Hargreaves Lansdown is rated very highly by Good Money Guide experts, who describe it as the “Waitrose of investing”, a premium, safe and full-service platform offering ISAs, SIPPs, funds and shares to over 1.8 million clients. Experts highlight its huge market range, strong research and award wins, including Best Stock Broker at the Good Money Guide Awards (multiple years). Customer reviews on Good Money Guide are generally positive but more mixed, with some users praising reliability while others flag that fees can be higher than newer app-based rivals, especially for fund holding charges.

Hargreaves Lansdown Customer Reviews

Tell us what you think of this provider.

Competitive and good help line

Competitive and good help line

expensive, flaffy

expensive, flaffy

Far too big

Far too big

Easy to use and customer…

Easy to use and customer focused

Excellent platform but expensive.

Excellent platform but expensive.

Excellent app and website

Excellent app and website

Good but expensive

Good but expensive

Excellent

Excellent

3/5

good enoughfor Isa and investments….

good enoughfor Isa and investments. on the expensive side

4/5

Easy to use & cost…

Easy to use & cost effective

Not had much interaction

Not had much interaction

Good

Good

Limited access through the app

Limited access through the app

Efficient service

Efficient service

Expensive recommendations not reliable

Expensive recommendations not reliable

The platform is easy to…

The platform is easy to use in both app and web form. Information is clear and making investments is very simple. They also have and Active Savings service which allows access to great savings rates with banks not accessible through other means

great app with good info

great app with good info

4/5

Hargreaves Lansdown Expert Review

Hargreaves Lansdown Review: The Waitrose of the investing world

Provider: Hargreaves Lansdown

Verdict: Founded in 1981 Hargreaves Lansdown is one of the largest investment platforms in the UK. They offer investing, savings, ISAs and SIPP account to over 1.8 million clients with 142bn in assets under management.

Is Hargreaves Lansdown a good broker?

Yes, Hargreaves Lansdown is one of our best-rated stock brokers and investment platforms. HL offers access to a huge range of investment types, through a wide range of general and tax-efficient accounts and is suitable for almost all types of investors.

I always think of Hargreaves Lansdown as the Waitrose of the investing world. Yes, it may be a bit pricier sometimes, but I think it’s just a nicer, safer place to shop for stocks.

Pros

- Wide range of investments and accounts

- Top-notch customer service

- Excellent research and analysis

Cons

- There are cheaper options for fund investing

- Limited portfolio hedging tools

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.9Capital at risk

Hargreaves Lansdown Facts & Figures

| ⬜ Public Company | ✔️ |

| 👉 Number Active Clients | 1,800,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | £142 billion |

| 📅 Founded | 1981 |

Account Costs | |

| 👉 Investment Account | 0% |

| 👉 SIPP | 0.45% |

| 👉 Stocks & Shares ISA | 0.45% |

| 👉 Junior ISA | 0% |

| 👉 Lifetime ISA | 0% |

Dealing Costs | |

| 👉 UK Shares | £11.95 |

| 👉 US Stocks | £11.95 |

| 👉 ETFs | £11.95 |

| 👉 Bonds | £11.95 |

| 👉 Funds | £0 |

Capital at risk

Hargreaves Lansdown News

Hargreaves Lansdown cuts platform fees from 0.45% to 0.35%

Hargreaves Lansdown has announced its first major fee shake-up in more than a decade, cutting platform and share dealing charges in a move the company says will deliver “even greater value” for the UK’s growing base of DIY investors and savers. The new pricing will take effect automatically from 1 March 2026. HL, the UK’s

Hargreaves Lansdown Lifetime ISA Could Make You £168,676 Extra Over 30 years

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Hargreaves Lansdown launches own-brand 3.45% Cash ISA App, but savers can still find higher rates elsewhere

Hargreaves Lansdown (HL) has launched its first own-brand savings product, a Cash ISA designed to give clients a “consistently competitive” rate and an alternative to low-paying high street banks. The new Cash ISA, unveiled during UK Savings Week (22–28 September 2025), is powered by a partnership with Shawbrook Bank. Deposits are FSCS-protected up to £85,000

Hargreaves Lansdown Active Savings Best Rate is 4.26% AER

Compare Hargreaves Lansdown Active Savings Against Other Savings Platforms: Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as

Hargreaves Lansdown launches first LTAFs in a SIPP with Schroders Capital

Hargreaves Lansdown (HL) has become the first UK investment platform to allow retail investors to access Long-Term Asset Funds (LTAFs) through a Self-Invested Personal Pension (SIPP), following a new partnership with Schroders Capital. From the week commencing 15 September, two Schroders Capital managed private markets funds will be added to the platform, giving eligible investors

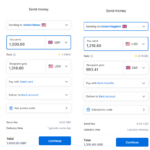

Hargreaves Lansdown Makes Cash ISA Transfers Easier with New ‘Move Money’ Tab

Hargreaves Lansdown (HL) has introduced a new feature designed to make it simpler for clients to move money between their ISAs, particularly into its Cash ISA savings accounts. The new ‘move money’ tab, available within HL accounts, allows customers to transfer uninvested cash from their HL Stocks and Shares ISA directly into an HL Cash

Hargreaves Lansdown Cash ISA Has Tax Free Savings With Exclusive Rates As High As 4.41%

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Hargreaves Lansdown Wins Best Junior ISA (JISA) 2025

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Hargreaves Lansdown Stocks & Shares ISAs Are Topped Up or Opened Every 6 Seconds At Peak Times

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Hargreaves Lansdown is cheaper than you think for share dealing

In our HL share dealing review below, we explain how much Hargreaves Lansdown charges for buying and selling shares and how they compare to other share dealing platforms. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a

How much does OEIC investing cost on Hargreaves Lansdown?

It’s free to buy and sell OEIC (open-ended investment companies) on Hargreaves Lansdown, but there is an ongoing charge. In our HL OEIC review below we go through the charges and specifics about investing in open-ended investment companies with Hargreaves Lansdown. There is no charge for buying and selling open-ended investment companies. Accounts are charged

How much does Hargreaves Lansdown charge for investment trusts?

Despite it’s reputation for being expensive Hargreaves Lansdown is actually free for buying and selling investment trusts. But the ongoing account charges can rack up if you have a large portfolio compared to other providers like Interactive Investor and AJ Bell. To help you navigate the investment trust market, Hargreaves Lansdown provides trust research, data

Is Hargreaves Lansdown good for ETF Investing?

We rate Hargreaves Lansdown as one of the best ETF investment accounts as HL has access to a huge range of UK and international Exchange Traded Funds. Plus the costs of holding ETFs are capped as they fall into their stocks and shares category. Hargreaves Lansdown’s ETF platform offers a huge range of exchange-traded funds tailored

Does Hargreaves Lansdown offer currency transfer services?

Yes, you can transfer currency abroad with Hargreaves Lansdown, but not directly, HL uses a specialist third-party currency specialist to facilitate international payments. Here’s a look at its currency transfer services in more detail. Currency transfers with Hargreaves Lansdown If you want to use Hargreaves Lansdown’s currency transfer services, you need to open a currency

Hargreaves Lansdown wins Best Stock Broker at the Good Money Guide Awards 2024

Hargreaves Lansdown won Best Stockbroker at the Good Money Guide Awards this year because they offer one of the cheapest accounts for share investing. They provide access to a wide range of large-, medium-, and small-cap stocks, tax-efficient wrappers, and IPOs for newly listed companies. Richard BerryRichard is the founder of the Good Money Guide

Hargreaves Lansdown Active Savings wins best savings platform at the 2024 Good Money Guide Awards

Hargreaves Lansdown Active Savings won Best Savings Platform at the Good Money Guide Awards in 2024 because they offer some of the widest selections of providers and some of the best fixed-rate options available. Backed by Hargreaves Lansdown, the platform also allows users to diversify by investing in both cash and the stock market. Richard

Hargreaves Lansdown Global Income fund targets DIY investors

The launch of the Hargreaves Lansdown Global Income fund brings another easy-to-use portfolio building tool to do-it-yourself investors on the platform. The new Global Equity Income fund invests in a portfolio of dividend-paying companies around the world favoured by selected expert managers. The strategy seeks to strike a balance between risk and return and offers

Hargreaves Lansdown clients swap investments for cash

Hargreaves Lansdown clients have been switching their investments to cash, the broker stated in its most recent quarterly trading update. Client cash balances at the firm rose to £12.7 billion during the three months to the end of September, up from £12.4 billion at the end of the first quarter of the financial year. Hargreaves

Hargreaves Lansdown kicks off Good Money Week with a look at the Emerging Markets

As part of this year’s Good Money Week, Hargreaves Lansdown, one of the UKs largest stockbrokers and investment platforms, has chosen to look at investing in the Emerging markets and the risks and opportunities within them with an emphasis on ESG. The initiative which goes on until October 6th, is designed to bring different sectors

Hargreaves Lansdown Versus Interactive Investor

Is it time to move your money away from Hargreaves Lansdown? Hargreaves Lansdown has been making headlines recently. This is due to the fact that the firm – which operates the largest investment platform in the UK with nearly two million customers – has received multiple bids from a private equity consortium (good news for long-term

Are Hargreaves Lansdown in trouble because of short sellers?

Hargreaves Lansdown is one of Britain’s largest stockbrokers and retail investment platforms helping millions of retail investors manage their savings investments and stock trading. So there is a certain amount of irony that the stock should be in the sights of that most speculative group of market participants, the short sellers. Why would you short-sell

Hargreaves Lansdown announces a new ready made pension plan for SIPP holders

The UK’s largest direct-to-consumer investing platform and stockbroker Hargreaves Lansdown has announced that it plans to introduce a new all-in-one investment plan for the firm’s Self-Invested Personal Pension or SIPP. Hargreaves Lansdown Ready Made Pension Hargreaves Lansdown hopes will remove “ a lot of the difficult decision-making” that clients face, when they try to pick

Hargreaves Lansdown now offers ready-made and managed investments

Ready-Made Index Funds and Managed Hargreaves Lansdown Investments are now available on HL for those who want a bit of help with their investments. A new range of index funds were made available from June 6th and complement the firm’s existing HL-managed ready-made fund range that was launched in 2023. The four new Hargreaves Lansdown

Hargreaves Lansdown cut direct debit & dividend reinvestment fees

Hargreaves Lansdown, one of the UK’s largest brokers and direct-to-consumer investing platforms, has removed fees for investors who invest regularly via direct debit and reinvest their dividend payments. Reducing direct debit and dividend reinvestment fees As of Tuesday, April 11th customers who invest regularly via direct debit payments to Hargreaves Lansdown, will no longer be

Hargreaves Lansdown launches Financially Fearless

Hargreaves Lansdown has launched “Financially Fearless” a new initiative to coincide with International Women’s Day, that aims to help close the gender investment gap between men and women. What is the gender investment gap? Men and women invest differently, men have historically been more inclined to invest, and have had more money to invest when

Why is the Hargreaves Lansdown falling? (LON: HL)

Hargreaves Lansdown is a leading investment platform in the UK Stock is stuck in a bear trend due to macro uncertainty LON:HL remains profitable; watch to buy on a further setback When Peter Hargreaves and Stephen Lansdown started their financial venture back in 1981 in Bristol (reputedly in Peter’s bedroom!), few would have anticipated the financial colossus

Hargreaves Lansdown’s trading update disappoints the market

The Hargreaves Lansdown (LON:HL) trading update showed net new business in Q1, worth £0.70 billion, though that figure was below analysts’ forecast of £0.85 billion. AUA or assets under administration rose to £122.70 billion as a result The D2C investing giant attracted 17,000 new customers in the first quarter and now has 1.754 million clients

Hargreaves Lansdown adds Santander to its Active Savings service

Hargreaves Lansdown, the UK’s largest investment and savings platform, has added Santander International to its Active Savings lineup. Santander International is the trading name for the Jersey and Isle of Man branches of Santander Financial Services plc, which in turn is a wholly-owned subsidiary of Santander UK Group Holdings plc, which itself is part of

Jefferies highlights the challenges of old age at Hargreaves Lansdown

US investment bank Jefferies has published a research note on the UK’s largest and some argue best investment platform, Hargreaves Lansdown. Jefferies has updated their coverage of Hargreaves Lansdown in an 11-page note the upshot of which is that the broker has downgraded the investment platform to underperform from its prior rating of hold, and

Hargreaves Lansdown boosts its Cash ISA interest rates

Hargreaves Lansdown the UK’s largest D2C savings and investment platform has raised the interest rate available to new Cash ISA customers. Hargreaves Lansdown cash ISA interest rates Hargreaves Lansdown has raised the interest rates that new customers can expect to receive on cash ISAs at the firm. The rate has been hiked by 20 basis

Hargreaves Lansdown bets on data and ESG, with a human touch

Hargreaves Lansdown the UK’s largest D2C investment and share trading platform, published interim results for the 6 months until the end of Dec 2021, this morning. Client funds up 17% The earnings release showed net new business of £2.30 billion taking assets under administration to £141.20 billion, a gain of +17.0% over the same period

Is Hargreaves Lansdown’s keeping up with the cool kids?

The last 18 months have been a period of strong growth for investment platforms and businesses within financial services particularly those that meet the needs of retail clients. Or so we thought because, despite headlines about sharply increased online trading activity and thousands of new accounts being opened, that hasn’t translated into increased profitability at

Hargreaves Lansdown between the rock and the hard place

The UK’s leading retail investment platform, Hargreaves Lansdown reported figures for the full year ending 30th of June 2021 this week, and though the headline numbers looked impressive, as is so often the case the devil was in the detail. HL net new business grew by £8.70 billion and assets under administration, or AUA rose

Peter Hargreaves, Chairman of Blue Whale Capital on investment strategies and the importance of investing in the next generation of fund managers

What do you do when you’ve stepped away from a FTSE 100 listed investment firm valued at around £9 billion you set up and have run for nearly four decades? Evidently, you set up another one. That’s what Peter Hargreaves the co-founder of Hargreaves Lansdown has done with Blue Whale Capital. Sometimes doing these interviews

Chris Hill, Hargreaves Lansdown CEO on HL being the most client focused business he’s ever experienced

I’ve always said that investing is a relationship business. Whether it be with a broker, a salesperson, a trading platform or a colour scheme. Choosing a broker can be in some cases more about how they treat you and how they make you feel rather than cold hard cash. It’s for those reasons that when

Hargreaves Lansdown FAQs

Yes, we rate Hargreaves Lansdown as one of the safest share dealing accounts in the UK because they are well established, listed on the London Stock Exchange, and regulated by the FCA. Hargreaves Lansdown is also a profitable company with millions of private and corporate customers.

As an FCA-regulated stock broker, if Hargreaves Lansdown were to go bust, client cash on account would be protected by the FSCS scheme. Client investments are held in nominee accounts on CREST and can be transferred to another FCA-regulated investment platform.

Yes, Hargreaves Lansdown is considered one of the more expensive trading apps, as they charge a commission per share deal as opposed to commission-free investing apps like Freetrade, CMC Invest or Dodl, where it is free. Hargreaves Lansdown is also very expensive for holding funds on account as there is no cap on their fund account charge. Whereas, AJ Bell fund fees are capped and Interactive Investor charges a flat monthly subscription.

Hargreaves Lansdown is a public company listed on the London Stock Exchange meaning anyone can buy shares. But only around 25% of HL shares are traded on the LSE as 75% of the company is still owned by the founders Peter Hargreaves, and Stephen Lansdown and employees. You can see the breakdown of Hargreaves Lansdown shareholders in our HL share price performance section.

Yes, Hargreaves Lansdown offers access to a huge range of UK-listed Government and corporate bonds that you can invest in to build an income-generating portfolio. We actually used Hargreaves Lansdown to demonstrate buying Retail Charity bonds when we reviewed them.

No, you cannot buy commodities directly on Hargreaves Lansdown directly, to do that you need a commodities broker. But, you can invest in commodities on HL through a commodity ETF which is listed on the stock exchange like the Legal & General Longer Dated All commodities UCITS ETF (CMFP).

No, you cannot buy fractional shares on Hargreaves Lansdown, you can only buy whole shares, ETFs and units of funds. If you want to invest in small slices of company shares or want to invest in monetary amounts rather than shares you can compare the best brokers for fractional shares investing here.

No, you cannot trade options on Hargreaves Lansdown. I view this as quite a significant disadvantage because options are a great way to hedge your long-term investment portfolio against potential short-term stock market falls. If you want to trade or invest with options you can compare the best options brokers here.

No, you cannot buy or invest in gold directly on Hargreaves Lansdown, to do that you need a gold trading platform. But, you can get exposure to gold and invest in a gold ETF that tracks the price of the gold and can be bought and sold on the Hargreaves Lansdown platform just like shares for example, SPDR Gold Trust, iShares Gold Trust or Aberdeen Standard Physical Gold Shares ETF.

No, you cannot short stocks or go short on the Hargreaves Lansdown platform. But if you think that the Hargreaves Lansdown share price will go down it is possible to short Hargreaves Lansdown shares with a short-selling broker using CFDs, options or financial spread betting. However, if you want to go short the overall stock market to hedge your portfolio held at Hargreaves Lansdown you can buy an inverse ETF (which goes up when the market goes down) like

Absolutely not! Hargreaves Lansdown is a traditional stock brokerage and is most suitable for those investing in the long term. Cryptocurrency is a very high-risk product and not apprapriate to hold alongside ISA or SIPP accounts. Having said that, the SEC has recently approved a Bitcoin ETF, which can be bought and sold on the stock market, so some UK investors may be able to buy cryptocurrency on HL if they pass the sophisticated investor threshold.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.