In this Tickmill review we give our ratings based on their nearest peers and tell you what we think of them after testing them thoroughly. Plus we highlight the key costs, facts and figures of their accounts.

- Overview

- Richard's Review

- CEO Interview

- Video Demo

- Facts & Figures

- Customer Reviews

Tickmill Review

Name: Tickmill

Description: Tickmill was founded in 2014 and offers CFD, forex and futures & options trading to 300,000+ traders via MT4 to, CQG and a range of other trading platforms on over 500 of the most popular traded markets.

Summary

Tickmill is more than just a run-of-the-mill broker to grind the market out tick by tick. It offers well-thought-out CQG setups and DMA access on various exchanges for smaller or high-frequency futures traders.

Pros

- Lots of trading platforms

- Direct markets access

- Low trading costs

Cons

- Subscriptions for DMA

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.1Ratings Explained

- Pricing: Tight pricing especially on CQG where you can trade DMA with micro futures.

- Market Access: Not huge, but fine for active traders on the main markets.

- Platform & Apps: All third-party – but a really good CQG set-up.

- Customer Service: Local dealers and account managers in London.

- Research & Analysis: A good team of in-house analysts providing daily market outlooks.

Richard’s Tickmill Review

There are a couple of great lines in the movie Rounders – which are quite relevant to trading – Matt Damon opens with, “It’s like any other job, you don’t gamble, you grind it out.” And that’s pretty much the markets as they are a full-time job if you are a high-frequency or regular trader. There is no dipping your toe in to see how you get on, you either commit to learning how they work, or you become another risk warning statistic.

It’s not just me that thinks that, a while ago, I interviewed Jamie Ross of Henderson’s EuroTrust about how he invests for his £320m fund and he said that one of his favourite books was Thinking in Bets, by Annie Duke, a professional poker player. And that one of his favourite expressions was “if you look around the table and you don’t know who the patsy is, you’re the patsy” Damon opens with this line too, “If you can’t spot the sucker in your first half hour at the table, then you are the sucker.” The same is true of trading, if you look at the order book and don’t know what’s going on, you’re in trouble.

However, whatever you may see on social media, the markets are not geared against small-time traders, there is no massive conspiracy against you. The markets move with the ebb and flow of demand and sentiment, it’s not a zero sum game, you can win without someone else losing. Sure there may be a bit of spoofing and some algos working in the background, but generally, the only thing that causes retail traders to lose money is, themselves.

To paraphrase the true grinder Joey Kinish from Rounders, “you don’t trade for the thrill of victory… you trade for money… you gotta have the stones to chase the markets, not pipe dreams”.

And I think that’s where Tickmill fits into the brokerage world. It’s there to provide access to the most popular and tradable markets, through a huge range of platforms. It’s up to you how you choose to trade them, you can grind it out, tick by tick with an algo or scalping on micro lots.

Before this review, I interviewed the Tickmill UK CEO Duncan Anderson, (it’s well worth a watch if you want to know what Tickmill as a company stands for) and spent an hour or so going through the platforms with Marco Aichner who has been with Tickmill for around 5 years (and in the markets for 20). So I was able to test some of the things that make Tickmill stand out, which if you don’t know much about them you wouldn’t know.

Markets Access

First off what can you trade? Tickmill provides access to the most popular markets through CFDs, forex, and on-exchange futures and options. It’s their futures trading offering that I think makes them stand out because not many retail brokers offer this and futures contracts are getting smaller in size, so they can be traded by a more diverse range of traders. Tickmill’s USP here is that can trade futures as big or small as you want on exchanges like CBOT, CME, COMEX, NYMEX, EUREX, ICE FUTURES EUROPE (Financials) or The Small Exchange. Access to The Small Exchange is particularly good because the contracts are tiny. You can see the contract specs when you are logged into CQG by hovering or right-clicking, but as an example, trading 1 lot of the mini S&Ps is about a $20k contract, but trading the micro minis is a tenth of the size around $2,000. This is particularly good for those getting started in high-frequency trading. You do get live and level two data from each exchange – but you must subscribe to each individually.

Trading Platforms

You can of course trade CFDs and Forex on MT4 with Tickmill, however, Tickmill probably has the widest range of trading platforms on offer of any broker we cover including:

- JIGSAW – Simplifies Your Trading

- CQG – Next-Generation Trading and Data Visualisation

- Multicharts – Advanced Market Analysis

- Sierra Chart Trading Platform – High-Performance Trading Platform

- TradingView – The Fastest Way To Follow Markets

- MotiveWave – Advanced Elliott Wave Software

- Bookmap – Identify market trends & hidden price patterns

- AgenaTrader – Multi-Asset, Multi-Broker, Multi Data feed trading platform

- Volumetrica – Developing of volume analysis trading platform

- Advanced Trading Analytical Software (ATAS) – Platform for volume and order flow analysis

You can decide what platform you want to trade on after you have funded your account, but for this review, we are going to focus on CQG – to quote Duncan and Marco “it’s an absolute beast”. Retail traders are fairly limited on who they can trade on CQG with and one of the good things about trading on CQG through Tickmill is that they do a lot of the heavy lifting before your account is set up.

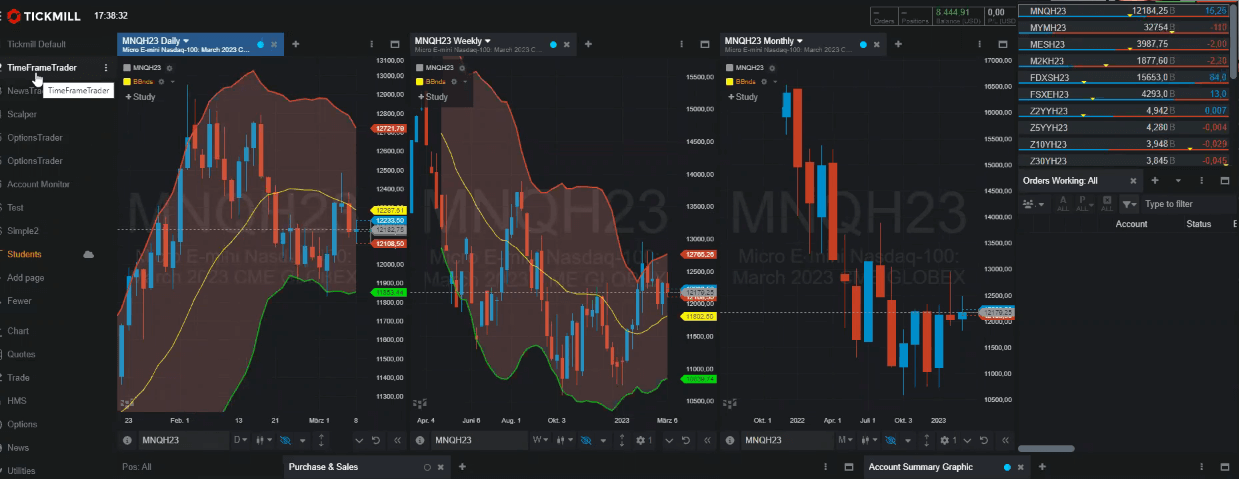

There are lots of pre-set templates based on different types of trading for traders who may focus on timeframe, news, scalpers or options (whereas the base CQG set up is very basic).

Volume comparison

There is a nice tool that shows volume comparison of the previous day, weeks and months, which is useful for sniffing out algorithms or if someone is spoofing the markets.

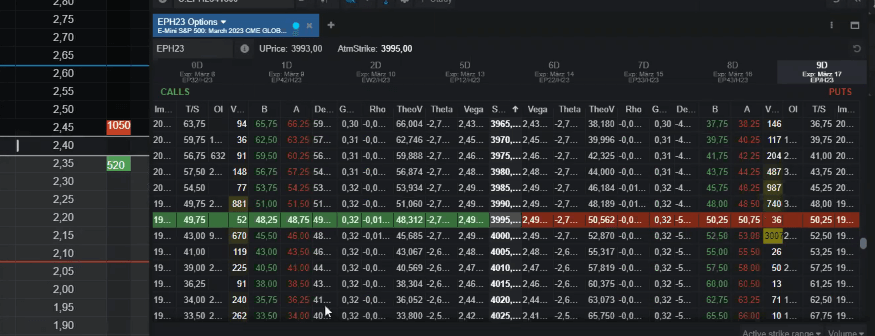

Options trading

Tickmill has a strategy builder that automatically builds options strategies. So say for example if you want to trade a condor spread, (where you aim to profit from either high or low volatility and sizable (or lack of) market moves) or any dozens of strategies, and don’t have the time to build it out individually, you just select your strategy and the legs are created for you.

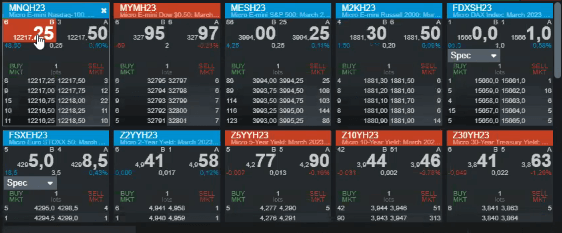

Scalping screens

As Tickmill offers DMA and charges a commission scalping is allowed. They have a scalping template that is good for legging between two different contracts. You can see the order books of multiple markets on side-by-side mini-trade tickets.

Hybrid order ticket

Their hybrid order tickt enables traders to open or close positions by dragging and dropping up and down the ladder as either a limit, market, or stop entry order. Or when working stops you can either set them as market or limit stops depending on how price sensitive you are. All the usual professional order execution types are there, like iceberg and fill or kill. Those orders go direct on the order book, and can be moved with your mouse. It’s quite nice to be able to move orders visually rather than tapping at numbers.

Grouped asset classes

Tickmill has also created their own “Spreadsheet trader” module which gives you a good overview of multiple related markets and shows you exactly what they are doing. They are lumped together by asset class or category (softs, metals, currencies etc.) and can also be ranked by contract size, if you like the micro minis.

Trading from the charts

CQG lets you can drag the line on the chart to either enter stops or limits if you prefer to trade on levels like support and resistance. It’ll also show your working orders and if you hover over them, it will show the order details.

Linked modules

All the windows are linked together – so if you switch one, all change. You can drag and drop windows anywhere you want, delete and add modules as appropriate – if you muck it up, you can go back and open the pre-designed layouts that Tickmill has set up.

Pricing

Tickmill are competitive on pricing and certainly in the top ten. Interactive Brokers is cheaper (but doesn’t offer CQG, only their own platforms), Saxo Markets (another retail futures broker) is more expensive.

Futures trading commissions are 85 cents on mirco lots and $1.30 on an e-mini contract. You do have to pay for platforms though, so it’s better for regular traders who can make full use of them and want DMA access to the most traded smaller futures contracts. It’s worth noting though that, unlike other brokers, Tickmill includes order routing and clearing fees in their commission.

You can also keep FX conversion costs down by choosing to have your accounts in several different base currencies: USD, EUR, GBP, PLN, CHF

Customer Service

Client support is very good, dealers can move orders for customers, if they for one reason or another are not able to trade themselves. If there is a problem and a client wants to get flat the client services team can handle it. When setting up my account, I had direct communication from a sales rep as opposed to an automated string of e-document requests.

Tickmill say that they are aiming to complete heavily on customer service because they want three things

- To make their product offering as simple as possible

- To provide inspirational trading ideas by creating templates and frameworks to help clients

- To be there when they are needed by providing personal customer service.

Research & Analysis

This is a big deal because Tickmill charges commissions on trades, and actually say on their email signature: “We want traders to succeed”.

![]()

So the better the research and analysis they can provide the better chance their customers have of making money and the more money their clients make, the more money Tickmill earns from them in commission, so everyone is happy, as they say.

When putting together their offering, and bear in mind that they say they are built “by traders for traders” they asked what would they have wanted 10-15 years ago when they first started trading and have put together quite a comprehensive set of research and analysis tools including:

- Market news – searchable on CQG

- Autochartist – trading signals and technical analysis

- Signal Centre – trading ideas (now owned by Acuity Trading)

- Webinars – free courses run by their expert analysts

- Trading masterclasses – fine-tune your strategies

- Education hub – get to know the basic

Overall, a good choice for retail traders who want to trade the most liquid futures markets on a robust trading platform with low costs.

Tickmill UK CEO Interview

Duncan Anderson, UK CEO tells us what Tickmill does and how they do it differently compared to other brokers.

Tickmill Video Demo

Tickmill Facts & Figures

Tickmill Total Markets | 578 |

| ➡️Forex Pairs | 62 |

| ➡️Commodities | 6 |

| ➡️Indices | 10 |

| ➡️UK Stocks | ❌ |

| ➡️US Stocks | 500 |

| ➡️ETFs | ❌ |

Tickmill Key Info | |

| 👉Number Active Clients | 327,000+ |

| 💰Minimum Deposit | 100 USD/EUR/GBP |

| ❔Inactivity Fee | ❌ |

| 📅Founded | 2014 |

| ℹ️ Public Company | ❌ |

Tickmill Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ✔️ |

| ➡️Options Trading | ✔️ |

| ➡️Investing Account | ❌ |

Tickmill Average Fees | |

| ➡️FTSE 100 | 0.9 |

| ➡️DAX 30 | 0.91 |

| ➡️DJIA | 2.52 |

| ➡️NASDAQ | 1.93 |

| ➡️S&P 500 | 0.39 |

| ➡️EURUSD | 0.1 |

| ➡️GBPUSD | 0.3 |

| ➡️USDJPY | 0.1 |

| ➡️Gold | 0.09 |

| ➡️Crude Oil | 0.04 |

| ➡️UK Stocks | ❌ |

| ➡️US Stocks | 0 |

Tickmill Customer Reviews

Tell us what you think:

71% of retail investor accounts lose money when trading CFDs and spread bets with this provider

FAQ:

Here are the answers to some of the most commonly asked questions people ask about Tickmill.

Yes, we rate Tickmill as a good broker as they are regulated by the FCA, offer direct market access to futures and options and have discounted commissions.

Yes, Tickmill is safe and legit, they have been in business since 2014, are regulated in multiple jurisdictions and have over 300,000 active customers. To find out more about them you can watch our Tickmill CEO interview.

Yes, beginners who understand the risks of futures and options can trade in small sizes with micro-mini futures contracts.

Yes, Tickmill is regulated by the:

- Financial Conduct Authority (FCA) – FCA Register Number: 717270

- Seychelles Financial Services Authority (FSA) – Licence number: SD008

- Cyprus Securities and Exchange Commission (CySEC) – Licence number: 278/15

- DFSA UAE – Reference No. F007663

- Labuan Financial Services Authority (Labuan FSA) – Licence number: MB/18/0028

- Financial Sector Conduct Authority (FSCA) – Licence number: FSP 49464

Read more about Tickmill’s regulation here.

Yes, Tickmill provides DMA access to futures exchanges through multiple trading platforms like CQG. You can see why using an ECN broker is important here.

No, Tickmill does not accept US clients even though they offer futures trading which is regulated in America. Tickmill also offers CFDs which are illegal in the USA. As Tickmill is not regulated by the CFTC, so if you are a US citizen and want to trade futures see our comparison table of best US futures brokers.

In the UK Tickmill is not a market maker they are a STP broker. When you are trading futures your trades are executed directly on exchange. They also state that “All clients’ trades are sent directly to be filled in by liquidity providers, with no interference from Tickmill. There’s no dealing desk involved and Tickmill does not trade against the clients.” This should also apply to CFD trading.

However, Tickmill’s exeuciton policy varies from region to region where regulations are different. For example, on their international website, Tickmill say that they operate a hybrid execution model and state that they are both a market maker and offer straight-through processing of orders.

This means that depending on what regulated entity you are trading through Tickmill could be running a b-book.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.