City Index Spread Betting Expert Review: Best Spread Betting Broker 2025

Account: City Index Financial Spread Betting

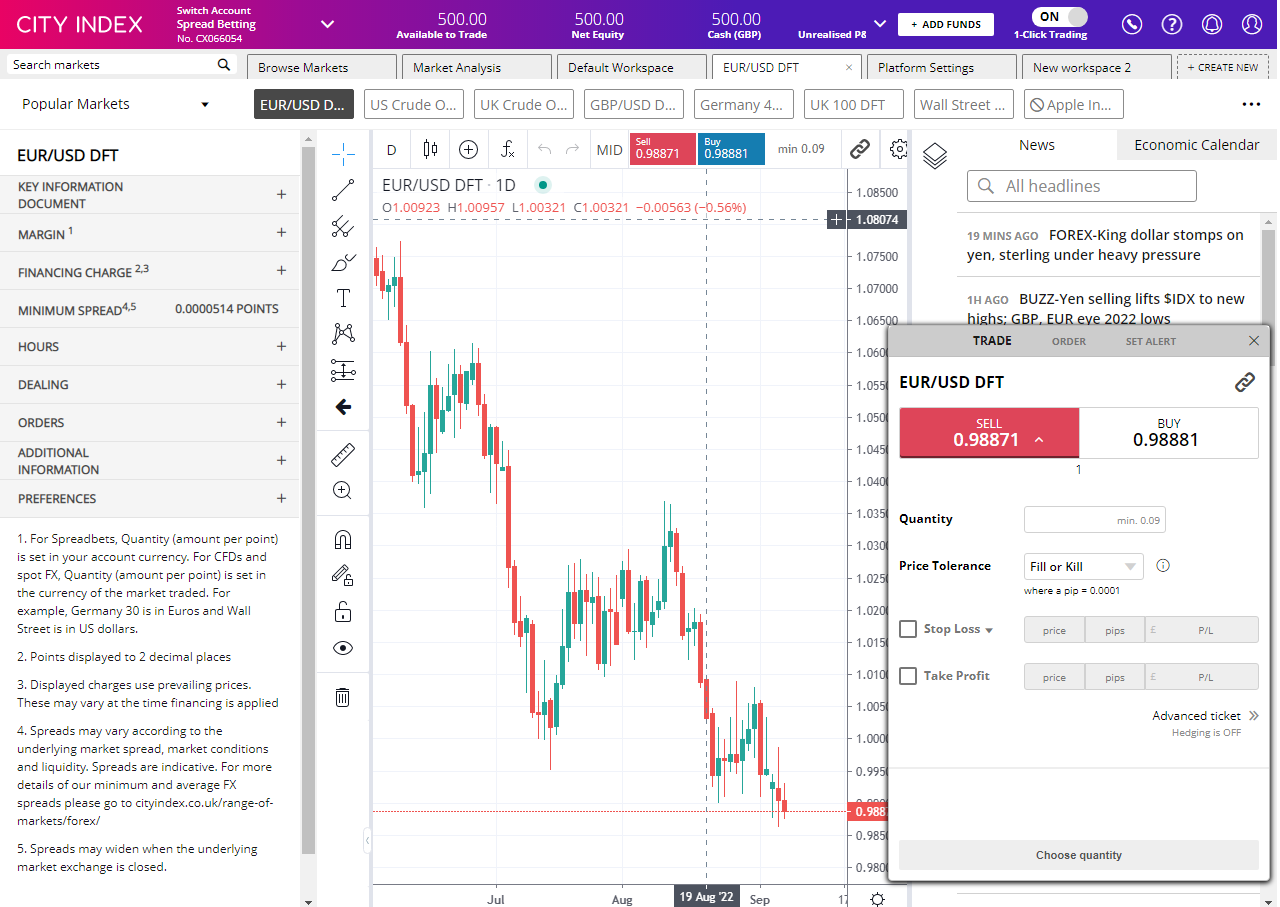

Description: City Index is one of the best spread betting brokers and is suitable for all types of traders looking for a tax-efficient way to speculate on the financial markets. City Index also won our “Best Trader Tools” award in 2023 and "Best Trading App" in 2024 and "Best Spread Betting Broker" in 2025..

70% of retail investor accounts lose money when trading CFDs with this provider

Is City Index a good spread betting broker?

Overall, City Index’s spread betting platform is one of the best around with competitive pricing, a wide range of markets to trade, and some very good added value tools to help traders seek out opportunities and improve their trading strategy.

Overall, City Index’s spread betting platform is one of the best around with competitive pricing, a wide range of markets to trade, and some very good added value tools to help traders seek out opportunities and improve their trading strategy.

I would say that overal,l City Index is a better spread betting broker than CMC Markets, especially if you are trading a broad range of shares, particularly smaller cap shares. CMC Markets is more focussed on the most liquid markets like EURGBP and indices and can have tighter pricing. But, for an all-round service, City Index is a better spread betting broker for most UK traders.

Spread bets at City Index are available on 12,000 markets including, 23 equity indices, thousands of UK and international stocks and ETFs, 19 commodities, bonds, and interest rates, and an industry-leading 182 FX pars. City Index also has an options desk for spread betting on index and populare stock options.

When I tested City Index’s spread betting account Performance Analytics really made it stand out which is unique to City Index. Whilst other brokers provide post-trade analysis, When StoneX (City Index’s parent company) acquired Chasing Returns, they were able to exclusively provide a huge amount of data to help their customers stick to a trading plan and provide insights into what can make them a better spread bettor.

As with most spread betting brokers, City Index clients trade via two-way bid-offer prices the difference between the bid and offer representing the spread. These vary by product and contract but in the FTSE 100 index City charges a minimum spread of 1 index point and on the Germany 30 or Dax it charges 1.20 points. You can trade Spread Bets on leading equity indices up to 24 hours per day. For stock trading, spreads of 0.8% for UK and 1.8 cents per share are built into the price.

Pros

- Wide range of spread betting markets

- Trading signals

- Post-trade analysis

Cons

- No DMA spread betting

- No investing account

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.9

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com