In this guide, we will explain the best ways to send money to New Zealand using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to New Zealand to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to New Zealand from the UK

Compare exchange rates for sending money to New Zealand

Use our New Zealand Dollar exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large NZD currency transfers versus using your bank when you send money to New Zealand.

Methodology

We have chosen what we think are the best ways to send money to New Zealand based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

History of New Zealand Dollar (NZD)

The New Zealand Dollar is the official currency of New Zealand. It is also a legal tender in number of islands including Cook, Tokelau, Niue, and Pitcairn. The current currency regime – dollar and decimals – was introduced in the sixties to replace the pound system. In the eighties, the currency was formerly converted into the free-float regime.

The NZ Dollar, mostly known in the market as the ‘Kiwi’, is a popular currency. According to the Bank of International Settlement survey (2019), NZD is the tenth most traded currency on a daily basis. But on a GDP basis, New Zealand is ranked outside the top 40 economy in the world ($240 billion).

The Reserve Bank of New Zealand controls the monetary policy and distribution of the NZ Dollar of the country. As with most central banks, the key focus of the central bank is inflation, unemployment, and price stability. The bank has a 1-3 percent target range for inflation.

The primary tool in which the central bank controls the economy is the Official Cash Rate (OCR). Since last March, the OCR is at 25 basis points (0.25%) – a record low. The quantitative easing program in NZ is called the Large Scale Asset Purchase (LSAP), which is running at a maximum of NZ$100 billion until June 2022.

Factors the move the New Zealand Dollar (NZD) exchange rate

Most currencies are driven by fundamentals, technicals, and sentiment. On the fundamentals side, traders will need to pay attention of key data releases such as GDP growth, inflation, unemployment and housing data as to gauge the prospect of interest rate movements.

Historically, one of the key allure of the New Zealand Dollar is its high interest rate. During the so-called Goldilock Years, during 2004- 06 NZD benefitted from the target leg of the carry trade because the NZD interest rate was so high. Traders borrowed from the low-funding currencies such as JPY and invested in NZD. As late as June 2008, the OCR was at 8.25%. But that was then.

These days, the OCD rate is at a record low. The carry trade no longer proved to be as attractive as before. Hence the NZD could not sustained a positive trend against other currencies.

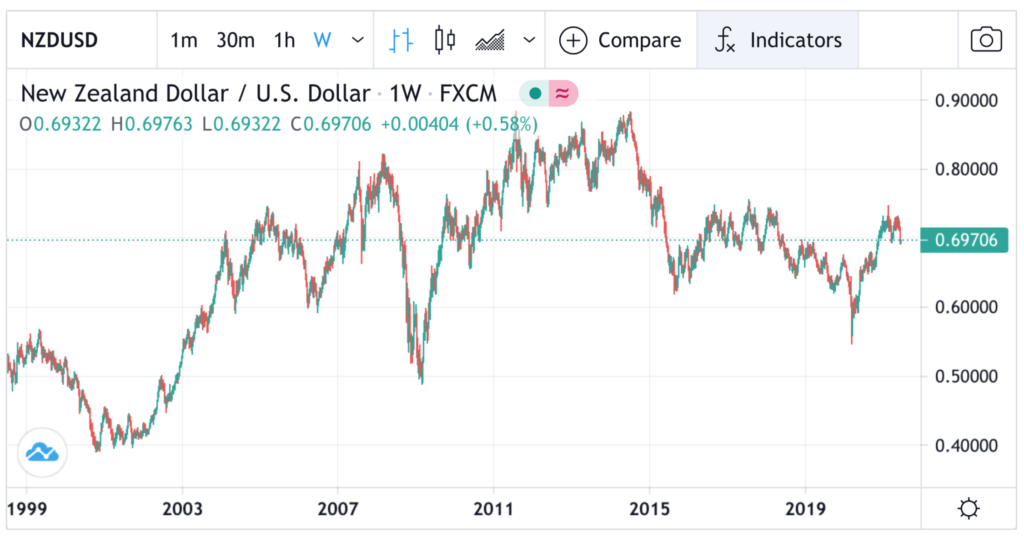

Moreover, the NZ economy is heavily geared towards commodities. This means that during periods of commodity price upswing, the NZD tends to outperform – and vice versa. For example, the NZD rallied significantly against the USD during the 2002-2006 and 2009-2012 when commodity prices were rising rapidly, When commodity prices fall, the NZD weakened (see below). Accordingly, if commodities continue to do well in 2021 and beyond, NZD will probably rally further, albeit in a choppy fashion.

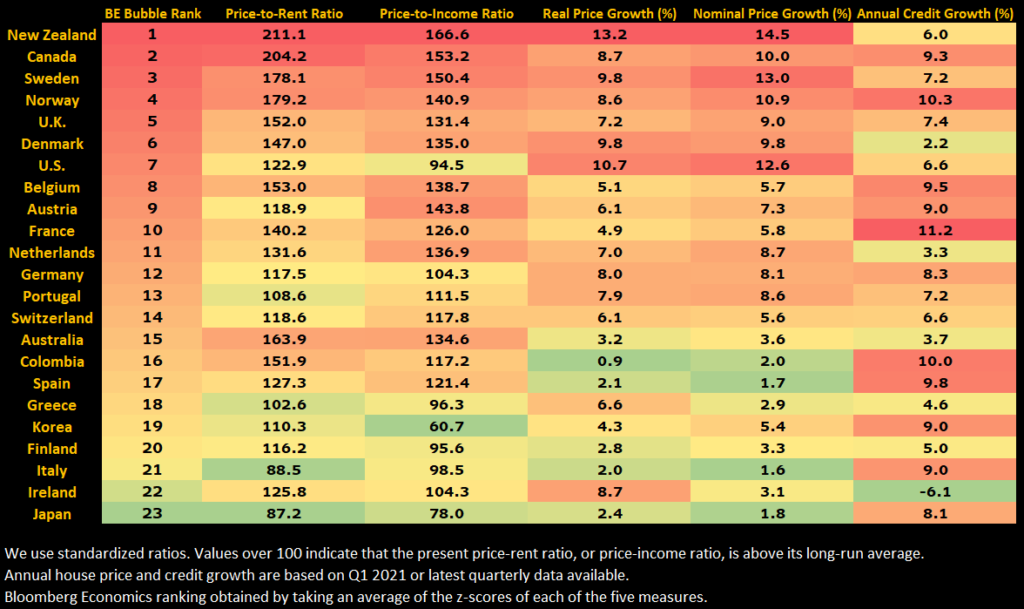

Going forward, a third factor may come into play. That is, house prices. The drastic fall in interest rates over the past 12 years (from 8.25% to 0.25%) has fuelled a housing boom in New Zealand. According to a recent Bloomberg Housing Risk monitor, New Zealand has the largest housing bubble in OECD (see below). The central bank may be forced to act if this continues further, as because surging house prices causes problematic social problems later.

Source: Bloomberg

Bottom line – The NZ Dollar is a favourite trading currency in the FX market due to its volatility. Large swings within a commodity cycle significantly impact the NZD. Historically the NZD benefitted from high interest rates. Nowadays it is the relative amount of QE that moves exchange rates. Important NZD pairs to watch for includes NZDUSD, GBPNZD, and NZDAUD.

Live New Zealand Dollar (NZD) Exchange Rates

The current best New Zealand Dollar (NZD) exchange rate versus other G10 currencies is the mid-market price which is:

| Australian Dollar (AUD) | 0.919435 |

| Canadian Dollar (CAD) | 0.8154155 |

| European Union Euro (EUR) | 0.555285 |

| Japanese Yen (JPY) | 91.259 |

| Norwegian Krone (NOK) | 6.4779 |

| United Kingdom Pound Sterling (GBP) | 0.474625 |

| Swedish Krona (SEK) | 6.462 |

| Swiss Franc (CHF) | 0.538295 |

| United States Dollar (USD) | 0.5901 |

Sending money to New Zealand FAQ:

The best way to send money to New Zealand is to use a currency broker.

As well as getting the best exchange rates, if you send money to New Zealand with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer New Zealand Dollars (NZD) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of NZD you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better NZD exchange rate than by using your bank.

Our comparison tables and NZD exchange rate quote request forms will help you find the best New Zealand Dollar exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas NZD exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best NZD exchange rate when sending money to New Zealand

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the NZD exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to New Zealand a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to New Zealand. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to New Zealand because of the high fees.

The three main ways to send money to New Zealand are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to New Zealand is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the NZD money transfer providers via a non-affiliate link, you can view them directly here: