Over the last decade, we have seen a spectacular growth in the popularity of so-called passive investing. That is investing or trading in funds, strategies or other instruments that seek to deliver a market return, rather than trying to outperform a benchmark, as actively managed money tries to do.

Using inverse ETFs to short the market or hedge risk

These passive investment strategies benefited from an 11-year bull market in US equities, low costs and management fees, and simplicity of asset allocation.

The vehicle that made all of this possible was the ETF or Exchange Traded Fund.

The ETF is an open-ended investment structure that seeks to track a specific benchmark, sector, investment strategy or commodity. The units or shares of an ETF fluctuate in price based on the performance of the underlying markets, they are tracking, and these units are traded in the same way that ordinary stocks are.

- Related guide – How to invest in a bear market

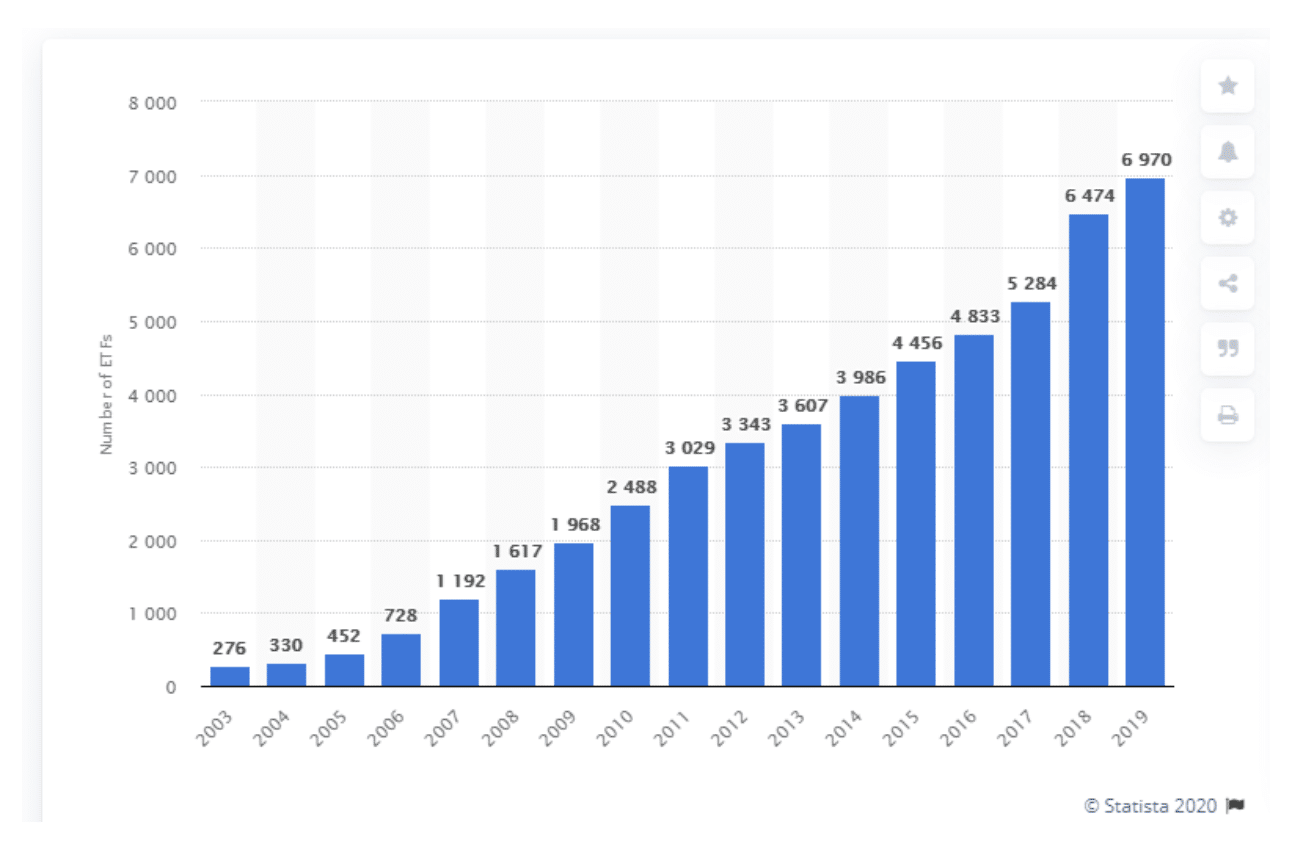

The number of Exchange-Traded Funds (ETFs) worldwide 2003-2019

Source Statista

The simplicity of the ETF concept appealed to fund managers, institutions and the investing public alike. As we can see above, the growth in the number of ETFs available has been pretty spectacular and consistent. As of the end of 2019, there were almost 7000 individual ETFs listed around the globe, with some US$4.0 trillion collectively invested in them, according to data from research firm ETFGI.

These days if you have an investment idea or theme you want to follow you can probably find an ETF to track that for you

A less considered way of hedging is with an inverse short ETFs

However, one strategy that investors don’t usually consider using an ETF for, is that of going short. That is selling a market or instrument now, in expectation of buying that market or instrument back, at a lower price (for a profit) at a future point in time.

In fact, many investors haven’t considered trading on the short side at all, but as we were reminded in the first quarter of 2020 (a period in which many major equity indices posted -20% falls or larger) the short side of the market shouldn’t be ignored.

ETFs are the ideal vehicle to trade on the short side of a market or instrument, because of the way they are structured.

- Related guide: Can you use shares in your portfolio as collateral for CFD trading and spread betting?

That is they are designed to track the price performance of an index, sector or commodity and to do that in either direction, be it up or down.

So how does shorting a market via ETFs work in practice?

Well, there are several possibilities.

Let’s imagine that you have a portfolio of UK blue-chip equities that wish to protect you, or that having looked around, and done some research you feel that UK equities are overvalued and are therefore due a correction, what are your options?

Well, there is an ETF that tracks the performance of the FTSE 100 index which is

the iShares Core FTSE 100 UCITS ETF which has the ticker ISF.

The fund manager or provider for this ETF is iShares, a division of Blackrock and the fund explicitly seeks to track the performance of the UK’s top 100 shares.

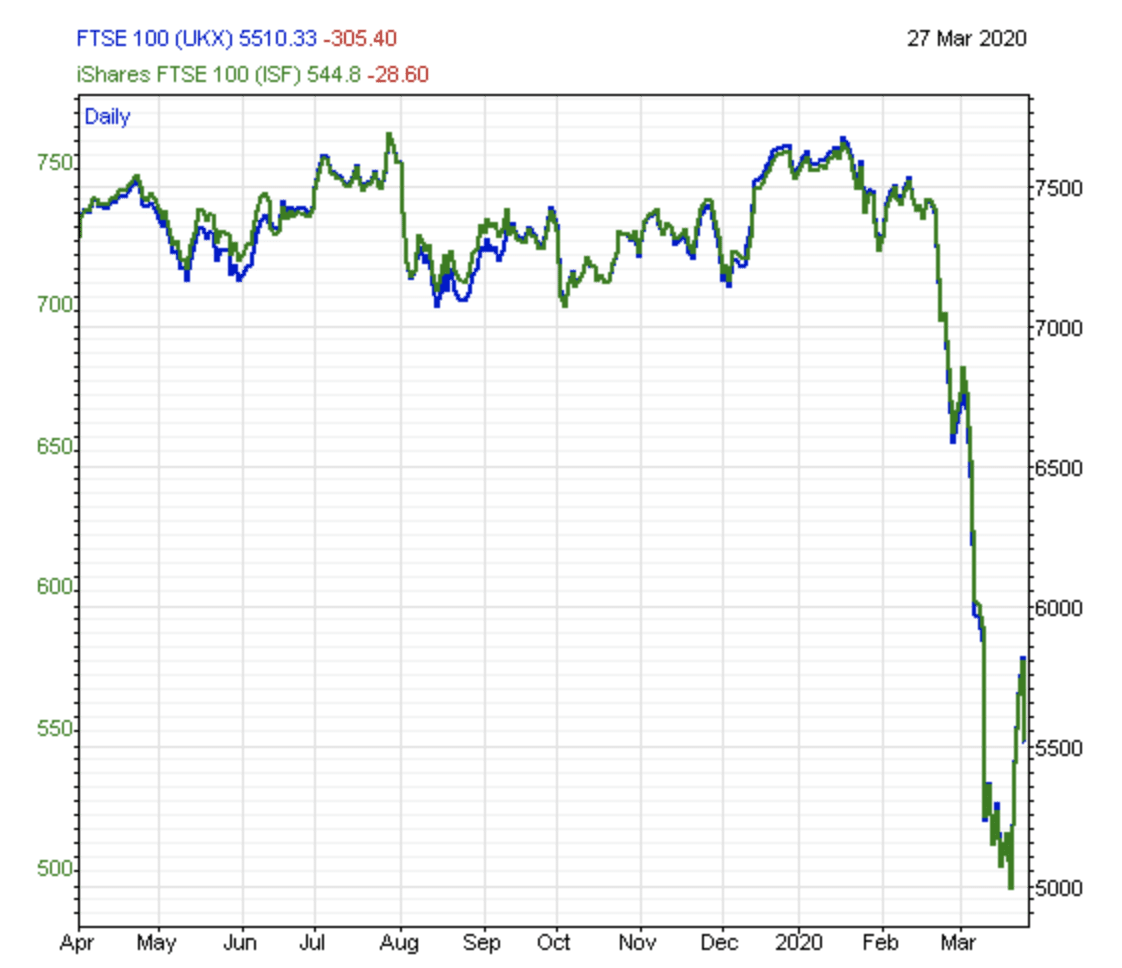

We can see how effectively it does this by looking at the chart below, which plots the FTSE 100 index in blue and the ISF ETF in green. So well does the ETF track the FTSE 100 that those two lines are often indistinguishable from each other.

Source Investors Intelligence

So if we want to hedge the downside on our blue-chip portfolio or take a speculative short position on leading UK shares, we just need to sell the ISF ETF.

We can do this on a money for basis by selling a value of the ETF equivalent to the size of our blue-chip portfolio, say for example £50,000. At that point, any downside move in our blue-chip portfolio should be offset by a similar fall in the price of the ETF.

As we are short of the ETF, a fall in its price creates a running profit for us, which can be realised by closing our short and buying the position back. The hedge will not be 100% perfect of course, as our portfolio is likely to differ from the FTSE100 index that the ETF tracks.

Where to buy Short/Inverse Exchange-traded Funds

You can use this comparison table of ETF platforms to compare account and dealing fees as well as see what type of accounts you can hold exchange-traded-funds in.

Trading on margin versus inverse/short ETFs

One of the best ways to affect a hedge, or trade the downside is to use a CFD or Spread Betting account through which to go short of the ETF. Of course, in either case this would be a margined position, meaning that you won’t have any ownership or beneficial interest in the underlying, instead you will simply be speculating on changes in its price.

Alternatively, if your stockbroker allows it you can sell the ETF in the cash market, and that’s a popular strategy among day traders, who will close their positions inside one business day.

Either way as the FTSE 100 rises and falls so will the price of the iShares Core FTSE 100 ETF.

An alternative approach for short ETFs

Financial ingenuity being what it is, there is an alternative to going short of an ETF, in order to trade the downside. That alternative is provided by so-called Inverse ETFs.

These are ETFs which are designed to move in the opposite direction to an underlying instruments price. That is rising when that underlying price falls and falling when it rises.

Top Ten Inverse ETFs for Shorting and Hedging the Market

In the table below we have listed the top 10 Inverse ETFs ranked by AUM or Assets Under Management, as of the time of writing. These ETFs are largely US centric and track a range of indices and sectors.

| Symbol | ETF Name | Total Assets* | YTD % Change | Avg Volume | Previous Closing Price |

| SH | ProShares Short S&P 500 | $3,020,684.54 | 17.63% | 16,289,308.00 | $28.22 |

| PSQ | ProShares Short QQQ | $516,429.04 | 6.73% | 7,082,543.00 | $26.17 |

| DOG | ProShares Short Dow 30 | $372,281.17 | 20.44% | 1,143,902.00 | $59.35 |

| RWM | ProShares Short Russell 2000 | $319,987.40 | 32.91% | 971,413.00 | $49.00 |

| HDGE | AdvisorShares Ranger Equity Bear ETF | $136,515.95 | 30.22% | 1,206,165.00 | $6.98 |

| SPDN | Direxion Daily S&P 500 Bear 1x Shares | $89,087.43 | 17.61% | 217,221.00 | $28.72 |

| YGRN | MicroSectors U.S. Big Oil Index Inverse ETN | $82,224.34 | 73.65% | 562 | $81.35 |

| EUM | Short MSCI Emerging Markets ProShares | $69,369.73 | 25.18% | 583,183.00 | $21.34 |

| EFZ | Short MSCI EAFE ProShares | $50,432.90 | 24.35% | 94,422.00 | $30.17 |

| GNAF | MicroSectors FANG+ Index Inverse ETN | $40,141.06 | -1.29% | 3,237.00 | $40.08 |

| EMTY | ProShares Decline of the Retail Store ETF | $33,005.98 | 45.83% | 28,984.00 | $48.88 |

Source ETF DB Good Money Guide research

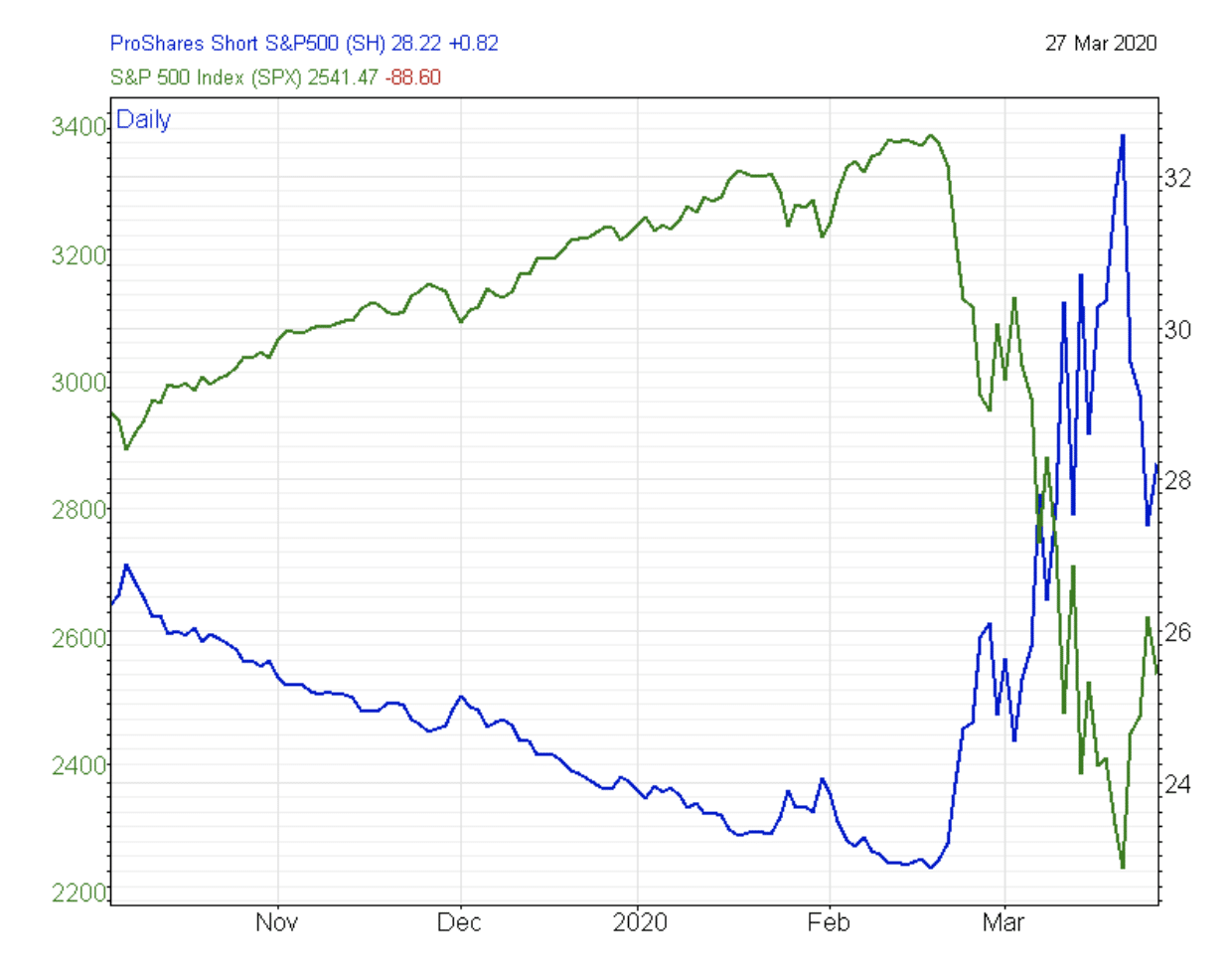

For example the first ETF in the list is the ProShares Short S&P 500. Ticker: SH, the fund was established back in 2006. However you can clearly see the inverse nature of the fund in this more recent chart of the ETF versus the S&P 500 index, over the last quarter of 2019 and the first quarter of 2020. The ETF is drawn in blue and the index in green.

Source Investors Intelligence

Traders or investors who wish to go short of an underlying index, for example, the S&P 500 can buy, or go long of the inverse ETF, and by extension if they wish to be long of the underlying index they can do so by being short of the appropriate Inverse ETF.

Be aware though that Inverse ETFs are specialist instruments and they are designed specifically for use in short term trading strategies and not for use in longer term buy and hold portfolios. As they are subject to price resets (which can occur daily) and value erosion, which acts in a similar way to time decay in the options market.

Outside of those that track major indices, Inverse ETFs often tend to be focused on a specific sector or theme. For example, in the table above ticker:EMTY is the ProShares “Decline of the Retail Store ETF” the fund is structured so that the price of its units should rise in value as, when and if, the shares of the quoted US bricks and mortar (high street) retail sector decline.

Additional enhancements of leveraged inverse ETFs

There is a further enhancement available to traders looking to gain downside exposure or hedge a portfolio through ETFs. That enhancement comes in the shape of Leveraged ETFs.

| Symbol | ETF Name | Asset Class | Total Assets ($MM) | YTD% Change | Avg. Volume | Closing Price |

| SDS | ProShares UltraShort S&P 500 | Equity | $1,399.10 | 27.27% | 14,948,670 | $31.59 |

| QID | ProShares UltraShort QQQ | Equity | $264.47 | 5.36% | 7,615,889 | $24.70 |

| DXD | ProShares UltraShort Dow 30 | Equity | $226.48 | 32.21% | 1,792,787 | $29.77 |

| FXP | ProShares UltraShort China 50 | Equity | $47.55 | 25.99% | 117,052 | $67.94 |

| EPV | ProShares UltraShort Europe | Equity | $26.91 | 52.19% | 46,213 | $39.38 |

| EEV | UltraShort MSCI Emerging Markets | Equity | $23.84 | 45.64% | 54,714 | $51.45 |

| BZQ | ProShares UltraShort MSCI Brazil | Equity | $19.32 | 88.13% | 324,624 | $34.34 |

| EWV | UltraShort MSCI Japan ProShares | Equity | $14.33 | 27.30% | 33,367 | $30.36 |

| REW | ProShares Ultra Short Technology | Equity | $6.86 | 4.08% | 44,200 | $13.06 |

| SSG | ProShares Ultra Short Semiconductors | Equity | $6.31 | -4.59% | 54,517 | $14.15 |

| RXD | ProShares Ultra Short Health Care | Equity | $2.78 | 19.37% | 7,438 | $20.44 |

| EFU | UltraShort MSCI EAFE ProShares | Equity | $2.56 | 45.72% | 5,356 | $29.27 |

| SZK | ProShares Ultra Short Consumer Goods | Equity | $2.24 | 27.00% | 8,495 | $13.71 |

Source ETF DB Good Money Guide research

Leveraged ETFs are exchange products that are geared. That is they move in a multiple of the move seen in the underlying that they are tracking.

Such as a 3x (three times) leveraged ETF, tracking index “A”.

A move in the price of Index A of +/- 10 points will mean a move of +/- 30 points (or equivalent) in the price of the leveraged ETF.

Leveraged ETFs can be structured to move in the same direction as their underlying benchmark or assets or in the Inverse or opposite direction.

The table above contains a selection of Leveraged Inverse ETFs. Once again, the table is ranked by AUM at the time of writing.

The ETFs range from the Pro Shares UltraShort S&P 500 ETF Ticker: SDS. A two times Levered Inverse ETF on the broad-based US equity benchmark, to the

UltraShort MSCI Japan ProShares Ticker EWV which provides two times Leveraged, Inverse exposure to large cap Japanese equities.

We can get even more exotic in terms of coverage for example one the best performers in our table above, with year to date returns of more than +88% (at the time of writing) is ticker: BZQ the ProShares UltraShort MSCI Brazil. This ETF is a two times geared daily inverse or short ETF on a basket of 55 Brazilian large cap equities, tracked by the MSCI Brazil index.

Closer to Home ticker: EPV is the ProShares UltraShort Europe ETF.

Once again this is a two times Leveraged Inverse structure, in this case one that tracks the performance of the MSCI Europe Index, which contains 438 large cap constituents drawn from markets across Europe and the UK.

Caveat emptor when invsting in inverse ETFs

Trading in exotic ETFs such as Inverse, Leveraged and Inverse Leveraged products contains a high degree of risk, particularly if we combine the leverage embedded in the product with a leveraged position on it. Many of these exotic ETFs are priced in US dollars and therefore those trading in them, from a base currency other than the US dollar, face added FX exposure on top of this.

Whilst we have used the generic term ETF to describe these instruments above, the actual structures and nature of these more exotic exchange traded products will vary and traders should always do their research, to ensure that they understand the products they are trading and the risks involved therein.

The rule of thumb is that the more” bells and whistles” that the product offers the more research you need to do to make sure you understand exactly what you are dealing in and how the product relates back to its underlying instruments or benchmark.

Remember that derivatives such as these are designed to allow for the diversification of risk not its concentration, though of course they can deliver that in spades if misused.

If you are in any doubt about the suitability of a particular product or trading strategy for you then you should seek the appropriate financial advice.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com