CMC Markets has a bright new TV advert which reminds us all about how the big moments in history can shape the markets.

CMC markets has been reminding us all of the power of moments with their latest TV advert. However, they are having a bit of a moment of their own with some disappointing revenue reports.

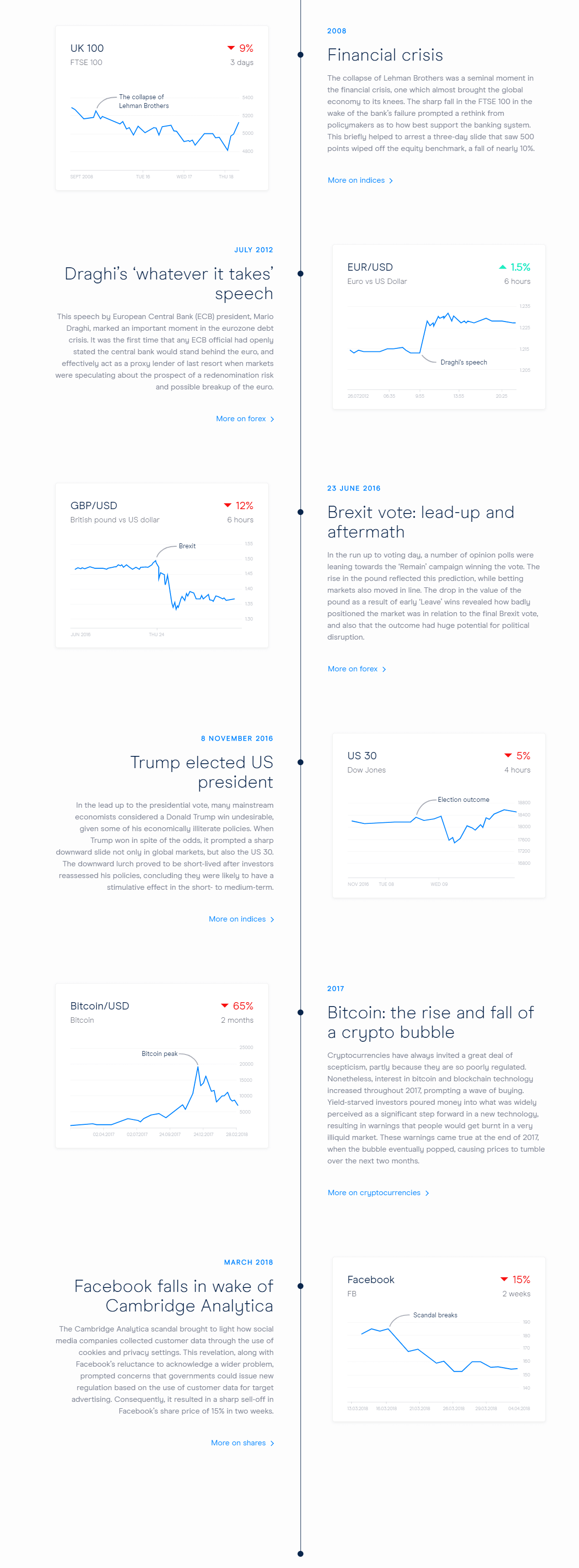

First let’s look at the ad – a quick trot through some stock footage of the last four decades including Ronald Reagan’s plea to Mikhail Gorbachev, the collapse of Lehman’s, 9/11 and Britain leaving the EU. As the advert said: these are moments which break boundaries, sink the unsinkable and divide opinion. They all, in their own ways, sent markets haywire.

The collapse of Lehman’s, for example, prompted a crisis in global markets and a dramatic shift in economic policy as governments stepped in to save the banks. Fresh regulations meant the financial sector would have to embrace a host of changes in the post 2008 world.

Similarly, Mario Draghi’s famous ‘whatever it takes’ speech back in 2012 came at a time when investors were openly speculating on the break-up of the Euro. It came in the nick of time and ensured the European currency would live to fight another day.

The point is that all these moments had a transformative impact on the markets – at least in the short-term – which generally meant bad news for many, but good news for those who had taken the right position.

So, if you were among the people who bet on the pound to take a nosedive after the referendum you’d have woken up feeling good about life the next morning. Likewise, the few who saw the 2008 crisis coming were able to put themselves in prime position to clean up big time when the proverbial finally hit the fan.

Which takes us to another little ‘moment’ in the world of financial spread betting. This week’s revelation from CMC Markets that revenue from CFDs and spread bets reflected some tougher times for the spread betting sector. Lower volatility in the market, and restrictions on the sale of CFDs from the European Union have all helped put the brakes on the company’s development.

So, once again wider developments in the economy and from regulators are having an impact on the markets. The question is: will CMC Markets take their own advice and find a way to take the right position?

Tom Cropper has been writing for us since 2015. Tom is a financial journalist and his work has appeared in titles such as the Guardian, Euromoney and many others.