CMC Markets Customer Reviews

Tell us what you think of this provider.

3/5

3/5

Pros:

app look nice, also first broker i opened an account with

Cons:

no thoughts

2/5

Pros:

Nothing

Aaron Parsons @ 10/09/2020 05:44

Their online trading platform has MAJOR KNOWN ISSUES as admitted to me via email and experienced first hand.

It leads to day trades not automatically cancelling and releasing your money and your money being held until you complain and force them to fix it.

This has cost me a full night and half a days trading, not to mention hours of my time trying to have the trades cleared and funds returned for use.

Also, your stock holdings vanish from your account summary from time to time for no apparent reason.

Their customer service ÔÇ£teamÔÇØ are a complete joke. No-one can do anything except take a message. They have no after hours support of any kind even though they allow customers to trade 24/7 on world wide markets.

This is simply not good enough from a Stock Broker, and I will be ensuring the AFCA and ASX know about it.

Eze Kenechukwu Daniel @ 08/15/2020 03:07

Is amazingly awasome

2/5

4/5

2/5

5/5

5/5

3/5

4/5

4/5

3/5

3/5

5/5

3/5

5/5

4/5

3/5

CMC Markets Expert Review

CMC Markets Review: Great Tech for Active Traders

Provider: CMC Markets

Verdict: CMC Markets is one of the best and fastest trading platforms available for active traders to speculate on the most popular markets. The company is one of the original spread betting and CFD brokers based in the UK. It’s been providing forex trading services since 1989 and is now listed on the London Stock Exchange. The broker has over 300,000 active clients trading online and is operated from 13 global offices, with headquarters in the City of London.

67% of retail investor accounts lose money when trading CFDs with this provider

Is CMC Markets a Good Broker?

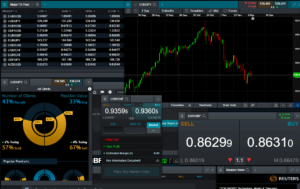

Yes, CMC Markets has always offered, and still offers, one of the best trading platforms for high-frequency and active traders. It’s a good choice for those who want to trade on tight spreads, with a platform built on exceptional tech.

I’ve used CMC Markets for 20 years now and it’s typically been my go-to broker for trading forex and equity sectors.

I recently gave it another full test with real money and live trades. I’ve also interviewed its founder and its head of product. In this review, I share my views on what CMC Markets is good at, where it needs to improve and which types of trader it suits.

Almost 20 years ago, when I first had my account, I remember sitting in CMC’s reception, eager to pick up a CD-ROM of the Market Maker trading platform so I could trade personal account when I was a stockbroker at Phillip Securities.

I used to flit between using IG and CMC Markets back then. IG had a few more markets, but the platform was a bit basic. CMC Markets had tighter pricing and because the platform had a dark background, and more flashing lights you felt like a real pro. Despite the fact that CMC’s heritage is in the FX markets, I could never really get the hang of those so I’d trade indices, and FTSE 100 shares (also, CMC only really did the main market stuff back then).

I could have waited for CMC to post me a disc, but I had a real itch to try it out. It was an excellent trading platform then, and it still is today.

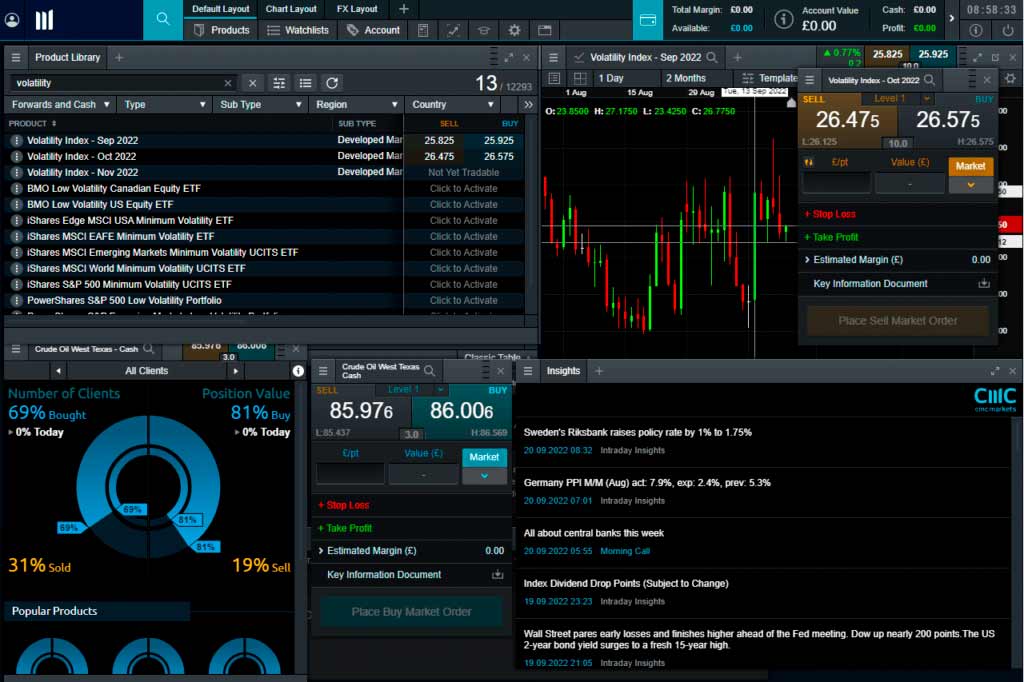

What Does the Platform Look Like?

History Of CMC

The current CEO, Peter Cruddas, set up CMC as Currency Management Corporation in 1989 after leaving Western Union, where he learned how the foreign exchange markets worked, in particular the market-making side of the business. Originally offering forex trading, then financial spread betting and moving into CFD broking in 2000, CMC began to expand internationally in 2002. CMC Markets was listed on the London Stock Exchange in 2016.

CMC Markets, which is now a member of the FTSE 250 index, has over 310,000 active clients globally, and in the 2023-24 financial year generated a net operating income of £332.8 million.

When I visited the CMC offices a few years ago, the brokerage world was switching from voice to online. CMC was one of the first forex brokers to invest heavily in technology and has always led the way in online trading platform innovation.

CMC Markets: Spread Betting & CFDs

CMC Markets only offers CFD trading, rolling spot forex and spread betting in the UK. These are generally short-term speculative products. You can invest in the long term and buy physical shares through CMC Invest in the UK (although in Australia CMC Markets does offer stockbroking).

If you don’t know what these are you shouldn’t be trading them. But if you do and you want to trade them, CMC Markets is in my view one of the best places to do so. In 2024, the platform came up with a nice tagline…

Calling all calculated risk takers…

This is the essence of trading, really. Yes, trading is risky, but it’s a calculated risk. And one way to reduce risk is to go with a well-established and well-capitalised provider. CMC Markets is a public company so you can see how well it’s doing as a business. Trading is hard enough without having to worry if your broker is going to go bust. In the UK, retail client money is held in segregated client bank accounts, in a regulated bank.

CMCX Share Price

The current CMC Markets (LON:CMCX) share price is 312p which is a change of 0.5 or 0.16% from the last closing price of 312.5 with 479,693 shares traded giving CMC Markets a market capitalisation of £873,024,048. The most recent daily high has been 326 and daily low 309. The CMC Markets share price 52 week high has been 326.06 and the 52 week low 183.4. Based on the most recent CMC Markets share price opening of 312, the current CMC Markets EPS (earnings per share) are 0.23 and the PE (price earnings ratio) is 13.52. Pricing data automatically updates every 15 minutes, last updated: 17:05 12-Jan-2026.

Although you’re out of luck if you want to trade CMC shares on CMC, I tried when I was demonstrating how to do a pairs trade against its main rival IG. I had to trade CMC on IG and IG on CMC.

Market Range

CMC Markets definitely has one of the best market ranges of all brokers. Although it doesn’t offer all shares – around 12,000 assets vs IG’s 17,000 or Interactive Brokers’ epic coverage – it has some really great markets that are exclusive to CMC. I’ve always used it for trading the most popular shares, and I would say it’s aimed at active traders more than its rivals. You only really miss out on smaller cap stocks that aren’t appropriate for margin trading anyway, as they are growth investments.

CMC Markets Sector Bets & Diversification

One of the things that I’ve always liked about CMC is its approach to diversification. Everyone knows that you shouldn’t put all your eggs in one basket when it comes to investing, and the same is true of trading. You’ve got a better chance of beating the market consistently if you spread your risk across different asset classes and don’t go crazy Rio trading.

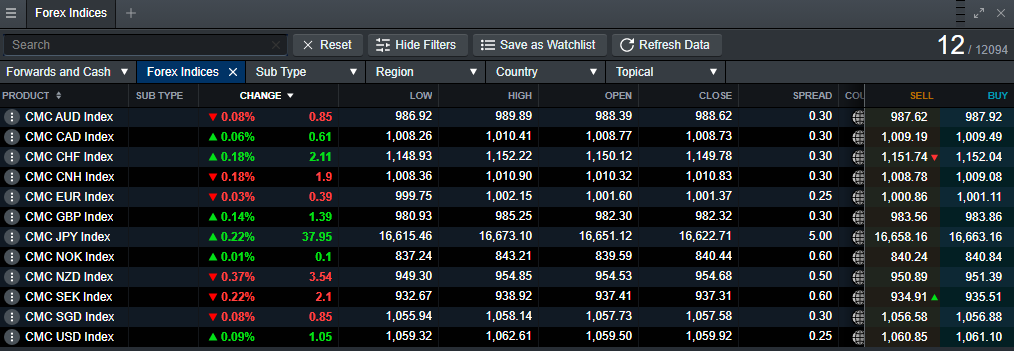

I find forex trading incredibly difficult. I’ve never been able to make any money at it because I can’t judge forex price action – I find it too fast-paced. What I like to speculate on is the overvaluation or undervaluation of one currency against another.

CMC has a market called weighted currency indices, which basket together one currency against many others. So you can trade how you think USD is going to perform against the EUR, GBP, AUD, CAD, CHF, CNH, JPY and SGD in one go. So instead of an outright punt, you are taking on a dollar position rather than a USD-GBP trade.

What Does the Forex Section Look Like?

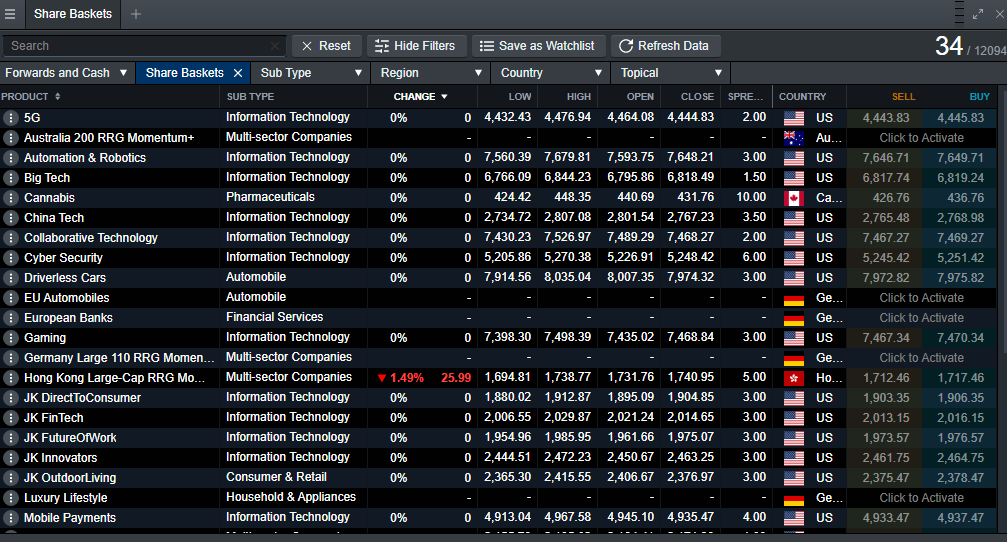

Share Baskets

CMC Markets has always enabled sector bets, but it has fine-tuned these over the years because of the proliferation of ETFs into share baskets, like US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology. This is great, because I really like trading stocks. I find this quite easy compared to forex as stocks are based on fundamentals I understand.

One trading strategy that is relatively simple is trend following, especially now with the Reddit generation getting so worked up. If you see a sector getting some good press you can jump on the bandwagon without having to sniff out the individual stocks. Likewise, if sentiment is turning negative, it may be time to go short.

Deal4Free

Did you know that CMC Markets was once called Deal4Free? You obviously can’t say that anything is free now, because the regulators frown on that sort of thing. Instead, you have to say something like “zero commission”, because you’re being charged something somewhere – you just don’t see it on your statement.

Trading with CMC Markets is obviously not free, but it is cheap. It has always been one of the best value trading platforms, primarily because it unashamedly acts as a market maker.

If you are spread betting, charges are built into the spread and are competitive. It’s always been part of the appeal that if you are trading the most popular and liquid assets, CMC is one of the cheapest places to do it. Commission charges on single stock CFDs are set at 2 cents per share in the US (minimum $10) and 0.10% for UK and European equities (minimum of £9/€9). So you get the choice. If you are a normal trader you can have your costs built into the spread, or if you are one of the bigger boys you can trade CFDs with better pricing and commission charged afterwards.

Alpha & Price Plus

There are two ways to get recognition at CMC. Firstly, you can buy your way in with a minimum deposit of £25,000 and join its premium membership, Alpha. It’s a nice name because, as I’m sure you know, an alpha in trading is trying to outperform the market. You get interest on cash balances and discounted spreads. There’s also a free subscription – it was to the FT but is now to Bloomberg.

If you can’t afford to buy your way in, you can still get reduced spreads by putting the volume through. The more you trade the lower your spreads will be…

CMC: Profitable Client Sentiment

CMC offers users access to client sentiment and positioning tools that show the aggregate positioning of its customers in various instruments. The data includes long-short percentages by clients and value as well as a breakdown of the current day’s order flow. Once again, this is broken down by both client percentage and value. What’s more, you can filter the positioning sentiment by client type, segmenting the data into top clients and other clients.

The top clients view shows the positioning, in a particular instrument, of those clients who have made money on their trading account in the last 3 months, and who have an open position in the instrument under observation.

The ability to filter the sentiment and positioning by client type gives CMC clients a potential advantage over peers who don’t get this additional insight.

Positioning and sentiment data can be used to trade, though how you use it will be determined by your outlook on the markets. Experienced traders take the view that as the majority of CFD and spread betting clients lose money it follows that positioning data is a reverse indicator, especially when the clients seem to be opposing an established trend.

In these days of social trading and large crowds, however, that may not always be the case. On balance it’s probably best to think of sentiment and positioning gauges as decision or trade support tools, rather than decision-makers in their own right.

CMC Markets: Education & Analysis

CMC has plenty of education and analysis available for its clients. It’s divided into separate sections: current news and analysis, a section on learning to trade that covers FX, CFDs and spread betting, and equities trading.

As well as technical analysis, CMC offers trading from home and trading strategies.

CMC Markets also offers what it calls market intelligence through its specialist website OPTO, which includes a magazine full of insightful articles, plus podcasts, and interviews with high-profile guests from the markets.

The trading guides are aimed at beginners and less experienced traders whereas OPTO is for more experienced traders who are looking for fresh ideas and inspiration. News and analysis from CMC’s in-house analysis team sits comfortably between them, and as we noted earlier, there is also an online moderated charting community within the trading platform.

All of this is available at no additional charge and much of it is available to the public as well as CMC clients. Many of the major providers have a general education program and support their traders with news and in-house analysis. But OPTO stands out from the crowd and, to my mind, this elevates the CMC offering above the competition.

CMC Markets offers an investment option with CMC Invest.

Institutional Prime Services (CMC Connect)

Recently rebranded to CMC Connect, the institutional side of the business is where CMC expects to grow over the next 5 to 10 years. The company has high profile joint ventures such as the stockbroking services it provides to the clients of ANZ Bank. Alongside these partnerships, it offers institutional liquidity, outsourced trading technology and connectivity, as well as pre and post-trade processing and trade reporting.

These services are aimed at institutional customers such as hedge funds, family offices and prop traders. HNWI and the most active professional clients might be able to use some of CMC Connect’s services but the division is really aimed at corporate customers and funds.

CMC competes with all of the large-scale margin trading brokerages in the CFD, FX and spread betting arenas. It’s also making inroads into the institutional and B2B spaces through liquidity provision, white labels, and JVs. That push on the institutional side and the firm’s focus on in-house trading technology, and the use of currency and share baskets, are the key differentiators from its competitors.

CMC Markets Review Ratings Explained

- Pricing. It used to be called Deal4Free, and pricing is still good…

- Market Access. CMC focuses on the main markets, but still offers many exotic pairs to trade

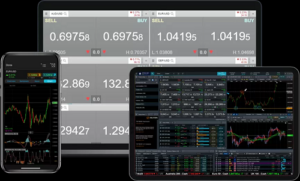

- Platform & Apps. CMC Markets has some of the best trading tech around for active traders

- Customer Service. London-based support staff (still thankfully, despite all the Brexit pomp)

- Research & Analysis. Top class client sentiment tools

Pros

- Excellent trading platform

- Good liquidity

- Unique sentiment tools

Cons

- Trading only (investing is on CMC Invest)

- Limited smaller cap stocks

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.6CMC Markets Awards

CMC recently won ‘Best Forex Broker’ in the Good Money Guide’s 2023 awards.

@good_money_guide Who is the top Forex broker? Check out the Good Money Guide Awards for the best trading platforms and brokers in the market. From shares to stocks, find the perfect broker to suit your trading needs. #GoodMoneyGuide #trading #stocks #broker ♬ original sound – Good Money Guide

Video Review Of CMC Markets

Watch as we trade live on the CMC Markets trading platform and highlight some of the features unique to them.

CMC Markets Facts & Figures

CMC Markets Total Markets | 12,000 |

| ➡️Forex Pairs | 338 |

| ➡️Commodities | 124 |

| ➡️Indices | 82 |

| ➡️UK Stocks | 745 |

| ➡️US Stocks | 4968 |

| ➡️ETFs | 1084 |

CMC Markets Key Info | |

| 👉Number Active Clients | Over 308,600 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | £10 per month |

| 📅Founded | 1989 |

| ℹ️ Public Company | ✔️ |

| 🏢 Head Office | London, UK |

CMC Markets Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

CMC Markets Average Costs | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1.2 |

| ➡️DJIA | 2 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.7 |

| ➡️GBPUSD | 0.9 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.3 |

| ➡️Crude Oil | 2.5 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | $0.02 per share |

Is CFD trading allowed with CMC Markets in the UAE?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC Markets Forex Trading Platform Review

I think CMC Markets is an excellent platform for forex traders. CMC was originally called Currency Management Corporation so its roots are deeply embedded in forex trading. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning

CMC Markets MT4 Review

Compare CMC Markets against other MT4 trading platforms below: Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as

CMC Markets Options Trading Expert Review

Robin AmosRobin has more than six years of experience as a financial journalist, most of which were spent at Citywire, and covers the latest developments in the investing, trading and currency transfer space. Outside of work, he enjoys reading literature and philosophy and playing the piano. You can contact Robin at robin@goodmoneyguide.com You may also

CMC Markets Trading App Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC Markets trading platform adds 24/5 out-of hours trading on 67 US shares

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC Markets Launches 24/7 Crypto Trading – But Not Yet for UK Retail Clients

CMC Markets has launched 24/7 cryptocurrency CFD trading as part of a strategic push into Web 3.0 and decentralised finance (DeFi), marking a major milestone in the company’s evolution. However, due to regulatory restrictions, UK retail clients will not yet have access to these crypto products. The FTSE 250-listed trading platform announced the move alongside

CMC Markets Launches 24/7 Cryptocurrency CFD Trading In Australia

CMC Markets has launched round-the-clock cryptocurrency CFD trading in Australia and other eligible regions. The service went live for the first time over the weekend. 24/7Crypto CFD trading is available to CMC clients in Australia. This means that clients who trade through CMC Markets’ Australia-regulated entity will now have access to continuous crypto CFD trading

CMC Markets Australian Expert Review

Tina TengTina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of

Can you trust CMC Markets for forex trading in the UAE?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC Markets extended hours trading comes to over 80 US stocks

CMC Markets has extended its trading hours on more than 80 US stocks. Users of the platform will now be able to trade these stocks from 9am until 9pm UK time, from 10 February 2025. This means they can trade in the pre-market session before the New York Stock Exchange and Nasdaq open at 2:30pm

CMC Markets extends trading hours for “Magnificent Seven” stocks

CMC Markets has extended its trading hours specifically for the “Magnificent Seven” US mega-cap tech stocks. From 27 January customers of the platform will be able to trade Google Parent Alphabet, Amazon, Apple, Facebook owner Meta, Microsoft, Nvidia and Tesla from 9am to 9pm UK time. This means CMC Markets’ UK customers will be able

CMC Markets demo trading account lest you trade with £10k virtual funds

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC Markets Spread Betting Gives Clues From Client Sentiment

In this expert review, we test CMC Markets with some live trades using real funds and explain if it is a good spread betting broker for those who want to trade with tax-free profits in the UK. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original

CMC Markets CFD Trading Expert Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

CMC CapX secondary funding service touts SpaceX and Klarna

Access to CMC CapX secondary funding is set to allow clients of the platform to invest in big name private companies, the capital raising service has stated in a recent update. Professional clients of CMC Markets‘ CapX service are expected to be able to invest in household names such as Elon Musk’s spacecraft manufacturer SpaceX

CMC Markets’ profit surges after Revolut onboarding

CMC Markets’ profit shot up to an estimated £51 million in the first half of the 2025 financial year, or the six months to the end of September, from a loss in the same period of the year before. In an unaudited trading update, the firm stated that the gains were driven by “sustained levels

CMC Markets posts dissapointing earnings

Multi-asset broker and would-be fintech CMC Markets announced a loss in its recent interim figures What did the interim earnings contain? CMC Markets the margin trading and investing business founded by Lord Peter Cruddas, recently announced interim results for the period ending September 2023. The numbers showed a sharp fall in net operating income compared

Can you trade commodities with CMC Markets?

Yes, CMC Markets has a very good commodities trading offering, with lots of spot and forward contracts. But you cannot trade on exchange commodities with DMA, instead, you have to trade them as a CFD or spread bet. CMC Markets lets you spread bet and trade commodity CFDs and with leverage on 100+ instruments. Commodity

Why does CMC Markets not call indices by their proper name?

Stock exchange and index owners charge a lot of money to use their trademarked names, so it’s cheaper for brokers to quote OTC prices with a descriptive name. CMC Markets Indices Trading CMC Markets lets you trade on over 80 cash and forward global indices based on the FTSE 100 and more, with leverage, on

Which trading platform is best, CMC Markets or City Index?

Looking at the data in our broker matrix we find that City Index offers the most trading instruments with 12,000 available to its customers versus just 9300 offered at CMC Markets. When we look at trading costs City Index edges ahead of CMC Markets as far as average FX spreads are concerned. In commodity markets,

CMC Markets adds open banking to its funding options

CMC Markets has introduced open banking payments in partnership with TrueLayer, a well-established FCA-regulated open banking services provider as an option for clients to deposit funds on account. By using open banking payments clients can quickly transfer funds without needing to remember passwords and bank account details instead they can simply use biometric data like

CMC Markets invests in StrikeX to access blockchain solutions

CMC Markets the margin trading and multi-asset investing platform, has taken another step towards its goal of becoming a diversified Fintech, by acquiring a 33% stake in Strikex Technologies, a customer-focused blockchain solutions business. CMC Markets has acquired a 33.0% stake in StrikeX, however, neither company has disclosed any financial details about the transaction. Though

CMC Markets FX Active – 0.0 pip spreads for active forex traders

CMC Markets has launched a FX Active account which it hopes will put it at the forefront of an increasingly competitive forex trading space where customers can save between 5% to 28.6% on spreads. What is CMC Markets FX Active? CMC Markets’ new FX account is called FX Active or Forex Active Trader, and it’s

CMC Markets full year 2022 earnings fall short of the mark

CMC Markets has published results for the year ending 31 March 2022 What did the CMC Markets earnings release tell us about the company’s performance? The full-year numbers show a sharp decline in net operating income, which fell by -31.0% to £281.90 million. Down from last year’s £409.80 million, reflecting the slowdown in activity that

CMC Markets launches a share buyback ahead of potential investment and trading arm split

CMC Markets the CFD broker and forex trading platform announced its intention to buy its own stock in the market, with an RNS announcement on March 2nd, and it will spend up to £30 million on the purchase of CMC Markets stock which trades in London under the ticker CMCX. In its inaugural trade, on

CMC Markets Alpha – what is it and is it worth it?

CMC Markets has launched a new Alpha initiative for active clients and with reduced spreads and perks for high volume traders. What is CMC Markets Alpha? CMC has launched Alpha a sort of members club for traders. Membership comes with a number of benefits that are designed to allow clients, to get more out of

CMC Markets (LON: CMCX) 2021 interim results fail to inspire confidence

CMC Markets published its interim results today and they contained few positive surprises What did the CMC Markets results contain? The figures covered trading up until the end of September this year and were broadly in line with the details released in the company’s pre-close trading update on October 7th. Net operating income came in

CMC Markets considers a breakup to separate trading and investing

CMC Markets is considering dividing itself into two separate companies. In an RNS announcement the company confirmed that it is evaluating whether or not to divide the business into two separately managed entities. One which would contain the margin trading operations of CFDs and Spread Betting. And another entity that would host the technology assets

CMC Markets share price lower as the platform goes more FinTech than broker

CMC Markets share price news The CMC Markets share price trades 2% lower as we ponder, could CMC Markets transform into the next Ocado? Readers may recall that CMC Markets published a trading update back on September 7th the announcement was unexpected and it amounted to a profits warning. Never nice but not the end

CMC Markets increases focus on longer-term investment products

Margin Trading and Spread Betting broker CMC Markets recently announced an acquisition. It is buying the share trading business, it has run in conjunction with Australia’s ANZ bank, for several years. CMC Markets provided online share dealing and investment services to the clients of ANZ, through a white-labelled technology partnership. CMC Markets will now assume

CMC Markets warns on profits as client activity dips

CFD trading platform CMC Markets announced an unscheduled trading update today that amounted to a profits warning. Management reported what it called subdued activity in July and August which followed on from a reduction in activity during Q1. The firm noted that reduced market volatility had resulted in lower client trading activity and that in

CMC Markets updates investors with positive surprises

As one of London’s leading margin trading houses CMC Markets is never too far from the headlines and never more so than when it’s updating the markets on trading performance or with its results as it did this morning. The company posted its pre-close period trading update back on the 25th of March in which

CMC Markets leverages the opportunities seen in H1 2021

CMC Markets posted a trading update for the 6 months until the end of September 2020 this week. Which provided an insight as to whether or not the boost in turnover and clients numbers seen in the spring had continued across the summer and into the autumn. CFD trading revenues rose by +135% over those

CMC Markets full-year figures (ending March 2020) buck the coronavirus

CFD trading and Spread Betting broker CMC Markets announced full-year figures on Thursday for the period ending the 31st of March 2020, and they made for impressive reading. Net operating income for the group reached 252.0 million up from just £130.80 in full-year 2019 and CMC’s pretax profits jumped to £98.70 million compared to just £6.30

CMC Markets adds US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology new share baskets

Spread betting broker CMC Markets has added four options to it’s share basket offering: US Gold, Oil & Gas, Luxury Lifestyle and Collaborative Technology The CMC Markets share baskets are a little like sector indices and allow you to trade a basket of stocks in one go so you get exposure to an industry or

CMC Markets launches another Artful Trader podcast series

CMC Markets starts the New Year with the launch of a series of high-profile Artful Trader podcasts A while ago we were a little rude about CMC’s Alexa app. Not their fault, it’s voice recognition devices in general. There are just some things they are not appropriate for. But nevermind, they seem to be back

CMC Markets publish a confident H1 2020 trading update

CMC Markets provided investors with an update yesterday, in the shape of its pre-close trading statement. Apparently it’s not all doom and gloom in the margin trading world. Recently IG posted a positive update, and now CMC Markets’ pre-close statement was pretty upbeat and contained some positive guidance. This is the last chance to look

CMC Markets reduces the margins on government bond spread betting & CFD trading

CMC Markets has decided to sharply reduce the levels of margin required on government bond contracts traded through it, a move that goes against the regulatory grain as it were. CMC Markets‘ reduction in margin levels are quite substantial with deposit levels falling from 20% of the trade value to just 3.30% on a wide

CMC Markets Launches Energy, Agricultural, Precious Metals & Commodity Indices

CMC Markets have launched a series of indices for spread bet and CFD traders to speculate on. The indices cover the energy, agriculture, precious metals, and commodities sectors. Sector trading is especially good for spread betting and CFD arbitrage when you think the market will move one way, but a particular section will out or

CMC Markets Tops Customer Satisfaction

CMC Markets is the trader’s favourite spread betting platform when it comes to customer service – that’s according to a new report into the investment industry. The annual Investment Trends Report for the leveraged trading industry has been surveying customer perceptions of the leading platforms for the past ten years. It assesses each of the

Peter Cruddas, CEO of CMC Markets on why he’s still running and improving the broker he founded nearly 30 years ago…

With the recent addition of DMA equity trading through CMC’s Prime Derivatives offering, we hear from Peter Cruddas on what makes CMC Markets appealing to larger traders, what keeps him involved on a day to day basis, his top resources for traders and what’s in store for CMC’s future. You’re one of the only pioneers

CMC Markets new TV adverts and the “Power of Moments”

CMC Markets has a bright new TV advert which reminds us all about how the big moments in history can shape the markets. CMC markets has been reminding us all of the power of moments with their latest TV advert. However, they are having a bit of a moment of their own with some disappointing

CMC Markets add DMA Equity CFDs to it’s Prime Derivatives offering

CMC Markets strengthens its offering for institutional clients with the launch of Prime Derivatives and DMA equity CFDs. Derivatives broker CMC Markets has announced the launch of a new institutional offering, Prime Derivatives. It’s a move which expands its institutional offering to include single stock CFD trading. The launch follows on from last year’s launch

CMC Markets set to embrace MT4

CMC announces an abrupt change of plan as it introduces MT4 and 5 trading solutions. From a tech geek’s point of view it’s a bit like Dylan going electric. CMC Markets has been famously dismissive of MT4 and 5, but all that appears to be changing. Among other things, its recently released financial report for

CMC Markets invites professionals to trade Bitcoin & Ether cryptocurrencies

CMC Markets, one of the largest publicly listed spread betting and CFD brokers has launched Bitcoin and Ethereum trading exclusively for professional clients. Please note that since this article was written the FCA has banned retail traders from trading cryptocurrency derivatives. If you would like to speculate on Bitcoin and cryptocurrencies you need to use

60% profit jump for CMC Markets precludes likely spread betting clampdown

CMC Markets is one of the biggest online spread betting brokers in the UK, and it posted a healthy rise in profits for its first half as work to target wealthier customers paid dividends. But its short-term outlook is more conservative as a regulatory crackdown is expected to hit the industry. In the 6 months

CMC Markets launches API Direct to give brokers and institutions better access

CMC Markets one of the leading CFD and spread betting brokers has launched a new product to compliment it’s recent Prime Brokerage FX institutional offering. API will allow institutions to provide their clients with CMC’s multi-asset coverage. The CMC Markets API includes: Over 80 index, commodity and treasury CFDs, plus more than 300 FX pairs

2016 Investment Trends Report shows IG and CMC Markets lead the way in terms of CFD and forex trading

Investment Trends, the leading brokerage research house has published its list of the best spread betting brokers, based on in-depth analysis. Investment Trends’ 2016 UK Leverage Trading Report is based on a survey of more than 12,000 UK investors and has revealed that IG and CMC Markets lead the way with investors. According to the

CMC Markets launches Knock-Out CFDs in Europe

CMC Markets, one of the top CFD brokers in Europe has launched a brand new offering to its German and Austrian customers. CMC Markets has expanded its product choices with the roll-out of Knock-Out CFDs in Germany and Austria, allowing clients to trade Knock-Outs in an easy and customisable way via their Next Generation platform.

CMC Markets Share Price (CMCX): Numis forecasts 280.

CMC Markets, one of the largest CFD brokers in the UK and the most recent to float on the London Stock exchange show it’s share price drop a little (it’s generally quite volatile) down to 272 (14:00 17th June) after corporate broker Numis initiated converge with a hold rating and price target of 280p. Since CMC markets

CMC Markets are offering a £2,000 Flight Centre voucher

The annual Investment Trends survey is here and top CFD broker CMC Markets are offering a £2,000 as a prize for taking part. In appreciation for your time, you will be eligible for entry into the Investment Trends draw* which contains a first prize of a Flight Centre gift card valued at £2,000 and two runner-up

CMC Markets FAQs

Yes. CMC Markets is allows scalping as it’s low costs and liquidity make high frequency trading possible on their platform.

CMC Markets makes money by widening the bid/ask spreads offered to clients, commission and overnight funding and running a B-book.

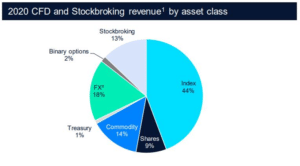

In 2023, CMC Markets made £233 million from spread betting and CFDs and just under £40 million from stock broking. CMC also benefited from high-interest rates and earned nearly £14 million from interest on client balances.

Yes, CMC Markets is a market maker as well as a broker so they make money from hedging. This is one of the reasons they are able to offer such tight pricing for clients. CMC Markets also provides market making liquidty for smaller brokers.

Yes. CMC Markets offers discount pricing, unique indices, innovative platform, well-established, pioneering, safe (in relative terms), staff always seem to know what they are talking about too.

Yes. CMC offers guaranteed stop-loss orders for which it charges users a premium, however, if that GSLO is not triggered, then the premium you paid is refunded.

Overall yes. Funds are protected by the FSCS as CMC Markets is regulated by the FCA in the UK which ensures that firms treat their customers fairly and have enough money to operate. You can also track the financial health of CMC Markets by looking at their share price on the London Stock Exchange.

I would say that CMC Markets is good for beginner traders if you already have a firm understanding of how the financial markets work. But, if you are brand new to trading you may find the trading platform a bit complex and be more suitable to a broker that offers a mix of trading and investing like eToro.

You cannot set your own leverage on CMC Markets and it is always set to maximum as a retail trader. You can increase your margin and leverage limits if you upgrade your account to “professional trader status”. If you want to set your own leverage as an active trader, Interactive Brokers offer this facility.

You cannot buy shares on CMC Markets, you can only go long (the equivalent of buying) or short (selling) through CFDs or financial spread bets.

If you want to buy physical shares your only option with CMC Markets is to open an account with CMC Invest, which is their sister investment app for longer-term investing.

67% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.