StoneX Group, the owner of Gain Capital and forex broker City Index, updated the market on its recent performance this week, with the release of its Q2 2022 results, a period which ended on March 31st.

Quarterly operating revenues rose by +16.0% to $544.70 million whilst net income for the quarter came in at $64.0 million. Stonex delivered EPS of $3.11 per share a figure that was up by 14.0% over the prior period.

That wasn’t the only metric in the earnings release that was rising, variable compensation and benefits rose by just over $6.0 million to stand at $124.10 million.

Whilst fixed compensation rose by $4.0 million to reach $83.0 million, a rise of 18.0% and 6.0% respectively.

Retail traders from Gain Capital and spread betting broker City Index made a significant contribution over the quarter generating $45.0 million in income that figure was up by 42.0% over the same period in 2021.

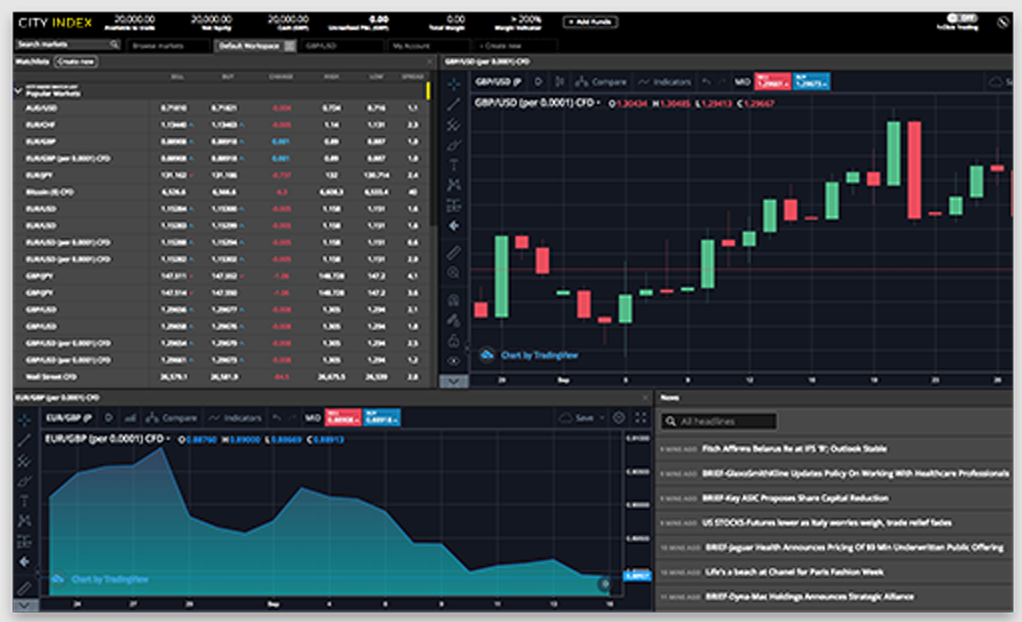

Looking at things from a product perspective we can get some further insight into the contribution made by Gain Capital and City Index over the quarter.

FX & CFD trading generated a turnover of $98.90 million which compares favourably to the $123.0 million the group generated in listed derivatives trading, and the $40.70 million of turnover derived from physical commodities.

Daily notional turnover in FX and CFDs during the quarter rose by an impressive +34.0% to $14.937 billion. The segment showed the second-highest growth rate within the firm’s trading divisions and was only eclipsed by other OTC derivatives trading.

Stonex CEO Sean O’Connor said of the results:

“Our broad product offering and diversified client base, combined with generally favourable market conditions, helped us deliver record core operating results in the second quarter of fiscal 2022. This included net income of $64.0 million, or $3.11 per share, with especially strong results coming from our Commercial and Retail segments”

Stonex shares, which are listed on Nasdaq under the ticker SNEX, reacted very positively to the earnings release, gaining +6.73%.

The move higher was all the more impressive, given the sharp sell-off experienced by the wider US equity market in Thursday’s trading.

Over the last week, Stonex has seen its share price rise by +8.39%, and by +22.73%, over the year to date, during which time the stock has printed 15 consecutive new highs.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com