Bestinvest Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

Capital at risk

Bestinvest Expert Review

Bestinvest has improved a lot recently. They’ve invested a huge amount in branding, their app and providing access to new markets. This is mainly becuase investors (or those in the UK at least) want more and they want it faster and cheaper than ever before). For this Bestinvest review, I’ve interviewed the CEO (in the studio and over a lovely lunch at Cobette on Gresham Street) and put some trades and investments on the app and desktop platform.

Bestinvest Review

Name: Bestinvest

Description: Bestinvest is one of the most established investment platforms in the UK. Bestinvest was founded in 1986 and is now owned by Evelyn Partners (a financial services firm with £52 billion under management). Bestinvest primary offering is low-cost premade portfolios costing as little as 0.2% a year, fund investing and discount UK share dealing.

Why we like them

Bestinvest has combined low-cost online investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. A good choice for large long-term investors.

Pros

- Expert advice

- Lowest comparable costs

- Ready-made portfolios

Cons

- Basic data on platform

- App a bit clunky

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(3)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.2Ratings Explained

- Pricing: Bestinvest scores top markets here for their low-cost ready-made portfolios and cheap dealing fees

- Market Access: Huge range of UK and US shares, bonds and funds to invest in, although they are let down by not offering emerging markets.

- App & Platform: Could be a lot better and the app was only released last year

- Customer Service: Excellent personal service, although advice is charged on a flat fee basis.

- Research & Analysis: Really good coverage of funds with their “Spot the Dog” report.

Another way to phrase this review title would be, that one of the worst things about investing online, is having to invest online…

This is because investing is a fairly solitary activity. Gone are the days of weekly investment club meetings down the pub, or regular lunches with your stock broker. Plus if you search for info on investing online, it’s awash with social media influencers coaching newbies, not for the purposes of providing financial advice (which they are not allowed to do anyway), but for clicks, likes and views.

Modernisation

I wasn’t going to talk about how the internet has revolutionised investing, because that is almost as outdated speil as how RDR has discouraged investors from getting advice on their investments. But both are true so I sort of have to talk about it in a review that takes online investing offline.

There are very few legitimate online resources that help people invest their money well. It’s absolutely staggering that Tiktok users spend on average 95 minutes a day scrolling through the app, almost double what people spend on facebook and Instagram*. The worry here is that, particularly after the pandemic and meme stock mania, more and more people are turning to social media for investment advice.

Social Media

It’s genuinely terrifying, I didn’t have TikTok before today, but I downloaded it to see and searched for videos on investing. Hyperbole aside, 20 minutes later, I looked up after having been hypnotised by a series of kids selling the dream.

It’s a trend, that has even worried Google, as people look to videos to answer questions rather than websites, luckily they own Youtube, where users only spend 74 minutes a day zoning out and watching “how to” videos.

But, there is a solution for investors who want actual advice and don’t have a wealth manager.

Advice & Guidence

What Bestinvest has done is added another layer to their historically, execution-only platform in the form of “Coaching”. This hybrid approach means that you can invest online, but also have a one-on-one chat with an expert.

For none clients, you can have a free 45-minute session with a qualified financial planner who will talk you through the various investment options on the platform and what may be most appropriate. Once you have an account, this service is unlimited.

When I spoke to Jason Hollands, the head of corporate affairs at Bestinvest before writing this reivew, he was keen to highlight that coaching is not financial advice, it’s guidance. Before you have a coaching session, you can go through a suitability questionnaire that sets out your investing goals and risk tolerance, but it’s not a full-on “know your client” process, as coaching is about what you “could” do, rather than what you “should” do.

If you want actual investment advice, to fine-tune your portfolio, get investment ideas, and help with what to buy and sell Bestinvest can do that by delving a bit deeper on the phone or by video chat. Which is something that most of the other investment platforms out there do not offer. If you are a new investor, Bestinvest charges £295 for a consultation and will recommend a ready-made portfolio (similar to what robo-advisors offer). Or, if you have an existing portfolio, for £495 one of their investment advisors will analyse your holdings and suggest what to keep, what to get rid of and what to replace it with. They can’t help with tax planning or inheritance issues, but if you need proper wealth management Bestinvest is part of Evelyn Partners which can offer those services (Evelyn currently looks after over £52bn).

Quality Costs

Before you gawk at the prospect of having to pay for something investment-related and bemoan “investing is for making money, not spending it“, think about what you are getting in return. In the past, this would have been free yes, but it would have been provided by a half-com hungry adviser stuffing new clients into any new old fund for the purposes of generating commission. But those days are over. I’ve seen a pattern emerge over the last few years in all investing, trading and currency providers. They want their customers to do well. Because a profitable customer is a happy customer, and happy customers stick around (and yes, to the cynics, incidentally generate more commission that way).

But this is where Bestinvest says they win business, not from new investors signing up to start investing, but from established investors with larger portfolios transferring in who need a little bit more from their broker. Which to be fair, are a better type of customer for Bestinvest anyway.

Why? Because they are cheap.

Low Cost Portfolios

Annual account fees for Smart portfolios, start at 0.2%pa up to £500k, then 0.1% to £1m, then nothing over £1m. To put that in comparison, Hargreaves Lansdown charges 0.45% up to £250k, and even upstart digital wealth managers like Nutmeg charge, 0.35% for portfolios above £100k (0.75% below that), whilst Moneyfarm charges up to 0.45% above £100k. Ongoing charges are a little higher though (the fee to the investment manager for running the fund) of 0.34%, versus about 0.2% for Smart ready-made portfolios.

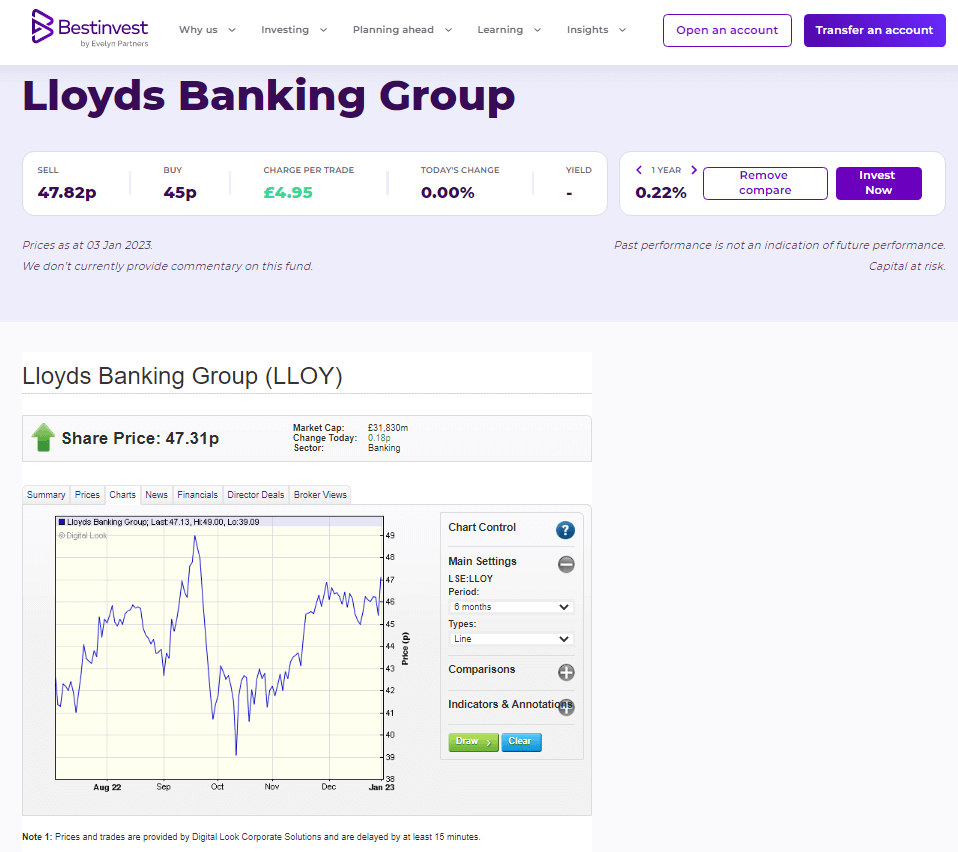

Another advantage of Bestinvest over Nutmeg and Moneyfarm, is that you can also buy individual UK shares for growth, dividends or if you just fancy a punt on the market. For share dealing, Bestinvest has the lowest commission of the big platforms, it’s £4.95 for dealing online, whereas HL is £11.95, Interactive Investor £7.99 and AJ Bell£9.95.

Ready-made portfolios are the “investments de jour”, and people like them because they are low-cost and diverse. Bestinvest launched a new range of Smart portfolios with Evelyn funds in January 2022 containing ETFs and trackers to keep costs down. You can also invest in more actively managed Expert portfolios, which target better returns, however fees are higher with ongoing fund charges around 1.5%.

They have some quite nifty widgets as well, the Goal Planning tool will analyse your holdings and produce a graph of where your investments maybe in the future. This is based on what you actually hold, rather than just an averaged-out market performance calculator, which is what you tend to get elsewhere.

Lagging Tech

However, for active investors, the online dealing platform is nowhere near as good as Interactive Investor or Hargreaves Lansdown. The fund and share research on the platform is limited to a fairly poorly integrated data portal from Digital Look although the fund factsheets are integrated well. When I tested it I found it quite hard to navigate to the actual “invest” button kept disappearing. But, as I said earlier this is online investing without investing online. It may actually be a blessing as too much tinkering with your long-term investments can be counter-productive.

Personal Service

What makes Bestinvest one of the best places to invest is that if you want to research stocks and funds and don’t want to trawl through online screeners on trustnet or get waylaid by pump and dump chat on Reddit you can pick up the phone and talk to someone who knows what they are talking about.

Capital at risk

Is Bestinvest general investment account any good?

I’d say the best thing about Bestinvest’s GIA is the added value. Market access is a bit limited, but you can get advice on what to invest in as and when you need it (at a cost).

Bestinvest’s GIA has recently launched a series of low-cost ready-made portfolios. You can also buy individual shares, funds and trusts. Bestinvest’s investment platform has combined low-cost online investing and share dealing with personalised expert advice to help clients choose suitable investments for their portfolios. A good choice for investors who want to talk to an actual human when investing, rather than doing everything online themselves.

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA, JSIPP

- Account charge: 0.2% to 0.4%

- Dealing fee: Shares £4.95, funds £0

Fees:

Bestinvest general account fees start at 0.2% a year for smart ready-made portoflios, which makes them one of the cheapest managed investment accounts. If you have more than £500,000 in your account, it reduces to 0.1%. For other investments, like bonds, shares and expert-managed portfolios, the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

For investment advice, Bestinvest will give you a full portfolio health check for £495, which includes advice on your individual holdings, and suggestions for new or alternative investments. There is also a more basic investment advice package priced at £295 where you speak to an advise who will send a report advising on a ready-made portfolio and some suggestions for creating your own portfolio.

Investing Platform:

Bestinvest’s investment platform is very simple to use and lets you connect with an investment advisor via video chat.

Capital at risk

Bestinvest Awards

Bestinvest won best added value account in our 2023 awards as they are one of the only major investment platforms to offer both advice and guidence.

Capital at risk

Bestinvest Video Review

Watch as we invest live on the Bestinvest website and app as well as highlight some of the key features that make them stand out from other providers.

Capital at risk

Bestinvest MD Interview

Capital at risk

How many investment trusts are on Bestinvest?

You can invest in around 270 investment trusts on Bestinvest and as they are regulated by the FCA your funds are protected by the FSCS.

For investment trust investing Bestinvest’s account fee is 0.4% up to £250k. This reduces to 0.2% after £250k.

Capital at risk

Can you invest in OEIC on Bestinvest?

Yes, Bestinvest do not charge commission for buying or selling open-ended investment companies, but their annual account fee is slightly higher than other providers like AJ Bell (who do charge commssion).

For open-ended investment company investing Bestinvest’s account fee is 0.4% up to £250k. This reduces to 0.2% after £250k.

Capital at risk

Is Bestinvest a good platform for buying ETFs?

One of the best things about buying ETFs through Bestinvest is the ability to ask a financial coach or advisor which ones are the best ones for you to buy with their advice service. Picking the right investments can significantly make up for costing a little bit more, or not having as broad ETF universe as other providers like Interactive Brokers.

A good choice for those that need a little help deciding what ETFs to invest in.

- ETFs available: 400+

- ETF account charge: 0.4%

- ETF dealing charge: £4.95

- Account types: GIA, ISA, SIPP, JISA, JSIPP

ETF Fees: Bestinvest ETF account fees reduce as your account gets larger. It costs £4.95 every time you deal, and when your portfolio goes above £250k fees are reduced from 0.4% to 0.2%.

Bestinvest can also give you guidance and advice on what are the best ETFs (exchange traded funds) to invest in for your investment objectives.

Capital at risk

How are Bestinvest share dealing fees taken?

When you deal shares on Bestinvest you are charged commision after you trade. You also have to pay an annual account charge that is deducted monthly.

A great for those that need a little help with what shares to deal. Bestinves can provide guidance and advice on what shares to add to your portfolio.

- Investments: Shares, ETFs, funds & bonds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA, JSIPP

- Share dealing account charge: 0.45%

- Share dealing fee: £4.95

Fees: Bestinvest share dealing account fees are 0.4% up to £250k. Share dealing commissions are £4.95 per online share trade.

Capital at risk

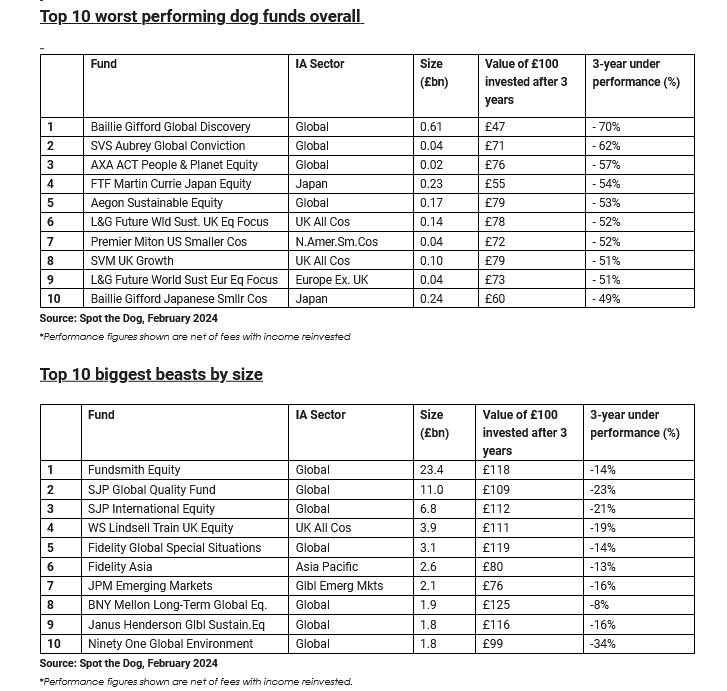

Fund Investing: Avoid bad funds with Bestinvest’s Spot the Dog list

If you want to invest in funds with Bestinvest, they have since 1994 produced a list of underperforming funds to avoid. It’s a great way to help you pick better funds to invest in if you have any in your portfolio.

- Available funds: 1,000

- Fund account fee: 0.2%

- Fund dealing commission: £4.95

- Minimum investment: £1

Fund Fees: Bestinvest charge a 0.2% account fee for holding ready-made portfolios. Above £500,000 it reduces to 0.1%. For other investments, the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

Unleashing the Truth: Bestinvest’s Spot the Dog Report Exposes Equity Funds’ Underperformance

The latest Spot the Dog report, published by Bestinvest in March 2024, has shed light on the underperformance of 151 equity investment funds which manage around £95.0 billion of investors’ wealth.

A sharp increase in underperformance

This figure marks a staggering +170.0% increase in the number of underperforming funds when compared to the previous Spot the Dog report.

Which recorded just 56 funds consistently underperforming their benchmarks, over the previous three years.

Global equity funds are feeling the pinch

The Bestinvest data highlights the growing challenges that investors face in keeping their investments afloat, amidst shifting market conditions.

- The latest report shows that 49 Global Equity funds were underperforming.

- A figure that is more than double the previous tally of just 24 funds.

Even funds managed by superstar investors, such as Terry Smith and Nick Train have recently been lagging behind broader market returns.

An unusual market backdrop

The last three years have played out against an unusual market backdrop, which has been characterized in turn by sharp gains in oil and gas shares and dramatic price rises in a narrow band of US mega-cap growth companies.

A combination that has left large parts of the stock market and many funds lagging behind.

The rise and fall of the Energy sector

If we measure its performance over the last three years, then the energy sector has been among the best-performing global industries.

With the MSCI World Energy Index delivering a total return of +125.0%, according to the BestInvest data

And as a result, funds that failed to capitalize on this trend, and which were underexposed to the energy sector struggled to keep up with their benchmark index.

More recently, however, energy prices have fallen. The S&P 500 Energy sector, growing by just +1.61%, for example, over the last 52 weeks.

Despite that decline in recent performance, almost half of the global funds on the Spot the Dog list, have a focus on sustainable investing, and therefore did not participate in the sharp rise in oil and gas-related shares.

What’s more the renewable energy sector faced its own challenges. with the MSCI Global Alternative Energy Index declining by -45.0%, finishing in negative territory in three consecutive years, 2021, 2022 and 2023.

For comparison, the MSCI Global Alternative Energy Index, fell by -25.23% in 2023, while the MSCI World Equity Index rallied by +24.42

The emergence of the Magnificent Seven

The leadership in equity markets switched from Energy stocks to the so-called ‘Magnificent Seven’ – a group of high-flying US tech companies – have significantly influenced the overall returns in equity indices, such as the S&P 500 and Nasdaq 100. Thanks largely to the buzz around AI and the growth of these businesses.

Microsoft, Apple and Nvidia now all have market caps that are above $2.0 trillion. Making these individual stocks larger than many national stock exchanges.

Microsoft has now become the world’s largest company when measured by market cap.

Many fund managers missed out on the initial gains in these stocks, believing that the Technology sector was already overvalued, and that value, rather than growth stocks offered better opportunities.

Over the last year the S&P 500 Information Technology sector, has rallied by +61.60% and the Communications Services sector by +58.81%.

Whilst the S&P 500 Value index is up by just +20.16% over those 52 weeks

Even the big guns can get it wrong

Two of Britain’s most prominent fund managers, Terry Smith and Nick Train, have seen their funds – Fundsmith Equity and WS Lindsell Train UK Equity funds – make an appearance in the Spot the Dog list, for the first time ever.

Though it’s true to say that despite their recent underperformance, both funds have delivered returns, that are significantly ahead of their relevant benchmarks, over the longer term.

For example, since November 2010 Terry Smith’s Fundsmith Equity, has delivered a total return of +563.0% to its investors.

In doing so, it comfortably outperformed the MSCI Word index, which returned +351.0% over the same period.

The importance of staying the course in fund investing

While it’s crucial for investors to monitor their investments and understand why certain funds underperform, it’s equally important to maintain a long-term perspective.

Shifts in market conditions and short-term underperformance do not necessarily indicate a need for drastic changes in investment strategies.

Investors should carefully consider the reasons behind a fund’s underperformance before taking action.

Factors such as changes in the management team, process, or fund size may have contributed to the weaker performance.

Ultimately, investors should view the Spot the Dog report as a starting point for further investigation rather than a definitive ‘sell’ list.

Capital at risk

Can you invest for your children with Bestinvest junior ISA?

Yes, with a Bestinvest Junior ISA you can invest upto £9,000 tax free in a JISA for your children for when they turn 18. One bonus here is that when they do turn 18 you can get them to talk to a financial advisor at Bestinves for some advice on what to invest it in, rather them spending it all on booze and vapes.

- Expert advice from professionals

- Low minimum deposit of £1

- Very low account fees from 0.2%

Bestinvest ISA

Bestinvest offer some of the best interest rates on uninvested cash in a stocks and shares ISA. Current Bestinvest interest rates are over 4%.

Bestinvest has combined low-cost online ISA investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. A good choice for large long-term investors.

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- ISA account charge: 0.2% to 0.4%

- ISA dealing fee: Shares £4.95, funds £0

ISA Fees: Bestinvest’s ISA costs 0.2% if you invest in a ready-made portfolio, which reduces to 0.1% above £500,000. For other investments like shares and bonds the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

Capital at risk

IPO access through partnership with PrimaryBid

Digital wealth manager Bestinvest allows customers of the firm to participate in IPOs and secondary offerings through PrimaryBid

In partnering with PrimaryBid, however, they have made the process of applying for new issues and secondary placings as straightforward as possible.

Jason Hollands, Managing Director of Bestinvest, said:

“We’re pleased to be able to offer this as a new feature as part of our ongoing programme of improvements to Bestinvest.

Since the heyday of the large privatisations in the eighties, private shareholders have gradually become squeezed out when it comes to getting access to IPOs and new share issues. These are now typically undertaken through placements and book builds among institutional investors.

“The great thing about teaming up with Primary Bid is that the service enables private investors to invest in new share issues on the same terms as institutional investors and not as second-class citizens.

How can you invest in IPOs?

To invest in IPOs Bestinvest clients simply need to link their existing Bestinvest account with PrimaryBid by creating an account there and adding their Bestinvest account number.

You can create an account at PrimaryBid by clicking on a dedicated link on the Bestinvest website.

You will need to provide PrimaryBid with details such as your name and address, date of birth, nationality and NI number.

Any new issue applications you make via PrimaryBid will be paid for from and settled into your Bestinvest account.

Do bear in mind, however, that you will need to have sufficient funds in your account to pay for new issues. And that all applications made via PrimaryBid are binding and it’s not possible to cancel an order once placed.

PrimaryBid & the LSE

PrimaryBid has helped manage over 270 share offers for UK-listed companies from members of the FTSE 100, the FTSE 350 and AIM indices.

Including issuers such as Ocado, Taylor Wimpey and Aston Martin Lagonda.

Most recently PrimaryBid has helped to raise money via follow-on or secondary issues for Big Yellow Group and Severn Trent.

Capital at risk

How much can you pay into a Bestinvest Junior SIPP each year?

Bestinvest’s Junior SIPP lets you start investing up to £3,600 a year for your children’s retirement. At 18 it turns into a regular SIPP which they can manage themselves (or with your help).

One of the key advantages of Bestinvest’s junior SIPP is that you can ask qualified investment experts for advice on what to invest in for your children’s retirement. As well as a wide range of funds and UK/US shares you can also invest a range of ready-made portfolios which gives you access to a wide range of investments in one go.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.