Find a Wealth Manager in Wandsworth

| Name | Logo | Minimum | Initial Fees | Ongoing Fees | Customer Reviews | CTA | Tag | Feature | Expand |

|---|---|---|---|---|---|---|---|---|---|

|

Minimum £250,000 |

Initial Fees 1%-2% |

Ongoing Fees 0.6%-1.5% |

Customer Reviews 5.0

(Based on 96 reviews)

|

Featured Wealth Manager |

Features:

|

Saltus Expert Review: Best Wealth Manager 2025 Provider: Saltus Verdict: Saltus won “Best Wealth Manager” in the 2025 Good Money Guide Awards for it’s tailored financial planning and investment services. Saltus stands out in the UK wealth management industry by blending personalised financial planning with a sophisticated investment approach more often found in institutional circles. Founded in 2004, the firm manages over £10 billion in assets and holds Chartered status for its financial planning division, reflecting high standards in advice. Summary

Saltus takes a highly personalised route from the outset, matching clients with advisers who align with their goals and communication preferences. Their planning process includes robust cashflow modelling and tax optimisation, resulting in comprehensive strategies that span life planning and investment management. Their investment performance, as independently benchmarked by the ARC Private Client Indices (ARC PCI), is particularly impressive. Saltus has outperformed peers over 3, 5, and 10-year periods across cautious, balanced, growth, and equity risk categories — all while generally taking less risk. For instance, their core Growth strategy delivered an annualised 7.2% return over five years to the end of 2025, compared to 4.6% for the ARC benchmark. Fees are competitive and decline as portfolios grow, with no exit charges and transparent upfront costs, especially for larger portfolios. The ongoing cost for a £1.5m client portfolio in their core investment strategies is around 1.45% (including financial planning), and investment-only clients benefit from reduced charges. Client satisfaction is high, reflected in a 2025 Net Promoter Score (NPS) of 67 (well above the financial services average) and a 97% client retention rate. For context, Apple’s 2025 NPS score was 61 and Amazon’s 47. Bain & Co suggest that a score of 70 or more places a company in the ‘world-class’ category. A good choice for high-net-worth individuals seeking top-tier financial planning and strong, risk-adjusted investment performance. Pros

Cons

Overall5 |

|||

|

Minimum £500 |

Initial Fees £0 |

Ongoing Fees 0.25%-0.75% |

Customer Reviews 4.6

(Based on 2,564 reviews)

|

Features:

|

Wealthify, part of the Aviva Group, won “Best Robo-Avisor” in the 2024 Good Money Guide Awards as it lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

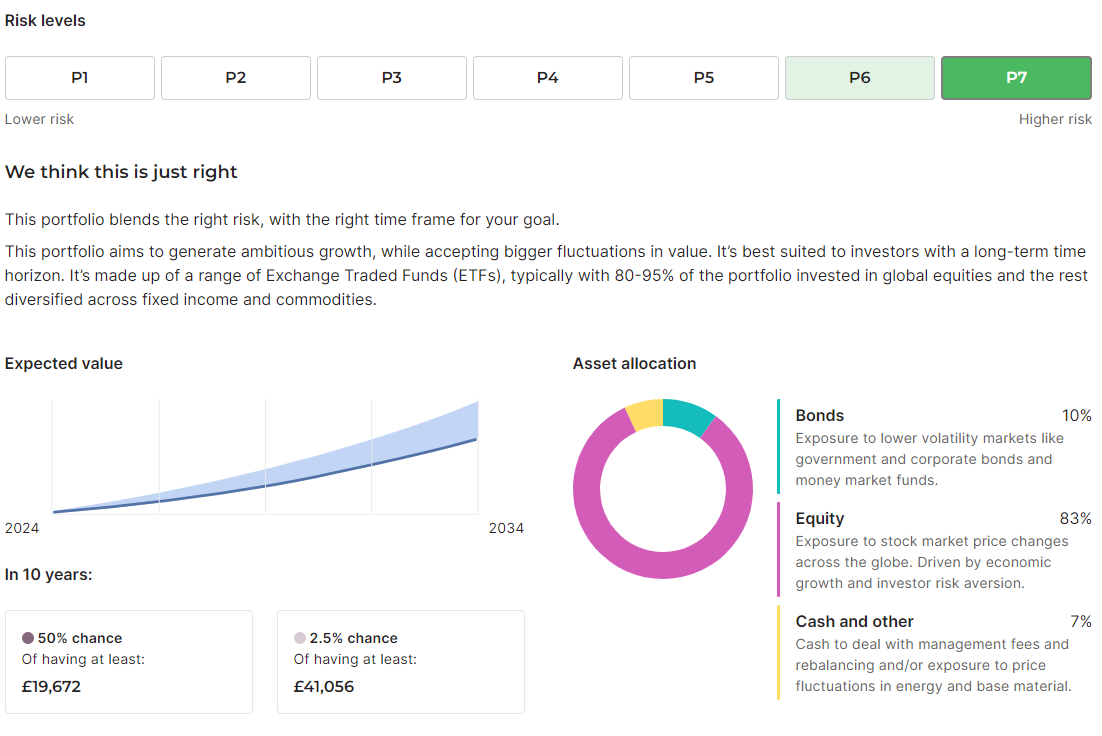

Wealthify Digital Wealth Management Review: Best Robo-Advisor 2025 Award Winner Provider: Wealthify Verdict: Wealthify won best “Robo-Advisor” in the 2025 Good Money Guide Awards as they offer simple, low-cost investment accounts made of pre-made diverse Original or Ethical investment plans. Owned by Aviva, customers can set their own risk/reward threshold and invest through a general investment account, stocks and shares ISA, junior ISA or pension. Wealthify Tested: Investing Isn’t A Sprint, Or Even A Marathon Anymore, It’s A Triathlon…

Investing used to be like a marathon, you’d have an annual four-hour meeting with a wealth manager who would recite your fund prices from the back of the FT, before rolling your portfolio over for his annual commission, but now it’s even harder work. To make investing interesting, robo-advisors like Wealthify (or ‘digital wealth managers’ as they prefer to be called) have been trying to democratise it and make investing open for everyone. They say, “Look, investing can be fun, if you don’t want it to be a marathon, we’ll make it a triathlon instead.” Which, as you know takes roughly about the same amount of time as a marathon, but is a swim, a bike ride and then a run. This closely translates into investing similes as, “it’s still a massive slog, but we’ll make it more interesting by giving you an app (like Strava) so you can track your performance in real-time and give you variety by risk and region”. So, by democratising investing, robo-advisors have actually made it harder. You have to make more decisions, be more involved, and you’ve now got an app so you’ll constantly be looking at (and therefore tweaking), your ISA and pension. When actually, what you should be doing is investing, then do nothing. Or should you? The Value of Compounding A while ago I interviewed the then Wealthify CEO, Andrew Russell, and one thing we discussed was how important it is to encourage people to start investing, instead of just saving. Because without the benefit of compounding returns in the long-term if you just save and don’t invest, your money will be worth less. He told me:

Clearly, if you tried to convince the young to start investing by explaining how compounding works, you’d have no customers at all. But one, thing Wealthify does really well is straight off the bat tell people how much their money “could” be worth in the future, particularly for regular investing. Which is a very powerful message to send, and one that should always be front and centre. Generally, the earlier you start investing, no matter how small, the better off you will be. When I was setting up an account, I said I would invest £1,000 initially, then £250 a month with one of their Confident plans, which Wealthify said after 25 years could be worth £122k (or £173k if the market performed better than expected). Think of the rubbish you spend £100 a month on. When I retire, I might be able to buy a Caterham, although I’ll be too old to drive it then.

It’s not entirely clear where this prediction comes from when they give it to you, but presumably, it’s based on historic returns from the various plans. Obviously, “Past performance is not indicative of future results.” If the market tanks (which it always does at some point) you’re going to be sitting on a loss. But before robo-advisors came along, if you wanted to open an account and invest with low-to-medium risk you had to go to the bank and sit down with an advisor, fill in a load of forms, and nod in bemusement as they explained why the Asia ex-Japan emerging markets fund would potentially make you more money than a treasury based fund of funds. I remember doing it, and it was exhausting, and I had just come back from working on the NYMEX oil trading floor in New York, so was in the business even back then. Thankfully now though, it’s so easy to open an account and invest, and that’s where the real democratisation of investing is. The way people are invested is basically the same, with diverse portfolios spread across asset classes and regions, albeit cheaper, with the use of low-cost funds instead of active fund managers. People have always been able to invest monthly, with even very modest amounts. But what makes investing accessible is not how it’s done, but how easy it is to get started. Even up to a few years ago, if you wanted to open an ISA account with Hargreaves Lansdown, you had to fill in a paper application and post it back. Simple Apps & Platforms Both are very easy to use with good portfolio projection tools. When setting up my Wealthify account, I didn’t even have to put in a password to get started. I managed to fund my account without getting my debit card out of my pocket, by directly linking my bank account, another massive bonus for regular investors (because if you pay by debit card and it expires, your contributions stop). I think overall it took less than five minutes to get a plan set up and funded. It’s a very slick app and website, and everything is where you expect it to be. There will always be a debate around active versus passive fund management, but the performance difference between wealth managers is generally very slim as there is a fairly standard way to create risk and region-based portfolios. Plus, if you want to beat the market, you have to take on more risk. If you just want to beat inflation, you probably won’t beat the market. Wealthify Fee Comparison One of the main advantages of robo-advisors is how cheap they are compared to traditional wealth managers (because you don’t get personal advice) and Wealthify is one of the cheapest of the bunch. Wealthify account fees are 0.6% a year of your portfolio, versus Nutmeg & Moneyfarm’s 0.75%. So if you have £100k on account, you’ll be paying Wealthify £600 as opposed to £750 for the other accounts. Over a 23-year period, that is a saving of £3,450 (and that doesn’t take into account compounding returns if you reinvested that saving). Wealthify pensions are a little cheaper, as Wealthify fees reduce to 0.3% on the portion of your pension balance over £100,000. You do, of course, have to pay fund fees on top, which are actually quite cheap with Wealthify. Wealthify say their average fund fees are 0.16% p.a. (Nutmeg & Moneyfarm are about 0.2%). Fund fees are the costs of the assets in the Wealthify plans, which are managed by investment professionals. These are higher for Ethical Plans, where the average investment costs are 0.70% p.a. Wealthify updated its minimum deposit amounts in January 2026. For the GIA, the mimimum is £1,000. Market Access You are limited to their own pre-made portfolios, but they are suitably diverse, and you can set your risk level. You can invest through a GIA, Stocks and Shares ISA or Private Pension. Unfortunately, there is no Lifetime Investment ISA to take advantage of the Government’s 25% top-up bonus. But you can invest for your children as well with a Junior Stocks and Shares ISA. Wealthify plans are made up of funds from Vanguard, L&G, HSBC, Fidelity and Mercer. All those funds charge a fee for choosing and managing the assets that the funds are invested in. If you want to know what is in the funds, you can look it up on Trustnet, see for example the HSBC America Index Fund (which is currently 28% of the Adventurous plan). So actually, just like everyone else, your investments are quite heavily linked to US tech stocks like Apple, Microsoft, Alphabet, Amazon, Tesla and Warren Buffet’s Berkshire Hathaway. Ethical Investing For the more ESG and ethically minded, you can still invest in an Ethical Adventurous plan, but assets include funds with “sustainable” in the title, like the Liontrust Sustainable Global Fund that contains stocks like 3i, a British company worth around £33bn takes a pragmatic approach to sustainable investing by influencing company boards to ensure that they assess their material environmental and social impacts and dependencies and, where relevant, support them in developing plans to mitigate ESG risks and invest in value creation opportunities that may arise. Despite that, 3i has generally performed well in recent years. Wealthify as a Business I also really like Weathify as a business. It seems there are new investing apps being set up every week, all with different USPs. But most are woefully underfunded and you have to wonder how many times they will be going back to Seedrs and Crowdcude to tap up investors because their burn rate is extortionate as they have yet to onboard a meaningful number of customers to generate revenue, or even, god forbid, make a profit. Wealthify has gone through that, but come out the other side. It was founded by Michelle Pearce-Burkestarted with £500k from Richard Theo in 2015, then a further £1m from crowdfunding on Seedrs in 2016, followed by £15m from Aviva in 2017. Even though I have invested with Wealthify, I wish I had also invested in Wealthify, but that’s a whole other story and one with a completely different risk appetite. Aviva Backed for More Security Being Aviva owned is great for clients because it offers a huge amount of financial security, and of all the robo-advisors out there only Wealthify and Nutmeg (JP Morgan), have the backing to ensure that they may still exist in twenty years time. This is important because investing isn’t like using a credit card or buying car insurance, where you can switch every year. When you invest, you may well be with that provider for 50 years. When I interviewed Linsey Rix, the head of UK Savings and Retirement at Aviva, one of the reasons they were so interested in Wealthify was it gives them a chance to get people investing, who may have been put off by the established and grown-up nature of Aviva. She told me:

You can tell Wealthify is owned by one of the bigger boys like Aviva as well, because even though it is very easy to set up an account, they are still heavy on the compliance. I actually failed the suitability test. I filled it in as though I was a beginner investor and was told I couldn’t invest because I didn’t understand the risks of stock market investing. Although, I re-took it with a greater appreciation for risk and was granted permission to create a plan. But it’s a good example, of how whilst everyone should be able to invest, not everyone should actually invest. After all, just like training for a triathlon, if you do it with friends it is easier, and just like investing if you take an active interest in your health you will be healthier and wealthier in the long run. Customer Service Wealthify is rated highly for support from real people in Wales, so you can handle most issues online, but also have the ability to phone straight through for more complex issues. Research & Analysis Some good analysis around portfolio rebalancing, although it’s mainly passive commenatry updating on performance rather then ideas on what to invest in. But this is not surprising as Wealthify is very much a “invest and forget platform”. So much so that When I tested the platform and set up some regular investments, I am genuinely surprised when I log on and see them. The way a long term investing account should be. Pros

Cons

Overall5 |

||||

|

Minimum £1 |

Initial Fees £0 |

Ongoing Fees 0.3%-0.6% |

Customer Reviews 4.4

(Based on 235 reviews)

|

Features:

|

Moneyfarm Digital Wealth Management Review Provider: Moneyfarm Verdict: Moneyfarm is a digital wealth manager that aims to make personal investing simple and accessible. It was launched initially in Italy in 2012 by Italian bankers Paolo Galvani and Giovanni Dapra and entered the UK in 2016 and has big-name financial backers such as Allianz Global Investors, Cabot Square Capital, United Ventures and Poste Italiane. Is Moneyfarm any good for wealth management? Yes, Moneyfarm is more of a digital wealth manager rather than a robo-advisor as the portfolios are put together by investment managers, rather than automatically. The automation, as it were, is fine-tuning your portfolio to match your risk/reward choices. Unlike with other robo-advisors, with Moneyfarm you can also top up your portfolio with individual shares and ETFs. Fees: Moneyfarm charges 0.75% to 0.6% up to £100k then 0.45% to 0.35% over £100k. Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%. Market Access: You can invest in 7 pre-made portfolios, but also (unlike a lot of other digital wealth managers and robo-adviors) also buy individual shares, ETFs, bonds and mutual funds online. It’s a bit of a shame you can’t buy US stocks, But Moneyfarm is best really for setting up regular investments in a GIA, ISA or SIPP, then letting them grow over time without too much tinkering and speculating on Tech stocks. App & Platform: It’s really easy to use, plus it puts you through your paces to make sure you understand what you are investing in. Apparently, my Moneyfarm investor profile is “pioneering”, which means I want to take on more risk for potentially better returns. Customer Service: This is mostly online as you’d expect but solves all issues – I’ve had some good calls with Moneyfarm about how its products work over the years, and its people really know their stuff. If you want to find out more about the ethos, you can read my interview with the CEO Giovanni Daprà on how they are so much more than a robo-advisor. Research & Analysis: Not much to speak of other than a few guides, but that’s ok, as I don’t really want Moneyfarm spamming me with stock trading ideas.

Pros

Cons

Overall5 |

||||

|

Minimum £50,000 |

Initial Fees £0 |

Ongoing Fees 1.1% |

Customer Reviews 4.8

(Based on 84 reviews)

|

Features:

|

JM FINN Wealth Management Review Provider: JM Finn Verdict: JM Finn provides bespoke wealth management services, including discretionary portfolio management, advisory services, and financial planning. JM Finn cater to high-net-worth individuals, families, trusts, and charities looking for long-term investment strategies and financial advice. Is JM Finn a good wealth manager? Yes, we rate JM Finn as a very good wealth manager who offer a high-quality, personalised investment management service that aims to meet the individual demands of today’s private and professional investors. JM FINN won our award for best wealth manager in 2024, 2023, 2022 and 2021. JM FINN also have one of the lowest minimum account opening thresholds with clients being able to open an account from £50,000. Fees: JM Finn’s charges a flat 1.1% annual management fee, based on the value of the assets under management, plus additional charges for specific services. Pros

Cons

Overall5 |

||||

|

Minimum £500,000 |

Initial Fees 0.25%-3% |

Ongoing Fees 0.4%-1% |

Customer Reviews 4.0

(Based on 17 reviews)

|

Features:

|

7IM Wealth Management Review Provider: 7IM Verdict: 7IM provides wealth management, investment management, and financial planning services to individuals, families, charities, and institutions. Their services include discretionary portfolio management, retirement planning, and a range of investment products designed for long-term growth and wealth preservation. Is 7IM a good wealth manager? A good all-round wealth manager for clients with £500k upwards. A simple pricing structure also helps keeps costs low. 7IM has a solid reputation for combining innovative technology with traditional wealth management services. They are known for their client-centric approach and transparent investment strategies. Their use of cutting-edge technology, such as their platform for managing investments, sets them apart in the wealth management space. Fees: 7IM has an initial charge for advice, research and arranging investments which is tiered from 3% to 0.25% f the sum invested as set out below: Up to £300k – 3% 7IM ongoing fees are charged based on a % of the relevant investment funds as per the table below: £300k to £2m – 1.0% Pros

Cons

Overall5 |

Please note that by completing this form you will NOT be added to any marketing lists. Your details will only be used for the wealth managers you select to contact you.

Why use the Good Money Guide to help you choose a wealth manager?

As Featured In

Wealth management commentary from the Good Money Guide has been featured in a wide range of the national financial press.

Want to feature your wealth management firm or services to potential customers in this region? Join Good Money Guide For Businesses.

Compare Wealth Managers

Use our wealth management finder to help you connect with prospective wealth management companies so you can receive the most appropriate advice for your investment objectives. Comparing wealth managers to take over your portfolio may seem like a daunting prospect, but Good Money Guide has made it simple through our short and simple wealth manager finder.

Please note that by completing this form you will NOT be added to any marketing lists. Your details will only be used for the wealth managers you select to contact you.

What people think of Good Money Guide

Alex H

Trustpilot

Elena

Trustpilot

Alex N

Trustpilot

A very useful, interesting and factual website.

Kurt

Trustpilot

For years people have been trying to make investing interesting, but it’s not, it’s dull. Trading is fun, high-risk, fast, dangerous and like sprinting. But, like trying to run too fast, especially when you hit 40, you’ll probably injure yourself just as in trading, you’ll probably lose money.

For years people have been trying to make investing interesting, but it’s not, it’s dull. Trading is fun, high-risk, fast, dangerous and like sprinting. But, like trying to run too fast, especially when you hit 40, you’ll probably injure yourself just as in trading, you’ll probably lose money.