-

Jackson Wong PhD

Jackson Wong PhD

- Updated

In this guide, we will explain the best ways to send money to Sweden using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Sweden to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Sweden from the UK

- Use a currency broker like OFX for large SEK money transfers

- Use a money transfer app like Wise for smaller SEK money transfers

- Never use your bank for SEK money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,603 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 910 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Methodology

We have chosen what we think are the best ways to send money to Sweden based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

Compare exchange rates for sending money to Sweden

Use our Swedish Krone exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large SEK currency transfers versus using your bank when you send money to Sweden.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

History of the Swedish Krone (SEK)

The Swedish Krona is the official currency of Sweden, with the FX abbreviation of SEK. The currency is one of the scandinavian currencies that includes the Krona, Norwegian Krone, Danish Krone, and Icelandic Krona.

Initially, there were plans for the Swedish Krona to join the Euro, but the electorate refused to vote for the plan. Therefore, the Krona survived as an independent currency. The country, however, joined the EU in 1995.

The central bank of Sweden, known as the Sveriges Riksbank, is the oldest central bank in the world (1668) and controls the monetary policy of Sweden. Like most other currencies, the Krona was initially linked to gold after the war but cut its cord in the seventies. Eventually, Krona moved into a free-floating regime a decade later.

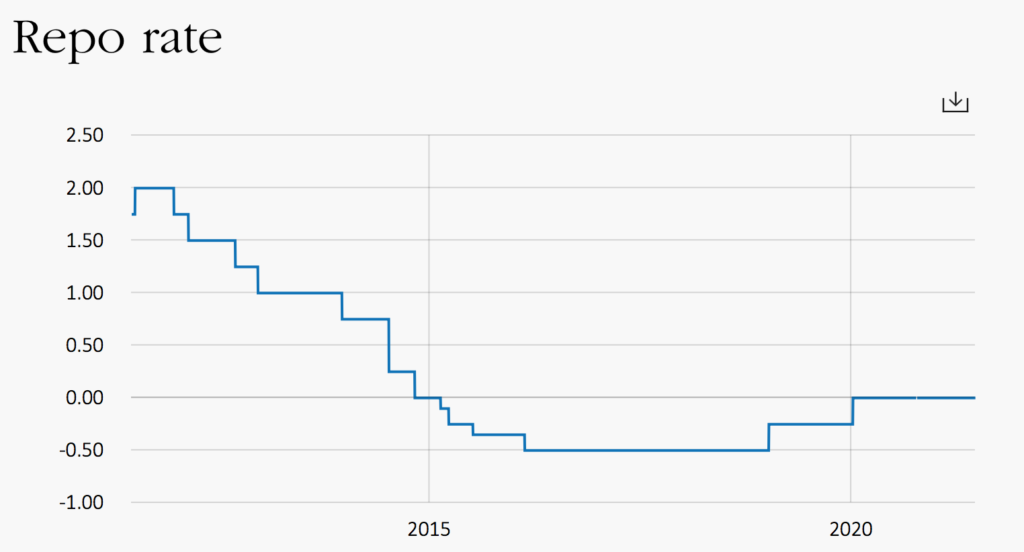

Riksbank’s key policy mandate is price stability. To achieve this target, the bank was forced into negative interest rates, one of the first central bank in the world to do so. But the side effects of that policy was too powerful and they discontinued the experiment after five years. The policy rate (known as the Repo Rate) is currently at zero percent.

Factors that move the Swedish Krone (SEK) exchange rate

The Swedish Krona is driven by a myriad of macro factors, including the risk sentiment, fundamentals and interest rates.

First, on interest rate. The Riksbank was one of the first central banks to introduce negative interest rate. The reason for doing so then (around 2015) was to pursue a more expansionary policy to reach the 2 percent inflation target. At that time, the US Fed was ending its QE and began to taper off asset purchases. As a result of this polar difference in monetary policies, the USDSEK rate rose rapidly during 2014-15 in favour of the USD (see below). Hence, one of the biggest drivers of exchange rate these days in the relative size of QE programs between two countries.

In fact, USDSEK has continued to trend higher (in favour of USD) as the Swedish Repo rate stayed in negative territory from 2015 to 2020. It was only in 2019 that the Riksbank decided to end the experiment and returned the repo rates back to zero. As soon as this was done, the pandemic hit and the Fed flooded the market with dollars. While the Riksbank also engaged in QE (SEK700billion), it was a small program relative to the Fed. As a result, the USD depreciated against the SEK.

Apart from interest rate and quantitative easing, other factors like housing market, unemployment, GDP and global business conditions – all play a role in moving the SEK. Sometimes, market psychology can move markets. New lows in a currency worth paying attention to because it signals something is badly wrong and the sellers rushing to exit the market. For example, USDSEK touched new lows in 2019 and this continued for almost a year.

Source: Riksbank

Bottom line – The Swedish Krona is one of the popular scandinavian currencies to trade. It is a fairly liquid currency and often produced long-lasting trends. Important rates to watch for are against the USD and the Euro (EURSEK). Relative monetary trends in these regions create conditions in which the Krona fluctuates persistently.

Sending money to Sweden FAQ:

The best way to send large amounts of money to Sweden is to use a currency broker.

As well as getting the best exchange rates, if you send money to Sweden with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Swedish Krone (SEK) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of SEK you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better SEK exchange rate than by using your bank.

Our comparison tables and SEK exchange rate quote request forms will help you find the best Swedish Krone exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas SEK exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best SEK exchange rate when sending money to Sweden

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the Swedish Krone exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Sweden a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to Sweden. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Sweden because of the high fees.

The three main ways to send money to Sweden are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Sweden is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the SEK money transfer providers via a non-affiliate link, you can view them directly here: