 dealer software. There is a cost, of course, but if you do a few trades that is rebated back. Brokers have to pay the exchanges for providing level 2 data to their clients, so the charge is there to dissuade everyone signing up without trading. If you are really clever and have developed your own trading algorithm, you can plug that into IG’s platform too. Or MT4/MT5 which it also offers, if you’re into that sort of thing.

Sticky Clients

A problem all brokers are desperate to address is people losing money. It’s always been the case that only around 20% of people made money. A few brokers have implemented post-trade analytics, to help their clients try and win more. IG’s Trade Analytics tool does just that. Its sole purpose is to try and help traders win more by getting a better understanding of where they profit and lose in the markets. It’s been developed in-house by IG, based on analytics and to provide clarity.

James Perry, a former IG Client Experience Manager, told me “We desperately want our clients to win, as the more they win, the longer they are going to be a client, and the more they are going to trade.” And the more commission IG will make.

I know this to be true from my own trading, when you’re on a winning run you trade more, and when you can’t call the market right you step away until another day.

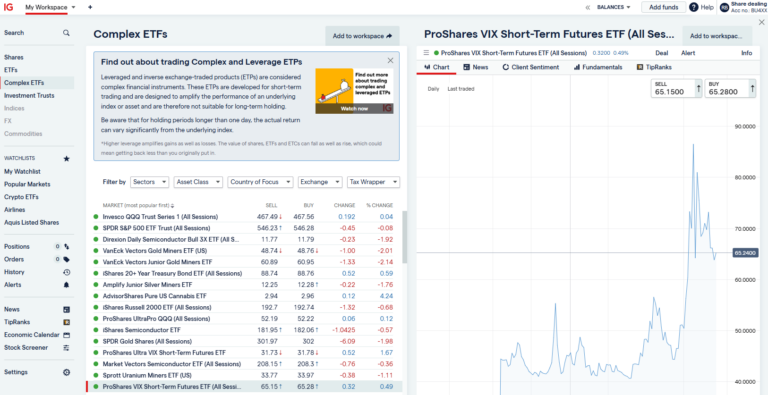

Investing, ETFs & Share Dealing

IG also offers longer-term investing products, where you can buy and hold stocks, ETFs and funds in a stocks and shares ISA, or IG Smart Portfolio. It has a trading academy so you can learn through video and interactive courses. IG can see from its analytics that clients that use these become better traders. IG bought DAILY FX (for $40m) and offers live webinars to provide analysis and trading strategy.

You can invest and trade ETFs with IG. You have the option of either investing in the long term by buying ETFs in the general investment account, SIPP or ISA. Or you can speculate on them going up or down by going long or short via CFDs or financial spread bets.

IG is not the cheapest place for investing in ETFs, (that is probably Interactive Brokers) but it does have very good customer service and is a really easy-to-use ETF platform.

Ratings Explained

- Pricing: Industry leading spreads and with DMA you can get inside the bid/offer.

- Market Access: Best around for spread betting and CFD trading.

- Platform & Apps: Loads of added value, signals and execution features.

- Customer Service: IG is very big, but still managed to score well here.

- Research & Analysis: Superb, news, analysis, social feeds, plus free premium subscriptions for active clients.

Overall, if you are going to trade, I would be surprised if you didn’t have an account with IG.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service occasionally slow

- No DMA futures trading

- Not the cheapest for ETFs

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7IG Facts & Figures

IG Total Markets | 17,000 |

| ➡️Forex Pairs | 51 |

| ➡️Commodities | 38 |

| ➡️Indices | 34 |

| ➡️UK Stocks | 3925 |

| ➡️US Stocks | 6352 |

| ➡️ETFs | Over 2000 |

IG Key Info | |

| 👉Number Active Clients | Over 313,000 |

| 💰Minimum Deposit | 250 |

| ❔Inactivity Fee | Yes – £12 per month |

| 📅 Founded | 1974 |

| ℹ️ Public Company | ✔️ |

| 🏢 Head Office | London, UK |

IG Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ✔️ |

IG Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1.2 |

| ➡️DJIA | 2.4 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.4 |

| ➡️EURUSD | 0.6 |

| ➡️GBPUSD | 0.9 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.3 |

| ➡️Crude Oil | 0.28 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | 0.1% |

IG News, Reviews & Interviews

IG FAQs:

IG has over 313,000 clients worldwide and is one of the latest online trading platforms globally

IG’s share dealing account is one of the cheapest of all the major stock brokers in the UK. You can buy UK shares from £3 per trade and there is no commission for buying US stocks.

Yes, you can trade gold on IG, through ETFs, CFD or spread bets. In fact, IG started off being called Investors Gold Index with a focus on making gold markets.

Yes, IG’s trading platform is ranked by us as one of the best in the UK. IG’s trading platform is specifically good for high volume traders that require deep liquidity.

Yes, IG offers around 51 forex pairs to trade and you can also invest in currencies by buying FX rate tracking ETFs.

- Further reading: Compare the best forex brokers here

IG Index was the previous full name of Investors Gold Index before they shortened it to IG. IG Index, was the pioneer of the spread betting industry.

IG Markets has the same spreads as IG Index. The difference is that IG Index offers spread betting to UK customers where as IG Markets offers CFD trading globally (except in America) to retail and professional traders.

IG offers spread betting, CFDs, forex and investing accounts through IG Markets.

IG was founded and is still based in London. Their current offices are in the heart of the City of London. IG’s London address is: Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA

Yes, IG offers a share dealing ISA where you can pick your own shares and also a Smart Portfolio ISA where you buy into a pre-made portfolio that contains a diverse range of investments and is ranked by risk.

- Further reading: Compare stocks and share ISA accounts

IG’s client sentiment shows how many traders are long or short in a market. It can be used as either a leading or contrarian indicator depending on whether or not you agree with crowd investing mentality.

IG is one of the most competitively priced trading platforms. IG spread sin major markets are often marketing leading. For example, they offer some of the tightest spreads for GBPUSD trading. They are also one of the cheapest brokers for holding positions overnight.

Further reading: Overnight Financing Explained: What is it and is it important?

Yes, In the UK IG Group and IG Markets is regulated by the FCA so if they go bust your money (up to £85k) is protected by the FSCS. However, your money is not safe from you making bad investment decisions or picking a bad trader to copy trade.

No. There are no withdrawal fees for taking money out of your IG account.

No, you do not have to pay tax on profits if you are spread betting or have a stocks and shares ISA account with IG. However, if you have a CFD or share dealing account, you will have to pay tax.

Yes. IG will charge you a monthly inactive fee of £12 if you do not use your account for two years. Once your account balance reaches zero you will no longer have to pay this fee.

Yes IG does have a SIPP account where you can invest in individual shares or their Smart Portfolios. IG partner with Options UK Personal Pensions LLP who are an independent pension administration company providing specialist pension services and products to the UK market. The trustee of the IG SIPP is MK SIPP Trustees UK Ltd.

- Further reading: Compare stocks and shares ISAs and SIPP providers

IG’s level-2 dealer is a trading platform that lets you trade with direct market access. Unlike normal IG spread betting and CFD accounts you are charged commission post-trade as you can work orders inside the market bid/offer spread.

- Further reading: Compare DMA trading platforms here

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.