Many investors are itching to buy metaverse-related securities, hoping to make a bundle on it quickly. New exciting concepts always attractive speculative capital, like the dot-com companies in the nineties. Companies know that too. Just re-brand the corporate name to ‘dot-com’ and – voila! – the stock price surges.

How do you invest in the Metaverse?

To invest in the Metaverse the safest and easiest way is to buy shares in companies that have exposure to the success of the Metaverse. There are three was you can do this:

- buy shares in individual companies (you have to pick these yourself)

- buy an ETF that tracks the metaverse (these are groups of shares bunched together traded on the stock exchange

- trade a Metaverse index (you can speculate on the metaverse going up or down with derivatives products like CFDs or spread betting)

Or, you can buy cryptocurrency related to the Metaverse, but this is extremely risky and unregulated.

Why invest in the Metaverse?

many older investors are struggling to understand the metaverse system because of its interconnectivity into many new sectors such as blockchain and cryptocurrency. In this sense, younger investors will have an edge because they may have already spent a lot of time immersing in different platforms, such as web gaming.

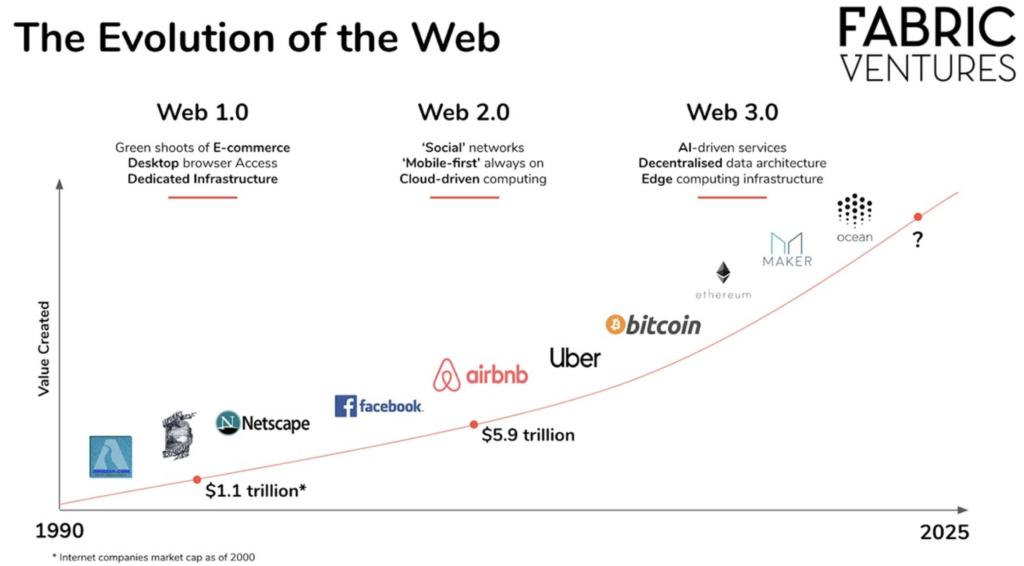

The Metaverse is a hot investment topic these days. Recognised as one of the fastest-growing segments of the internet (dubbed ‘Web 3.0’), many of the biggest corporations are rushing into this space. Facebook (FB) even went as far as changing its identity to ‘Meta’, with the goal of bringing “the metaverse to life and help people connect, find communities and grow businesses.”

What is the metaverse?

The metaverse is a form of interactive reality that exists in cyberspace. The movie Ready Player One by Steven Spielberg is a good example of the depth and expansiveness of virtual reality. You can, for example, create a new ‘virtual you’ in different avatars. Well, kind of.

The metaverse is not a new concept. The term was created by Neil Stephenson back in 1992 in the futuristic book Snow Crash. It was not a popular phrase until recently. Suddenly, every one is talking about it. Microsoft CEO Satya tweeted about how the metaverse will rapidly impact the workplace.

One of the reasons that sparked a boom in the metaverse is Covid-19. Socially distanced in the physical world, people became bored and restless. They seek to interact in whatever medium they can find, including the web. Humans are social beings after all.

The huge rise in the digital communication attests to this popularity. People go to Zoom meetings (see how to buy Zoom shares from the UK here), online chatrooms, and web games to talk and play with one another. This trend might have faded somewhat this year if not for the covid variant Delta and Omicron. Now, another covid wave lurks. Travelling is being curtailed again. People seek refuge in the online world.

First to notice the popularity of online interaction are games and social companies like Roblox (RBLX) and Facebook (now Meta, FB). The CEO of Roblox is certainly pivoting into virtual reality, saying “we’re shepherds of the Metaverse.”

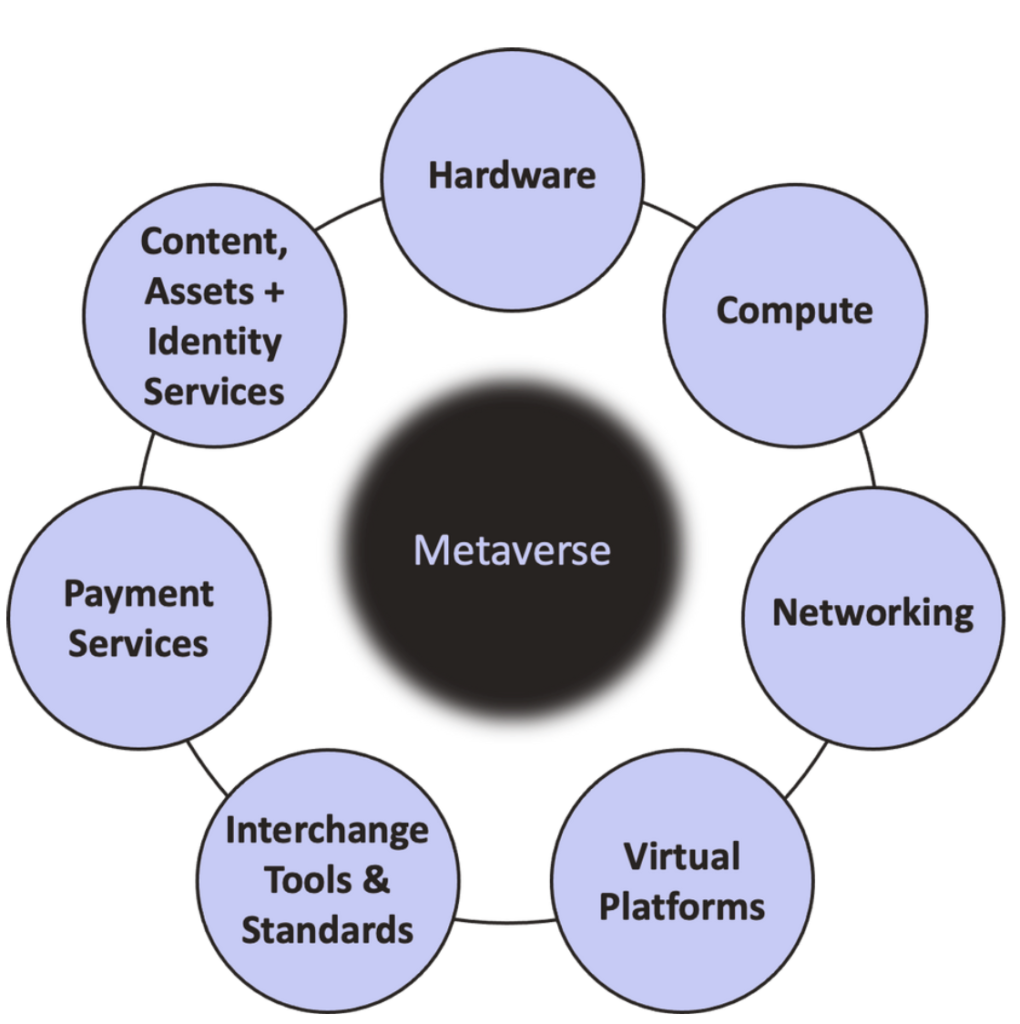

Metaverse has links to a large number of dynamic and fast-changing industries, such as crypto tokens and blockchain (compare cryptocurrency exchanges here). This sector is also part of the so-called Web 3.0 (a brief summary of Web3 is found here). Because the metaverse is still a growing industry, developers are scrambling to create the social setting, payment systems, and links back to the real world. Companies are experimenting with different systems.

To latch all these things together is hard work. But once the platform has acquired enough users, it may lead to a ‘winner takes all’. Think of Google in the search business. That’s why big companies are vying to establish themselves in the metaverse. Early movers appear to have an advantage in the cyberspace.

Not surprisingly, capital is pouring into the space, from investment in metaverse-related projects to metaverse tokens. Some companies are even snapping up ‘virtual real estate’ by paying millions for parcels of land in metaverse platforms. For example, Tokens.com (SMURF) just executed one of the largest cyber land acquisitions in Decentraland, the ‘first virtual world owned by its users’. These executives justify the transaction with bullish views like ‘buying 5th avenue in the 1800s.’

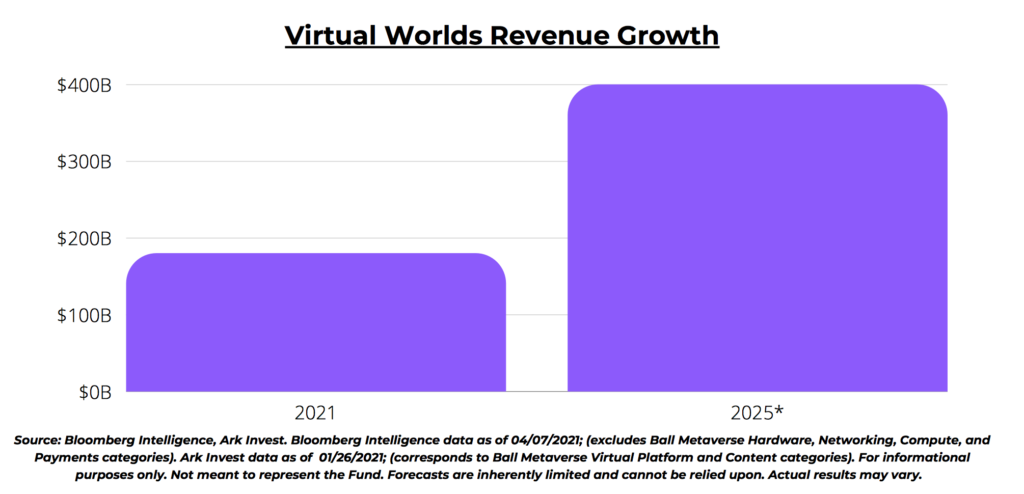

Long-term growth of the virtual world is expected to exceed $400 billion. That’s the kind of projections that Wall Street likes to hear. No doubt investors too. Metaverse is booming no doubt, but how does an average investor gain exposure to the sector?

Source: Roundhill Investment

Should you invest in the metaverse?

In a fast-changing industry like the metaverse, perhaps waiting is a good strategy. Peter Lynch, the investment guru, has articulated this critical rule for investors in this fantastic video presentation:

“People are in an unbelievably rush to buy stocks. You can buy Walmart (WMT) ten years after it went public, and make 35 times your money. You could wait three years after Microsoft (MSFT) went public and make 10 times your money.”

Take Amazon (AMZN), the internet giant. You could have waited 12 years after it went public in 1997 and still make a 35x return on the company. Another example is Bitcoin (BTC). If you have bought your first Bitcoin 8 years after its inception, returns are fantastic (yes still unproven as an investment and very risky).

Finding metaverse investment opportunities

Waiting is not enough. You need to develop some sort of industry knowledge about the metaverse to understand the key industry players, concepts, and long-term developments. Only when you’re armed with this knowledge you can develop an ‘edge’ over the rest of the market. This edge can provide you with insights that may help you with your investments.

If you’re still very curious about the metaverse and know nothing about how the thing works, perhaps starting with an ETF is a more suitable option. You can buy the RoundHill Ball Metaverse ETF (META, factsheet), which has 41 holdings related to the metaverse. Assets under management totalled about $100 million, hence META is not a large ETF.

Of course, you can pick individual stocks if you know which companies have good exposure to the metaverse, such as Nvidia (NVDA), Roblox (RBLX) or Microsoft (MSFT). Broad metaverse sectors include:

- Computing – companies that provide the computing power to power the metaverse platforms

- Software – companies that design the platforms

- Payments – companies that design, facilitates, and secure the platform’s payment system or crypto tokens that being used

- Platforms – companies that design and maintain the virtual platforms

Once you dig deeper, you will find that not all tech companies can be everything in the metaverse industry. Specialisation becomes important. A sample of some of the industry players is shown below:

Source: Morgan Stanley

While investing in the metaverse industry is exciting, risk management is an important consideration.

What are the risks of investing in the metaverse?

The risk of investing in metaverse now is high. Why? Because it is new. The whole industry is still developing rapidly. Nobody has a clear understanding of who the eventual winner will be. New players will likely emerge; older companies fade away.

Take the search industry. In 1996, Netscape was the clear innovator in web browsing. That baton passed to Yahoo! in 1998. By 2005, Google was the dominant player. Web technology changes quickly and current leaders may not stay competitive for long unless they achieve monopolistic positions like Microsoft.

Similarly, the metaverse will undergo several paradigm shifts before the winners can be identified. Therefore, investors must diversify to spread the risk to avoid backing the wrong horse.

The other risk relates to the pricing of metaverse securities. When a novel industry emerges from nowhere, very few have any idea how to price these stocks. Therefore, the market can bid these securities to a very high level, especially when FOMO (Fear of Missing Out) kicks in.

History tells us that most asset bubbles collapse over time, simply because the fundamentals can not justify the pricing. A permanent impairment of capital is real if you pay too high a price for metaverse stocks.

Furthermore, macro factors unrelated to metaverse may cause the current equity bull market to end abruptly, including a sudden rate change or new governmental regulation on the metaverse industry.

Because of these risks, the rewards for buying into metaverse are high, especially if you’re early in the game. The key here is early. Who doesn’t want to buy the next Microsoft or Amazon? The bragging right would stick with the investor for decades.

But are we early in the metaverse? Well, not exactly. Note that there are a number of large players in the game already. Facebook, Google, Disney, Roblox – all multi-billion dollar companies.

The financial rewards on the payment tokens on metaverse platform may be bigger. But then the risks are also commensurately higher.

As an investor, until you can identify companies that can reliably monetise the metaverse system, perhaps you should just dip in instead of going ‘all in’.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.