To invest in foreign stocks you need a stock broker that offers international investing like Hargreaves Lansdown or IG. This guide shows you how to invest in international markets and benefit from world-class global companies.

The old adage ‘ the world is your oyster’ is more relevant to investors than ever before. International investing is about channelling capital into foreign markets beyond the domestic economy. Interconnected financial markets means investors have more choices to allocate their portfolios optimally.

Why should invest internationally?

Many investors exhibit the ‘home bias’ effect. What this means is that they only invest in well-known domestic corporate names. However, this strategy only works if the local economy is large and growing rapidly.

Unfortunately, all economies experience upswings and recessions. By investing in overseas markets, investors can benefit from exceptional growth found in other industries.

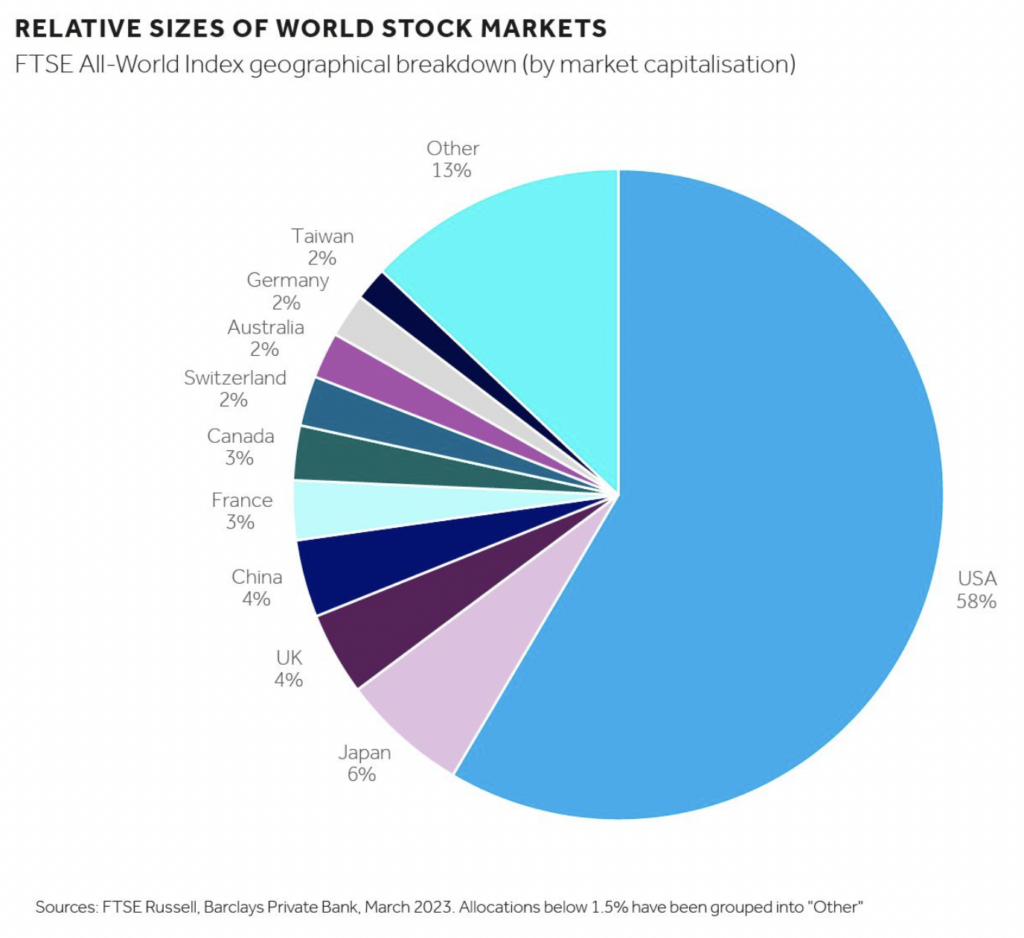

For UK-based investors, hard statistics tell you that UK is a small market relative to the rest of the world. The aggregate market capitalisation of all the companies in the London Stock Exchange comprises only 4% of the world’s. Sticking to only British stocks, you miss out the other 96%.

Source: Barclays (2023)

Legendary investor John Templeton, the founder of the Templeton funds, achieved lasting fame by investing globally. He was one of the first to discover that there are many excellent growth companies around the world at any one time. Templeton’s diligent research spotted these excellent growth stocks early and having invested in them over decades, he outperformed many of his peers. You can replicate his success in global investing too.

Three key benefits of international investing:

- Diversification – your portfolio gain exposure to other markets, thus increasing returns and reducing risk

- Growth – you gain from other fast-growing companies, especially in tech and emerging markets (e.g., China and India)

- Bargain opportunities – you can pick up good bargains when a financial crisis hit others markets (e.g., 1997 in Asia)

GMG Guide: How to Invest in Emerging Markets

From the perspective of Sterling-based investors, there are two additional reasons why you must buy foreign shares.

First, the largest and best growth companies reside outside the UK. Apple (AAPL), Tesla (TSLA), Google (GOOG) are some of largest corporations that have achieved $1-trillion plus valuation over the past decade – and they are not here in the LSE. In comparison, the largest market cap in the UK are AstraZeneca (AZN) or Shell (SHEL) with only around $215 billion a piece.

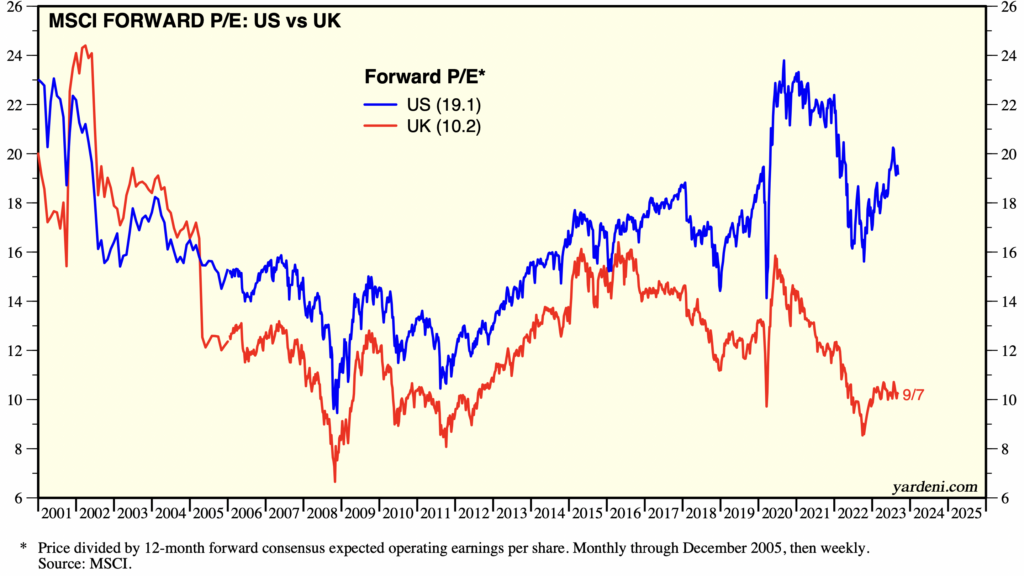

The second reason is that international investors, for whatever reasons, are not pricing in growth on UK shares. The past decade saw the forward price-earnings ratio of UK stocks trading below that of the US. In fact, this gap has been widening since 2020 (see below).

Yes, UK stocks are undervalued, perhaps even reaching bargain territory. Unless a bullish catalyst emerges, a re-rating for UK shares seems unlikely for the foreseeable future. You need to own some growth stocks elsewhere.

Source: Yardeni.com

Types of International Markets

There are two main types of international markets:

- Developed markets – these economies are mostly found in Western Europe, US/Canada and pockets of Asia. Key characteristics of these markets are: industrialised, high GDP per capita and possess excellent regulatory frameworks. UK-based investors can buy in most of these markets without much hassle.

- Emerging markets – is a large diverse group of economies striving to achieve developed status. There are about 150+ developing countries with about 40+ emerging stock markets that are suitable for investors. However, risks are somewhat higher than developed markets since they are still acquiring the economic know-how. Growth is higher.

GMG Guide: How to Invest in Emerging Markets

How To Invest In International Stocks & Markets

To invest in overseas shares you first need a stockbroker that offers global market access.

In the UK, there are now many investment platforms offering low-cost international share dealing. You can buy some foreign shares as easily as domestic UK ones.

GMG Guide: How to invest in stocks and buy shares online

There are several ways to buy foreign stocks, including:

- Direct purchases – you buy and hold foreign stocks directly in your stock accounts.

- Funds – Buy dedicated and actively managed investment funds that invest in foreign markets

- ETFs – Buy ETFs that tracks foreign stocks markets.

When positioning your portfolio with the inclusion of international shares, understanding the following factors will help to optimise the asset allocation process:

- Risk appetite – how much capital do you wish to invest in developed markets and emerging economies?

- Knowledge – of the destination markets will determine where you invest. This is particularly helpful if you one industry or market inside out.

- Time frame – are you intending to trade or hold for the long term? When you are actively buy and sell foreign stocks, charges will increase. The ISA route may no longer be the best choice.

After ironing out these issues, which markets will you invest? If you can’t decide, perhaps buying a global equity fund may be more apt.

For active traders, having a foreign broker account may be more suitable – as ISA stock and shares accounts mostly convert foreign currencies back to Pound Sterling after dealing in foreign markets.

International Investing Accounts

Once you have narrowed a list of potential international markets, the next step is to find out more how international dealing works for each broker.

Some starter pointer questions include:

- Can you buy and sell foreign shares within the ISA framework? ISA offers enormous tax advantages for UK investors because it is tax efficient.

- Which markets do they operate? The most popular ones are US, Asia, and Europe

- What is the transaction cost for each trade? Does it drop for frequent investing?

- What is the additional foreign exchange costs for each trade? Most brokers will incur a spread around the prevailing spot rate.

- Is there a minimum size to deal in that market?

- Can you trade the market online? Some markets are phone-only, meaning you need to call the broker to ask them to execute the trade on your behalf. This may be more expensive.

- Does the broke offer foreign currency account that let you buy and sell, say, USD stocks, without converting back to sterling each time?

- How do the stockbrokers keep track of your foreign ownership? These days are mostly electronic.

Costs Of International Investing

Most UK stock brokers will charge the same for investing in major foreign shares. The commissino charged on the trade is the major cost.

| Brokers | Transaction Cost |

|---|---|

| Interactive Investor | £7.99 |

| Hargreaves | £11.95 |

| IG | £10 (US) 0.1% (European) |

| AJ Bell | £9.95 |

In addition to the above transaction cost, there is the FX charge. Many start from 0.5%-1.0%, which tends to go down depending on the size of the trade.

There may be further costs involved, for example, local transaction tax, stock exchange fees, stamp duty, or takeover levy et cetera. Some these fees are only applicable above certain threshold or in certain markets. You will have to find out more from your stockbroker.

Risks Of International Investing

While there are many advantages in buying international shares for your portfolio, these securities are not risk-free.

In finance, remember, there is no free lunch.

Buying foreign shares is slightly more involved than buying local stocks because of additional trading frictions, such as foreign exchange movements, higher transaction costs and added complexity on taxation.

Some factors that you should look for when trading international shares include:

- Price risks – are you buying or selling at the wrong time? Is the stock expensive or cheap?

- Exchange rate risk – is the local currency trending up or down? A severe drop in the local currency may erase most of the capital gains

- Exchange rate charge – can the expected investment returns overcome this cost?

- Transaction costs – how much per round trip?

- Taxation of dividends – how large are the dividends and is that doubly taxed?

Most platforms can buy and sell foreign shares on your behalf for a reasonable fee. For example, Interactive Investor charges a fixed £7.99 fee to buy shares in some popular foreign markets such as Canada.

Major International Markets

There are a few major international markets that UK-based investors should consider:

- US – is the biggest stock market in the world, backed by the most dynamic economy and deepest capital markets (Wall Street). Major sectors include technology (Nasdaq), consumer, finance and healthcare. Fast-growing companies such as Meta (META) or Nvidia (NVDA) have provided good returns over the years.

- Europe – Europe is the closest international equity markets to the UK. The continent is highly-developed and filled with many advance economies. Unsurprisingly, it offers a host of world-class companies available to British investors. The top five stocks in the region are: Novo Nordisk (NVO), LVMH (MC), L’Oreal (OR), ASML (ASML) and Hermes (RMS) – all worth more than $200 billion each.

-

Japan – is the third largest economy in the world. While the Japanese economy has stuck in a low-growth environment for years due to the bursting of the asset bubble back in 1990, it is recovering. Even Warren Buffett has piled in, acquiring billions worth of trading houses in the country recently.

- Australia – is one of the most popular investment destinations in Asia. Its continent-sized land mass houses plenty of valuable commodities, including rare earths, uranium, iron ores, coal, copper and precious metals. Because the country is part of the Commonwealth, it is relatively easy for UK-based investors to invest there. Particular of interest are miners such as Rio Tinto (RIO) and BHP (BHP), both of which are LSE-listed too.

- Canada – is part of the British Commonwealth. Like Australia, Canada is well endowed with mineral resources, which makes the market a magnet for investors. UK investors have always been interested in the territory due to proximity, shared culture and language. Most major brokers offer the possibility of investing there.

International ETFs Listed In The UK

One of the most important developments of the fund industry over the past twenty years is the proliferation of exchange-traded funds (ETFs). The revolution started in the US and is now growing rapidly in Europe.

ETFs enable investors to acquire exposure far beyond their home markets easily. It provides diversification for average investors.

GMG Guide: How to Invest in ETFs

The key aim of ETFs is to replicate a popular index, such as the S&P 500 or FTSE 100 at a low cost.

These ETFs offer huge advantages for UK-based investors because:

- Availability – Available to buy in local markets at low cost (same as local stocks)

- Trading hours – you can buy and sell these ETFs during local market hours (8am – 4.30pm UK time)

- International exposure – as the fund tracks the foreign index

- Currency hedged – most ETFs automatically take foreign currency movements into account

- Foreign currency account – is not needed to hold these ETFs (lower conversion fees)

In the past, you can only buy say, S&P 500 ETF (SPY) in the US. Now, major popular ETFs have multiple listings in other exchanges (priced in the local currency). This enables local investors to buy these instruments.

For example, one of the most popular ETFs listed in the LSE is the Vanguard US ETF (VUSA).

The £32 billion fund tracks the S&P 500 Index and is priced in Sterling. Its LSE listing means most investors have buy them for ISA stock accounts. You can trade it like a local stock. In other words, Sterling investors can capture the extensive upside of the US market without the hassle of FX complications (see below). Isn’t this wonderful?

More impressively, look at its bullish chart in Sterling: New all-time highs in the making.

UK investors who wish to buy into the large Nasdaq-listed stocks can look to the LSE-listed Nasdaq 100 ETF (EQQQ) or Nasdaq 100 Sterling Hedged (EQGB). The latter hedges the currency impact.

If you want to buy a market with luxury stocks like Hermes or Kering, the LSE-listed ETF Lyxor CAC 40 (CACX) is a good one. It has Euro 3.4 billion AUM and holds all the stocks as defined by the CAC 40 Index. The weighting of LVMH in the fund is 12% (see factsheet here).

You can invest in Australia using the ETF route as well. One instrument is the LSE-listed iShares Australia (SAUS), which is USD-based but trades in sterling. The ETF rose to new high earlier in 2023. You can check its factsheet here.

Next, one LSE-listed fund that focussed solely on Canadian stocks is the iShares Canada (CCAU, factsheet). The fund tracks the MSCI Canada Index and trades in sterling.

US-Listed Regional and Single Country ETFs

Next we highlight two groups of ETFs that may help investors to diversify international investing.

The first group are regional equity ETFs covering a wide region:

- Vanguard FTSE Developed Markets (VEA)

- iShares Core MSCI EAFE (IEFA)

- Vanguard FTSE Emerging Markets (VWO)

- iShares Core MSCI Emerging Markets (IEMG)

- Vanguard Total International Stock (VXUS)

- iShares MSCI EAFE (EFA)

N, below is a list of single-country ETF traded over in the States.

- Canada – iShares MSCI Canada (EWC)

- Germany – iShares MSCI Germany (EWG)

- Italy – iShares MSCI Italy (EWI)

- Spain – iShares MSCI Spain (EWP)

- Switzerland – iShares MSCI Switzerland (EWL)

- Hong Kong – iShares MSCI Hong Kong (EWH)

- South Korea – iShares MSCI Korea (EWY)

- Japan – iShares Japan (EWJ)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.