City Index is an OTC CFD Broker, which means it does not offer DMA CFD trading, you can only trade as an OTC CFD or as a financial spread bet. If you want direct market access to exchanges for equities trading you can compare DMA brokers here. However, City Index CFD pricing is tight enough for the majority of traders who do not want to work orders inside the bid/offer spread. The other advantage of trading CFDs “over-the-counter” is that commission is included in the quote as opposed to DMA brokers like Saxo Markets who add commission after you trade.

City Index CFD Trading Review

Name: City Index CFD Trading

Description: City Index offers CFD trading on over 13,500 markets including 40 equity indices, 4,700 international shares, ETFs, 19 commodities, 183 forex pairs, government bonds and interest rates giving it one of the largest market ranges of all the major CFD brokers.

70% of retail investor accounts lose money when trading CFDs with this provider

Summary

A good CFD trading platform for traders who want trading signals and post-trade analytics.

- CFD markets available: 12,000

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

Charges and commissions are included in the spread for CFD trading and are very competitive including 0.5 pips for EURUSD, 1 point spreads on the FTSE (UK100 CFDs), 0.8% on UK shares and 1.8 cents per share on USD stocks (2 cents per share being industry standard).

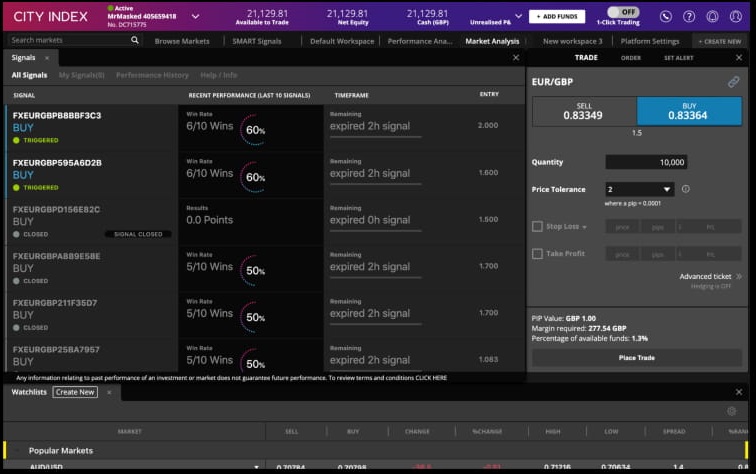

Whilst I was testing City Index’s CFD trading platform for this review there were a few things that make them stand out. Firstly they offer proprietory trading signals on CFDs through SMART Signals. These signals have been developed in-house and enable trades to quickly see upcoming trading opportunities. Signals are ranked based on how successful the type of signal has been in the past for specific assets and you can see the assets signal historic P&L performance based on the pre-determined stop and limit levels.

Performance Analytics is another tool that can help traders improve their CFD profitability. Performance Analytics looks at your CFD trading history and shows you where you do well and when you do not. The idea is to make you a better trader by encouraging you to stick to a trading plan and gives you guidance on when your plan is working and what markets, times and conditions suit your trading style the most.

As well as offering a CFD trading platform and mobile app City Index has always catered to, and still does, to high-value traders over the phone. It is one thing that makes them different from the majority of trading platforms in that you can actually talk to an experienced dealer who knows your account as well as deal electronically.

For new traders, there is a huge amount of educational and informational content from “how-to” videos and articles to more lighthearted CFD, and focussed programming like the Traders Academy.

Overall, City Index offers one of the best CFD trading platforms, on a wide range of markets with low costs and is suitable for large traders who want personal service and new traders how need assistance looking for trading ideas.

Pros

- CFD trading signals

- Post CFD trading analytics

- Wide range of CFD markets

Cons

- No DMA CFDs

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3- Expert opinion: City Index reviewed & rated

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.