Ethical investment accounts let you invest in companies, funds and portfolios focused on making the world a better place and which avoid companies operating in unethical sectors. We have ranked, compared and reviewed some of the best ethical investment platforms and accounts in the UK that are regulated by the FCA.

Interactive Brokers IMPACT app: Best app for ethical investing

- ✔️Excellent market coverage

- ✔️Advanced ethical investment app

- ✔️Low-cost share dealing of 0.05% or £1 minimum*

Interactive Brokers IMPACT app makes it easy to find and invest in companies that share your values, helping to better align your portfolio with the kind of world you want to create. The IMPACT app automatically scans your investment portfolio and ranks your position on an ethical basis. It will even suggest more ethical alternatives with a similar investment profile and let you switch with a single click. *Minimum dealing commisssions are £1 in the UK or 0.05% of the deal size.

Hargreaves Lansdown: Best overall account for ethical investing

- ✔️No account fee for shares

- ✔️Wide range of shares to buy

- ✔️Excellent ethical investment research

Capital at risk

Hargreaves Lansdown lets you invest in a wide range of large and small cap ethical companies as well as investment funds and investment trusts with an ethical bias. You can also build your own portfolio of ethical ETFs with the help of HLs in-house expert research. *There is no account charge for shares. Funds are charged at 0.45% for the first £250,000. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

Interactive Investor: Best fixed-fee ethical investing

- ✔️Low share dealing commission

- ✔️£1 minimum deposit

- ✔️ii ACE 40 ethical investment list

Capital at risk

Interactive Investor provides a specific tax-efficient stocks and shares ISA for ethical investing. As well as being able to pick your own ethical companies, funds and ETFs to invest in they have created an ethical growth portfolio, a long list of ethical companies to invest in their II ACE 40 is a list of sustainable investment funds. *Dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

AJ Bell: Best for low-cost ethical investing

- ✔️Account fee capped at £3.50 per month

- ✔️Lots of account types

- ✔️Good research on ethical investing

Capital at risk

AJ Bell is the cheapest ethical investment platform for shares, funds and ETFs in sustainable sectors. They provide a wide range of research and analysis on who to invest ethically, as well as constantly update their AJ Bell Favourite funds list with ethical investing choices. *Share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £9.95 for shares but drop to £4.95 where there were 10 or more online share deals in the previous month

Nutmeg: Best robo-advisor for ethical investing

Approved by Nutmeg on the 11 September 2023

- ✔️Managed ethical investment account

- ✔️Low account fee of 0.75% for their socially responsible portfolio

Capital at risk

J.P. Morgan owned Nutmeg’s socially responsible portfolios lean towards companies and bond issuers that have high environmental, social and governance (ESG) standards. Nutmeg invest in exchange traded funds (or ETFs) that avoid companies engaged in controversial activities, while focusing on those that lead their peers on ESG. This is a low-cost way of quickly building an ethical investment portfolio run by expert investment managers. *Nutmeg account fees drop to 0.35% for balances over £100k. There is an addition charged by the investment fund managers of around 0.2% and the market spread on buying and selling portfolios is on average 0.07%

Moneyfarm: Excellent choice of risk-based ethical portfolios

- ✔️Simple managed ethical account

- ✔️Set your own risk and reward

- ✔️Low account fee of 0.75%*

Capital at risk

Moneyfarm’s ethical investment plans and socially responsible portfolios are designed using funds invested in some of the most forward-thinking and impactful companies in the world – along with many others working hard to improve. *Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Wealthify: Invest ethically from just £1

- ✔️Managed ethical investment account

- ✔️£1 minimum deposit

- ✔️Low 0.6%* account fee

Capital at risk

Wealthify, part of the Aviva Group, lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments. *There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Bestinvest: Good for ethical investment advice and low costs

- ✔️Advice and recommendations

- ✔️Low £4.95 share dealing fee

- ✔️No inactivity fee

Capital at risk

Bestinvest has combined low-cost online investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. A good choice for large long-term investors. *0.2% account fee is for holding ready-made portfolios. above £500,000 it reduces to 0.1%. For other investments the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

❓ Methodology: We have chosen what we think are the best ethical investment accounts based on:

- over 17,000 votes in our annual awards

- our own experiences testing the ethical investment accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative ethical investment platforms dealing platforms.

- interviews with the ethical investment account CEOs and senior management

Compare Ethical Investment Platforms

You can use our comparison tables of what we think are the best accounts for ethical investing and compare if they are managed or DIY, plus if they offer the opportunity to invest ethically in tax-efficient accounts.

| Ethical Investment Platform | Ethical Edge | GMG Rating | More Info |

|---|---|---|---|

| IMPACT APP helps you switch to more ethical investments | Visit Platform Capital at Risk |

|

| Ethical Investments Available (shares & funds) | Visit Platform Capital at Risk |

|

| Ethical Investments Available (shares & funds) | Visit Platform Capital at Risk |

|

| Ethical Investments Available (shares & funds) | Visit Platform Capital at Risk |

|

| Socially Responsible Investing Portfolios | Visit Platform Capital at Risk |

|

| Ethical Investments Available (shares & funds) | Visit Platform Capital at Risk |

|

| Ethical Investments Available (shares & funds) | Visit Platform Capital at Risk |

|

| Socially Responsible Investing Portfolios | Visit Platform Capital at Risk |

|

| Ethical Investment Plans | Visit Platform Capital at Risk |

|

| Ethical and ESG Investing | Visit Platform Capital at Risk |

⚠️ FCA Regulation

All ethical investment platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK ESG trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature ethical investment accounts that are regulated by the FCA, where your funds are protected by the FSCS.

Ethical Investment Funds

Ethical and ESG investing is also about focussing on firms that are more socially responsible and better governed. Collectively, these companies tend to score higher in the environment, social, and governance factors (ESG), described below:

- Environment – Is the firm a steward of the environment?

- Social – Is the firm making a positive impact on its employees, suppliers, customers, and its wider social circle?

- Governance – Is the firm showing leadership in internal control, audit, diversity and shareholder rights?

The argument for ethical investment is clear: To make the world a better place by channeling funds into high-ESG firms.

Choosing ethical investments

The first step is to define which sectors to avoid. This is known as negative screening. Generally, there is a common list of sectors to keep clear (see above). But remember that within ethical investing there are sub-sectors, such as Green-Focussed, Health-Focussed, Community-Focussed, Gender-Equality etc.

Ethical investing not investing in companies that engage in unethical operations. Examples of these activities include:

- Tobacco

- Defence-related

- Alcohol

- Gambling/Casino

- Adult entertainment

Ethical investing is different from impact investing in that it is about avoiding investing in bad things, where are impact investing is about investing in companies that actively do “good”, like climate tech.

Once the universe is defined, the next step is to apply a ESG scoring mechanism to the firms and rank them.

The last step is to find the best-in-class firms using traditional financial metrics, and build a narrowed list that we can invest in.

The above process, you may observe, is generic. The devil is in the details. How does one apply a EGC scoring mechanism to a firm? What specific financial metrics should we look for? What is the portfolio weightings should we apply?

Ethical companies to invest in

According to Peter Michaelis of the Liontrust UK Ethical 2 Net Acc fund the best ethical companies to invest in through his fund are:

- Kingspan Group

- Prudential

- Smurfit Kappa

Although it is worth noting that the top ten holdings in the ethical fund are:

- LEGAL & GENERAL GROUP – 5.09%

- PARAGON BANKING GROUP – 4.35%

- SMURFIT KAPPA GROUP – 4.27%

- PRUDENTIAL – 4.13%

- COUNTRYSIDE PROPERTIES – 3.87%

- SOFTCAT – 3.75

- LONDON STOCK EXCHANGE GROUP – 3.41%

- HARGREAVES LANSDOWN – 3.30%

- HALMA – 3.24%

- OXFORD INSTRUMENTS – 3.17%

So ethical investing funds still have a long way to go before you can call them completely ethical. For instance, the London Stock Exchange earns income from mining and oil companies.

Ethical funds to invest in

Here is a list of ethical funds that you can invest in through a share dealing platform like Hargreaves Lansdown or Interactive Investor.

- Mirabaud Equities Global Focus

- Legg Mason ClearBridge US Equity Sustainability Leaders

- Liontrust Sustainable Future Global Growth

- BMO Sustainable Opportunities Global Equity

- Janus Henderson Global Sustainable Equity

- Liontrust Sustainable Future Absolute Growth

- Royal London Sustainable World Trust

- BMO Responsible Global Equity

- Sarasin Responsible Global Equity

- Kames Global Sustainable Equity

- AB SICAV | Sustainable Global Thematic Portfolio

- Davy ESG Equity

- Liontrust UK Ethical

- Royal London Sustainable Leaders Trust

- Liontrust Sustainable Future Managed

- Vontobel mtx Sustainable Emerging Markets Leaders

- Liontrust Sustainable Future UK Growth

- ASIUK Responsible Equity

- BMO Responsible UK Equity

- Janus Henderson Inst Global Responsible Managed

- Royal London Sustainable Diversified Trust

- Liontrust Sustainable Future Cautious Managed

- ASIUK Ethical Equity

- Thesis Climate Assets

- Newton SRI for Charities

- Liontrust Sustainable Future Defensive Managed

- Janus Henderson UK Responsible Income

- BMO Responsible UK Income

- Unicorn UK Ethical Income

- Royal London Sustainable Managed Growth Trust

- Rathbone Ethical Bond

- 7IM Sustainable Balance

- Royal London Ethical Bond

- Liontrust Sustainable Future Corporate Bond

- Royal London Sustainable Managed Income Trust

- Royal London Short Term Money Market

Ethical ETFs (exchange-traded funds)

ESG-based investment has been around for a decade or so. There are many financial services companies that cater for this niche sector, such as Morgan Stanley Capital International (MSCI). They have build screening frameworks to invest in high-ESG firms. I show one example below.

Example – UBS MSCI World Socially Responsible (LSE: UC44)

In the UK, you can invest in Exchange-Traded Funds (ETFs) to gain exposure to foreign and domestic markets, here is how to invest in ETFs.

Here I pick one ETF that is engaging in socially responsible investing. It is sponsored by UBS and is based on the MSCI Socially Responsible Index (SRI, with factsheet here). LSE-listed with the ticker UC44, the fund has AUM of about £730 million. It has been around since 2013. (Note, there is a sister fund with ticker UB39.)

According to the MSCI SRI fact sheet, the SR index excludes firms “involved in Nuclear Power, Tobacco, Alcohol, Gambling, Military Weapons, Civilian Firearms, GMOs and Adult Entertainment” and that “current constituents of the MSCI SRI Indexes must have an MSCI ESG Rating above B and the MSCI ESG Controversies score above zero to be eligible.” Finally, the construction the SRI is “float-adjusted market capitalization weighted.“

Here are some of the most popular ETFs for ethical investors and what they invest in:

| What do they invest in? | ETF Name & Ticker |

| Ageing | IShares Ageing Population UCITS ETF (AGES) |

| Smart City | IShares Smart City Infra. UCITS ETF (CT2B) |

| IT, Digital | IShares Digital. UCITS ETF (DGIT) |

| Health, Bio | IShares Healthcare Innovation UCITS ETF (DRDR) |

| Digital | Lyxor MSCI Digital Economy ESG Filtered UCITS ETF (EBUY) |

| World | IShares MSCI World ESG Enhanced UCITS ETF (EGMW) |

| Mobility | Lyxor MSCI Future Mobility ESG Filtered UCITS ETF (ELCR) |

| Gender, Equality | Lyxor Global Gender Equality (DR) Ucits ETF (GEND) |

| Climate, Paris Aligned | HSBC MSCI World Climate Paris Aligned UCITS ETF (HPAO) |

| Climate, Clean Energy | IShares Global Clean Energy UCITS ETF (INRG) |

| Climate, Impact | RIZE ENV. IMPACT 100 UCITS ETF (LVNG) |

| World, Low Volatility | IShares Edge MSCI World Min. Volatility ESG UCITS ETF (MVEW) |

| Auto, Robotics | IShares AUTO & ROBOTICS UCITS ETF (RBTX) |

| Digital, Security | IShares Digital Security UCITS ETF (SHLG) |

| Water | Lyxor World Water UCITS ETF (WATL) |

| SRI, World, Paris Aligned | Amundi Index MSCI World SRI UCITS ETF (WSRI) |

Is ethical and ESG investing sustainable?

ESG has also become synonymous with sustainable investing which means that an investment should not be continuously depleting the planet of its natural resources. A sustainable process is one that can continue without the need for (too many) additional inputs and which has a minimal negative effect on the environment and in the best case an outright positive effect on it.

A Wind Farm could be a good example of a sustainable enterprise. Though sustainability could also address issues such as low-cost housing, skills and education etc.

The corporate world could once have been accused of paying lip service to some of these aims and goals. However, those days seem to be behind us, with research from FactSet suggesting that there was a +137% increase in mentions of ESG issues, in the earnings calls of S&P 500 constituents, in Q4 2019, compared to the prior quarter.

It seems the worst offenders are the most concerned with energy and utility companies being the most vocal about these issues in their earnings calls, particularly around the area of carbon footprint, according to FactSet research.

To emphasise this point, Larry Fink, the boss of the world’s largest fund manager Blackrock, said in a letter to CEOs in January 2020, that his firm would put ESG issues at the heart of its investment process and that the actively managed funds, run by Blackrock, would no longer hold shares in companies who derive more than +25% of their revenue from thermal coal.

Mr. Fink was quoted as saying that

“Climate risk is the top issue clients raise with BlackRock and I believe we are on the edge of a fundamental reshaping of finance.”

Given that Blackrock manages around US$1.80 trillion of assets and are advisors to the likes of the US Federal Reserve these are weighty words indeed.

What are ethical and ESG qualified investments?

So what specifically can ESG investors put their money into?

Investing with ESG in mind is becoming easier, simply because companies are paying more attention to their environmental social and governance footprints and reputations.

However, it is far from a level playing field and many ESG rating systems are being applied across the investment universe. For example, MSCI ranks companies on the risks and opportunities they present in regard to “environmental issues, social and impact investing, and good governance practices.”

Whilst rating agency S&P scores companies on an average of 23 separate ESG criteria and so on. There are dedicated ESG mutual funds and ETFs, or funds which invest in sectors that score highly on ESG and sustainability rankings.

For example, the First Trust Global Wind Energy ETF is a US-listed ETF (ticker FAN) that has the highest ESG rating from MSCI of AAA.

Whereas the Global X MSCI China Energy ETF (ticker CHIE) which invests in energy generation infrastructure in China and Hong Kong has an MSCI ESG rating of CCC, the lowest score available. That’s not so surprising when you consider that the majority of its holdings are related to fossil fuels.

What’s not in the ESG investing universe?

So just as there are business and industries which are very much part of the ESG universe there are sectors and industries which are not.

These include alcohol and tobacco, gambling, the manufacture or supply of weapons, unsustainable or environmentally unfriendly businesses or projects. So a basket of non-ESG friendly stocks could include household names such as BAT, BP, GVG (owners of Ladbrokes ), British Aerospace, Diageo, Billiton and so on.

Now before we go any further, I think we should point out that beauty, as far as ESG is concerned, can be in the eye of the beholder. We say that because pictures of used wind turbine blades being consigned to landfill and the nuclear industry pinning the ”source of low carbon power” name tag to their chests, can muddy the waters somewhat.

Does ethical and ESG provide better investment returns?

Having looked at what does and does not constitute ESG investing let’s turn our attention to the returns that ESG can offer. Can the style match the returns from investments that don’t specifically consider ESG factors?

Once again, we have to use a certain amount of judgement and good sense to answer that question.

However, if we look at the performance of AA and AAA ESG rated ETFs, we find that the Technology Select Sector SPDR Fund (ticker XLK) returned +28.0% over the last year.

This fund is AA rated for ESG and invests in a broad spectrum of US technology stocks. Some tech stocks are of course energy-hungry and could have a large carbon footprint as a result.

Do ESG investments outperform?

However, if we are stricter in our selection criteria and only look at AAA ESG rated ETFs, we find that over the last year the iShares MSCI USA ESG Select ETF (ticker SUSA) has returned +5.32%. While the First Trust Global Wind Energy (tickerFAN) which we mentioned earlier is up by +2.01% over this period.

We have just highlighted a couple of examples here but on balance it does appear that there is a trade-off between performance and ESG credentials. Of course, it will be for the end investor to decide how ethical and sustainable they want their investments to be.

For most people, it will probably be easier to incorporate ESG criteria into their existing investment process by screening for opportunities that meet your thresholds, in the same way, that you may screen PE ratios or multi-year returns.

If you want ESG and sustainability to be foremost in your investment allocations and decisions then, you can screen for only those funds and businesses that have attained the highest scores on the relevant rating systems. The stricter you are then the narrower your investment universe may be, however.

For example, If we screen for a universe of AA and AAA ESG rated ETFS (Under the MSCI rating systems we find well over 100 names. However, if we restrict our search to just AAA-rated we shrink that universe to just 7 constituents and that could present an issue in terms of diversification.

We also need to consider that though these names score highly for ESG, they may not align to our wider investment goals or strategy. For example, if you are looking for capital growth then the First Trust Stoxx European Select Dividend Index Fund (ticker FDD) which is, AAA-rated by MSCI for ESG, may not be for you.

ESG Performance Charts

The table below compares seven ETFs over a series of quality, performance and ESG metrics the ETFs include funds that track short term money market instruments,a bond market proxy US & Non-US equities wind energy and the value factor or style all have a minimum ESG rating of single “A” under the MSCI system.

| Ticker | Name | ESG Rating | 1 Year | 3 Years | 5 Years | AUM | Carbon Intensity |

|---|---|---|---|---|---|---|---|

| BIL | SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | A | 1.59% | 1.57% | 0.98% | $19.11B | — |

| BND | Vanguard Total Bond Market ETF | A | 10.36% | 5.00% | 3.99% | $52.51B | 308.87 |

| EFA | iShares MSCI EAFE ETF | A | -9.74% | -2.17% | -0.73% | $44.16B | 145.56 |

| FAN | First Trust Global Wind Energy ETF | AAA | 2.01% | 0.98% | 4.14% | $90.40M | 817.96 |

| SPY | SPDR S&P 500 ETF Trust | A | 4.26% | 9.13% | 8.67% | $259.48B | 171.46 |

| VTV | Vanguard Value ETF | A | -8.49% | 3.30% | 4.89% | $46.48B | 301.86 |

| XLK | Technology Select Sector SPDR Fund | AA | 28.51% | 21.79% | 18.96% | $28.93B | 20.94 |

Data from ETF.com

As you would expect, risk and reward are proportionate here,the cash and near cash in the T-Bill ETF (BIL) producing low returns whilst offering security of funds.

The S&P 500 ETF (SPY) produced mid range returns, with the benefits of diversification but only scored a single A rating for ESG. The value factor ETF (VTV) , also single A rated, has performed relatively poorly over the last 12 months.

The Technology Select fund (XLK) offers an AA rating for ESG and a low carbon intensity score. It has also posted impressive returns over the periods under observation. However it is sector focused and therefore could be considered to be “risk concentrated” from a portfolio construction point of view.

Is ESG investing riskier than other forms of investing?

Not necessarily, we have outlined some of the shortcomings of ESG investing but they are the same issues and challenges you would come across if you were trying to construct a portfolio based around any single factor or theme.

Investors should be pragmatic, not dogmatic in our opinion. After all this is an evolving investment trend and we could, for example, explicitly exclude non ESG industries such as those mentioned above and invest in and reward those who are improving their own ratings.

As we noted earlier there are many ESG scoring and ranking systems in operation currently. And as the FT recently pointed out, unlike credit ratings these ESG scores are not subject to regulatory scrutiny. There have been calls for standardisation and regulation of these systems to prevent significant discrepancies occurring.

For example, Korean electronics giant Samsung scores positively for ESG under the system employed by Dutch asset manager Robeco, but scores very poorly under the system used by independent research house KLD leaving us to ask who is right?

Is the popularity of ESG Investing Growing?

Given that some of the world’s largest investment managers are now paying close attention to these issues you would expect ESG to become an increasingly important consideration for businesses and projects.

Interest in and pressure for ESG issues in investing is not just coming from the top down either. There’s growing momentum from the bottom up as well.

Investment Week magazine recently highlighted a 37-fold increase in the amount of money flowing into ESG investments in the UK. With some £3.90 billion flowing into ESG funds over the 33 months since July 2017, compared to just £107million in the 33 months previous to that. There are now 373 funds marketing themselves in the UK under an ESG label.

Across Europe, more than €120 billion was allocated to ESG and sustainable investments in 2019, according to Morningstar data. As of late February 2020, there were more than €668 billion of assets under management in the sustainable sector, that figure is up by some +58.0 % alone since 2018.

The history of ESG investing

ESG or Environmental, Social and Governance investing can trace its roots back to the 18th century and the Methodist and Quaker movements who laid out strict guidelines about how businesses should be run, and which types of companies’ investment could made into.

ESG become more formalised and in the latter part of the twentieth century an ethical stance on investments was instrumental in ending the apartheid regime in South Africa. Whilst environmental disasters such as Exxon Valdez and Chernobyl raised awareness about our stewardship of nature.

The biggest driver for ESG, however, has been climate change which has made us all think about our carbon footprint and the wider environment and what we can do to reduce that impact.

Is ESG investing a bubble?

I think the answer to that question must be no. The concerns that ESG investing tries to address are now part of the mainstream. They may not be foremost in every investor or fund managers minds but the influence of ESG is only likely to grow. Particularly when it has the backing of many large investors

It is just 16 years since the then UN Secretary General Kofi Annan wrote to the CEO’s of 50 leading financial institutions inviting them to participate in an initiative to bring ESG into the investment mainstream.

That initiative would lead to the publication and launch (in 2006) of the Principles for Responsible Investing. A set of guidelines that more than 2250 organisations and companies have signed now up to.

Those signatories control assets with a value of more than US$80.0 trillion a significant sum and an indicator of how far ESG investing has come in short space of time.

How can the retail traders & investors get started ESG investing?

With ESG moving more into the mainstream there has probably never been a better time for retail investors and traders to get involved with these investing themes.

For example, the EU has announced on 25th May 2020 that it will continue to pursue its “Green Deal” aimed at promoting sustainable finance and investment. With the goal of attracting funds towards sustainable and environmentally friendly projects to help Europe meet its target of being carbon neutral by 2050.

The EU will likely use a mixture of the carrot and stick to encourage investors and business owners to follow its goals so there could well be incentives for ESG investing in the future.

The first thing for an investor to decide when considering ESG investing is how much of a priority this is for them.

Do you want to only invest in an ESG and sustainable way?

Or would you prefer to treat ESG as one of several factors considered in your portfolio construction?

If it’s the former, then you will probably want to start by looking at the ESG credentials of any existing investment you may have. That in itself will be an educational and informative process.

In the first part of this guide we highlighted some of the sectors and businesses which do not meet ESG investment criteria with that in mind there may be some moral judgements to be made about your existing portfolio.

It may be more appropriate to transition your portfolio and investments towards a better ESG footing over time, rather than selling everything and starting again This phased approach is one that both governments and many businesses have adopted around issues such as carbon emissions, boardroom representation etc.

Strategies to incorporate ESG into your portfolio

One strategy might be to allocate a proportion of your portfolio to ESG investing and to increase the weighting of that allocation over time as new opportunities present themselves or you sell down your non ESG holdings.

You can invest using ESG principles through individual equities or collectives such as mutual funds and ETFs. These days most company websites will contain information about the business’s commitments to good governance, environmental issues and sustainability. And if you can’t find that information easily then that in itself may be a red flag from an ESG standpoint.

If you choose to invest in specialist funds, you’ll find many providers offer ESG products including Vanguard, Fidelity, Legal and General, Schroders and many more. There are actively managed and passive funds and strategies. Strategies which invest domestically and those which invest overseas or globally. As noted in part one of the guide some funds specifically target ESG investment opportunities whilst others use ESG factors as part of their selection process.

The end investor will need to decide what exactly it is they are looking for from a collective scheme and then find the fund or funds that are the best match for their objectives. That will mean research and reading on your part to determine which managers views and strategies tally with your own. For example if you are keen on environmental issues above all else or if you are keen to see workers in the developing world treated fairly, or indeed see more diversity in the business culture and boardrooms at home.

ESG Investing standards and principles

There are no hard and fast guidelines as to what constitutes ESG investing and best principles therein though there are obvious “smell and taste” tests that we can apply. The closest we can come to a definitive set of rules are initiatives such as the UNs PRI or Principles for Responsible Investing- the six key tenants of which are set out below.

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

These are broad guidelines rather than prescriptive rules, the PRI drills down into and makes suggestions about how to implement these measures in day-to-day business. The PRI summarises its approach in the following mission statement;

“The PRI defines responsible investment as a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership”

Signatories to the initiative are expected to consider and apply the six core principles in all of their activities.

Though these guidelines and others are not enforceable, fund managers and businesses can be held to account or measured against them, and a number of organisations have sprung up to track and record the performance of businesses around ESG issues.

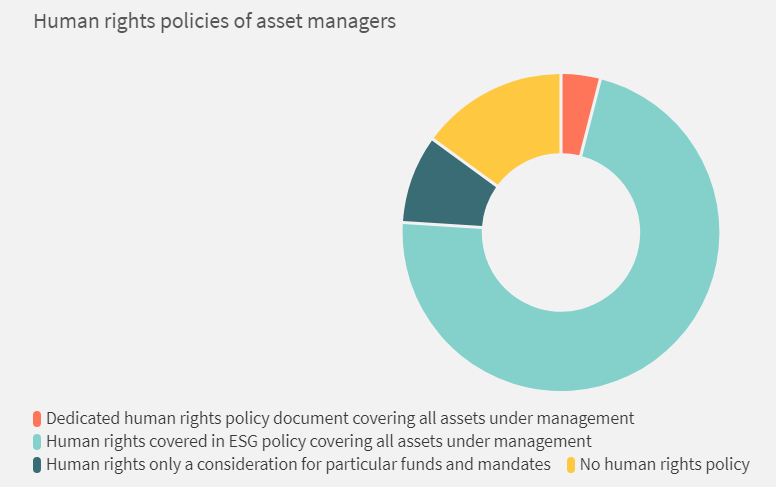

The PRI produces its own annual reports but organisations such as ShareAction go further and rank the performance of businesses based on the adherence to ESG principles. For example in this graphic examining the human rights policies and principles of asset managers.

The majority of asset managers have a policy that covers all of the assets under management, though some still do not. ShareAction however would like to see a dedicated human rights policy rather than one which is part of a wider ESG policy.

Source ShareAction

ShareAction has also recently ranked 75 asset managers from best to worst on ESG principles and found Robeco, BNP, Legal and General to be among the best and MetLife Fidelity and Credit Suisse among the worst performers.

As we have already noted, however, there are multiple ranking & scoring systems for ESG compliance and different systems can produce different results. For example in a report from What Investment magazine, funds managed by Mirabaud, Kames, Janus Henderson and Legg Mason were all highly-ranked for ESG. Interestingly, Swiss and US managers did not fare well overall in the ShareAction report.

Where can you invest?

Another sign that ESG investing is on the up is the fact that retail traders and investors can not only invest domestically but can also invest abroad, for example, the Mirabaud Equities Global Focus fund which topped the What Investment ESG rankings is described as;

“ a multi-thematic global portfolio which seeks to find innovative opportunities and take advantage of long-term trends and sustainable growth”

Fund manager and head of global equities at the Swiss bank Anu Narula said of his investment approach that

“Our ESG strategy and process involves both a top-down as well as a bottom-up approach. We have a best-in-class and best-in-universe screening which is accompanied with our ongoing meetings with company management.”

That approach seems to work as between December 2016 and December 2019 the fund returned a cumulative 59.16%.

Another fund that has been doing well is the Baillie Gifford Positive Change fund, the best performing global fund for the last three years. According to the UK trade body the Investment Association or IA. As of April 2020, the fund had returned +110% since its launch in 2017

The fund management team puts that performance down to a simple philosophy that of investing in high-quality growth companies that can deliver positive change

“Ultimately the team believes that it will be the companies that are addressing a major societal challenge who will outperform,”

Judging by the returns that these two funds have produced it seems there is a case for seeking out actively managed investments in the ESG space.

We looked at a selection of ESG related ETFs in part I of this guide noting a potential trade-off between performance and ESG credentials. ETFs are of course passive investment vehicles which track a market rather than trying to outperform it.

As a growing trend for investors, more retail banks will likely follow the likes of HSBC bank who began offering sustainable investing products in June 2020 and AJ Bell who followed suit in November 2020 alongside Close Brothers Asset Management who also began offering sustainable investing funds.

The benefits of ESG investing

The case for using either ETFs or actively managed funds is to achieve diversification that is not having all your eggs in one or two baskets.

Though top performing funds and ETFs in the ESG space may often have a weighting towards particular sectors and that may need to be borne in mind too.

The case for ESG investing is an increasingly persuasive one if we can make money for ourselves and benefit the environment and others at the same time then it becomes much harder to argue against it as a concept.

As we have seen it is possible for funds to show above-average performance whilst scoring highly for ESG and on that basis it almost becomes a moral imperative, if nothing else it’s one that is surely only going to gain momentum over time.

What is impact investing?

Another form of Socially Responsible Investing that is all about creating momentum is Impact Investing.

This is investing to create a defined and measurable change or difference in say social or environmental issues as well as financial return. Impact investments can address a wide range of issues such as social housing, provision of medication, community development and education among others.

Impact investing tends to be more project-focused, with the funding provided to attain a specific outcome or result. For example, helping farmers in Africa to buy their own land or providing microfinance to help individuals launch a business in developing economies.

Impact investing has previously been associated with charities and relief efforts, however, this now also moving more into the mainstream.

What is the future of ESG Investing?

In summary, ESG investing is here to stay and is likely to become a part of many people’s portfolios whether through choice or simply through default as companies, businesses and organisations become ever more attuned to the ideas contained within it.

If fund managers and investment strategies that utilise ESG continue to demonstrate superior returns, then simple market economics suggests that more money will flow into the sector and style.

Yes, definitions ratings and terminology need to be tightened up and standardised. And in some cases, there may be an argument for a regulated approach.

However, best practice under the various voluntary codes and initiatives can provide investors with a framework through which to make comparisons and to determine who is and who isn’t playing ball. Researching the ESG credentials of your existing investments is likely to prove just as informative and educational as seeking out new ones and the exercise may actually reinvigorate your interest in the markets.

Ethical Investing FAQs

Yes. Ethical investing is a growing financial phenomenon that could last for years. Public companies, with increased public scrutiny, can no longer shy away from their public responsibilities. Those firms that showed leadership in this area may benefit from higher investment ratings.

However, from the investor standpoint, it is better to buy into a ‘ethical’ fund that can diversify into multiple holdings and regions. Maintaining a ESG framework is difficult and so it should be outsourced to professional financial firms. Even some newcomers, such as Nutmeg, are latching on to ethical investing. You should do so too.

Similar to ESG investing, ethical investments are growing in popularity because of the rise in social awareness and transparency. For example, many investors are asking: “Do I want to be associated with firms that thrive from gambling/addictions?” Probably not.

As the popularity of ESG investing continues to rise, more banks will likely offer more choice in ESG investment products, like HSBC.

Yes. Although with all types of investing you can also lose money. If you compare the 5-year performance to 2019 of this ETF and the FTSE 100 Index, the return difference is stark (see below). If you compare MSCI SRI and MSCI World Index, there are some improvements too over traditional investments.

Yes, if you invest with an FCA-regulated ethical investment platform as your money is protected by the FSCS.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the ethical investment accounts via a non-affiliate link, you can view the product pages directly here: