-

Richard Berry

Richard Berry

- Updated

We have ranked, compared, and reviewed some of the best FCA-regulated CFD trading platforms for US stocks to help you choose the most appropriate stock broker for your investment objectives. US stock trading platforms let you buy and sell US companies via CFDs or financial spread betting so you can potentially profit when they go up or down and trade on leverage to maximize your risk capital.

In our comparison of US stock trading platforms, you can see how much a broker charges when you go long or short US stocks as well as how much they charge for holding positions overnight. You can also compare how many US stocks are available on their platform as well as if they offer access to US stocks through CFDs, spread betting, have direct market access and also offer longer-term investing accounts.

| US Stock Trading Platform | US Stocks Available | US Stock Trading Costs | Overnight Funding | Customer Reviews | More Info |

|---|---|---|---|---|---|

| 2,000 | 1.8¢ per share | 2.5% +/- SOFR | 3.8

(Based on 124 reviews)

| See Platform 69% of retail investor accounts lose money |

| 2,000 | 1.8¢ per share | 2.5% +/- SOFR | 4.2

(Based on 19 reviews)

| See Platform 74% of retail CFD accounts lose money. |

| 890 | 2¢ per share | 2.9% +/- SOFR | 4.6

(Based on 86 reviews)

| See Platform 71.9% of retail investor accounts lose money |

| 107 | 0.7% | n/a | 3.7

(Based on 146 reviews)

| See Platform 76% of retail investor accounts lose money |

| 3,500 | 0.003% | 1.5% +/- SOFR | 4.5

(Based on 1,330 reviews)

| See Platform 59.7% of retail investor accounts lose money |

| 2,110 | 0.15% (max $3.5) | 3% +/- SOFR | 4.3

(Based on 257 reviews)

| See Platform 61% of retail investor accounts lose money |

| 6,352 | 0.1% | 2.5% +/- SOFR | 3.9

(Based on 678 reviews)

| See Platform 68% of retail investor accounts lose money |

| 1,000 | 1¢ per share | 2.5% +/- SAXO RATE | 3.6

(Based on 74 reviews)

| See Platform 62% of retail investor accounts lose money |

| 4,968 | 2¢ per share | 2.9% +/- SOFR | 3.7

(Based on 149 reviews)

| See Platform 64% of retail investor accounts lose money |

| 1,080 | 0.08% | +9% / – 0.14% | 4.6

(Based on 136 reviews)

| See Platform 72% of retail investor accounts lose money |

❓Methodology: We have chosen what we think are the best US stock trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the US stock trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the US stock trading platform CEOs and senior management

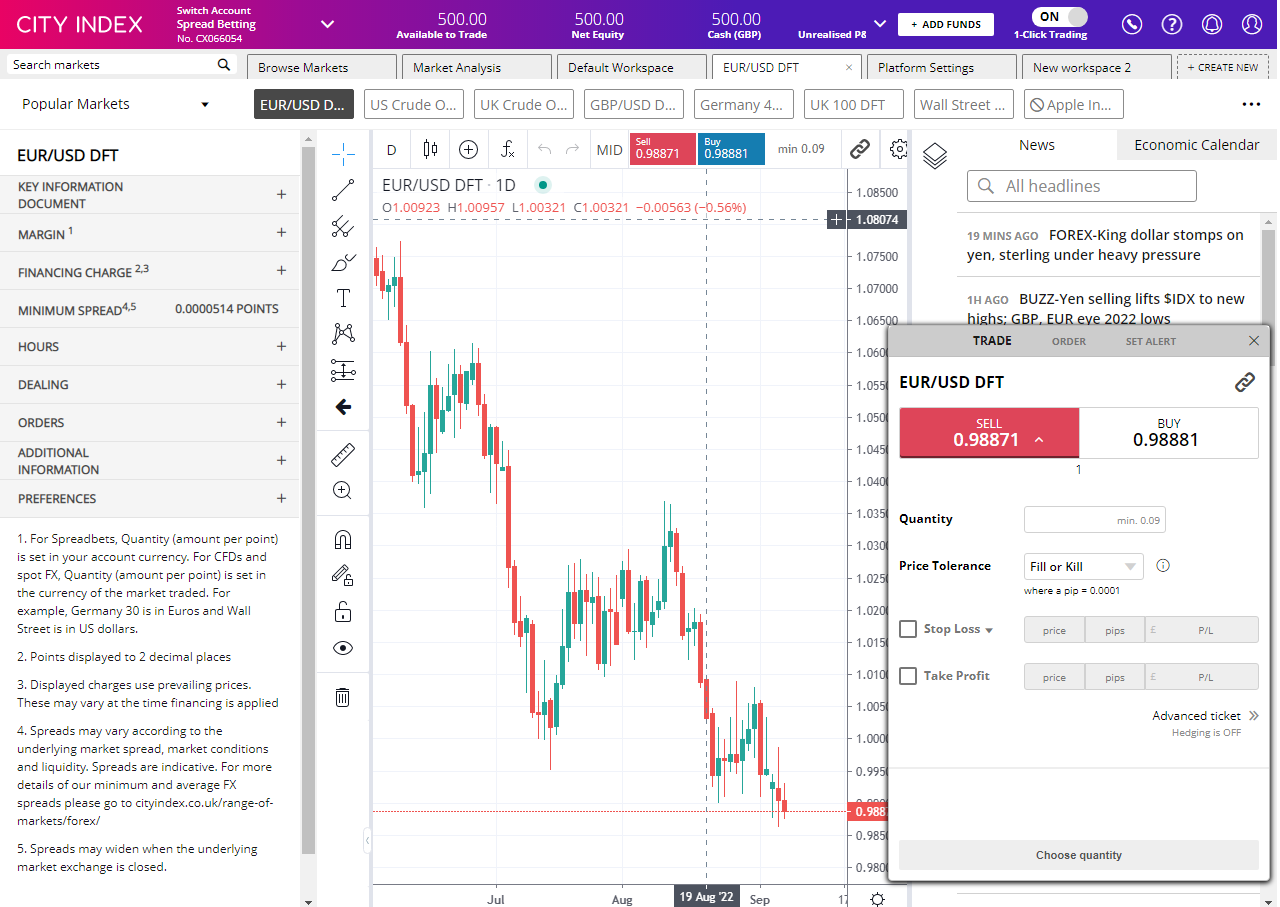

City Index: US stock trading signals and post-trade analysis

- Costs & spreads: 1.8¢ per share

- US stocks available: 2,000

- Overnight financing: 2.5% +/- SOFR

- Account types: CFDs & spread betting

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

City Index Gives Traders A Huge Range Of Added Value & Markets

Provider: City Index

Verdict: City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders. City Index is also one of the oldest spread betting and CFD brokers based in the UK founded in 1983 and offer trading in over 13,500 financial markets, to around 126,000 active clients. City Index is currently owned by StoneX, a US brokerage listed on the NASDAQ valued at over $4bn.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Is City Index a good broker?

I really like City Index and have used them for years. They offer some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

A big plus for me is that they are one of the oldest and most established trading platforms offering CFDs and financial spread betting, with a huge range of markets to trade, post execution analytical tools and trading signals.

Some of the best trader tools around

I opened my first City Index account way back in 2008, when they were one of only a handful of spread betting firms catering to high net worth traders in the City of London. Back then when I was a derivatives broker at MF Global, City Index used to hedge their CFD business through us so I could see they always had a fairly sophisticated client base. But over the years, as traders and investors have become more educated and akin to taking more risk, City Index now takes on more and more private clients.

If you’re thinking about trading with City Index, but haven’t quite made up your mind yet, I’ve tested all their trading platform’s features, visited their offices and interviewed their senior management for my review to hopefully provide enough information for you to decide if they are the right broker for you.I’ve always liked City Index, it’s been a stalwart of the London CFD broker scene since it was founded by Chris Hales and Jonathan Sparke in 1983 as a way for institutions to hedge their exposure through spread betting and CFDs. But soon became popular with more retail traders. Always advertising on billboards in the City, always having a colourful client base, always being bought and sold at the whim of billionaires and bigger boys. But in recent years, it had gone off a bit from its glory days. Back in the good ol’ days, you could open an account and put on a million-dollar trade over the phone with no ID, no deposit, and no idea. Well, you could if you happened to be on a yacht with Michael Spencer (the then City Index owner and City grandee), who was convinced he knew which way the Euro was headed and goaded one of his guests into putting the trade on, as the story goes away.

But those days are long gone and incumbent brokers have to fight hard to differentiate themselves against the fintechs nipping at their heels, as well as provide more trader tools to lure new customers back to traditional markets away from the wild west of Crypto.

City Index seems to have matured nicely though, it’s grown out of its lumbering adolescence under the ownership of Gain Capital and is now owned by US Behemoth StoneX (previously INTL FCStone). Since then, the platform has had a few upgrades and long-term investment products will hopefully be added shortly.

City Index Awards

In our latest awards City Index won “best trading app” in 2024 and “best trader tools” 2023. City Index has in previous years won “best trading platform”, “best trading app” & “best forex broker” in 2022.

Giles Watts, Senior VP of UK & EU at City Index said after winning best trader tools in 2023: “We are delighted to have been recognized for the added value we provide our clients. Delivering actionable post trade insights direct to the platform, is just one of the reasons our clients stay with us over the long term.”

Trading Platform

The City Index platform used to have a slightly off-the-rack feel about it, instead, the business relied on word of mouth and friendly referrals from HNW clients who would use experienced dealers to work large orders over the phone. Whilst voice brokerage still forms part of City Index’s offering, they are, as with everyone else, doing the majority of their business online and working hard to make their platform stand out.

Pricing & Spreads

City Index has always been competitive with it’s pricing. As City Index is an OTC broker they charge customers by widening the spread rather than adding commission after you trade. They are one of the cheapest around for trading UK stocks with the bid/offer being widened by only 0.08% (20% less than the industry standard of 0.1%) and for US stocks they only charge 1.8 cents per share (industry standard is 2 cents per share). Overnight financing rates are also inline with what you would expect 2.5% over/under SONIA rates.

Stocks, Forex, Indices and Commodities

You can buy over 13,500 stocks on City Index as a CFD or financial spread bet, however, you can’t trade equity options or invest in physical shares.

Obviously, they have access to more than the usual forex, index and commodity markets and add value with some nice thematic-themed indices (like ESG), and a good pool of sectors to speculate on. You can also trade options (CFD or spread bets thereof) on a good range of indices and commodities like Natural Gas or EU stocks. Plus, you can trade on synthetic markets. Everyone loves a bit of volatility speculation in choppy markets.

Spread Betting

Spread betting is City Index’s forte, and it’s the product that a lot of their high-net-worth customers use for trading stocks. As one of the original spread betting brokers City Index offers access to one of the widest selections of UK, US and European shares (as well as the major indices). The key advantage of spread betting of course is that profits are free of capital gains tax.

CFD Trading

Unlike spread betting CFD profits are subject to capital gains tax, so are less popular among UK traders. Historically, City Index would offer CFDs to more professional traders and spread betting to smaller clients. CFDs and spread betting are similarly priced with City Index, with the commission being included in the spread, which is slightly wider than the underlying market bid/offer. The main reason why both products are on offer is that spread betting is only available to UK residents, whereas City Index can offer CFD trading to its global client base.

Trading App

I actually prefer the City Index app to the desktop version of the trading platform. Sometimes I can find the desktop version to be a bit clunky, but the app is really slick, and clearly in our mobile-first world, where all the recent development has been focused. And why not, the desktop trading platform is brilliant for research, trading signals and post-trade analytics, but at the point of execution the app is a quick and simple stripped-down version with all the salient features front and centre.

MT4 (MetaQuotes)

You can trade on MT4 and MT5 with City Index, but functionality and market access is not as good as their main proprietary trading platform or some of their MT4 competitors. You can only trade around 84 markets on MT4 through City Index, but if you just want to trade the major markets, City Index is a good broker for MT4 based on their regulation, service and pricing.

Performance Analytics

Another acquisition from parent StoneX is Chasing Returns, now integrated into the platform as Performance Analytics. Which really drills down into where you are trading well and where you are losing money. Performance Analytics can break down your wins and losses and tell you what markets you trade best, what time of day you are most profitable, if you make money trading in quick succession or, if you do better if you take a break between trades. It’ll even tell you if your first trade of the day is often a winner or loser, or if you are a better bull or bear and also if you are as good at trading volatility as you pretend to enjoy doing, but letting you know if you trade better in calm or erratic markets.

Economic Calendar

One thing, though that does let them down is City Index’s economic calendar, it’s terrible. In fact, most brokers, even IG just have a bog standard list of upcoming earnings and economic announcements. But I think you need more from a trading platform these days, especially as when logged into the desktop platform the format is all off. One broker that has absolutely nailed their economic calendar is ThinkMarkets. With TM when you’re logged in you get a really good visualisation of previous data, volatility and most importantly what impact it had on relevant institutions like EURUSD. It’s a great way to see how markets have moved against previous numbers. Honestly, City Index should embed this too as it’s available from Trading Central who they have a deal with anyway.

Extended Hours Trading

You can trade CFDs premarket and after the market closes on a range of US equities in the pre and post-market sessions which bookend regular share trading in New York that takes place between 9.30 a.m. and 4.00 p.m. Eastern time.

The list of 73 stocks available to trade in the pre and post-markets includes leading US shares such as Apple, Microsoft and Nvidia. Widely traded names such as the Ark Innovation ETF, Coinbase, Robinhood and Gamestop.

As well as established blue chips like Bank of America, Boeing, Procter and Gamble, and Walmart, alongside a selection of index-tracking and thematic ETFs.

Verdict, overall, a great all-round platform that is backed by one of the largest financial institutions in the world.

Pricing: Always competitive, especially for major markets.

Market Access: Excellent coverage, especially for small-cap stock and exotic currency pairs.

Platform & Apps: Some excellent added value trading signals and portfolio analytics (even though the desktop version can be a bit fiddly).

Customer Service: Lots of experienced dealers to help with any issues, who you can get through to on the phone.

Research & Analysis: City Index excels here, lots of educational guides, trading ideas and analysis, to keep traders aware of major market moves.

Pros

- Excellent trading tools

- Post-trade analytics

- Publicly listed (part of StoneX)

Cons

- Trading only, no investment account

- Limited options markets

- No direct market access

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.8Forex.com: US Stock & Currency Trading

- Costs & spreads: 1.8¢ per share

- Minimum deposit: £100

- Overnight financing: 2.5% +/- SOFR

- Account types: CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

FOREX.com Won Best Forex Broker in our 2025 Awards

Provider: FOREX.com

Verdict: FOREX.com is one of the largest forex brokers operating globally and owned by Nasdaq-listed institutional broker StoneX. Forex.com offers traders access to 7,000+ assets including 80+ currency pairs, thousands of stocks, popular commodities, indices and cryptocurrencies (pro accounts only in the UK & EU). Pricing is competitive, especially for those on the RAW spread account or active trader programmme.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account. Pricing may also vary depending on your region and the specific entity that manages your account.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Is FOREX.com a Good Trading Platform?

FOREX.com won Best Forex Broker in the 2025 Good Money Guide Awards.

Plus, as well as being regulated by the top tier FCA in the UK, FOREX.com is regulated by CySEC, NFA, CIRO, MAS, ASIC, CIMA, and FSA with access to over 7,000 markets, exclusively via CFDs.

24-Hour FOREX.com Test

I took FOREX.com out for a 24-hour test drive, to trade with real money and try out some of the key features on the streets of the City of London. Here’s what happened…

“For FX sake”, I thought to myself when faced with writing a review about a forex broker. Firstly because all these brokers do is offer access to the forex market (or so I believed). Secondly, because I’ve never had much success with forex trading. I find the nuances of intra-day technical analysis too complicated.

I’m an old-fashioned trader – I like to look at the market and think it’s either overvalued or undervalued and, in my mind anyway, that’s easier when looking at a company’s share price, an index or even a commodity. But for some reason, with forex trading, I’ve never really got the hang of it.

Having said that, I have dealt currency for about 20 years now, but more as a broker rather than as a trader. For instance, I used to do some prime brokerage for institutions that would hedge their currency exposure when buying aeroplanes.

But I was so frustrated with how opaque pricing was in currency trading, that I decided to start up my own currency brokerage specialising in high-value currency transfers (£250,000 upwards) and undercutting everyone. It was called Berry FX, you can still see the demo on YouTube. Basically, personal service with the best rates anywhere ever. But now I just let other currency brokers compete for clients by trying to offer the best exchange rates.

But you want to know what I think of FOREX.com.

24 Hour Test

I took FOREX.com out for a 24-hour test drive around the City of London, putting some real trades on whilst going about my business to see if I could make any money.

I started out at the Bank of England with £10,000 on account at 11:30am. Lunch was a few minutes’ walk from the tube station, so I took the opportunity to put some trades on using FOREX.com’s trading signals. I’ve used these for years; back in 2018, they were known as GetGo and it was a standalone forex trading app. When I reviewed it then, I said these were the future of forex trading signals but are they still?

There are a couple of things that make these signals better than the rest.

- They tell you the success rate.

- The signal is linked to an order ticket.

When I was walking down King William Street to L’Antipasto to meet some contacts for lunch, I put a few trades on. First, I looked at the traders that had a historic success rate of over 50% and followed them. Then I looked at trading signals that had a success rate of less than 50% and traded against them. It’s a pretty simple strategy that generally works (not always, though). I used the classic stop/limit risk/reward ratio, aiming for twice the potential loss as a potential win. Again, simple forex trading strategies. The market is not hard to call, but if you get a trade right, it often pays to let it run for longer, but if it’s wrong, close it sooner.

Trading Central

On the way to my next meeting, I took a few moments on London Bridge to look at some of the other signals on FOREX.com: Trading Central. Now, Trading Central has been providing technical analysis to brokers for decades and supplies a constant stream of manually and automatically updated trading ideas throughout the day to give traders an indication of where the markets may go.

It’s not as fluid as the trading signals, as you have to put the trades in manually, but still gives you a bit of stimulus. This is great for someone like me because I generally have an idea of what I want to do from eyeballing a chart (I did, after all, run a technical analysis division for 5 years), but it’s nice to get confirmation of your thoughts one way or another.

Execution

When you are actually trading there are some great other features on the app:

- Swipe to trade: a bit like Tinder (so I hear)

- Chart on tickets: with a quick tap, you can bring up a chart when on the order ticket (to double-check)

- Working orders on charts: when looking at a chart, you can see your working orders and positions

- Position potential: as well as seeing what margin is required when placing a trade, you can also see and set your stops and limits as a potential monetary amount instead of pips

Post-Trade Analytics

Once you’ve done a bit of trading, you can review your trading history and see where you do well and where you can improve. This is a great feature as it can break down how well you trade by time of day, markets or volatility.

You can also set up “Play Maker” if you have a trading strategy and want to stick to it. Obviously, you can’t get that sort of data in a 24-hour test drive, so I’ll have to revisit that another time.

Demo Account

FOREX.com has a pretty good demo account. In fact, it’s hard to tell the difference between the demo and live trading platform. You get the same functionality and as trades are OTC, the same prices.

However, when I opened a demo account to test it, I already had a real account. So after I got my demo account login details, I clicked through to the “Webtrader” portal and (funny or alarming, depending on how you look at it) my live account details were auto-filled in by Google Chrome.

Now, had I not been checking my email, to ensure that the platform had sent me through my credentials, I might not have noticed that I was logging into a live account. It could have been disastrous if I’d started trading away thinking it was paper money. Even more so as you get £10,000 in demo funds and I’d deposited £10,000 in my live account when I took FOREX.com on a 24-hour trading signal test drive.

It reminded me of when a trader thought that he was trading on a demo account and put $1bn worth of orders through and then sued his broker because it voided his €10m profits.

TradingView & MetaQuotes

I had a good play about with TradingView, as it’s now the go-to destination for traders. TradingView is a sort of social network for traders where you can view charts (they are excellent) and post trading ideas (take with a pinch of salt). As TradingView has grown, it has also become an execution venue, so you can link your FOREX.com trading account and deal straight from the charts. This shouldn’t be too much of a stretch for most traders as the charts on the app and web-based platform are provided by TradingView (which, incidentally, is one of the largest financial-based websites in the world now).

You can also trade on MT4 or MT5 (but only MT5 in the EU), if you are into that sort of thing…

Am I a Forexpert?

I did make money on day one, mainly thanks to putting on a GBP-USD trade that covered most of the losses from some of the other trades. When I used the trading signals 5 years ago, I also made money. Day 2 wasn’t so good. On my way to an investor show, I gave back a few pennies but still ended up on top. But I have to admit my traders were calculated guesses rather than heavily researched positions.

I don’t like holding positions overnight, as day trading reduces not only your margin requirements but also increases the amount of sleep you get because you don’t wake up with cold sweats in the middle of the night worrying about Asian interest rates.

Overall would I recommend forex.com? Yes, if you are going to trade forex and don’t know where to start, as it’s a massive brand with global reach and owned by a listed brokerage with an institutional pedigree. As far as box-ticking is concerned, it ticks the lot. Or should I say pips the lot…

Pros

- Trading signals

- Post trade analytics

- Forex specialist

Cons

- Limited market range

- No DMA

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.6Pepperstone: US stock trading on MT4

- Costs & spreads: 2¢ per share

- US stocks available: 890

- Overnight financing: 2.9% +/- SOFR

- Account types: CFDs & spread betting

71.9% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone is a great broker for automated trading and active traders

Provider: Pepperstone

Verdict: Pepperstone is a great all round broker for active traders looking for low costs. Especially for those that want to automate their trading as they are one of the biggest and best MT4 brokers with a very good set of EA packages. Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges.

71.9% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone a good broker?

Pepperstone is a great trading platform for traders who want low costs, wide market access and wide range of trading platforms, including one of the best MT4/MT5 packages available to retail traders worldwide.

Pricing: Razor tight pricing (on their Razor account).

Market Access: Mainly FX, but lots more stocks are being added.

Platform & Apps: Pepperstone’s MT4 and cTrader packages are top-notch.

Customer Service: Local offices around the world and personal account managers for large active traders

Research & Analysis: Lots of education and technical and algo indicator documentation.

Yes, I’ve used both trading platforms that Pepperstone offer, MT4/5 and cTrader, which include TradingView charting. cTrader is a more traditional trading platform with a basic layout, simple order execution and sentiment indicators. Whereas MT4 is one of the most popular and complex trading platforms available used by millions of traders and thousands of brokers.

However, what makes Pepperstone’s MT4 offering stand out is the brokerage behind it. Pepperstone offers it’s MT4 clients experienced account executives based in London and other local offices around the world. Plus, Pepperstone have put together a package of expert indicators and trader tools that are available to download for free that can be plugged into MT4.

To win business Pepperstone competes on price and compared to other trading platforms it is one of the cheaper options. For example, the Razor account can offer forex trading with zero pips, with the commission charged post-trade. Or traders can opt for the standard account, which adds a 1 pip markup, but is built into the spread.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts (apart from the Tennis and now sponsoring Aston Martin) and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. They are a global brokerage so you can at the moment trade crypto, but only if you are a professional client in the UK or are in a jurisdiction that hasn’t banned crypto derivatives.

Management: If you want to know more about the man currently running Pepperstone you can read my interview with Tamas Szabo, who has been Group CEO of Pepperstone since 2017, joining from IG where he started in 1996. So plenty of experience at the helm, Tamas, has been in the business for 25 years.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts or anything like that and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign.

As I said Pepperstone offers CFD trading for international clients and spread betting for UK customers. Spread betting of course unique to the UK as trades are structured as bets so if you make money trading you don’t have to pay capital gains tax on your profits.

Trading Platforms: Pepperstone doesn’t actually have its own proprietary trading platform instead they offer TradingView, MT4/5 and cTrader. MetaTrader is gradually pushing brokers and clients to MT5 because it’s faster and a bit more user friendly, however, there is a lot of resistance from traders, especially those that use EA’s or Electronic Advisors, as most have been written for MT4 and can’t be converted for MT5 without being re-written.

Automated Trading: If you haven’t used one an EA, an Electronic Advisor enables you to trade automatically based on certain market criteria, usually based on technical analysis. So if the market does x, you buy, if the market does y you sell. The idea is that you set up a trading strategy and set it on autopilot to trade on your behalf. It’s not necessarily high-frequency trading that was featured in Flash Boys or Flash Crash, but it’s similar.

If you want to know more about high-frequency trading those are two books well worth reading, Michael lewis has an excellent way of explaining complex derivatives and I particularly enjoyed Flash Crash because the chap it’s about was a client at the brokerage where I used to work and some people I know were mentioned in it, which is always quite amusing.

A few things to note though about EAs, unless you have a VPS or VPN they won’t work if you turn your trading screen isn’t on and you can’t use them on the web version or mobile. However, Pepperstone will set you up with a free VPS connection if you want one and do a certain amount of business.

MT5 versus MT4: MT5 is one of the most popular trading platforms on the planet and is used by millions of traders and hundreds of brokers. The key benefits are that it’s pretty simple to use and universally recognised, so if you used MT4 or 5 with one broker, switching accounts is fairly easy. Initially, it does have a clunky institutional feel to it, but once you get the hang of it it’s fairly simple to use.

Pepperstone’s MT5 does have its advantages over other brokers though. Mainly the packages they offer, the spreads and the execution, but also the regulation. Pepperstone are regulated by the FCA, so if you are a UK client a certain amount of your funds are protected by the FSCS if Pepperstone was to go bust. You are not protected if you are using MT4 or 5 through an offshore broker, and to be honest, if you are based in the UK you should always be trading with an FCA regulated broker, or the FCA regulated entity of a broker. It is tempting to go offshore to get better margin rates since ESMA capped them but you can get them as a professional client and if you can’t qualify as a professional client you probably shouldn’t be trading with excessive leverage anyway.

One of the main things that make Pepperstones MetaTrader offering stand out is market range, you get loads of forex pairs, the major indices and they are also increasing the number of shares they offer. They have the major FTSE 100 stocks and a few hundred US, European and Australian stocks, but that is growing. But, it is still nowhere near as many markets as someone like IG or Saxo offers. Also, Pepperstone is still only a trading platform so you can’t hold any of your long-term investments with them.

Trading Tools: Pepperstone also has a unique package of MT5 downloads which they call Smart Trader Tools, which include plugins like Trade Terminal where you can set your preferences for assets. So for example if you always trade cable in 1 lot, and have a stop 10 pips away and a limit 20 pips that will be your default OCO when you trade.

You also get things like a Pivot Points plugin where you can trade off previous highs and lows. Some other main features of MT4 are one-click trading, and the ability to trade off the charts. You can also move your entry and exit points automatically. If you trade four markets you can have four set up on screen and have your defaults for each one.

cTrader: One of the major drawbacks about MT5 though is that it doesn’t show your margin when you trade, which to be honest isn’t great if you are a beginner because you have no idea what your exposure is or how much risk capital is going to be used up. It will tell you your overall margin position, but it won’t show you your individual margin rates. Which is daft. However, Pepperstone’s other platform cTrader does do this. To be honest, I actually prefer cTrader, I think it’s more user-friendly, it breaks down your margin. The disadvantage of course is that you can’t run net and hedged positions.

You can’t trade with EAs but I don’t really like them anyway, I think the chances of clients making money with an off-the-rack automated trading strategy is pretty slim. It may work for a bit to nick a trade here and there but if you leave it running over a massive market correction you can get wiped out. You also can’t trade as many shares on cTrader as you can on MT5, which is a shame.

I think it has a cleaner layout, with everything pre-installed and you can trade in a web browsers rather than having to download the software. If you are building your own EA then MT5 is for you but if you are just eyeballing the market and taking a view I prefer cTrader as you get news, calendars, plus Autotrachtists is on there as well and is linked to the pair you are looking at.

Education & Analysis: One other thing to note as well is that when it comes to learning to trade or understanding the markets it is incredibly difficult. Pepperstone has partnered with The Corillian Academy, to provide some educational content. Corillian was set up by some fairly sophisticated traders with decent backgrounds. Richard Adcock for example has been on the board of the society of technical analysts for 30 years.

Customer Service: Although probably the main benefit of Pepperstone over the majority of MT4 brokers is customer service. It’s a big risk trading the financial markets and there are often big sums of money involved. So being able to phone someone up who can execute trades for you and give you a full demo of the platform is almost more important, in my mind anyway, than pricing and market access. If you’re in the UK, you get to talk to your dealers in London, through direct dial.

Pros

- Tight pricing

- Wide range of MT4 markets

- Pre-built MT4 indicator packages

Cons

- Limited market access

- Only third-party platforms

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1Plus500: Global CFD Trading Platform for Major Indices

👍Featured👍

- Indices available: 39

- Minimum deposit: £100

- Account types: CFDs

76% of retail investor accounts lose money when trading CFDs with this provider.

Plus500 Expert Review 2026: A user-friendly platform with access to global markets

Provider: Plus500

Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Is Plus500 a good broker?

Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks.

Opening a Plus500 account is really simple:

- Submit some documents to the company (identification, residence verification, etc.)

- Read through several documents and complete a questionnaire

- To be able to trade, you will need to fund your account (in the UK, the minimum initial deposit is £100).

Pricing: It’s dynamic so moves with the market for minimum spreads.

Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

- Overnight funding fees – This is either added to or subtracted from your account when holding a position after a certain time

- Currency conversion fee – There is a fee (0.7%) for all trades on instruments denominated in a currency different to the currency of your account

- Guaranteed stop-loss order fees – If you request a guaranteed stop loss on a trade, there will be a small fee

- Inactivity fees – If you do not log in to your trading account for three months, a fee of up to USD $10 per month will be applied to your account.

Withdrawals are free of charge no matter how many you make per month.

Deposits are also free of charge.

Market Access: Very good, Plus500 are always first to try new asset classes

With Plus500, you can trade CFDs on a range of assets and instruments including:

- Shares (e.g. Lloyds Bank, Tesla, Apple)

- Currencies/forex (e.g. GBP/USD)

- Commodities (e.g. gold, oil)

- Options (exchange-traded options)

- Exchange-traded funds (ETFs)

- Indices (e.g. FTSE 100, S&P 500, ESG indices)

Overall, there are over 2,800 assets you can trade with CFDs.

The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital.

Plus500 margin rates:

- Shares – 1:5

- Forex – 1:30

- Commodities – 1:20

- Indices – 1:20

- Options – 1:5

- ETFs – 1:5

Platform & Apps: Basic execution, but it does the job well

Plus500 trading apps and platform also offers several tools to help traders manage risk including:

- Stop-loss orders – Traders can use these orders to automatically close out a losing position at a specific level

- Guaranteed stop-loss orders – A guaranteed stop-loss puts an absolute limit on your potential loss from a losing trade

- Trailing stop-loss orders – This type of stop loss moves upwards as the price of the security being traded rises

- Take profit orders – Traders can use these orders to automatically close out a winning position at a specific level.

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient

Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered.

It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week.

If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

- A dedicated premium service client manager.

- Periodic emails containing expert analysis of upcoming trading events.

- External trading webinars.

- A premium service customer support team.

The premium service is invitation only. To become a premium customer, you must have a real-money trading account.

However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares).

To be eligible for a professional account, you must meet two of the following three criteria:

- You’ve performed an average of at least 10 transactions per quarter, of significant size, over the previous four quarters on the relevant market (with Plus500 and/or other providers)

- You have a portfolio worth more than €500,000 (including cash savings and financial instruments)

- You have worked in the financial sector for at least a year in a professional position that requires knowledge of the related transactions or services.

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

- Charting tools – Plus500’s platform offers charts with a wide range of indicators and drawing tools to help traders identify and capitalise on patterns and trends (there 13 charting tools and over 100 indicators)

- Market news – On its website, there is a section dedicated to news and market insights

- Alerts – With Plus500, you can set up real-time email, SMS, and push notifications for trade alerts (e.g. price alerts or % change alerts)

- An economic calendar – The economic calendar is designed to help traders prepare for important economic data (e.g. inflation data, retail sales data, job reports, PMI data)

- +Insights – This is a feature that allows Plus500 users learn more about market trends based on the company’s internal data (e.g. most bought stocks, most sold stocks)

- Watchlists – Users can manage multiple watchlists.

- Trading Academy – Plus500’s Trading Academy offers a range of educational products including eBooks, videos, and FAQs

- Webinars – Plus500 offers regular webinars to its professional clients

- A free unlimited demo account – With the demo account, novice traders can learn to trade CFDs without risking real money.

Pros

- With Plus500, you can trade CFDs on a range of assets including shares, currencies, indices, and ETFs.

- There are no commissions when placing a CFD trade on Plus500’s platform.

- Plus500 offers a range of features to help traders navigate the markets and capitalise on opportunities including charting tools, alerts, an economic calendar, and market news.

Cons

- Other platforms offer more markets than Plus500.

- You can only trade CFDs on the platform (you can’t invest in stocks directly).

- You can’t contact the company by telephone if you require support.

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.6Spreadex: US stock trading with personal service

- Costs & spreads: 0.15% (max $3.5)

- US stocks available: 2,110

- Overnight financing: 3% +/- SOFR

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Expert Review: Financial Trading With Excellent Personal Service

Provider: Spreadex

Verdict: Spreadex is a financial spread betting broker that has been in operation since 1999. It was founded by ex-city trader Jonathan Hufford and unlike many of its peers, it is not based in London, but instead is headquartered in St Albans Hertfordshire. Spreadex offers both financial spread betting and CFD trading from the same account. The company has some 60,000 account holders and offers access to more than 10,000 financial instruments, including UK small-cap shares, where it is something of a specialist.

61% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex a good broker?

Spreadex offer some of the best personal service for large spread betting and CFD traders and has built a reputation for great tech and trading and as such won “best spread betting broker” in the 2024 Good Money Guide Awards.

Pricing: Spreadex is super competitive and not afraid to undercut the competition

Market Access: Excellent, lots of access to exotic derivatives and smaller cap stocks

Platform & Apps: All developed in house and quick to add new features

Customer Service: Personal service is what sets Spreadex apart from other brokers

Research & Analysis: A good mix of technical indicators on the Spreadex platform and daily briefings from the financial dealing desk.

Pros

- Spread betting & CFDs

- Smaller cap stock trading

- Great customer service

Cons

- Not publically listed

- No physical investing

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

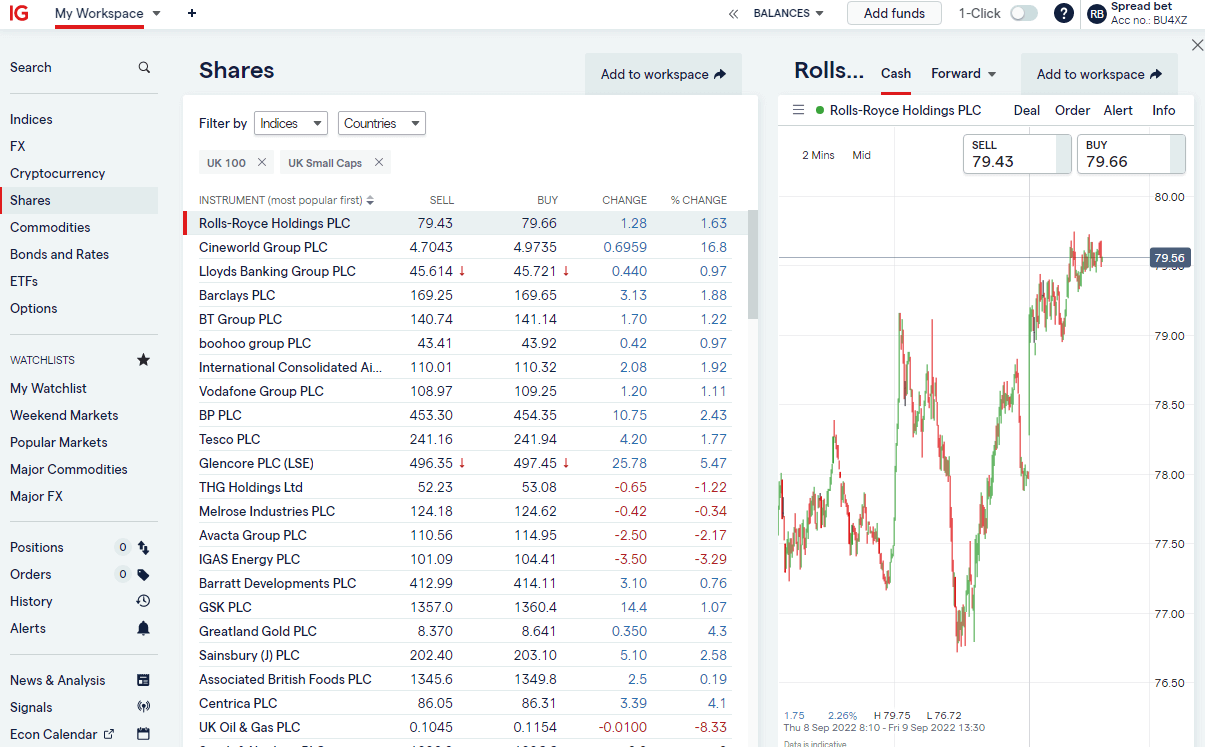

4.4IG: Deep US stock trading liquidity & market range

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

IG Won Best Trading App in the 2025 Good Money Guide Awards

Provider: IG

Verdict: IG is one of the largest and best brokers in the world and offers the full suite of investing and trading accounts for all types of investors. Highly recommended. Founded in 1974 as Investors Gold Index, then IG Index, and now just “IG”, it’s one of the world’s largest margin trading brokers. IG offers contracts for difference (CFDs), FX and spread betting (in the UK) alongside share trading and prime brokerage to over 400,000 clients, and covers 15,000 tradeable markets. IG also offers physical share dealing and smart portfolios for longer-term investors.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Is IG a Good Trading Platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

First up, I must disclose that IG is my default broker. When I review brokers, I ask: “Why would you trade here rather than at IG?” It was my first trading account – I’ve had it for about 20 years and I remember the first online trading platform when it was basically a messaging system through to the dealing desk. When I was interning on the NYMEX and IPE trading floors in London and New York as a ticket checking clerk, I’d tap away on IG on my Ericsson R380. Along with Trading Places (my dog is even called Winthorpe #notobsessed) I hold IG accountable for the path my career has taken.

Who is IG?

Stuart Wheeler, IG’s founder, basically invented financial spread betting in the attic of a Chelsea townhouse in 1974. It was first called Investors Gold Index, then IG Index and then just IG. As the product range grows, the name shortens.

His biography (Winning Against the Odds, My Life in Gambling and Politics) makes clear IG was founded for the love of the business (that business being gambling and investing).

One of the things that makes IG stand out is that it’s good at what it does, and seems to want to be the best.

I certainly gathered from my interview with the former IG CEO, June Felix, that the company wants to be on the client’s side, believing it’s better to try to help the client win, and give them good service, so they’re still a client 20 years later, rather than the churn and burn approach.

Index & Forex Trading

IG was one of the first brokers to let private individuals trade the financial markets, and IG clients can now trade a market-leading 80+ indices.

You can also trade forex on the platform. But unlike most other forex brokers, which see the largest percentage of their volumes in the forex markets, IG’s most popular asset class is indices, followed by currency trading.

Quality Service

IG has always taken the view that clients trade with it because of the service it offers, rather than because of any incentives.

No B-Book

One draw for big clients is that whilst IG does internalise orders, it has symmetrical exposure limits, so it doesn’t take a view on the markets. This means that IG is not betting against you with a B-Book. And, if you’re a big trader, because of IG’s liquidity there may actually be bigger volume on IG’s bid and offer than there is in the underlying market. You get positive slippage, so if you place a limit order and the market suddenly moves in your favour you get filled at a better price than your limit.

Spread Betting & CFD Trading

With IG you can trade CFDs or spread bet 24 hours on major indices, forex and commodities markets. There are extended hours on global equities, where some fairly significant volume goes through, particularly on US equities when company announcements are made after the main market shuts.

IG is one of the few brokers to allow trading during the weekend, so you can still take a view or limit your exposure if something big comes out politically.

IG is one of the best CFD trading platforms as it offers a huge range of markets to trade and DMA access for more sophisticated traders. Also, because IG offers CFDs globally (with the exception of the US) it has a huge amount of volume and liquidity meaning that sometimes you can place bigger orders via IG’s order book than you could do on the underlying exchanges like the LSE or NYSE. Because of the sheer volume of CFD trades, IG is able to internally match up orders for quicker and larger fills.

One key disadvantage of trading CFDs through IG is that you have to pay tax on profits. However, CFDs are not the only product that IG offers. You can also trade financial spread bets, where you do not have to pay capital gains tax on profits as this is classed as gambling.

IPO Grey Market

One feature that’s now unique to IG (lots of other brokers used to do it) is the “grey market”, where it will offer you a price in unquoted stocks that are due to come to market. You essentially take a bet on what the market cap will be of a company when it lists. Or you can just apply for shares in the IPO through PrimaryBid, which will deliver them to your IG account.

Global Differences

IG is good at knowing what customers in each region want. The UK, for example, is the only country that is offered financial spread betting, and the rest of the world trades on margin with CFDs. That’s with the exception of the Americans, who trade on margin by taking out a loan to buy stock (from their broker) or trade options, which are much more popular on equities. Japan has knockouts and Europe has barrier options and Turbos Warrants.

What Does the Trading Platform & App Look Like?

IG’s trading platform is DIY online, but still with phone support if you need it.

IG is keen to push its added value; the platform tries to integrate as much as possible. IGTV is based on the platform analytics of what people are trading, and IG creates programmes around what markets and assets traders are looking for information on. The news and analysis comes from Reuters, with snapshot videos and a series of IG market commentary videos.

We rate IG’s trading app as extremely safe because of IG’s regulation and reputation. However, it’s important to note that while trading on the app itself is financially secure, the products on offer are high risk and IG does offer investments that are not safe for capital preservation. IG offers financial spread betting and CFDs which are high risk, potentially high reward products.

High Net Worth Accounts

If you are a high-volume trader, you can also trade DMA with ProRealTime, and you can get level 2 pricing and trade directly on the exchange order book. This can be done on the IG trading app or by downloading the L2 dealer software. There is a cost, of course, but if you do a few trades that is rebated back. Brokers have to pay the exchanges for providing level 2 data to their clients, so the charge is there to dissuade everyone signing up without trading. If you are really clever and have developed your own trading algorithm, you can plug that into IG’s platform too. Or MT4/MT5 which it also offers, if you’re into that sort of thing.

Sticky Clients

A problem all brokers are desperate to address is people losing money. It’s always been the case that only around 20% of people made money. A few brokers have implemented post-trade analytics, to help their clients try and win more. IG’s Trade Analytics tool does just that. Its sole purpose is to try and help traders win more by getting a better understanding of where they profit and lose in the markets. It’s been developed in-house by IG, based on analytics and to provide clarity.

James Perry, a former IG Client Experience Manager, told me “We desperately want our clients to win, as the more they win, the longer they are going to be a client, and the more they are going to trade.” And the more commission IG will make.

I know this to be true from my own trading, when you’re on a winning run you trade more, and when you can’t call the market right you step away until another day.

Investing, ETFs & Share Dealing

IG also offers longer-term investing products, where you can buy and hold stocks, ETFs and funds in a stocks and shares ISA, or IG Smart Portfolio. It has a trading academy so you can learn through video and interactive courses. IG can see from its analytics that clients that use these become better traders. IG bought DAILY FX (for $40m) and offers live webinars to provide analysis and trading strategy.

You can invest and trade ETFs with IG. You have the option of either investing in the long term by buying ETFs in the general investment account, SIPP or ISA. Or you can speculate on them going up or down by going long or short via CFDs or financial spread bets.

IG is not the cheapest place for investing in ETFs, (that is probably Interactive Brokers) but it does have very good customer service and is a really easy-to-use ETF platform.

Ratings Explained

- Pricing: Industry leading spreads and with DMA you can get inside the bid/offer.

- Market Access: Best around for spread betting and CFD trading.

- Platform & Apps: Loads of added value, signals and execution features.

- Customer Service: IG is very big, but still managed to score well here.

- Research & Analysis: Superb, news, analysis, social feeds, plus free premium subscriptions for active clients.

Overall, if you are going to trade, I would be surprised if you didn’t have an account with IG.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service occasionally slow

- No DMA futures trading

- Not the cheapest for ETFs

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

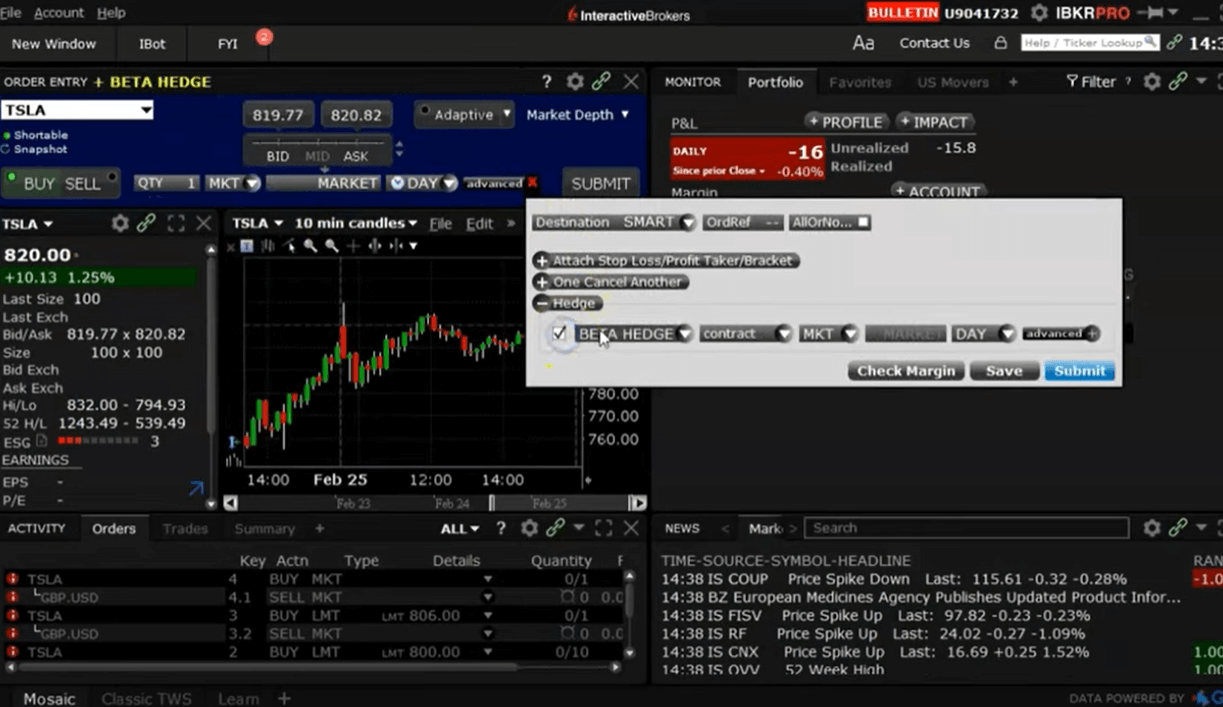

4.7Interactive Brokers: Discount US stock trading & investing

- Costs & spreads: 0.003%

- US stocks available: 3,500

- Overnight financing: 1.5% +/- SOFR

- Account types: CFDs, DMA & investing

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers has a platform for everyone with very low costs

Provider: Interactive Brokers

Verdict: Interactive Brokers is an exceptional trading platform that offers institutional-grade trading capabilities to private clients around the world. IBKR has some of the lowest trading and investing fees and the widest market range in the industry. Interactive Brokers is a major US online automated electronic broker company. The financial broker is listed on the Nasdaq Exchange with ticker IBKR. The firm operates in 150 electronic exchanges in 34 countries, and offers trading in 28 currencies. Interactive Brokers has more than 3.19 million institutional and retail customers.

Is Interactive Brokers any good?

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.

The proof they say is in the pidding and IBKR, has increased it’s market share in the UK dramatically over the past few years. In 2024 alone, they increased the number of accounts by 142%. An amount I suspect will continue to rise, of all the brokers we cover, they provide the most updates, most platforms and are always looking to offer new markets, that investors actually want.

2025 Awards: Best Professional/DMA Broker 2025

Pricing: Top marks as IBKR don’t charge a custody (account) fee and commission are the cheapest around

Market Access: Top marks again for the widest selection of markets available

App & Platform: Hard to beat – excellent range of institutional grade execution tools and simple apps for beginners

Customer Service: IBKR let themselves down a bit here. If you are a big customer you get an account manager, otherwise online support is slow

Research & Analysis: Some of the best education, screeners and market data for free on their website and integrated into IBKR platforms.

I’ve used Interactive Brokers for about 20 years now. I’ve interviewed their founder (Thomas Peterffy), their UK MD (Gerry Perez), they’ve been a competitor (when I was a broker myself), a customer and a partner over the years. I’ve traded live with real money when thoroughly testing their platforms.

This included an in-depth conversations with their Head Of Product (Steven Sanders) to get inside insights on the best parts of the platform and services that some clients may not know about. In this review, I lay out my verdict on Interactive Brokers as an industry expert so you can decide if they are the right investing and trading platform for you.

There is one thing that Interactive Brokers gives you above all other brokers, and that is control. You can invest and trade in pretty much anything you want, in pretty much any account type, pretty much how you want.

If you are not familiar with Interactive Brokers (IBKR) they are American, but global, as most American things are, with the notable exception of their news, which always seems to be local. But I digress, IBKR was one of the first brokers to offer electronic trading to the masses. They were founded in 1978 and if you want to know more about the man who founded them and is still running the show, read my interview with Thomas Peterffy, the founder and chairman.

Highlights: The key things to focus on if you are considering opening an account with Interactive Brokers is that:

They are cheap: No other investment or trading platform can match their discount commissions, FX rates and zero account charges

Huge market range: IBKR offer by far the best access to global stock exchanges around the world

They innovate and create :You can invest in so many different ways through IBKR, from their beginner IBKR LITE apps, to their institutional-grade desktop workstation trading platform. They have some of the most advanced and easy-to-use features available to private investors.

Interactive Brokers Account Types: IBKR offer by far the most types of accounts globally including regular investing account, active trader accounts, direct market access, futures, options and fractional stock trading

You can also earn money on your cash, you can buy bonds (high and low yielding), buy warrants, partake in placings, vote on company corporate actions. You can convert currency at 0.2%, which is cheaper than most specialist currency brokers or money transfer apps.

Foreign Exchange: Which actually segues me nicely to prove my control point. With most brokers you have to choose an account base currency (if you are in the UK that is probably going to be GBP) and when you trade, no matter what currency an asset is traded in your P&L will be converted to that base currency. But with Interactive Brokers you can run your account in multiple currencies.

So, if you put in GBP and trade the S&P for example, your P&L will be in USD. If you buy USD stock you get the option to attach a currency conversion to the transaction so you can convert exactly the right amount to cover the purchase, or you can choose to run a deficit in USD.

It’s not such an issue for small traders, as currency exposure, whilst important to be aware of, isn’t the most pressing matter. But if you are running a net flat long/short global macro portfolio, then keeping on top of your currency exposure could be the difference between making money or not.

Desktop Trader: Through ScaleTrader, (one of the founder’s favourite features) IBKR also gives you some very advanced order functionality, the sort you usually only get with professional trading systems like Fidessa (for stocks) or TT (for futures).

If you’re building a big position and don’t want the market to know you’ve got a big order to work, IBKR’s order ticket will let you gradually feed that into the market (but only charge you for the single order).

You can automatically drop bids and offers into the market based on time and price to take advantage of volatile markets. You can also set it to scalp for quick profits in choppy markets.

Pairs Trading: You can trade one stock against another automatically by spread, percentage or price.

Why is that important? Because it can help you build a market-neutral portfolio and when we asked the boss of IBKR the habits he saw in his most profitable customers, (referring back to our interview with him for the third time) he said the ones that traded one stock against another, often did well.

Interactive Brokers Universal Account: You can of course do these things with other brokers, but what you can’t do is do them all in one place.

For this review, I spent a while talking to Steven Sanders, IBKR’s head of Marketing & Product Development, and he said in the twenty years, he’s worked for Interactive Brokers the thing he’s most proud of (other than it being founder lead and therefore very little red tape when you want to get things done) is the implementation of the Universal Account, where everything is done from one account.

What’s amazing to me is that nobody else really offers it. Ten years ago when I was a derivatives broker at Man Financial, we offered everything that IBKR did, but all on separate platforms. We have a couple of big accounts, £20m upwards, that we were always trying to lure back from IBKR with our personalised voice brokerage where you could phone us up we’d take care of your complicated orders for you.

But times change, there is still demand for bespoke voice brokerage, but not as far as Interactive Brokers are concerned. They do offer it from specialists desks if needed, but most trading and investing is done online.

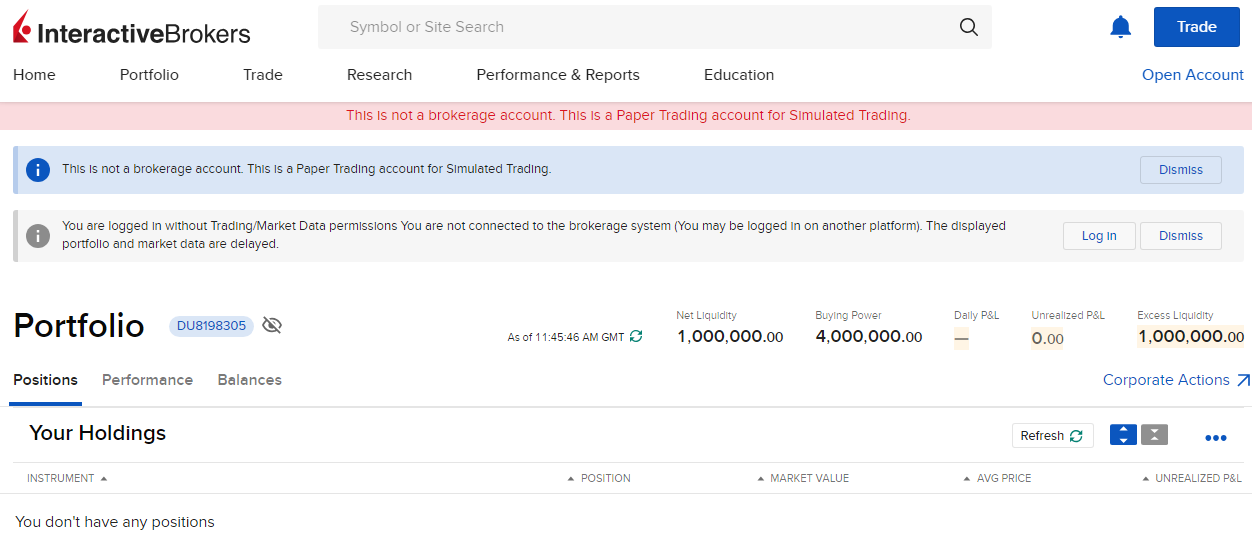

Demo Account: Interactive Brokers does have a demo account, but they call it a free trial instead. This is odd, because you don’t actually have to pay to have an account with IBKR. In fact, Interactive Brokers is one of the only trading platforms that does not have a custody fee for investing in a GIA, SIPP and ISA.

If you want to know more about that, you can listen to my podcast with Gerry Perez, the UK MD, who explains, how they offer such amazing market access for such little cost.

You get a cool $1m to paper trade with on the Interactive Brokers demo account or ‘Paper Trading version’ as they call it. You get access to the easy-to-use investors portal and the more complex IBKR TWS provides delayed market data, simulated trading and access to all of our unique tools and offerings, including the IBKR Risk Navigator, the Volatility and Probability Labs, Portfolio Builder, Research and News.

But, to be honest, I didn’t find the demo account very good. Lots of information was missing and I couldn’t place a trade. I’m not sure why, and actually, that’s going to be a bit of an issue for Interactive Brokers because demo accounts are a great way to get client’s interest. In a world where so many brokerages a vying for the same business, even small hiccups like that can cause a massive drop off rate in opening an account.

Usually, IBKR’s technology is first-rate, but the demo account isn’t up to scratch. I didn’t use the paper trading account, just the live trading platform with real market orders.

Customer Service At Interactive Brokers: It’s not all great, it takes a while to get through on the phone to customer service, and it has a slightly outsourced feel about it (if you know what I mean).

The desktop trading platform, despite its exceptional functionality, is also a bit ‘Windows 95’. But if you don’t need all the bells and whistles, the web based platform, or app has a more modern feel to them.

Options Strategy Builder: Options trading is gaining in popularity in the UK, mainly because of the press attention they derived from meme stocks (where US traders punt via options). But they are still a very complicated product. So what Interactive Brokers has down is create a Strategy Builder product, that essentially reverse the process of putting on options strategy trades.

You tell Strategy Builder what you think the market is going to do. For example, either, go up, stay still, not move for a while, or volatility will increase and it will create an options strategy around that. Instead of you having to know what strategy to put in place or working out the individual options legs.

IMPACT Ethical Investing: In tune with moving with the times, Interactive Brokers has also released the IMPACT app to help people investing in ESG and impact sectors, so they can put their money to good.

You can see the IMPACT dashboard on desktop, but it also operates as a standalone app that connects directly to your IBKR account and scores your portfolio based on how ethical the stocks you hold in it are. Ratings come from FactSet and Refinitiv, and there is this excellent feature that allows you to swap into more ethical stocks.

If one of your holdings is flagged as not that ethical, the app will suggest another one and at the click of a button, it will sell your shares and calculate how many new shares of a more ethical but similar company to buy and do it all for you. If you’re in the US, you can also make charitable donations directly on the app.

Interactive Brokers For Beginners: There is no doubt that Interactive Brokers is a proper trading platform, for those who know what they are doing and cater mainly to the more sophisticated investor. But they are making an effort to open their services up to the newer breed of investor and trader.

It’s standard now among many fintechs, but IBKR were actually the first to offer no commission trading. They also offer fractional shares through IBKR LITE and IBKR Pro accounts and have removed the monthly minimum account charge.

The hope of course is that by onboarding investors when they just start, they can look after their investments for the next 40 years, just as they have been doing for their existing clients for the last 40.

Interactive Brokers runs a Student Trading Lab where students from 600 schools and universities take part in a $1m paper trading account for the purposes of getting a better understanding of the markets. No broker these days can tell you what to buy or sell, but IBKR GlobalAnalyst helps you hunt out undervalued opportunities, across the world, not just in the US.

IBKR offer a Trading Academy, podcasts, webinars and blogs for beginners and experienced traders so that new customers survive the markets to become long-term clients.

Plus, they are cheap.

24-Hour ETFs At Interactive Brokers:Interactive Brokers has a list of 24 selected ETFs available to trade around the clock from Sunday evening, east coast time, through to the close on Friday, by adding these funds to its US overnight trading facility.

Clients who are permissioned to deal in US stocks, are able to trade these ETFs 23.50 hours a day, five days per week, allowing them to react to news stories, macroeconomic and geo-political events as they happen, rather than waiting for US markets to open.

The trading hours and ETFs are available to both retail and institutional clients alike and are traded via the firm’s IBEOS system. Trades can be submitted using multiple order types.

The range of ETFs is pretty broad and includes firm favourites such as SPY, QQQ, DIA and IWM, which track the S&P 500, Nasdaq 100, Dow 30 and Russell 2000 indices respectively. You can also short those indices by trading the SH, PSQ, DOG, and RWM inverse ETFs.

Pros

- Very low dealing fees

- Wide market range

- Direct market access

- Complex order types

Cons

- Customer services can be slow

- No financial spread betting

-

Pricing

(5)

-

Market Access

(5)

-

Apps & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.8CMC Markets: High-tech US stock trading platform

- Costs & spreads: 2¢ per share

- US stocks available: 4,968

- Overnight financing: 2.9% +/- SOFR

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Review: Great Tech for Active Traders

Provider: CMC Markets

Verdict: CMC Markets is one of the best and fastest trading platforms available for active traders to speculate on the most popular markets. The company is one of the original spread betting and CFD brokers based in the UK. It’s been providing forex trading services since 1989 and is now listed on the London Stock Exchange. The broker has over 300,000 active clients trading online and is operated from 13 global offices, with headquarters in the City of London.

64% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets a Good Broker?

Yes, CMC Markets has always offered, and still offers, one of the best trading platforms for high-frequency and active traders. It’s a good choice for those who want to trade on tight spreads, with a platform built on exceptional tech.

I’ve used CMC Markets for 20 years now and it’s typically been my go-to broker for trading forex and equity sectors.

I recently gave it another full test with real money and live trades. I’ve also interviewed its founder and its head of product. In this review, I share my views on what CMC Markets is good at, where it needs to improve and which types of trader it suits.

Almost 20 years ago, when I first had my account, I remember sitting in CMC’s reception, eager to pick up a CD-ROM of the Market Maker trading platform so I could trade personal account when I was a stockbroker at Phillip Securities.

I used to flit between using IG and CMC Markets back then. IG had a few more markets, but the platform was a bit basic. CMC Markets had tighter pricing and because the platform had a dark background, and more flashing lights you felt like a real pro. Despite the fact that CMC’s heritage is in the FX markets, I could never really get the hang of those so I’d trade indices, and FTSE 100 shares (also, CMC only really did the main market stuff back then).

I could have waited for CMC to post me a disc, but I had a real itch to try it out. It was an excellent trading platform then, and it still is today.

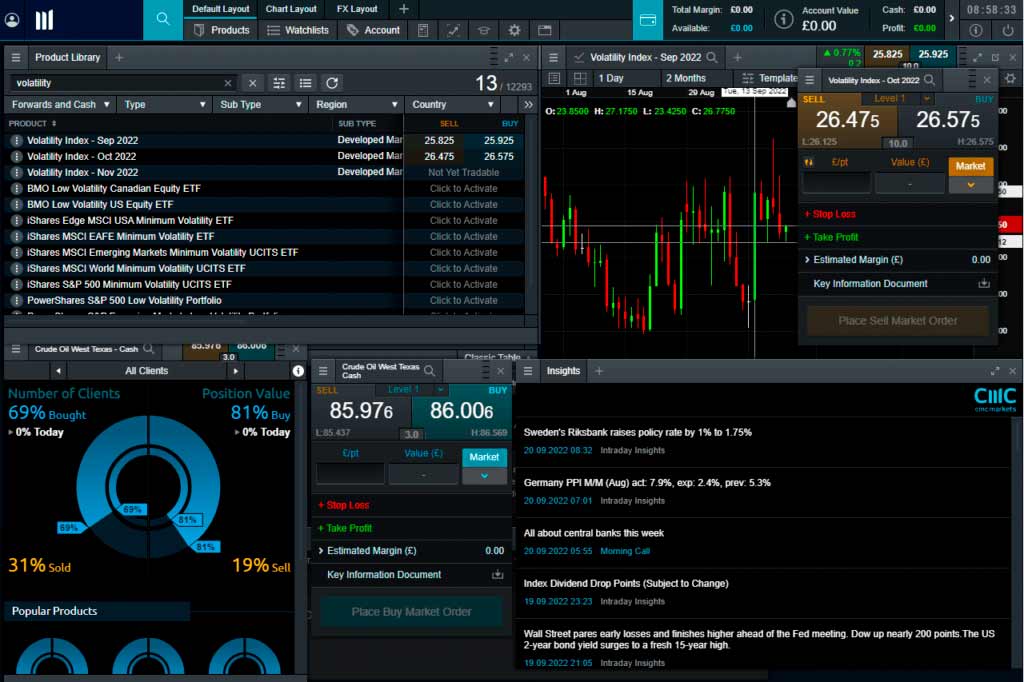

What Does the Platform Look Like?

History Of CMC

The current CEO, Peter Cruddas, set up CMC as Currency Management Corporation in 1989 after leaving Western Union, where he learned how the foreign exchange markets worked, in particular the market-making side of the business. Originally offering forex trading, then financial spread betting and moving into CFD broking in 2000, CMC began to expand internationally in 2002. CMC Markets was listed on the London Stock Exchange in 2016.

CMC Markets, which is now a member of the FTSE 250 index, has over 310,000 active clients globally, and in the 2023-24 financial year generated a net operating income of £332.8 million.

When I visited the CMC offices a few years ago, the brokerage world was switching from voice to online. CMC was one of the first forex brokers to invest heavily in technology and has always led the way in online trading platform innovation.

CMC Markets: Spread Betting & CFDs

CMC Markets only offers CFD trading, rolling spot forex and spread betting in the UK. These are generally short-term speculative products. You can invest in the long term and buy physical shares through CMC Invest in the UK (although in Australia CMC Markets does offer stockbroking).

If you don’t know what these are you shouldn’t be trading them. But if you do and you want to trade them, CMC Markets is in my view one of the best places to do so. In 2024, the platform came up with a nice tagline…

Calling all calculated risk takers…

This is the essence of trading, really. Yes, trading is risky, but it’s a calculated risk. And one way to reduce risk is to go with a well-established and well-capitalised provider. CMC Markets is a public company so you can see how well it’s doing as a business. Trading is hard enough without having to worry if your broker is going to go bust. In the UK, retail client money is held in segregated client bank accounts, in a regulated bank.

CMCX Share Price

The current CMC Markets (LON:CMCX) share price is 323p which is a change of -2.5 or 0.77% from the last closing price of 325.5 with 149,720 shares traded giving CMC Markets a market capitalisation of £903,803,742. The most recent daily high has been 335 and daily low 323. The CMC Markets share price 52 week high has been 335.5 and the 52 week low 183.4. Based on the most recent CMC Markets share price opening of 323, the current CMC Markets EPS (earnings per share) are 0.23 and the PE (price earnings ratio) is 14. Pricing data automatically updates every 15 minutes, last updated: 16:36 04-Feb-2026.

Although you’re out of luck if you want to trade CMC shares on CMC, I tried when I was demonstrating how to do a pairs trade against its main rival IG. I had to trade CMC on IG and IG on CMC.

Market Range

CMC Markets definitely has one of the best market ranges of all brokers. Although it doesn’t offer all shares – around 12,000 assets vs IG’s 17,000 or Interactive Brokers’ epic coverage – it has some really great markets that are exclusive to CMC. I’ve always used it for trading the most popular shares, and I would say it’s aimed at active traders more than its rivals. You only really miss out on smaller cap stocks that aren’t appropriate for margin trading anyway, as they are growth investments.

CMC Markets Sector Bets & Diversification

One of the things that I’ve always liked about CMC is its approach to diversification. Everyone knows that you shouldn’t put all your eggs in one basket when it comes to investing, and the same is true of trading. You’ve got a better chance of beating the market consistently if you spread your risk across different asset classes and don’t go crazy Rio trading.

I find forex trading incredibly difficult. I’ve never been able to make any money at it because I can’t judge forex price action – I find it too fast-paced. What I like to speculate on is the overvaluation or undervaluation of one currency against another.

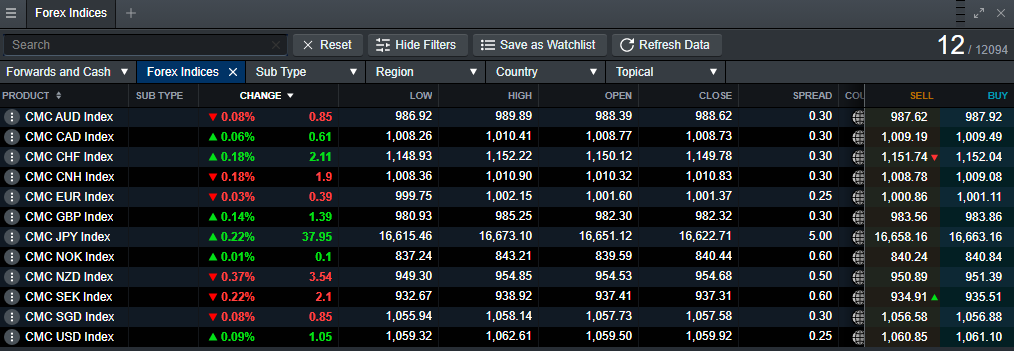

CMC has a market called weighted currency indices, which basket together one currency against many others. So you can trade how you think USD is going to perform against the EUR, GBP, AUD, CAD, CHF, CNH, JPY and SGD in one go. So instead of an outright punt, you are taking on a dollar position rather than a USD-GBP trade.

What Does the Forex Section Look Like?

Share Baskets

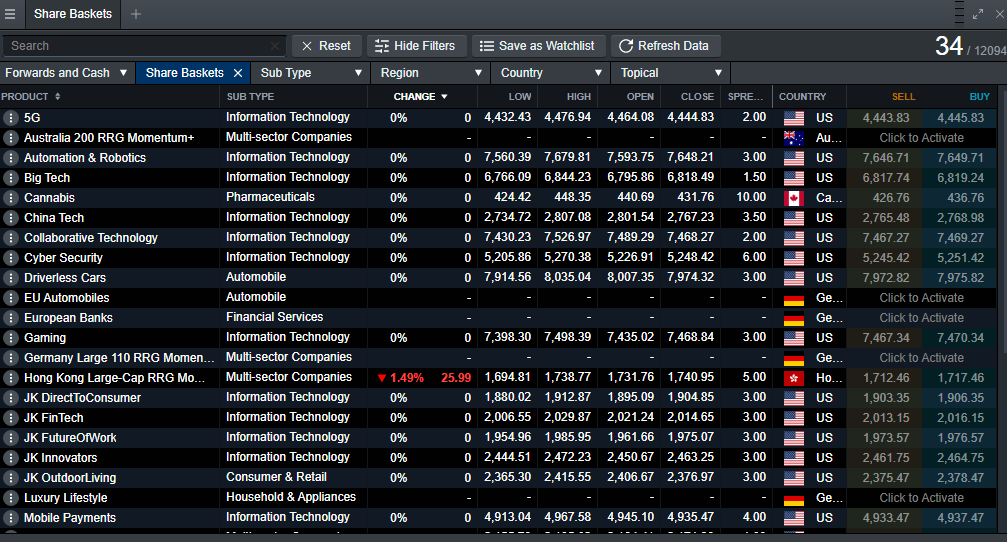

CMC Markets has always enabled sector bets, but it has fine-tuned these over the years because of the proliferation of ETFs into share baskets, like US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology. This is great, because I really like trading stocks. I find this quite easy compared to forex as stocks are based on fundamentals I understand.

One trading strategy that is relatively simple is trend following, especially now with the Reddit generation getting so worked up. If you see a sector getting some good press you can jump on the bandwagon without having to sniff out the individual stocks. Likewise, if sentiment is turning negative, it may be time to go short.

Deal4Free

Did you know that CMC Markets was once called Deal4Free? You obviously can’t say that anything is free now, because the regulators frown on that sort of thing. Instead, you have to say something like “zero commission”, because you’re being charged something somewhere – you just don’t see it on your statement.

Trading with CMC Markets is obviously not free, but it is cheap. It has always been one of the best value trading platforms, primarily because it unashamedly acts as a market maker.