Trading In Futures At A Glance

👉 Futures are a financial contract where a commodity or financial instrument is bought or sold for a fixed price at a certain date

👉 Futures can be futures on stock indexes, commodities, precious metals and US Treasury (e.g. bonds)

👉 Futures can be traded at a futures market like the New York Mercantile Exchange.

What Are Futures?

Futures are a type of financial contract. They are agreements that mean the buyer has to purchase, or seller has to sell, an asset on a specific date at an agreed price. That asset might be an index, currency, or commodity a treasury (interest rate).

The idea is to let people hedge exposure and speculate (and hopefully profit on) price movements. For the buyer, the future means they can lock in a price (so not having to worry about fluctuations). Whilst for the seller, they can ensure future sales at a given price.

What Is Futures Trading?

Futures trading is entering into a contract to buy or sell a given instrument at a set price and a set date in the future.

This could be Oil, Gold, FTSE, DAX or bonds and be a month or year ahead. Futures trading is used for both hedging and speculation and they are a very important component of today’s global marketplace. Read on to discover more about trading in futures, with all your questions answered.

How Does Futures Trading Work?

When you trade futures you are trading the price of an underlying instrument or commodity out to a future date.

Futures trading platforms access futures exchanges to match buyers and sellers, for example, farmers with crops to sell and food manufacturers with ingredients to buy, both sides would like to get and lock in the best price they can. Through futures markets, farmers can sell crops they have yet to harvest and food manufacturers can secure supplies and fix their costs.

Futures markets are exchange-traded and usually, have a central counterparty or clearinghouse that acts as buyer to all sellers and the seller to all buyers. Effectively guaranteeing the settlement of all trades conducted on the exchange. Many futures contracts are deliverable though there are also a growing number of CFDs or contracts for the difference which are settled for cash and not the underlying instrument or commodity.

- Related guide: 50 rules for successful trading

Futures trading takes place on a margined basis with an initial margin or deposit required at the outset of the trade and then variation or maintenance margin as required throughout the lifetime of the trade. These margins are pledged to the clearinghouse or central counterparty.

What is A Futures Market?

A futures market is a marketplace where futures contracts are traded. The vast majority are electronic (and therefore open 24/7). These include the Chicago Board of Trade (CBOT) and the New York Mercantile Exchange (NYMEX). Futures markets allow buyers and sellers to access clearing houses – basically ‘middlemen’ of the trade.

What Can You Trade With Futures?

You can trade on a wide range of things. The most popular markets for futures trading are:

- Indices

- Foreign exchange

- Commodities

- Treasuries

There are futures markets on all sorts of different products ranging from cheese to short-term interest rates and carbon emissions. What’s more new contracts are regularly introduced, for example, we have recently seen the launch of Bitcoin futures contracts on a cryptocurrency for crypto trading and environmental sustainability.

How To Start Futures Trading

To start trading futures you need a futures broker, a thorough understanding of the financial markets and some risk capital (money).

👉You can compare the best futures brokers that are regulated in the UK here.

When choosing a futures trading platform you want to look for the same traits in a futures broker as you do in any other financial services provider.

- They need to be regulated by the FCA, well capitalised and based in a jurisdiction with a proper legal framework.

- As a retail customer or beginner futures trader, you should also expect them to offer segregated accounts for client money and be happy to disclose those details.

- Any broker you trade futures with should also be a member of leading futures exchanges or have agents who are.

Futures Trading Versus CFDs

There are several major differences between futures trading and CFDs;

- Firstly in terms of the counterparty risk when you trade exchange-traded futures your counterparty risk, the risk of not being paid, resides with the clearinghouse, whilst when you trade OTC CFDs or make spread bets your counterparty risk is between you and your provider.

- From a structural point of view futures contracts have a finite lifetime and expiry dates, CFDs are typically open-ended and can run indefinitely, though they may become uneconomic to finance over the very long term.

- CFDs can also be traded quarterly and structured in a similar way to futures contacts, i.e. with a finite lifespan and financing costs factored into their pricing at the outset, rather than being charged as rollovers/swaps in running.

- Profits from both CFD trading and exchange-traded futures are taxable and subject to Capital Gains Tax under UK law.

Futures Trading Versus Spread Betting

The major difference between futures trading and financial spread betting is around tax treatment.

- Profits made from financial spread betting by individual UK taxpayers are currently not subject to Capital Gain Tax (CGT).

- Losses made in futures or CFD trading may be offset against gains made elsewhere, which is not the case for spread-betting losses.

- Spread betting is similar to CFDs although unique to the UK, they can vary in duration, they can run on indefinitely like a CFD or they can have daily, weekly or monthly formats and durations.

What Are The Major Exchanges For Futures Trading?

There are many futures trading venues across the globe however the major exchanges are:

- CME (Chicago Mercantile Exchange)

- CBOT (Chicago Board of Trade)

- ICE (Intercontinental Exchange)

- Eurex (European Exchange)

The CME and ICE are US exchanges, they have a global presence and have aggressively grown through acquisitions of smaller rivals over the last decade or more. Eurex is the principal European futures exchange and a genuine competitor to the US businesses. There are also futures exchanges in most major developed and leading developing nations.

Pros Of Futures Trading

The key pros of futures trading are:

✔️Reduced counterparty risk

✔️Financial market transparency

✔️Standardised contracts

✔️Market liquidity

The various benefits from trading futures the central counterparty/clearinghouse model effectively eliminates counterparty risk and guarantees delivery and payment even in the event of default such as the failure of an exchange member.

Futures markets create price discovery across the calendar that benefits both producers and consumers, this is particularly useful in commodity markets, but it also allows us to visualise interest rate and yield curves and future market expectations for a whole host of other markets.

Futures markets offer standardised contracts that trade a fixed quantity and quality of an instrument and these contracts trade in an orderly series or progression to a known expiry and delivery calendar.

Futures contracts can provide instant asset allocation, for example, imagine a fund manager who has a new investment mandate and a view on equities, but who does not yet have their exact stock selection nailed down. The manager can quickly get long or short of equity index futures to gain exposure, then reduce and refine that exposure as when he has a more stock-specific investment list.

Cons Of Futures Trading

The main cons of futures trading are:

❌Volatility

❌Unpredictability

❌Leverage multiples losses

Futures markets can be volatile and are often very sensitive to geopolitical tension, natural disasters and the weather.

The supply of agricultural products and foodstuffs can be greatly affected by climatic events, such as excessive rain or drought, wildfires etc. Whilst oil supplies can be interrupted by conflict, natural disasters or man-made barriers such as sanctions and tariffs.

If supply constraints or fears of one become particularly acute, then futures price can spike very sharply and often without much warning. Conversely, a bumper harvest or expectations of growing supply can quickly depress futures prices.

In a leveraged or margined product, big price swings mean large swings in a traders PnL. If prices move against a trader, then they will need to add variation margin to their account, the clearinghouse may also choose to vary the initial margin required to open and hold positions in volatile futures contracts.

Futures Trading Costs And Fees

The principal costs when trading futures are commissions and exchange fees.

Commissions are typically calculated and charged on what is known as a round trip basis that is the opening and closing of a trade, any exchange fees are usually paid on the opening side of a trade only.

Commissions will vary across products and providers; exchange fees will also vary based on the venue you are trading on. If you are trading in deliverable products, then there may be additional charges associated with delivery and storage. As ever it’s best to be aware of all charges and fees before you trade, and your broker should be happy to provide with that information.

Trading Futures On Margin With Leverage

There are two types of margin you need to consider when trading futures:

- Initial Margin

- Variation Margin

Margin rates on futures contacts are set by the exchange and clearinghouse, for each contract there will be an initial margin, for example, say US$10,000 per lot or contract traded.

The larger the notional or underlying value of a contract then the larger the initial margin is likely to be.

Variation margin may be required to sustain an open position throughout its lifetime. The more a position moves against you the larger your variation margin liability will be on that position.

Futures exchanges and their clearinghouses use complex mathematical models to determine risk profiles and appropriate margin levels, vanilla long or short positions will have the most straightforward risk profiles, whilst spread trades and other complex strategies will have a very different risk profile.

Variation or maintenance margins are payable on demand if you don’t pay you are likely to be “stopped out”. Active traders will often leave collateral or cash with their broker/the clearinghouse against that possibility.

Most Popular Futures Contracts

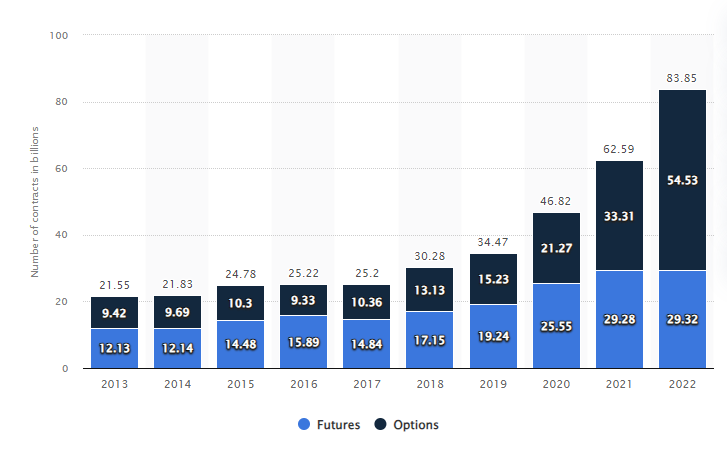

Futures volumes have been rising over the last five years as we can see in the graphic below. Global futures volumes reached 54.53 billion in 2022, according to data from the Futures Industry Association.

Equity indices and interest rate futures/options volumes grew by +23% and +24% respectively in 2018 and equity index volumes continued to grow during H1 2019.

Trading volumes reflect global macro themes and changes investor sentiment and it’s interesting to note that both Latin American and Indian futures exchanges saw sharp rises in volumes during 2018.

The Dax 40 the Eurostoxx 50, S&P 500, Nikkei 225 and the FTSE 100 are perennially popular with traders, as are benchmarks such as US ten-year bonds, crude oil and coffee and gold.

Source: statista.com

Basic Strategy For Futures Trading

The best way to trade futures is to use their underlying characteristics to your advantage.

One of the main benefits of trading futures is the ability to get instant asset allocation. That means that you can trade market sentiment and the changes in it, while it’s happening.

For example, if the market sentiment starts to move towards risk-off perhaps after some poor data or a hawkish central bank statement, traders can quickly get short of risk assets such as equities and long of safe havens such as 10-year bonds and gold as and when the market mood swings back towards risk-on traders will look to take the opposite positions i.e. long risk assets short safe-havens.

Futures are often driven by market momentum and from our experience, they tend to respect support and resistance levels, so knowing where recent period highs, lows and key moving averages are on the chart can be a powerful tool. Trading the price action at those levels (breakouts, failures etc.) can be an effective way to trade futures.

Of course, traders will always need to be on the lookout for false breakouts when pursuing this type of strategy good money management and stoploss placement will also play a big part.

Futures Trading FAQs:

The best time to trade futures contracts in the regular session when you are likely to have the largest number of market participants and the best liquidity. Futures responds to changes in market sentiment and to the value of the underlying asset so it makes sense to trade it when it’s most exposed to these influences. In practical terms that mean the London and New York sessions and the crossover between them.

Futures spread trading is the practice of taking a position where you are long one delivery month and short another for example, long December and short March. This is effectively a market-neutral position and traders are usually looking for the differential between the prices of the two contract months to narrow or widen depending on their view and the potential drivers for change.

In commodity markets, this kind of trade is often to trade expectations about the supply chain i.e. shortages, gluts etc. Spread trading is also popular in interest rates and bond futures as traders take positions anticipating changes in the shape of the yield curve that maps short and long-term borrowing costs.

Spread trading is also popular in energy futures here participants will trade so-called “crack spreads” which is trading crude oil against its refined products, cracking is the process in which crude oil is heated and broken down into these underlying components.

Yes. Exchange-traded forex futures contracts have many benefits but by nature, they are standardised and inflexible and for the most part not designed for retail traders. FX is the world’s largest market and most of the turnover within it is conducted off-exchange, for now at least retail traders could be thought to be better off trading OTC FX with a reputable, well established and regulated FX Broker.

The reasons why you would trade futures instead of stocks are around asset allocation and exposure. For instance, if you are trading changes in a stock index it’s far easier to get long and short of a futures contract on that index than to make multiple trades in the individual component stocks within it.

The futures price could also be said to reflect all the influences on the market whereas individual stocks will not necessarily do so.

By return, that means that the stock or stocks may move in a different direction to the futures, that individualistic price action is known as Alpha and the propensity of a stock to move in line with the market is its Beta. Traders may try to isolate these components by being long the future and short the stocks and vice versa.

Yes you can, but you will need the same skill sets and discipline required to trade any other financial markets to trade futures.

Do your homework, get to know your markets and products, always be disciplined around position sizing, risk and money management, don’t overtrade and do respect your stop losses.

Yes, the large exchanges all have educational programs such as this one from the CME and there are many books and other resources around futures trading out there for would-be traders to read and digest.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.