- Hargreaves Lansdown is a leading investment platform in the UK

- Stock is stuck in a bear trend due to macro uncertainty

- LON:HL remains profitable; watch to buy on a further setback

When Peter Hargreaves and Stephen Lansdown started their financial venture back in 1981 in Bristol (reputedly in Peter’s bedroom!), few would have anticipated the financial colossus it would become thirty years later.

Hargreaves Lansdown (LON:HL/), the multi-billion broker and wealth management company, is now a FTSE 100 company worth £4.4 billion. It made both founders very rich. Peter Hargreaves’ net worth is estimated to be worth more than £2.5 billion.

The stock broker was floated during the bull market in 2007. The first trading day saw prices surge by double-digits. Soon after, Hargreaves Lansdown rode the post-GFC recovery bull trend and peaked at more than £20 back in 2019. It was an incredible 10x rally from the IPO price. But that multi-year rally had given way to a multi-year bear trend. As the time of writing, prices are trading beneath £10 – a level last reached a decade ago in 2013 (see below).

Is Hargreaves Lansdown a good investment in the long term?

Given the stock is struggling to resuscitate the bull-trend, many are wondering: is HL stock still a long-term buy?

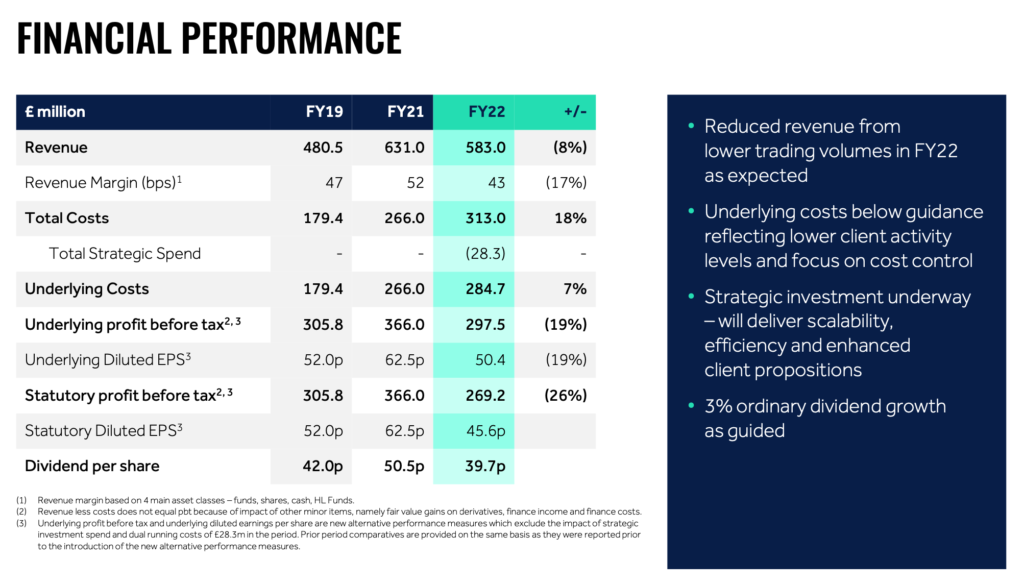

There are pros and cons. First let’s talk about the positive side. Hargreaves Lansdown’s investment platform is very popular and currently has around 1.7 million customers. Client retention is good; recurring revenue is sufficiently strong. Pre-tax annual profits for FY22 is more than a quarter of a billion (£269 million). Moreover, Hargreaves Lansdown distributes generous dividends. A yield of 4.3 percent is good in today’s environment. This makes the HL a viable long-term investment proposition.

However, there are downsides too. For one, despite making more money from the pandemic stock trading boom, the stock failed to benefit greatly. It merely rose to near £19. When a stock doesn’t rally during a strong bull market, then it is hardly going to during a bear market.

Indeed, as soon as negative sentiment arrived, Hargeaves’ share slumped from £14 to £8. While there is some support at £8 the stock may retest the lows should the current bear market extend into 2023, especially as stock trading activities decline.

Even the founder Peter Hargreaves has criticised the company in a recent interview (with FT, behind paywall). “The board,” he said, “indulged in completely unnecessary irrelevant programmes, which have distracted the firm from its prime objective.” Some cost-cutting is needed to restore investor confidence in the company.

The CEO Chris Hill is leaving too. So there will be a period of uncertainty at the helm.

And there are other competing stocks out there which may lead to better stock returns here. For example, AJ Bell (LON:AJB) and Rathbones Group (LSE:RAB).

Over the long term, Hargreaves Lansdown may still be a great company – but whether it will repeat another 10x run (2009-2019) I am not so sure. If buying the stock now, I would set my expectations a little lower.

Source:

When is the best time to buy Hargreaves shares?

During the 2009-2019 bull market, the best time to buy Hargreaves shares was when price corrected into the previous pivot lows. For example, during 2015, 2017 and 2019.

However, that decade-long bull run has ended. Now investors are facing a completely different set of long-term trends, which is down.

If you keep buying Hargreaves at each downside pivot, soon the position will be deeply underwater. To deal with this, either you hold for the very long-term (we are talking about years) and sit out the drawdown. Or you conduct shorter-term buys and sells.

For instance, wait patiently for a period of decline. When the market becomes deeply oversold, buy a portion of the stock. On a rebound, let go of the shares and then wait for another leg down. This way, you build up more capital to buy more Hargreaves shares.

Of course, such trading tactics may not be suitable for everyone. Perhaps you may want to wait until the bear market has ended and then buy the stock in one clip.

Is the Hargreaves Lansdown share price overvalued or undervalued at the moment?

Hargreaves Lansdown is a great investment platform. Many investors have used the platform over the years. Recurring revenue is substantial.

That said, the company is now entering into an uncharted period where trading activities are subdue. Meanwhile, costs have increased. The macro environment is no longer supported by an equity bull market, which reduces HL’s profit margin. In FY22, for instance, pre-tax earnings have dropped below 2019’s level.

As a result, HL’s share price dropped sharply.

However, should HL’s stock continue to decline, a modest level of ‘undervaluation’ may emerge here, especially when HL’s market cap is a single-digit multiple of its annual profits. If that price arrives, you know the stock is a good buy.

Source: Hargreaves Lansdown plc

Why has Hargreaves Lansdown’s share price risen recently?

The global equity market has rebounded on either side of the Christmas period. There are a few reasons why:

- Less restrictive monetary policy – which is caused by a change in market outlook on policy rates. No longer is the Fed expected to hike rates by 75bps. Now the consensus is 50bps in 2023.

- A rebound in UK stocks – led by a new administration in Downing Street

- Oversold rebound – as Hargreaves had fallen persistently for a good few months

However, after weeks of base building at 750-700p Hargreaves is now testing overhead resistance at 1,000p. Watch for an upside breakout at this psychological round number level.

What is the Hargreaves Lansdown share price prediction?

Compared to a year ago, the consensus on Hargreaves’ share has plummeted into more negative territories.

For example, in Jan 2022 there were only 4 ‘Hold’ recommendations. Now there are 11. More ‘Sell’ ratings too. Taken together, it seems the investment community is not too keen on the investment platform.

On price forecast, the medium level is at 925p – which is right where Hargreaves is trading right now. This begs the question if City is too bearish on the stock. Perhaps only if HL, is able to muster an upside breakout then analysts will start to warm up to the stock again.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com