I’ve used CMC Markets on and off now for 20 years now and it’s typically been my go-to broker for trading forex and equity sectors. I recently gave them another full test with real money and live trades, interviewed their founder, and sat down in the studio with their head of product. In this review, I give my opinion on what CMC Markets is good at, where they let themselves down, and what sort of traders they are appropriate for.

- Overview

- Richard's Review

- Awards

- Video Demo

- Facts & Figures

- Customer Reviews

CMC Markets Review

Name: CMC Markets

Description: CMC Markets is one of the original spread betting and CFD brokers based in the UK. They have been providing forex trading services since 1989 and are now listed on the London Stock Exchange. The broker has over 300,000 active clients trading online and is operated from 13 global offices, with headquarters in The City of London.

67% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets legit?

Yes, CMC Markets has always offered, and still does one of the best trading platforms for high-frequency and active traders. It’s a good choice for those who want to trade on tight spreads, with a platform built on exceptional tech.

Pros

- Excellent trading platform

- Good liquidity

- Unique sentiment tools

Cons

- Trading only, no investing account

- Limited smaller cap stocks

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.6Ratings Explained

- Pricing: They used to be called Deal4Free, but pricing is tight…

- Market Access: CMC mainly focus on the main markets, but still a lot of exotic pairs to trade.

- Platform & Apps: Some of the best trading tech around for active traders.

- Customer Service: London-based support staff (still thankfully, despite all the Brexit pomp).

- Research & Analysis: Top class client sentiment tools that show which way profitable traders are.

Richard’s CMC Markets Review

I remember way back almost 20 years ago when I first had my account, sitting in CMC’s reception eager to pick up a CD-Rom of the Market Maker trading platform so I could trade PA (personal account) when I was a stockbroker at Phillip Securities in the opposite building on Mansell Street.

I used to flit between IG and CMC Markets back then, IG had a few more markets, but the platform was a bit basic. CMC Markets had tighter pricing and because the platform had a dark background, and more flashing lights you felt like a real pro. Despite the fact that CMC’s heritage is in the FX markets, I could never really get the hang of them so I’d trade indices, and FTSE 100 shares (but also because CMC only really did the main market stuff back then).

I could have waited for them to post me a disc, but for some reason, I had a real itch to trade with them right then. Choosing a broker isn’t just about what they offer, it’s how they make you feel.

It is obviously a lot easier to start trading now, but my point is that back then, it was an excellent trading platform, and it still is today…

History Of CMC

CMC was originally set up by its current CEO, Peter Cruddas, as Currency Management Corporation in 1989 after leaving Western Union, where he learned how the foreign exchange markets worked, in particular the market-making side of the business. Originally offering forex trading, then financial spread betting and moving into CFD broking in 2000, CMC began to expand internationally in 2002. CMC Markets was listed on the London Stock Exchange in 2016.

CMC Markets, which is now a member of the FTSE 250 index, currently has over 310,000 active clients globally, and in the 2021-22 financial year, generating a net operating income of £281.9 million.

I haven’t been to their offices for a few years, but the last time I was there was when the brokerage world was switching over from voice to online, CMC were ahead of the curve then and was one of the first forex brokers to invest heavily in technology and have always led the way in online trading platform innovation.

CMC Markets – Spread Betting & CFDs

CMC Markets only offers CFD trading, Rolling Spot Forex, Spread Betting in the UK which are generally short-term speculative products. You can invest in the long term and buy physical shares through CMC Invest in the UK (although in Australia they do offer stockbroking).

If you don’t know what these are you shouldn’t be trading them. But if you do and you want to trade them, CMC Markets is in my view one of the best places to do so. They’ve got a nice new tagline…

Calling all calculated risk takers…

I really like this is it’s the essence of trading really. Yes, trading is risky, but it’s a calculated risk. And one risk you can always reduce is going with a well-established and well-capitalised provider. CMC Markets is a public company so you can see how well they are doing as a business. Trading is hard enough without having to worry if your broker is going to go bust.

CMCX Share Price

The current CMC Markets (LON:CMCX) share price is 236p which is a change of -2 or 0.84% from the last closing price of 236 with 300,954 shares traded giving CMC Markets a market capitalisation of £660,364,344. The most recent daily high has been 237.88 and daily low 231. The CMC Markets share price 52 week high has been 245.5 and the 52 week low 86.9. Based on the most recent CMC Markets share price opening of 236, the current CMC Markets EPS (earnings per share) are 0.04 and the PE (price earnings ratio) is 65.7. Pricing data automatically updates every 15 minutes, last updated: 16/04/2024 17:24.

Although you’re out of luck if you want to trade CMC shares on CMC, I tried when I was demonstrating how to do a pairs trade against it’s main rival IG. I had to trade CMC on IG and IG on CMC.

Market Range

CMC Markets definitely has one of the best market ranges of all the brokers out there. They don’t offer the most shares by a long shot (they offer around 12,000 assets versus IG’s 17,000 or Interactive Brokers epic coverage, but they have some really great markets that are exclusive to them. I’ve always used them for trading the most popular shares, and I would say they are aimed at more active traders than the other platforms. You only really miss out on smaller cap stocks that aren’t appropriate for margin trading anyway, as they are growth investments.

Sector Bets & Diversification

One of the things that I’ve always liked about CMC is its approach to diversification. Everyone knows that you shouldn’t put all your eggs in one basket when it comes to investing, and the same is true of trading. You’ve got a better chance of beating the market consistently if you spread your risk across different asset classes and don’t go crazy Rio trading.

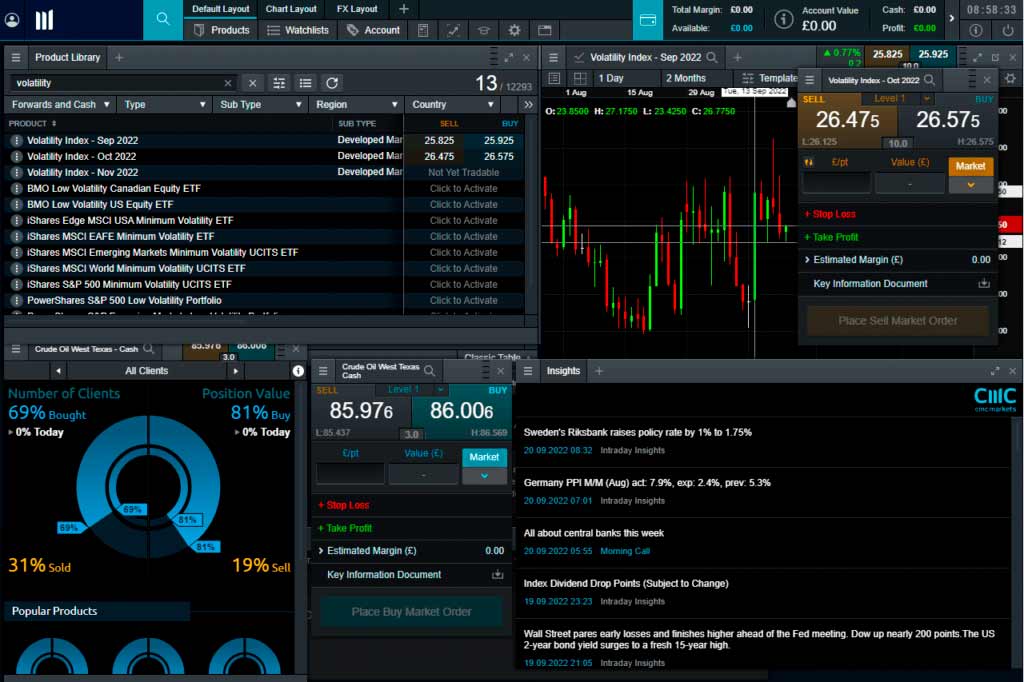

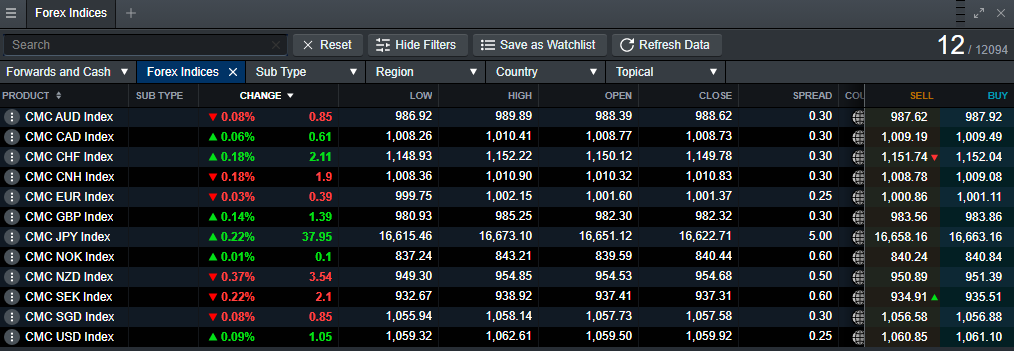

I find forex trading incredibly difficult, I’ve never been able to make any money at it because I can’t judge forex price action, I find it too fast-paced. What I like to speculate on is the overvaluation or undervaluation of one currency against another. CMC has a market called weighted currency indices, which basket together one currency again many others. So you can trade how you think the US Dollar is going to perform against the EUR, GBP, AUD, CAD, CHF, CNH, JPY and SGD in one go. So instead of an outright punt, you are taking on a Dollar position rather than a USDGBP trade.

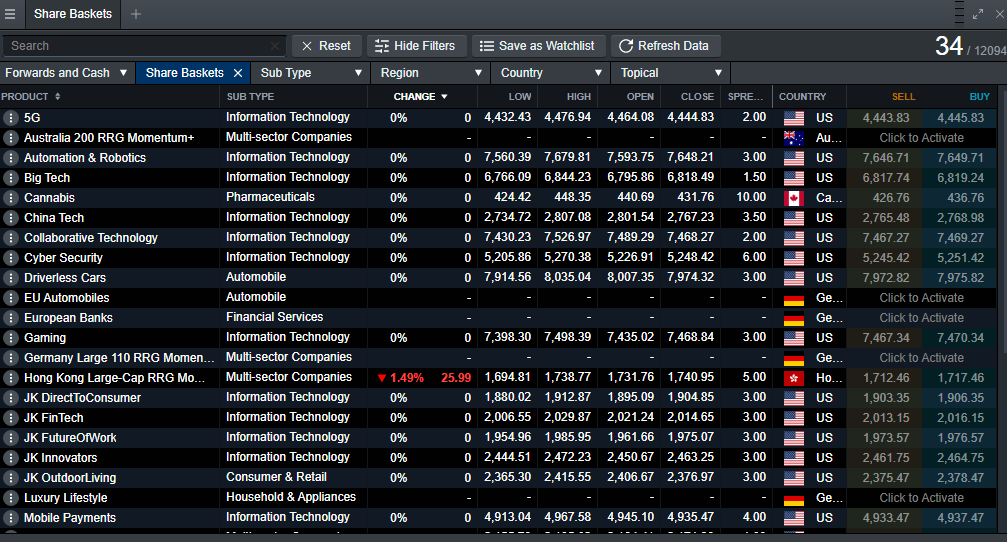

CMC Markets, has always enabled sector bets, but they have fine tuned these over the years because of the proliferation of ETFs into share baskets, like US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology. This is great, because I really like trading stocks, I find it quite easy, compared to forex as they are based on fundamentals I understand. Plus, one trading strategy that is relatively simple is trend following, especially now, with the Reddit generation getting so worked up. If you see a sector getting some good press you can jump on the bandwagon without having to sniff out the individual stocks. Likewise, if sentiment is turning negative, it’s time to go short.

Deal4Free

Did you know that CMC Markets was once called deal4free? You obviously can’t say that anything is free now, because the regulators frown on that sort of thing, instead, you have to say something like “zero commission”, because you are being charged something somewhere, you just don’t see it on your statement.

Trading with CMC Markets is obviously not free, but it is cheap, they have always been one of the best value trading platforms. Primarily because the unashamedly act as a market makers.

If you are spread betting, charges are built into the spread and as the name suggests very competitive. It’s always been one of their appeals that if you are trading the most popular and liquid assets, they are one of the cheapest places to do it. Commission charges on single stock CFDs are set at 2 cents per share in the US and 0.10% for UK and European equities. So you get the choice, if you are a normal trader you can have your costs built into the spread, or if you are one of the bigger boys you can trade CFDs with better pricing and commission charged afterwards.

Alpha & Price Plus

There are two ways to get recognition at CMC. You can either buy your way in with a minimum deposit of £25k and join their Alpha. It’s a nice name because, as I’m sure you know Apha in trading is trying to outperform the market. You get interest on cash balances, discounted spreads and free access to the FT. Or if you can’t afford to buy your way in, you can still get reduced spreads by putting the volume through. The more you trade the lower your spreads will be… Or if you can’t afford that and still want free access to the FT, you just have to copy and paste an FT headline into Google and it’ll get you through the paywall. It’s a trick that everyone knows, which is odd really because if you share an FT login and they see that you are logged in from multiple PCs, the subscription department will give you a quick “courtesy call” to ask what you are doing”.

CMC – Profitable Client Sentiment

CMC offers users access to clients sentiment and positioning tools that show the aggregate positioning of its customers in various instruments. The data includes long-short percentages by clients and value as well as a breakdown of the current day’s order flow. Once again this is broken down by both client percentage and value. What’s more, you can filter the positioning sentiment by client type, segmenting the data into top clients and other clients.

The top clients view shows the positioning, in a particular instrument, of those clients who have made money on their trading account in the last three months, and who have an open position in the instrument under observation.

The ability to filter the sentiment and positioning by client type provides CMC clients with a potential advantage over those of their peers who don’t offer this additional insight.

Positioning and sentiment data can be used to trade though how you use will be determined by your outlook on the markets. Experienced traders take the view that as the majority of CFD and Spread Betting clients lose money it follows that positioning data is a reverse indicator, especially when the clients seem to be opposing an established trend.

Though, in these days of social trading and large crowds that may not always be the case going forward. On balance it’s probably best to think of sentiment and positioning gauges as decision or trade support tools, rather than decision-makers in their own right.

CMC Markets – Education & Analysis

CMC has plenty of education and analysis available for its clients. It’s divided into three separate sections: current news and analysis which does exactly what it says on the tin, a learn to trade section that covers FX, CFDs, Spread Betting and equities trading.

As well as technical analysis, trading from home and trading strategies.

CMC also offers what it calls market intelligence through its specialist website OPTO, which includes a magazine full of insightful articles, plus podcasts, and interviews with high-profile guests from the markets.

The trading guides are aimed at beginners and less experienced traders whereas OPTO is for more experienced traders who are looking for fresh ideas and inspiration. News and analysis from CMC’s in-house analysis team sits comfortably between the two, and as we noted earlier, there is also an online moderated charting community within the trading platform.

All of this is available at no additional charge and much of it is available to the public as well as CMC clients. Many of the major providers have a general education program and support their traders with news and in house analysis. However, OPTO stands out from the crowd and to my mind, this elevates the CMC offering above the competition.

CMC Markets will shortly be offering an investment option with CMC Invest.

Institutional Prime Services

Recently rebranded to CMC Connect the institutional side of the business is where CMC expects to grow the business over the next five or ten years. The company has high profile joint ventures such as the stockbroking services it provides to the clients of ANZ Bank. Alongside these partnerships, it offers institutional liquidity, outsourced trading technology and connectivity, as well as pre and post-trade processing and trade reporting.

These services are aimed at institutional customers such as hedge funds, family offices and prop traders. HNWI and the most active professional clients might be able to utilise some of CMC Connect’s services but the division is really aimed at corporate customers and funds.

CMC competes with all of the large-scale margin trading brokerages in the CFD, FX and Spread Betting arenas. It’s also making inroads into the institutional and B2B spaces through liquidity provision, white labels, and JVs. That push on the institutional side and the firm’s focus on in-house trading technology, and the use of currency and share baskets, are the key differentiators from their competitors.

CMC Markets Awards

CMC recently won “best forex broker” in our 2023 awards.@good_money_guide Who is the top Forex broker? Check out the Good Money Guide Awards for the best trading platforms and brokers in the market. From shares to stocks, find the perfect broker to suit your trading needs. #GoodMoneyGuide #trading #stocks #broker ♬ original sound – Good Money Guide

Video Review Of CMC Markets

Watch as we trade live on the CMC Markets trading platform and highlight some of the features unique to them.

Facts & Figures

CMC Markets Total Markets | 12,000 |

| ➡️Forex Pairs | 338 |

| ➡️Commodities | 124 |

| ➡️Indices | 82 |

| ➡️UK Stocks | 745 |

| ➡️US Stocks | 4968 |

| ➡️ETFs | 1084 |

CMC Markets Key Info | |

| 👉Number Active Clients | Over 308,600 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | £10 per month |

| 📅Founded | 1989 |

| ℹ️ Public Company | ✔️ |

CMC Markets Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

CMC Markets Average Costs | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1.2 |

| ➡️DJIA | 2 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.7 |

| ➡️GBPUSD | 0.9 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.3 |

| ➡️Crude Oil | 2.5 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | $0.02 per share |

CMC Markets Customer Reviews

Tell us what you think:

67% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets FAQs

Yes. CMC Markets is allows scalping as it’s low costs and liquidity make high frequency trading possible on their platform.

CMC Markets makes money by widening the bid/ask spreads offered to clients, commission and overnight funding and running a B-book.

In 2023, CMC Markets made £233 million from spread betting and CFDs and just under £40 million from stock broking. CMC also benefited from high-interest rates and earned nearly £14 million from interest on client balances.

Yes, CMC Markets is a market maker as well as a broker so they make money from hedging. This is one of the reasons they are able to offer such tight pricing for clients. CMC Markets also provides market making liquidty for smaller brokers.

Yes. CMC Markets offers discount pricing, unique indices, innovative platform, well-established, pioneering, safe (in relative terms), staff always seem to know what they are talking about too.

Yes. CMC offers guaranteed stop-loss orders for which it charges users a premium, however, if that GSLO is not triggered, then the premium you paid is refunded.

Overall yes. Funds are protected by the FSCS as CMC Markets is regulated by the FCA in the UK which ensures that firms treat their customers fairly and have enough money to operate. You can also track the financial health of CMC Markets by looking at their share price on the London Stock Exchange.

I would say that CMC Markets is good for beginner traders if you already have a firm understanding of how the financial markets work. But, if you are brand new to trading you may find the trading platform a bit complex and be more suitable to a broker that offers a mix of trading and investing like eToro.

You cannot set your own leverage on CMC Markets and it is always set to maximum as a retail trader. You can increase your margin and leverage limits if you upgrade your account to “professional trader status”. If you want to set your own leverage as an active trader, Interactive Brokers offer this facility.

You cannot buy shares on CMC Markets, you can only go long (the equivalent of buying) or short (selling) through CFDs or financial spread bets.

If you want to buy physical shares your only option with CMC Markets is to open an account with CMC Invest, which is their sister investment app for longer-term investing.

67% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.