-

Jackson Wong PhD

Jackson Wong PhD

- Updated

In this guide, we will explain the best ways to send money to Norway using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Norway to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Norway from the UK

- Use a currency broker like OFX for large NOK money transfers

- Use a money transfer app like Wise for smaller NOK money transfers

- Never use your bank for NOK money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,603 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 910 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Methodology

We have chosen what we think are the best ways to send money to Norway based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

Compare exchange rates for sending money to Norway

Use our Norweigan Krone Dollar exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large NOK currency transfers versus using your bank when you send money to Norway.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

History of the Norwegian Krone (NOK)

The Norwegian Krone is the official currency of Norway. Its FX designation is NOK.

The Norwegian Krone is an actively traded currency in the world. According to the Bank of International Settlements tri-annual survey (2019), NOK is the 14th most traded currency, ranking just behind the Singapore Dollar. The currency was shepherded into a float-rate regime in the early nineties.

The Krone is one of the independent currencies outside the Euro. The country is outside the European Union (due to a referendum vote in 1994) but is a member of the European Economic Area (EEA). Thus the country has full control of its monetary policies.

The central bank in charge of Norway’s monetary and currency is the Norges Bank. As with most other central banks, its mandate is maintaining price stability at around 2%. The central bank’s executive board decides the policy rate and other monetary directives, and meets eight times annually.

Any travellers to Norway will know that it is an expensive country to live in. This is because Norway is a high-income developed nation with a low population (5.4m). As of 2021, Norway’s GDP per capita is ranked 6th in the world. Unsurprisingly Norwegian Krone is one of the three currencies to be overvalued according the Economist‘s Big Mac Index.

Factors that move the Norwegian Krone (NOK) exchange rate

Foreign exchange markets are a huge marketplace where billions of dollars change hands daily. Hedgers, speculators, investment funds and central banks buy and sell currencies one way or another (spot or swap). Moving a major currency in a particular direction is not easy. Even more difficult is changing the direction of a currency in the opposite direction, which requires a concerted effort.

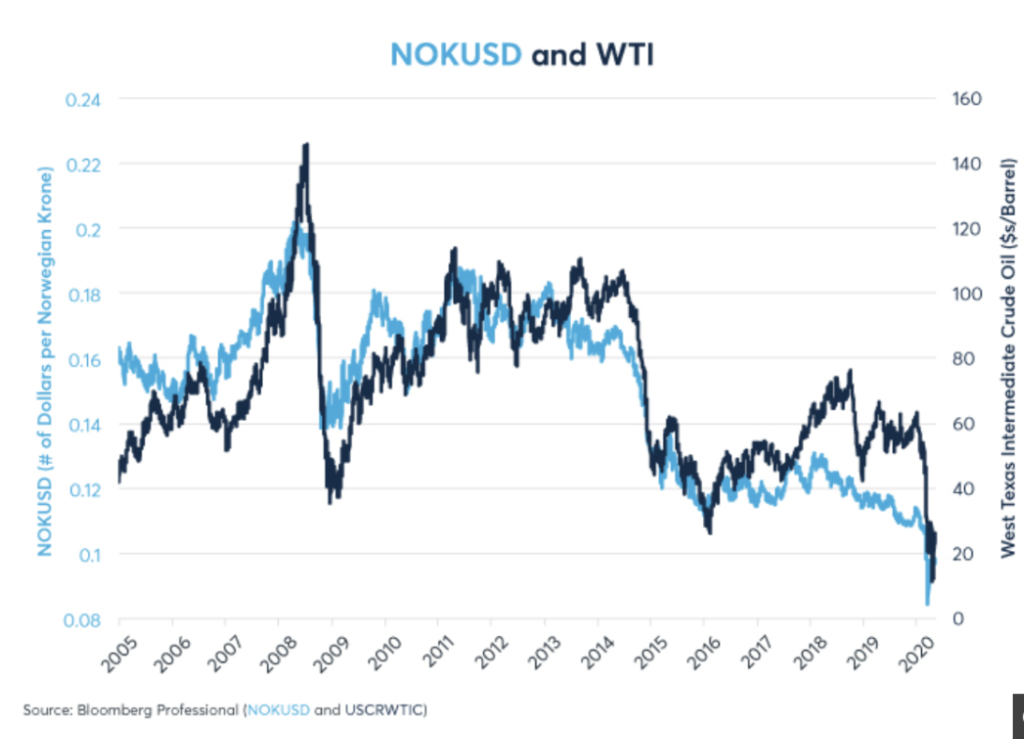

To understand what drives the Norwegian Krone, you will have to understand what it produces and how its economy is structured. Since the discovery of oil in the North Sea, the Norwegian Krone is linked closely to oil. A rough estimate is that 40 percent of Norway’s export are oil and natural gas. This means that if oil rallies, the Krone is likely to follow suit. If oil weakens, like it did in March 2020, then the Krone is likely to fall. A long-term chart of the Norwegian Krone shows their broad correlation (see below).

Source: Benzinga

Apart from oil, the next factor to consider is interest rates. Since 2020, the Norges Bank has slashed the policy rate from 1.50 percent to zero percent. This is to reflate the economy due to the covid pandemic. The impact of this zero interest rate policy weakened the Norwegian Krone – until the Fed started to print trillions of dollars. A recovery in oil prices in the second half of 2020 helped to stabilise the Krone.

Key Norwergian pairs to watch include USDNOK, NOKSEK, and EURNOK. The latter surged to record highs in 2020 in favour of the Euro and has retraced some of its gains (see below).

Inflation should be closely watched due to Norges Bank’s inflation-targeting monetary regime. Should Norway start to raise its policy rate earlier than the ECB, this may cause the Krone to appreciate further.

Lastly, another factor worth watching is the Norwegian sovereign wealth fund (called Government Pension Fund Global), a pot of well-managed capital accrued from its oil exports. The fund, worth around $1.3 trillion, holds 1.5% of all listed shares in the world! GPF invests in 9,000 companies in 74 countries. This fund is set to grow even bigger in decades ahead. By then, oil will be irrelevant to the Norwegian Kroner (due to a rise in non-oil products).

Bottom line – The Norwegian Kroner is an actively traded currency that correlates highly with energy commodities. However, it is possible that Krone’s dependence on oil will weaken over time as the world strives to reduce oil consumption (e.g., electric vehicles). Moreover, the Krone may strengthen further because the central bank did not engage in quantitative easing during 2020, instead tapping its sovereign wealth fund.

Live Norwegian Krone (NOK) Exchange Rates

The current best Norwegian Krone (NOK) exchange rate versus other G10 currencies is the mid-market price which is:

| Australian Dollar (AUD) | 0.14995 |

| Canadian Dollar (CAD) | 0.133538 |

| European Union Euro (EUR) | 0.08382766 |

| Japanese Yen (JPY) | 14.45391 |

| New Zealand Dollar (NZD) | 0.164189 |

| United Kingdom Pound Sterling (GBP) | 0.07271756 |

| Swedish Krona (SEK) | 0.94775 |

| Swiss Franc (CHF) | 0.0781065 |

| United States Dollar (USD) | 0.0974394852 |

Sending money to Norway FAQ:

The best way to send large amounts of money to Norway is to use a currency broker.

As well as getting the best exchange rates, if you send money to Norway with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Norwegian Krone (NOK) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of NOK you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better NOK exchange rate than by using your bank.

Our comparison tables and NOK exchange rate quote request forms will help you find the best Norwegian Krone exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas NOK exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best NOK exchange rate when sending money to Norway

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the Norwegian Krone exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Norway a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to Norway. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Norway because of the high fees.

The three main ways to send money to Norway are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Norway is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the NOK money transfer providers via a non-affiliate link, you can view them directly here: