Direct Market Access (DMA) brokers give traders direct market access to exchange order books for better pricing and execution of futures, options and CFDs. We have tested, ranked, compared and reviewed some of the best direct market access brokers in the UK to help you choose the most appropriate account for your trading strategy.

Saxo Markets: Best Overall DMA (Direct Market Access) Broker

🏆Award Winner🏆

- DMA markets available: 9,000

- Minimum deposit: £1

- DMA account types: CFDs, futures & options, DMA, investing

- GMG rating: (4.2)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

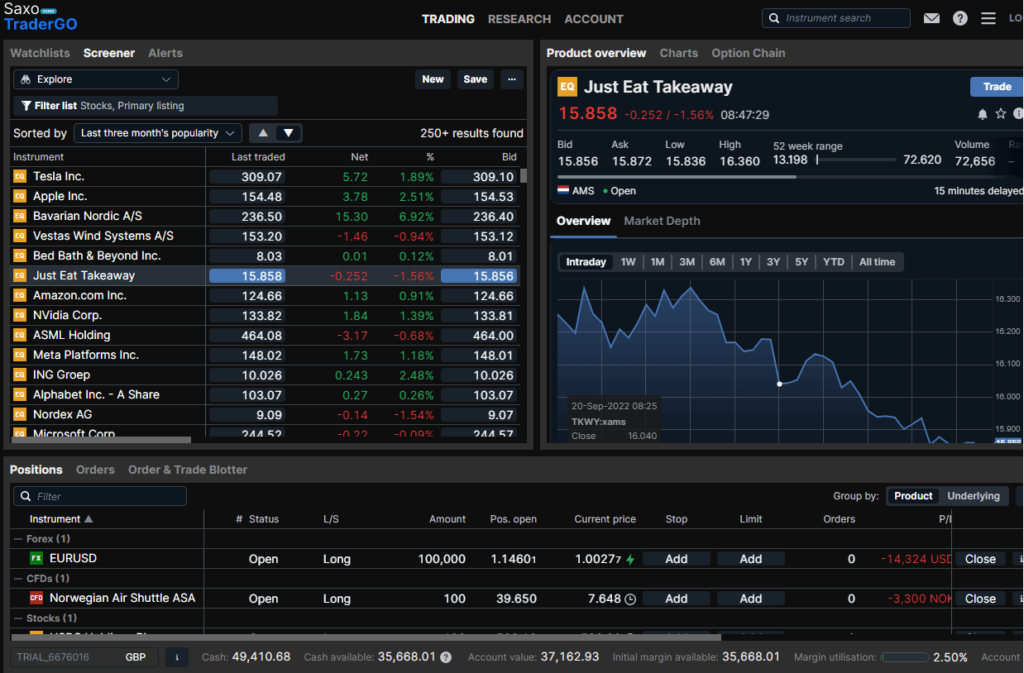

Saxo Markets DMA Trading Review

Name: Saxo Markets DMA Trading

Description: With Saxo Markets you can trade DMA stock CFDs, on-exchange futures and options with ultra-tight DMA spreads, with prices derived from a wide range of Tier 1 institutions.

64% of retail investor accounts lose money when trading CFDs with this provider

Summary

- DMA markets available: 9,000

- Minimum deposit: £1

- DMA account types: CFDs, futures & options, DMA, investing

Pros

- Professional DMA trading platform

- Good research and data

- Futures & options

Cons

- No DMA spread betting

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2Interactive Brokers: Excellent direct market access pricing

- DMA markets available: 20,000+

- Minimum deposit: £2,000

- DMA account types: CFDs, DMA, futures & options, investing

- GMG rating: (4.4)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

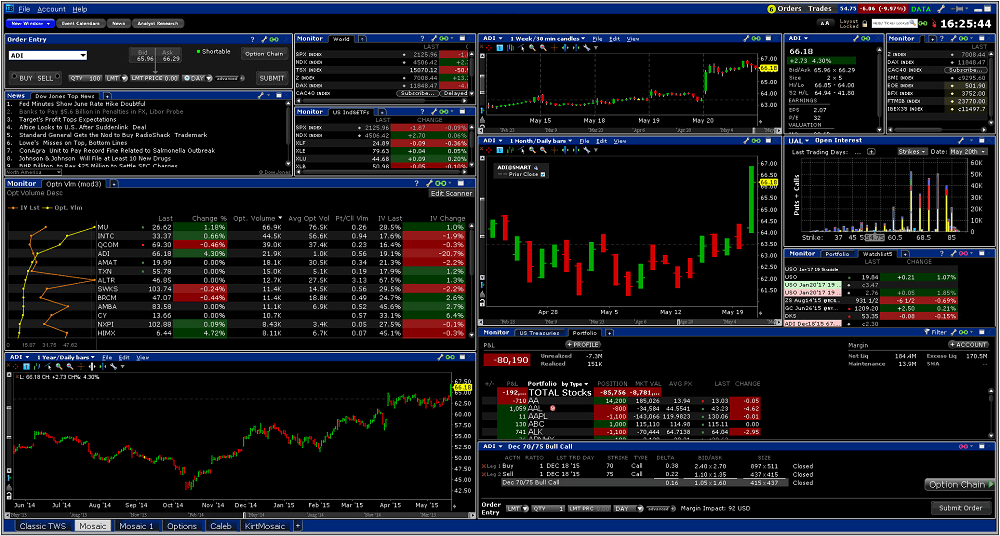

Interactive Brokers DMA Trading Review

Name: Interactive Brokers DMA Trading

Description: IBKR offers direct market access to 30+ market centres with low commissions from USD 0.25 to 0.85 per contract and a trading platform with advanced order execution types and futures tools.

60% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- DMA markets available: 20,000+

- Minimum deposit: £2,000

- DMA account types: CFDs, DMA, futures & options, investing

Pros

- Low-cost DMA trading

- Wide market range

- Complex order execution strategies

Cons

- No DMA spread betting

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

4.4IG: Best for liquidity direct market access markets

- DMA markets available: 12,000

- Minimum deposit: £250

- DMA account types: CFDs, spread betting, DMA, investing

- GMG rating: (4)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

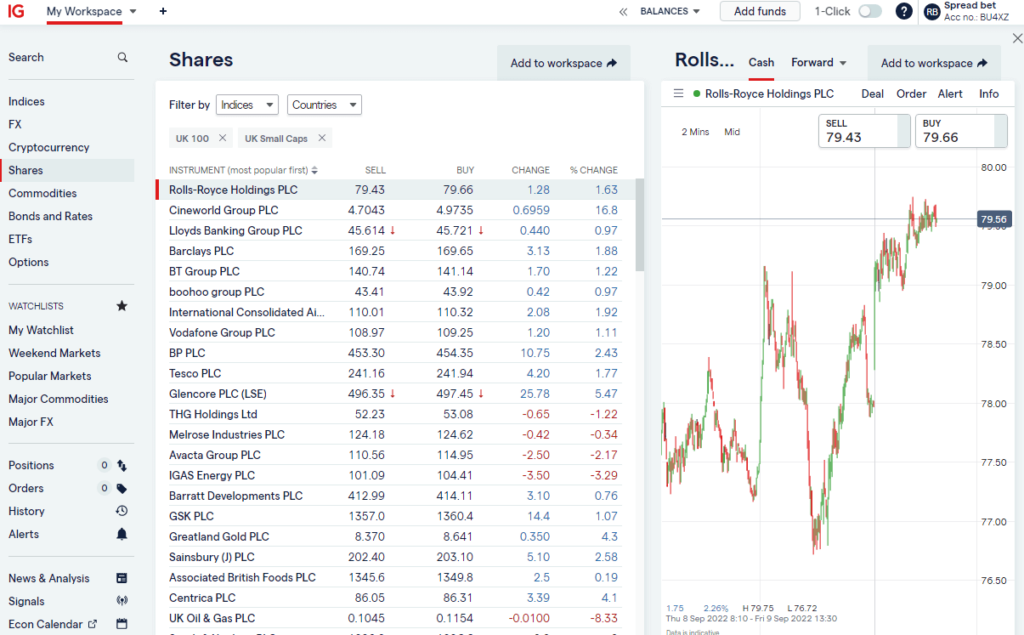

IG DMA Trading Review

Name: IG DMA Trading

Description: IG’s L2 Dealer lets you trade on over 12,000 shares and 80 forex pairs against multiple liquidity venues, including primary exchanges, multilateral trading facilities (MTFs), dedicated market makers and dark pools.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- DMA markets available: 12,000

- Minimum deposit: £250

- DMA account types: CFDs, spread betting, DMA, investing

Pros

- Wide range of equity DMA CFDs

- Voice brokerage

- DMA & level-2 pricing

Cons

- No futures and options

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Tickmill: DMA trading on CQG

- DMA markets available: 578

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: US Shares 0, FTSE 0.9, GBPUSD 0.3

- GMG rating: (3.9)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

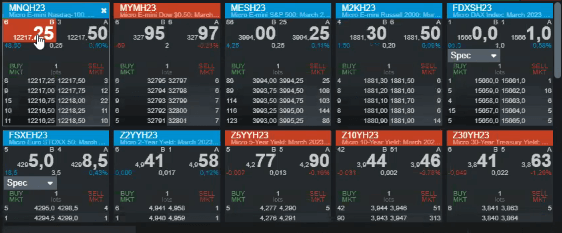

Tickmill DMA Trading Review

Name: Tickmill DMA Trading

Description: Tickmill lets you trade DMA futures and options on micro, mini and full size futures contracts so is a good choice for high frequency scalpers who need direct market access to the most popular markets.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- DMA markets available: 578

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: US Shares 0, FTSE 0.9, GBPUSD 0.3

Pros

- DMA trading on CQG

- Low trading costs

- Exchange fees built into commission

Cons

- Only the most popular markets

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

3.9❓Methodology: We have chosen what we think are the best DMA trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the direct market access accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative DMA brokers.

- interviews with the DMA broker CEOs and senior management

You can use our comparison of what we think are the best DMA broker for trading CFDs, shares, forex, indices and commodities to compare market access, minimum deposits and what type of direct market access they offer.

Compare DMA Trading Platforms

| DMA Trading Platform | DMA Markets | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 20,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 9,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider |

Futures

Saxo Markets is the best DMA broker for futures trading as they offer DMA futures on 300 contracts across 16 future exchanges. Saxo Markets has won “best futures broker” in our awards three out of the past four years. For more information on futures trading platforms, you can compare futures brokers here.

Options

Saxo Markets is the best DMA options broker as it offers options trading on over 30,000 stocks and indices across 60 exchanges. Saxo Markets has won “best options broker” in our awards three out of the past four years. For more information, you can compare options brokers here.

CFDs

Saxo Markets is the best broker for trading DMA CFDs as it offers CFD with direct market access on over 9,500 shares, indices and commodities. Saxo Markets has also won “best CFD broker” in our awards for the past four years running

DMA CFDs (offered by CFD brokers that offer professional accounts) are for when you have a big account and work big orders or are trading on a high-frequency basis or a trading strategy requires you to be inside the bid/offer spread.

Forex

Saxo Markets is the best broker for trading forex DMA as they offer on-exchange forex futures and options compared to other forex brokers like IG and CMC Markets that only offer DMA forex to institutional clients as a prime offering.

UK Shares

IG is the best DMA broker for UK equities according to our broker matrix as they offer access to the most shares. With IG you can also trade UK shares as a spread bet or CFD whereas other DMA stock brokers do not.

US Stocks

Interactive Brokers is the best DMA broker for trading US stocks, IBKR are US based but take on non-US residents through their international offices.

⚠️ FCA Regulation

All DMA trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK direct market access trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature DMA brokers that are regulated by the FCA, where your funds are protected by the FSCS.

DMA Broker FAQs:

DMA stands for Direct Markets Access

Direct market access, also commonly referred to as DMA, is a service offered on more sophisticated trading platforms by CFD, futures and options brokers that enables clients with sufficient experience to place buy and sell orders directly on the electronic facilities and order books of stock exchanges around the world.

Direct market access is commonly used by investment firms and sophisticated traders as it allows for implementing strategies based on algorithmic trading and can help make the trading process more efficient due to the overall speed of execution, better pricing and the lower costs associated with trades.

The main things to consider when comping direct market access brokers are:

- Commission rates – these are often volume-based for larger DMA traders and can be significantly cheaper than the published rate card.

- Leverage and margin – exchanges set margins for DMA futures and options trading, but DMA brokers set their own margin rates for DMA CFDs

- Types of DMA – Do you need direct market access for trading futures, options or CFDs?

The main advantages of direct market access trading platform is that you get clean pricing directly from the exchange order book. You can place your DMA orders directly on the exchange and get in between the bid and offer price.

- Speed of execution of trades

- Better prices due to fewer middle man cuts

- Lower potential for human error by a broker acting on your behalf

- Anonymity can be higher for

If you are upgrading from a spread betting or CFD broker that widens the spread rather than charging a commission, there is an added layer of administration because you have to include commission in your profit and loss calculations.

- Commission charges to factor into profit and loss

- No tax benefits of financial spread betting

- High minimum account size

Yes and no. If you want to get inside the bid-offer you need to be trading with direct market access (DMA). However, this is a tricky thing to do if you want a spread betting broker to provide direct market access.

The reason is quite simple. The mechanics just don’t work. Spread betting is over the counter (OTC), in that it is conducted off-exchange and structured as a bet. There is no exchange to access and the quotes provided by the spread betting brokers are based on the prices in the underlying exchanges.

It is possible to spread bet with DMA, although it’s all about relationships. You can ask your dealers at brokers like IG or Spreadex to work order in the market for you. However, you will need a big account and a good relationship with your account executive to get the service.

Yes, IG offer direct market access trading. You can find out more about their account offering here. Other brokers like Saxo Markets & Interactive Brokers also offer it.

The FCA regulates all DMA brokers in the UK. All of the brokers we include in our comparison are authorised and regulated by the Financial Conduct Authority.

Yes, DMA brokers if you are a high-frequency day trader making short term trades you will get better pricing and fills with direct market access.

Yes, as they provide direct market access to exchange order books they do not have to internally match or decide whether or not to hedge client positions.

DMA stock trading means buying and selling shares on stock exchanges like the LSE with direct market access. It enables clients to place bids and offers directly on the exchange order book.

No, DMA trading platforms are not suitable for beginners. Leveraged trading is a high-risk form of speculation and generally, it’s only economical using a direct market access provider if you are trading with over £50,000 and are a regular and experienced trader.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the DMA brokers via a non-affiliate link, you can view their direct market access pages directly here: