The commodity market is a vital part of the global economy. From agriculture to soft commodities, these goods are critical to the running of a modern economy. Even the fast-growing green sectors require key commodities like lithium and copper. But commodities are a large asset class; so large in fact that most investors and traders should consider having exposure to them. This guide explains how you should approach investing in, and trading commodities.

What Is Commodities Trading?

Commodities trading is the buying and selling of commodity contracts like coffee, oil and soybeans. Many engage in this activity to speculate on the movement of commodity prices. In the days of yore, commodities were traded physically. For many old timers, the image of commodities trading remains that of a large frantic crowd shouting excitedly at one another on the trading floor.

Those days are largely over. The advent of new technology means most commodities are traded over an electronic networks, at a speed that is unimaginable to traders just a generation ago. High-frequency trading now dominates financial markets, especially in futures trading.

The global trading community widely uses commodity derivatives like futures, options, CFDs and financial spread bets as one attractive point of commodities is the sector’s gyrating and volatile prices – a fertile ground for market makers, fund managers and individual traders.

Commodities are widely traded on these major exchanges:

- Intercontinental Exchange (www.ice.com)

- CME Group (www.cmegroup.com)

- London Metal Exchange (www.lme.com)

- Eurex (www.eurex.com)

The world needs commodities. There is always a bull market somewhere in this sector and investors should learn to analyse this market. Not just to gauge the demand for raw materials, but to see if some ‘low-risk’ investment opportunities exist that traders can profit from.

Industry experts told us

"Commodity prices like Oil, Natural Gas and Gold are never out of the news, and prices can be extremely volatile making them very attractive for traders wanting to take a view on production, supply and demand."What Are Commodities?

Commodities are the building blocks of modern life. Everywhere you go, you are surrounded by commodities that are produced around the world. These essential ingredients are normally grouped under the following broad sectors:

- Food/Agriculture – soybean, wheat, corn, rice

- Energy – crude oil, natural gas, gasoline, heating oil

- Metals – gold, silver, copper, aluminium, nickel

- Softs – coffee, sugar, cotton, orange juice

- Livestock – lean hog, live cattle

Agriculture encompasses most edible food staples, while energy is the backbone of most industrial machines like cars and aeroplanes. Metals are typically extracted from the ground.

Some commodities are abundant in nature. Some aren’t. A few commodities are so desired by people, now and then, that they are used as currencies. Gold and silver, for example, are two primary metals frequently used in the past to underpin monetary exchanges in an economy. The ‘Gold Standard’ – a form of monetary system with gold or silver as the anchor reserve asset – dates back thousands of years.

Did you know that nearly all modern gadgets, such as mobile phones, rely heavily on commodities? According to some estimates, a modern smartphone is 25% silicon, 14 aluminium, 7% copper and 6% lead.

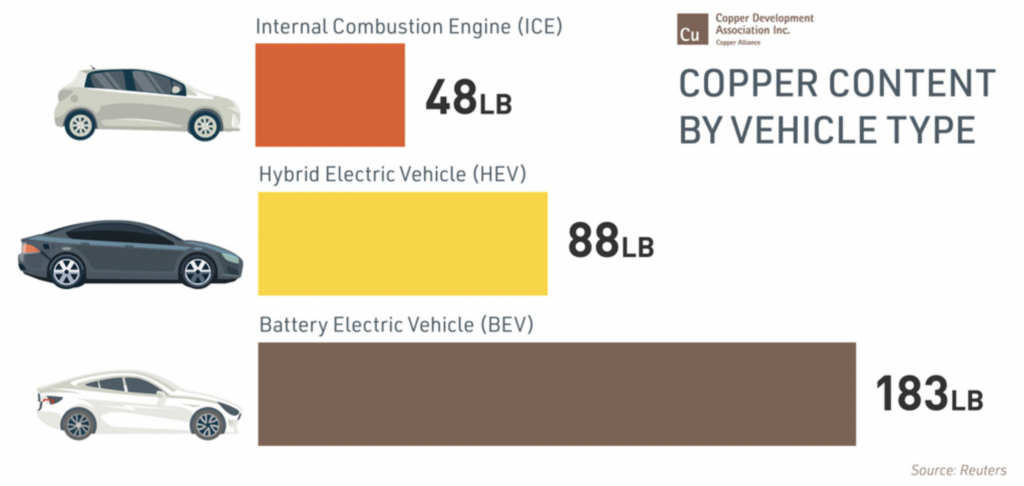

More importantly, the expanding green economy is heavily reliant on many traditional metals and commodities. Each electric vehicle, for instance, requires almost a mile of copper wiring and three times more copper than a traditional ICE car (see below).

Wind turbines need many rare element elements.

Source: Copper.org

When China was industrialising during 1980-2020, the nation imported a vast quantity of copper and iron ore. So much so that the market coined the phrase ‘commodity supercycle‘. Legendary investor Jim Rogers is a major proponent of this supercycle thesis way back in 2004 (see his book here). He advised time and again that (p.4):

Commodities are so pervasive that, in my view, you really cannot be a successful investor in stocks, bonds, or currencies without understanding them. You must understand commodities even if you only invest in stocks. Commodities belong in every truly diversified portfolio. Investing in commodities can be a hedge against a bear market in stocks, rampant inflation, even a major downturn in the economy. Commodities are not the “risky business” they have been made out to be.

Years later, this approach remains true. Commodities have always been been with us; it will stay with us in the years to come.

Best Commodities For Beginner Traders

The simple rule of thumb when starting out is to choose the largest and most liquid commodities to monitor. Maintain a small set of commodities and watch their price movements over time (preferably on a daily basis). My preference is this small set of commodities is:

- Crude oil – tells us about the general demand in the global economy

- Natural gas – a crucial commodity in many parts of the world like Europe

- Gold – a fear gauge and an inflation hedge

- Silver – poor man’s gold and a higher beta version of gold

- Wheat – food inflation proxy

- Copper – a major commodity required by many emerging nations to build their economies

With this small set you can learn about how the global commodity market works. These commodities are heavily traded by institutional funds, especially quantitative funds and commodity brokers. Liquidity of these commodities is ample.

Commodity Indices

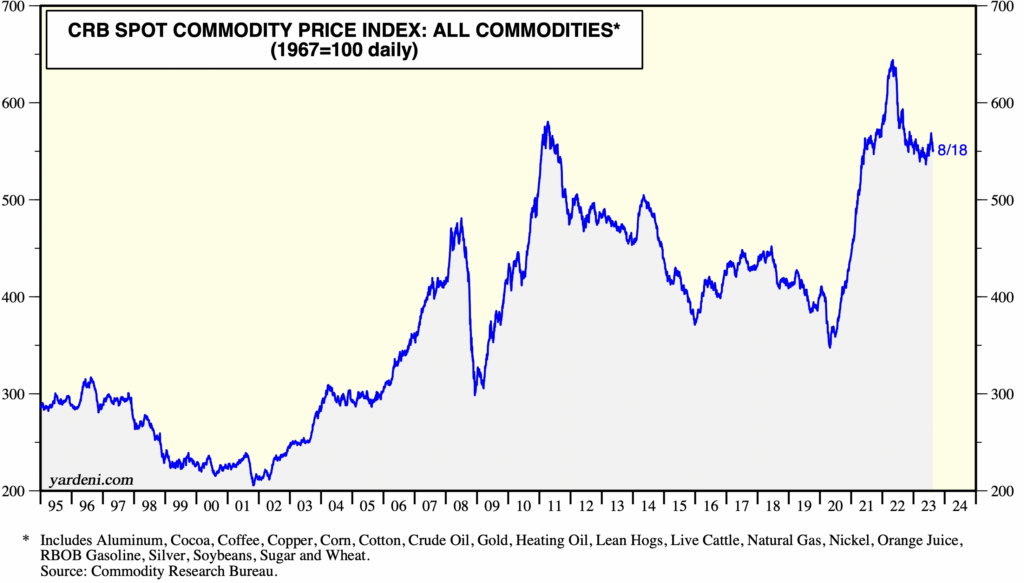

At this point, interested readers should take a look at an index known as the Commodity Research Bureau index (CRB).

For years, there was no equivalent of a ‘blue chip’ index in the commodity market. In the 1960s, some agencies started to gather some commodity returns and started an index. This became the CRB index – a standard commodity index for many investors. A word of caution: Calculations of this index have changed dramatically over time. Constituent commodities were altered; pricing methods modified significantly. Refinitiv, the data company, is maintaining this index.

Currently, the CRB index is comprised of 19 commodities (factsheet here). The largest weighting comes from energy contracts (39%) followed by agriculture (34%). The Index’s historical price movements is highly interesting as bear and bull markets interchanged regularly.

Source: Yardeni.com

Direct & Indirect Commodity Exposure

There are two ways to gain exposure to commodities: Direct and indirect.

If you want to own commodities such as gold directly, you buy gold bars/coins from a reputable dealer and store them in your house (or in a bank vault). This method entails risk since the metal can be stolen or misappropriated. Plus, you need a warehouse if you buy barrels of oil or stacks of copper.

Did you know that during the Great Depression owning gold is forbidden? The Gold Reserve Act of 1934 banned household from owning the yellow metal for some years. While such restrictions have been lifted, many prefer to own commodities indirectly.

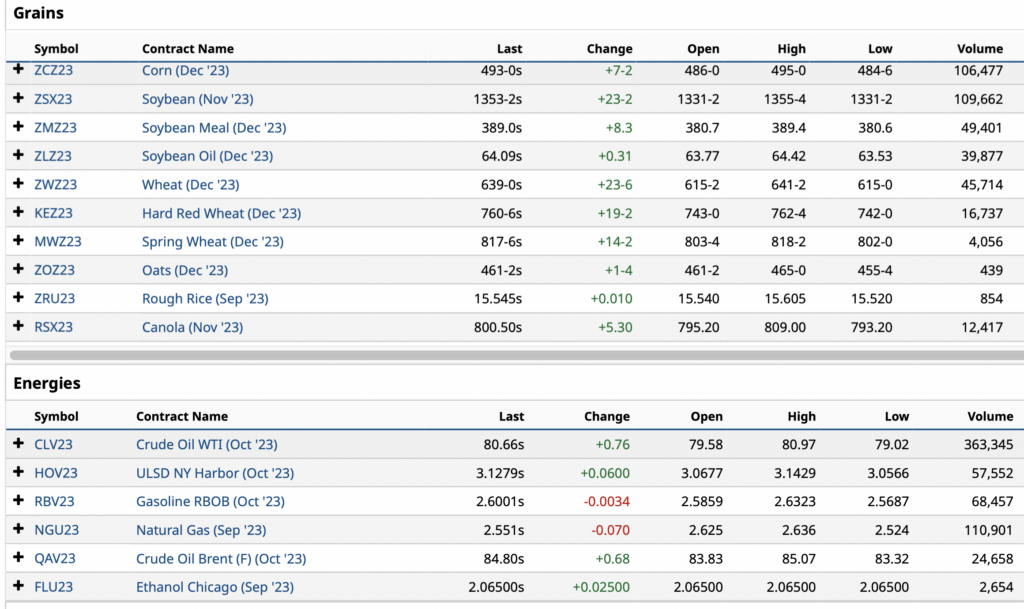

The most common way to trade commodities indirectly is via futures. Commodity futures have been around for many decades. They are a form of financial derivatives and are a permanent feature of the financial landscape. Aspiring traders should learn these contracts well. A small snapshot of available commodity futures are shown below:

Source: Barchart.com/futures

To trade commodities profitably, you will have to learn about futures contracts and many of the terminologies, such as expiry contracts, contract symbols, rollover dates, specifications of each commodity, margin requirements (initial and maintenance), embedded leverage, contango/backwardation, forward pricing, basis trading et cetera.

Some commodity futures contracts may be too large for novice traders, unless the accounts are well capitalised.

Another thing worth remembering about futures is that traders can sell short the contract. Commodity prices move up and down regularly. When traders take a bearish view of a commodity, they can open a sell position. If prices dive, they profit from it. They can buy the contract back (or roll over to the next nearest month) when it is near expiry.

Commodity Sector Returns Vary Over Time

One important characteristic of the commodity asset class is that each commodity is different. Just like a stock market contains different sectors and stocks. These commodities are priced differently due to their unique supply and demand dynamics.

For example, crude oil suddenly skyrocket due to bigger-than-expected OPEC cuts; while industrial metals sink on falling demand. We can hardly lump all commodities together and expecting them perform similarly.

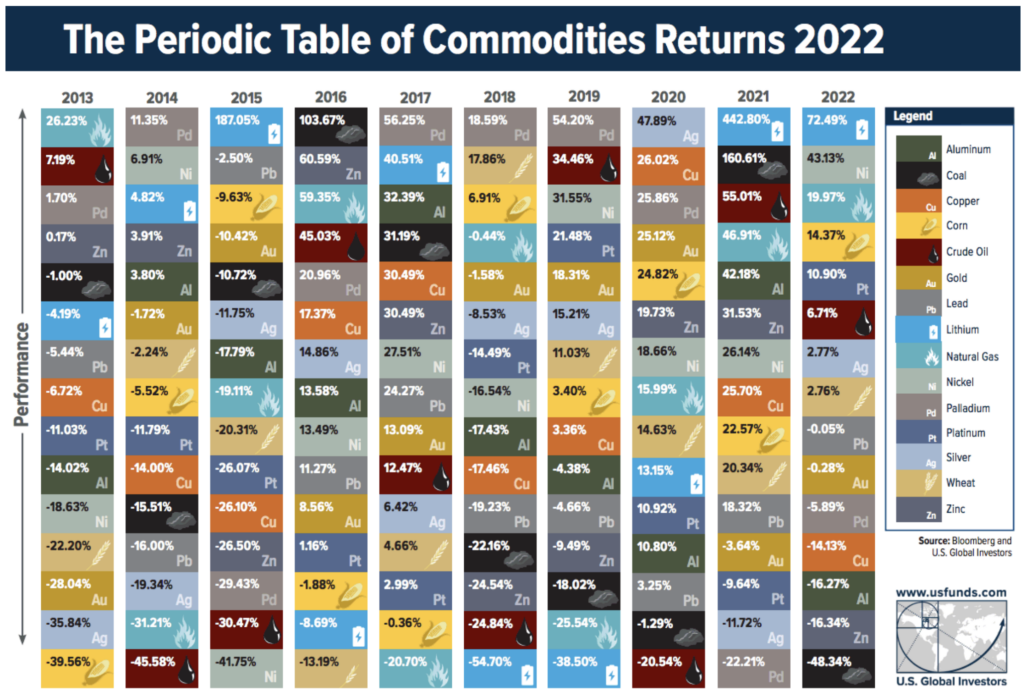

Moreover, the performance of these commodities varies significantly over time. Look at the chart below – a chart ranking the performance of different commodities from 2013 to 2022.

In 2015, lithium was the best performer in the commodity world. Next year coal topped the table. In 2020, silver rose to the top spot. The return gap between the best and worst-performing commodities each year was huge. Sometimes they’re over 30-50 percent (see below).

And the yearly price swings can be massive. In 2018 and 2019, for instance, lithium prices slumped by 55% and 39% respectively. Then in 2021, it soared by 442%; followed by another impressive 72% jump in 2022.

Therefore predicting the return of a single commodity in any single year is difficult. Most traders focus on trends. You should do so too.

Source: visual capitalist.com

What Drives Commodity Prices?

Commodity markets are impacted by many factors. Some of it is macro; some are supply-demand related. To generalised further, the impact of each factor may vary over time. Sometimes, macro concerns dominate. At times, supply issues spark concerns.

All in all, there are about four broad factors that move commodity prices:

- Supply and demand

- US Dollar

- Business cycle

- Unpredictable shocks

Supply & Demand

For most commodities, the basic rule is that supply and demand drive prices. Supply shocks are mostly down to natural disasters, unpredictable weather, or sudden export bans. This is hard to predict since a devastating frost can happen at any time.

As a rule of thumb, when a commodity is scarce – be it oil or food – prices go up. When the supply is plentiful, prices drop. Of course, like all other financial instruments, prices can overshoot to the upside and on the downside, depending on investor psychology.

US Dollar

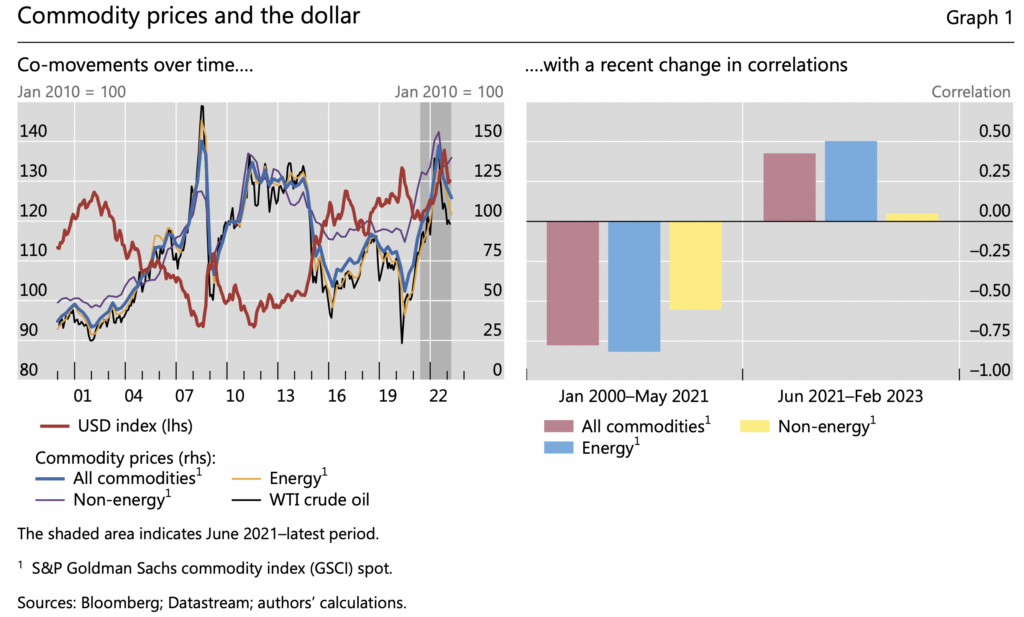

The second driver of the commodity market is the movement of the US Dollar. Why? This is because most commodities are priced in the greenback.

In the past, when dollar weakened commodity prices rose. But this correlation is breaking down. According to a recent BIS study, this is because US is becoming a net-exporter of energy. So the dollar is moving in tandem with commodity prices.

Source: Bank of International Settlement Research (2023)

Business Cycles

The third factor impacting commodity prices is the business cycle. During an upswing, demand expands. Industrial commodity price rises. Since the 1950s, there are a couple of these bull markets that drove commodity prices significantly higher.

Shocks

The last driver of commodity prices is shocks, be it supply shocks (e.g., mine shutdowns), demand shocks (e.g. new applications), or external shocks (e.g. pandemic or war).

Take crude oil in 2020. Prices were trading in the forties until April 2020. The pandemic caused a demand collapse. Transportation ground to a screening halt. No domestic or international travelings. Everyone was quarantined at home. Ergo, obody wanted oil at any prices. For the first time in its history, crude oil slumped to negative levels.

Then, two years later, Russia invaded Ukraine. Natural Gas contracts soared as traders feared a supply crunch. Only when supply was brought under control did price slump. War often causes commodity prices to spike.

Different Ways To Trade & Invest In Commodities

Commodities are widely traded across the world. For new investors, finding out how to invest in commodities alone can be a daunting task. The trick is to gain exposure to the asset at a suitable level for you.

Broadly speaking, there are four types of financial instruments to trade commodities:

- Futures – derivatives that track the underlying spot commodity prices

- Exchange Traded Funds (ETFs) – funds that hold either the physical commodity or commodity futures

- Spread betting – spreadbetting/CFDs do not hold the underlying

- Stocks/Commodity Funds – commodity-related equities or investment funds that hold commodity companies

The first question for traders starting in commodities trading is to assess their methods. Are you a long-term investor or a short-term swing trader?

Commodity Derivatives

Remember the first trading rule is not to lose money. For risk-averse investors starting out, buying commodities on margin with futures, CFDs or spread betting is probably best avoided. Simply because commodity prices are volatile and novice traders can lose their shirts quickly. Start with a small sum you can afford to lose. However, if you are experienced, these high-risk derivative products may be suitable.

Commodity ETFs & Funds

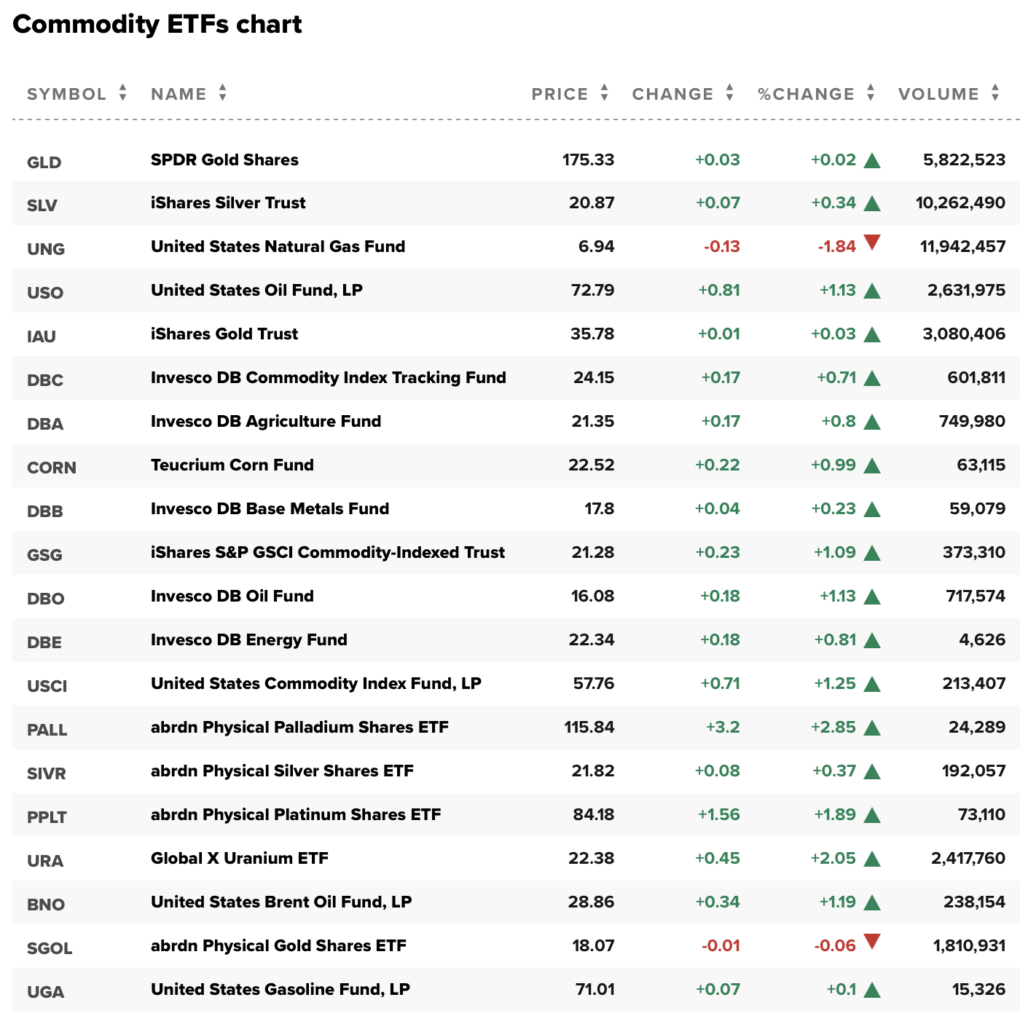

Perhaps investing at ETFs is more appropriate as leverage is lower as you begin to learn the ropes. Below is a sample of major commodity ETFs that you should look at (USD listed).

Source: CNBC

Another choice is to buy a diversified basket of commodities. This avoids picking which commodity sector will outperform this year. This is like buying the S&P 500 index fund or a Nasdaq exchange-traded fund.

One of the most popular commodity ETFs is the Invesco DB Commodity Index Tracking Fund (DBC). According to its website, the $2 billion ETF ‘‘seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Diversified Commodity Index Excess Return™ “ and the fund is “designed for investors who want a cost-effective and convenient way to invest in commodity futures.”

DBC tracks 14 commodities and is rebalanced annually. Because of the fund’s weight on energies, prices plummeted during the pandemic and then surged in 2022 due to the Ukraine conflict. Volatile stuff.

For investors wanting to buy a single-commodity ETF such as gold, the SPDR Gold ETF (GLD) is often a first choice. The ETF was once the largest ETFs in the world. Currently, it has more than $55 billion assets under management.

Lastly, traders to search to gain exposure to commodities indirectly should investigate stocks/companies that produce commodities.

In the UK, there is a sizeable number of miners listed on the London Stock Exchange. The two well-known miners are BHP Billiton (BHP) and Rio Tinto (RIO). The partial list of UK-listed miners include:

- BHP (BHP)

- Rio Tinto (RIO)

- Glencore (GLEN)

- Anglo-American (AAL)

- Antofagasta (ANTO)

- Fresnillo (FRES)

- Endeavour Mining (EDV)

Buying a miner is different tobuying a commodity simply because there is an added risk of the stock market movements and earnings outlook. During a commodity bull market, they often outperform commodities.

Junior miners, if you research them thoroughly, often provide outstanding returns if the timing is right.

Yes, as the sector provides return diversification. Many commodities as viewed as inflation hedge.

Perhaps start at single-commodity ETFs like GLD or SLV as they are unleveraged. Dip into the sector first and research as you develop your trading style. For this you need an ETF investing platform.

Yes, you can profit when commodity prices fall, primarily through futures trading. Essentially, you sell the commodity’s contracts and roll over the derivatives when they expire. If not, you may have to deliver the physical commodity. Options and CFDs are other ways to short-sell commodities.

Yes, but this will entail significant storage costs. Novice commodity traders should look to buy and sell commodity future contracts, commodity stocks or single commodity ETFs.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.