Macroeconomic data is one of the main drivers of the financial markets and changes in this data influences investment decisions that affect billions, if not trillions of dollars daily. Yet with so much macro data available to us what items should the retail trader be aware of and pay attention too?

In this guide we look at the best economic indicators for traders, we will look at six crucial figures and why they are the ones to watch when trading including:

- Non-Farm Payrolls

- Interest Rate Decisions

- GDP or Gross Domestic Product

- PMI or Purchasing Managers Index

- Inflation

- Trade Balance

To make trade decisions from economic events you can use an economic calendar to show key upcoming economic events, announcements and news. You can set up relevant economic calendar filters in a few clicks, selecting event importance and affected currencies.

Non-Farm Payrolls

This monthly release is also known as the unemployment situation report, and it takes a look at job creation or new payrolls added to the US economy over the prior month.

The title Non-Farm tells us that jobs created in the agricultural sector are excluded from the reports, on the basis that they are mainly temporary seasonal roles.

Alongside the headline NFP figures, the release contains data on the overall unemployment rate in the US, as well as details of average weekly earnings and average hours worked.

Despite being purely a US-centric data point, Non-Farm Payrolls are probably the most widely followed economic indicator on the planet. The numbers provide traders with a snapshot of the US economy and being monthly they do so ahead of quarterly reports such as GDP.

That said, for all this Non-Farms are a lagging indicator, in that they report on what has already happened in the economy. As opposed to forward-looking indicators such as PMI that can shine a light on what’s to come.

The NFP reports are normally released on the first Friday of each month at 1.30 pm London time, though there are occasional deviations around daylight saving times and US holidays.

More than anything, NFP releases affect sentiment in the markets.

As such, they can and do move the valuations of equity indices, both in the US and abroad. The data also often drives the dollar and its exchange rates with other major and indeed minor currencies.

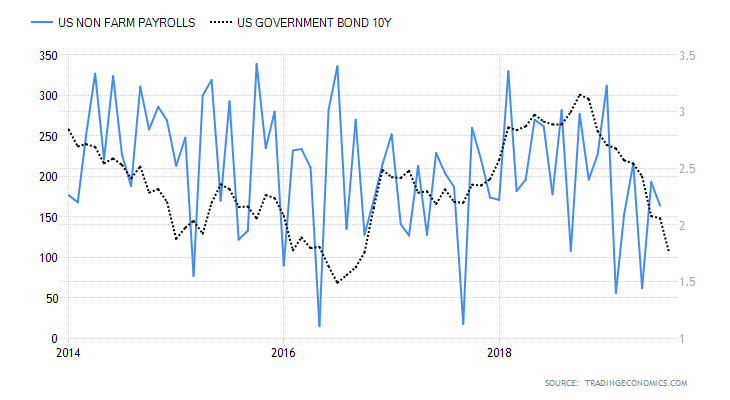

Perhaps the market that NFP data can move the most is the US 10 year treasury bond yield, which is a benchmark of US government borrowing costs.

The chart below plots the yield of the US ten year bond against the headline change in Non-Farm Payrolls since 2014, in essence when job creation picks up bond yields have risen perhaps reflecting a risk-on attitude among traders. By the same token as job creation rates slow, so bond yields have fallen reflecting a risk-averse or risk-off approach among traders and money managers.

Trading the Non-Farm Payrolls is notoriously tricky, and the moves immediately after the release are often said to be the wrong ones, prices can whipsaw sharply in the moments immediately after the data.

Perhaps that’s because the figures need to be viewed and considered in their entirety, including any revisions, positive or negative, to previously released data.

As such, many traders choose to have limited exposure over the numbers themselves and will wait for a trend to appear in the market before jumping in.

Most major banks, brokers and fund managers publish a forecast for upcoming NFP releases these are aggregated and averaged to form what is known as the consensus forecast, though there can be some widely differing opinions and figures behind that consensus figure.

- Related guide: 50 rules for successful trading

Deviations in the data releases that differ from the market’s expectations are what causes sharp price changes: There are two factors to consider here firstly the direction of the deviation, i.e. does the latest release reflect the pre-existing trend and secondly is the number larger or smaller than the market had anticipated.

For example, the September 2017 NFP release showed a decline of -33,000 new jobs versus a forecast of +90,000, that followed on from gains of +156,000 and +209,000 new jobs in August and July respectively. In this case, the data was in the opposite direction to the prior trend and massively offside of the forecast as a result.

Interest Rate Decisions

Non-Farm Payrolls may be at the top of the economic data tree, but they have a rival for the number one spot in the shape of interest rate decisions made by central banks.

Major central banks typical hold policy and interest rate meetings monthly throughout the year, though some months may be excluded, for example, the US Federal Reserve does meet during August.

Interest rates are of course the price of money, so changes in those rates and their future path can have a dramatic on the markets as well as the broader underlying economy.

Financial markets are forward-looking, and this is particularly true of Bond and FX markets.

The participants in which spend much of their time thinking about the future path of interest rates and the shape of what is known as the yield curve, which is simply a plot of implied future interest rates, overtime.

Markets dislike uncertainty, and this is particularly true where central banks are concerned. These institutions are amongst the most conservative in the world and markets can get very nervous, very quickly if they change course unexpectedly.

If a central bank or its senior staff lose credibility with the markets, it’s tough to win back that trust. To avoid that situation occurring, central banks try to keep the markets informed about what they are thinking through the release of policy statements, meeting minutes, and by holding press conferences.

Changes in interest rates and associated monetary policy can affect all financial markets.

Lower interest rates mean cheaper borrowing and can offer a potential boost to the economy. While higher interest rates, push borrowing costs up and may reduce growth as a result. However, the reasons behind any change in rates and the banks outlook after that and how this tallies with market expectations are just as important as the rate change itself.

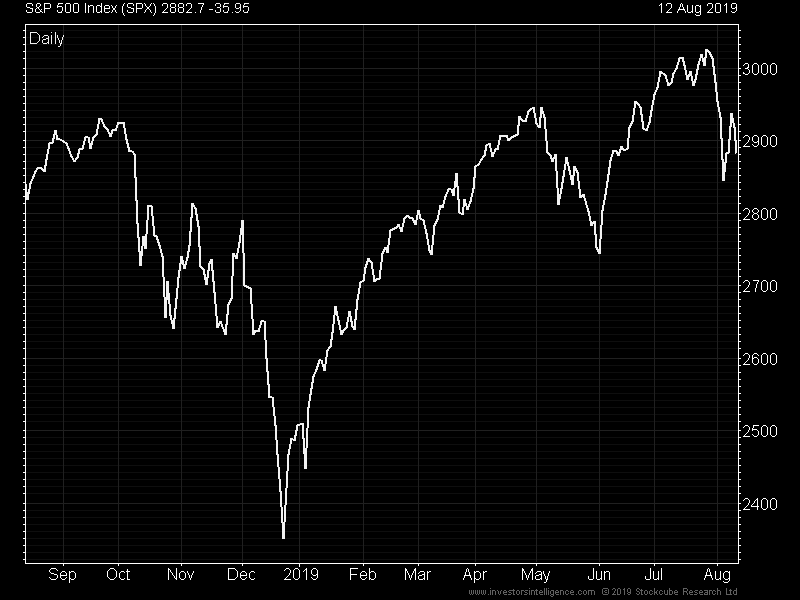

If we want to see an example of how a change in central bank policy can affect the markets we need look no further than the end of 2018 and the beginning of 2019 when it became clear that far from continuing to raise interest rates in 2019, the US Federal Reserve was on hold and likely to cut interest rates later in the year.

We can clearly the sharp sell-off in US equities in anticipation of rising interest rates that continued into late December 2018 and the sharp and sustained rally that greeted the Fed’s about-face.

The level of interest rates and policy changes by a central bank affects all domestic markets, but equity indices are often the most sensitive to them as they act as a barometer of the market sentiment towards those decisions.

GDP (Gross Domestic Product) Figures

GDP or Gross Domestic Product is a measure of the total economic activity in a nation-state or region. The data shows us how quickly or otherwise the local economy is growing and the figures reflect both a percentage change over a prior period, usually the preceding quarter, as well as the total monetary value of the activity with the economy. For reasons of convenience the markets focus on the percentage change figure.

Be aware, however, that these figures are not always expressed in the same format; for example, in the UK and Western Europe, the GDP figures reflect a quarter on quarter percentage change.

While in the USA, the figures are expressed on an annualised basis, i.e. what the growth in the economy would look like if the rate of growth were repeated over four quarters.

GDP is another widely followed data point and for the world’s major economies there is a regularly updated consensus forecast for the figures. Indeed there are now models (some of which are available to view online) that try to predict the level of GDP growth in the current quarter.

Once again, it is a deviation in the GDP data from the prior trend, and or, analysts forecasts that moves the financial markets. Traders look for a continuing trend in the data or a turning point within it. That’s not so surprising when you realise that two consecutive quarters of negative GDP growth in an economy constitutes a technical recession.

The most influential and important GDP data is that of the world’s largest economies, over recent years the growth rates of China have taken centre stage, as the country moved from a developing economy to rapidly advancing one. At the time of writing, China was on track for annual GDP growth of +6.20%, an enviable figure but well below China’s average long term growth rates of +9.49% per annum.

GDP data is a lagging indicator in that it looks back at what happened in a prior quarter rather than looking ahead. That said it can confirm or confound the expectations of the market about growth in an economy or region, and if that country or region is a major importer or exporter then changes in its GDP can also affect their trading partners around the globe.

FX rates are among the most sensitive instruments towards changes in GDP though commodity prices will also reflect any changes in sentiment, for example, if growth in a significant economy appears to be slowing then oil prices may fall in anticipation of weaker demand.

PMI (Purchasing Managers Index) Figures

The PMI or Purchasing Managers Index is a forward-looking indicator that takes the form of a monthly survey, in which, those people who are in charge of purchasing and investment decisions within a business are asked a series of questions about their intentions and expectations for the month ahead.

The surveys are sent to companies in both the manufacturing and service sectors within the economy. The data are reported individually at a sector level, but are also combined to produce what is known as the composite figure.

PMIs are what are called data-rich reports in that they shed light on areas such as output, new orders, inventories, employment and backlogs of work. They are also considered to be “soft” rather than ” hard” data as they are based on surveys and expectations, rather than cold hard facts and events. Nonetheless they are becoming an increasingly important data point.

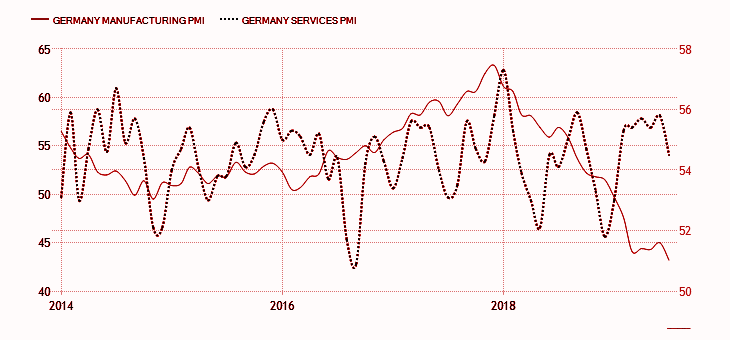

PMI data can be used to track the performance of a sector within an economy or to make comparisons between sectors or indeed between economies. In the chart below you can see the rapid slowdown in economic activity in the German manufacturing sector from early 2018 onwards.

Which was a precursor to a wider slowdown that included the more significant services sector.

PMI data is reported monthly and is expressed as a number between 0 and 100. Under this scaling, readings above 50 indicate expansion and readings below 50 indicate contraction.

For some countries, we receive a flash or early read on the data which is followed a week or two later by an updated or final read. Some economies have two rival sets of PMI data, the most notable of which are China and the USA.

As with GDP FX, equities and commodities are all sensitive to changes in PMI data. Traders look for continuing trends or changes within them, but they will also consider the marginal changes month on month, and any deviations between sectors.

Given that the reports are survey-based the PMI data tends to be more of a slow burn in terms of its effect on the markets, but the depth of information contained in the full reports allows traders to get a feel for what’s happening on the ground in the economy right now and how that could affect expectations for the future.

Inflation Figures

Inflation is a measurement of price growth within an economy, but it can also be seen as a proxy for the level of demand. Modest levels of inflation are seen to be a positive influence as they suggest that demand is outstripping supply and that prices are rising accordingly, as the supply side catches up the economy grows.

However, high levels of inflation are seen as being very harmful to an economy because continuously rising prices undermines the purchasing power of money.

And if those price rises are compounded annually for any length of time, then a currency can quickly become virtually worthless.

Central banks try to keep inflation at low but positive levels, and they use interest rates and other monetary policy tools to do so. Inflation data is reported monthly; however, there is not one single measure for price rises, for example, in the UK we have RPI and CPI that’s the retail and Consumer Price Indices. In Europe, the ECB uses a measure known as HICP or the Harmonised Index of Consumer Prices.

Inflation measures are also split into core and non-core readings; the core readings exclude items such as food and fuel.

Markets look at the implied annual rate of inflation as well as the monthly changes and they study these very carefully. That’s because if rates of inflation are higher than interest rates in a country then cash deposits and investments in bonds, in that country, will produce a negative real return- that is the income received will be less than the reduction in the spending power of the local currency.

Since the global financial crisis of 2007/8 inflation has been subdued in most developed nations, and we have even seen periods of deflation where prices and demand begin to contract. This lack of inflation is one of the reasons central banks such as the Fed and ECB have been having policy re-think during 2019.

Trade Balance Figures

More commonly referred to as the Balance of Trade, this data point tracks and records the volume and value of imports and exports into and out of a country every month. The net difference between the value of imports and exports is the country’s trade balance.

If a country exported more than it imported then the country is said to have a trade surplus, however, if it imported a greater value of goods and services than it exported then the country is said to have a trade deficit.

For certain states, for example, Germany, Sweden, the UK, Japan and China, the level of exports is a crucial factor because their respective economies are what are known as export-led.

China and Japan are also major importers of raw materials and the interplay between levels of exports and imports can tell traders a lot about what’s happening in their economies.

In recent times trade surpluses and deficits between individual economies and regions have become a matter of contention.

Donald Trump views the trade surpluses that China and other countries, such as Germany, enjoy with the USA as a sign of unfair trade terms. As such, they have played a role in the introduction of trade tariffs by the Americans. The terms of trade that the UK will enjoy with the EU under Brexit have also been a matter of much debate.

Trade surpluses are generally thought of as being positive for an economy. Prolonged trade deficits are considered to be negative.

Trade surpluses can help to build foreign currency reserves through the sale of goods overseas where goods are sold in a foreign currency and can strengthen the domestic currency if international buyers are paying in an exporter’s local currency.

Trade deficits can weaken a currency if importers are paying for goods in a currency other than their own.

FX rates and bond markets tend to move the most on balance of trade data, central banks can try to adjust the value of their currency if the country’s trade balance swings too far in one direction, for example, weakening the currency by selling it, in order to make the country’s goods and services cheaper to foreign buyers.

Featured Brokers For Trading Economic Indicators

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com