I opened my first City Index account way back in 2008, when they were one of only a handful of spread betting firms catering to high net worth traders in the City of London. Back then when I was a derivatives broker at MF Global, City Index used to hedge their CFD business through us so I could see they always had a fairly sophisticated client base. But over the years, as traders and investors have become more educated and akin to taking more risk, City Index now takes on more and more private clients.

If you’re thinking about trading with City Index, but haven’t quite made up your mind yet, I’ve tested all their trading platform’s features, visited their offices and interviewed their senior management for my review to hopefully provide enough information for you to decide if they are the right broker for you.

- City Index Overview

- Richard's Review

- Awards (Video)

- CEO Interview

- Video Demo

- Facts & Figures

- Customer Reviews

City Index Review

Name: City Index

Description: City Index is one of the oldest spread betting and CFD brokers based in the UK. They were founded in 1983 and offer trading in over 13,500 financial markets, to around 126,000 active clients. City Index is currently owned by StoneX, a US brokerage listed on the NASDAQ valued at $1.75bn.

70% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Why we like them:

City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

Pros

- Excellent trading tools

- Post-trade analytics

- Publically listed (part of StoneX)

Cons

- Trading only, no investment account

- Limited options markets

- No direct market access

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3Ratings Explained

- Pricing: Always competitive.

- Market Access: Excellent coverage, especially for small-cap stock and exotic currency pairs.

- Platform & Apps: Some excellent added value trading signals and portfolio analytics (even though the desktop version can be a bit fiddly).

- Customer Service: Lots of experienced dealers to help with any issues.

- Research & Analysis: City Index excel here, lots of education, signals and analysis.

Richard’s Review

I’ve always liked City Index, it’s been a stalwart of the London CFD broker scene since it was founded by Chris Hales and Jonathan Sparke in 1983 as a way for institutions to hedge their exposure through spread betting and CFDs. But soon became popular with more retail traders. Always advertising on billboards in the City, always having a colourful client base, always being bought and sold at the whim of billionaires and bigger boys. But in recent years, it had gone off a bit from its glory days. Back in the good ol’ days, you could open an account and put on a million-dollar trade over the phone with no ID, no deposit, and no idea. Well, you could if you happened to be on a yacht with Michael Spencer (the then City Index owner and City grandee), who was convinced he knew which way the Euro was headed and goaded one of his guests into putting the trade on, as the story goes away.

But those days are long gone and incumbent brokers have to fight hard to differentiate themselves against the fintechs nipping at their heels, as well as provide more trader tools to lure new customers back to traditional markets away from the wild west of Crypto.

City Index seems to have matured nicely though, it’s grown out of its lumbering adolescence under the ownership of Gain Capital and is now owned by US Behemoth StoneX (previously INTL FCStone). Since then, the platform has had a few upgrades and long-term investment products will hopefully be added shortly.

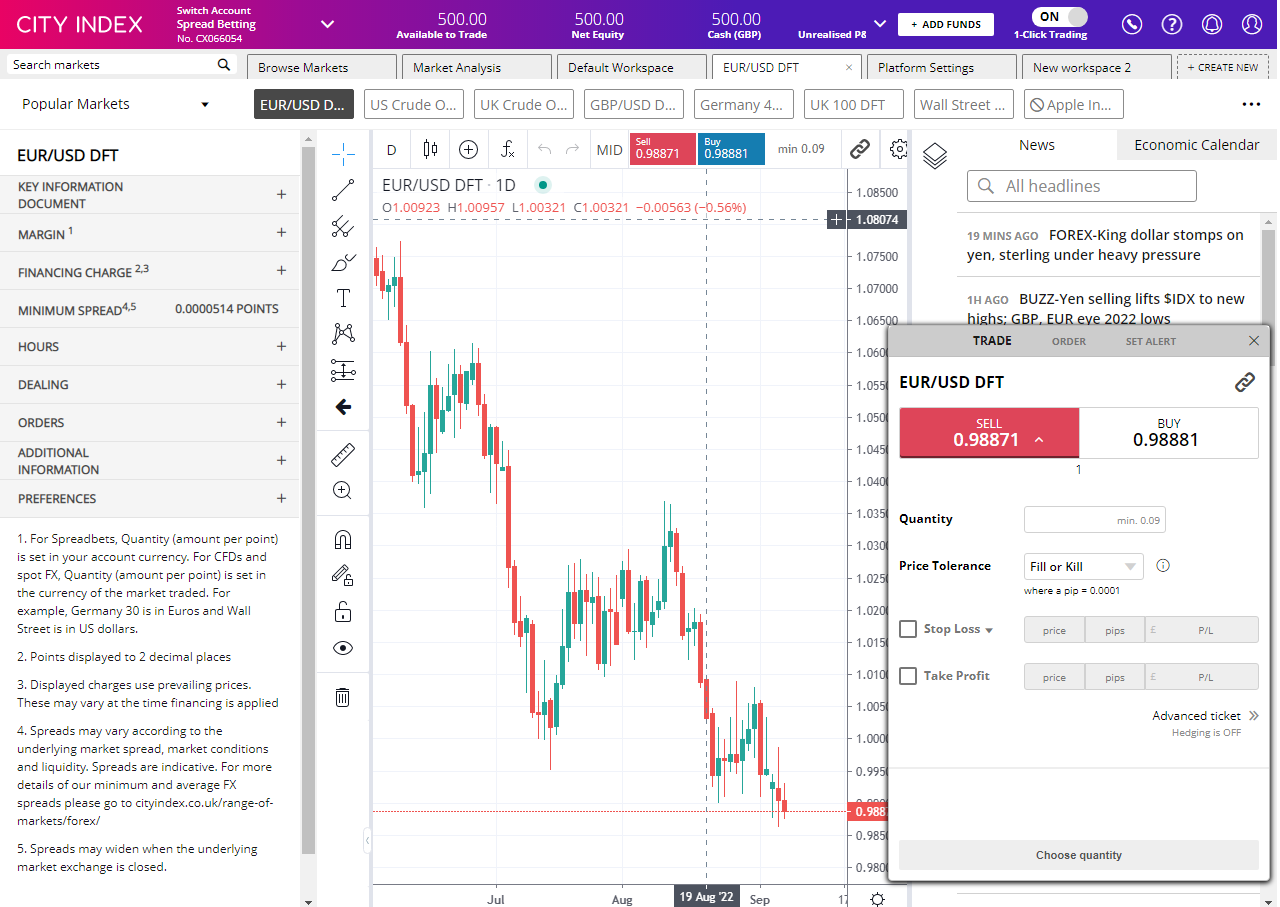

Trading Platform

The City Index platform used to have a slightly off-the-rack feel about it, instead, the business relied on word of mouth and friendly referrals from HNW clients who would use experienced dealers to work large orders over the phone. Whilst voice brokerage still forms part of City Index’s offering, they are, as with everyone else, doing the majority of their business online and working hard to make their platform stand out.

- Further reading: Is City Index a good trading platform?

Pricing & Spreads

City Index has always been competitive with it’s pricing. As City Index is an OTC broker they charge customers by widening the spread rather than adding commission after you trade. They are one of the cheapest around for trading UK stocks with the bid/offer being widened by only 0.08% (20% less than the industry standard of 0.1%) and for US stocks they only charge 1.8 cents per share (industry standard is 2 cents per share). Overnight financing rates are also inline with what you would expect 2.5% over/under SONIA rates.

Stocks, Forex, Indices and Commodities

You can buy over 4,700 stocks on City Index as a CFD or financial spread bet, however, you can’t trade equity options or invest in physical shares.

Obviously, they have access to more than the usual forex, index and commodity markets and add value with some nice thematic-themed indices (like ESG), and a good pool of sectors to speculate on. You can also trade options (CFD or spread bets thereof) on a good range of indices and commodities like Natural Gas or EU stocks. Plus, you can trade on synthetic markets. Everyone loves a bit of volatility speculation in choppy markets.

Further reading:

- Is City Index commodity trading CFDs, Spot, DMA or Futures?

- What indices can you trade with City Index?

- Is City Index or Forex.com better for forex trading?

Spread Betting

Spread betting is City Index’s forte, and it’s the product that a lot of their high-net-worth customers use for trading stocks. As one of the original spread betting brokers City Index offers access to one of the widest selections of UK, US and European shares (as well as the major indices). The key advantage of spread betting of course is that profits are free of capital gains tax.

- Further reading: How does City Index spread betting compare to CMC Markets?

CFD Trading

Unlike spread betting CFD profits are subject to capital gains tax, so are less popular among UK traders. Historically, City Index would offer CFDs to more professional traders and spread betting to smaller clients. CFDs and spread betting are similarly priced with City Index, with the commission being included in the spread, which is slightly wider than the underlying market bid/offer. The main reason why both products are on offer is that spread betting is only available to UK residents, whereas City Index can offer CFD trading to its global client base.

- Further reading: Is City Index CFD Trading DMA (Direct Market Access)?

Trading App

I actually prefer the City Index app to the desktop version of the trading platform. Sometimes I can find the desktop version to be a bit clunky, but the app is really slick, and clearly in our mobile-first world, where all the recent development has been focused. And why not, the desktop trading platform is brilliant for research, trading signals and post-trade analytics, but at the point of execution the app is a quick and simple stripped-down version with all the salient features front and centre.

- Further reading: Is the City Index trading app safe?

MT4 (MetaQuotes)

You can trade on MT4 and MT5 with City Index, but functionality and market access is not as good as their main proprietary trading platform or some of their MT4 competitors. You can only trade around 84 markets on MT4 through City Index, but if you just want to trade the major markets, City Index is a good broker for MT4 based on their regulation, service and pricing.

Added Value & Research

One example of how they are populating their platform with new trader tools is SMART Signals. Of course, all, or at least most brokers have Trading Central or AutoChartists, (City has Trading Central) whose signals are used by so many platforms that they almost become self-fulfilling, or a barrel for larger traders to shoot down small fry, depending on which way you look at it.

SMART Signals

SMART Signals is a new iteration of GetGo, which I tested and reviewed a few years ago. At the time, it was a stand-alone app, and actually quite fun, and did well highlighting some trading opportunities (full GetGo review here). Now, it’s fully integrated into the City Index platform, so you can look at what trading signals are being spat out by the algorithm and either dive in manually, or opt to trade when the signal is triggered, with corresponding stops and limits in place. It’s a great feature for stimulus and saves you a bit of time if you’re on the hunt for trades.

Whether it can make you money is another thing, but SMART gives a full breakdown of its P&L from previous trading signals, so whether or not you make money will largely depend on what signals you decide to follow and also (as you will know from reading “The Art of Execution”) how you manage the positions once open.

Performance Analytics

Another acquisition from parent StoneX is Chasing Returns, now integrated into the platform as Performance Analytics. Which really drills down into where you are trading well and where you are losing money. Performance Analytics can break down your wins and losses and tell you what markets you trade best, what time of day you are most profitable, if you make money trading in quick succession or, if you do better if you take a break between trades. It’ll even tell you if your first trade of the day is often a winner or loser, or if you are a better bull or bear and also if you are as good at trading volatility as you pretend to enjoy doing, but letting you know if you trade better in calm or erratic markets.

Economic Calendar

One thing though that does let them down is City Index’s economic calendar, it’s terrible. In fact, most brokers, even IG just have a bog standard list of upcoming earnings and economic announcements. But I think you need more from a trading platform these days, especially as when logged into the desktop platform the format is all off. One broker that has absolutely nailed their economic calendar is ThinkMarkets. With TM when you’re logged in you get a really good visualisation of previous data, volatility and most importantly what impact it had on relevant institutions like EURUSD. It’s a great way to see how markets have moved against previous numbers. Honestly, City Index should embed this too as it’s available from Trading Central who they have a deal with anyway.

Extended Hours Trading

You can trade CFDs premarket and after the market closes on a range of US equities in the pre and post-market sessions which bookend regular share trading in New York that takes place between 9.30 a.m. and 4.00 p.m. Eastern time.

The list of 73 stocks available to trade in the pre and post-markets includes leading US shares such as Apple, Microsoft and Nvidia. Widely traded names such as the Ark Innovation ETF, Coinbase, Robinhood and Gamestop.

As well as established blue chips like Bank of America, Boeing, Procter and Gamble, and Walmart, alongside a selection of index-tracking and thematic ETFs.

City Index Awards

In our latest awards City Index won “best trader tools” 2023 and has in previous years won best trading platform, best trading app & best forex broker in 2022. Giles Watts, Senior VP of UK & EU at City Index said after winning best trader tools in 2023: “We are delighted to have been recognized for the added value we provide our clients. Delivering actionable post trade insights direct to the platform, is just one of the reasons our clients stay with us over the long term.”@good_money_guide Check out the top trader tools in the industry! Stay ahead of the game with these award-winning resources for trading, shares, and stocks. Don't miss out on the latest tools to help you navigate the stock market like a pro. #goodmoneyguide #goodmoneyguideawards #trading #shares #stocks #stockmarket #toptraders #investment ♬ original sound – Good Money Guide

Inside City Index

As part of our City Index review, we visited their offices in The City and spoke to some of the senior management to find out what makes City Index different.

City Index Video Review

In our City Index video review we test the platform with real money, put some trades on and highlight some of the broker’s unique features.

City Index Facts & Figures

City Index Total Markets | 13,500 |

| 👉Forex Pairs | 183 |

| 👉Commodities | 19 |

| 👉Indices | 40 |

| 👉UK Stocks | 3500 |

| 👉US Stocks | 1200 |

| 👉ETFs | ✔️ |

City Index Key Info | |

| 👉Number Active Clients | Over 126000 |

| 💰Minimum Deposit | 100 |

| 💰 Inactivity Fee | Yes – £12 per month |

| 📅 Founded | In 1983 |

| ⬜ Public Company | Yes |

| 🏢Head Office | London, UK |

| 📜Regulated? | Yes – by the FCA |

City Index Account Types | |

| 👉CFD Trading | ✔️ |

| 👉Forex Trading | ✔️ |

| 👉Spread Betting | ✔️ |

| 👉DMA (Direct Market Access) | ❌ |

| 👉Futures Trading | ❌ |

| 👉Options Trading | ❌ |

| 👉Investing Account | ❌ |

City Index Average Fees | |

| 👉FTSE 100 | 1 |

| 👉DAX 30 | 1.2 |

| 👉DJIA | 3.5 |

| 👉NASDAQ | 1 |

| 👉S&P 500 | 0.4 |

| 👉EURUSD | 0.5 |

| 👉GBPUSD | 0.9 |

| 👉USDJPY | 0.6 |

| 👉Gold | 0.8 |

| 👉Crude Oil | 0.3 |

| 👉UK Stocks | 0.08% |

| 👉US Stocks | $0.018 per share |

City Index Customer Reviews

Tell us what you think:

70% of retail investor accounts lose money when trading CFDs with this provider

City Index FAQs:

City Index offer spread betting and CFD trading on forex, indices, shares and fixed-income products. One of their unique selling points is their integrated trading signals on their app and trading platform.

Yes, based on our data matrix, testing, analysis and the fact they are regulated by the FCA City Index is a good broker. Your funds are also protected under the FSCS with City Index.

You can trade FX on Sunday nights with City Index when the forex markets open around 10 p.m. for UK traders. But you cannot trade indices, stocks or commodities on the weekend. If you want to trade more markets on the weekend you need a broker like IG that offers a wide range of financial markets on Saturday and Sunday.

Yes, City Index is a highly trusted broker as they are well established, well respected in the industry, have a sophisticated and high-net-worth client base and most importantly, are regulated in multiple jurisdictions.

City Index was founded in 1983 and is regulated by the FCA which means they have to keep client funds safe and segregated from their own money. Your money is also protected by the FSCS.

Retail clients trading with City Index get leverage of 5:1 for indices, 30:1 for FX, 10:1 for commodities and 5:1 for UK and international share trading. It is possible to increase your leverage rates if you apply for a professional trading account.

No, City Index is not available to US residents. However, City Index is owned by StoneX, which is a US broker that US citizens can trade through. City Index is also part of the group that own Forex.com which offers forex trading in America.

Yes, City Index does allow scalping for short-term high frequency trading. For more information see our guide to scalping.

Yes, City Index is a good platform for day trading as they have low spreads, access to a wide range of markets and intra-day trading signals provided by SMART Signals.

City Index has its own trading platform called Web Trader but also offers trading via their mobile app, TradingView and MT4.

No, the FCA has banned retail derivatives brokers in the UK from offering welcome bonuses.

City Index makes money through charging commissions (either added to CFD trades or built into the spreads of financial spread bets). Other revenue streams include overnight financing charges, where City Index levies extra interest on top of what it lends you to trade on leverage.

70% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.